An important part of running a business is establishing good financial procedures and systems to monitor the financial health of the business and ensure the business's tax obligations are met. Financial policies and procedures should reflect a business’s values and culture, be easily interpreted and understood, and followed by everyone in the business.

Financial procedures should be:

- Factual, succinct, and simple to understand.

- In a format fit for purpose e.g. a procedure could be presented as written steps, a flow chart or a checklist.

- Written in a style that steps people through how to follow the procedure from beginning to end.

- Include references or links to any related documents and forms that must be completed.

Financial accounting process

Having good financial processes and procedures in place enables organisations to produce timely and accurate financial reports in line with their reporting requirements. Management also needs accurate and timely financial statements to understand the current position of their business, stay on top of its operation, and plan for growth.

Reporting requirements may vary from organisation to organisation. However, under the Corporations Law disclosing entities are required to maintain records that accurately record their financial transactions and enable the preparation of financial statements and the audit of those financial statements.

Annual financial statements consist of:

- Balance sheet.

- Profit and loss statement.

- Cash flow statement.

Financial policies and procedures will also vary among different organisations. Generally, they will include policies and procedures for:

- Credit policy and procedures.

- Purchasing policy and procedures.

- Policy and procedure for preparing and processing.

- Policy and procedure for the end of period reporting (could be daily, weekly, monthly, quarterly, or annually).

- Security procedures for handling electronic payments and cash.

- Safety procedures for the organisation’s preferred banking method.

- Journal authorisation procedures.

In Topic 3 Process Financial Transactions we looked at double entry bookkeeping and how with every journal entry at least two accounts change, one is debited and the other one credited.

Remember the accounting equation?

Changes in the accounting equation get recorded through double entry bookkeeping.

Asset accounts increase when debited and decrease when credited.

Liabilities and equity accounts increase when credited and decrease when debited.

If an asset increases with a debit, then the credit side of the entry will either affect another asset by decreasing it, or affect a liability or equity account, increasing it, to keep the assets = liabilities + equity equation in balance.

There are specific legislative requirements that must be adhered to when completing journal entries. These include GST reporting and taxation compliance relating to calculations of incoming and outgoing monies and to wages and wage payments and general bookkeeping processes. Depending on the structure of the organisation, the industry sector and whether the business is a private or not-for-profit organisation, there will be corporation's law requirements and auditing requirements that might apply to the bookkeeping processes.

Relevant legislation and compliance requirements can include:

- Codes of Practice.

- Australian Consumer Credit Code.

- Privacy Laws.

- Australian Competition and Consumer Commission (ACCC), National Competition Policy.

- Bills of Exchange Act 1909.

- Cheques and Payment Orders Act 1986.

- Financial Transaction Reports Act 1988.

- Commercial Tenancies legislation.

- Corporate law.

- Credit Reference Association of Australia (CRAA).

- Electronic Funds Transfer (EFT) Code of Conduct.

- Financial Institutions (FI) Code.

- Payroll tax assessment laws and Regulations.

- Prescribed payments laws and Regulations.

- Stamp duties laws.

- Taxation assessment laws.

GST

GST is a tax of 10% on most goods and services. It is paid at each step as the goods go from the manufacturer through various entities (wholesale, retail etc.) to the retail customer/ consumer. All entities along the chain except for the consumer can claim back the GST which they have, in effect, paid as a credit. GST liability is reported to the Australian Taxation Office (ATO) on either a monthly or a quarterly basis in the form of a Business Activity Statement (BAS).

GST calculation

It is easy to calculate GST when the cost of the individual goods/service is known:

| Cost of goods/service (Ex GST) | $720.00 |

| GST | $720 x 10% = 72.00 |

| Total cost | $792.00 |

If GST is already added to goods/services and individual costs are not known, it is necessary to divide the total (the GST inclusive figure) by 11.

| Cost of goods/ service including GST | $792.00 |

| GST | $792.00 ÷ 11 = $72.00 |

Cash & accrual accounting

There are two ways a business can account and pay GST:

- Cash basis: Business recognises income and expenses only when money changes hands. They don’t count sent invoices as income, or bills as expenses – until they’ve been settled.

- Accrual basis: Business recognises income as soon as they raise an invoice for a customer. When a bill comes in, it’s recognised as an expense even if payment won’t be made for another 30 days.

The Australian Securities and Investment Commission (ASIC)

ASIC is Australia’s corporate, financial markets and financial services regulator. All companies should keep financial records, however, some types of companies need to keep these records for the purposes of preparing and lodging financial reports with ASIC.

Some companies carrying on a business in Australia are required to prepare and lodge audited financial reports with ASIC at financial year-end.

Generally, companies must lodge reports if they have any of the following characteristics:

- There are substantial sums of money involved.

- The general public has invested funds with the company.

- The company exists for charitable purposes (registered with the Australian Charities and Not-for-Profits Commission) only and is not intended to make a profit.

ASIC financial reporting

Financial reports must be prepared in accordance with the Corporations Act and comply with Australian Accounting Standards. The Australian Accounting Standards are set by the Australian Accounting Standards Board (AASB), an independent Australian Government agency. The standards are legislative requirements for corporations.

Correctly allocating transactions means you must follow the rules of accounting and your organisation's policies and procedures.

Accounting concepts are the rules of accounting that are to be followed while recording business transactions and preparing final accounts. Some of the most fundamental accounting concepts are:

- Accrual accounting: Recording revenue (when a sale is made regardless of when collected) and recording expenses (irrespective of when paid). The key principles of accrual accounting are the:

- Revenue principle: States that revenue is earned when the sale is made. This is typically when goods or services are provided.

- Expense principle: States that an expense occurs when the business uses goods or receives services.

- Matching principle: States that when revenue is recognised, related expenses should be paired with it. This means that expenses are only reported during the period in which the revenue was made to ensure that the profit reported accurately reflects the business's performance in that period.

- Double-entry accounting: There are always two (2) entries for every transaction. When recording transactions for every credit, a corresponding debit is made.

- Going concern assumption: Also known as continuity assumption, states that accounting systems assume that a business will continue to operate.

- Cost principle: States that amounts in the accounting system should be quantified or measured by using historical cost.

- Objectivity principle: States that accounting measurements and accounting reports should use objective, factual and verifiable data.

- Unit-of-measure assumption: Assumes that a business's domestic currency is the appropriate measure for the business to use in its accounting.

- Separate entity assumption: States that a business and its owner should be treated separately as far as their financial transactions are concerned.

To safeguard a business' assets appropriate internal controls need to be in place to ensure transactions are processed and approved by people authorised to do so.

Internal controls over sales and payments

- Incorrect/unauthorised sales prices, discounts and credits: Any discounts given or credit applied to invoices should be authorised by a person who is not directly responsible for generating the invoices.

- Sales incorrectly recorded or not recorded: In the case where employees manually enter sales, have a process to ensure that the sales are being recorded and that they are being recorded accurately. If invoices are not being generated from a computer system, use pre-numbered invoices and conduct regular audits to check all invoices are accounted for.

- Payments not received: To mitigate the risk of payments not being received implement a process to ensure that all payments are receipted in a timely manner and credited to the correct customer’s account.

Internal controls over bills and payable payments

- Authorisation for purchases: Authorisation for purchasing should be clearly delineated in writing. Both in terms of what types of goods a person can purchase, and the maximum dollar amount they can spend.

- Purchase order: - All invoices over a certain dollar limit should quote a purchase order number

- Receipt of incorrect order: This can occur if a different item (or quantity) is delivered than what was ordered. Goods that are received should be checked closely to what was ordered and invoiced.

- Payment for goods not received: This may occur due to an error on the part of the supplier, a loss in transit, or as the result of a fictitious invoice. An internal control needs to be in place to ensure invoices correspond with the receiving records before they are paid.

Errors in the amount paid: Payments should always be checked against the invoice before being processed. For example, if a bookkeeper prepares the payment cheques, the person who signs them should review the related invoices.

When entering data into any accounting system it must be in line with organisation policies and procedures and regulatory reporting requirement.

Bookkeeping uses seven journals covering different transaction types. All the journals follow the same debit and credit format. All transactions are recorded in one of these seven journals following the rules of accounting.

Cash Receipts Journal (CRJ)

The cash receipts journal records all cash that has been received by the business. This includes cash from:

- Sales.

- Bank loan.

- Accounts receivable.

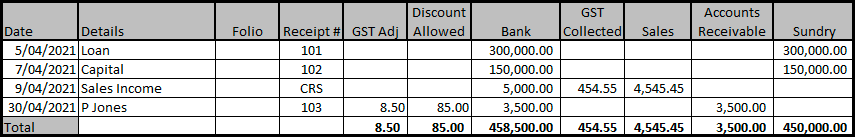

Cash Receipts Journal

In Xero cash receipts are processed through the invoices function as received payment or as receive money when reconciling the bank statement.

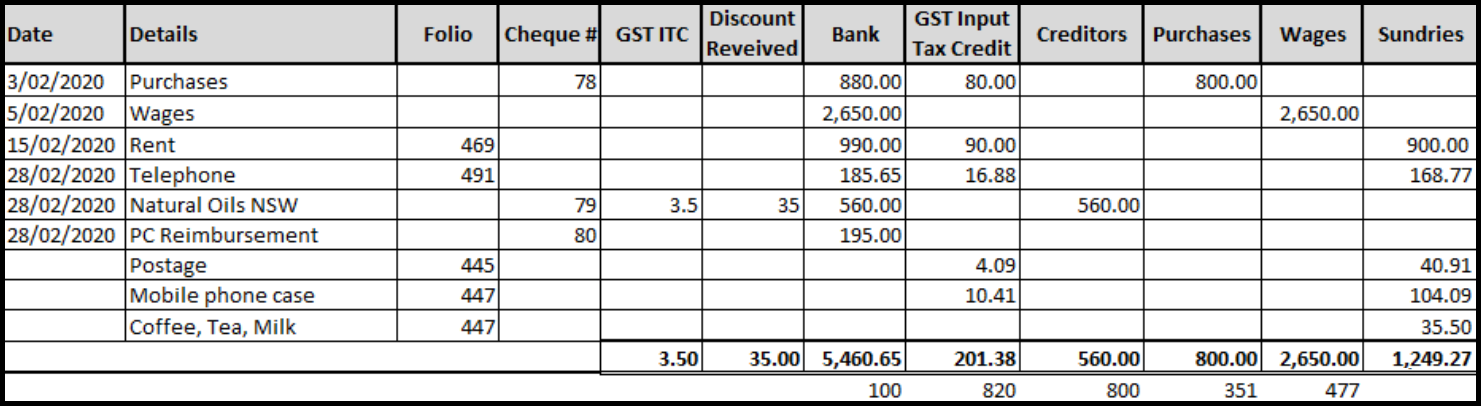

Cash Payments Journal (CPJ)

The cash payments journal records all payments made by the business. This includes:

- Business expenses.

- Wages.

- Drawings by owner.

- Accounts payable.

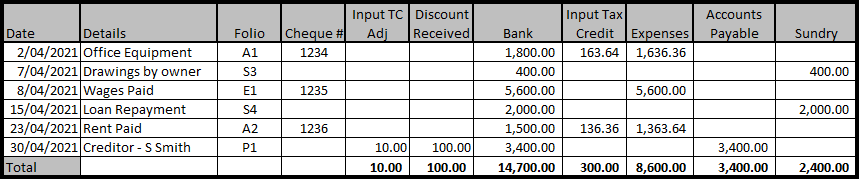

Cash Payments Journal

In Xero cash payments are processed through the bills function as make a payment or as spend money when reconciling the bank statement.

Sales Journal (SJ)

When a business sells trading stock on credit the transaction is recorded in the Sales Journal.

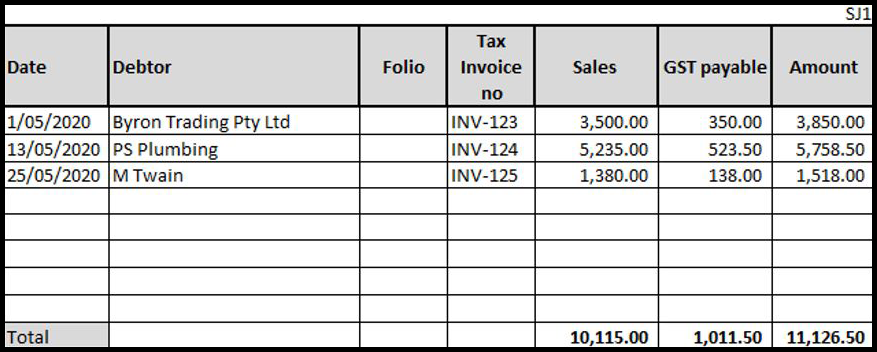

Sales Journal

In Xero sales are processed through the invoices function.

Sales Returns Journal (SRJ)

When a customer returns stock to the business the transaction is recorded in the Sales Returns Journal.

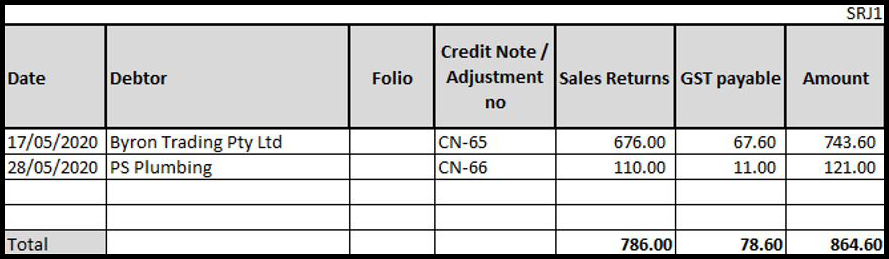

Sales Returns Journal

In Xero sales returns are processed as credit notes through the invoices function.

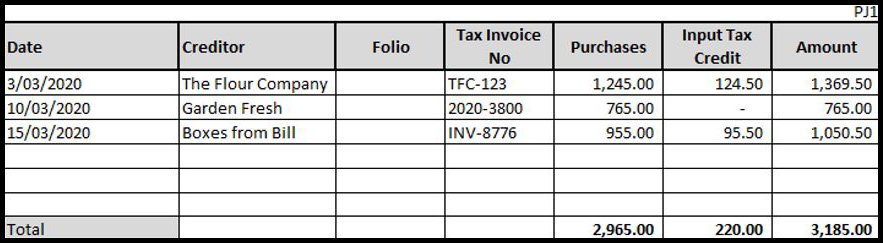

Purchases Journal (PJ)

When a business buys trading stock on credit the transaction is recorded in the Purchases Journal.

Purchases Journal - Pete's Pizza Shop

In Xero purchases are processed through the bills function.

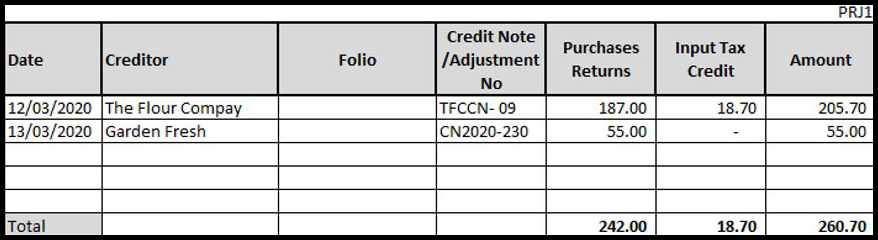

Purchases Returns Journal (PRJ)

When trading stock is returned to the supplier the transaction is recorded in the Purchases Returns Journal.

Purchases Returns Journal - Pete's Pizza Shop

In Xero purchase returns are processed as credit notes through the Bills function.

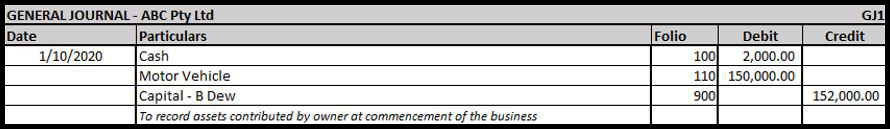

General Journal (GJ)

The general journal records any transaction that is not recorded on any of the other journals. It is recorded using the intended general ledger entry so you need to use debit and credit rules when recording a general journal entry.

General Journal

In Xero general journal entries are created using the Manual Journal Entry Report.

Accounting software

Accounting software has replaced many of the manual accounting processes by automating data entry. Organisational, financial and tax details, entered during the initial set up, automatically flow through the system reducing the need to manually enter data into subsidiary accounts and ledgers. This improves efficiency and helps to eliminate errors.

To assist businesses accounting software packages have documented process on how to use the software and process transactions.

Get help from Xero support

With Xero you get free, unlimited support 24/7 from their customer support team. When you're looking for help with the software, start by searching the support articles, online support and learning materials in Xero Central. Then, if you still have questions, use the Get in touch button at the bottom of any support article.

You can contact Xero support from your Xero organisation

When you search using the help icon in Xero, you see a list of suggested articles based on the words you enter.

- Click the help icon at the upper right-hand corner of the screen.

- Type your question or issue in the search box, then click the search icon or press Enter on your keyboard. As you type your query, Xero suggests articles for you.

Everyone in an organisation needs to have information to do their tasks and to do this it must be current and up-to-date.

No matter what position or level people hold within an organisation, they all have access to information which somebody will need at some stage. Updating related systems allows people within organisations to access and share knowledge, that they can use which is specific to their needs.

Integrated apps

Xero and MYOB host a range of third-party apps that integrate and enhance the software's capabilities. The apps connect and share data with the software unlocking deeper functionality and integration. Apps can help businesses:

- Save time and reduce errors.

- Automate daily processes.

- Speed up the payment process.

Input devices

There are literally hundreds of devices to enter and input data, from general-purpose input devices to special-purpose devices used to capture specific types of data.

- Computer input devices.

- Voice recognition devices.

- Digital computer cameras.

- Terminals.

- Scanning devices.

- Optical data readers.

- Magnetic Ink Character Recognition (MICR) devices.

- Point Of Sale (POS) devices.

- Barcode scanner.

When adding any devices or apps that integrate with the accounting system, data security or accuracy must not be compromised. Factors that can affect the integrity of data include:

- Human error: This can occur when individuals enter information incorrectly, duplicate or delete data, don’t follow the appropriate protocols, or make mistakes while implementing procedures meant to safeguard information.

- Transfer errors: This can occur when data can’t successfully transfer from one location in a database to another.

- Bugs and viruses: Spyware, malware, and viruses can invade a computer and alter, delete, or steal data.

- Compromised hardware: Compromised hardware may render data incorrectly or incompletely, limit or eliminate access to data, or make information hard to use.

Risks to data integrity can be minimised by doing the following:

- Limiting access to data and changing permissions to restrict changes to information by unauthorised persons.

- Validating data to make sure it’s correct both when it’s gathered and when it’s used.

- Backing up data.

- Using logs to keep track of when data is added, modified, or deleted.

- Conducting regular internal audits.

- Using error detection software.

Manual instructions

The cash payments journal is used to record all cash going out of the business. Cash payments include:

- Payment of cash for cash purchases.

- Payment of cash for previous credit purchases, e.g. payment to accounts payable or creditors.

- Payment of cash for various expenses, e.g. rent, advertisement, wages and salaries.

- Payment of cash for the purchase of an asset.

- Cash refunds for goods returned by customers.

- Payment of cash for donations.

Recording transactions in the cash payments journal

- Written receipts, cheque butts and a remittance advice are all source document for the cash receipts journal.

- The cash payments journal has separate columns to record regular payments, e.g. creditors, GST Input tax credits, purchases and wages.

- A sundries column is used to record all other payments, and the details column is used to record the ledger account the transaction is posted to.

- The business can claim any GST Input tax credits back from the ATO when it lodges its Business Activity Statement (BAS).

- Discount received is recorded in a separate column, as is the amount of any GST Input tax credit adjustment.

- Transactions are recorded in date and cheque number order to ensure that all cheques are accounted for.

- The petty cash imprest system provides the details to support entries in the cash payments journal for both the initial petty cash advance and the reimbursement cheques.

- The petty cash reimbursement amount is recorded in the Bank column, and the individual petty cash transactions are allocated to an item column.

- Cancelled cheques are to be recorded in the cash payments journal.

- The person or entity to whom the payment is being made is recorded in the detail's column.

- The cheque column is used to enter the cheque number belonging to the payment.

- Discount received is not a payment of cash and therefore will not appear in the bank column.

- GST Input tax credit for discount received also will not appear in the bank column.

- GST Input tax credit is included in the bank column.

- The bank column is used to record the total amount paid. This amount must be net of any purchases discount received from suppliers.

- At the end of the month, the total of the bank.

- At the end of a period, a line is drawn under the GST Input tax credit Adj, Discount Received, Creditors Purchases, GST Input tax credit, Sundries and Bank columns. The columns are totalled, and a double line is drawn.

- Under the total column, the account number the total has been posted to is recorded.

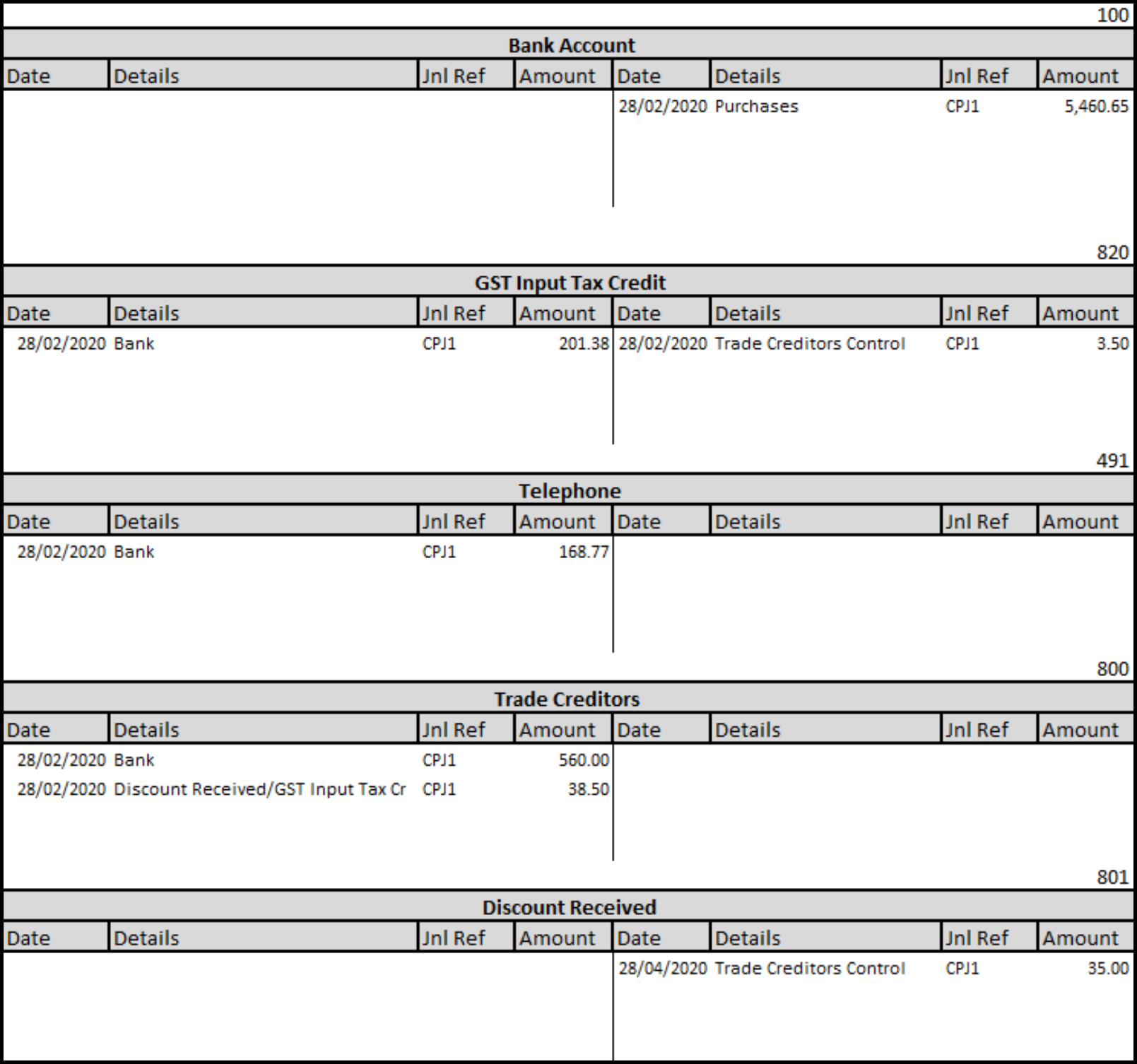

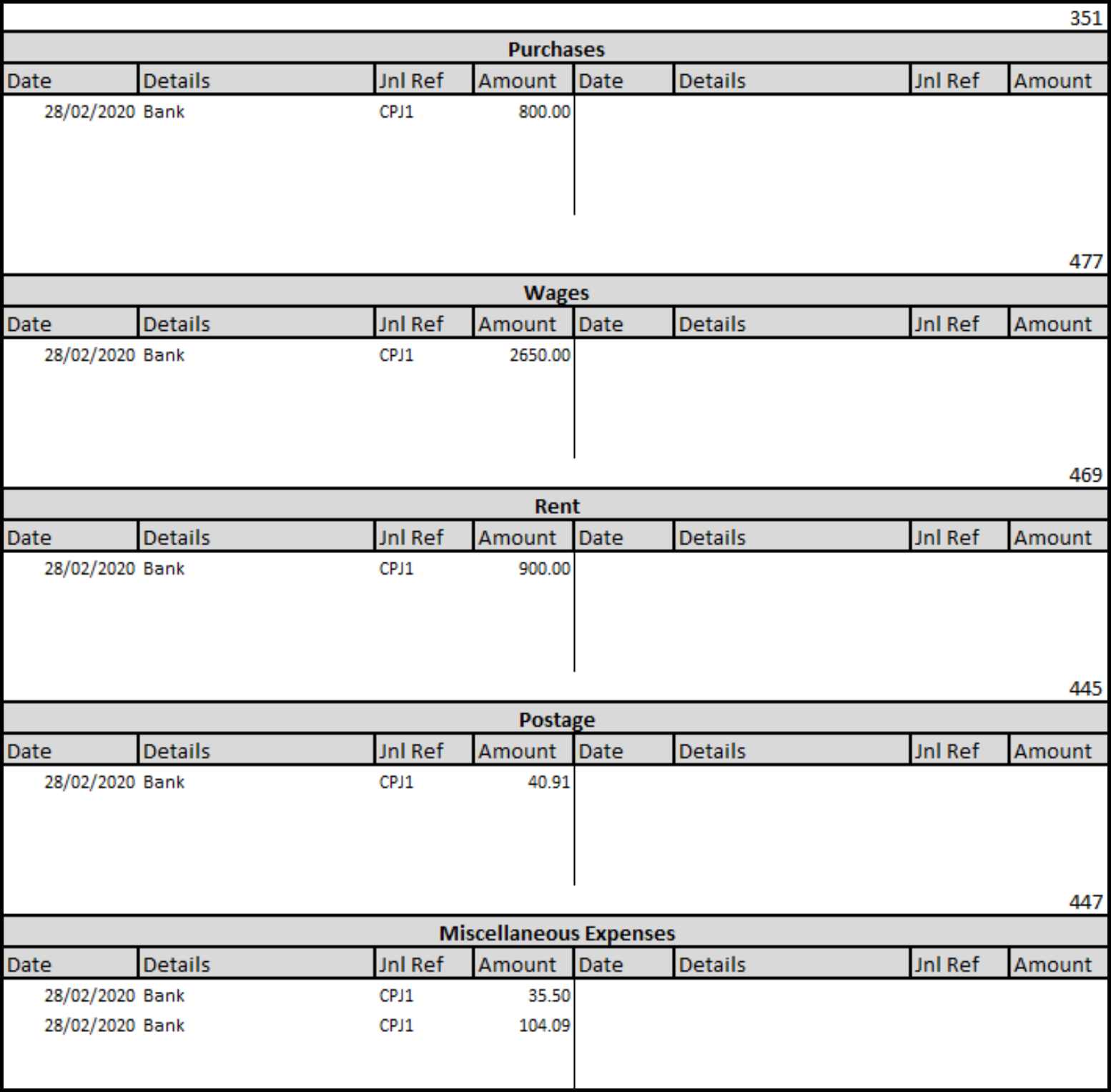

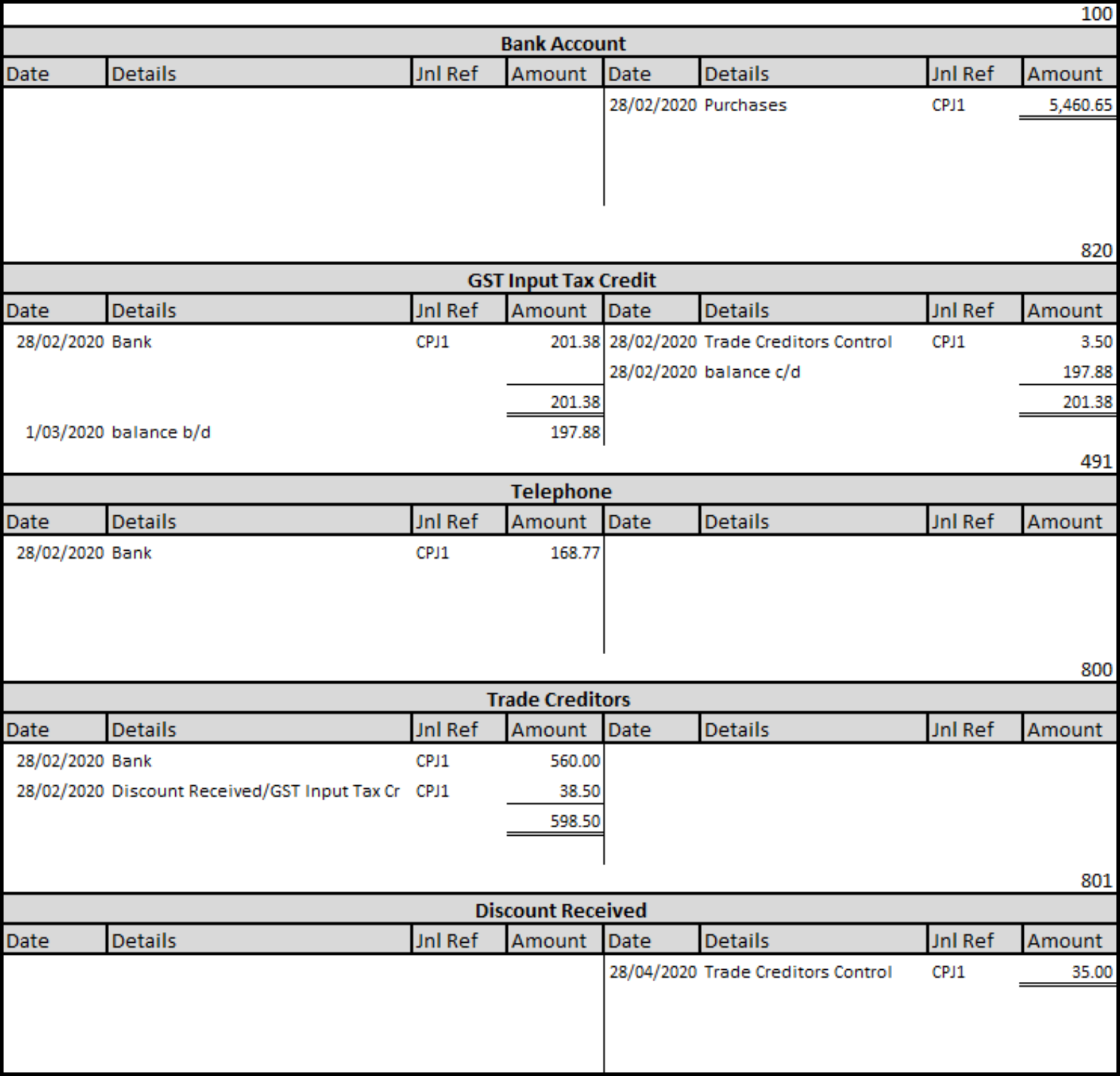

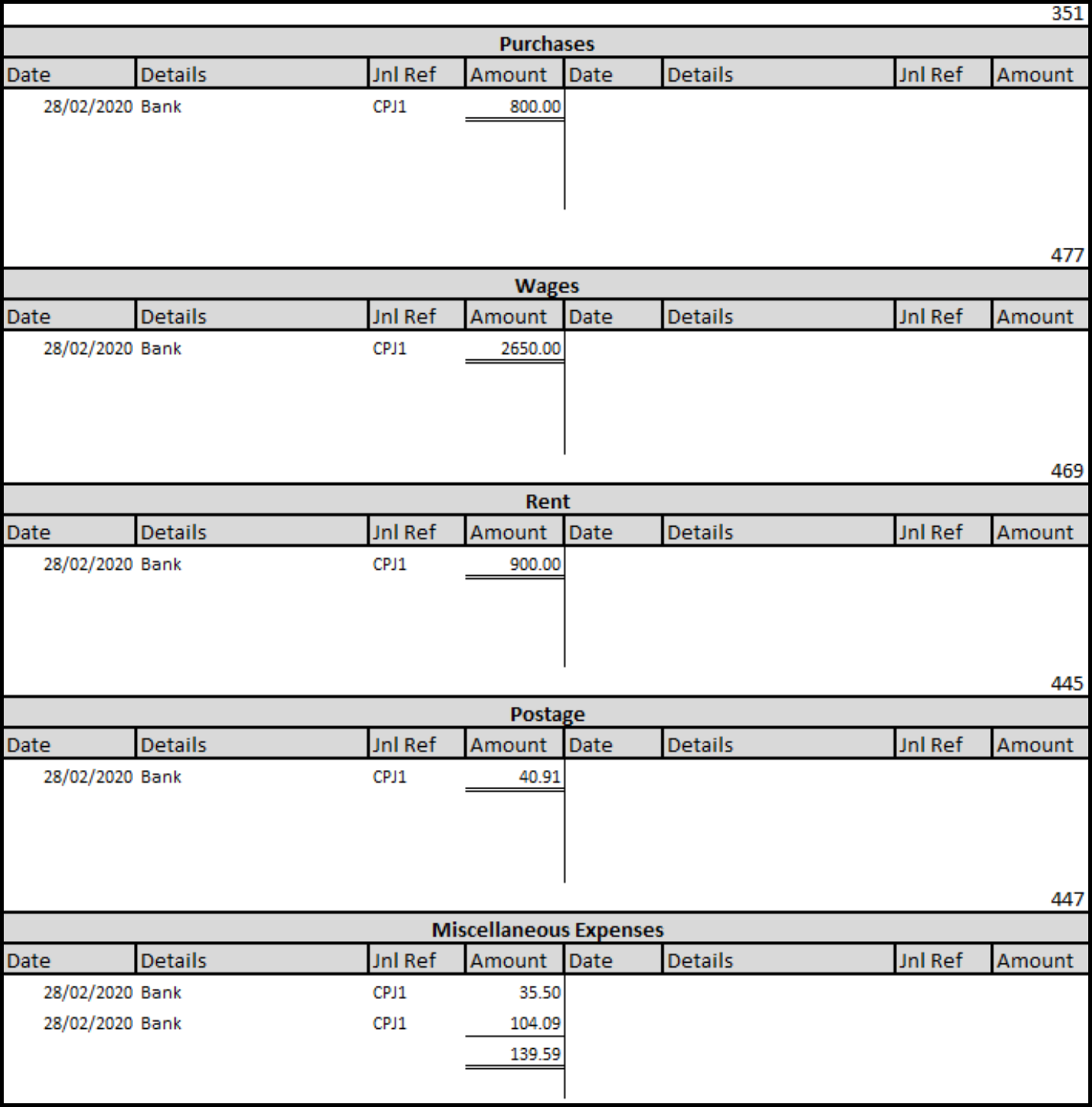

Cash Payments Journal- Bay Side Physio

The following two transactions can summarise the cash payments journal posting.

| Dr GST Input tax credit | $201.38 |

| Dr Purchases | $800.00 |

| Dr Creditors Control Account | $560.00 |

| Dr Wages | $2650.00 |

| Dr Rent | $900.00 |

| Dr Telephone | $168.77 |

| Dr Postage | $40.91 |

| Dr Miscellaneous Expense | $139.59 |

| Cr Bank | $5460.65 |

| Dr Debtors Control Account | $38.50 |

| Cr Discount Received | $35.00 |

| Cr GST Input tax credit | $3.50 |

Posting from the cash payments journal to the general ledger

- The last date show in the cash payments journal is used when posting to the ledger.

- The transactions in the sundries column are posted separately to the individual ledger accounts.

- The folio column in the cash payments journal is used to record the ledger account sundry items are posted to.

- The journal ref in the ledger is used to cross-reference the journal (CPJ1).

- The cash payments journal includes a discount received column. By using a discount received column, the cash payments journal can record the billed amount, the discount received, and the cash payment.

- Petty cash transactions are posted in the same way as other payments in the cash payments journal.

Balance general ledger accounts

To check that double-entry accounting principles have been followed and no addition or subtraction errors have been made, balance the general ledger accounts and prepare a trial balance.

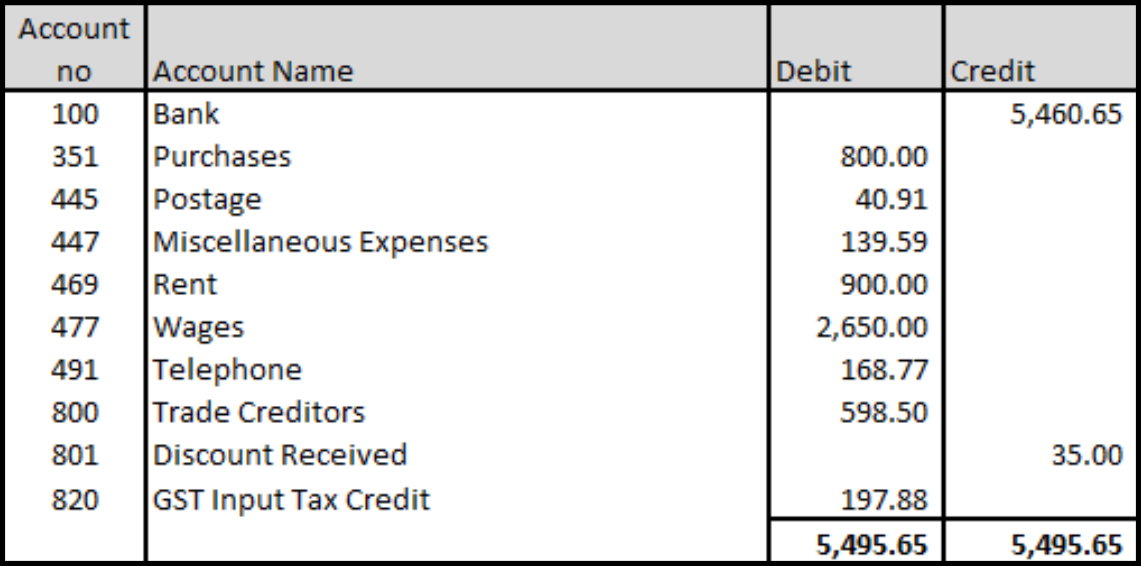

Bay Side Physio

Trial Balance as at 28/02/2020

Test your understanding

Using this excel workbook, record the following payments for Ken's Candy Shop

- Total the journals.

- Post to the general ledger.

- Generate a Trial Balance as at 28/02/2020.

| Ken's Candy Shop | ||

|---|---|---|

| Date | Details | Amount |

| 03/12/2020 | Purchased stock | $880 (GST incl) paid with cheque #100 |

| 05/12/2020 | Paid wages | $1500 via direct deposit |

| 15/12/2020 | Paid Insurance | $1100 (GST incl) via direct deposit |

| 16/12/2020 | Withdrew cash from the bank to reimbursed Petty Cash |

Postage $45.00 (GST Incl) Paper Bags $95.00 (GST incl) Sugar & Milk $35.50,/p> |

| 28/12/2020 | Paid computer repair | $125 (GST incl) via direct deposit |

| 28/12/2020 | Purchased stock | $1530 (+ GST) Paid with cheque #101 |

| 28/12/2020 | Paid Supplier – CFR Food Supplies | $1350 cheque #101 paid before due date and received a discount of $55.00. cheque # 102 |

Xero instructions

Suppose you have spent money from your bank account that does not relate to a bill, refund or expense claim transaction that is already entered in Xero. In that case, you can create a spend money transaction for the item directly from a bank account or bank feed and reconcile it to the general ledger.

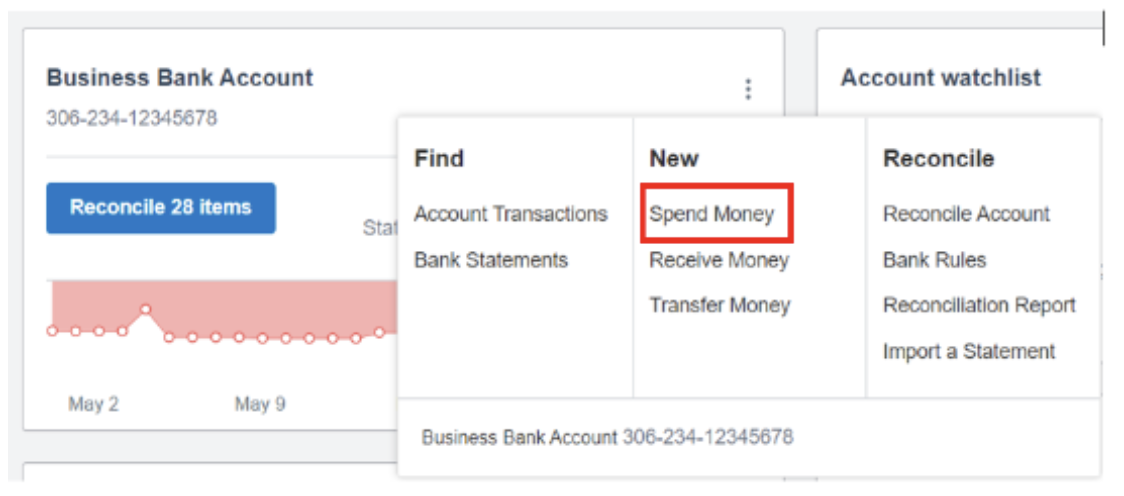

Create a spend money transaction from a bank account.

From the dashboard, select the bank account that you have made the payment from.

Click on the three dots in the right-hand corner and select spend money.

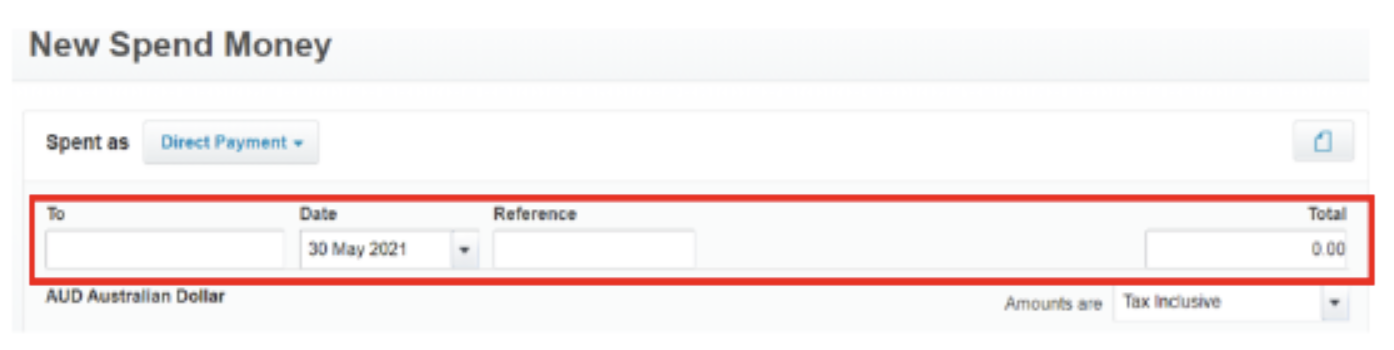

Complete the transaction details:

| Spend Money Fields | Information to be entered |

|---|---|

| To | Start typing to select an existing contact or to add a new one. |

| Date | Date money was paid |

| Reference | A reference can be added to help you search the payment |

| (Optional) Click the file icon to upload a copy of any relevant documentation. |

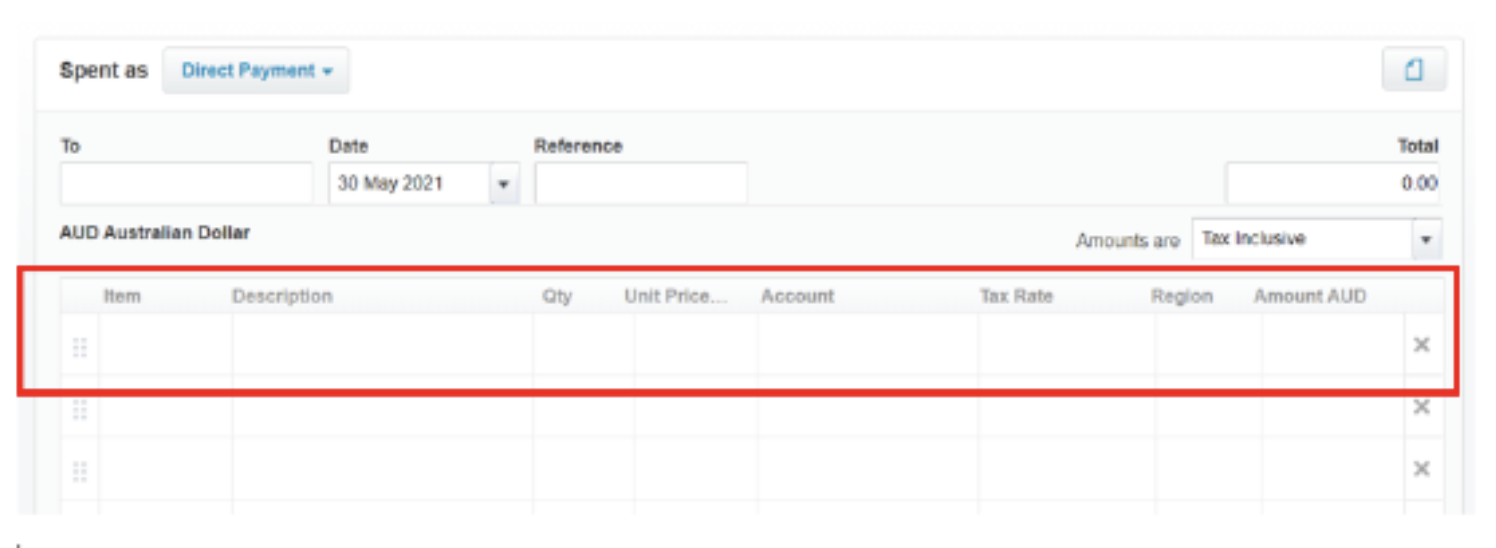

Enter information about the line item.

| Spend Money Fields | Information to be entered |

|---|---|

| Item | Optional - Select an existing item or add a new item. |

| Description | Description of the item that you have bought. |

| Quantity | The quantity of the items & you have bought. |

| Unit price | The price of the item. |

| Account | The account from the chart of accounts to code the item to |

| Tax Rate | The default tax rate for the account |

Click 'Save'.

Create a spend money transaction from a bank feed and reconcile to the general ledger.

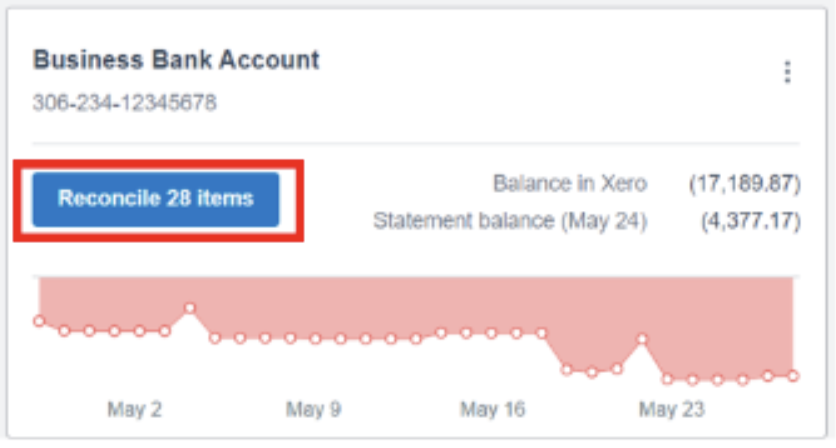

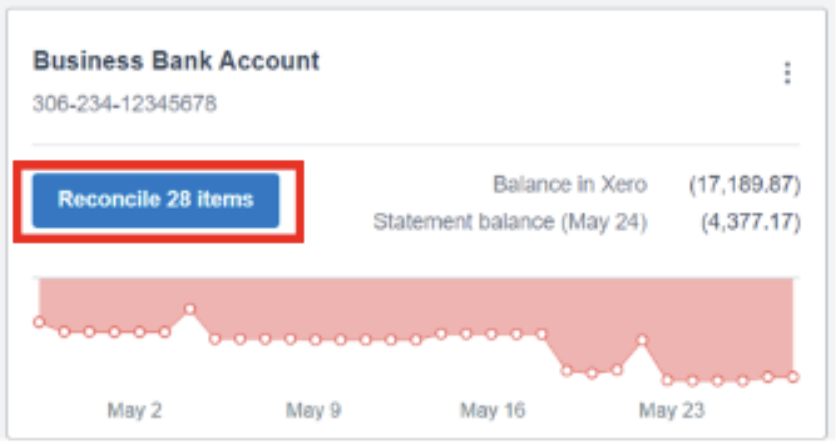

A bank reconciliation is the process to confirm that all the transactions in your bank accounts are recorded in your business accounting records. In Xero, this is done by selecting the 'Reconcile' button on the bank account panel on the dashboard. The 'Reconcile' button shows how many transactions on the bank statement are waiting to be reconciled. Transactions not in Xero can be recorded directly from the bank reconciliation as spend money transactions.

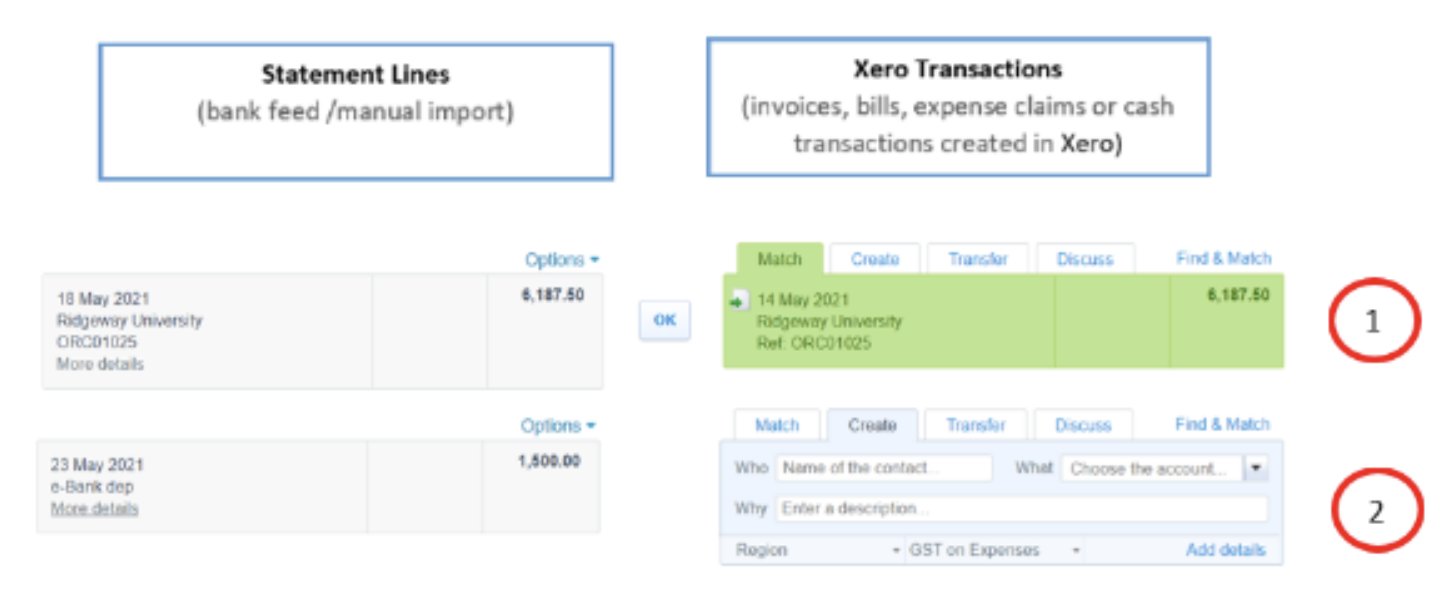

Select the bank account > Reconcile items

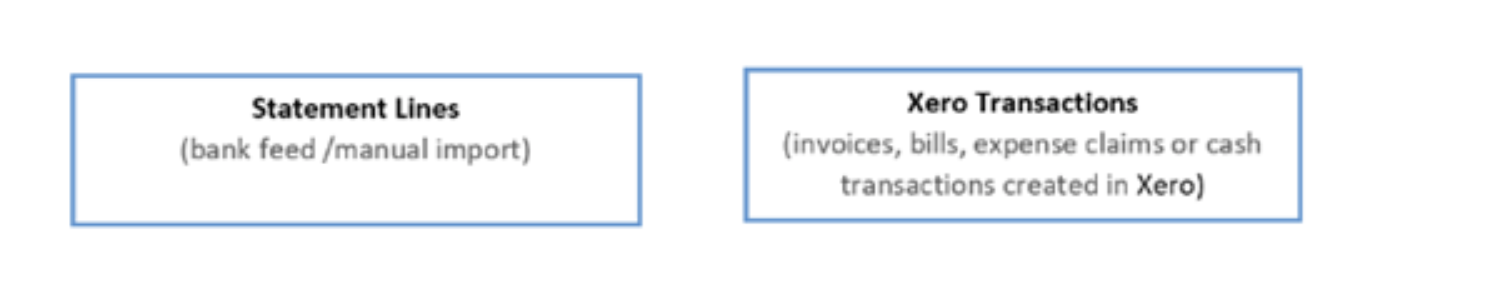

You will notice two columns of transactions.

The transactions in the left column are statement lines imported from your bank account via a bank feed or manually imported.

Statement lines with a debit amount are amounts that have been paid from the bank account.

Statement lines with a credit amount are amounts that have been received into the bank account

The transactions in the right column are transactions that have been created in Xero. These could be invoices, bills, expense claims or cash transactions.

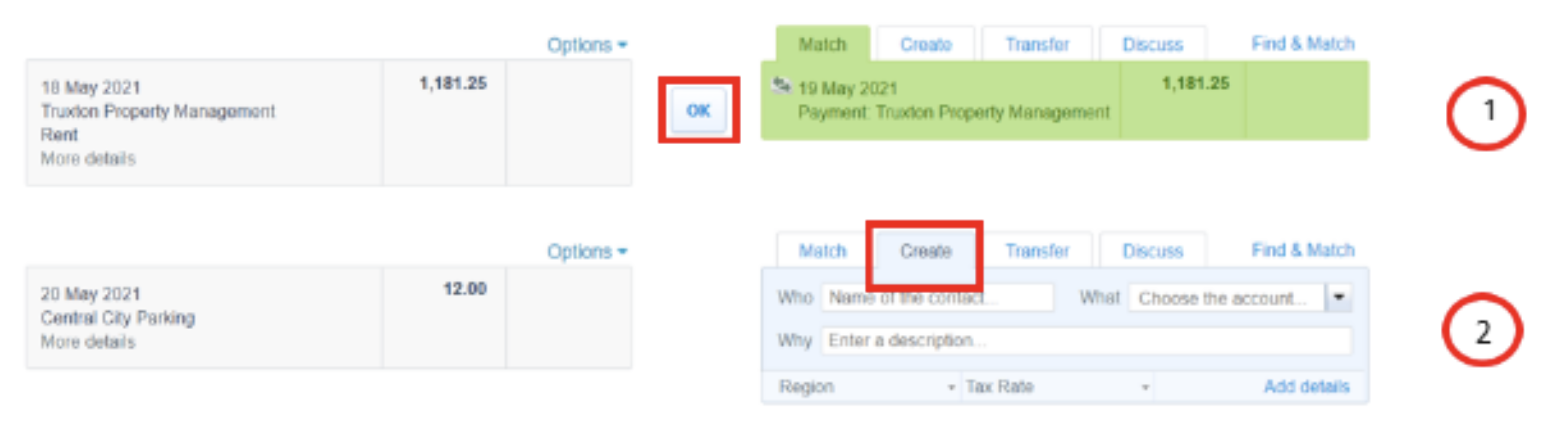

The bank reconciliation in Xero matches each statement line in the bank account to an existing transaction in Xero or create a transaction during the reconciliation process.

- Xero will automatically suggest transactions to match against statement lines. If the correct transaction is suggested, click 'OK'.

- When a transaction does not already exist in Xero that matches the bank statement line, you can create this transaction using the 'Create' tab. Enter:

- 'Who' - who the payment is to.

- 'Why' - description of the payment.

- 'What' - account from the chart of accounts to allocate the payment to.

- 'Tax Rate' - select the correct tax rate.

If you want to include more information about the transaction or attach a document, click 'Add details'. Click 'OK' once you have entered the details to reconcile the transaction.

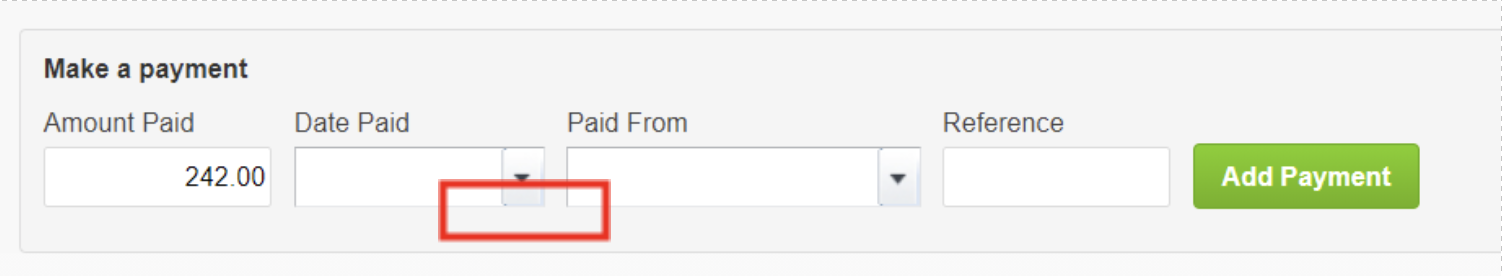

Apply a payment to a bill

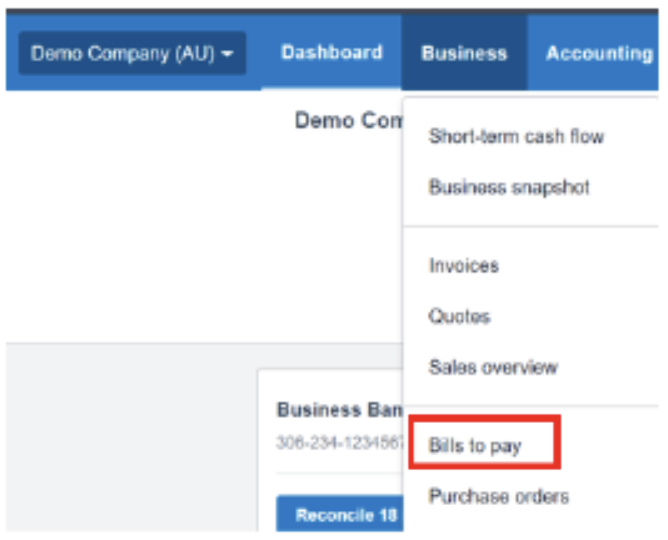

In the Business menu, select Bills to pay

Select the Awaiting Payment tab and open the bill you want to record a payment against.

Scroll down to Make a payment.

Complete the payment fields and click 'Add Payment'.

Once the bill is fully paid, it moves to the 'Paid' tab. If you've recorded a part payment, only the bill stays in 'Awaiting Payment' until it is fully paid.

Test your understanding

Access your Xero Course.

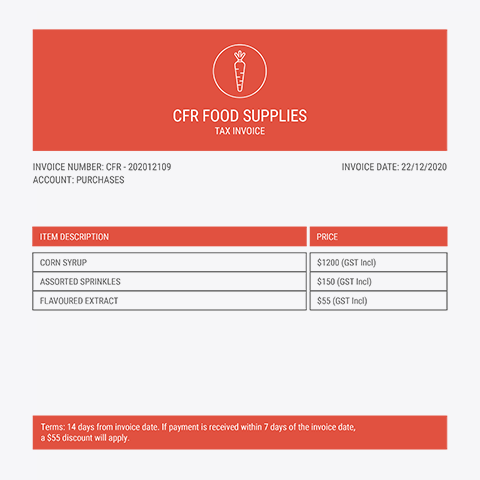

Create a New Bill for CFR Food Supplies. The details of the bill are:

Create a credit note (CNCFR 202012109) dated 28/12/2020 for the early payment discount and apply it to the bill.

(check your bill against the model answer in the excel workbook)

Create the following 2 bank accounts:

| Bank | Commonwealth Bank |

| Account Name | Business Bank Account |

| Account Type | Every day(day-to-day) |

| BSB | 111-111 |

| Account Number | 123456789 |

| Bank | Petty Cash |

| Account Name | Petty Cash |

| Account Type | Other |

| BSB | 111-111 |

| Account Number | 11111111 |

Set up a general ledger expense account (422) for Insurance.

Record the following payments from the Business Bank Account of Ken's Candy Shop.

Consider if they are to be spend money transactions or bill payments.

Generate a trial balance as at 31/12/2020.

| Ken's Candy Shop | ||

|---|---|---|

| Date | Details | Amount |

| 03/12/2020 | Purchased stock from B Grey. | $880 (GST incl) paid with cheque #100 |

| 05/12/2020 | Paid wages | $1500 via direct deposit |

| 15/12/2020 | Paid Insurance | $1100 (GST incl) via direct deposit |

| 16/12/2020 | Withdrew cash from the bank to reimbursed Petty Cash |

Postage $45.00 (GST Incl) Paper Bags $95.00 (GST incl) Sugar & Milk $35.50 |

| 28/12/2020 | Paid computer repair (The Computer Man) | $125 (GST incl) via direct deposit |

| 28/12/2020 | Purchased stock from C White. | $1530 (+ GST) Paid with cheque #101 |

| 28/12/2020 | Paid Supplier – CFR Food Supplies | $1350 cheque #101 paid before due date and received a discount of $55.00. cheque #102 |

Xero instructions

The cash receipts journal is used to record all cash coming into the business. Receipts of cash are usually divided into:

- Receipt of cash from cash sales.

- Receipt of cash from credit customers or receivables.

- Receipt of cash from other sources.

Recording transactions in the cash receipts journal:

- Written receipts, cheques, cash register rolls and point of sale system receipts are all source document for the cash receipts journal.

- The cash receipts journal has separate columns to record regular receipts, e.g. debtors, GST payable and sales.

- A sundries column is used to record all other receipts.

- Discount allowed to customers is recorded in a separate column, as is the amount of any GST adjustment.

- Transactions are recorded in date order.

- In the detail's column for:

- a receipt issued to a debtor, use the debtor's name.

- cash sales, use sales.

- sundry receipts, use the name of the ledger account that the payment is to be posted.

- The receipt column lists the receipt numbers in numerical order.

- Discount allowed is not a receipt of cash and therefore will not appear in the bank column.

- GST adjustment for discount allowed also will not appear in the bank column.

- GST payable is included in the bank column.

- The bank column is used to record the total amount banked each day/week, depending on the frequency of banking.

- At the end of a period, a line is drawn under the GST Adjustment, Discount Allowed, Debtors, Sales, GST payable, Sundries and Bank columns. The columns are totalled, and a double line is drawn.

- Under the total column, the account number the total has been posted to is recorded

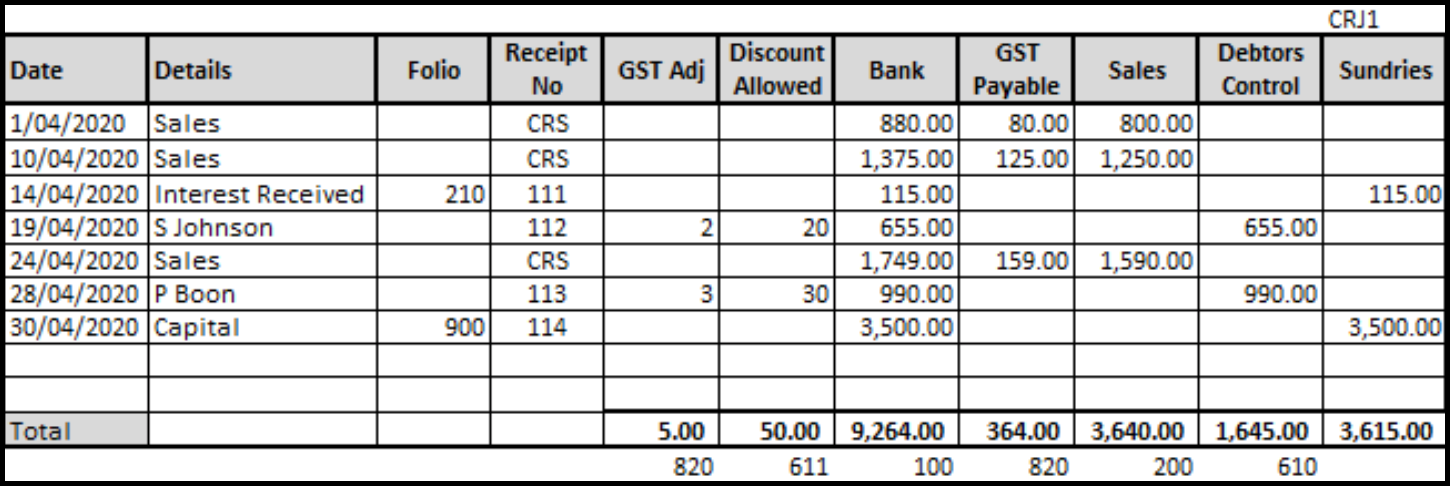

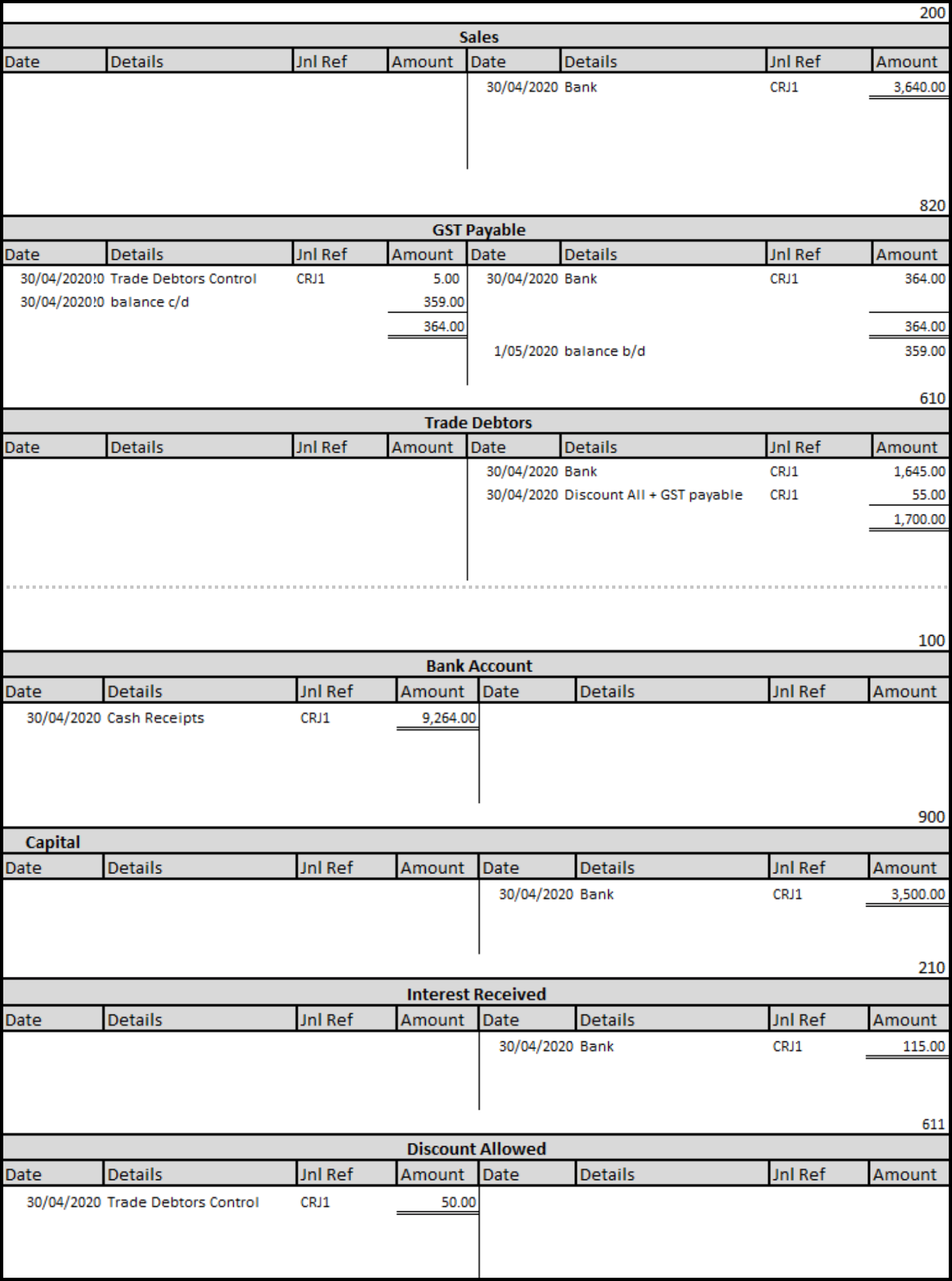

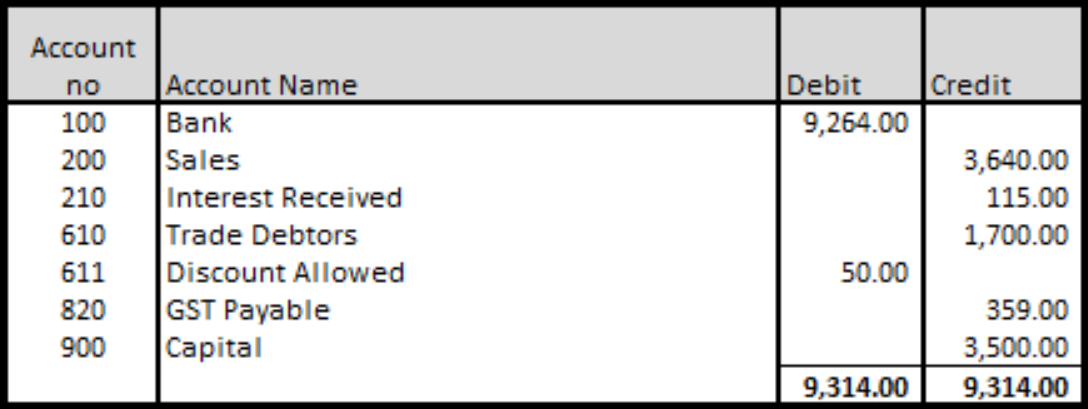

Cash Receipts Journal- Magical Materials

The following two transactions can summarise the cash receipts journal posting.

| Dr Bank | $9264.00 |

| Cr GST Payable | $364.00 |

| Cr Sales | $3640.00 |

| Cr Debtors Control Account | $1645.00 |

| Cr Interest Received | $115.00 |

| Cr Capital | $3500.00 |

| Dr Discount Allowed | $50.00 |

| Dr GST Payable | $5.00 |

| Cr Debtors Control Account | $55.00 |

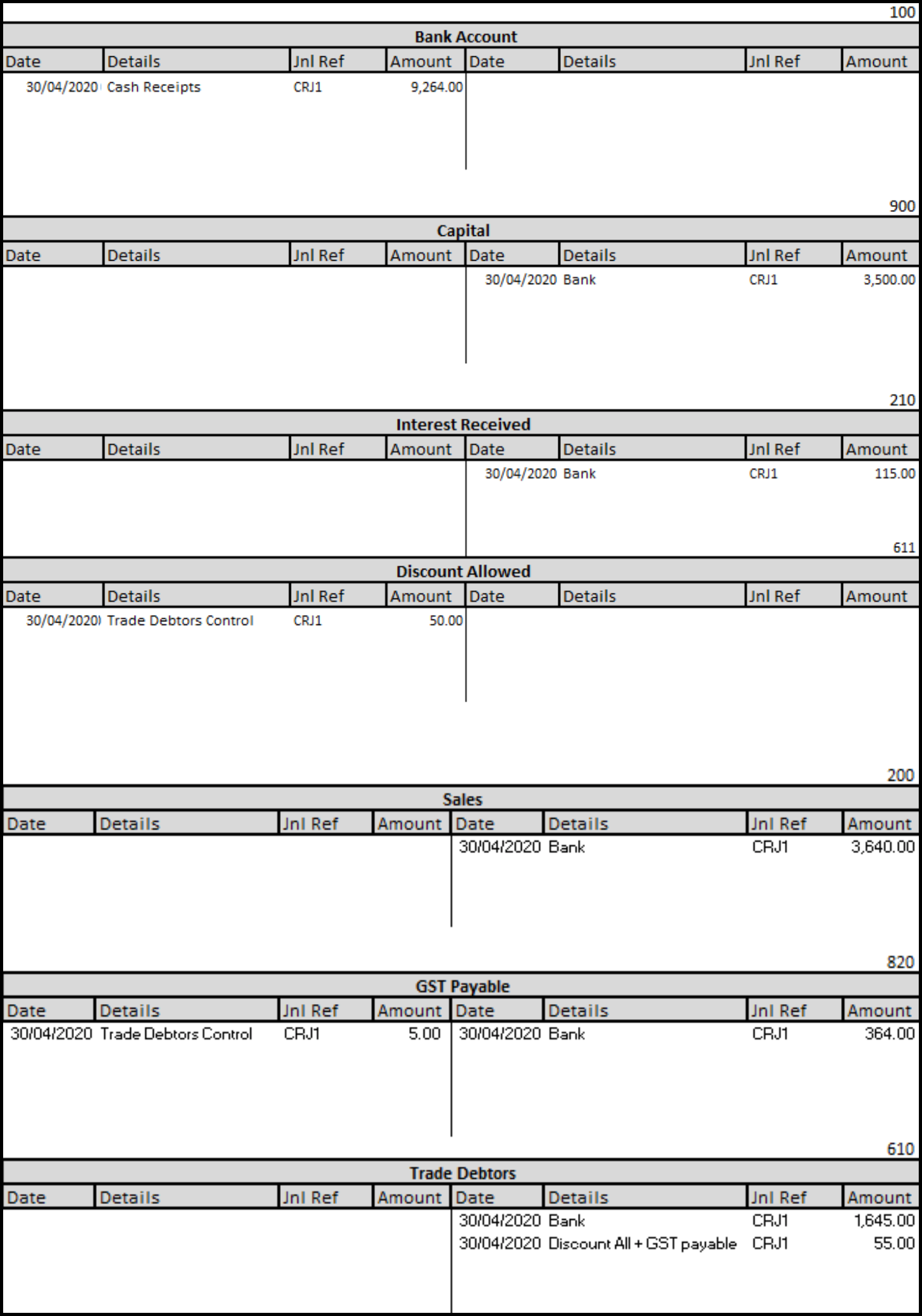

Posting from the cash receipts journal to the general ledger.

- The last date show in the cash receipts journal is used when posting to the ledger.

- The transactions in the sundries column are posted separately to the individual ledger accounts.

- The folio column in the cash receipts journal is used to record the ledger account sundry items are posted to.

- The journal ref in the ledger is used to cross-reference the journal (CRJ1).

- The cash receipts journal includes a discount allowed column. By using a discount allowed column, the cash receipts journal can be used to record the invoiced amount, the discount allowed, and the cash receipt.

Balance general ledger accounts

To check that double entry accounting principles have been followed and no addition or subtraction errors have been made, balance the general ledger accounts and prepare a trial balance.

Magical Materials

Trial Balance as at 30/04/2020

Test your understanding

Using this excel workbook, record the following receipts for Greg's Golf Shop

- Add 10% GST to all cash sales.

- Total the journals.

- Post to the general ledger.

- Generate a Trial Balance as at 28/02/2020.

| Greg's Golf Shop | ||

|---|---|---|

| Date | Details | Amount |

| 01/02/2020 | Cash Sales | $700 |

| 18/02/2020 | Cash Sales | $1500 |

| 19/02/2020 | Interest received on investment. | $145 (Receipt 012) |

| 24/02/2020 | Greg Green invested cash into his business. | $3500 (Receipt 013) |

| 26/02/2020 | APX social club paid amount due | $795 (Receipt 014) less discount of $33 |

| 28/02/2020 | Cash Sales | $1200 |

Xero instructions

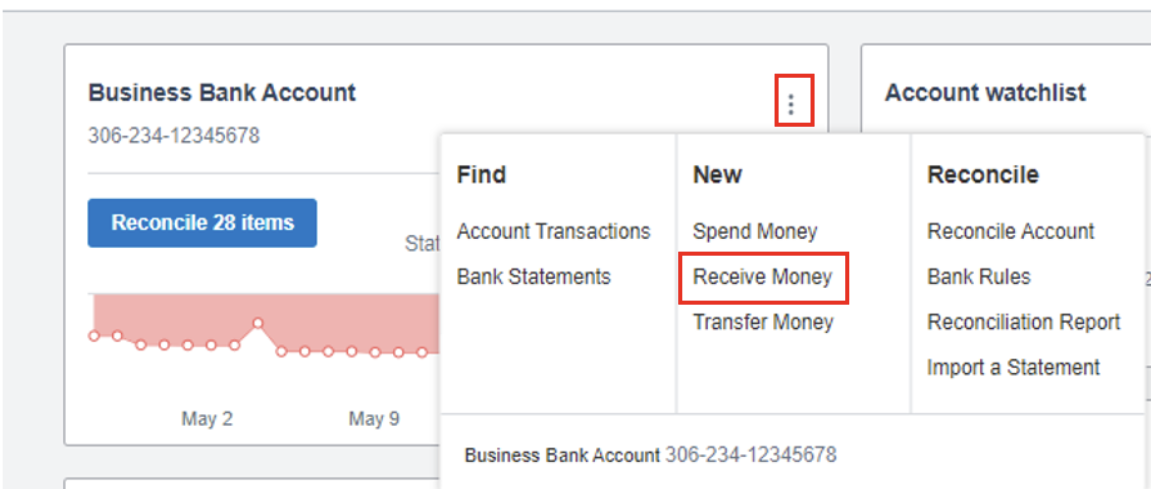

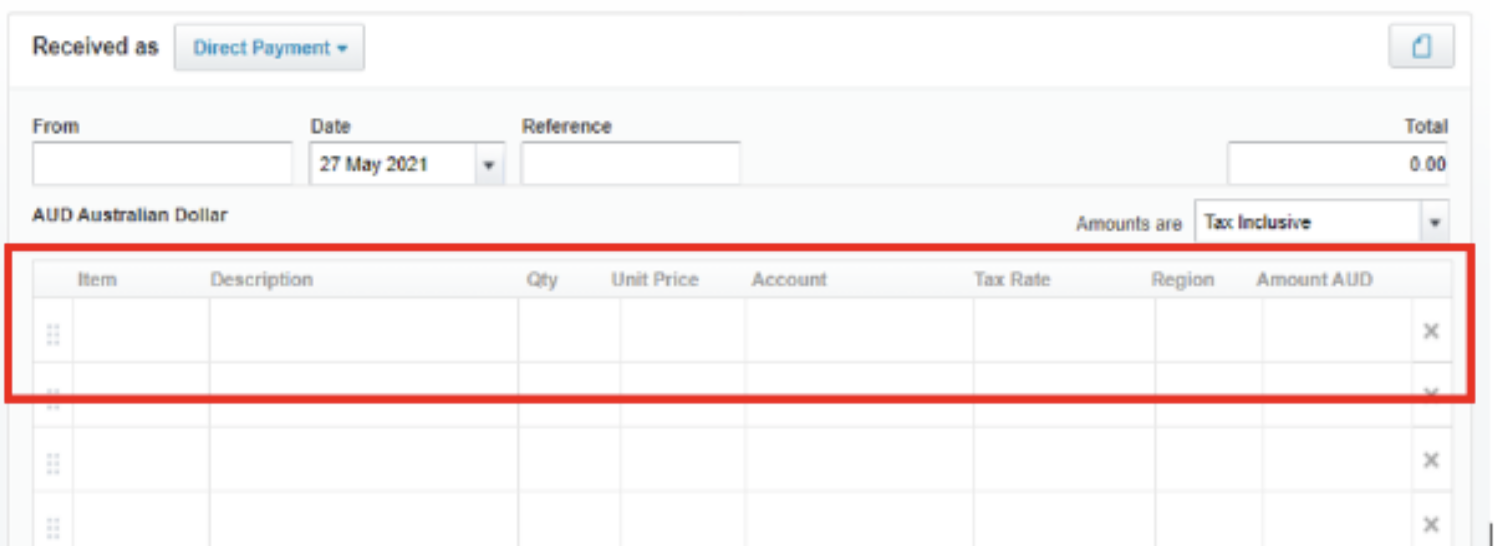

Suppose you received money in your bank account that does not relate to an invoice, refund or transfer transaction that is already set up in Xero. In that case, you can create a receive money transaction for the item directly from a bank account or bank feed and reconcile it to the general ledger.

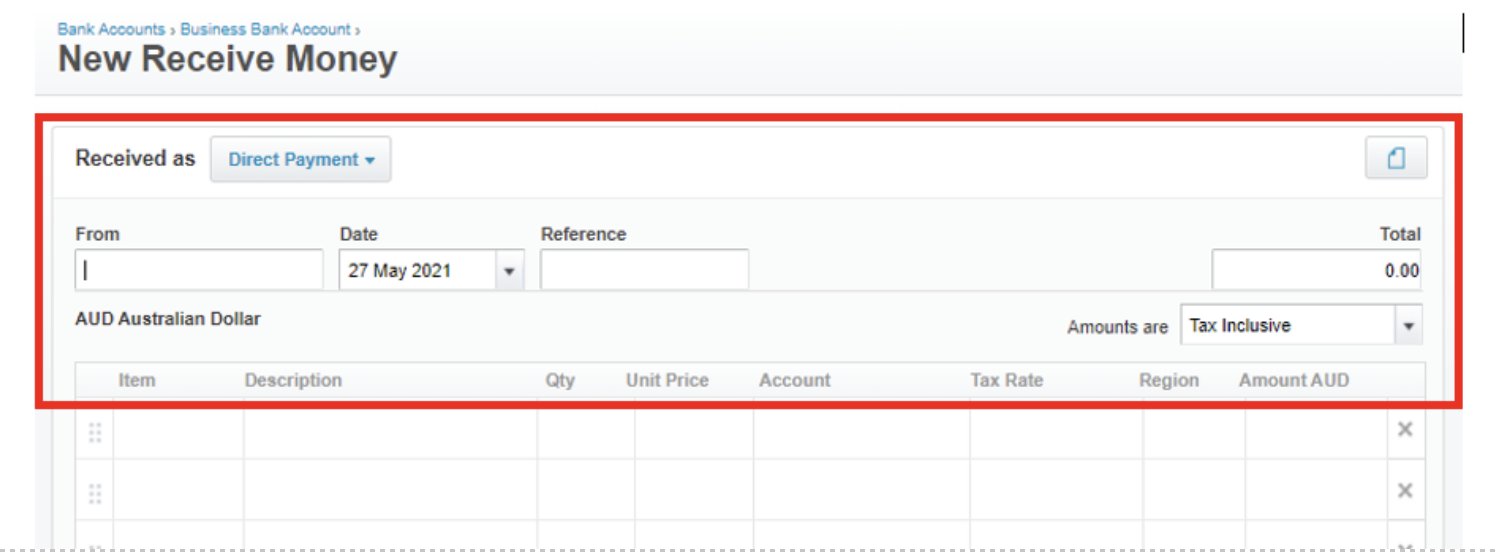

Create a receive money transaction from a bank account.

From the dashboard, select the bank account that you have received the money into.

Click on the three dots in the right-hand corner and select receive money.

Complete the transaction details:

| Receive Money Fields | Information to be entered |

|---|---|

| From | Start typing to select an existing contact or to add a new one. |

| Date | Date money was received. |

| Reference | A reference can be added to help you search the payment. |

| (Optional) Click the file icon to upload a copy of any relevant documentation. |

Enter information about the line item.

| Receive Money Fields | Information to be entered |

|---|---|

| Item | Optional - Select an existing item or add a new item. |

| Description | Description of the item that you have purchased. |

| Quantity | The quantity of the item you have bought. |

| Unit price | The price of the item. |

| Account | The account from the chart of accounts to code the item to. |

| Tax Rate | The default tax rate for the account. |

Click 'Save'.

Create a receive money transaction from a bank feed and reconcile to the general ledger.

A bank reconciliation is the process to confirm that all the transactions in your bank accounts are recorded in your business accounting records. In Xero, this is done by selecting the 'Reconcile' button on the bank account panel on the dashboard. The 'Reconcile' button shows how many transactions on the bank statement are waiting to be reconciled. Transactions not in Xero can be recorded directly from the bank reconciliation as receive money transactions.

Select the bank account > Reconcile items

You will notice two columns of transactions.

The transactions in the left column are statement lines imported from your bank account via a bank feed or manually imported.

Statement lines with a debit amount are amounts that have been paid from the bank account. Statement lines with a credit amount are amounts that have been received into the bank account.

The transactions in the right column are transactions that have been created in Xero. These could be invoices, bills, expense claims or cash transactions.

The bank reconciliation in Xero matches each statement line in the bank account to an existing transaction in Xero or create a transaction during the reconciliation process.

- Xero will automatically suggest transactions to match against statement lines. If the correct transaction is suggested, click 'OK'.

- When a transaction does not already exist in Xero that matches the bank statement line, you can create this transaction using the 'Create' tab. Enter:

- 'Who' - who the payment is from

- 'Why' - description of the payment

- 'What' - account from the chart of accounts to allocate the payment to.

- 'Tax Rate' - select the correct tax rate.

If you want to include more information about the transaction or attach a document, click 'Add details'. Click 'OK' once you have entered the details to reconcile the transaction.

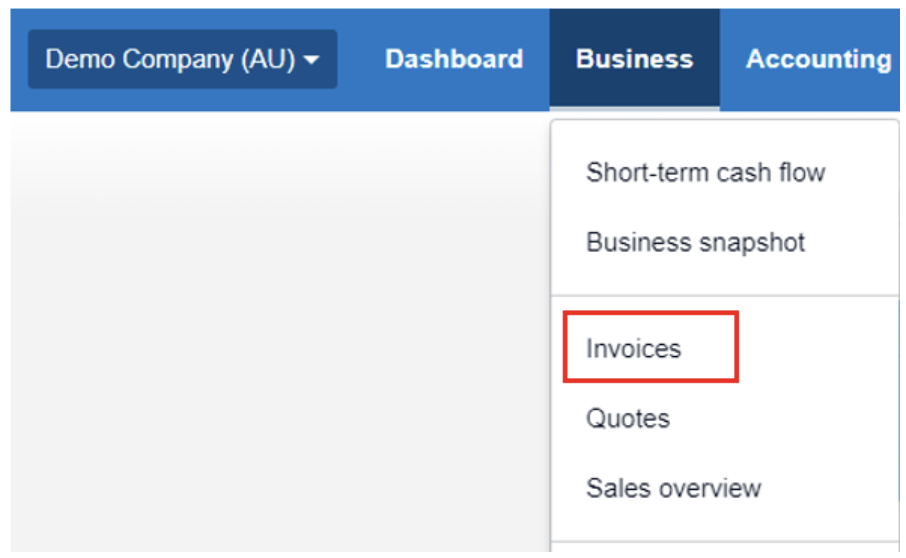

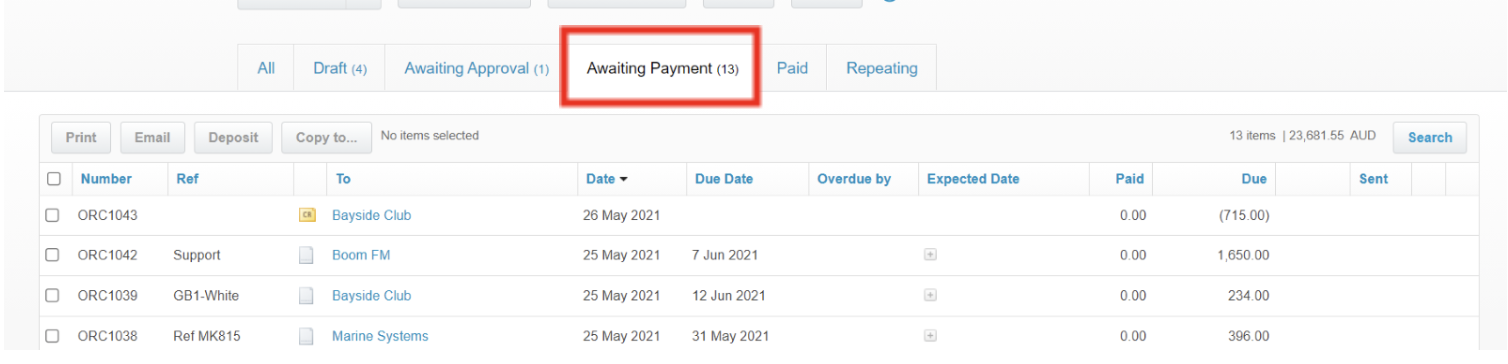

Record a payment against an outstanding customer invoice

In the Business menu, select Invoices > Awaiting Payment

Locate the invoice that you want to record a payment against.

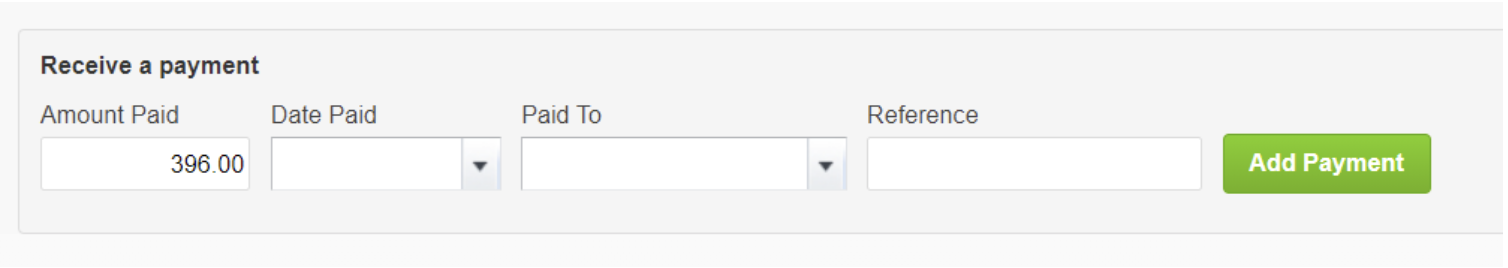

Open the invoice and scroll down to 'Receive a payment'.

Complete the payment fields and click 'Add Payment'.

Once the invoice is fully paid, it moves to the 'Paid' tab. If an invoice still has an outstanding amount due, it stays in 'Awaiting Payment' until it is fully paid.

Test your understanding

Access your Xero course.

Access your Xero course.

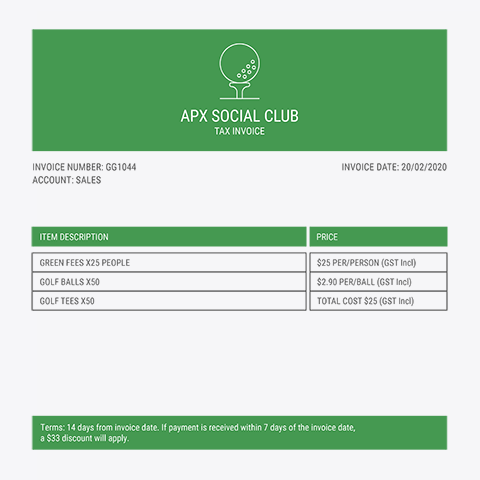

Create an invoice for APX social club. The details of the invoice are:

Create a credit note for the early payment discount and apply it to the invoice.

(Check your invoice against the model answer in the excel workbook)

Create a business bank account. The details are:

| Bank | Commonwealth Bank |

| Account Name | Business Bank Account |

| Account Type | Everyday (day-to-day) |

| BSB 111-111 | 111-111 |

| Account Number | 123456789 |

Record the following receipts for Greg's Golf Shop in the Business Bank Account.

Consider if they are to be receipted as receive money transactions or payment for an outstanding invoice.

- Add 10% GST to all cash sales.

- Check the tax rate on all transactions and recode if required.

- Generate a Trial Balance as at 28/02/2020.

| Greg's Golf Shop | ||

|---|---|---|

| Date | Details | Amount |

| 01/02/2020 | Cash Sales | $700 |

| 18/02/2020 | Cash Sales | $1500 |

| 19/02/2020 | Dividend received from investment. | $145 (Receipt 012)(BAS Excluded) |

| 24/02/2020 | Greg Green invested cash into his business. | $3500 (Receipt 013) |

| 26/02/2020 | APX Social Club paid amount due. | $795 (Receipt 014) less discount of $33 |

| 28/02/2020 | Cash Sales | $1200 |

Compare your trial balance with the model answer in excel.