New business ventures can be a new business formed with the purpose of financial gain or can be a new division within an existing business. Most new ventures have a clear business strategy and plan, but it is equally important to have clearly expressed financial strategies that support them. Financial strategies should be aligned to and based on the business plans. Based on your sales forecasts, you can project your income and your anticipated business expenses (including those related to workforce equipment, material, operating overheads, marketing costs and promotion costs). These projections can be for the coming weeks, months, and years, depending on the type of business venture. This helps create your financial plan which is forward-looking and is different from your financial statements, which only present what has already happened.

New ventures require access to adequate funding as it takes time to acquire new customers and get the sales and marketing efforts up to full speed. In the interim, expenses are to be paid and materials, equipment, and inventories are to be bought. There can be different strategies to meet the funding requirements. You may decide to invest your own personal funds, get funded by friends and family, find external investors (angel investors or venture capitalists), do crowdfunding or borrow funds from banks and financial institutions. Many innovative ideas meet an early demise as they run out of capital. Hence it is critical to have a plan to negotiate and manage your business capital.

New ventures are risky, even those within existing organisations; they may expend more cash than they generate. There may be a lag between the time you get paid and the time you must pay your vendors, and you may incur regular running costs like salaries, rentals, and utility payments. Hence it is critical to have financial strategies in place to maximise your cash flows. You should develop, monitor, and maintain your customer credit and collection policies based on these strategies. You should also ensure that you make adequate provisions to meet all your regulatory liabilities.

These projections are tools that will help you assess and manage your progress. You need to decide on the key indicators that you will select to monitor financial performance. These key performance indicators can provide early warning signals for trouble. Finally, it is essential that you record procedures when implementing these strategies and that you communicate them to the required personnel.

Your financial strategies will assist you to monitor your finances, plan for dips in cashflows, identify financing needs, and deciding when to start new projects.

Financial strategies aim at maximising the value of any venture. They look at the financial implications of the business strategy of the venture and help find the best financial course of action to achieve the business goals.

The first few years of any new business venture are extremely critical, and the long-term viability of the business venture will depend on it. New ventures are very risky, and you may spend more cash to set up the business than you can generate from running the business. The main causes of many failed new ventures are that they did not plan properly, did not keep track of their expenses, had run-away costs, or failed to collect payments from their clients fully or on time. Some of them may not have planned contingencies or may have failed to understand their regulatory liabilities and obligations properly. Some may fail to distribute their limited available funds towards business-critical expenses. They may end up spending too much on ‘nice-to-have’ expenses upfront and then run out of funds for more critical payments that may come up later.

Hence you must manage your company's finances carefully. You should keep a close eye on your cash flows, do sensible controlled spending and grow your venture without taking excessive financial risks.

Financial Information Requirements

To implement your financial strategy effectively, it is important to identify the financial information that you will need to follow each step of your strategy. This financial information may exist in your business venture’s financial records as well as business and operational strategies and plans. Financial information requirements may include information relating to:

- Asset and liability

- Income and expenses

- Cash flow

- Tax

- Strategy and planning

Asset and liability

Your venture’s balance sheet shows what the venture owns (assets), what it owes (liabilities) and what belongs to the owners (owners’ equity). It shows the following:

This is the amount of capital required to commence business operations. This is what you will need to pay for the expenses involved in starting a new venture. This will help meet all initial costs, which may include rent or lease expenses, legal and accountants fees, cost of purchasing equipment, inventory and supplies, employee salaries, etc. Starting capital or start-up capital helps you fund your expenses till you start generating revenue or income.

This is the amount of outstandings or owings that the business venture has. You may take long-term or short-term loans. Loans are borrowings that are to be paid back with interest.

Assets are anything that your venture owns that has economic value and is capable of generating future benefits like generating income or reducing expenses. It is reported in your balance sheet. Assets can be classified as fixed, current, intangible or financial.

Income and expense

Your venture’s profit and loss (P&L) statement shows how much income your venture has earned and spent over a particular time period. It is also known as an income statement or earnings statement. It shows you a profit if your income is more than your expenses or a loss if your expenses are higher than your income. It shows the following:

Revenue is the direct operating income earned by the venture through sales of its products or services. It is also called the top line as it is placed at the top of the P&L statement.

This is the direct cost of producing goods or services that are sold by the business venture. It includes all direct costs incurred for creating the product or service but excludes indirect expenses like overheads.

This is the income that the venture can earn which does not directly relate to the sale of its goods or services. It can include interest income earned, rental income, sale of shares or other assets.

These are operating expenses that the venture incurs and can include rent/lease expenses, fees paid to accountants, legal fees, payroll, insurance, and depreciation on assets.

Cash flow

Cash flow statements answer the core question – ‘Is the business venture viable?’. It shows all the inflows (+) and outflows (-) of cash for your business. The cash flow statement usually shows the monthly cash flow over a twelve (12) month basis. . They start with the opening balance of cash. To this, the monthly inflows are added, and outflows are subtracted to arrive at the actual or projected closing cash balance. For a new business venture, this enables you to make accurate financial decisions and financial plans for daily operations as well as expansion. It provides insight that can be used in planning for future trends to enable business growth.

The flows of cash can be on account of the following activities:

This is the amount of cash generated or expended on account of normal operations. For example – sales proceeds (+) or cost of stock purchases (-).

This is the amount of cash generated or spent on non-current assets that are expected to give a future benefit. For example – the sale of shares or securities (+) or capital expenditure incurred (-).

This is the net flow of cash used to finance the business and includes the cash received from issuing stock or debt (+) and the cash that is paid out as dividends (-). Interest paid on account of loans taken is normally taken under operating cash flows and not as a financing cash flow.

Tax

The following are some of the tax-related documents that you may need:

In Australia, if you are a business venture registered for GST, you need to submit a BAS, which will help you report and pay your GST, Pay as you go (PAYG) instalments and withholding tax, as well as any other taxes.

This is needed to be filed on an annual basis and helps the government know how much income your business has earned and if you are claiming any deductions.

This is a tax on goods and services consumed in Australia.

This is a list of all transactions in your bank account for a particular period.

Staff

The following are some of the staff-related information:

This is the number of leave days employees have earned according to your employee benefits policy that they have not used or been paid for yet.

This is documentation containing details of the salary, numbers of hours worked as well as the amount your employees are entitled to be paid to provide for their retirement.

Strategy and planning

This can include:

This presents your business venture’s strategy for managing your assets, cash flows, income and expenses.

These are projections or estimates of future financial outcomes for your business. It helps you prepare for the future. One of the key projections is the cash flow forecast.

Financial ratios are indicators used to measure the performance and financial situation of a business. They can also be used to analyse trends and to compare a firm’s financial figures to those of competitors or those of the business sector in which it belongs.

Financial markets, threats from project failures at any phase, legal liabilities, credit risk, accidents, natural causes or disasters, etc., can all lead to financial risks that will need to be managed. Information is required to effectively identify, assess and prioritise risks to be treated. To treat these risks, you can transfer the threat to another party by taking insurance or contracting the activity, avoiding the activity causing the threat, reducing the negative impact or even accepting some of the risks.

To identify the financial information that you will need to implement your business venture’s financial strategy, you must refer to the requirements of the financial strategy. Here is an example:

Kwik Eats Pty Ltd is a new business venture that home delivers customised ready-to-cook meal ingredients to customers. The financial strategy of Kwik Eats Pty Ltd requires them to create financial budgets for the next 12 months. They will need to gather the following financial information to enable them to create the budgets:

- Historical performance: Sales, expenses, cost of goods sold (COGS)

- Monthly targets for the next 12 months

- Financial resources that are available to be budgeted.

Specialist Services

When you are starting a new business venture, you may need the services of specialists to help you navigate technical areas in which you may not have sufficient expertise. Professional assistance can make the difference between the success and failure of the venture. Some of these specialists can include:

Accountants

An accountant is a professional person who performs accounting functions such as audits or financial statement analysis. Accountants can either be employed with an accounting firm, a large company with an internal accounting department, or set up an individual practice. Accountants must abide by the ethical standards and guiding principles of the region where they practice. The type of educational background and designation that an individual has will determine their professional duties.1

Financial advice is required to prepare detailed financial forecasts and verify that they are accurate and reasonable, as well as that all issues have been taken into account. Mistakes are most commonly found in areas such as income tax and GST. If there are missing expenses and cash flows have not been timed correctly, the business case is weakened, and it does not help to build up confidence in the business and its management.

Most commonly, accountants are the ones chosen to be professional advisors. So, finding the right accountant is an essential element of monitoring and managing the financial well-being of your business. Having an expert third party review your records means you will be alerted to problems with your recordkeeping methodology or computational errors. An accountant can help with things like financial advice and managing growth. You can also appoint them as an ‘agent’ to deal with your tax affairs, and submit your GST returns.2

Further Reading

The Institute of Chartered Accountants Australia is the professional accounting body representing Chartered Accountants in Australia. From 1st July 2014, the Institute of Chartered Accountants in Australia and the New Zealand Institute of Chartered Accountants have decided to operate jointly under the trading name of Chartered Accountants Australia and New Zealand. You can search for a suitably qualified accountant on their website.

Business Advisors and Consultants

Business advisors and consultants are individuals that offer information to business owners to help them operate their businesses more efficiently. Advisors can be hired for consultation on a one-time basis to help streamline or enhance your business, or they can take a more active role by offering recurring advice sessions to your business.

Government Agencies

These are administrative divisions of the government, which are formed by the national, regional, or local governments. Each of these agencies has its own area of responsibility. Government agencies are normally separate from the government departments or ministries. Some may report to these ministries/departments. Others, especially those with regulatory responsibilities, function as independent units. Regulatory agencies define standards and ensure compliance with them. Legislatures create them, and their regulations carry the force of law.

Industry/Trade Associations

Industry or trade associations are organisations whose members are involved in a particular business or trade, such as retail and wholesale, fabrics, foodstuff, and transportation. These associations support their members by providing the following services:

Further Reading

Business Queensland can offer more details on what industry associations do that can be applied regardless of state and territory.

Lawyers and Providers of Legal Advice

Lawyers are persons whose job is to guide and assist people in matters relating to the law. Barristers and solicitors are other providers of legal advice. Barristers may offer legal advice and information relevant to their client's legal matters. However, barristers do not work directly with their clients; instead, they coordinate with their clients’ solicitors, who then provide the information to their clients. Solicitors are legal professionals who assist clients with legal issues and offer legal advice and assistance when serving their client's legal interests.

Mentors

A mentor refers to an experienced person who assists another (the mentee) in developing specific skills and knowledge to enhance the mentee’s professional and personal growth.3 This relationship between the mentor and the mentee is called mentoring, a development activity that focuses on the future.

Providers of Training in Accounting Software

To prepare and implement your financial strategy, you may use accounting software to prepare your projections, maintain your records and monitor actuals vs projections and budgets. Some specialists can help you understand how to use them. These specialists can also be a source of information on the industry as well as key practices in implementing financial strategies.

The professional advice required will depend upon the areas of expertise of the management, the type of business and a range of other issues. Some core areas where specialist services will be required are accounting and legal issues.

Given below are guidelines that will help you when you are obtaining the services of specialists.

- Get an estimate from any advisors you plan to work with and agree in advance on what they will do. Some advisors will charge an hourly fee, and others may offer a fixed price for a piece of work. You should try to get several quotes before you decide who to use so that you can compare prices.

- Gather information from peers in the business community. Other local business people should be familiar with the specialist. You should receive positive recommendations about them from peers in the business community.

- Meet up with and interview a few advisors before you finalise one. You should ask yourself the following:

- Do they specialise in businesses the size of your business?

- Do they adequately understand your area of business and its unique problems?

- Do they specialise in income taxes?

- Did they explain their fee structure to you?

- Are you comfortable using them as your advisor?

This is especially important as you should be comfortable with and feel you can trust the person you finally select.

- Look for an accountant well in advance. Shopping around for an accountant in the busy season is the worst time as they are too busy for interviews or may not be able to take on new clients.

Further Reading

For more information on resources provided by Business Australia, refer to the following links:

Managing your finances and related cash flows should be an integral part of your strategic plans. Producing budgets and financial projections help you get clarity about the direction your venture is heading in. Having a superior product, service or business idea, or a great marketing strategy is not sufficient to be a successful entrepreneur. It is also extremely important to understand the financial numbers of your business venture, what can affect these numbers, and the implications of each of these numbers.

Various stakeholders who may be outside your organisation will also use your financial projections and budgets. After preparing them, you will need to also distribute them to these stakeholders according to legal requirements and your workplace procedures.

Financial Budgets and Projections

A financial budget reflects a business’s strategy for managing its assets, income and expenses, and cash flow. Financial projections are simply forecasts of future revenue and expenses. Your business strategy may include many plans for your business venture. For example, you may be planning to purchase new manufacturing equipment or to open new shopfronts. All these plans will impact your business’s cash flow. You may even need to borrow money from lenders or raise money from investors to finance your planned activities.

Your business venture can run into serious financial difficulties if you do not make and use financial budgets and projections based on your strategic plan. Realistic annual financial budgets and projections can help keep your business running smoothly in line with your strategic plan, year after year. You should start by creating a monthly financial budget for the next 12 months, compare the actual performance every month against the budget, and make financial projections for the remainder of the year. Adjust them month after month to reflect changing business conditions. In this case, each month will represent a ‘forward period’. If you choose to prepare quarterly financial budgets and projections, then the forward periods will be quarters.

The key difference between the financial budget and the financial projection is that the budget will set out the plan for what your business is aiming to achieve based on the strategic plan. In contrast, the financial projection will indicate where the business venture is heading based on actual performance.

You can create and use financial budgets and projections based on your strategic plan in three easy steps:

-

Look one year ahead and plan for it

- Identify the business activities that are planned for the year ahead based on the business strategy in your strategic plan.

- Estimate your business venture’s annual sales revenue based on the business activities you will implement.

- Estimate how much of this revenue will be received in cash from customers who pay immediately.

- Estimate how much of this revenue will be receivable from customers who pay on credit terms based on your business venture’s credit policy.

- Estimate the total annual expenses that your business venture will incur to implement all the business activities fully.

- Add to these estimated total annual expenses, all the business venture’s regular operating expenses. These operating expenses include the following:

- Rent

- Overhead costs such as selling, general, and administrative expenses (SG&A)

- Utilities

- Wages and salaries

- Loan interest

- Estimate capital cash outflows related to:

- Loan principal repayments

- Purchase of machinery

- Purchase of vehicles

- Purchase of computers

- Developing a new app, website, or software

-

Prepare financial budgets

Using the estimated annual revenue, expenses, and cash flow requirements, prepare projected monthly financial budgets for the next 12 months. You can use your business venture’s accounting software or even a simple Microsoft Excel spreadsheet

The main components of financial budgets and projections are:

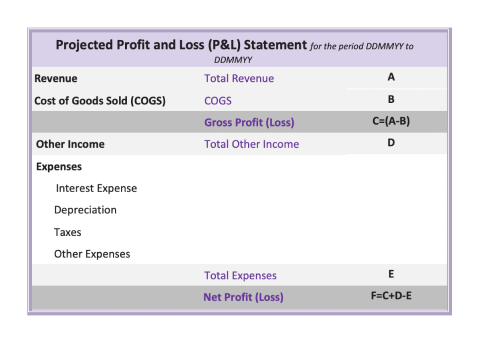

- Projected monthly Profit & Loss (P&L) Statement: Given below is a sample P&L Statement that shows how the gross and net profit (loss) is calculated.

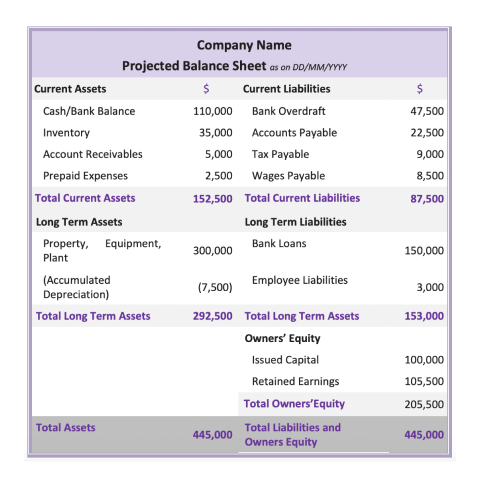

- Projected monthly Balance Sheet: This reflects the key accounting equation: Business Assets = Liabilities + Owners Equity. Given below is a sample:

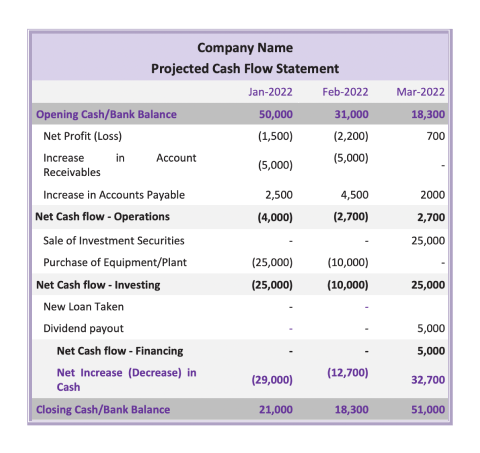

- Projected monthly Cash Flow Statement: A business can operate for many years without profit but can not survive without cash. Cash flow projections will help you forecast the cash available to meet the obligations over the budget period. A cash flow forecast is an estimate of the amount of money you expect to flow in and out of your business and includes all your projected income and expenses. A forecast usually covers the next 12 months; however, it can also cover a short-term period such as a week or month. You will need to include:

- Cash flow from operating activities

- Net profit (+) or Loss(-)

- Increase (-) or decrease (+) in accounts receivable

- Increase (+) or decrease (-) in accounts payable

- Change in other working capital

- Cash flow from investing activities

- Purchase (-) or sale(+) of property, plant, and equipment

- Cash flow from financing activities

- Loan repayments (-) or taken (+)

- Cash flow from operating activities

Given below is a sample projected Cash Flow Statement for three months.

- Projected monthly Profit & Loss (P&L) Statement: Given below is a sample P&L Statement that shows how the gross and net profit (loss) is calculated.

-

Monitor actual financial performance and prepare financial projections

- Every forward period, review your business venture’s actual financial performance compared to the financial projections.

- Identify all significant unfavourable variances, i.e. actual performance items that are worse than their respective budgets.

- Take action to address the causes of the unfavourable variances. You can do this by making improvements to your business operations.

- Prepare financial projections for the remainder of the year to reflect the improvements you will make.

When starting a business, people are often overly optimistic about the future financial results of their business. This enthusiasm could cloud their judgement, leading to problems. For one, they could underestimate the time it takes to get things down and the cost associated with it. You need to ensure that you are as realistic about the prospects as possible to be able to make reasonable projections. You can base your numbers on research, or you may speak with others in the same industry or connect with professional and industry bodies.

You must have:

- A clear understanding of the purpose and audience of your projections

- Knowledge of the key drivers of financial results for the business

- Some knowledge of accounting and financial statement analysis

- Skill in using spreadsheet software such as Excel

- Creativity, attention to detail, and good judgment.

Young Entrepreneurs Forum is a YouTube channel that aims to provide entrepreneurial content to help businesses. Watch the video below to know more about building financial projections for your business.

Users of Financial Budgets and Projections

The stakeholders who will use your financial budgets and projections may include:

Legislative and Regulatory Requirements That Apply to New Business Ventures

When you start a business, you need to comply with legislative and regulatory requirements. It is advisable to consult a legal expert or a business consultant or advisor to understand the requirements that apply to your business so that you can adhere to them.

Corporations Law

Corporation law (also known as business law, enterprise law, or company law) is the body of law governing the rights, relations, and conduct of persons, companies, organisations and businesses. While all companies must keep financial records, there are a few regulatory requirements under the Corporations Act 2001. Australian Securities and Investments Commission (ASIC) regulates compliance with the financial reporting and auditing requirements for entities subject to the Corporations Act. It provides relief from those requirements in certain circumstances. A business must keep up-to-date financial records that record and explain transactions and the company’s financial position. Larger companies have additional obligations to lodge financial reports with ASIC.

Further Reading

To get more information about these requirements as provided by ASIC, read Legal requirements for companies.

Australian Accounting Standards

These refer to legislative requirements set by the Australian Accounting Standards Board (AASB) for financial reports from private and public sector organisations.

Further Reading

Find out more about the Australian accounting Standards (aasb.gov.au)

Taxation Laws

There are many taxes that you may be required to register for. You can investigate and register at the Australian Taxation Office (ATO) website. The ATO offers a range of online services and information. Seek advice from your accountant.

You may need to comply with tax obligations that require you to register for:

- Australian Business Number (ABN)

- Goods and services tax (GST)

- Tax file number (TFN)

- Pay as you go (PAYG) withholding

Further Reading

The Australian Taxation Office can provide you with more information regarding the registrations your business may need and how to lodge your registrations and statements. You can also get more information about these registration requirements in Business Australia - Legal essentials for business.

Industrial law (for payroll records)

The pay and conditions for Australian workers may be determined by some sources, or a combination of sources, including legislation, awards, agreements, and contracts of employment. In addition, state or territory legislation may apply or federal legislation. Fair Work Australia is the primary body.

Further Reading

The Fair Work Commission can provide you with more information on awards and agreements, as well as provide you with additional resources such as guides, fact sheets and videos.

Financial Reporting

Financial reporting is done to promote investor confidence and integrity in the market, your business, other organisations, and the economy. You may be required to report to the following entities:

- Australian taxation office (ATO)

- Australian Securities and Investments Commission (ASIC)

- Australian Securities Exchange (ASX)

When conducting financial reporting, there are some factors you must consider and adhere to. These factors include the following:

- Business Activity Statement (BAS)

BAS are documents that must be lodged to the ATO for your organisation to make payments and reports on your tax obligations. This can be done digitally or physically and needs to be lodged on a monthly, quarterly, or annual basis dependinH4g on when your organisation's instalments are due. - Financial reporting requirements

Your organisation is required to prepare and lodge your financial reports with ASIC. This is typically done at the end of the financial year, and the report must be audited. According to ASIC, your organisation must lodge reports if:- Substantial sums of money are involved

- Funds from the general public have been invested in the organisation

- Your organisation is non-profit and exists for charitable purposes.

- Australian Stock Exchange reporting requirements

If your organisation is listed under the ASX, your organisation is required to adhere to periodic and continuous requirements on disclosure. - Australian Accounting Standards

You need to adhere to the standards as laid out by the Australian Accounting Standards Board.

Workplace Procedures for Distributing Financial Budgets and Projections

Comprehensive workplace procedures are established to ensure all activities help meet the organisational policies. Workplace financial procedures must follow legislative and regulatory requirements to ensure that the business does not violate any provisions in implementing its financial strategy. They give assurance that key processes are executed consistently across the business.

Once you have produced your financial budgets and projections, you need to distribute them to the required people according to your workplace procedures.

These can include procedures that do the following:

- Ensure that you have prepared the projections honestly and to the best of your knowledge

- Ensure that you have followed legal disclosure requirements without suppressing any material information

- Detail the format that your business will use for different documentation

- Outline the process for distributing different financial documentation

- Specify the length of time all financial projections, shared as per legislative and contractual requirements, are to be kept

The purpose of distributing financial budgets and projections is to keep all stakeholders informed of what the business would like to achieve in the future as well as how it is doing financially month after month.

The process of distributing different financial documentation includes the following steps:

- Consider the people you will need to distribute the financial documentation to

- Use the company’s suggested communications forms, channels and modes according to the communication plan to distribute the documentation

- Ensure all the recipients are informed about any disclosure requirements when distributing the financial documentation

Forms, Channels and Modes of Communication Used in Relation to Managing Business Finances

Effective communication is a critical but often overlooked aspect of managing business finances. Workplace communication takes place in a variety of contexts for different purposes. Additionally, the audience has internal and external stakeholders, i.e., any person, group, or organisation that has an interest or concern in an organisation. The defining characteristic of workplace communication is that it is usually aimed at generating tangible results. Communication in managing business finances includes communicating your financial projections and key aspects of your financial strategy to external stakeholders (lenders, potential investors, government, and its agencies) as well as to internal stakeholders (like employees and shareholders). It also involves communication with specialists.

Choosing a method of communication depends quite significantly on whom the message is for, what the purpose is, and what outcome is desired. While managing business finances, you will need to consider what the most effective method of communication would be for your communication goal. You also need to consider if the chosen method is a suitable and effective one for the task at hand, if there are any downsides to the chosen method, and how they can be mitigated.

Forms of Communication

Communication of information about business finances takes place in various forms, which include:

Using accounting software:

- Xero

- MYOB

- QuickBooks Online

- Sage

Information contained in financial statements:

- Balance sheet

- Profit and loss statement

- Cashflow statement

- Statement of changes in equity

Accounting software

These refer to all automated programs that help in recording and reporting the financial transactions of the business. These are especially useful when you estimate the start-up costs and other finances of your business. Some of the common accounting software businesses can use include:

- Xero

Online accounting software for small and medium-sized businesses. Key features include:- Track financial performance

- Create summary reports

- Track billable invoices

- Track purchases orders

- Estimate costs and expenses

- Manage bills payment

- MYOB

Accounting software for small and growing businesses. Key features include:- Track performance against budget

- Generate reports

- Cash flow management

- Invoicing

- Create estimates

- Tax compliance

- QuickBooks Online

Cloud-based software, which is designed for freelancers, small businesses, and independent accounting firms. Key features include:- Profit and loss reporting

- Balance sheet reporting

- Payment tracking

- Estimate creation

- Expense management

- Expense tracking

- Sage

Cloud-based accounting and invoicing software for small businesses. This software is smartphone friendly. Key features include:- Manage cash flow

- Send and track invoices

- Monitor inventory

- Bank reconciliation

- Send quotes and estimates

- Snap and post receipts

Most businesses today use accounting software to manage their financial transactions as the software makes it more convenient to help prepare reports. This includes preparing the estimated start-up costs, income and expenses, and cash flow of the business.

- Financial statements

These statements help you communicate the financial activities and performance of your venture to different stakeholders. They include:- Balance Sheet

This is also known as a statement of financial position and is a written record that summarises the assets, liabilities, and equity of a business within a specific period. It is a snapshot of the current finances of the business. This can help you, as well as the investors and lenders, know if the business is financially viable.Assets = Liabilities +Owners Equity - Profit and Loss Statement

This statement records the income and expenses of a business for the year. A business may have varying ways on how revenue, costs, and expenses are recorded in the P&L, but they all follow the formula:Sales – Costs = Net Income - Cash Flow Statement

This statement communicates all the cash inflows and outflows for your business. It records actual cash flows and not income. It helps you communicate your cash position and if you are generating sufficient cash to meet your operating requirements. - Statement of Changes in Equity

This is also known as Statement of Retained Earnings and shows how much money the business has kept rather than paying to its shareholders. It is essentially a reconciliation of the opening and closing equity balance during a period. These are not prepared every month but on an annual basis.Opening Equity+Net Income-Dividend±Other Charges=Closing Equity

- Balance Sheet

Channels of Communication

There are primarily two channels of communication that you can use while managing your business finances:

- Formal

- Meeting with your bank manager to discuss restructuring of your repayment terms

- Informal

- A family dinner where you discuss possible funding from relatives

Modes of Communication

Communication can take place in various modes. These include:

- Verbal communication

- Meeting with specialists to discuss legal or accounting requirements

- Non-verbal communication

- Nervous body language when discussing loan repayment terms with banker

- Written communication

- Filing of regulatory reports with the ATO or documenting workplace procedures relating to credit policies

- Visual communication

- Presenting financial budgets and projections to potential investors using charts and graphics to show trends and projected growth, market share and. profitability

A business plan is a written document that articulates the business’s key activities, objectives and how it is going to meet its goals. It covers what products and services the business will sell, what the business structure will be, what are the marketing and distributions strategies. Once you have finalised your strategic business plan, you need to decide the amount of funds required at each stage to convert the plan into action. Documenting a detailed business plan will help decide how much business capital you need to make a success of your business venture. Business capital is the money required for meeting the needs of any venture. Financial capital is the debt and equity business capital required for meeting the needs of any venture. Financial capital is used by the business to create or purchase business assets.

Hence one of the key financial strategies for new business ventures is the plan to negotiate and manage business capital to ensure proper implementation of its business plan. This applies to both entrepreneurs looking to start a new business or business owners looking to expand the business into new areas. When a new business has limited capital then it becomes exceedingly difficult to successfully implement its business plan. One of the main reasons for the failure of new ventures is the lack of adequate business capital.

Sources of Business Capital

It is quite likely that you will not have all the money your need to commence and trade for the short-term, and equally likely that you will need to borrow funding or arrange finance to cover the shortfall. If this is the case, there are several potential sources of such funding. Each will carry its own benefits and costs. It is important to carefully explore and evaluate each option to find the best solution to the needs of your business. The main sources of business capital are:

Debt

The business borrows these funds and needs to repay them at some point. It can be a business loan, a personal loan taken by the owner, or even a credit card with a limit. It is usually secured against some assets, like business receivables. These types of loans are normally at a higher rate of interest as there is a greater risk associated with a new business venture. The providers of debt capital are creditors to the venture and do not become part owners of the venture, unlike providers of equity capital.

Providers of debt capital are:

- Financial institutions

- Include banks, building societies and credit unions

- Provide business loans, lines of credit, overdraft services, lease financing, invoice financing

- Family or friends

- Loans offered are debt financing arrangments

- Factor companies

- Buy outstanding invoices at a discount. Different from invoice financing as provided by financial institutions as here the factor company foloows with debtors to ensure collections

- Retailers

- Provide goods like furniture, technology or equipment on credit

- Suppliers

- Purchase of goods and inventory on credit by paying for it at a later date

- Finance companies

- Offer loans similar to financial institutions but at a higher rate as they are willing to fund riskier ventures and start-ups

Equity

This is when you get funds for your business in return for a share in the ownership of the venture. The amount of ownership given to people who give external funds (as opposed to your own funds) is based on the amount of funds that is invested and the expected value of the business. While getting external funding as equity capital, you need to be careful of the following two points.

- External investors will try to get maximum ownership for the least amount invested. Thus, you must have a fair understanding of the expected value of your business to help you negotiate better.

- Investors, unlike debt capital providers, try to have a say in the running of your venture. You should be clear about whether you feel you can work with them closely and not allow your judgement to be coloured by your need for immediate funds.

The common sources of equity capital are:

Own funds also known as ‘bootstrapping,’ is the most preferred form of capital, as there is no interest cost involved and nor is there any dilution of ownership. However, often it may be difficult to have sufficient funds to cover all your requirements over the early years.

Family Sources which include friends and family members, are often willing to invest in you and are more likely not to interfere in the running of your venture. However, raising finances from them may have a few drawbacks. It may result in the souring of relations if there is a loss. It may become awkward if they decide to give you unsolicited advice.

Crowdfunding is gaining popularity as a source of business capital for many new ventures, especially when people want to support and speed up the production of products, they may find interesting or useful. Normally these are in the form of donations. However, sometimes they could get shares in the company. The latter is also called crowd-sourced funding.

Grants are a source of finance that is not expected to be paid back, and nor do they attract financing costs. However, they come with very strict conditions. The aim of those who give grants is to give businesses, usually small and start-up businesses, a helping hand. However, to receive a grant, a business must meet the terms and conditions of the grant provider. Grants can be offered by the government, private corporations or philanthropists.

Private Investors are the most common source of financing. These include angel investors, high net-worth individuals who provide financial financing to new business ventures. They take a share of profits and equity in the venture in return.

Venture Capitalists are large organisations who provide equity funding in return for a controlling stake in the venture. The advantage of both angel investors and venture capitalists is that they are a valuable source of business contacts, advice and expertise.

Based on Source of finance: debt vs equity, used under CC BY 3.0 AU. © Commonwealth of Australia 2020.

Given below is an extract that gives a comparison between debt and equity capital:

Based on Business Funding Guide, used under CC BY 3.0 AU. © Commonwealth of Australia 2020.

Financial Decision Making

Financial decision making involves all decisions related to the business assets, liabilities and owners equity. Most financial decisions for new business ventures revolve around the following:

- When and how should you raise business finance

- When and how should you spend it

- How to maximise the available funds.

These decisions will make a difference between a financially viable business in operations for years and a business that has to shut down. Financial decision making depends on the financial information. It will be based on the projections and financial budgets. It will rely heavily on the three financial documents, namely the balance sheet, profit and loss statement and the cash flow statements and projections.

The key features of financial decision making relevant to business are:

Financing decisions involve decisions on whether to go for debt capital, equity capital or a mix of both. It also involves deciding on the amount, timing and sources of raising capital.

Investing decisions involve decisions about purchasing or leasing assets, the cost associated as well as the timing of the same.

Operating decisions can include whether to plough back profits into growing the business or to keep them as cash in hand to cater to contingencies or to distribute them to the shareholders.

While taking these decisions, you should be mindful of balancing long term growth with short-term solvency.

For instance, you may wish to plough all capital raised into the purchase of assets that can yield future benefit in terms of greater production capacity and sales, but if you do not keep enough working capital, you may not be in a position to make regular expense payments.

Planning to Negotiate Business Capital

Whether you raise money through debt or equity or a combination of both, you will need to plan how you are going to negotiate with the lenders, investors and suppliers to secure the funding that your new business venture will need. You can develop your plan using these steps:

Determine amount of business capital your business venture requires

You need to make realistic financial projections. Working out detailed projections and budgets based on realistic assumptions, helps you get a grip on the amount of business capital you will require. Investors will be only willing to invest in your venture if they know how what is the projected profitability, how much will you sell, what will be your cost of selling your products and services. Similarly, banks, financial institutions, and other lenders will need to know your projected cash flows. This will give them a sense of your ability to service the debt in the immediate term and your ability to remain in operations on a longer timeframe.

The best way to calculate how much capital you will need is to sit down and work out a realistic monthly plan for your business for the next three to five years. Calculating your projected cash flows, profitability and balance sheet position will be invaluable while negotiating your business capital.

To be able to get the best terms from your investors or lenders, you need to know your business’s current and future financial standing. You need to ensure that you have all the details of your current and projected costs and expenses, your revenue history and your cash in hand position. This information and how you present it can either make or break the deal. You need to be well prepared and confident of your numbers, both the actuals and the projections.

Add a buffer for contingencies

You must add a buffer to cater for unforeseen contingencies and emergencies that might crop up. You may consider adding a buffer of, say, 10%.

Determine what an optimal mix of debt and equity capital for your venture is

Based on the circumstances of your business, its current financial standing and access to assets that you can pledge as security, you should evaluate your options and see what is best suited to your requirements.

For instance, if you need business capital for funding the purchase of long-term assets or for expansion, you are best advised to go for additional capital raises from investors or to go for a business loan. However, if your requirement is for working capital needs, you may decide to negotiate better terms from your suppliers. If you need to purchase vehicles, you may opt for lease financing. Purchase of office equipment may be best funded by taking the credit terms offered by retailers.

Plan how you will negotiate with lenders, investors and suppliers

Lenders

You must firstly shortlist the lenders you would like to approach. To do this, you must:

- Study the features offered by different lenders.

- Ask others in the local business community for their feedback on their lenders.

- Approach industry and professional bodies to get their opinions and suggestions.

Once you have shortlisted the lenders, you must ensure that you have looked into the following:

- Terminology

You should familiarise yourself with the terminology that lenders use so that you are confident in the course of your negotiations with them and do not find yourself at a disadvantage during the discussions. - Interest Rate

Before you meet with the lenders, be aware of what are the prevailing interest rates for different lending arrangements and if there is room for negotiating it. - Repayment Terms

Ensure you have a realistic understanding of what repayment schedule you can service based on the projections of the cash flow you have done earlier. - Pre-payment Terms

You should aim at repaying debt as early as possible to reduce your interest burden. You should have the different scenarios ready, so you can negotiate better pre-payment terms with your lenders. You should know what current market practices are to be able to plan for this negotiation. - Security

Security is the collateral that you need to pledge or deposit with your lenders as an assurance that their funds are safe and the loan will be repaid in full. Security can be of various kinds, some of which are:- Property owned by the business or by you in your personal capacity. This can include business or residential property.

- Assets are another common form of security that you can pledger with your lenders to get access to loan financing. These are items that reflect in your balance sheet and may include plant, equipment amongst others.

- Guarantees, both personal and third-party, may also be requested by your lenders as surety that their loan will be repaid and that you will not default on interest payments.

By doing the above planning, you will ensure that you do not enter into an inappropriate lending arrangement that is unsuitable for your business or has unfavourable terms. Knowing what available options are and using the same terminology that the lenders do will better equip you to negotiate favourable terms and an arrangement that best suits your business venture.

Investors

To negotiate the best terms from a position of strength, you need to ensure you have a viable business proposition, a good team, a well-developed business plan and most critically, an understanding of the investment process. To plan for successful negotiations with investors, you need to:

- Know your end goals.

While developing your plan for negotiating with investors, be very clear as to what are the outcomes you desire. Also, at the same time, try to understand what will appeal to the investors. You should also attempt to find out what the investor goals are and emphasise those aspects that align with the investor goals. - Decide on your terms.

You may want the maximum investment for the least dilution of your ownership. Investors, on the other hand, want just the opposite. You should be clear in your mind as to what will be an acceptable balance. You should list out what are non-negotiable terms. Sometimes it is better to walk away than accept onerous terms. By having a well-thought-out list, you will not be caught unaware when you are on the negotiating table. - Determine what value your venture can offer.

You should be well prepared before you start your negotiations and should be clear what is the value of your business. Articulate it well in advance and be confident when you discuss it with investors. If you are not convinced of the value, you will not be able to convince investors. You may end up giving up a larger share of your business in desperation. This will result in issues along the way when you will have interference in your business plan implementation. Giving voting rights or control of the board can also reduce your say in the business decisions. You may also lose your company totally if the board decides to replace you if there is a major disagreement. - Focus on the big picture.

At the same time, be clear what are the issues you will be ready to make concessions on. Ensure that you do not allow minor disagreements to derail your entire deal. - Know how to close the deal.

Ensure you seek the next steps at the end of the meeting especially if the discussion went well. It is not sufficient to have investors like your business plan; you need to get them to sign on the dotted line. Also, clearly articulate how investors can get back their investments. They should know what are the exit options as the main incentive for investors is not a notional valuation increase but an actual return on their investment in a reasonable time period.

Suppliers

Most new ventures focus on developing plans to negotiate with lenders and investors and forget that negotiating favourable payment terms with your suppliers can be an additional source of capital that you can deploy for improving your business’s prospects. To plan for successful negotiations with suppliers, you need to:

- Understand their business

- Know which supplier to build long term relations with

- Speak their language

- Show them the benefits

- Prepare and collect all relevant documentation

- You should ensure you have prepared all your financial statements and collected all supporting papers before you meet with lenders or investors. Supporting papers may include your property papers, asset purchase invoices, bank statements, among others.

Negotiating business capital is a very critical aspect of your financial strategy. Whether you are going to negotiate with lenders, suppliers or investors, some key points are:

- Be confident and do not show nervousness or over-eagerness.

- Be prepared and do your homework.

- Be clear about what is important for your business.

- Be honest.

- Know your numbers.

- Have accurate financial reports ready to back up your negotiations.

Planning to Manage Business Capital

Once you have secured the required business capital, it is important to plan how you are going to manage it efficiently. You can follow the steps given below:

Review the financial budgets and projections

Begin by re-evaluating the financial budgets and projections that you had prepared earlier. Confirm the following:

- Have there been any significant changes to the short-term funding needs for meeting operating expenses?

- What are the gaps in timing between expected receipts from customers and when the operating expenses are due to be paid?

- Have there been any significant changes to the long-term funding needs for capital purchases?

Determine your working capital

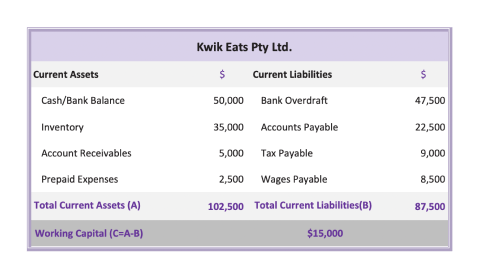

Working capital is the amount of cash your venture has after taking into account your short-term debts. It is calculated by taking your current assets and subtracting your current liabilities from them.

Working capital is calculated as shown in the example below:

Working capital is an important liquidity indicator for businesses and helps measures the operational efficiency of the business. It is important to properly balance your working capital. If you have low working capital, then any emergency can put you in a tight spot. You need a sufficiently high working capital to meet your short-term financial obligations. But if your working capital is too high, you are not adequately optimally investing your excess cash and maybe favouring liquidity over growth.

Allocate adequate business capital to working capital needs

Allocate a portion of the business capital you have sourced to meet the working capital needs. This could be by setting up a working capital line of credit with your lender. The remainder of the business capital can then be allocated for capital purchases and contingencies.

It is also a good idea to hold surplus cash and investments in different banks to use if economic events cause tightening of credit available.

Maximise working capital

Negotiate the longest possible credit terms from your suppliers and the shortest possible credit terms with your customers. Both these strategies will maximise the cash available with your business venture at all times.

Integrate financial reviews

Integrate the review of ongoing business capital requirements with the schedule of monitoring actual financial performance and updating financial projections that you prepared earlier. This will ensure that business capital requirements are reflected in the updated financial projections.

Activity 1 - Drag and Drop

Tax planning should form an integral part of the plan of every business. To plan effectively, it is necessary to know what the applicable taxes are and to ensure that you have made adequate provisions for the same. Efficiently organising a business’s tax affairs helps to reduce reliance on external finance and to maximise the business’s existing resources.

This section will discuss what financial provisions for taxation are, how to develop and maintain strategies to enable adequate tax provisioning, and what are legal requirements relating to the same.

Financial Provisions for Taxation

Managing tax affairs and the responsibility of your organisation is an essential part of the day-to-day business activities. Your organisation's tax obligations and rights will vary depending on the type of work you do, the number of employees you employ, and the type of benefits you offer. Engaging in a business as a sole proprietor, firm or in any other form of organisation will have different tax implications.

Provisions are finances set aside to cover an expected future expense or liability. A tax provision is the estimated amount that your business will pay in income taxes for the current year. Businesses must pay a range of taxes to the Australian Taxation Office (ATO), for which they must make appropriate provisions so that they can pay them on time and avoid fines and penalties. Maintaining adequate provisions also help in ensuring you do not have a cash flow problem when the taxes are due for payment.

The key taxes affecting most businesses in Australia are:

Payroll tax is a tax your business on the total wages you pay each month. . Unlike other taxes, the tax paid is state or local tax, which means that instead of paying it to an ATO, you pay it to your state or regional treasury office (e.g., Revenue NSW).

You must pay payroll tax only if the total amount paid by your business as Australian salary exceeds a certain threshold in each month. You should visit the website of your state or regional revenue's office to find out what the relevant threshold is.

Develop and Maintain Strategies to Enable Adequate Tax Provisioning

You must have strategies in place to ensure that your business accurately estimates the amounts of different taxes that will be payable to the ATO periodically. Operating without required tax registrations or not lodging returns on time and paying taxes accurately may expose your business to interest and penalties from the Australian Taxation Office (ATO).

Given below are some examples of strategies to enable adequate tax provisioning:

Process to develop your strategies

To develop strategies that enable adequate tax provisioning, you must do the following:

1. Understand your obligations

You must understand the tax obligations that apply to your business entity. Your business should have proper procedures in place to comply with all tax administration obligations. These should include:

- payroll procedures for deducting PAYG withholding tax

- superannuation procedures for making Superannuation Guarantee contributions to employees

- using specialist tax advisory services for new, complex, or unfamiliar taxation requirements.

2. Adopt sound decision-making processes

You should document your policies and procedures to help factor tax risks into decision-making, particularly for one-off, new, or large transactions such as the purchase or sale of assets. You can also involve tax advisers and conduct formal reviews to ensure that the decision-making processes are adequate to address complex tax issues.

3. Seek advice

It is especially useful to consider the ATO’s view on deciding the proper tax treatment for significant transactions. The ATO supplies guidance and advice products that you can refer to for understanding how the law applies to your circumstances:

- Tax alerts

- Taxation rulings

- Interpretative decisions

You can also seek advice directly from the ATO before lodging tax returns.

Moreover, you should also engage qualified professional tax advisers who understand your business. This will help:

- meet your regulatory tax obligations

- reduce ongoing tax risks

- provide a sounding board for tax issues.

You should work with your tax advisers to identify and discuss:

- significant transactions that may carry tax risks

- pre-CGT assets, including carried-forward losses and shares

- any transactions for which tax treatment may be ambiguous.

Here is an example:

Kwik Eats Pty Ltd identified two significant tax issues related to the purchase of a used packaging machine imported from overseas. They are not sure how the tax laws apply in their unique circumstances.

They seek advice from their tax adviser, who is unsure of whether the tax treatment in this specific instance will be following the ATO’s view on similar transactions. The tax adviser recommends engaging with the ATO directly. Accordingly, Kwik Eats works with their tax adviser and the ATO to formulate an agreed position on tax treatment. This enables Kwik Eats to make an adequate tax provision for the transaction.

4. Develop an effective tax governance framework.

To ensure that your tax governance framework effectively addresses tax risks, you can:

- put in place effective procedures for rectifying errors that affect tax obligations, such as flagging the issues early with your tax advisers and the ATO

- employ tax and accounting staff who have the requisite skills and knowledge

- use exception reporting systems to flag unusual transactions

- document all transactions that carry tax risks due to ambiguous tax treatment

- engage a registered tax agent to lodge tax returns

- ensure that all tax advice is implemented in full and documented

- ensure procedures are in place to make specific provisions for higher-risk transactions.

5. Use effective systems and controls.

Your tax governance framework should include systems and controls to identify, evaluate, and manage tax risks as well as to ensure accurate reporting.

For example, the Information System Risk Assessment (ISRA) tool can help you evaluate the integrity of your information technology systems to establish if they are governed effectively and have appropriate controls to meet tax and super reporting obligations.

Process to maintain your strategies

You must maintain your strategies to always keep them up-to-date and effective as given below.

- Remain informed about the requirements as the regulation may change

- Review the ATO's taxation requirements for business on at least an annual basis

- Enlist the services of specialists like tax advisors

- Test your systems and controls

- Review your tax governance framework periodically

- Review your policies and procedures periodically to ensure they are up-to-date with current tax laws

- Ensure accounting and tax staff undertake continuing professional development to maintain their skills and knowledge

- Maintain up-to-date tax modules in your accounting systems

Further Reading

When new tax and superannuation measures and legislation are introduced, the ATO provides practical guidance for taxpayers deciding whether to follow the existing law or attempt to anticipate the proposed changes.

Legal Requirements

In addition to the taxes applicable to your business venture, the legal requirements related to taxation include those related to reporting and payment of the taxes that were provided for. It is critical to adhere to these legal requirements as non-compliance can attract regulatory scrutiny. While minimising tax payouts is acceptable, tax evasion carries the risk of reputational damage. Your taxation and accounting strategies should be developed, keeping in mind both the business goals and corporate image.

You must report your business’s income, expenses, and tax obligations to the ATO by filing a Business Statement (BAS). If your business is not registered under GST, you report your business tax obligations through a simple Installation Activity Statement (IAS).

Filing a BAS will be dependent on your organisation’s annual turnover.

Most small businesses file their BAS quarterly.

The ATO will send you your BAS electronically at the time of submission, with few details in the form already completed for you. These include:

- tax period

- your business’s details

- due date.

Based on your records, you can file the final BAS by completing the residual details about sales, expenses, and tax deductions. This helps you determine how much taxes you need to pay to the ATO.

Activity 2 - Drag and Drop

Extending credit to your customers allows them to purchase your products and services today and pay for them later. You are assuming that your customers will have the ability to make the payments later. By extending credit to your customers, you increase sales as customers may buy more if the payment is staggered or deferred. It also allows you to remain competitive.

You must have clear, documented credit policies and procedures in place. You should ensure that while your credit terms are in line with current market practices and are competitive, they are not detrimental to your cash flows. While extending credit to your customers, you need to know some customers may default. Hence, your policies should have clearly articulated strategies and procedures for debt collection and contingencies for debtors in default.

This topic will show how to develop, monitor, and maintain these credit policies to maximise your cashflows.

Extending Credit to Clients

Advantages of Extending Credit to Customers:

- Increased sales

- Customers can buy more

- Increased market share

- You attract more new customers

- Be competitive

- In line with market practices

Risks involved in Extending Credit to Customers

- Reduced Cash Flows

- If you must wait for customer payments, your working capital will be heavily impacted, and your ability to purchase products from suppliers may decrease.

- Reduced Profit Margins

- Extending credit also reduces your profit margins, thus impacting your profit and loss statement.

- Increased Debts

- Unpaid debt can pose a risk to your business, especially if you are exposed to huge transactions.

Given the above risks, it is necessary to develop strong and well-thought-out credit policies for your business venture.

Credit Policies and Main Components

If you are going to provide credit to your customers, you must have well-defined credit policies. Well-defined credit policies will help you maximise your revenue, manage your cash flows and minimise the risks outlined in the previous section.

Your credit policies should be:

- Aligned with the business objectives, goals, and plan

- In line with your business’s culture

- In line with the existing standards prevalent in your business market that allows you to be competitive

- Clear and easily understood by all

- Compliant with prevailing legislation.

Having a clearly articulated credit policy will safeguard you if any of your clients make overdue payments or defaults in making payments. It will help your employees know when they can extend credit and to which customers. It also defines the steps to take if a customer defaults and how to follow up with the customer. Finally, it will help you define when you need to close or terminate defaulting customers’ accounts or take them to court to recover the amount that they owe to you.

The main components of good credit policies are:

Credit Practices

You need to establish your credit practices and detailed policies before you allow your customers to buy goods and services on credit. Ensure that you cover the following:

- Establish clear rules for allowing credit and deciding which customers your business will be extending credit to:

- Individual or business customers?

- New or existing customers?

- All or only large value customers?

The amount of credit you extend and to whom will depend on your risk tolerance. You may decide that your business will allow credit only for larger value transactions above a certain threshold as it may not be economical to extend credit for low-value transactions.

- Ensure you run credit checks on all customers before you extend credit. You will get permission to gather information and look at credit reports and scores during the credit application.

- To check if the client is creditworthy, you may check with their trade creditors or their bankers.

- If the credit limit is large, ask for additional information such as financial statements and written bank and trade references.

The Australian Securities and Investments Commission (ASIC) website provides a list of credit information brokers offering a range of services, including credit check reports.4 When you approve new credit, you keep the credit low initially unless it is an existing customer whose credit standing with you is good, or if it is a well-known customer. You should monitor the transactions and payments in the first year. If the customer pays on time, you may increase the limit gradually.

- Finalise your credit application, which includes the following information:

- Name and full contact details of your customer

- ABN and details of owners, directors, or partners.

- References details if a new client.

- Client’s signature confirming that they have understood terms and conditions, they agree to abide by it and their permission for a credit check.

To summarise, your credit practices should include:

- Credit rules

- Credit checks

- Credit applications

Payment Policies

You need to decide and finalise your policies relating to payments which may include:

Invoicing Method and Frequency

Ideally, you should raise invoices as soon as you deliver the goods or services. However, for some businesses, you may need to invoice periodically.

Payment Methods

Small businesses normally allow payments by cash, cheque, EFTPOS, credit or debit cards, online payments, and direct debits.

Payment Terms

This will include the number of days of credit or the limit in case of a revolving credit line. Terms may also include discounts, if any, offered for early payments and penalties for delayed or missed payments. All bills should show when the payment is due and when will you consider it delinquent.

Debt Collection Including Contingencies for Debtors in default

As per the Australian Competition and Consumer Commission, ‘Debt Collection takes place when creditors and collectors seek to secure payment from consumers or businesses who are legally bound to pay or to repay the money they owe.’5 It is important for any business that extends credit to recognise the possibility of defaults in payments or delayed payments, both of which can impact the cash flow and profitability of the business adversely.

You must define clear strategies for debt collection and list out detailed procedures that your business will follow in case of missed or delayed payments. You must also define clear strategies for handling contingencies for debtors in default. Your credit policies should include a clear policy on recognising that some of your debts may become bad debts and you may need to write them off.

Regular Debts are the cases where you have extended credit to your customers where you do not foresee any problems in collecting on the debt. It may also include cases where your regular paying customers may have missed making a payment or may have delayed making a payment.

Bad Debts are those debts where the likelihood of recovery is minimal, or the amount in question is so low that it does not justify the efforts to try and follow up for payment. These are debts that are uncollectable after all efforts for collection have been made.

Doubtful Debts are those that a business will assess as likely to become bad debts in the future. Any business that extends credit to its customers must account for Bad and Doubtful Debts as contingencies since there is a risk that the customer may default.

Australian Consumer Law (ACL) and the ASIC Act covering debt collection conduct govern debt collection in Australia. Australian Securities and Investments Commission (ASIC) and the Australian Competition and Consumer Commission (ACCC) regulates the same. Whether you decide to pursue debt collection by yourself or hand over the defaulting customer account to a specialised collection agency, you need to be aware of the code and comply with it.

Key strategies for debt collection

1. Implementing customer-oriented operations

To make your debt collection more efficient and effective and to ensure that you minimise the number of bad debts, you need to ensure that you have customer-oriented operations. If customers are unhappy, they may decide to not pay up. Also, sometimes they may not have an intention of defaulting, but due to inconvenient methods of payments, they may miss or delay payment.

2. Using automated communication techniques

This may reduce your costs of debt collection. By sending out automated SMS alerts or email alerts before the due date or by automating the reminders for missed payments, you can save on time, effort and money otherwise spent on employing staff to do these ‘soft’ collections. Often customers may not intend to default or delay payment, but they may have simply been otherwise occupied.

3. Using data analytics

This will help you focus your resources for better results. Systems like Collection Tracking and Analysis can help you determine trends and assign customers to risk categories. They help you predict increases or decreases in payments by geography, profession, or other criteria. Based on the output of data analytics, you can improve your collection efforts.

4. Deciding the collection team structure

Depending on the size of your operations, you may also consider keeping an in-house centralised collections team or contracting with third-party collection agencies who can take over the collection efforts from your sales and service team, leaving them free to generate business.

5. Keeping debtor records

Keeping accurate and updated records of all your debtors will assist you in keeping track of overdue payments and manage your cash flow. You may do this manually or use commercially available software depending on the size of your business. To track customers who owe you money, you need a sound filing system that allows you to track overdue payments and control your cash flow quickly. Tax laws also require you to keep a record of your debtors.

Further Reading

The Debtors and creditors analysis table - Dataset - Publications | Queensland Government has made available a sample debtors and creditors analysis table to allow you to see the impact of debtors on your cash flow.

Contingencies for Debtors in Default

Some key strategies for contingencies for debtors in default may include:

- Follow up Strategy

Defining a minimum threshold amount below which you may only rely on regular internal calls and emails for demanding outstanding payments, and above which you may employ the use of a qualified debt collection agency. - Provisioning strategy

It is important to recognise the possibility of defaults by debtors. You need to define a clear strategy for making accounting provisions for the same. You should have clear criteria for estimating bad debts and making an allowance for doubtful debts. - Termination Strategy

Sometimes it may be costing you more in terms of time and money to follow up than the sum involved. You should immediately terminate such customers. - Write off strategy

Defining the amount of time, you will follow up internally or with the help of a professional debt collection agency after which you will write off the debt and move it from your accounts receivables to booked loss. - Legal Action strategy

You may decide to pursue defaults legally only for debts above a certain value. - Negotiating Payment Plan Strategy

The strategy of negotiating a payment plan is normally employed when you have a customer you have had a long-standing relationship with, who may be experiencing a temporary downturn or inability to pay due to unavoidable circumstances.

For instance, Kwik Eats Pty Ltd.’s payment terms are immediate payments for new customers, and they offer between 15 days to 30 days of credit to their existing clients according to the value of the billing. Their credit policy contains the following policy for Contingencies for Debtors in default.

Debtors in Default – Provisioning and Write-off Policy

- For debts under $500:

- For 50 % of debts aged between 60 days and 90 days overdue, the company will create a provision for doubtful debts (unless there is an explicit payment plan as agreed to with the customer that is being adhered to).

- For 100% of all debts aged over 90 days overdue, the company will create a provision for doubtful debts (unless there is an explicit payment plan as agreed to with the customer that is being adhered to).