Taxation

Taxation is the process of imposing contributions for the purpose of raising funds needed in operationalising government plans. There is a tax imposed on almost every transaction that involves earnings and gains.

The most common types of taxes that businesses have to deal with are the following:

| Type of Tax | Overview |

| Income Tax | The tax imposed on assessable income and capital gains |

| Goods and Services Tax (GST) | The tax imposed on the sale of GST supplies |

| Fringe Benefits Tax (FBT) | The tax imposed on the fringe benefits provided by the employers to their employees |

| Payroll Tax | The tax imposed on the salaries and wages paid by the employers to their employees |

The three main obligations of businesses for each type of tax are to:

- maintain business records

- report taxes

- pay taxes due

Income tax

Income tax is the tax imposed on the income generated by individuals and businesses. The burden of this tax is imposable upon whoever earned the income. Income taxation in Australia is governed by the following legislation:

- Income Tax Assessment Act 1997

- Income Tax Assessment Act 1997

- Taxation Administration Act 1953

The table below presents the difference in tax treatment among the following business structures:

|

Business Structure |

Tax Treatment |

|

Sole Trader |

The owner is taxed as an individual taxpayer; thus, the owner should report all his business income to his individual income tax return and shall be taxed at the individual tax rate. |

|

Partnership |

Each partner is taxed as an individual, and thus each partner should report their share from the net income of the partnership to their individual income tax return. |

|

IMPORTANT: Although partnerships are not taxed as a separate legal entity, they are nevertheless required to report their total distributable income in the Partnership Tax Return. |

|

|

Company |

Construction businesses that operate as a company are taxed as a separate legal entity and are taxed at either 30% or 27.5%. Companies shall report their assessable income in the Company Tax Return. |

Capital gains tax

Capital gains

A capital gain can be described as the financial gain made either from sale or disposal of assets such as land, buildings, residences, businesses or securities at a price higher than its historical value. Under s102.20 of the ITAA97, a capital gain or loss only arises if a CGT event occurs. It should be further noted that CGT events only involve CGT assets. The different types of CGT assets may be found in Section 108 of the ITAA97. Some examples of CGT assets include:

- Goodwill

- Foreign currency

- Shares

- Collectables

Capital loss

A capital loss may be written off against other capital gains in the same year of income however if no capital gain occurs in that same year, the loss is carried forward and is offset against a future capital gain. A capital loss that arises on the disposal of a collectable asset can only be offset against a capital gain arising from the disposal of another collectable asset.

Net capital gain

A taxpayer’s assessable income includes any net capital gain for the income year. A net capital gain is the total of the difference between the taxpayer’s capital gains and capital losses.

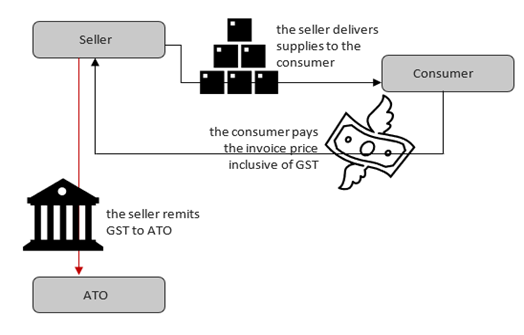

Goods and services tax

Goods and Services Tax (GST) is the tax imposed upon the goods and services offered by a business. Here are some of the important things to remember about GST.

- GST is governed by the Goods and Services Tax Act 1999

- Currently, the GST rate for goods and services is at 10%.

- The burden of GST is ultimately borne by the final consumer, and the seller is the one to charge and collect GST for those supplies that are taxable.

Registration for GST

The business will be required to register for GST if either of the business’s current GST turnover or projected GST turnover amounts to $75,000 or more. Turnover is equal to the total gross income but excluding:

- GST included in the sales

- Input Taxed Sales

- Sales that are not made for consideration

- Sales not connected with the business

- Sales not connected with Australia

Current GST turnover is the turnover for this month plus the turnover for the past 11 months. Projected GST turnover, on the other hand, is the turnover for this month plus the turnover for the following 11 months.

Input-Taxed Supplies and GST-Free Supplies

Here are some of the important things to know about input-taxed supplies and GST-free supplies:

- Input-taxed supplies are not subject to GST. (Part 3-1 Division 40 of the GST Act sets out what supplies are considered as Input Taxed Supplies.)

- No GST can be imposed upon GST free supplies; however, their related input tax credits are nevertheless claimable. (Part 3-1 Division 38 of the Act sets out what supplies are considered as GST free supplies.)

The Amount of GST to Remit

The amount that a business would remit for GST can be calculated by deducting the total amount of input tax credits from the total amount of GST charged. Input tax credits, however, may only be claimed if related to creditable acquisitions and creditable importations.

Fringe benefits tax

Fringe Benefits Tax is the tax imposed on fringe benefits. The burden of this tax shall be borne by the employer. Fringe benefits are benefits granted by an employer in respect of the employees’ employment to the business, in addition to their basic salaries, which may either be in cash or in kind. Here are some other basic points to remember about GST

- The Fringe Benefits Tax is governed by the following legislation:

- Fringe Benefits Tax Assessment Act 1986

- Fringe Benefits Tax Act 1986

- Fringe Benefits Tax (Application to the Commonwealth) Act 19

- The FBT rate as of 2021 FBT year is 47%.

- FBT year is from 1 April to 31 March.

- You report all the items relevant to the assessment of FBT in the Fringe Benefits Tax return. The business will have to lodge a Notice of Non-Lodgement if the business, registered for FBT, does not have assessable fringe benefits to report for the current FBT year

Types of fringe benefits

The following are the different types of fringe benefits:

- Car fringe benefits

- Car parking fringe benefits

- Entertainment-related fringe benefit

- Expense payment fringe benefit

- Debt waiver fringe benefit

- Loan fringe benefit

- House fringe benefit

- Board fringe benefit

- Living away from home allowance

- Property fringe benefits

- Residual fringe benefits

Registration for fringe benefits

Employers must be registered for fringe benefits tax (FBT) if they have assessable FBT during the FBT year. Employers can register through the following:

- Through Australian Government Business Registration

- By phoning ATO

- Acquiring help from a registered tax agent

- Through paper form

- By lodging an annual FBT return

FBT payable

FBT payable can be calculated by multiplying the total grossed-up value of all fringe benefits provided by the current FBT rate. Here is how to calculate the grossed-up value of the following:

- Fringe benefits from which input tax credits can be claimed: the taxable value of the fringe benefit is multiplied by the type one gross-up rate

- Fringe benefits from which input tax credits cannot be claimed: the taxable value of the fringe benefit is multiplied by the type two gross-up rate

IMPORTANT: The computation for the taxable value of the fringe benefit shall vary depending on what type the fringe benefit is.

Grossed up value

Businesses who provide fringe benefit with a taxable value of $2,000 or more should report its gross-up taxable value on the employee’s payroll summary or through the Single Touch Payroll. The grossed-up value of the fringe benefit which must be reported in the employee’s payroll summary shall be computed by multiplying the taxable value of the fringe benefit by the type 2 gross-up rate (The type 2 gross-up rate as of 2021 is 1.8868).

Differentiating a contractor from an employee

Differentiating a contractor from an employee is important for FBT purposes because said benefits cannot be considered as fringe benefits for FBT purposes if such were provided to contractors.

Payroll tax

Here are some of the important things to remember about payroll tax:

- Payroll tax is the tax imposed on wages paid or payable by an employer to its employees.

- Payroll tax is imposable upon employers.

- It is described as a self-assessed tax which means that the taxpayers (the employers) themselves determine the amount of their tax obligation.

- It is a state and territory tax.

- Businesses who go beyond the payroll tax threshold in their state or territory shall register for payroll tax.

To know more about the administration of payroll tax in each state or territory, access the links below:

|

State/Territory |

Webpage title and link |

|

Australian Capital Territory |

|

|

New South Wales |

|

|

Northern Territory |

Northern Territory Government, Department of Treasury and Finance - Payroll tax |

|

Queensland |

Queensland Treasury: Budget and Financial Management - Revenue and Taxation |

|

South Australia |

|

|

Tasmania |

|

|

Victoria |

|

|

Western Australia |

Lodgement of tax returns and other reports

Tax returns

One of the most important tax obligations of your organisation is to be able to lodge tax returns on time. A tax return is a type of document where you report all items relevant to the related tax assessment. Your tax reporting requirements for each type of tax are listed below:

|

Type of Tax |

Tax Return |

|

Income Tax |

|

|

Fringe Benefits Tax |

Fringe Benefits Tax Return |

|

Payroll Tax |

Payroll Tax Return |

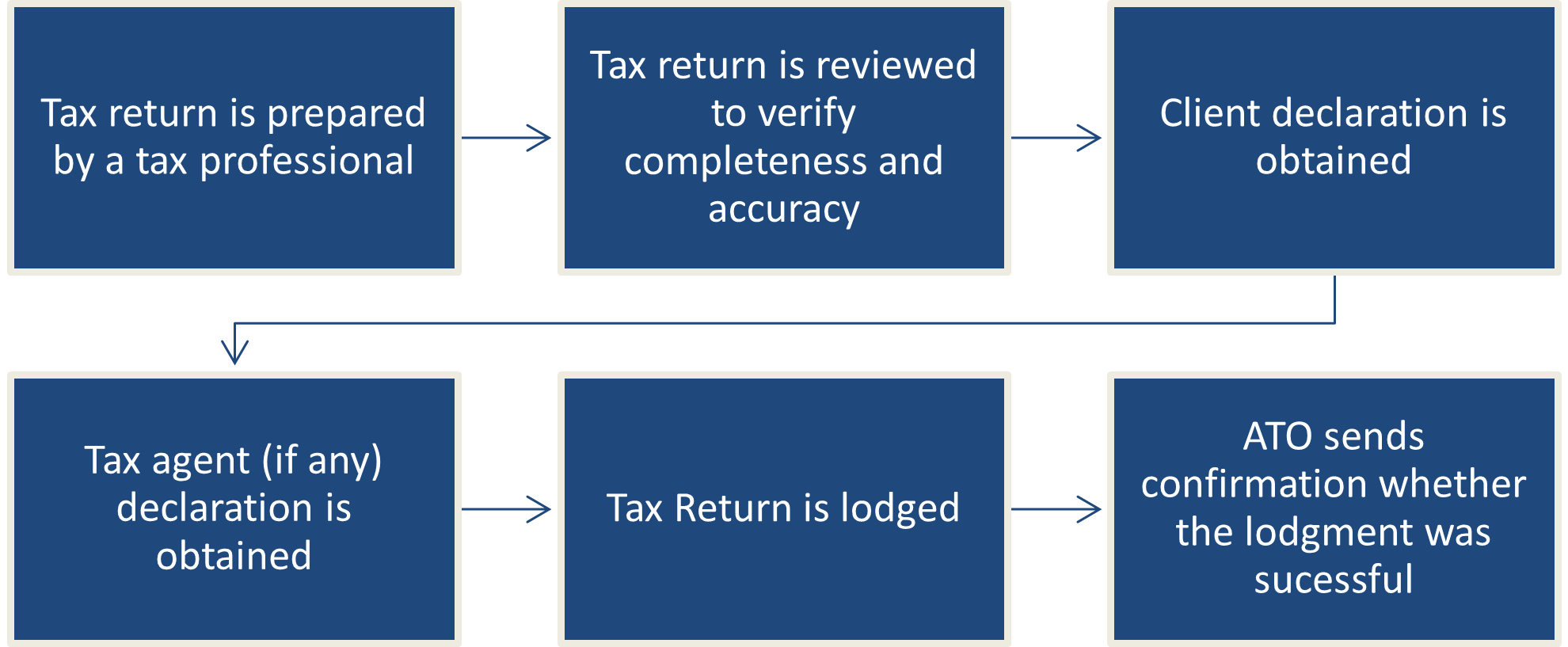

The normal workflow for the lodgement of tax returns is presented below:

Once the lodgement is completed, a notice of assessment (NOA) will be sent to the business to provide details on the assessment (e.g., refund, errors, amount of tax to pay).

How to lodge tax returns

Here are four ways of how you can lodge tax returns:

- You may lodge on your own with myTax. If the business is operating as a sole trader, the sole trader may lodge its income tax return through MyTax. MyTax is a web-based application designed to help individuals in their tax compliance processes with ATO, and that includes the lodgement of tax returns. However, do remember that to be able to lodge through MyTax, you will need to have a MyGov account linked to the ATO. Here are the basic steps of how you can lodge tax returns through MyTax:

- Access MyTax and log in your MyGov account.

- Prepare the return. MyTax lays out several guide questions to help you fill out the information required in return. Ensure that the information reported in the tax return is complete and correct by letting a registered tax agent prepare it for you.

- Secure the necessary declarations. Every approved form lodged with ATO must be accompanied by the necessary declarations. As per section 388-65(1) of the Taxation Administration Act 1953, the necessary declarations that must be included are as follows:

- An assertion that the information presented in the approved form is true and correct

- If the approved form was completed by a tax agent, a statement declaring that the tax agent was authorised by the taxpayer to complete the approved form through the information supplied by the taxpayer

- Lodge the return.

- You may lodge through a registered tax agent. Here is how you can lodge through a tax agent:

- Have the tax agent prepare the tax return.

- Assist the tax agent in filling out important business details.

- Discuss and resolve issues in the tax return.

- Provide client declaration.

- Secure declaration from the agent.

- Instruct the agent to lodge the return

- Lodge on your own through paper form. Here is how you can lodge through the paper form:

- Obtain a paper form of the return. You may either:

- Download and print a copy online from the ATO website; or

- Order a copy online or through phone

- Follow the ’Instructions’ that can be found from the ATO website (e.g., Partnership Tax Return Instruction 2020) in filling out all the required fields.

- Secure necessary declarations.

- Pay service fees.

- Send the tax return to the postal address designated for paper form lodgements.

- Obtain a paper form of the return. You may either:

- Lodging through an accounting software. The general steps in lodging a tax return through accounting software are simple:

- Fill out important business details

- Generate the income tax return that will be lodged

- Review the tax return basic business details to check for errors (e.g., business name, date of the lodgement, reporting period, type of tax return, bank account details, Tax File Number, etc.)

- Obtain necessary declarations

- Lodge the return

IMPORTANT: To be able to lodge through accounting software, you must check whether your accounting software is Standard Business Reporting (SBR) enabled. You will not be able to use your accounting software for electronic lodgement if it is not SBR-enabled.

Activity statements

With activity statements, taxpayers are able to report many of their tax liabilities all in one form to ATO. There are two types of activity statements:

|

Type of Activity Statements |

What can be reported on it |

Who can use the form |

|

Business Activity Statements |

|

GST-registered taxpayers |

|

Instalment Activity Statement |

|

All taxpayers even if not GST registered |

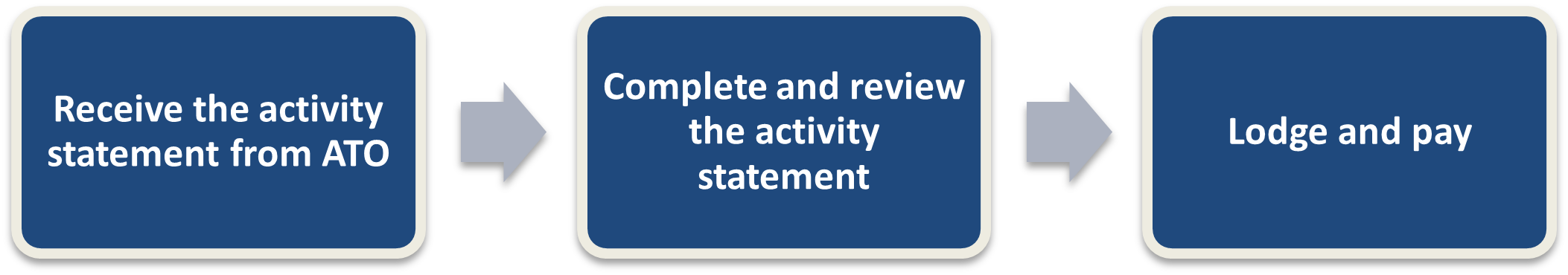

The general process involved is presented below:

Receiving activity statements

Once the business receives the Business Activity Statement from ATO; the business will then have to complete the form and lodge the same regardless of whether the business has anything to report. The manner of how you will receive the next fillable form of activity statements for the coming reporting period depends on how you have lodged your previous activity statements. For instance, if you lodged through Business Portal, your next BAS shall be sent through the Business Portal. In any case, ATO shall notify its taxpayers through email whenever the next activity statement has become available for lodgement. That is why it is important to always have your contact details up to date.

Deadline of lodgement

The deadline for the lodgement will be stated on the form sent by ATO. Business Activity Statements are lodged on a quarterly basis unless the business’s GST turnover is $20 million or more. Businesses that have a GST turnover of $20 million or more are required to lodge. BAS monthly while businesses who only registered for GST voluntarily may lodge their BAS annually.

Instalment notice

The taxpayer will receive an instalment notice instead of a fillable form of BAS or IAS if the taxpayer:

- Report and pay GST or PAYG instalments quarterly.

- Pay the instalment amount determined by ATO

- Has no other reporting requirements

Instalment notice indicates the amount that the taxpayer has to pay to ATO and as well as the due date for the payment.

How to Lodge Activity statements

There are three ways to lodge a Business Activity Statement:

- Lodge online.

- Sole traders can lodge their BAS through MyGov. They just have to:

- Go to ato.gov.au.

- Sign in to their myGov account

- Access the ‘ATO’ from ‘My member services’

- From the main menu, select ‘Tax’, then ‘Activity statements’

- Select ‘Lodge activity statement.’

- All business structures other than sole traders can lodge their BAS through the Business Portal. To lodge through the Business Portal, just follow these steps:

- Go to the Business Portal.

- Log in to the Business Portal using your myGovID

- Select ‘Activity Statement’.

- Select the activity statement from the ‘Not lodged’ list to prepare a new activity statement.

- Click ‘Edit’ and fill out the required fields. Make sure to ask assistance from a tax professional when filling out the activity statement. Once you are done, click ‘Save and continue’. If you have nothing to report in the activity statement for the current period, click ‘Prepare as Nil’. If you want to reverse this action, select ‘Undo Nil’.

- Once you are ready to lodge the activity statement electronically, read the declaration, check the checkbox, and click ‘Lodge’. To view all the activity statements that were processed, lodged, and/or cancelled in the last two years, you may check ‘History’.

- Businesses may also opt to lodge their BAS through their SBR-enabled accounting software. To know how to lodge a BAS through the accounting software utilised by your organisation, enquire with your software provider and ask for an instruction manual.

- Sole traders can lodge their BAS through MyGov. They just have to:

- Lodge through a BAS agent. You may avail of the services of a BAS agent and let the agent lodge the BAS on your behalf. Just make sure that:

- you prepare the required declarations

- you have checked the TPB Register and verified whether the tax agent is duly registered.

- Lodge by mail.

- Complete the BAS paper sent to you by ATO. You may ask a tax professional when doing this step. If you have not received the BAS paper from ATO yet, you may phone ATO and directly request for a copy.

- Attach other necessary documents and review the BAS.

- Secure declarations, as necessary

- Mail you completed BAS using the pre-addressed envelope included in the BAS package provided by ATO.

Taxable payments annual report

The Taxable Payments Annual Report (TPAR) can be used to report the payments the business makes to its contractors or subcontractors regardless of their business structures. The payments your report in the TPAR can help ATO in checking whether contractors duly comply with their tax obligations. Here are some of the important things to remember about TPAR:

- The business will have to lodge a TPAR if 50% or more of its business income or business activity is from building and construction services.

- TPAR is lodged every 28 August of the year.

- The details you should include in the report are the following:

- the contractor’s Australian business number (ABN), if known

- the contractor’s their name and address

- the gross amount you paid to them for the financial year (including any GST)

How to lodge a TPAR:

- Lodge online through myGov if the business is a sole trader. Just access myGov, sign-in to your account, select Tax > Lodgements > Taxable payments annual report.

- If the business is not a sole trader, the business may lodge their TPAR through the Business Portal. Just access and sign the Business Portal, select Online forms from the main menu then select Taxable payments annual report.

- Lodge through a registered agent.

- Lodge through paper form. To lodge through the paper form:

- You will need to order a paper copy of the TPAR (NAT 74109) either online or through the phone. It is important to note that ATO will not accept any other forms of TPAR except the original one provided by ATO.

- Complete the report and submit to ATO’s postal address.

Payment of taxes

Frequency of payment

Income tax is paid either:

Annually:

Income tax can be paid annually upon the lodgement of the income tax return and upon the receipt of the notice of assessment. The notice of the assessment shall provide payment advice indicating the amount currently owing to ATO.

In PAYG instalments:

In the PAYG instalments scheme, the total annual income tax payable by the taxpayer is settled in partial payments throughout the financial year. Accordingly, an instalment amount has to be determined every instalment period. Here are some of the other important things to remember about PAYG instalments:

- the instalment amount is either based on:

- the calculation of ATO; or

- the calculation of the taxpayer (but using the instalment rate provided by the ATO)

- The table below outlines the different circumstances where a business would be required to pay income tax in PAYG instalments:

|

Base |

The Threshold for Individuals and Trusts |

The Threshold for Companies and Super Funds |

|

Instalment income from the taxpayer’s latest tax return |

$4,000 or more |

$2 million or more |

|

Tax payable on the latest notice of assessment |

$1,000 or more |

n/a |

|

Estimated notional tax |

$500 or more |

$500 or more |

|

The taxpayer is the head of the consolidated group |

n/a |

$0 or more |

- You pay PAYG instalments upon your lodgement of the activity statements.

The business should complete its activity statements and report all its PAYG instalments for the tax year before lodging the income tax return so that the business would know whether there are still outstanding tax dues or whether there are refunds that can be claimed by the end of the year.

IMPORTANT: Other tax liabilities of the business would be settled upon lodgement of activity statements.

Remittance of PAYG withholding

PAYG Withholding is the process of withholding a certain amount from specific types of payments, the most common type of these, being salaries and wages. Here are some of the important things to remember about PAYG Withholding:

- Employers remit PAYG withholding to ATO upon the lodgement of the Business Activity Statement. Remittance can be done the same way as to how you pay taxes to ATO.

- Upon remittance, taxpayers may be required to lodge payment summaries to ATO for data matching purposes. Payment summaries include a report of the amounts withheld by the payor and as well as the amount received by the payee.

IMPORTANT: You may refer to Section 10-5(1) in Schedule 1 of the Tax Administration Act 1953 to see the list of all other various withholding events.

How to pay taxes

Businesses pay taxes as they lodge tax returns and activity statements with ATO. ATO will let the taxpayer know of their payment options upon the receipt of the lodgement. Here is the general process that you can follow when paying taxes:

- Review the amount of taxes due and as well as the due dates for the payment. You can check the details of the pending payments through ATO online services. ATO also helps their taxpayers know how much they owe by sending notice of assessments, statement of account, or instalment notices.

- Get the correct Payment Reference Number (PRN). PRN is a unique set of numbers used by ATO to:

- identify who made the relevant payment

- identify what the payment was for (e.g., income tax, fringe benefits, BAS, etc.)

- To get the correct PRN, you may:

- Log in to the Business Portal. From the left menu, select ‘Payment Options’

- Find the relevant PRN from the list

- Choose from your payment options and gather all of the important details you need in processing the payments:

|

Payment Option |

Important Details and Other Requirements |

|

BPAY® |

You can pay with BPAY through online or mobile banking. Upon logging in to your bank account online, select BPAY and enter the following details:

|

|

Credit/Debit card |

You can pay with your credit/debit card through the ATO online, through BPAY, in person, or via phone service. Here are some of the important details to remember:

|

|

Electronic transfer |

You can pay your taxes through the electronic transfer services offered by various financial institutions. Just have the following details ready:

|

|

In-person |

You can pay in person at the Australia Post with cash, debit card/debit card, or check. Here are some of the important things to remember:

|

- Secure payment receipts or any other kinds of proof for the tax payments made (e.g., confirmation from ATO, receipt generated by the bank, bank statements, etc.)

Employee Liabilities

As an employer, a building and construction business will have the following obligations:

- Pay the Salaries and Wages of the employees

- Remit PAYG Withholdings to ATO (as discussed previously)

- Make superannuation contributions to the superannuation provider

- Process Single Touch Payroll (STP) and submit other reports

How to pay employee salaries and wages

- Review the payroll records.

- Choose a payment option. You can pay your employees either:

- Through direct deposit, which can be done:

- By making the payments directly in the bank

- Through online or mobile banking

- Through payroll software with integrated banking services

- In-person with cash or cheques

- Through direct deposit, which can be done:

- Process the payments. The specific steps to follow when processing the payments for salaries and wages will vary depending on which payment option you choose.

- If you are paying in person, you will have to follow your organisation’s policies and procedures which may likely require you to:

- Secure payment vouchers

- Withdraw cash from the bank and secure withdrawal receipts

- Print payment slips

- If you are paying through direct deposit, you will need to:

- Follow your organisation’s policies and procedures

- Follow the instructions specific to the mode of payment you choose to employ (e.g., payroll software, online banking, bank)

- If you are paying in person, you will have to follow your organisation’s policies and procedures which may likely require you to:

Superannuation (Super)

Under the Australian legislation, employers are required to make superannuation contributions amounting to 9.5% of their employee’s Ordinary Time Earnings (OTE). These contributions are intended to help employees save up for their retirement.

The superannuation contributions required to be shouldered by the employers are appropriately referred to as the Super Guarantees (SG). The following employees are entitled to a Super Guarantee:

- An employee who is 18 years of age, AND who is earning $450 or more (before tax) per month

- An employee who is under 18 years of age, BUT works for more than 30 hours per week AND earns $450 or more (before tax) per month

IMPORTANT: Contractors are also entitled to Super Guarantees. The minimum amount of super that you have to pay to contractors is the same as the amount you pay to your employees. This is because, contractors are treated as employees for superannuation purposes, except if they are operating as a company, trust, or a partnership.

Nevertheless, it is important to remember that you need to calculate the SG you pay to contractors based on the labour component of the contract. If you cannot determine the labour component of the contract, you can make the SG computation based on the current market value available or the current industry practices.

SuperStream

Employers may pay SGs by means of SuperStream. SuperStream pertains to the required electronic processing of superannuation payments and records. Here are some of the important things to know about Super Stream:

- If the system employed by your business has a SuperStream feature, you will be able to:

- Transmit payments and information electronically and consistently across your system and the system of the superannuation fund provider and ATO.

- Make your superannuation contributions to different super funds in a single transaction

- Process contributions more efficiently and with fewer errors and ensure that your superannuation report follows a standard format

- SuperStream is available on:

- selected payroll systems (Refer to the ATO’s SuperStream Certified Product Register to know which payroll systems are SuperStream compliant:)

- the online system of the superannuation provider

- the super clearing house’s system

- messaging portal

Superannuation information

Here is some important information that you will have to gather from your employees when reporting superannuation:

|

Category |

Required Information |

|

Employees without self-managed super fund (SMSF) |

|

|

Employees with the self-managed super fund (SMSF) |

|

|

IMPORTANT: If the employee does not respond within a reasonable period, you can ask them to complete a Superannuation Standard Choice Form and have them return it to you within 28 days from the receipt. If the employee does not complete the form within the allotted time, the employer could send the relevant contributions to their default fund. |

Paying Super

Here is the general process that you can follow when paying for Super:

- Check your superannuation set-up and make sure that you have recorded the correct superannuation details in your system. Check whether you have indicated the correct superfund of each employee, their correct TFN, the correct ABN or SUI of their superannuation fund, bank details, etc.

- Process the pay run how you normally would. (i.e. set payment frequency, review timesheets, process employee net pay, send STP report, process payments, send out payment slips, etc.)

- Lodge superannuation contribution reports and make sure to include all of the required information. These can be generated through a system that is SuperStream-compliant. Upon the lodgement of contribution reports, payments to superannuation are automatically processed using the details you have entered into the system.

- Secure proof of payment. Make sure that you keep records of any kinds of document which you can use to prove that the payments for supers were processed accordingly. This may include confirmation receipts, screenshots of the online transfer, bank statement, etc.

Single Touch Payroll Reporting

Through STP reporting, the payroll information of each employee processed automatically and reported to ATO every time a pay run is processed. Thus, employers will no longer need to complete an annual payment summary every end of the year. Here are some other important reminders about for STP reporting:

- Starting 1 July 2021, all employers will be required to report payroll information through STP. This means that businesses will be required to employ a payroll solution that will enable them to report payroll information with STP.

- STP should be processed on or before payday.

- To know how to process STP reporting with your current payroll software, enquire with your payroll solution provider and ask for an instructional guide.

- The normal process of STP reporting would involve:

- processing of pay run

- generation the required report

- securing of necessary declarations/authorisations

- sending of the report

Once you have filed the report, your payroll software should let you know about its status (i.e. whether it is sending, accepted, rejected, etc.)

How insurance works

Basically, what happens here is that the insurance company promises the business to receive a certain amount of insurance benefit if certain conditions in the insurance policy are satisfied and as long as regular insurance premiums are paid to the insurance company. A business can get an insurance policy in order to protect itself from possible financial losses associated with the occurrence of different types of adverse events (fire, accidents, etc.)

Different types of insurance policies

There are different insurance policies available to businesses:

|

Type of Policy |

Purpose |

Required or Not |

|

Public Liability |

This insurance policy serves to cover the damages and financial burden arising from the negligence brought upon by the business against a third party. |

Mandatory |

|

Builder’s Risk |

This insurance serves to cover the loss and damage to property in the course of the construction. |

Depends on the contract terms |

|

Loss of Income |

Loss of Income insurance policies serve to protect the business from the possible loss of income brought upon by events such as fire, other fortuitous events, illegal acts of directors, employee theft or fraud, etc. |

Depends on the contract terms |

|

Workers Compensation |

This policy serves to protect the company and its employees from financial loss due to work-related accidents or illnesses. |

Mandatory |

|

Commercial Vehicles |

The coverage provided by commercial auto insurance is intended to help policyholders avoid high vehicle repair costs, medical expenses, or lawsuits resulting from auto accidents. |

Depends on the registration requirements of the State/ Territory |

Review and adjust insurance covers

Here is the general process involved in reviewing and adjusting the existing insurance covers of the business:

- Read the terms of the insurance policies. Ask the assistance of a legal professional if you need some help in interpreting and understanding the terms of the policy. Accordingly, you must take note of the following details in your review:

- the type of policy

- the insurance carrier

- the policy number – this is the unique set of numbers used to distinguish one insurance policy from another

- issuance date

- premium payments required – this refers to the regular payment that is required to be paid in order to avail of the insurance benefits states in the policy

- the conditions of the policy, including what items are excluded from its coverage

- Understand the circumstances of the business. As the business grows, your insurance coverage should also be adjusted and increased accordingly. For example, if the business’s income continues to increase rapidly, the coverage of your current Loss of Income policy should also be updated. For instance, a business that has an average annual income of $70,000 should have a coverage of at least $70,000 in its Loss of Income policy.

- Once you have determined the necessity to adjust your current insurance covers, you must then enquire with an insurance broker for your options. Make sure not to make a hasty decision; do your research and identify the additional costs to incur for availing such increase in your insurance coverage.

Ensuring payments are made on time

To ensure that you will be able to pay your employees, contractors, and suppliers on time, it is integral that you take note of all the relevant due dates. Here are some other tips on how you can ensure that you process these payments on time:

- Manage funds. One of the common reasons why there are delays in payments is the lack of funds. To ensure that the business has enough cash to settle these payments, the business may undertake the following measures:

- Have a separate fund for payroll. If the business is making extra cash, make sure to appropriate a portion of it to the payroll fund.

- Factor the invoices of the business. You may factor the invoices of the business in a factoring company who can immediately pay the invoice amount. The amount that you receive from the factoring company can then be used to settle your obligations with your contractors, suppliers, and employees. However, remember that once your client finally settles the invoice, you will need to remit the payment to the factoring company and also pay for the factoring fee.

- Assess whether you need to obtain a loan. Assess whether you can obtain a loan agreement from a financial institution that offers a lower interest rate than the rate already agreed upon with a supplier or a contractor.

- Make use of a time management tool. There is a variety of management tools that you can use when keeping track of due dates. Fortunately, most payroll and accounting software nowadays have a feature that can automatically send a notification whenever a particular payment falls due.

- Communicate with your team to ensure that you will meet the deadlines. If you are working with a team, make sure to monitor how they are doing with certain tasks. For instance, to ensure that payments to employees are not delayed, touch base with the person-in-charge of the payroll records and ask if there are current issues that can cause a delay in the payroll processing. This way, you can address the issue ahead of time and avoid the delay.

Consequences of delay in payments

Delay in payments can have the following consequences:

- Delay in payments can negatively affect the credit standing of the business. Maintaining a good credit standing is important in obtaining new loans, especially if obtaining loans from banks.

- The business may encounter legal disputes if a delay in payments will not be avoided. This is especially true because there are legislation and regulations protecting the rights of the suppliers, sub-contractors and employees to receive payments on time.

- Delay in payments increases the total interest payments made to the creditors. Until the business settles its obligations to suppliers and creditors, the business will have to continue paying for interest.

- Delay in payments can negatively affect your relationship with your suppliers, sub-contractors and employees. Your supplier might no longer offer you discounts on your next transactions. Your sub-contractors and employees might no longer be motivated to perform quality work.

Loan amortisation schedule

One way to effectively monitor loan and interest repayments is by preparing a loan amortisation schedule. When preparing a loan amortisation schedule, you must ensure that you have first thoroughly reviewed the loan agreement. In your review of the loan agreement, you must be able to identify:

- The amount of the loan proceeds

- The conditions of the loan

- The corresponding interest payments

- The maturity dates

- Other payments terms

There are a lot of templates of loan amortisations schedule that are accessible for free. You may use these templates when monitoring interest and loan repayments. Just ensure that you modify the template according to the payment terms of the loan agreement and according to the policies and procedures of your organisation.

Importance of monitoring loan and interest repayments

Monitoring loan and interest repayments are important for the following reasons:

- Monitoring them allows you to ensure that you comply with your obligations with your outside creditors.

- It allows you to avoid possible legal disputes that can be brought by late loan payments.

- It allows you to avoid having a negative credit standing.

- It allows you to ensure that you do not pay more than the amount that is currently due and demandable.

Reviewing project budget against cost reports

By the end of every period, the project budget should be reviewed against relevant cost reports. A cost report is a living document that should be updated regularly to reflect the actual costs incurred by each project for the current period.

The difference between the actual cost and the budget cost is referred to as the cost variance. This also means that the actual cost incurred for the project is not equal to its related budgeted cost. These variances can occur for a variety of reasons, including the following:

- normal spoilages were not taken into account in the estimate for the budgeted cost

- changes in the market price

- changes in delivery costs

- untimely purchase of supplies

- loss of purchase discounts

- changes in taxes and duties

- use of substitute materials

- careless handling of materials

- changes in the basic wage rate

- unplanned overtime payments

- revision of wages due to new rewards entitlement

Cost variance analysis report

To properly document these cost variances, you must prepare a Cost Variance Analysis Report. You can start by using a template, but make sure that your report follows your organisation’s policies and procedures. There is no standardised format for this type of report, but as a minimum, your report should include the following information:

- the cost items being reviewed

- the amount of actual cost incurred for each item

- the amount of budget cost for each item

- the difference between the actual cost and the budgeted cost (cost variance)

- the analysis for each variance (i.e. determine the cause of the variances)