There are different ways bills, expenses, and petty cash are processed in Xero. The videos below demonstrate and explains these processes. Although the video refers to English pounds and Sales Tax the information in the video is still relevant for Australia.

The second step in the accounting cycle is to journalise the business transactions.

Transactions can be journalised in either a computerised accounting system or a manual system. A computer system records the transactions in a database, while a manual accounting system uses a series of books to record the transactions. Common computerised accounting systems include Xero and MYOB. The principles in accounting are the same whether you use a computer based or manual system.

Chart of Accounts

The chart of accounts is a list of every account in the general ledger of an accounting system. Each account is assigned a unique number based on the order it appears in the financial statements. Balance sheet accounts are usually presented first followed by income statement accounts.

Most accounting software packages like Xero and MYOB come with a default chart of accounts for different business and industry types. Bookkeepers can set up and customise their account structure to fit their business.

General Ledgers

The general ledger contains a listing of all accounts in the accounting system’s chart of accounts. It is sorted by account number and organised into:

- balance sheet accounts

- assets

- liabilities

- owners equity

- income statement accounts

- revenue

- expenses

In a manual accounting or bookkeeping system, the general ledger is a "book" with a separate page or ledger sheet for each account. (When a significant amount of detailed information is needed for an account such as Accounts Receivable, a subsidiary ledger is often used.)

In a computerized system, the general ledger will be an electronic file of all the needed accounts. This also facilitates the electronic preparation of the company's financial statements.

What is a journal?

In accounting and bookkeeping, a journal s the company’s official book in which all transactions are recorded in chronological order. A journal is often defined as the book of original entry. The definition was more appropriate when transactions were written in a journal prior to manually posting them to the accounts in the general ledger or subsidiary ledger. Manual systems have a variety of journals such as a sales journal, purchases journal, cash receipts journal, cash disbursements journal, and a general journal. Double-entry bookkeeping is the method used to record journal entries.

Double-entry Bookkeeping

Double-entry bookkeeping is an accounting method that keeps a company's accounts balanced and provides an accurate financial picture of a company's finances. In double-entry bookkeeping for every debit, there must be a corresponding credit.

Double-entry bookkeeping relies on the accounting equation, Assets = Liabilities + Equity to ensure that the accounts are always balanced.

- Assets are the resources a business owns.

- Liabilities are money owed by the business.

- The owner’s equity is the share the owner has on these assets.

The accounting equation is a condensed version of the balance sheet.

| Assets | = | Liabilities | + | Owner's equity | ||||||||

| Assets | = | Liabilities | + | Capital | + | Retained earnings | ||||||

| Assets | = | Liabilities | + | Beginning capital | + | Additional contributions | + | Income | - | Expenses | - | Dividends |

There is an extended version of the accounting equation that breaks down owners equity.

Assets = Liabilities + Owners Capital + Income - Expenses

- Asset accounts increase when debited and decrease when credited.

- Liabilities and equity accounts increase when credited and decrease when debited.

Asset accounts increase when debited and decrease when credited. Liabilities and equity accounts increase when credited and decrease when debited. If an asset increases with a debit, then the credit side of the entry will either affect another asset by decreasing it or affect a liability or equity account, increasing it, keeping the assets = liabilities + equity equation in balance.

The table below will help you to understand which accounts get debited or credited.

| Type of account | DR | CR |

|---|---|---|

| Assets | Increase | Decrease |

| Expenses | Increase | Decrease |

| Owner equity | Decrease | Increase |

| Liabilities | Decrease | Increase |

| Revenue | Decrease | Increase |

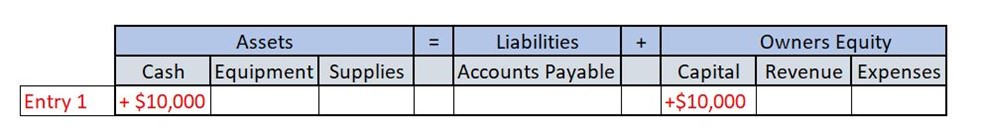

Let’s work through a few examples of how the accounting equation works in a double-entry bookkeeping system.

James invests $10,000 in his company, Tall Timbers.

This transaction will result in an:

- an increase of $10,000 in the cash asset account

- an increase of $10,000 in the owner’s equity capital

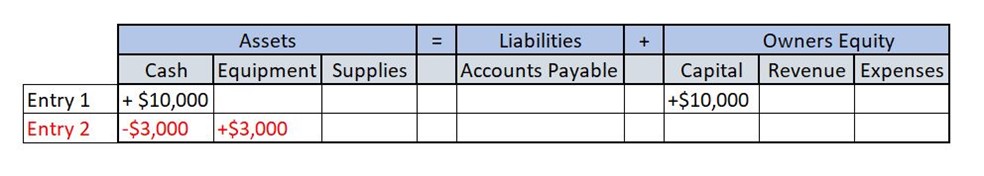

Tall Timbers purchase a new piece of equipment for $3,000.

This transaction will result in an:

- a decrease of $3,000 in the cash asset account

- an increase of $3,000 in the equipment asset account

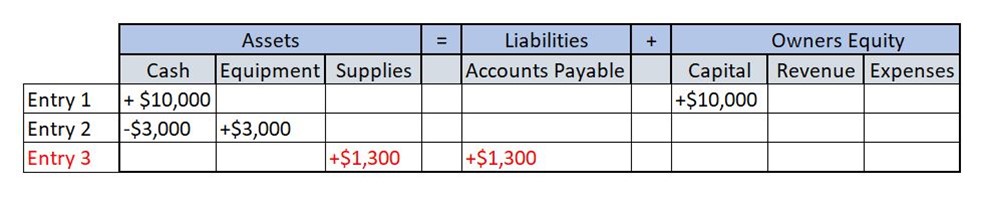

Tall Timbers purchase $1,300 of supplies on credit from Nicks Nails.

This transaction will result in:

- An increase of $1,300 in the asset supplies account

- An increase of $1,300 in the liability accounts payable account

How to create a journal transaction

There are three steps involved when you create a journal transaction. We will use Craig to demonstrate the steps.

Craig started a computer retail business on the 1st of March 2021 He deposited $500,000 into his business bank account.

- Identify that a business transaction has occurred. Using our example, Craig started a new business and deposited $500,000 into his business bank account. This means a new asset (cash) must be added to the accounting equation

- After we have identified that an event that impacted the accounting equation has occurred the business must analyse how the event changed the accounting equation. When Craig contributed funds to start his new business, the business bank account increased and Craig's capital increased. The bank account is an asset (an increase in an asset is a debit). Craig's capital account is Owners Equity (an increase in owners equity is a credit). Each side of the accounting equation has increased by $500.000 keeping the accounting equation balanced.

- After we have identified a transaction has occurred and analysed the impact on the business we can record the journal entry. The format of journal entries is to record the debit entry before the credit entry. Here is an example of how the journal entry would be recorded.

| Date | Account name | Debit | Credit |

|---|---|---|---|

| 1/03/2021 | Cash | 500,000 | |

| Capital - Craig | 500,000 | ||

| Capital contributed to start business by owner Craig | |||

When entering data, it is important to ensure the information you are entering is accurate. This includes applying the correct tax rates. In Xero the initial tax treatment and the tax rate determine whether a transaction is included in the activity statements and how it is classified. You choose the tax treatment and tax rate when you enter the transaction.

If you select None for your GST Accounting Method in your Financial Settings, all transactions will default to the No Tax setting and not be included in your activity statement.

How tax is calculated

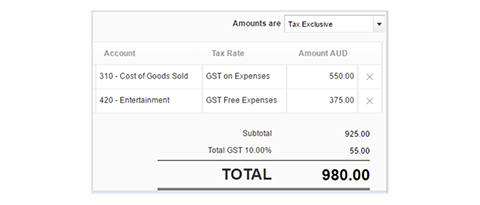

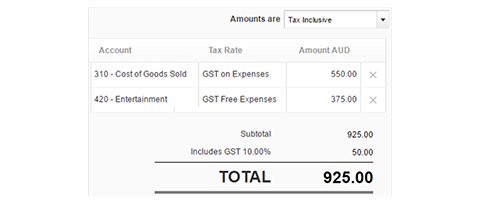

Xero calculates the GST on each transaction line, rounding each line amount to two decimal places. The Total GST is the sum of the separate GST. Sometimes this may mean the Total GST differ slightly from a percentage amount calculated on the transaction total. While Xero doesn't let you adjust the GST, you can add a line item, coded to an account such as ‘rounding’ to adjust, the transaction total.

Choose the tax treatment

Next to Amounts are, choose whether your whole transaction is:

- Tax Exclusive - Each line item is shown before GST. Tax is calculated on line items and shown separately.

Tax Inclusive - Each line item includes GST. The tax component is shown before the transaction total.

If you open a transaction after it's been approved it displays as tax exclusive, even if you entered it as tax inclusive.

- No Tax - No GST is charged on the transaction. You can't select a tax rate for any line item.

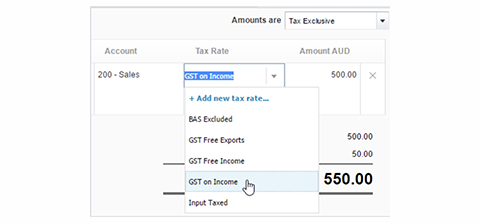

Choose the tax rate

Each account has a default tax rate which might vary depending on the contact or the transaction type. When you create a transaction that is tax exclusive or tax inclusive, Xero applies the default tax rate to each line item.

You can change the tax rate, if required.

Policies and procedures are an essential tool for both managers and staff. When a workplace has a set of policies and procedures, staff are not constantly having to make decisions about what to do. Written policies and procedures empower staff to perform their duties consistently and systematically, reducing the occurrence of human errors. Furthermore, they provide management with some assurance that the work and actions of their staff are compliant with industry regulations and guidelines.

Accounting policies are important to any business to maintain consistency and to set up a standard for decision-making. Accounting policies are usually approved by top management and do not change much throughout the years. They are developed for long-term use, reflecting an organisations values and mandatory requirements.

Accounting policies and procedures should also be regularly reviewed and updated. As organisations change in size and complexity, implement new systems, or are subjected to changes in regulations or accounting standards, their existing policies and procedures will need to be modified.

Policies and procedures for payment authorisation are critical to:

- reduce or eliminate duplicate payments

- prevent and detect fraud

- be cost-effective

- compliant with regulatory requirements

They should be in writing and available for all staff to access. Employees should be fully conversant with the organisations accounting policies and procedures so when they encounter a situation that they are unsure about they can reference the relevant policy or procedure to verify the correct way to deal with the situation.

What is a policy?

A policy is a statement that describes an organisation's views in regards to particular matters. It is a set of principles, or rules, that provide a definite direction for an organisation and embraces the general goals and acceptable procedures. In short, policies assist in defining what must be done when particular events occur.

What is a procedure?

A procedure is a clearly laid out, step-by-step method that shows workers how to implement an organisation's policies, responsibilities and work tasks in a correct and consistent manner.

Policies and procedures are usually compiled together to form a Policy and Procedures Manual which is a compilation of the written records of the agreed policies and practices of an organisation. The manual should be maintained in a physical documentation system so that it can be updated and added to as policies and practices are reviewed and changed.

It is important to match transaction documents to ensure validity before processing.

Matching can occur in different ways:

- Two way matching: invoice and purchase order

- Three way matching: invoice, purchase order and receipt

- Four way matching: invoice, purchase order, receipt and inspection report

If you identify a discrepancy in matching you will need to investigate the reason. For example, a $40.00 cheque is entered as $400.00, resulting in a $360.00 discrepancy. This can be easily identified by comparing each payment received against each transaction processed.

Another common error that occurs is numbers being transcribed. Any such errors can be adjusted easily once they are identified.

Validity of cheques

The details of each cheque received should be recorded on the receipt and a check of the details to ensure validity must include the:

- Amount written in both words and figures matches

- The cheque is not dated more than 15 months ago

- Cheque is not pre-dated

- Cheque is signed

- The payees name is the same as the account into which the cheque is deposited

Validity of electronic payments

An electronic payment is any kind of non-cash payment that doesn’t involve a paper check. This includes:

- Credit cards

- Debit cards

- Direct debit

- BPay

- EWallet payments

- Online banking

Electronic payments are considered to be more secure however they are not without risk. Some ways that risk can be mitigated include:

- Don’t share passwords

- Reconcile electronic payments regularly so that anomalies can be quickly identified.

- Ensure that high-value transactions always require multiple approvers.

- Have all transactions uploaded and approved separately.

Reconciliation is the process of checking one source against another to ensure its accuracy.

Reconciling payment information is an important aspect of balancing deposits and withdrawals. Each organisation will have their own accounting system which will influence how the reconciliation process works, but they will all follow the same general principles as outlined below.

Bank reconciliations

One part of the reconciliation process is checking cash journals against bank statements. It enables discrepancies to be identified, tracked and amended.

A bank statement is a record of the transactions that have been made into and out of a bank account over a specific period of time. Online internet banking allows you to access and print statements whenever they are needed, directly from your account. As such, reconciliation procedures must be regular and set to high priority.

When you receive a bank statement you reconcile the actual payments that were made against the statement to ensure the organisation's payment figures matches the bank’s figures.

A reconciliation is done to ensure:

- only valid and authorised purchases are made

- duplicate payments are identified

- all funds received are deposited

A reconciliation may mean comparing a variety of documents including:

- Billing documents > billing summaries

- Funds collected > accounts receivable postings

- Cash collected >cash deposits

- Deposits > ledgers

- Stock levels > stock purchased and sold

End of day reconciliations

At the end of a day of trading, there will be deposits, payments and receipts that will need to be reconciled. This reconciliation usually takes place once the business is closed.

Each business will have specific policies and procedures for completing the reconciliation, including how much total cash is to be held in a cash drawer, and how cash and cheques are transported securely.

Reconciling non-cash transactions

Most businesses will have procedures on how to reconcile non-cash transactions.

Examples of non-cash transactions include:

- Visa card transactions

- MasterCard transactions

- Diners Club transactions

- American Express (AM EX) transactions

- Cheques

- Gift vouchers

- EFTPOS transactions

Credit Card receipts should be kept in a designated place throughout the month and reconciled to the credit card statement at the end of the month. Any errors or unauthorised transactions should be investigated with the bank.

EFTPOS transaction are instantly deducted from your chosen bank account and should be visible on your statement within 24hrs. Any unauthorised transactions should be investigated with the bank.

Reconciling bank accounts in Xero

In Xero you are able to categorise your transaction by coding them to relevant accounts in your chart of accounts from the bank reconciliation. Xero then automatically updates your financial reports.

Spend and receive money transactions in Xero

In Xero the spend or receive money transaction is how you can create a payment or receipt that doesn’t relate to an existing invoice, bill, bank transfer, over-payment or pre-payment of an invoice. For example, making a donation by cheque or general expenses paid by debit card.

Without adequate controls, petty cash can become a problem. Often petty cash is the area where money is lost and usually, not a lot of attention is paid to recording accurately.

The imprest system

The imprest system is the more popular system of petty cash. Under the imprest system, a fixed sum is established as petty cash to meet the business requirement. For example, you might have a petty cash float of $100 per month. That is the total amount of petty cash that can be spent in the month.1

If during the month $45.00 was issued from petty cash then at the end of the month a sum of $45.00 would be placed in the petty cash float to bring the total back up to $100.00.

The advantage of the imprest system is that it helps ensure that you document how petty cash is spent. In the imprest petty cash system, petty cash dockets are written for each amount issued. When all of the dockets are totalled at the end of the month that sum is deducted from the opening petty cash float. The calculated amount must agree with the amount that is left in the petty cash float. With the imprest system, the amount that is recorded as spent is the amount of money provided to replenish the petty cash.

Petty Cash Controls

Some suggested control methods include:

- Have a maximum amount that can be taken out of petty cash for a single transaction.

- Always ensure that a petty cash voucher is completed for each item of expenditure and before making the payment.

- Sequentially number petty cash vouchers and if policy ensure appropriate authorisation.

- Keep petty cash tin in a secure place.

- Keep petty cash vouchers and receipts in the petty cash tin until balancing at end of month.

- Maintain a detailed description of what money is spent on, e.g. Stationery, postage, cab fees etc.

Managing petty cash in Xero

The simplest way to manage small expenses in Xero - for day-to-day items like milk, parking meters and postage - is to set up a bank account dedicated to petty cash. This won't be an actual bank account. It's just somewhere to record transactions made with your petty cash float or fund, and it will make reconciling easier.

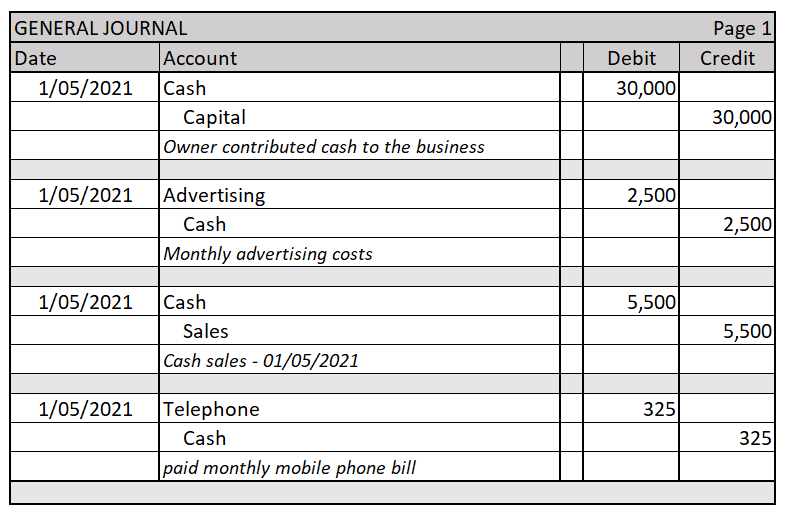

Manual Instructions

Transactions are recorded in relevant special journals. If there is not an appropriate special journal to record transactions, they are recorded in the general journal. The general journal records the intended general ledger entry, so you will need to use debit and credit rules when recording a general journal entry.

Recording general journals:

- All entries in the general journal are in date order.

- For each transaction, the debit entries are listed first, followed by the credit entries.

- The total debits must equal the total credits.

- The folio column is used to record the ledger number where the journal entry is posted to.

- After listing the debit and credit entries, a narration with a brief explanation of the transaction is recorded.

- When completed, each general journal entry is ruled off.

Posting general journal entries to the general ledger:

- A general ledger account is created for each account listed in the chart of accounts.

- General journal entries are posted directly to the ledger accounts affected.

- The date of entry in the general journal is the same date used in the ledger.

- Total debit entries are equal to the total credit entries.

- The information in the details column of the ledger account is cross-referenced to the other account/s affected by the transaction.

- The folio column in the general journal is used to track the ledger account the transaction has been posted to.

Preparing a trial balance

A trial balance is prepared to ensure that double-entry bookkeeping principles have been followed and that no addition or subtraction errors have been made.

To prepare a trial balance:

- List all the general ledger accounts with their account numbers and balances.

- The debit and credit columns are totalled.

- Total debits should equal total credits.

Trial Balance ABC Pty Ltd as at 01/10/2020

Test Your Understanding

Using this workbook follow the instructions below to test your understanding.

- Record the general journal entry for the commencement of business of Pan’s Flight School using the information contained in the internal memo from Peter Pan to his accountant.

- Record the computer purchase by Peter Pan in the general journal.

- Post the journal entry to the general ledgers.

- Generate a trial balance as at 31/12/2020.

| Pan's Flight School – Internal Memo | ||

|---|---|---|

| To: | Accountant | |

| From: | Peter Pan - owner | |

| Date: | 01/12/2020 | |

| Subject: | Owners contribution | |

| The following items were contributed at the start of business. | ||

| Cash | $250,000 | |

| Office furniture | $3,500 | |

| Plane | $350,000 | |

| Advertising- local newspaper paid from personal funds | $230 | |

| Rent- office space at the airport paid from personal funds | $1,400 | |

On 08/12/2020, Peter purchased a computer priced at $3300 (GST incl) on credit from Olga’s Office Supplies (Tax invoice # 2020-4343).

Xero Instructions

Create a manual journal and post to the general ledger

In Xero, you need the adviser or standard + all reports user role to be able to add and post manual journals.

To add a manual journal entry:

- In the Accounting menu, select Manual journals.

Click New Journal.

Enter the journal details in the relevant fields.

| Journal fields | Information to be entered |

|---|---|

| Narration | Enter a title to help you search the journal |

| Date | The date the journal is to be posted to the general ledger. |

| Auto reversing date | The field is optional. Select a future date if you want to reverse the journal automatically on a selected date. |

| Description | Add a description for each line item. |

| Account | The account to code each line item. |

| Tax rate | The tax rate for each line item defaults to the tax rate assigned to the account in your chart of accounts. You can edit the tax rate. |

| Debit/credit | The debit or credit amount for each line item. |

Click ‘Save as draft’ or ‘Save & add another’ to save the journal without posting it to the general ledger.

Click ‘Post’ or ‘Post & add another’ to post the journal to the general ledger.

Generate a trial balance report

- The trial balance report shows the balances of the general ledger accounts at a chosen date.

- Accounts with a zero balance will not display in the report.

To run the report:

- In the Accounting menu, select ‘Reports’.

- Under the Accounting menu, click 'Trial Balance New.'

| Report fields | Information to be entered |

|---|---|

| Date |

Enter a date range.

|

| Columns | Select the information that you want to display in the report |

| Comparison period(s) | Select what periods you want to display as a comparison on the report. |

| Allows you to hide decimal places and change from an accounting basis (accrual/cash). |

Click 'Update'.

Once you have generated the trial balance report, you can:

- Reorder the columns.

- Sort the contents by clicking on the headings.

- Add a header or footer to the report.

- Save the report as a draft, publish, or save as a custom report.

- Export the report to a PDF, Excel, or Google Sheet.

Test Your Understanding

This will be completed in a Xero course by following the instructions below.

Access your Xero course.

Instructions:

Add a bank account by selecting the accounting > Bank account >Add Bank Account.

Enter the following bank account information:

- Bank: ANZ

- Account Name: Pan's Flight School

- Account Type: Everyday Account

- BSB: 111-000

Account: 11111100

Once you have created your bank account:

- Create a manual journal entry to record the commencement of Pan’s Flight School and post to the general ledger. (Cash was deposited into the ANZ account)

- Create a manual journal entry to record the computer purchased on 08/12/2020 and post to the general ledger.

- Generate a trial balance report as at 30/12/2020.

| Pan's Flight School – Internal Memo | ||

|---|---|---|

| To: | Accountant | |

| From: | Peter Pan - owner | |

| Date: | 01/12/2020 | |

| Subject: | Capital contribution - owner | |

| The following items were contributed at the start of business. | ||

| Cash | $250,000 | |

| Office furniture | $3,500 | |

| Aircraft | $350,000 | |

| Advertising- local newspaper paid from personal funds | $230 | |

| Rent- office space at the airport paid from personal funds | $1,400 | |

On 08/12/2020 Peter purchased a computer priced at $3300 (GST incl) on credit from Olga’s Office Supplies (Tax invoice # 2020-4343).

Manual Instructions

The petty cash book is a summary of all the cash movements in and out of the petty cash fund. As payments are made from the petty cash fund the balance of the petty cash fund falls. Periodically the fund is reimbursed for the amount spent.

Process for opening the petty cash fund:

- A petty cash fund is established when the imprest cheque is cashed, and the money is placed in the petty cash tin.

- The amount and cheque number are recorded in the petty cash book.

Processing petty transactions:

- A voucher is completed for all purchase made from the petty cash fund.

- All vouchers are recorded in the petty cash book.

Balancing the petty cash book at the end of the period:

- Total the Payments, Input Tax Credits and Expense columns.

- Verify the total of the payments column by adding together the totals from each expense column and the total of the Input Tax Credits column.

- Subtract the total of the Payments column from the amount in the Receipts column and record this amount under the payments total. This is the carried forward (c/f) cash amount.

- Physically count the amount of cash in the petty cash fund. The amount should equal the c/f amount.

- Rule off the Receipts column and the Payments column below the Cash on Hand amount. Total and rule off with a double line. The Receipts and Payments columns should equal each other.

- Transfer the Cash on Hand amount to the receipts column.

Reimbursing the petty cash fund:

- Request a cheque for the amount that needs to be reimbursed.

- The cheque will need to be made out to cash and not crossed so that it can be taken to the bank and cashed.

- The cheque butt will record the amount of the cheque, the total of each of the expense column and the GST paid.

Test Your Understanding

On 01/02/2020 a petty cash fund was established using cheque # 01367 for the amount of $280.00.

Using this excel workbook, follow the instructions below to test your understanding.

- Record the establishment of the petty cash fund.

- Create petty cash vouchers for each of the February petty cash transactions in the table below.

- Total and balance the petty cash book as at 28/02/2020.

- Prepare the cheque for the reimbursement amount. (cheque # 01388)

- Record the reimbursement in the petty cash book.

February 2020 Petty Cash Transaction

| Date | Details | Supplier | Petty cash voucher number | Total amount | GST amount included |

|---|---|---|---|---|---|

| 3/02/2020 | Postage | Australia Post | 1 | 17.50 | 1.59 |

| 14/02/2020 | Parking | Wilson Parking | 2 | 42.00 | 3.82 |

| 18/02/2020 | Morning tea supplies | Coles | 3 | 18.95 | 1.72 |

| 23/02/2020 | Taxi fares (sundry expenses) | Cabcharge | 4 | 38.00 | 3.45 |

| 24/02/2020 | Pens and stationery | Officeworks | 5 | 75.90 | 6.90 |

| 28/02/2020 | Flower display for office (office expenses) | Flowers on Fitzroy | 6 | 65.00 | 5.91 |

Xero Instructions

Create a petty cash account

In the Xero dashboard set up a bank account that will represent the transactions in the petty cash tin.

Click on Accounting > Bank accounts

Click on ‘Add Bank Account’. In the search bar, enter ‘Petty Cash’ and then click ‘Add It Anyway’.

Enter:

- Account Name: Petty Cash

- Account Type: Other

- Account Number: A dummy account number e.g. BSB 111-111 111111. It does not matter what number you enter here as the software will not attempt to verify the number online.

- When you are all done, click ‘Save’. A petty cash account should now display on your dashboard along with your bank accounts.

Introduce funds to the petty cash account

To withdraw funds from another bank account to use as petty cash, click on Manage Account > ‘Transfer Money’.

Enter:

- From: Account money has been transferred from

- To: Petty Cash

- Date: Date of transfer

- Amount: Amount transferred to establish petty cash fund or reimburse petty cash fund

- Reference: Cheque number or if money has been withdrawn from bank use ‘Branch withdrawal’.

- When you are all done, click ‘Transfer’.

Record petty cash purchases

To record purchases made with your petty cash fund:

- Click on Manage Account > ‘Spend Money’

Enter spend money transaction fields:

- To: contact’s name

- Date: date that you made the petty cash purchase

- Reference: (optional)

- Item: (optional) an existing inventory item if one has been set up

- Description: description of the item purchased

- Qty: the quantity of items bought

- Unit Price: the price of the item

- Account: the account to code the transaction to from your chart of accounts

- Tax Rate: the tax on the transaction

- When you are all done, click ‘Save’.

Attach a copy of the receipt to the spend money transaction.

To add a photo or scanned image of your receipts to the transaction:

- Click the file icon

- Click ‘Upload Files’

- Select the file you want to attach from your device

- Click ‘Open’

- The spend money transaction will display 1 file attached.

Reconcile the petty cash account

As there is no petty cash bank statement to reconcile the petty cash transactions against you need to manually mark the transaction as reconciled. When you mark an account transaction as reconciled, Xero creates a new bank statement line to reconcile the transaction against.

To manually reconcile petty cash transactions:

Click on the ‘Petty Cash’ account.

Click the help icon, in the top right-hand corner. Turn on ‘Enable Mark as Reconciled’.

In the account transaction tab, select the transactions you want to manually reconcile.

Click ‘More’ > ‘Mark as Reconciled’.

Click ‘Mark as Reconciled’ again to confirm.

Test Your Understanding

This will be completed in a Xero course by following the instructions below.

Access your Xero course.

On 01/02/2020 a petty cash fund was established using cheque # 01367 for the amount of $280.00 by Peter Pan.

In Xero:

• Create a petty cash account for Pan’s Flight School.

| Pan's Flight School – Petty Cash Account | |

|---|---|

| Bank | Petty cash |

| Account name | Petty cash |

| Account type | Other |

| Account number | 111-111 |

| 11111111 | |

- Record a transaction for each of the February petty cash transactions in the table below.

- Attach the Officeworks and Cabcharge receipts below to the petty cash transactions in Xero.

- The petty cash was reconciled at the end of the month. Record the petty cash reimbursement. (cheque # 01388)

- Reconcile the petty cash account.

- Print the reconciliation report.

February 2020 Petty Cash Transaction

| Date | Details | Supplier | Petty cash voucher number | Total amount | GST amount included |

|---|---|---|---|---|---|

| 3/02/2020 | Postage | Australia Post | 1 | 17.50 | 1.59 |

| 14/02/2020 | Parking | Wilson Parking | 2 | 42.00 | 3.82 |

| 18/02/2020 | Morning tea supplies | Coles | 3 | 18.95 | 1.72 |

| 23/02/2020 | Taxi fares (sundry expenses) | Cabcharge | 4 | 38.00 | 3.45 |

| 24/02/2020 | Pens and stationery | Officeworks | 5 | 75.90 | 6.90 |

| 28/02/2020 | Flower display for office (office expenses) | Flowers on Fitzroy | 6 | 65.00 | 5.91 |