Accounting principles are rules and guidelines that businesses must follow when reporting financial data. They are designed to ensure a business's financial reports are complete, consistent and comparable.

These principles, which serve as the rules for accounting for financial transactions and preparing financial statements, are known as the Generally Accepted Accounting Principles (GAAP). By Applying these rules, accountants ensure financial statements are reliable and informative for stakeholders.

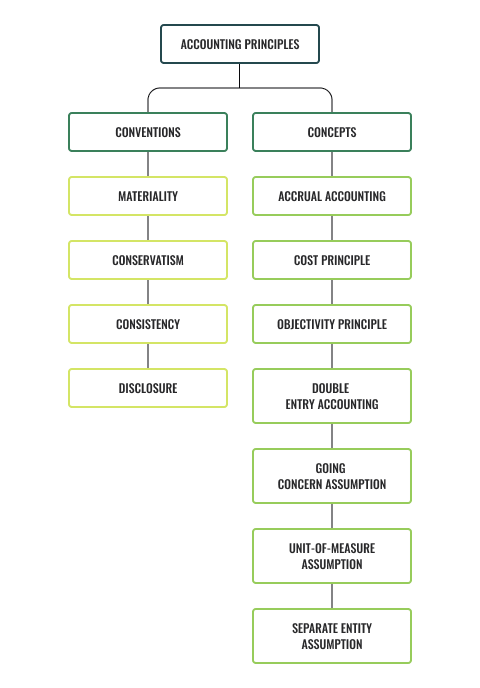

Accounting principles include accounting concepts and accounting conventions.

Accounting concepts refer to the rules of accounting which are to be followed while recording business transactions and preparing final accounts. Some of the most fundamental accounting concepts are:

- Accrual accounting: Recording revenue (when a sale is made regardless of when collected) and recording expenses (irrespective of when paid). The key principles of accrual accounting are the:

- Revenue principle: States that revenue is earned when the sale is made. This is typically when goods or services are provided.

- Expense principle: States that an expense occurs when the business uses goods or receives services.

- Matching principle: States that when revenue is recognised, related expenses should be paired with it. This means that expenses are only reported during the period in which the revenue was made to ensure that the profit reported accurately reflects the business's performance in that period.

- Double-entry accounting: There are always two (2) entries for every transaction. When recording transactions for every credit, a corresponding debit is made.

- Going concern assumption: Also known as continuity assumption, states that accounting systems assume that a business will continue to operate.

- Cost principle: States that amounts in the accounting system should be quantified or measured by using historical cost.

- Objectivity principle: States that accounting measurements and accounting reports should use objective, factual and verifiable data.

- Unit-of-measure assumption: Assumes that a business's domestic currency is the appropriate measure for the business to use in its accounting.

- Separate entity assumption: States that a business and its owner should be treated separately as far as their financial transactions are concerned.

Accounting conventions are practices that are widely accepted and adopted as a guide in the preparation of final accounts.

The basic accounting conventions are:

- Consistency: This convention requires accounting methods to be consistently applied from one period to the next.

- Disclosure: This convention requires a financial statement to be prepared in such a way that they disclose all the material information to users, so users can make a rational decision.

- Conservatism: This convention states that a business should not anticipate income and gains but provide for all expenses and losses.

- Materiality: This convention states all significant items must be reported in accounting reports. This allows for immaterial amounts to be omitted.