Accounts Payable

Accounts payable is a general ledger account that identifies the amount of money the business owes to its creditors/suppliers for providing goods or services on credit. Accounts payable represent the short-term debt obligations of the business and as such form a part of the current liabilities on the businesses balance sheet.

A business must know not only the total amount of money that it owes to suppliers but also how much is owed to each individual supplier. To manage payments made to individual creditors, individual accounts are kept in the Accounts Payable Subsidiary Ledger. The total of the individual Accounts Payable Subsidiary Ledgers must agree with the balance of the Accounts Payable Control Account in the General Ledger.

Before a supplier (or vendor) grants credit to a customer, a check should be undertaken of the customer’s credit worthiness. This usually involves completing a credit application form and sometimes obtaining a directors’ guarantee. A guarantee ensures if the company gets into financial difficulties the directors’ can be held liable for the debt. If the credit application is approved an agreement is signed allowing the customer is to purchase goods or services on credit and make payment according to the terms set out in the agreement. Terms are dependent on the type and size of the organisation.

Businesses need to purchase goods and services to supply their customers and meet their needs on a regular basis. They way in which a business manages this purchasing process impacts on the overall performance, profitability and efficiency of the business.

The purchasing process is sometimes also referred to as the procurement process.

- Purchasing Process - is more confined to actually obtaining goods and services

- Procurement Process - the overall framework established to optimise purchasing for maximum value, savings, and efficiency.

While the purchasing process may vary from business to business as well across different industries, they all follow a similar pattern which is as follows:

| Purchasing Process Steps | |

|---|---|

|

1. Need for Goods or Services Identified |

The purchasing process starts with identifying a business need to procure an item. This need could be triggered by any number of reasons, for example:

|

|

2. Purchase Requisition Created |

A purchase requisition is an internal document submitted to the purchasing department to initiate a purchase and is the first step in creating an effective audit trail for purchasing. Once the purchase requisition is approved, a purchase order can be issued to the supplier of the requested goods or services. Purchase requisition forms generally require the following information:

Not all companies use purchase requisitions in their purchasing process while other companies require a purchase requisition for purchases over a set dollar amount. |

|

3. Supplier Selection |

If a business is replenishing low stock levels, they may already have an established relationship with a preferred supplier and this step is not required. If a business needs to source a new supplier, choosing the right suppliers is vital. If the supplier is not reliable or does not provide high quality products or services, it can ultimately affect the products or services that are provide to customers. When selecting a supplier, some considerations are:

|

|

4. Purcahse Order Reviewed and Approved |

A business will create a purchase order when they want to go ahead and officially purchase goods or services. When the business has an approved purchase requisition, the purchasing department can create a PO from the information in the requisition. Purchase requisitions within established budget thresholds are often automatically updated to purchase orders and submitted to the preferred supplier. More expensive purchases, or unexpected purchases not in the budget, are forwarded to the designated person for review and approve before they are converted to a purchase order.

|

|

5. Purchase Order Sent to Supplier |

Once the supplier receives the purchase order and accepts it, the purchase order becomes a legally binding contract for both parties. The purchase orders status is "open" once it has been placed. An open purchase order is one where the products or service have not yet been delivered, or only a portion of the order has been delivered. In either case, it indicates that the order delivery is incomplete |

|

6. Order Shipped by Supplier and Received by Customer |

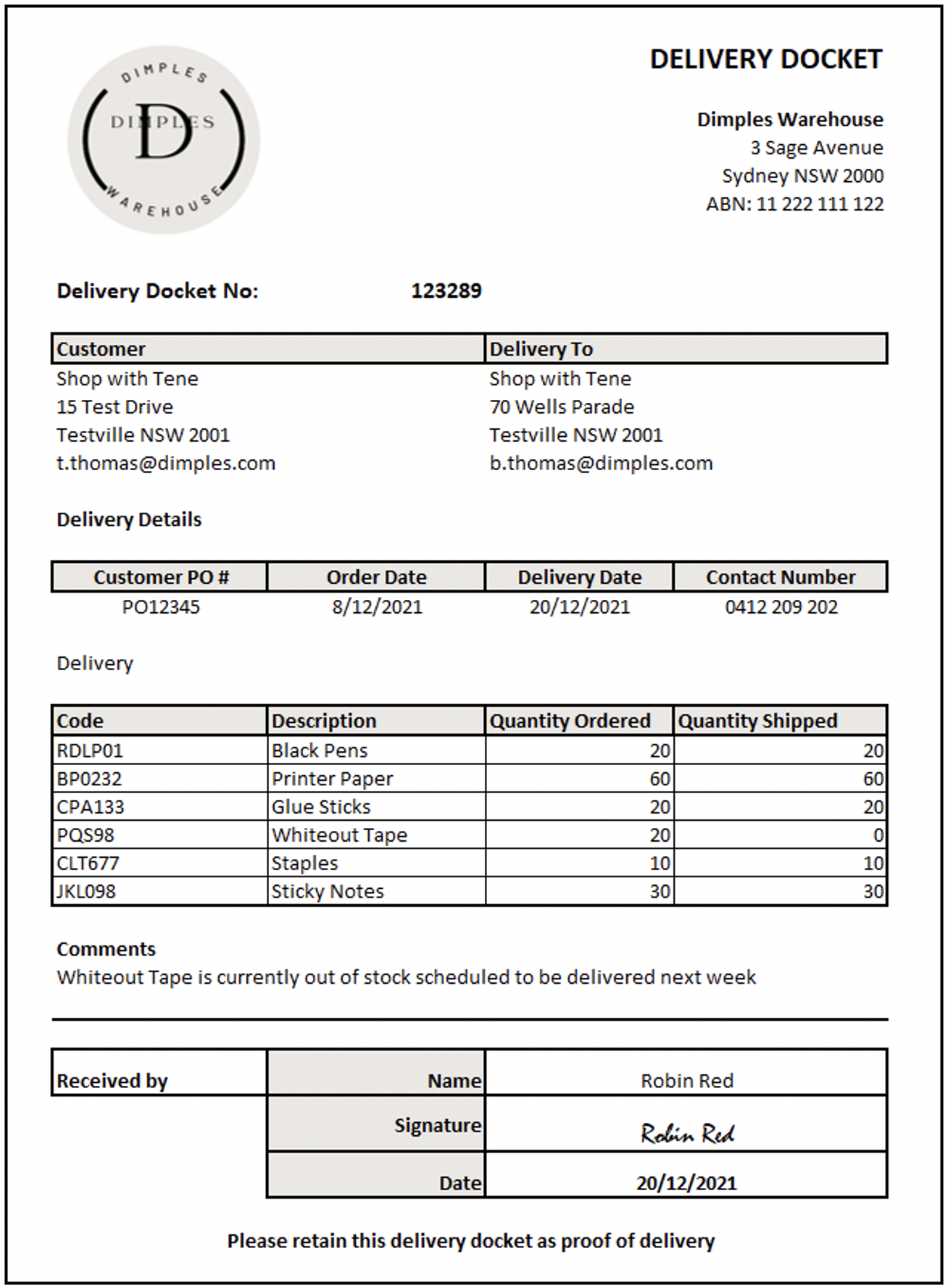

The supplier delivers the goods or services within the agreed-upon timeframe. A delivery docket, sometimes called a packing slip is included with goods when they are dispatched by the supplier. A delivery docket describes what has is being delivered and received and the quantity of goods included in the delivery. To ensure that each party acknowledges the exact contents of the delivery, it is crucial that the delivery docket is signed. Once the order has been accepted, the purchaser carefully reviews the goods and or services to ensure they have received what was ordered and notifies the supplier of any issues. |

|

7. Invoice Reveived and Three-way Matching of Documentation |

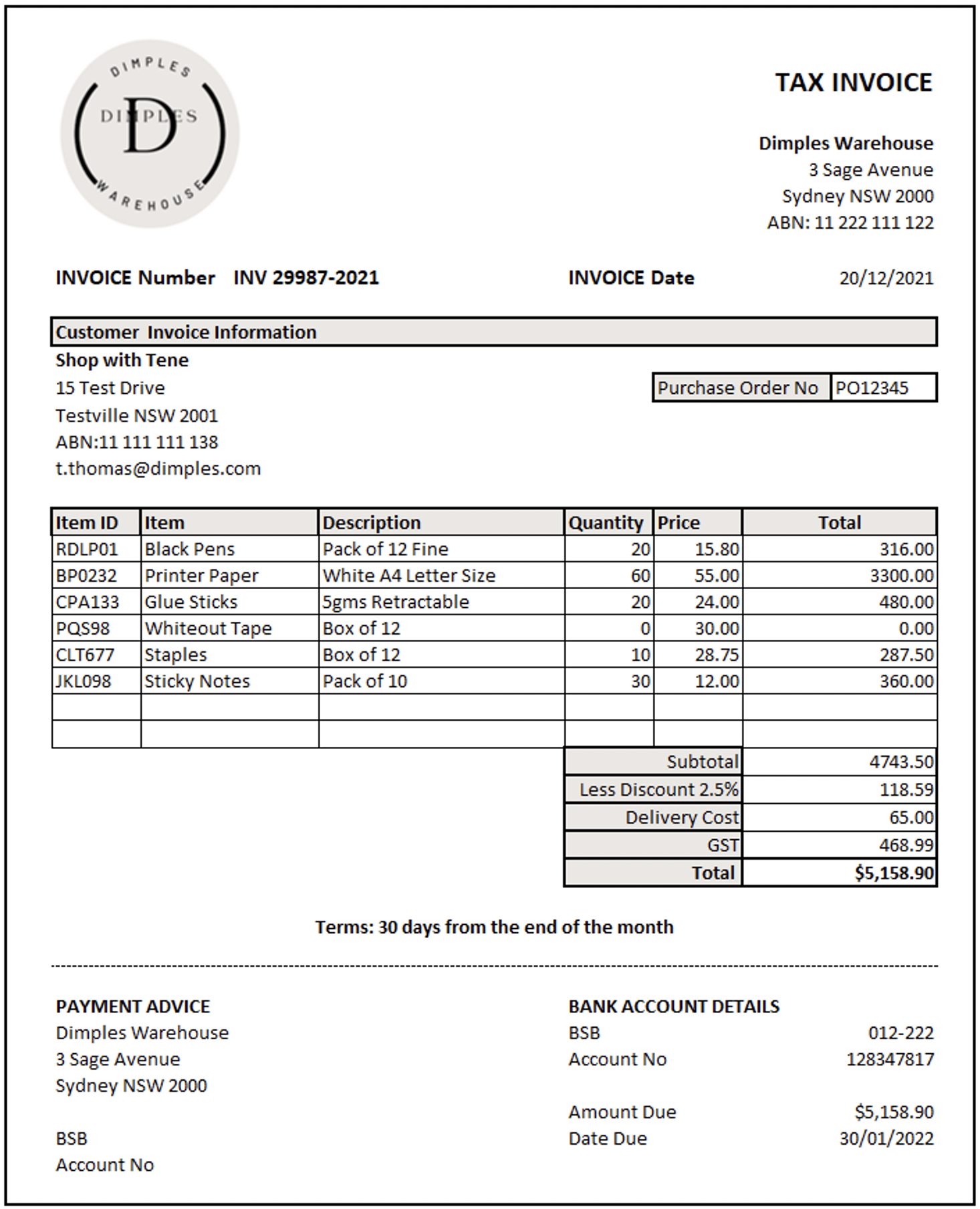

The supplier sends and invoice to the purchaser with a payment due date after the goods or services have been delivered. Once the invoice has been received, the purchaser performs a three-way-matching of the delivery docket with the original purchase order and the invoice issued by the supplier. This comparison ensures all the information related to the transaction is accurate. Any discrepancies identified must be corrected as soon as possible to avoid additional charges, payment delays, or damage to supplier relationships. |

|

8. Accounts Payable Processing |

Before an invoice can be paid, it must go through a series of checks with the accounts payable department. This will include a review of quantities, prices, and terms to ensure that the supplier has fulfilled their contractual obligation according to the details of the purchase order. If any discrepancies are discovered, such as incorrect pricing, inaccurate quantities or damaged goods, the payment will not be processed until these issues are rectified. Once the invoice has been approved for payment, the payment is forwarded to the supplier’s according to the agreed payment terms. The documents related to the transaction are then filed and securely stored according to the purchases record management procedure. |

Direct invoicing can only occur in the particular circumstances such as:

- Electricity payments

- Telephone charges

- Contract payments

- Insurance premiums

- Standard periodic maintenance charges

- Monthly invoices relating to the organisation's corporate cred it cards (within established limits)

- Petty cash reimbursements

- The monthly payment relating to vehicles leases and fuel cards membership and subscription renewals

In these circumstances the signature of the manager holding the appropriate authority on the original invoice or agreement is sufficient for the payment of these to occur.

Once a supplier has issued an invoice on credit, the supplier becomes a creditor (accounts payable); a person or organisation to whom money is owed by a debtor. The debtor in this case is the customer or organisation that purchased to goods or services. Creditors (accounts payable) are liabilities on the balance sheet as they are amounts owing to other parties for goods and/or services already supplied under a credit arrangement that must be paid for on a future date.

The accounts payable process is managed by the accounts payable department in a large company, a small team of staff in a medium-sized company, or by a bookkeeper or the owner of a small business

While it should be a relatively simple task it can become complicated if good processes are not developed and followed.

Invoice fraud is serious and becoming more widespread across the world. Last year a Lithuanian man managed to swindle Facebook and Google out of over $100 million by sending falsified invoices requesting payment for services that were not requested or delivered. Both Facebook and Google paid the invoices.

A technique that businesses use to manage their accounts payable process is three-way matching.

The three-way matching process

| Document | Generated By | What it shows |

|---|---|---|

| 1. Purchase Order | Customer | What the business has ordered and the cost |

| 2. Delivery Document | Supplier | What the business received |

| 3. Invoice | Supplier | What the supplier billed the business |

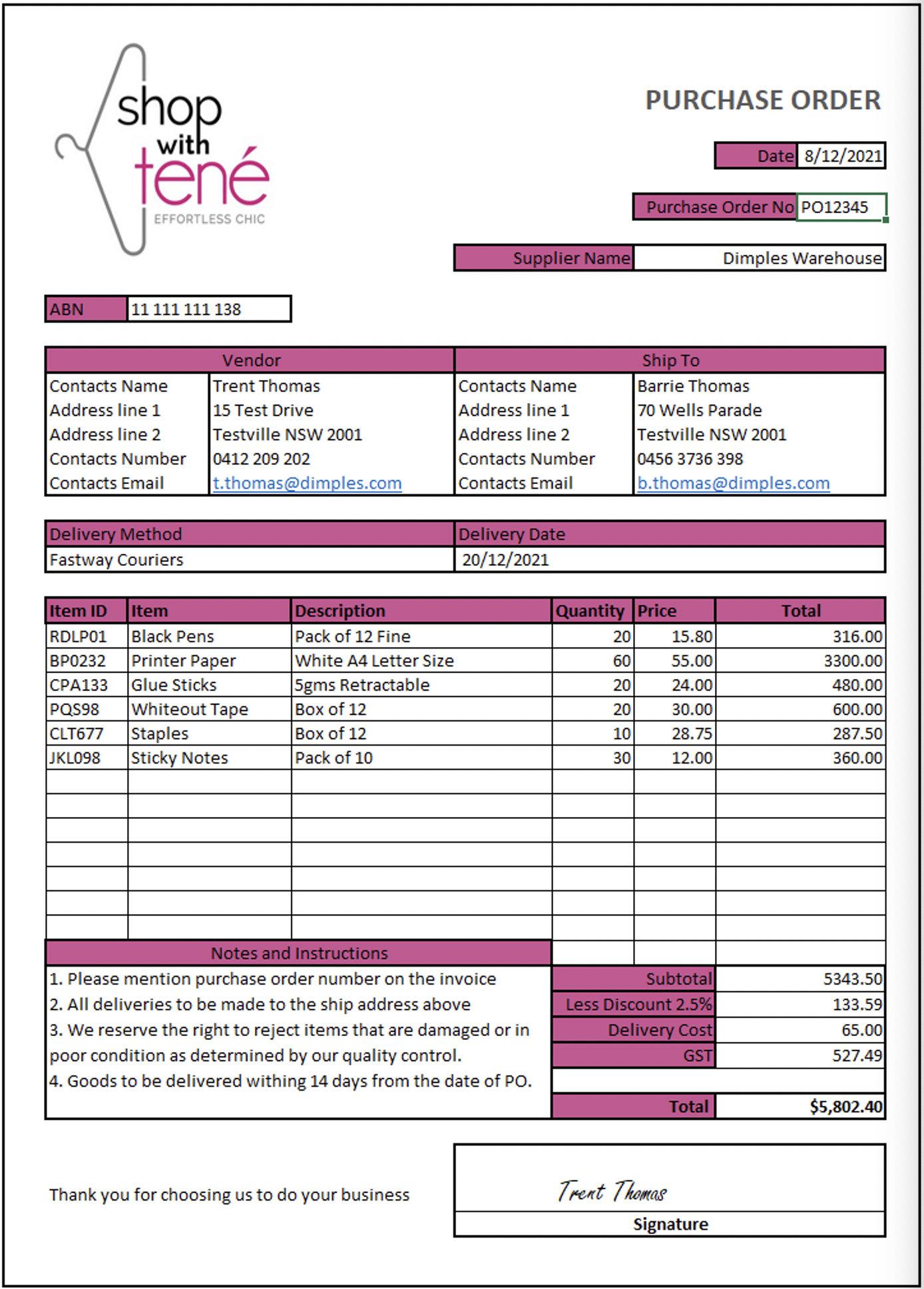

Example – Purchase Order

Example - Delivery Docket

Example - Tax Invoice

Three-way matching is an internal control process that compares details and costs recorded on:

- the purchase orders

- delivery dockets or packing slips

- invoices sent to customers

It verifies invoices by using relevant documents to prove that:

- the business requested the goods/services the invoice is issued for

- the business received the goods/services the invoice is issued for.

Using this process only when the details in the three documents agree allows a supplier’s invoice to be entered into the Accounts Payable system and scheduled for payment.

Three-way matching can be performed both manually and using computerised accounting software. Manual three-way matching is very time-consuming and while the matching process is intended to identify errors it does not eliminate human error.

Computerised accounting software automates this matching process and provides alerts that notify users of missing documents, duplicate invoices, and looming deadlines to make sure that all invoices are processed and paid in a timely manner.

Identifying discrepancies

In some cases, a three-way match may not occur, and this causes discrepancies. When discrepancies occur, it is often caused by actions taken outside of the accounts payable department, but they will all have to be investigated and rectified by someone within in the accounts payable department. This is to ensure the accounts payable subsidiary ledger matches the statement received from the supplier. If discrepancies are not investigated and rectified these accounts will not reconcile with each other. Discrepancies can arise from:

- Purchase orders never sent to accounts payable

- Inaccurate invoices

- Lost invoices, late invoices, early invoices

- Incomplete purchase orders

- Purchase orders never completed

- Inaccurate purchase orders

- Incorrect delivery documents

- Delivery documents not checked against the goods or services received

- Invoices sent in for payment more than once.

It’s important to establish a routine where you review and check all accounts payable documentation on a regular basis and in a systematic way. That said, discrepancies will still happen no matter how thorough and frequent your reviews. The important thing is to have a system in place to minimise errors and quickly spot and correct any that do happen.

Check invoices to ensure the accuracy of:

- All calculations including extensions, discounts, GST and totals are correct

- That delivery of the goods has been signed off by an authorised person

- That goods delivered have been checked against those ordered

- Invoice and delivery dates are correct

- Payment terms stated on the invoice are correct

- Any extensions, changes or corrections have been accurately recorded.

Types of discrepancies

- A quantity discrepancy is the difference between the receipt quantity and the invoice quantity.

- A cost discrepancy is based on a comparison between the invoice cost and the purchase order cost.

- A billing discrepancy is when the pricing or discount calculation is incorrect.

Pricing of goods and services and discount calculations should always be checked against source documentation such as the creditor's agreement and current supplier pricelist. If discrepancies or errors are noted, the supplier should be contacted to verify the currency of the pricing. If there has been an error made a new invoice should be created. When the new invoice is received, payment can be processed.

Credit adjustment notes

If an examination of an invoice indicates a discrepancy, this should be clarified with the supplier immediately. In these situations, the business should endeavour to obtain a credit adjustment note from the supplier. Original invoices should NOT be amended.

Disputed invoices

Most queries can be resolved between the organisation and the supplier. Often the reason for non-payment is that the goods supplied, or services delivered did not agree exactly with what was ordered, or the goods/services have not been satisfactory. These situations must be resolved between the two parties, resulting in the account being paid or a credit note (full or partial) being provided by the supplier.

Payments to suppliers are equally as important as the payments you need from your customers. They should be made on time and in line with purchasing agreements.

Supplies of incoming goods should always be checked against the delivery dockets or invoices on arrival and while the delivery person is still present. If in such situations, discrepancies occur, they can often be rectified on the spot or credit notes can be organised immediately.

If this does not occur, you might contact the supplier to discuss the discrepancy. Be calm and polite. Have all the source documents, invoices, delivery dockets etc. available, so you can provide any details the supplier needs. You might need a copy of the purchase order, delivery docket, receipt, and payment details.

If the supplier disputes your claim, your call might be escalated to someone whose job it is to deal with disputes.

Direct invoices

In addition to supplier invoices businesses will have direct invoices. These are purchases that don’t directly relate to the manufacturing or supplying of a product or service. They are however necessary for the business to run efficiently.

Direct invoicing can only occur in particular circumstances such as:

- Electricity payments

- Telephone charges

- Contract payments

- Insurance premiums

- Standard periodic maintenance charges

- Monthly invoices relating to the organisation's corporate credit cards (within established limits)

- Petty cash reimbursements

- The monthly payment relating to vehicles leases and fuel cards membership and subscription renewals

In these circumstances the signature of the manager holding the appropriate authority on the original invoice or agreement is sufficient for the payment of these to occur.

As mentioned earlier, accounts payable are current liabilities that are paid by the business within twelve months. The accounts payable account in the general ledger is credited when the company purchases goods or services on credit. When the company repays a portion of its account payable, its balance is debited.

To illustrate the accounts receivable controlling account/subsidiary ledger relationship, let’s examine the amounts owed by Peter Swing who runs The Golf Shop. The following balances were for 30 April 2020:

Peter maintains an accounts payable subsidiary ledger, which is summarised by an accounts payable control account in the general ledger. The example below shows the relationship between the two.

Each time Greg purchases goods on credit two entries are posted from the purchases journal to the ledger:

- One to the subsidiary ledger account of the creditor from whom the purchase was made on the date of the purchase.

- One to accounts payable control account in the general ledger at the end of the month.

PURCHASES RETURNS JOURNAL – The Golf Shop

Likewise, if Greg returns any goods to the supplier two entries are posted from the purchases returns journal to the ledger:

- One to the subsidiary ledger account of the creditor on the date of the purchase return.

- One to accounts payable control account in the general ledger at the end of the month.

The example below shows how these transactions are recoded using the subsidiary ledger.

For a business to effectively monitor and record accounts payable, it must have well documented accounts payable policies and procedures which should be available for relevant staff members to access. An accounts payable policy should cover the following:

- approved suppliers

- obtaining quotes

- purchase order approval

- acceptance of goods and services

- procedures for recording accounts payable transactions

- credit for returns and allowances

- discounts offered

- monitoring accounts payable

- accounts payable payment procedures.

In large businesses these functions can be spread over several departments with reporting, and lines of authority being different for every organisations. Ultimate the responsibility generally sits with an organisations chief financial officer (CFO). It is important that accounts payable policies and procedures are regularly reviewed so they remain effective in ensuring that accounts payable transactions are properly authorised, monitored and recorded. They also provide a framework for developing effective internal controls.

Businesses are increasingly moving to automated accounts payable systems which are designed to make sure the accounts payable process is being operated correctly and to assist with identifying errors and anomalies.

Regardless of the reason, if an invoice does not match with the purchase order and the delivery docket, payment should be stopped pending further information. The accounts payable staff should seek further clarification from the requisitioner, who may need to liaise with the supplier to address the discrepancies before the invoice can be authorised for payment.

You may find that authorisation to make payments is often set for different amounts. For example, a supervisor might be able to authorise payments up to $1,000. A manager might authorise amounts up to $10,000, while the CFO is required to authorise amounts in excess of this.

The company must act, at all times, within the legislative guidelines and regulations applicable to the industry and/or industry sector. You must ensure that your work and/or reports are compliant to ensure there are no breaches of any of the Acts.

If you need authorisation to make a payment, then you will need to contact the appropriate person and have this authorisation given in writing before proceeding to pay an account.