The payroll process can be divided into eight main elements:

- Setting up a new employee: recording payroll data on the engagement of an employee that meets the legislative and organisational requirements to allow for the person to be setup in the payroll system

- Security of information: the setup of a secure payroll system that ensures all legal compliance and record-keeping requirements are met

- Time tracking: recording the time worked by employees

- Preparation: of the payroll system

- Processing payments: manage payroll and employee payments

- Remitting PAYG(W) tax amounts: manage the withheld tax amounts and forward them to the Australian Taxation Office

- Superannuation and additional deductions: manage amounts to relevant authorities or authorised by the employee

- End-of-year Tasks: reporting checklists, wage reconciliations, payment summaries, EMPDUPE file, and magnetic media forms

Each of these elements is crucial in themselves but also in support of the overall system. A well-constructed and maintained payroll system goes a long way to help avoid errors and missed obligations involving deadlines, compliance, legislation, and payments.

A payroll system is only as good as the information entered, so collecting current information and relevant materials from the employee is essential to setting them up in the system and ensuring all legal compliance issues are satisfied.

This includes not only personal identifying information and wages but also TFN declaration, super choice form, apprenticeship and traineeship agreements, etc.

There are three forms that your employee needs to complete or sign:

A letter of offer or employment contract informs new employees about the terms and conditions of their employment with your business, including:

- start date

- position

- hours of work

- pay

- any other entitlements.

The TFN declaration form determines the amount of tax to be withheld from your employee's payments. It's completed by the employee for you to then enter the answers into your software. You can download this form from the ATO website.

You will need to provide new employees with a superannuation choice form to complete so they can advise you of their choice of super fund and you configure MYOB to make contributions to their nominated fund. The details of your nominated (default) super fund must be filled in before providing it to your employee for them to complete. You can view more information about the form at the ATO website.

Create Employee

MYOB provides a choice for the new employee details to be entered securely by the employee, or the traditional way — deciphering handwriting and entering the details into the system to create an employee record.

Start by selecting Create Employee from the drop-down list beneath Payroll in the main menu. Or, you can select Employees from that menu, and click the green button (Create employee) on the Employees page.

Employee — self-onboarding

Next, you will see a pop-up window that allows you to provide a name and email address to send an electronic form for the employee to complete. Note, until the employee responds, they will not appear in your employee list, however, they will be noted on a list of invitees.

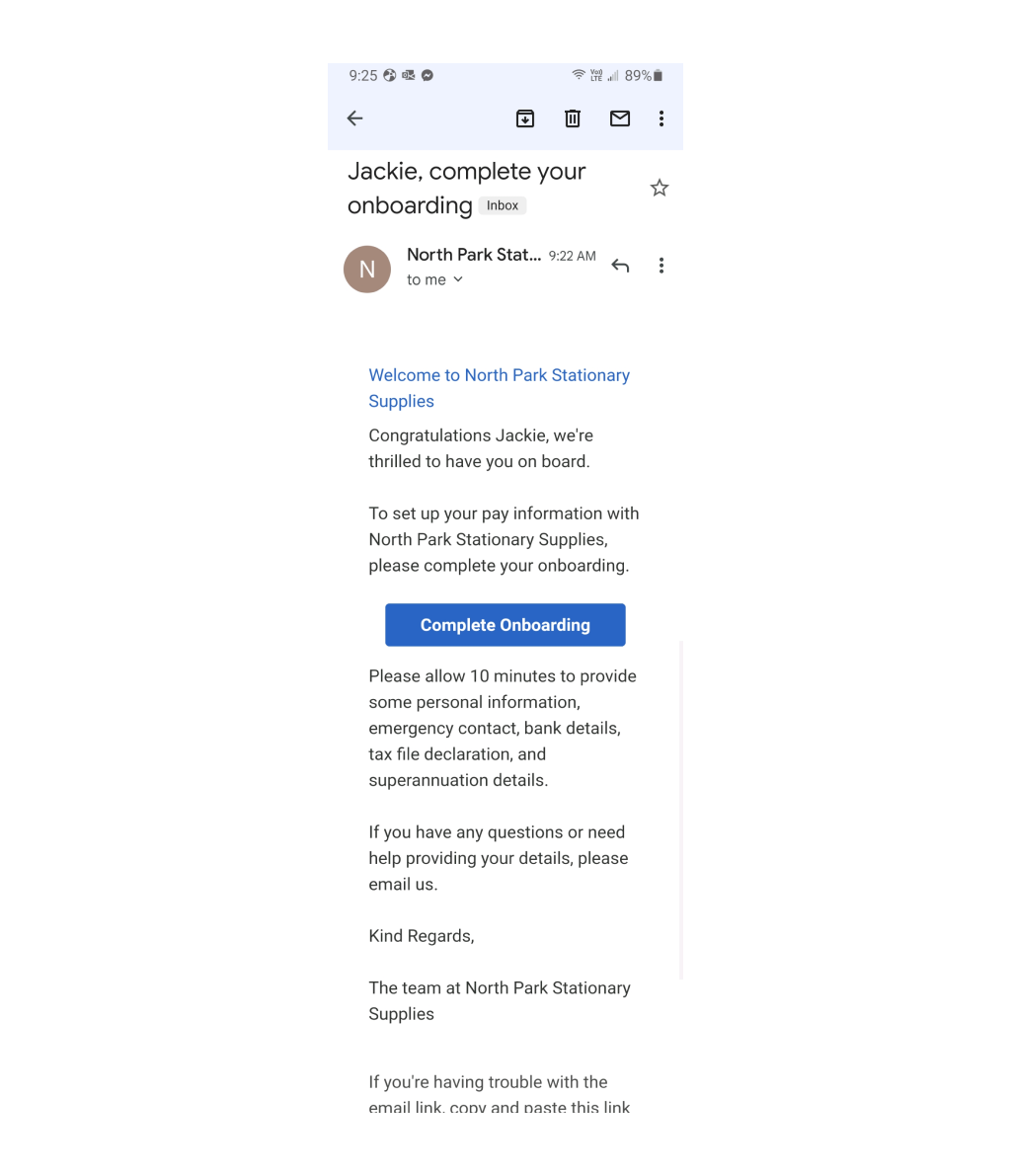

This is the email the employee will receive:

To learn more about self-onboarding, view this tutorial: Employee self-onboarding

To enter the details yourself, simply dismiss the pop-up window and work through the three main tabs, at the top:

- Contact details

- Payroll details

- Payment details.

After the employee is entered into the system, either through the form or manually, this is the screen you will come to when clicking their name in your list of employees. Here you can add or update the information your employee provided.

Contact details

This section contains the address and phone numbers along with notes, such as a referral. It also includes a checkbox to make the employee inactive.

Active/Inactive employees1

Once you've started paying an employee, you can't delete them. But if the employee is no longer needed, for example, you've processed their final pay, you can mark them as Inactive.

It is recommended that you keep your employee reports tidy with only active employees so you won't have to worry about accidentally paying them or including them in reports.

To reactivate an employee:

- From the Payroll menu, choose Employees.

- Select the checkbox option Show inactive employees.

- Click the employee to be reactivated.

- On the Contact details tab, deselect the Inactive employee option.

- Check that the employee's other details are correct.

- Click Save

- Note: If you're reinstating an employee in the same payroll year they were terminated, you'll need to undo their finalisation for Single Touch Payroll reporting. This lets the ATO know the employee has been reinstated.

- Go to Payroll > Single touch payroll reporting.

- Click Employee terminations.

- Deselect the finalised employee and remove the Employment End Date.

- Click Notify the ATO.

- When prompted to send your payroll information to the ATO, enter your details

- click Send

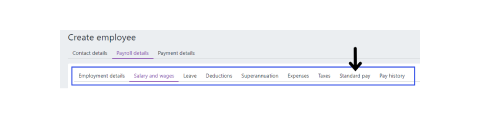

Payroll details

This area stores the following information:

- Employment Details

- Salary and wages

- Pay items

- Calculations and adjustments

- Payment details

1. Employment Details

- Date of birth, start/termination date, employment basis, payslip delivery preference

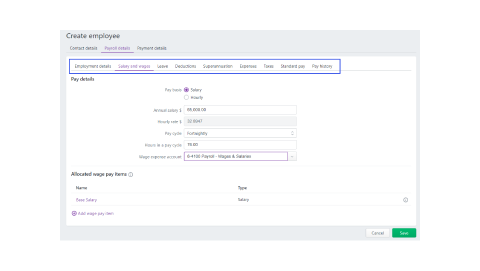

2. Salary and wages

- Pay Basis:

- Hourly: the employee is paid based on the number of hours worked, multiplied by their hourly rate. This means their pay can change from week to week depending on the number of hours worked.

- Salary: your employee is paid based on an agreed annual amount, paid at agreed intervals, such as monthly or fortnightly.

- Comparison: Let's look at these two wage types side by side.

Paid on an Hourly Basis Paid on a Salary Basis Paid on an hourly basis at a set rate per hour – Hourly rate provided on the employee wages and salary detail – Category can be used for any employee regardless of the value of the hourly rate Paid on a fixed weekly rate regardless of hours worked – Weekly rate provided on the employee wages and salary detail in an annual value – this can be used for any employee regardless of the value of the annual salary Only required where hourly-basis is to be accrued to a specially created expense account other than the standard singular salaries and wages expense account. (See note 2) Only required where Salary-basis is to be accrued to a specially created expense account other than the standard singular salaries and wages expense account. (See note 2) There are no exemptions for tax There are no exemptions for tax This allows for either the use of the hourly rate, or a fixed rate per hour other than the rate shown on the employee's details. (only used where there is a special reason) No variations are allowed as no hourly rate is applicable for fixed annual payment

- Pay cycle

- Wage expense account

If salaries and wages are to be split into two separate accounts, then the suggested method of set up should set the default salaries and wages account to the default payroll expense account.

For example:

- 6-5200 Salaries

- 6-5210 Wages

- 6-5800 Default payroll expenses (set as the default account for the salaries and wages. This default account will be discussed in more detail later in this text)

3. Pay items (Leave, Deductions, Superannuation, Expenses, and Taxes)

- Leave they are entitled to:

- See the section called Pay items for additional detail.

- 17.5% Leave Loading - Where a base award is paid to an employee, that employee is entitled to receive a leave loading when they take holiday leave and also unpaid leave on termination.

-

Paid on an Hourly Basis Paid on a Salary Basis Paid on an hourly basis at a set rate per hour. Hourly rate is provided on the employee card. Category can be used for any employee regardless of the value of the hourly rate (see point 4) Paid on an hourly basis at a set rate per hour. Hourly rate is provided on the employee card. Category can be used for any employee regardless of the value of the annual salary (see point 4) Most hourly employees are entitled to leave loading If salaried staff are being paid this loading, which is not normally the case, then select the salaried staff loading is to be paid to as well This loading is NOT exempt from tax, no exemptions This loading is NOT exempt from tax, no exemptions The rate multiplier is .175 of normal rate, which is of course 17.5%.

For example if the hourly rate was $10 per hour then the hourly rate would be 10 x .175 = 1.75While an employee may be paid on an annual salary value, MYOB also converts this to an hourly rate, and it is this rate that is used to calculate loading on any holiday hours that are taken in the same way as is done for hourly staff.

- Uniform allowance

- Union Fee

- Deductions or expenses they've opted for such as a salary sacrifice

- TFN and current tax table

- Public Holidays

- Care has to be taken when paying hourly staff for special circumstances such as public holidays they are required to work. The activity later in this topic will help provide additional understanding around this complicated area of leave accrual.

- Overtime (x1.5 and x2) Pay items - these are only applicable to Base Hourly pay basis employees.

- Superannuation

4. Calculations and adjustments (Standard Pay, Pay history)

- A view of the payroll details entered for the employee, such as their pay cycle, and all the pay items assigned to them, such as wages, deductions and leave accruals.

- Automatic calculations to occur at pay run, such as PAYG Withholding and leave accruals.

- Enter the details for items not calculated automatically

- Assign a job to a pay item for tracking purposes

5. Payment details (Standard pay, Pay history)

- How your employee will receive their payment. This could be done through cash, cheque or electronically, as well as paid out into one or multiple bank accounts.

- Additional detail about Standard pay is provided below.

Standard Pay

You will want to familiarise yourself with the Standard Pay tab. As you create and assign wage and salary amounts and pay items to your employees, the Standard pay will be automatically updated.

However, if you need to make a permanent change in your employee's pay, you'll see that some pay items are editable and some will be automatically calculated for you. This is because the pay basis of hourly employees is a calculation, whereas the calculation basis of any other pay item is a user-entered amount so it remains editable.

Editable hours

An editable pay item lets you manually enter hours or amounts, which will apply for your employee’s next pay runs. As an example, let’s say Paula’s uniform allowance is increased from $40 to $50. Simply enter the new amount in the Uniform allowance field and it will be reflected as of the next pay period.

Note: You can update your employee's standard pay, but the only time that you would need to do that is if this change for this employee is permanent.

- If it's a one time change for that pay period (like working overtime) or if it requires manual entry each time the pay item is used (such as travel per kilometer) you would update this in the pay run when processing that pay period.

- If the pay item changes for one or more employees who've been assigned to this pay item (for example, the uniform allowance increases from $40 to $50 per pay period), you would update the pay item.

Automatic calculations

Other pay items are automatically calculated when you do a pay run for the employee. Unlike editable fields, these amounts cannot be changed.

3. Payment details

This is where the method of payment is stored:

- Cash

- Cheque

- Electronic - including the details to create a money transfer.

Activity - Public Holidays - Paying Permanent Staff on Hourly Rate

As mentioned earlier, care has to be taken when paying hourly staff for special circumstances such as public holidays they are required to work. The common mistake that most make is to create and use a x2.5 category, which will ultimately result in employee being disadvantaged, or the employer being disadvantaged. Our responsibility is to ensure this does not happen.

Read through the following scenarios so you can get a sense of the complicating factors when managing leave accrual.

- The employees wage if they did not work the public holiday and it was paid as a public holiday only.

- The employees wage if they were paid on a x2.5 category, with the category exempt for personal leave holiday leave and superannuation accruals as an overtime rate would normally be set up.

- The employees wage if they were paid on a x2.5 category with the category not exempted from personal leave holiday leave and superannuation which is opposite to how an overtime rate would normally be set up.

- The employees wage if it were paid on a normal category, and a x1.5 category. The normal category is not exempt for personal leave holiday leave accruals or superannuation, however the x1.5 category would be exempt from these accruals.

What the pay would look like if the employee did not work the public holiday and it was paid as a public holiday only.

| Paid public holiday not worked | ||

|---|---|---|

| Hourly rate | 16.29 | |

| Ordinary time hours x1 | 7.5 | 122.18 |

| Overtime rate hours x1.5 | 0.00 | |

| Overtime rate hours x2.5 | 0.00 | |

| Personal leave accrual rate | 3.8462% | 0.2885 |

| Holiday leave accrual rate | 7.6923% | 9.5769 |

| Superannuation rate | 9.00% | 11.0 |

| GROSS WAGE | 122.18 | |

| Sick leave accrued | 0.2885 | |

| Holiday leave accrued | 0.5769 | |

| Superannuation | 11.0 | |

When looking at this category you will find that the personal leave accrual entitlement for the day is .2885 hours. The holiday leave accrual is .5769 hours, and the superannuation entitlement would be $11 for the day, these values MUST be maintained.

What the pay would look like if the employee was paid on a x2.5 times category with exemptions for personal leave, holiday leave and superannuation accruals as an overtime rate would normally be set up.

| Paid public holiday not worked | ||

|---|---|---|

| Hourly rate | 16.29 | |

| Ordinary time hours x1 | 0.00 | |

| Overtime rate hours x1.5 | 0.00 | |

| Overtime rate hours x2.5 | 7.5 | 305.44 |

| Accruals on entitlements | ✗ | |

| Personal leave accrual rate | 3.8462% | 0.0000 |

| Holiday leave accrual rate | 7.6923% | 0.0000 |

| Superannuation rate | 9.00% | 0.00 |

| GROSS WAGE | 305.44 | ✔ |

| Sick leave accrued | 0.0000 | ✗ |

| Holiday leave accrued | 0.0000 | ✗ |

| Superannuation | 0.00 | ✗ |

When looking at this category you will find that the personal leave accrual for the day actually results in zero. The holiday leave accrual also results in zero, and the superannuation accrual results in a zero, all of which are clearly incorrect. In this case the employee would receive the correct dollar value payment but would not receive the correct entitlements.

What the pay would look like if the employee was paid on a x2.5 times category with no exemptions for personal leave, holiday leave and superannuation which is opposite to how an overtime rate would normally be set up.

| Paid public holiday not worked | ||

|---|---|---|

| Hourly rate | 16.29 | |

| Ordinary time hours x1 | 0.00 | |

| Overtime rate hours x1.5 | 0.00 | |

| Overtime rate hours x2.5 | 7.5 | 305.44 |

| Accruals on entitlements | ✔ | |

| Personal leave accrual rate | 3.8462% | 0.2885 |

| Holiday leave accrual rate | 7.6923% | 0.5769 |

| Superannuation rate | 9.00% | 27.49 |

| GROSS WAGE | 305.44 | ✔ |

| Sick leave accrued | 0.2885 | ✔ |

| Holiday leave accrued | 0.5769 | ✔ |

| Superannuation | 27.49 | ✗ |

When looking at this category you will find that the personal leave accrual for the day is correct. The holiday leave accrual is also correct, but the superannuation accrual results in a zero value, this is of course clearly incorrect. In this case the employee would really see the correct dollar value but would receive only some of the correct entitlements.

The employees wage if it were paid on a normal category, PLUS a x1.5 category. The normal category is not exempt for personal leave holiday leave accruals or superannuation, however the x1.5 category would be exempt from these accruals.

| Paid public holiday not worked | ||

|---|---|---|

| Hourly rate | 16.29 | |

| Ordinary time hours x1 | 7.5 | 122.18 |

| Overtime rate hours x1.5 | 7.5 | 183.26 |

| Overtime rate hours x2.5 | 0.00 | |

| Personal leave accrual rate | 3.8462% | 0.2885 |

| Holiday leave accrual rate | 7.6923% | 0.5769 |

| Superannuation rate | 9.00% | 11.00 |

| GROSS WAGE | 305.44 | ✔ |

| Sick leave accrued | 0.2885 | ✔ |

| Holiday leave accrued | 0.5769 | ✔ |

| Superannuation | 11.00 | ✔ |

When looking at the results of this method, it can be seen that the gross payment is still correct, the sick leave accrual is correct, the holiday leave accrual is correct and the superannuation is correct.

Annual (holiday) leave accrual

Remember, MYOB Business is simply a tool to make the tasks less laborious and is not a replacement for the bookkeepers knowledge and skill to understand and perform the tasks.

2Most employees are entitled to a certain number of days of leave that they can take during the year. This might include annual leave, personal leave (sick leave), bereavement or compassionate leave, or carer's leave. Regardless of the name, MYOB handles all leave in a similar way.

Leave accrual and administration is important to understand, and often employees will require explanation so along with not making errors, you'll need solid answers.

| Paid on an Hourly Basis | Paid on a Salary Basis |

|---|---|

| Paid on an hourly basis at a set rate per hour – Hourly rate provided on the employee card – Category can be used for any hourly employee regardless of the value of the hourly rate | Paid on an hourly basis at a calculated rate per hour – Hourly rate is calculated from the annual salary provided on the wages and salary detail – this can be used for any salaried employee regardless of the value of the annual salary. (See note 1) |

| You can adjust the number of ordinary time hours to be paid to the employee by the number of hours taken as holiday leave. (See note 2) | You can adjust the value of the salary to be paid to the employee by the value of the number of hours taken as holiday leave. (See note 2) |

| You can select all hourly paid employees who are entitled to be paid holiday leave payments | You can select all employees paid on a salaried basis who are entitled to be paid holiday leave payments |

| Annual leave is NOT exempt from tax | Annual leave is NOT exempt from tax |

NOTE 1

This must be set as hourly as a salaried employee cannot be paid on a salaried basis when taking either holiday leave or personal leave.

NOTE 2

This is designed as an assistance to the paymaster but is not meant to remove the ability to think about what is happening. It is always a requirement to check your work.

How Entitlement Accrual Works2

MYOB uses leave pay items to track the hours of leave an employee accumulates. The payment of leave is handled using a wage pay item. So when an employee takes leave, the wage pay item looks after the payment and the leave pay item keeps track of their leave balance.

What Happens When Leave Is Taken?

When wages are paid that include any leave taken during the pay period, the pay item will deduct the leave hours paid from the leave entitlement total recorded for the employee and leaving a new reduced entitlement balance.

The same thing happens whenever annual leave, personal leave or unused annual leave is processed.

To get a big picture view of leave entitlements, head over to the Fair Work website.

Unused Annual Leave Pay item

This pay item is only used when terminating an employee and paying out any unused annual leave entitlement. We use this pay item because it will allow for variations in the processing of entitlements and accruals.

The differences between using an annual leave wage pay item and an unused annual leave pay item are shown in the following table.

Payment of Annual Leave

- Payment accrues for annual leave entitlement

- Payment accrues for personal leave entitlement

- Payment accrues for superannuation guarantee entitlement

- Leave loading applies on payment

- PAYG withholding should be applied at normal rates

Payment of Unused Leave

- Payment does not accrue for annual leave entitlement

- Payment does not accrue for personal leave entitlement

- Payment does not accrue for super guarantee entitlement

- Leave loading applies on payment

- PAYG withholding should be applied at the marginal tax rate

| Payment of Annual Leave | Payment of Unused Leave |

|---|---|

| Payment accrues for annual leave entitlement | Payment does not accrue for annual leave entitlement |

| Payment accrues for personal leave entitlement | Payment does not accrue for personal leave entitlement |

| Payment accrues for superannuation guarantee entitlement | Payment does not accrue for super guarantee entitlement |

| Leave loading applies on payment | Leave loading applies on payment |

| PAYG withholding should be applied at normal rates | PAYG withholding should be applied at the marginal tax rate |

Note: Unused annual leave is paid on an hourly basis regardless of whether the employee is paid on an hourly or a salaried basis.

Remember that while there is tax applied to termination payments, it is not applied from a normal periodic tax scale. Tax is applied at the marginal rate for that employee.

Example:

Assume that 65 unused holiday hours are required to be paid for a terminating employee who has an annual taxable wage of $36,103.60 per annum with an hourly rate of $18.2711 per hour.

The marginal tax rate would be .19 cents in the dollar, or 19% plus medicare levy of 2% making a tax rate 21% of the gross taxable value.

| 65 hours Unused holiday leave | $1,187.62 |

| 65 Hours Leave Loading 17.5% | $207.83 |

| Total Taxable value | $1,395.45 |

| Tax (Tax needs to be calculated and entered manually) |

-$293.04 |

| NET Payment | $1,102.41 |

You may like to review the help centre article at MYOB: Managing your Employees' leave in additional detail.

Assigning Leave and working with carryover balances

Set up wage pay items for leave payments

Wage pay items are used to include payments on an employee's pay. For each type of paid leave you have in your business, you'll need a wage pay item.

- Go to Payroll > Pay items.

- On the Wages and salary tab, click to open the Annual Leave Pay pay item. This pay item should already be set up for you, and it's the same setup for both hourly and salaried employees.

- Choose the applicable ATO reporting category. If unsure, check with your accounting advisor or the ATO.

- If you've set up a separate account to track these leave payments, select the option Override employees' wage expense account and choose the account in the field that appears.

- Select the option Automatically adjust base hourly or base salary details. This ensures that when you pay an employee for leave, their regular pay hours and amounts are adjusted accordingly—so they're not overpaid.

- Under Allocated employees, choose the employees entitled to annual leave.

- Click Save.

- Repeat these steps for the Personal Leave Pay pay item, and any additional leave types you pay your employees.

Set up the leave pay items for leave accrual

Leave pay items are used to track the leave an employee has accrued. For each type of leave that accrues in your business, you'll need a leave pay item.

- Go to Payroll > Pay items.

- Click the Leave tab.

- Click to open the Annual Leave Accrual pay item.

- Set up the Calculation basis.

Option Description User-entered amount per pay period

Select this option if you want to enter the hours to accrue in each employee’s standard pay, or manually enter hours accrued when recording the pays.Equals a percentage of wages Select this option if your employees are paid on an hourly basis or work variable hours.

You'll need to specify a percentage rate, which will be multiplied by the hours worked in the pay period, to determine the number of leave hours accrued.

Select the pay item to base the calculation on from the Percent of selection list. We suggest you select the Gross Hours option and then use the Exemptions below to choose the pay items you don’t want the entitlement to accrue on.

For example, say your employees work a 38 hour week, and occasionally work overtime. You need to exempt any pay items that are paid in addition to the employee’s standard 38 hour working week, such as overtime hours, holiday leave loading. But don’t exempt pay items that are paid instead of their normal hours, such as annual leave or personal leave, otherwise the accrual will not calculate correctly.

The National Employment Standards specify that as a minimum, full-time and part-time employees get 4 weeks of annual leave, based on their ordinary hours of work. Also, the minimum personal leave entitlement is 10 days per year for full-time employees, or pro rata of 10 days for part-time employees, depending on their hours of work.

If your employees are entitled to... Use this %... 4 weeks annual leave per year (or pro-rata for part-time employees)

7.6923%10 days personal leave per year (or pro-rata for part-time employees)

3.8462%Equals dollars per pay period Select this option if your employees are paid a salary.

To calculate the correct number of entitlement hours, you need to specify a fixed rate that should be accrued each Pay Period, Month or Year, regardless of the hours worked by the employee. No matter which option you choose, the total hours accrued per year will be the same, so choose the calculation that’s easiest for you to work out.

Example:

Say your employees are entitled to 4 weeks annual leave per year, and they work a 7.6-hour day (38-hour week). You would enter:- 152 hours per year (4 weeks x 38 hours) or

- 12.67 hours per month (152 hours / 12 months) or

- the rate per pay period, which you calculate by dividing the entitlement hours by the number of pay periods. For example, if your employees are paid fortnightly, you would enter 5.846 per pay period (152 hours / 26 pay periods).

- (Optional) To show the accrued leave on pay slips, select the option Print on pay slip.

- (Optional) To carry over the accrued leave into the next payroll year, select the option Carry remaining leave over to next year. If you don't select this option, the leave balance will reset to zero at the start of the new payroll year.

- Under Link wage pay item, choose the associated wage pay item.

- Under Allocated employees, choose the employees entitled to annual leave.

- If the Calculation basis you chose at step 4 is Equals a percentage of wages, under Exemptions you can choose all wage pay items that shouldn't accrue this leave. For example, if a bonus payment shouldn't accrue this type of leave, select that bonus pay item here.

- Click Save.

- Repeat these steps for the Personal Leave Accrual pay item, and any additional leave types your employees accrue.

To enter opening leave balances

If an employee had already accrued leave before you set them up in MYOB, you can record their opening leave balance.

Here's what to do:

- Go to Payroll > Employees

- Click the employee's name.

- Click the Payroll details tab.

- Click the Leave tab. The leave pay items the employee is entitled to should be listed. You can add or remove pay items here if needed.

- Enter the employee's opening leave balances in the Balance adjustment column for each applicable leave pay item.

- When you're done, click Save.

- Repeat for all other employees with opening leave balances.

Learn more about Leave pay items at the MYOB help centre. There are several useful FAQs on the page including separating leave for full and part-time employees.

Leave Balances

Keep track of entitlement balances anytime by running the appropriate report.

Go to Reporting > Reports > Payroll

The two reports to look at are:

- Leave balance - a summary report

- Leave balance (detail)

Run the reports from the beginning of the payroll year until the current date.

The Leave balance summary report displays the Opening Hours carried over from the previous years for each entitlement category. It also contains the total hours accrued and taken in the reporting period. This shows the current available balance.

The Leave balance (detail) report displays everything that has affected the leave balance in the reporting period. It also checks for any differences between payslip balances and employee cards.

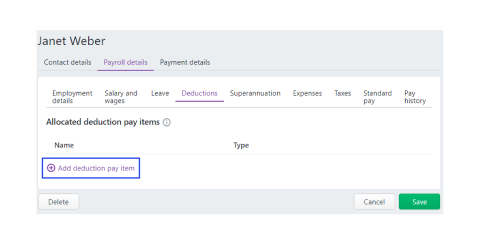

Deductions

MYOB provides an excellent overview of the Super requirements and expectations in this video:

Superannuation Guarantee Pay items

Superannuation guarantee could be paid using only one category, or it could be paid using a breakup method, which seeks to keep these accruals separate from each other, for example, one category and one general ledger payables account for each super fund involved. The benefit of this method is that the tracing of errors and the reconciliation process for each fund is greatly improved.

The down side of this method is where you have a lot of different superannuation funds you would need a lot of categories and also a lot of general ledger payables accounts. This may or may not be a feasible proposition, so the decision on which method to use becomes an individual one for the business itself.

Setting up Super

MYOB provides Pay Super, a portal to facilitate the payment of Superannuation contributions. This area of payroll is complicated and multi-faceted. We will provide an overview here, and links to the help centre at MYOB to provide additional depth.

All businesses are required to pay super for eligible employees from the day they start their employment before the quarterly due dates.

| SG QUARTER | DATE PAYMENT DUE |

|---|---|

| 1 July - 30 September | 28 October |

| 1 October - 31 December | 28 January |

| 1 January - 31 March | 28 April |

| 1 April - 30 June | 28 July |

Paying super on time means the business can claim the payments as a tax deduction and avoid late penalties.

Be aware! 3Employers who don’t make the minimum super guarantee contributions required on behalf of eligible employees risk having to pay the Super Guarantee Charge (SGC), a charge imposed under the Superannuation Guarantee (Administration) Act 1992. The charge is made up of the super guarantee that’s owed, interest on the outstanding amount and an administration fee.

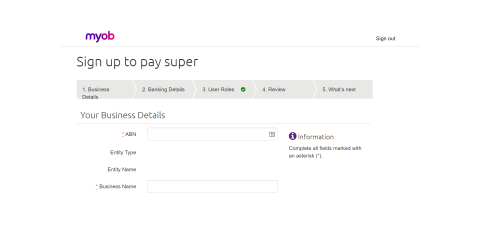

You will need to start by activating the Pay Super feature:

- Payroll > Super payments

- Sign up for PaySuper.

- Complete all of the requested details in each of the tabs.

- The banking details tab is where you provide details about actual bank accounts, not an MYOB Essentials bank account.

There are several considerations that are unique to the particulars of each business. You may like to review the help centre page for additional detail about MYOB's super portal.

To assign the Superfund to the employee:

- Ensure the Employee details tab is complete for the employee, providing data for each field on the tab.

- Ensure the Business details fields for the business are complete including ABN. (Business name > Business settings > Business details tab

- If you haven't already, enter your bank details for paying superannuation at PaySuper as noted above.

- Set the Super guarantee for employees by completing all of the fields on the Superannuation tab.

Payroll menu > Employees > [employee name] > Superannuation tab - Determine if there is a need to pay super to the employee. Employers are generally required to pay super guarantee (SG) contributions for employees who:

- Are paid $450 or more (before tax) in a calendar month

- Are aged 18 years or over (or under 18 and work at least 30 hours per week)

- Are employed on a full-time, part-time or casual basis (including those who are working in Australia temporarily).

- Use this handy calculator, provided by the ATO to clarify the Super requirements for employees.

In addition to Super...

The business may have other pay items to keep track of, and these pay items provide flexibility so a business can keep track of one-offs and more unusual employee contractual obligations.

Deduction categories are used to deduct monies from an employees’ wage. A deduction from wages must have a written request from the employee and be for the principal benefit of the employee, not the employer

Expenses Categories

This category is not often used, but if you paid other benefits other than Superannuation you could set them up as expenses.

Taxes Categories

PAYG Withholding is usually the only category in this group and is very simple to set up as it only requires the selection of the Payables Liability account.

MYOB Tutorial on Pay items

Please use the tutorial at the MYOB help centre to learn how to add various types of pay items. A deep and complete understanding is necessary to avoid compounding problems by entering the initial data incorrectly.

MYOB Help Centre : Setting up pay items

Pay items include the additional earnings and deductions in an employee's pay, on top of their normal salary or wages. This includes payments for things like overtime, allowances, bonuses, and penalty rates, or deductions like union fees, child support payments or salary sacrifice.

When you add an employee, these pay items are automatically assigned to them.

- Base Salary → salary-based

- Base Hourly → hourly-based

At the bottom of the each of the Pay items is the option to Add [type] pay item.

Clicking to add a pay item brings up a drop down menu to select the relevant item. From there, a pop up enables you to edit the details and view the employees assigned to this pay item.

To remove a pay item, simply click the x at the far right.

Note: Base Salary cannot be removed and so is shown with an ‘i’ rather than an ‘x’. Changing the Pay basis on this screen results in the Base Hourly and Base Salary pay items adjusting accordingly.

Setting up an hourly employee

The step-by-step process to set up hourly employees is shown here. Once you think you understand what you need to do, select the interactive video walkthrough and test your knowledge.

Your Task: Set up Paula Tap, a new hourly employee for a fictitious company called IckyLeaks.

Go ahead and click through the areas of MYOB where you would need to enter this information.

Review the employment documents below that provide the information you would need to complete the following:

- Employee's personal details and banking information

- Employee's deductions and super fund

- Tax details - based on their TFN declaration form

- Paula has no expenses.

Download the PDF: Paula Tap - Employment Forms - Hourly

Have you tested yourself to ensure you know where to enter the information from the forms to set up Paula as a new employee? Once you have, use this video walkthrough to confirm your understanding.

Setting up a salaried employee

The step-by-step process to set up employees that are paid an annual salary is shown here. Once you think you understand what you need to do, select the interactive video walkthrough and test your knowledge.

Your Task: Set up Jeffery Pipe, a new salaried employee for a fictitious company called IckyLeaks.

Go ahead and click through the areas of MYOB where you would need to enter this information.

Review the employment documents below that provide the information you would need to complete the following – it should look familiar:

- Employee's personal details and banking information

- Employee's deductions and super fund

- Tax details - based on their TFN declaration form

- Jeffery has no expenses.

Download the PDF: Jeffery Pipe - Employment forms - Salary

Have you tested yourself to ensure you know where to enter the information from the forms to set up Jeffery as a new employee? Once you have, use this video walkthrough to confirm your understanding.

Learning Checkpoint

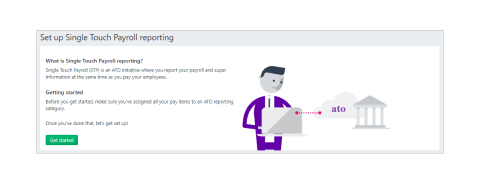

4Single Touch Payroll (STP) is a simple way to report your employees’ payroll information to the ATO and keep your business compliant. Watch this video to get a quick overview of what it is.

Setting up doesn't take long and can be done by whoever processes pays for your business. If a tax or BAS agent looks after your payroll, they'll need to complete the steps below to set up STP on your behalf.

If you pay employees using more than one MYOB Business file, you'll need to set up STP in each file.

Note: Since we're using a fictitious business you will not be able to complete the setup. Please watch the videos, and considering making notes about where you can find the information later, when and if you do need to set up STP for your or your employer's company.

How the process works: an overview4

- Your business, employee and payroll details will be checked to make sure they meet the ATO's requirements.

- You'll then notify the ATO that you're using MYOB to send your payroll information.

- You can then add other people who process your payroll so they can also send payroll information to the ATO.

Getting started: checking payroll details4

| To fix... | Do this... |

|---|---|

| Business Details |

|

| Employee information |

|

| ATO Reporting |

|

- Go to Payroll > Single Touch Payroll reporting

- Click Get Started to check your payroll details for any issues

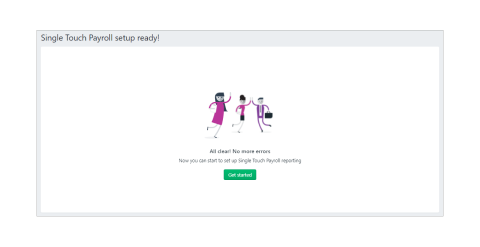

- If no issues are found, you're ready to Notify the ATO for Single Touch Payroll reporting.

- View the instructions to complete this on this MYOB tutorial.

- If any issues are found, click View errors to see the details on the Single Touch Payroll setup errors page.

- Fix all the issues listed under Business details, Employee information and ATO reporting

- To run the check again, either click Refresh on the Single Touch Payroll setup errors page, or repeat the above steps.

- When no more issues are found, click Get started.

- You can now continue setting up STP by notifying the ATO for Single Touch Payroll reporting. View the instructions to complete this on this MYOB tutorial.

Note: View what Payroll details are checked here. On the same page, you can learn about your BMS ID and where to find it.

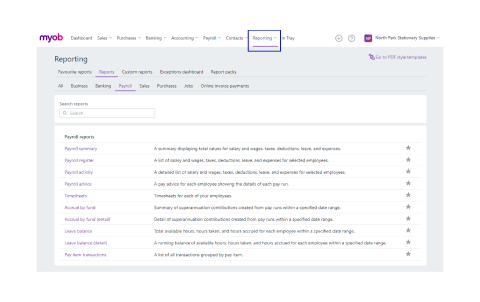

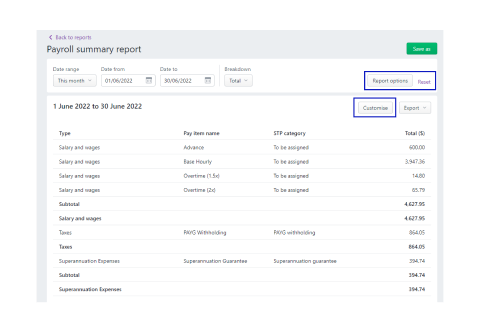

MYOB Business offers customisable reporting to facilitate payroll monitoring and legislative reporting requirements. It is vital that staff involved with processing payroll perform checking processes by running reports to guarantee the accuracy of payroll data.

Failure to check payroll data can result in inaccurate payroll calculations and records, which would likely cause over or underpayment of employees.

Every organisation should regularly run reports to assist in checking the accuracy of payroll data and records. Luckily MYOB provides easy access to monitor payroll activities and transactions.

Note: The Payroll advice has been changed to the Pay run history since this screenshot was taken.

How to run a payroll report

- Go to Reporting > Reports.

- Click the Payroll tab.

- Click the type of report to run.

- Determine the content and some visual attributes of the report:

- Choose the Report filters (which options you have are determined by which report was selected) such as date range, and the way you would like the information broken down, i.e., Monthly by Q2, Quarterly by payroll year, or just the total.

- Report options across the top — these might vary depending on the report you're running and provide some formatting options. As you add filters and options, the report will update automatically.

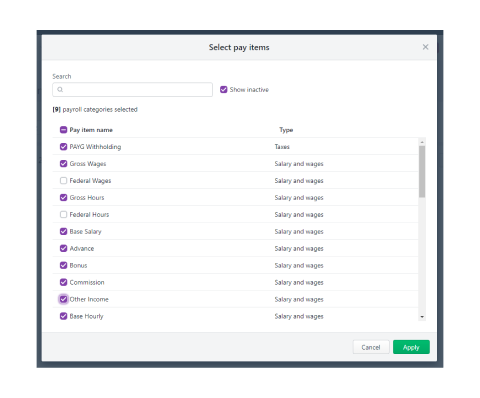

- Customise the report further. For example, you can select and reorder columns.

Examples:

- To report on pay items within a certain date range, enter the range in the From and To fields.

- To filter employees, click All employees to select all, or individually select employees, then click Filter.

- To filter pay items, click All pay items to select all, or individually select pay items, then click Filter.

-

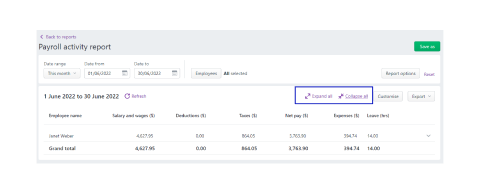

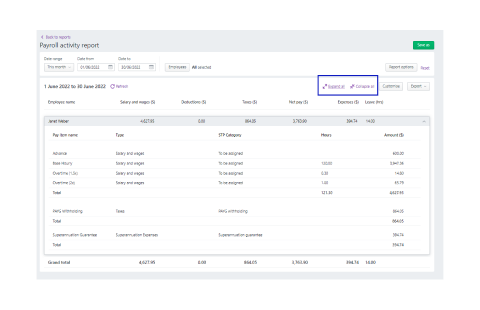

In some reports you can see a detailed view by expanding and collapsing information as shown below.

Collapsed view of a Payroll activity report:

Expanded view of the same Payroll activity report:

Export, save, and print your report output5

- When you are ready, select the Export button (to the right of the Customise button.) The report appears as a PDF in an Adobe Reader window, ready for you to review, save or print.

- For PDFs, you can also choose which style template you want to use. When the PDF displays, you can save or print it.

- Note: editing must be enabled from within Excel. If editing is disabled, the spreadsheet will not display the totals calculated in the report.

Save the filters and options as a custom report

You can also SAVE the report so you can run it without having to configure the details again by selecting the green button on the top right. This brings up a window that enables you to add a title and details and indicate if anyone else can see the report.

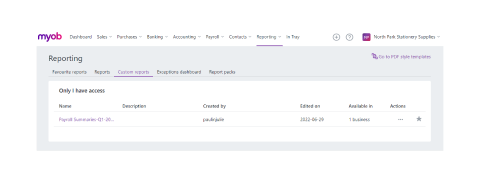

To access the report again later go to Reporting > Custom reports

There will be times when an employee is confused by their compensation package and requires a breakdown of their pay slip.

At some point, an employee may be concerned the information is incorrect and they were owed more money, or leave accrual for example. When that happens, you can use MYOB reporting to discover an error, or explain — respectfully with the data — what the employee has misunderstood. Additional information about how to handle employee enquiries is provided in another section.

For additional information about Payroll reporting in MYOB, review their help centre. (Please ignore instructions provided for New Zealand MYOB Essentials.)

Please complete the quiz question to test your knowledge of reports and then complete the two scenario-based activities that put you in the position of a payroll officer.

Activity 1: Consequences of missing payroll information

Scenario: As the payroll officer at a business, part of your role is to add new employees to the company’s payroll system and check their details for accuracy. A new employee has failed to provide his tax file number and has indicated on his Tax File Number Declaration that he wants to claim the tax-free threshold. He has also stated that he is a working holiday maker.

Task: Draft an email to the employee and your manager explaining the following:

- Identifying and explaining the discrepancy.

- How to take action to correct it.

- The rate the employee will be taxed at if he does not supply a TFN.

Note: The text of the email should be in grammatically correct English, written in an appropriate (polite, business-like) style. Use the forum to share your email with your classmates.

Activity 2: Required information for new employees

Scenario: You have been burned too many times by new employees not providing correct or complete information. You have decided to address the problem.

Task: Create a checklist for new employees that lists the information they need to provide so that you can set them up in the payroll system. Share it on the forum.

Review the content at the MYOB Help Centre

You may find it helpful to review this tutorial, adding an employee, to ensure you have a clear understanding before moving on with the course.