What is the definition of value? What are the true costs of products and services to customers? The capacity to pinpoint the value of a product or service for a consumer has never been more critical. Companies are increasingly looking for methods to boost profits and, as a result, are putting pressure on suppliers to lower prices, especially for customers whose costs are dictated by what they buy.

Before a marketer starts thinking about marketing tactics for a company, they need to know what their consumers value. This differentiates a good creative marketer from the competition and allows one to service the target customers the best. Let us delve into what customer value is all about and how to measure it.

Customer value is a method to estimate the worth of a product or service. This value is determined by whether the customer believes they received more value from the goods or service than they paid for.

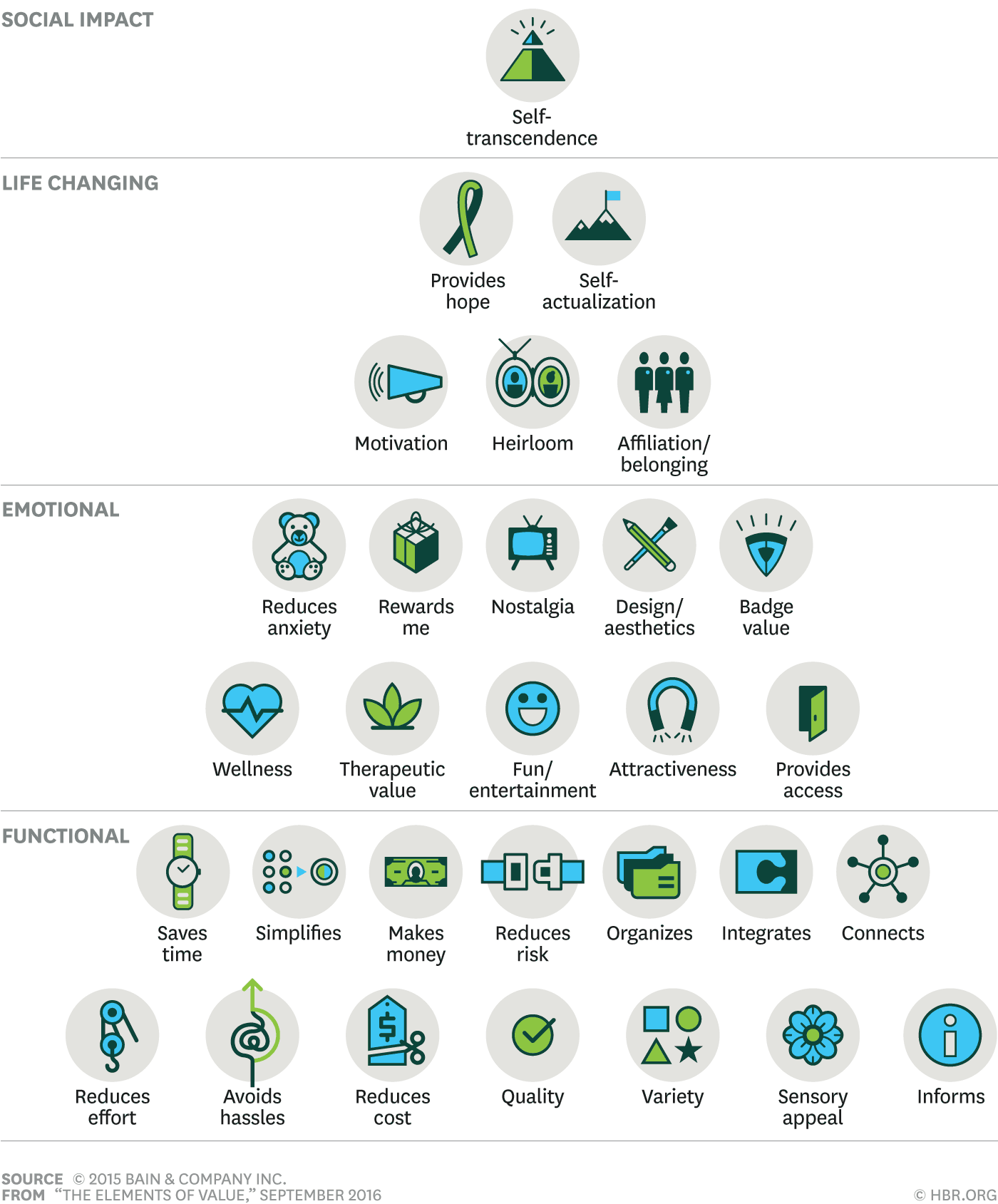

These 30 "value elements" fall into four elements.

- Functional

- Emotional

- Life-changing

- Social impact.

Some components are more inward-looking, focusing on the needs of individual customers.

Element of value pyramid

Products and services deliver fundamental elements of value that address four kinds of needs: functional, emotional, life changing and social impact. In general, the more elements provided, the greater customers' loyalty and the higher the company's sustained revenue growth.

This model has its conceptual roots in Abraham Maslow’s hierarchy of needs. Human activities, according to Maslow, stem from an underlying need to satisfy wants to range from the most basic (security, warmth, food, rest) to the most complicated (self-esteem, altruism). Maslow's hierarchy is well-known among today's marketers. By focusing on people as consumers and defining their behaviour related to products and services, the aspects of the value approach expand his findings.

Determining what consumers genuinely value can be challenging and psychologically complex. How can leadership teams actively manage or invent ways to deliver additional value, whether functional or emotional? Discrete choice analysis and similar research techniques are powerful and useful tools for simulating demand for different combinations of product features, pricing, and other components. Still, they are designed to test consumer reactions to preconceived notions of value.

A good example of a company doing well on multiple elements and creating growing revenue faster than others is Amazon.

“Amazon achieved high scores on eight mostly functional elements, illustrating the power of adding value to a core offering. It has chosen product features that closely correspond to those in our model. For example, in creating Amazon Prime in 2005, the company initially focused on reducing cost and saving time by providing unlimited two-day shipping for a flat $79 annual fee. Then it expanded Prime to include streaming media (provides access and fun/entertainment) unlimited photo storage on Amazon servers (reduces risk). Each new element attracted many consumers and helped raise Amazon’s services far above commodity status. Prime has penetrated nearly 40% of the U.S. retail market, and Amazon has become a juggernaut of consumer value.” (Almquist, Senior and Bloch, 2021)

Customer value can be simplified to dollars and cents for some businesses. It is crucial to remember, though, that customers contribute more to your organisation than the price tag.

When making a purchasing decision, customers consider:

- Time costs

- Energy expenses

- Emotional costs.

To measure customer value, we must first understand the various sorts of costs and benefits. The image below can assist you by outlining the aspects to consider when determining customer value.

Identify customer benefits

Some of the more specific benefits that can be considered to reduce friction within the customer experience are:

- The product's or service's quality

- Ability to propose a more effective solution

- The brand's image or one-of-a-kind customer experience

- The customer service team's professionalism

- The social benefits of collaborating with the company.

Value decisions can be made in a particular context. There is always a competitive option, even if no equivalent market offerings exist. One competitive alternative in business markets is for the customer to elect to produce the product rather than buy it.

Customer costs

People consider both tangible and intangible benefits when deciding on a product to buy. Tangible costs can be measured in money, whereas intangible costs cannot be defined in money but have a substantial business impact. Material advantages are tangible and can be long-term or short-term. In contrast, intangible benefits are typically long-term assets, not physical property but intangible assets.

Some examples of tangible costs are:

- The price of your product or service

- Installation or onboarding costs

- The cost of accessing your product or service

- Maintenance costs

- Renewal costs.

Some examples of intangible costs are:

- Time invested in buying your product or service

- A poor customer experiences

- Physical or emotional stress-induced from buying or installing your product

- A poor brand reputation

- Time spent understanding how your product or service works.

In some cases, tangible costs are prioritised over intangible ones. Since they are quantitative and easily identifiable, on the other hand, intangible costs need equal consideration because they account for a large portion of customer value. According to experts, intangible costs such as brand image and market share now account for more than 25% of a company's worth.

To determine customer value, one can use the following equation:

Customer value = perceived customer benefits – total customer cost

This formula would not seem like a traditional arithmetic equation because you will be working with tangible and intangible elements. One must weigh the costs of time investment, mental stress, and physical commitment against the rewards of brand recognition, social standing, and service ease. The value of a client depends on the section of customers looked at. Because everyone is different and has different requirements, goals, and expectations, the concept of "good value" may differ.

Customer Lifetime Value (CLV) is defined as a forecast of net profit created throughout a customer's whole business relationship. Instead of referring to the value brought by their first transaction, CLV demonstrates how important a customer is to your business for an indefinite amount of time.

“You will see that not all customers are profitable from their first purchase. Why? It takes time to build trust with a brand. You need the efforts of your customer success team to influence their customer journey and boost CLV, retention rates, and customer loyalty. By comparing Customer Lifetime Value to Customer Acquisition Costs (the cost of winning a customer to purchase a product), you will find how profitable your business is and how much you can invest in new customer acquisition and customer retention.” (Customer Lifetime Value (CLV) - how to calculate, measure, and improve it - Omniconvert Blog, 2021)

How to calculate Customer Lifetime Value

The easiest way to calculate customer lifetime value clv would be to subtract the cost of acquiring and serving a customer from the customer revenue.

Let us say that every year, for Mother’s Day, you send your mother the same $70 flower bouquet that you buy from the same flower shop. If you’ve been doing this for the past five years, your lifetime value for the flower shop is $350. (Customer Lifetime Value (CLV) - how to calculate, measure, and improve it - Omniconvert Blog, 2021)

One of the most significant measures you can take for your organisation is measuring and tracking customer lifetime value. CLV acts as a business health indicator, indicating how solid your customer relationships are, what can improve CLV, and how to avoid loss at the earliest signs of CLV decline. Determining your customer lifetime value is just the beginning. What you do with that information will determine your business’ success. Because now you know how much you should be spending to acquire a customer, from overhead to marketing.

Case study

Let’s look at Netflix. An average Netflix subscriber stays on board for 25 months and has a lifetime value of $291.25.

If you’d subscribe to Netflix right now, you would pay around $8.97 per month (that’s the cheapest price plan), which means $107.64 per year. Would you spend $150 to acquire a customer if you were Netflix?

It seems counterintuitive to spend more to acquire a customer and still be profitable, but that’s why determining your customer lifetime value is essential. Yes, Netflix would lose $42.36 in the first year, but the average Netflix user stays a customer for 25 months. So even if the company doesn’t make an immediate profit, it doesn’t mean it remains unprofitable.

You shouldn’t be afraid to lose money in the short run if that can boost your revenue in the long run.

To determine how much you can afford to lose in the short run, you need to know the lifetime value of your customers. Without that number, it is impossible to optimize your revenue.

Maximizing the customer lifetime value

Each customer is unique. Some will not pay for Netflix, not even for a month. Some might remain customers for several years, while some never want to cancel their subscription.

Not to mention that Netflix offers three different price plans – a premium user who remains a customer for three years is more valuable than a customer who has the cheapest price plan for four years.

By tracking each customer individually, Netflix can optimize its lifetime value.’

(Customer Lifetime Value (CLV) - how to calculate, measure, and improve it - Omniconvert Blog, 2021)

For a marketer, customer value provides a wealth of information about how healthy a business is and what its customers expect in the future. A business with a solid customer value balance earns too little margin and eventually goes out of business.

A marketer may make timely modifications to increase the predictability of a business and future margin by calculating customer value. The marketing and sales teams should consider the following question: "How can we boost long-term profitability for customers?"

Task

Starbucks is always opening new stores worldwide, and its purchasing approach is often imitated.

Look at the given menu and calculate your own customer lifetime value over 20 years.

Discuss how your customer lifetime values differ from your peers in the forum.