At the end of the day, the cash component of the takings is made up of all the notes and coins that are left once the float is removed. This amount is added to the non-cash transaction amounts which equal the day's takings.

Point of Sale reconciliation is the process of:

-

Counting cash.

-

Combining cash totals with non-cash transaction records.

-

Checking for discrepancies against reports.

-

Record keeping.

Point of Sale reconciliation is a vital task in the operations of a business, helping to catch errors, even innocent accidental ones, early before they spiral out of control and cause major accounting issues.

A cash float is the money set aside for the start of each shift to provide enough change for cash transactions. The amount and make-up of the cash float will be different for each workplace. The float needed will depend on factors such as the store's size, how busy it is, how many customers tend to pay in cash and the average price of items sold. If you are unsure of how much your float should be or how to make this up then refer to your internal policies and procedures or ask a supervisor.

Before the cash takings are counted for a final balance, the cash float must be removed. Follow your store's policy about which notes and coins you take as part of this process, ideally, it should be the same denominations as the original float was made up of. For example, if the cash float at the start of the day was $200, then this should be made up of a variety of notes and coins. When removing the float at the end of the day don't simply take four $50 notes out.

A separate money bag, usually a brown calico bank bag, is often used to keep the cash float apart from the takings. It should be clearly labelled so the next person to use the terminal can easily see what's inside.

Here's an example of a cash float that totals $200:

-

2 x $20 notes.

-

1 x $10 notes.

-

10 x $5 notes.

-

$50 of $2 coins.

-

$20 of $1 coins.

-

$10 of 50 cent coins.

-

$12 of 20 cent coins.

-

$4 of 10 cent coins.

-

$4 of 5 cent coins.

To make counting cash easier and to prepare it for storing or banking, it should be put into groups, eg all $100 notes together, all $1.00 coins together, etc. Most stores do this the same way. Notes are grouped in lots of ten.

After notes are grouped they can be rolled, bundled into folds and secured using a band or clip, or banded flat. Whichever method is used, it's important that all notes face the same way and the denomination (amount) is clearly visible.

Coins are bagged, usually in standard bank issue coin bags. Take note of the recommended amounts per individual bag, this will be printed on the bag.

Some coins can come from the bank in rolls too. When this happens, 20 cent coins and 10 cent coins can sometimes be in $4.00 rolls.

Once notes and coins are prepared, it's easier to count. First, count the bundles. Then count the loose notes. The same applies to coins.

(cropped to 16_9) _500kb.jpg)

(cropped to 16_9) _500kb.jpg)

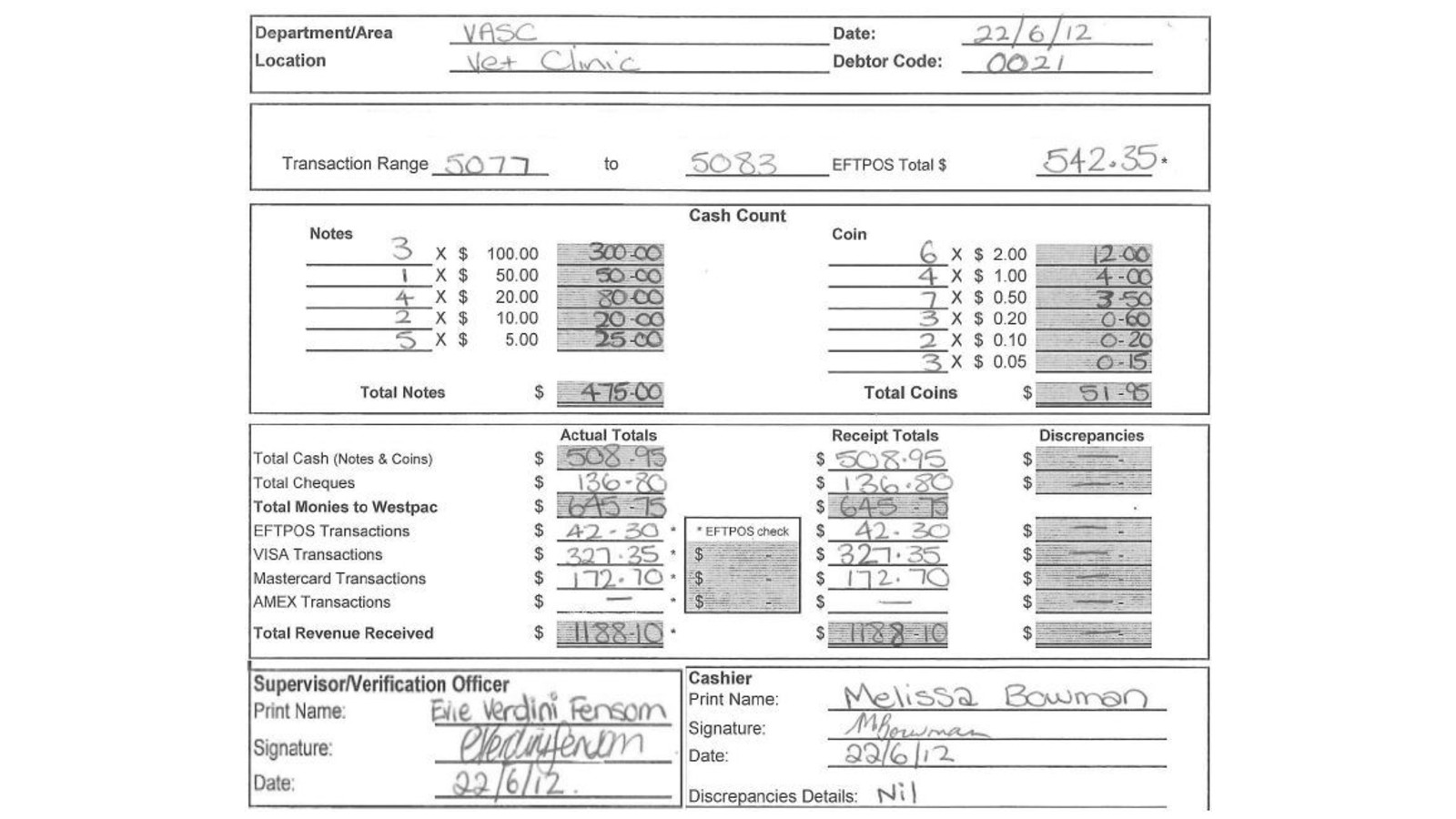

Count the cash, one denomination at a time, and record the totals in the Cash Count section of a Daily Reconciliation Form. This might be a blank form, a pre-printed pad, or an application in a computer software package.

Whichever format is used, you'll need to record the total of each note and coin and then calculate the final total.

Cash Count

| Notes | |||

|---|---|---|---|

| 3 | × $ | 100.00 | 300.00 |

| 1 | × $ | 50.00 | 50.00 |

| 4 | × $ | 20.00 | 80.00 |

| 2 | × $ | 10.00 | 20.00 |

| 5 | × $ | 5.00 | 25.00 |

| Total Notes | $ | 475.00 | |

| Coins | |||

|---|---|---|---|

| 6 | × $ | 2.00 | 12.00 |

| 4 | × $ | 1.00 | 4.00 |

| 7 | × $ | 0.50 | 3.50 |

| 3 | × $ | 0.20 | 0.60 |

| 2 | × $ | 0.10 | 0.20 |

| 3 | × $ | 0.05 | 0.05 |

| Total Coins | $ | 51.95 | |

Non-cash items are all items in the cash drawer that are not cash but form part of the takings. Even though these items are not real money, they should be treated as such.

Examples include:

-

EFTPOS receipts.

-

Gift vouchers.

-

Credit notes.

-

Corrections/voids.

-

Cheques.

To make sure the terminal balances, it's important that you keep an accurate record of the non-cash documents.

When counting these items, some will need to be added and some subtracted from the total non-cash items. Sales, eg EFTPOS, vouchers, lay-by payments, are added, and deductions, eg, refunds, voids, discounts, are subtracted.

These steps should be the same, no matter what forms your workplace uses.

-

Separate all the non-cash items into piles, eg EFTPOS receipts, cheques, vouchers, etc.

-

Add the totals for each pile.

-

Record the totals in the non-cash section of the Daily Reconciliation Form.

_500kb_0.jpg)

There are two types of terminal readings that are required for reconciliation.

-

The Final Terminal Reading also referred to as a Daily Payment Register or End of Day Transaction Summary, is a record of all transactions performed since the last time the Point Of Sale terminal was reconciled. This is compared with the cash and non-cash items in the till (minus the float) to perform a reconciliation and identify any discrepancies.

-

The EFTPOS terminal reading will vary from terminal to terminal, but generally, there are two types of reading you can request: subtotals and settlement. Subtotal reading provides a breakdown of the transactions based on their payment type (eg Visa, Mastercard, Debit card). This reading is most useful for completing your Daily Reconciliation Sheet. Settlement reading provides only the final total for the transactions and then resets the terminal. Settlement can only be performed once per day and is usually conducted at the end of the final shift. Some EFTPOS terminal are programmed to settle automatically overnight and do not require a settlement be performed.

Once the cash and non-cash items in the cash drawer have been counted and recorded, and all the final readings have been printed for the POS terminal and the EFTPOS device, the takings can be reconciled against the reports.

This is done by comparing the summaries of the cash and non-cash with the final POS terminal reading and making sure the amounts all match. If they don't match, there is a discrepancy and it must be fixed.

To reconcile, you'll need the following items:

-

Cash summary information – The totals of all cash takings listed in each denomination.

-

Non-cash summary information – The totals of all non-cash items.

-

Final terminal reading – Showing the breakup of all cash, non-cash and other transactions.

-

EFTPOS subtotals terminal reading - Showing the number of EFTPOS, debit and credit card transactions.

Once you have all these documents, you can compare them to see if the totals match. Be mindful of the following:

-

The total cash transactions on the POS Final Terminal Reading must match the total of cash takings listed in the cash count section of the Daily Reconciliation Sheet.

-

The total EFT transactions listed on the POS Final Terminal Reading must match the EFTPOS terminal reading.

-

The total non-cash items you recorded in the non-cash section of the Daily Reconciliation Sheet must match the total non-cash items on the POS Final Terminal Reading.

-

The individual categories of non-cash items you recorded on the Daily Reconciliation Sheet must match the categories listed on the POS Final Terminal Reading.

-

The total takings in the cash drawer (cash and non-cash items) must match the total takings on the POS Final Terminal Reading.

Finalise the Daily Reconciliation Sheet by completing the receipt totals section and compare the amounts to identify any discrepancies. If there are no discrepancies then you can sign-off and obtain supervisor approval.

In summary, the steps for performing a reconciliation are as follows:

-

Remove the cash float from the cash drawer. If your workplace does not have a specific float breakdown (2 x $5, 10 x 10c etc), ensure the float is made up of a good variety of coins and notes.

-

Count the remaining cash and record the cash breakdown on the Daily Reconciliation Sheet.

-

Collate the EFTPOS transaction slips, cheques and/or vouchers and record these on the Daily Reconciliation Sheet.

-

Print off the Final Terminal Reading and the EFTPOS Terminal Reading (subtotals).

-

Record the transaction type totals from the EFTPOS Terminal Reading on to the Daily Reconciliation Sheet in the actual totals column.

-

Record any cheques and voucher totals on to the Daily Reconciliation Sheet in the actual totals column.

-

Enter the totals from the Final Terminal Reading into the receipt totals column. Compare the actual totals column to the receipt totals to ensure the totals for each transaction type match. If these columns match then the till is balanced and the reconciliation is completed.

-

Once you have performed your reconciliation, bundle the cash and place it with the EFTPOS slips and completed Daily Reconciliation Sheet in a secure place (usually a safe) until it can be deposited at the bank. Cash floats should also be kept in a secure location when not in use.