Before this point, you may have already encountered the Asset Register in your learning. It’s an integral part of reports, so we’ll review it again here.

Before we get started, answer these questions and see if you are already in the know about this critical tool.

You may remember that one of the costliest aspects of doing business is the purchase and maintenance of fixed assets. Fixed assets are any type of asset that cannot be immediately turned into cash; instead, they need to be sold to turn them into liquid assets.

Fixed assets are generally:

- property (land, buildings)

- furniture and fittings (office equipment, décor, etc.)

- plant and equipment. (machines, vehicles, etc.)

- intangible assets (patents, copyrights, brand names)

The asset register is an accounting method that records details about a business's assets. It is a vital part of asset management, regardless of the size and types of their assets. Because of the expense involved in purchasing fixed assets, a business must have procedures in place for recording purchases, disposal, and depreciation (which allows you to expense out the cost of the purchase over several years – thus reducing your profit and subsequent tax obligations) of fixed assets.

An asset register may be manual or computerised. For the most part, modern businesses use a computerised system; however, you can use a card-based system where every asset has a card filled in with all the relevant details.

The primary purposes of the fixed asset register are:

- asset planning (how old is the asset and how long before it needs replacing)

- support in accounting, taxation and insurance (computation of asset depreciation to determine its current worth and a repository of information in the case of an insurance claim)

- ensuring control and preventing misappropriation of assets

- providing a source of information for various management reports

A well-maintained asset register allows you to meet your taxation, statutory and sale-of-business obligations. It is also an appropriate place to record serial numbers, make, model, etc.

Your asset register needs to perform these functions:

- process the purchase of fixed assets per your organisation's authorisation and record-keeping procedures

- maintain adequate accounting records of assets-cost, description, and where they are kept in the organisation

- maintain accurate records for depreciation

- provide management with information to help plan future asset investments

- record the retirement and disposal of assets.

For the fixed asset register to perform all of these functions, it must include the following information. Items marked with an asterisk are not optional to have an efficient register.

- serial number of the asset (or an asset ID code)*

- a unique description of the asset that sets it apart from any other similar asset*

- the date it was purchased*

- how much it was bought for*

- how it was paid for

- insurance coverage information

- warranty information

- the depreciation method, period, and rate used for the asset*

- the asset’s current book value*

- estimated life of the asset (which is the depreciation period)

- salvage value if there is one (the value of the item at the end of its usable life, also called residual value and scrap value)

- the date it was sold or disposed of*

- the reason for any such disposal or sale

- how much was gained or lost from the sale of the asset

This information is critical to a business because it allows the company to stay on top of its investments in fixed assets.

The asset register allows the business to:

- maintain a list of assets, so the business can monitor resources and track location and condition

- determine the current net book value of an asset so that this can be added to the ledger accounts

- determine how values in the balance sheet are obtained

- determine the financial status of any asset, which is vital if an asset is to be sold.

You can watch this video for a different way of learning this content or confirming your understanding of creating and maintaining an asset register.

- Identify the assets – if the business already has a set of accounts books, you can look at the balance sheet for information. You will want to look under property, plant, equipment, motor vehicles and intangible assets.

- Physically inspect the assets by walking around the business. Note any items not included in the balance sheet. They may have been removed because the asset’s value has fully depreciated over time to zero. It still needs to be in your asset register.

- Be sure to be thorough, and keep in mind that any piece of property that you plan on keeping and not converting into cash for over a year that is involved in the production of the company's income would be considered a fixed asset.

- Decide on a method of organising your asset register. Remember that you can use:

- a physical record, such as binders or cards

- a digital version such as a spreadsheet (as we provide below). You can use tabs (one worksheet per asset) as we have, or a single worksheet where the rows apply to a specific asset, and the columns show information about them, such as date and price purchased, description, etc.). Alternatively you can search online for a “fixed asset register template” and find one you like

- A cloud-based accounting system that includes this feature.

- Decide on a depreciation period during which the asset's value will decrease. To determine depreciation, you must first know over what time period the depreciation will occur.

- During the depreciation period, a percentage of the asset's value is converted from an asset to an expense. At the end of each accounting period, the asset's value expended is determined by the depreciation method, which is explained shortly.

- The depreciation period is based on the projected useful life of the asset. The manufacturer can provide this information.

- Often, the depreciation period for a specific asset is dictated by tax regulations. Confirm this with tax authorities.

With all of this information in hand, you can get started on creating your asset register. Once you have a working register, it won’t stay current automatically – it takes diligence and monitoring to ensure it remains useful.

Note: Assets that have been lost, stolen, or have become nonfunctional no longer have value to the organisation and, therefore, the remaining book value of such assets must be written off for accounting purposes. It is imperative, however, to keep all records in the asset register, whether or not the asset has any value or is still in use.

Each year the ATO releases a Guide to depreciating assets. Download Guide to depreciating assets 2022[pdf] and familiarise yourself with this for the financial year 1 July 2021 through June 30 2022. Notice a sample depreciation chart for assets and another for low-value-pool assets.

MYOB Business does not have an integrated Fixed Asset Register, nor any plans to include this in their feature set anytime soon. In choosing a fixed asset software app to support your accounting system, it's important to review all of the functions and choose one that supports the most crucial features of your business.

Activity

Using the template below (or you can recreate the depreciation worksheets for primary use and low-value pool), enter a few assets using fictitious information.

Download and save this Excel workbook as a template for your Asset Register [.xlsx]. Then use it to create new documents and keep that one as a template.

Note the tabs along the bottom, one for each asset. The document contains linked cells. To ensure you don’t accidentally lose them, save this document as a blank template that you never modify, and use SAVE AS to create a new document to complete the practice exercises.

Simplified depreciation rules currently in place allow an immediate write-off for assets costing less than $20,000. Tax-paying businesses that do not qualify as a small business must use the general depreciation rules where assets costing more than $100 need to be depreciated over their effective life.

Throughout this module, we have referred to depreciation (the business's method for financially reducing an asset's value over time), because it impacts the company's financial picture.

Several methods are used to accomplish this — the two most common of which are Straight Line and Reducing Balance. The method of depreciation is chosen by management and depends on business features, the economic environment of operating activity and the organisational policies of the company.

Depreciation is a method used to reduce the value of fixed assets over the useful life of that asset. For depreciation to be effective, the business must ensure that it is applied consistently throughout the life of all assets across the business operations and in line with general rules regarding depreciation in terms of tax.

Why is depreciation necessary?

- The business needs to try and match its income and expenses

- For financial accuracy, the business needs to ensure that its asset values are not overstated in the books. Think of a car — in nearly all cases, five years after it was purchased, it’s worth less.

- It is an ATO requirement for certain business deductions.

If the concept is still unclear, it may help to consider this example: If you spent $20,000 on a truck for the business in 2015, and today, you could only sell it for $10,000, then the business has ‘spent’ $10,000 on that truck over the years since it was purchased, which has become a business expense that can reduce the tax burden on the company. This is because they no longer own a $20K truck; now, they own a $10k truck and that other $10K was used as a business expense over time that generated revenue for the company.

Property, Plant and Equipment which are depreciable include buildings, plant and equipment, machinery, vehicles, office and computer equipment, furniture, etc. An exception is land because of its indefinite life. All these types of assets will last more than one year, and they will put some part of their value on produced goods and services every year. The used portion of the asset is the depreciation expense.

Depreciation is used for tax purposes and accounting procedures. For example, depreciation reduces taxable income, allowing the company (taxpayer) to use this money for cost-recovery purposes. For a business to be allowed a depreciation deduction, according to IFRS, the asset has to meet some requirements:

- The taxpayer must own the asset

- A taxpayer must use the asset in business or an income-producing activity

- The asset must have a determinable useful life of more than one year

Land and property

While depreciation applies to land improvements such as buildings, plant, and equipment, it does not apply to the land itself because the property improvements will become less valuable and beneficial to the business over time; however, the land itself will not lose value and may even increase.

This delivery van has seen much better days. It may currently have some value as a vintage vehicle; however, in most cases, an asset past its usefulness is depreciated to zero dollars or a small salvage amount.

These are the standard methodologies; the first two are the most widely used:

- Straight-line method

- Accelerated methods

- Diminishing value

- Units of production

- Sum-of-years-digits depreciation

All of the methods rely on the following three factors:

- Cost: For tax purposes, the purchase price includes the capital it takes to make the new equipment operational, such as freight and insurance during transit, expenditures for assembly (including branding), installation and testing. As one-time costs, they can be included in the purchase price. However, motor vehicle registration and accident insurance are treated as business expenses as they are annually recurring expenses.

- Useful life: You will need to estimate the expected productive life where that asset is in service to the company. Considerations include repairs and maintenance costs, the asset not becoming obsolete, and the legal life. Different rules apply to:

- capital works such as buildings and structural improvements

- horticultural plants and water supply facilities used in primary production

- electricity and phone connections

- assets used in mining exploration.

- Residual/Salvage/Scrap value: The scrap value is calculated based on an estimate of the asset's value at the end of its useful life (such as the trade-in value). The scrap value amount cannot be depreciated because the residual value remains useful to the company regardless of the physical age of the asset. Items like cars and machines will likely have residual value, while office equipment such as computers may have zero value at the end of their useful life since they may have become obsolete.

Take a look at this video about depreciation methods before diving into the calcuations and detail below.

Straight-line depreciation method

This method of depreciation is the easiest to calculate and is, therefore, the one you see used most often. It is also called the Prime Cost Method.

Using this method, an organisation will determine the salvage value (this is the value of an asset at the end of its life) of a fixed asset, subtract that from the original cost of the asset and expense the remaining value over the useful life of the asset equally each year.

(cost of asset – salvage value) / life span of asset

For example:

- Car purchased for $30,000

- Determined the life of the car (depreciation period) to be six years

- Estimated the value at the end of the 6 years (salvage value) to be $12,000

- Calculation 1: 30,000 – 12,000 = 18,000

- Calculation 2: 18,000 / 6 = 3,000

The depreciation rate for a car is $3000 per year, which can be expensed using the straight-line method.

The depreciation schedule for this asset would look like this:

| Book value at beginning of year | Depreciation expense | Accumulated deprecation | Book value at end of year | Year |

|---|---|---|---|---|

| $30,000 | $3,000 | $3,000 | $27,000 | 1 |

| $27,000 | $3,000 | $6,000 | $24,000 | 2 |

| $24,000 | $3,000 | $9,000 | $21,000 | 3 |

| $21,000 | $3,000 | $12,000 | $18,000 | 4 |

| $18,000 | $3,000 | $15,000 | $15,000 | 5 |

| $15,000 | $3,000 | $18,000 | $12,000* | 6 |

*The remaining $12,000 is the salvage value of the asset.

Accelerated method

Accelerated depreciation allows for the likelihood of assets to decline over time and require higher repair and maintenance costs in later years than when first purchased.

Reducing Balance method

Reducing Balance is also called Diminishing Value Method. The main point of difference between the straight-line method and this one is that this method considers that an asset loses more of its value in the first few years of its life than later.

For example, you may have changed your mind just after driving off the car lot with a brand new car, but the moment you do, now that you have owned it, the car's value is significantly reduced. However, the difference in value between a car that is eight years or nine isn’t near as great as the loss of value between a brand new and used car.

In the first year, depreciation is calculated based on the portion of the 12-month financial year you owned the asset. So, if you purchased the asset in October, you would get eight months of depreciation in the first year.

The government introduced a fast track to writing off some assets for certain businesses. They provide an excellent resource to ensure the information and rates you are using are current with this depreciation and capital allowance tool.

The formula to calculate depreciation using this method is:

Base value × (days held ÷ 365) × (200% ÷ asset’s useful life)

Here is what that looks like:

If the asset cost $80,000 and has a useful life of five years, the calculations for the claim for the first full year will be:

- [Asset Purchase Cost] 80,000 × (365 ÷ 365) [days of ownership] = 80,000

- 80,000 × (200% ÷ 5 [useful years]) = $80,000 × 40% = $32,000

- 80,000 – 32,000 = $48,000 [current depreciated value]

As you can see, the base value reduces each year by the decline in the value of the asset. This means the base value for the second year will be $48,000; that is, $80,000 minus the $32,000 decline in value in the first year.

The claim for the second year will be:

$48,000 × (365 ÷ 365) × (200% ÷ 5) = $48,000 × 40% = $19,200

In the third year, the base value will be $28,800, and the claim will be $11,520.

In the fourth year, the base value will be $17,280, and the claim will be $6,912.

This will continue until the value reaches zero.

The schedule for the example above looks like this:

| Book value beginning of year | Depreciation rate | Depreciation expense | Accumulated deprecation | Book value end of year | Year |

|---|---|---|---|---|---|

| $80,000 | 40% | $32,000 | $32,000 | $48,000 | 1 |

| $48,000 | 40% | $19,200 | $51,200 | $28,800 | 2 |

| $28,800 | 40% | $11,520 | $62,720 | $17,280 | 3 |

| $17,280 | 40% | $6,912 | $69,632 | $10,368 | 4 |

| $10,368 | 40% | $4147 | $73,779 | $6,221 | 5 |

Note: If you started to hold the asset before 10 May 2006, the formula for the diminishing value method is: Base value × (days held ÷ 365) × (150% ÷ asset’s useful life)

Units of production method

Units of Production Depreciation method is often used in production line businesses, and this is because of a link between the activity of an asset and its capacity to wear down.

Here is the outline of the Units of Production depreciation method:

- Depreciation per unit of production = (Assets cost - Expected salvage value) / Expected total units of production during the useful life of the asset involved.

- Depreciation expense = Depreciation per unit of production * Number of units produced.

For example, RedBrick Manufacturing purchased a fabrication machine that cost $200,000 with a salvage value of $0. The machine is expected to handle 10,000 units of production during the useful life of this asset; in the first year, it produced 500 units.

The depreciation expense, in this case, will be:

($200,000 - $0) / 10,000 * 500 = $10,000.

Sum-of-the-years' digits method

Sum-of-the-years' digits (SYD) is an accelerated method for calculating an asset's depreciation. This method takes the asset's expected life and adds together the digits for each year; so, if the asset was expected to last for five years, the sum of the years' digits would be obtained by adding: 5 + 4 + 3 + 2 + 1 to get a total of 15. Each digit is then divided by this sum to determine the percentage by which the asset should be depreciated each year, starting with the highest number.

A schedule for a five-year plan would have a depreciation expense of:

- Year 1: 5/15 = 33%

- Year 2: 4/15 = 27%

- Year 3: 3/15 = 20%

- Year 4: 2/15 = 13%

- Year 5: 1/15 = 7%

New accelerated depreciation measures

Measures introduced in March 2020 incentivise businesses with an aggregated turnover of less than $500 million to deduct the cost of depreciating assets at an accelerated rate in 2019-20 and 2020–21. See Backing business investment for more information.

Measures introduced in October 2020 provide further incentive for businesses with an aggregated turnover of less than $5 billion (or corporate tax entities satisfying the alternative test) to deduct the total cost of eligible depreciating assets if they are first held and first used or installed ready for use, by them for a taxable purpose from 7:30 pm (AEDT) on 6 October 2020 to 30 June 2022. Businesses can also deduct the total cost of improvements to these new or existing eligible depreciating assets made during this period.

See Interaction of tax depreciation incentives for information about which new accelerated depreciation measure applies to an asset.

Update the Asset Register using the book value

The depreciation schedule should provide information for the Asset Register so that it always shows the current and correct value for the assets, including any depreciation they may have incurred.

Use the book value total at the end of the financial year to reflect each asset's end-of-year value on the register.

The ATO website is the best source of current information. Here are some resources that will help to understand and comply with depreciation requirements.

- The depreciation and capital allowances tool provides depreciation rates for specific assets.

- At the moment, there are specific regulations due to Covid-19, under a section titled Stimulus measures for COVID-19 on a page about general depreciation rules – capital allowances.

- Certain businesses can enter 100% depreciation for the business expense, based on this temporary measure, Temporary full expensing.

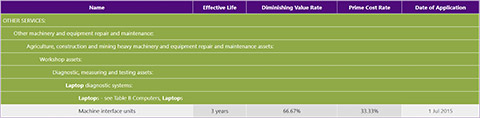

Another excellent tool, depreciationrates.net.au, allows you to use a dropdown list at the top of the page to select an asset and learn the ATO’s suggestions for:

- the effective life

- diminishing value rate

- prime cost (straight line based on the effective life) rate.

Laptop was selected from the dropdown list to produce this result.

Asset Register software

While MYOB Business does not offer Asset Register software, there are solutions for accountants who want to avoid the spreadsheet. Check out this list on Capterra. Look through some of their programs and use the forum to discuss which you might use and why.

Fixed Asset Management Software as collected by Capterra.com.au.

Download the template of an Asset Register

If you haven’t done it yet, download and use a copy of this asset register throughout the module to complete activities. Keep the unedited original as a resource.

Activity: Take this opportunity to practice your depreciation calculations.

The Scenario

You run a ski field and have just purchased a new chairlift. You paid $200,000 for the item and $3000.00 in insurance and transit fees. You then had to hire ten-day workers to assemble it on-site at $2,800.00 for the five days it took to erect. Insurance for the chairlift adds $2,800 to the yearly premiums. These chairlifts last about ten years before they incur too much expense in maintenance and require replacing. At the end of its life, the parts of the chairlift can be sold for an approximate total of $10,000.00.

Using the template excel spreadsheet you just downloaded, create:

- a straight line depreciation schedule

- a diminishing value depreciation schedule