What is Tax?

“Tax” is described as a compulsory contribution to State revenue. Taxation involves directing consumer resources to the government for spending programs. In Australia, taxes are levied by State and Federal Governments and may be classified as “direct” or “indirect” as follows:

Direct taxes include:

- Income tax

- Goods and services tax (GST)

- Capital gains tax (CGT)

- Company tax

- Payroll tax

- Indirect taxes include

- Customs duty

- Transfer duties

- Local government rates

- Land tax

Income tax is imposed upon individuals, companies and other entities based on a taxpayer’s taxable income for the current year. The Australian taxation system is a progressive tax system. Taxes are increased in line with increases in an individual’s taxable income, e.g., those with a greater income pay more tax.1

For an individual non-business taxpayer, the amount of income tax is withheld by the employer from gross wages and salaries, e.g., pay as you go (PAYG). The total amount is recorded and shown on a payment summary at the end of the financial year.

Legislation Governing the Australian Taxation System

Section 51(ii) of the Australian Constitution provides the Commonwealth Parliament the power to make laws for the peace, order and good government for the Commonwealth of Australia concerning taxation. The principal legislation governing taxation in Australia is as follows:

- Income tax assessment act 1936 (ITAA36)

- Income tax assessment act 1997 (ITAA97)

- Any accompanying regulations

Case law (common law) is also applied in decisions handed down by the courts. The ITAA97 has replaced some, but not all, of the provisions of the ITAA36, some of which are still in force. The general rules dealing with tax liability are contained in ITAA97. The Australia Taxation Office (ATO) administers the income tax system. 1

History of the Australian Taxation System

Until 1916, income tax was levied by each of the Australia States. South Australia was the first Australian State to impose a general tax on income in 1884, and by 1907 all States were collecting income tax. The first federal income tax was levied in 1916 to raise additional revenue. Between the years 1916 and 1942, income tax was levied by both the State and Federal Governments. In 1936, with the introduction of the ITAA36, a uniform tax system was introduced. With the outbreak of the Second World War, fundamental changes were made to Australia’s taxation system. In 1942, income taxation was consolidated and collected by the Commonwealth Government in order to increase revenue. The Commonwealth Government is still responsible for collecting all income tax in Australia today; however, some funds are handed back to the States and Territories for State funding programs.1

The constitutional considerations of Australian tax law are following and adhering to:

- Employment laws

- GST

- CGT

- Income tax

- Superannuation

- Financial reporting

- Privacy and confidentiality

The separation of powers in Australia divides the institutions of government into three (3) branches; legislative, executive, and judicial. The legislature makes the laws, the executive puts the laws into operation, and the judiciary interprets the laws.

Sources of Taxation Law

There are three (3) sources of taxation law. These are:

Statute Law: Legislation in the form of taxation legislation such as the ITAA36 and ITAA97.

Therefore, statutory power means a power conferred by – the Constitution or legislation. The Income Tax Assessment Act was written to enact the collection of income tax. The ITAA 97 has replaced some but not all parts of the ITAA36.

Case Law: Case law is legislation created by the courts and the Administrative Appeal Tribunal to interpret statutes.

Practices of the Australia Taxation Office (ATO): The ATO has the power to make legally binding rulings and determinations.

- s.51(ii) of the Constitution: empowers the Commonwealth Government to impose income tax

- Statutes: Legislation on income tax matters enacted by the Federal Parliament

- Australian Taxation Office: Administers the income tax system

The Role of the ATO

The ATO is the government’s principal revenue collection agency and is responsible for administering the income tax system. Its role is to manage taxation, excise and superannuation systems that fund services for Australians and to manage taxation planning and taxation debtors. The ATO also assists individuals in understanding their rights and obligations with respect to taxation issues.

Who Must Lodge a Return?

The ATO website sets out a comprehensive list of resident individuals who must lodge an income tax return. These requirements may change annually. It also provides information for preparing and lodging tax returns for business, partnership and trusts.

In accordance with s161 of the ITAA36 every person, if required by the Commissioner must lodge an income tax return as follows:

s161 Annual returns

Requirement to lodge a return

- Every person must, if required by the Commissioner by notice published in the Gazette, give to the Commissioner a return for a year of income within the period specified in the notice. Note: The Commissioner may defer the time for giving the return: see section 388-55 in Schedule 1 to the Taxation Administration Act 1953.

The Commissioner may, in the notice, exempt from liability to furnish returns such classes of persons not liable to pay income tax as the Commissioner thinks fit, and a person so exempted need not furnish a return unless the person is required by the Commissioner to do so. - If the taxpayer is absent from Australia or is unable from physical or mental infirmity to make such return, the return may be signed and delivered by some person duly authorized.

- Nothing in this section prevents an approval by the Commissioner of a form of return under section 35D of the Superannuation Industry (Supervision) Act 1993 from requiring or permitting a return under that section to be attached to or to form part of a return under this section.

Note: However, the rules applicable to a return under section 35D of the Superannuation Industry (Supervision) Act 1993 are those specified in that Act.

Form 1 Income Tax Return

There are two (2) types of forms that can be used for individual taxpayers:

- Form 1- which is completed by the individual taxpayer

- Form 1- used by tax agents for clients.

These forms are provided on the following website:

Lodge your tax return online with myTax

Prepare and lodge your own tax return online it is the quick, safe, and secure way to lodge, most process in two weeks.

Lodge your tax return with a registered tax agent

Use a registered tax agent to prepare and lodge your tax return, they are the only people that can charge a fee.

You can use the paper tax return to lodge your tax return by mail, most refunds issue within 50 business days.

Read more about the instructions that provide a guide for completion of the individual tax return.

Where the return is prepared by a tax agent, the agent must complete the tax agent’s declaration by signing the return, stating that the information furnished in the return is true and correct. Taxpayers including individuals, partnerships and trusts are generally required to lodge returns by 31 October each year.

The source information required in order to lodge an income tax return is set out below:

- Copies of any payment summaries received from employment or in respect of a pension, benefit, or allowance or for other tax withheld from any payments made.

- Income received from an Australian government pension as a war veteran, war widow or widower.

- For the purposes of the senior Australians and pensioner tax offsets information regarding any rebate income.

- Details of any investment income or as beneficiary of a trust.

- Information regarding franking credits from a dividend or trust distribution.

Further Reading

To learn more about how a tax practitioner must prepare and lodge returns with the ATO, access the APES 220 Taxation Services guide here.

APES 220 Taxation Services

Taxation Services – Home 2019, Apesb.org.au, viewed 20 September 2022.

Responsibilities and Duties of Tax Agents

Tax accounting refers to accounting for the tax-related matters. It is governed by the tax rules prescribed by the tax laws of a jurisdiction. Often these rules are different for the rules that govern the preparation of financial statements for public use (i.e., GAAP). Tax accounting, therefore, adjusts the financial statements prepared under financial accounting principles to account for the differences with rules prescribed by the tax laws. Information is then used by tax professionals to estimate the tax liability and for tax planning purposes.

Accounting Principles and Practices

Apart from legislation, tax practitioners must also follow accounting principles and practices when preparing the tax documentation of their individual clients. These can include but are not limited to the following.

- Accrual Principle

The accrual principal accounts for all income earned within the financial year, even if the money itself has not yet been received. All assessable income for the year must be recorded even if the entire payment has not been made yet. - Cash Principle

Following this principle, the tax practitioner must include all of the assessable cash income for the financial year when recording the transaction. However, only cash that has been received will be counted as assessable income for that same financial year.

Tax Agent Services Act 2009 (TAS Act)

The TAS Act came into effect on 1 March 2010. The Act introduced a number of changes including:

- The creation of a national Tax Practitioners Board (TPB)

- A requirement that taxes agents and Business Activity Statement (BAS) providers be registered and regulated

- The introduction of a Code of Professional Conduct for registered tax agents and BAS agents

- The provision for sanctions to discipline registered tax agents and BAS agents.

The Act aims to ensure the services provided to the public by registered tax agents and BAS agents are of appropriate ethical and professional standards.

Tax Agent Services Regulations 2009 (TASR 2009)

The Tax Agents Services Regulations 2009 (TASR 2009) commenced on 14 November 2009. It has since been updated by the Tax Agents Services Regulations 2022 (TASR 2022).

The TASR 2022 provides that an individual tax agent must satisfy one of a number of academic and relevant experience combinations depending upon the applicant’s circumstances.

To become a registered tax agent, individual applicants must satisfy certain qualifications and experience requirements. A summary of qualifications and experience requirements for registration (including renewal) as a tax agent are set out in the TPB summary of qualification and experience requirements for tax agent regisitration table. For more information on the TPB qualifications and experience requirements click here.

The TPB requires partnerships and companies seeking registration or renewal of registration to have a sufficient number of individuals, being registered tax agents or registered tax (financial) advisers, to provide tax (financial) advice services to a competent standard, and to carry out supervisory arrangements. You can find out more about this requirement here.

Registered agents must notify the Board in writing if there is a change in their circumstances, which may include the agent ceasing to meet one of the tax practitioner registration requirements or if an event affecting their continued registration occurs (s40.20 TAS Act).

Tax Practitioners Board (TPB)

The TPB is a national board responsible for the registration and regulation of tax practitioners and for ensuring compliance with the TAS Act, including the Code of Professional Conduct.

This is achieved by:

- Administering a system to register tax and BAS agents, ensuring they have the necessary competence and personal attributes.

- Providing guidelines, information, and webinars on relevant matters.

- Investigating conduct that may breach the TAS Act, including non-compliance with the Code of Professional Conduct and breaches of the civil penalty provisions.

- Imposing administrative sanctions for non-compliance with the Code.

TPB Code of Professional Conduct

Registered tax agents are bound by the TPB Code of Professional Conduct.

The Code of Professional Conduct (Code) is a legislated code that sets out the professional and ethical standards required of registered tax agents and BAS agents. It outlines the duties that agents owe to their clients, the Tax Practitioners Board (Board) and other agents. The Code includes a number of core principles organised into five categories:

- Honesty and integrity

- Independence

- Confidentiality

- Competence

- Other responsibilities.

The Board Condcut Committee (BCC) of the TPB reviews alleged failures to comply with the with the Tax Agent Services Act 2009 (TASA), including the Code of Professional Conduct (Code). If the BCC finds from investigation that a registered tax practitioner has failed to comply with the TASA, it may impose administrative sanctions.

Fit and proper requirements for tax agents

To be eligible for registration an applicant must satisfy a fit and proper person requirement. The fit and proper person requirement applies to:

- individual applicants

- each partner and director in respect of partnership and company applicants.

For more information refer to the TPB explanatory paper on fit and proper person.

Civil Penalty Provisions for Tax Agents

There are several civil penalty provisions in the Tax Agent Services Act 2009 (TASA) for tax agents. These civil penalty provisions can be grouped into two categories, those relating to:

Your organisation may have policies and procedures in place that are relevant to the preparation of non-complex tax documentation for individual clients. These key features may include, but are not limited to the following:

Recording and filing systems

Client files are kept and contain working papers and worksheets, authorisation forms and copies of the lodged returns.

Financial management manuals

What file and documents are used in the business to assist with the preparation of the tax returns.

Electronic data entry

Does the business use an electronic system to lodge the relevant information with the ATO or do they still use paper-based methods.

See Also Topic 2.2 Of This Resource

Discussing and Confirming Documentation with Client

Tax agents should exercise reasonable care when preparing returns and should take positions in those returns that are reasonably arguable. It is essential for tax agent to discuss and agree on returns with their clients. If clients disagree with the relevant tax treatments, tax agents need to confirm the statutory requirements with clients. Errors or omission of items in the returns can thus be avoided if tax agents discuss the returns with clients. If tax agents fail to discuss and agree on the returns with clients, the returns may be lodged with errors.

Safe harbour is the term which applies if taxpayers (and taxpayers’ registered agent if taxpayers use one) take reasonable care in making the tax returns or statements, taxpayers will not incur a penalty. However, if reasonable care wasn’t taken, there are different rates of penalty, based on the reasons for the error. For statements made on or after 1 March 2010, the clients may not be liable to an administrative penalty for making a false or misleading statement if:

- The statement is made by a registered agent

- The clients provide all relevant tax information to the registered agent to enable the statement to be made correctly

- The shortfall amount or the false or misleading nature of the statement was due to the registered agent’s lack of reasonable care.

In addition, the clients may recover damages against their tax agent by suing for damages due to negligence under common law. This negligence may also be considered a breach of contract as the contract may (implicitly) require the agent to act reasonably and with due competence.

The Code of Professional Conduct under the Tax Agents Services Act (TASA) establishes a number of obligations upon Tax and BAS agents, including:

- To act with honesty and integrity

- To act in the best interests of clients and avoid conflicts of interest

- To maintain client confidentiality

- To provide a competent service

- Not to obstruct administration of the tax laws

- To advise clients of their rights and obligations under tax laws

- To maintain professional indemnity insurance

- To respond to requests from the Board

Further Reading

The Code of Professional Conduct acts as a guide for tax practitioners to identify and prevent conflicts of interest from occurring. Learn more about how the Code helps practitioners manage conflicts of interest here.

TPB Information Sheet: Code of Professional Conduct – managing conflicts of interest

Non-compliance with the Code of Practice can result in any of the following actions by the Board:

- Written caution

- Order the agent to complete a course of action

- Suspension of registration

- Termination of registration

Tax practitioners must also inform individuals of their tax obligations.

Further Reading

For a list of an individual’s tax obligations access the ATO Taxpayer Charter

Checklist of Information to be Obtained from Taxpayer

When obtaining instructions to prepare an individual tax return the following information needs to be obtained from the client:

Personal details of the client

- Full name, date of birth, whether the same name was used in the last return lodged and details of previous name as applicable.

- Tax file number

- Occupation

- Residential address

- Postal address as applicable

- If postal address has changed since lodgement of the last return

- Telephone numbers for work and mobile as applicable

- If taxpayer is a war veteran, widow, widower and under the aged pension age

- If the client has an ABN

- Family details:

- Spouse’s full name, date of birth, whether the same name was used in the last return lodged and details of the previous name as applicable

- Spouse’s tax file number

- Spouse’s occupation

- If married or de facto in current year – date of event

- If there are dependent children and date of birth of each child

- As of January, whether each child is in primary of high school

- If the client has shared care of the children in which case the % of care allocated by the family assistance office

Tax agent details

- A copy of the previous return needs to be attached if the client is using the services of the organisation for the first time.

- If an accountant prepared the previous tax return.

- Details of previous accountant if applicable.

- If the agent’s fee is to be paid from the refund.

- Bank account details for direct deposit of refund, e.g., BSB, account no, account no.

Income

- If the income was received from salary or wages. If applicable obtain payment summaries from client.

- If allowances were received, e.g., bonuses. Where details are not provided in payment summaries details of allowance need to be provided.

- If the client received an ETP. ETP summary needs to be provided.

- If the client received an Australian government allowance or payment, e.g., Newstart, youth allowance or sickness benefits. Payment summaries must be provided.

- If income received from Australian annuities or superannuation income streams. Payment summary needs to be attached from super fund.

- If income was received from Australian super lump sum payments.

- If interest was received from bank accounts or investments. Account details and interest must be provided.

- If a divided income was received. Statements must be provided.

- If income was received from partnerships or trust. Information needs to be obtained.

- If any business income was received. Business schedule may need to be completed.

- If capital gains or losses were made during the financial year. A CGT schedule needs to be completed.

- If income was received from overseas sources. Description of income to be provided.

- If income was received from ownership of a rental property. Information to be provided.

- If bonuses were received from a life assurance policy. Statements to be provided.

- If income was received from forestry managed investments. Information to be provided.

- If any other income was received, e.g., royalties, share rights, jury duty. Details to be provided.

Deductions

- If a vehicle is used for work purposes. Car makes, model, number, and engine capacity to be provided. Logbook should also be provided of kilometres travelled and receipts for expenses.

- If there are any other work-related travel. Details to be provided.

- If there are any other travel-related receipts, e.g., accommodation. Receipts to be provided.

- If there are work related uniform and other clothing expenses. Description to be provided including laundry expenses, e.g., number of washing loads.

- If the client attended an educational institution or courses. A description and cost need to be provided including student union fees, textbooks, course fees, stationery, parking. Travel can be claimed from home to place of education or from work to place of education. You cannot claim travel from place of education to your home if you went to work first. Details of car make, model, number and engine capacity must be provided.

- If expenses were incurred from working from home, e.g., electricity, internet access, stationery, telephone calls, printer cartridges, computer depreciation.

- If tools or equipment were purchased for work. A description and amounts need to be provided.

- If there are any subscriptions for union fees or professional bodies, journals, periodicals. Receipts must be provided.

- If the client works outside in the sun, a deduction can be made for sunscreen.

- If there are any other work deductions. A description needs to be provided.

- If there have been any gifts or donations to charitable organisations. Description needs to be provided.

- If the tax affairs were managed by a tax agent, the previous year the amount incurred.

- If personal superannuation contributions were made more than those made by the employer. A description of the dates, names of fund and policy number needs to be provided.

- If personal superannuation contributions were made on behalf of a spouse.

- If the client has income protection insurance. Name of fund and policy number needs to be provided.

Tax offsets

- If the client has a dependent spouse (without child), child housekeeper or housekeeper. Details to be provided.

- If the client has private health insurance. Who does the policy cover, give details of fund and number and no of days covered.

- If there have been any expenses incurred by any school-aged children. This will exclude any items such as school fees, tutoring costs, uniforms, and subject levies. Description to be provided.

- If the taxpayer lived in a remote zone or served overseas with the defence force. Details including no of days need to be provided.

- If medical expenses of more than $2,000 were incurred. Details regarding medical expenses will exclude reimbursements received from medical practitioners. All details need to be provided.

- If a parent, parent-in-law, or invalid relative was maintained by the taxpayer during the year. All details to be provided.

Other

- If the taxpayer became a tax resident of Australia during the financial year. Dates need to be provided.

- If the taxpayer stopped being a tax resident of Australia during the financial year. Dates to be provided.

- If notification has been received from the ATO regarding an impending audit or review. Details to be provided.

- If money is owed to a government department, e.g., child support, HELP, family tax benefit debts. Details to be provided.

- If capital returns were received on listed company shares? Details to be provided.

When gathering and obtaining information from clients it is important not to stereotype individuals. Cultural differences can sometimes affect the outcome of an interview. Listed below are some useful tips to follow when interviewing clients from different cultural backgrounds and/or where English is their second language:

- Give proper personal space: Different cultures have different norms regarding what personal space is public and private.

- Be sensitive towards their religious views.

- Learn about other cultures, e.g., greetings, goodbye rituals.

- Where there are lapses in communication apply humour and avoid being defensive.

- Do not interrupt if the client is speaking.

- Keep the language simple and avoid jargon.

- Speak at the right pace and speak clearly.

- Pause between sentences to allow time for comprehension.

- Avoid completing the customer’s or client’s sentences.

- Names and addresses may need to be written or spelt out.

- Do not raise your voice, patronise, or condescend.

Further Reading

For more information on withholding mechanisms, access the ATO guidelines.

Identifying Discrepancies or Any Unusual Features and Conducting Research to Resolve, or Referring to Appropriate Authority

Tax agents may identify discrepancies or unusual features and may raise queries during the analysis and verification of clients’ tax information.

Discrepancies may include mismatches between expenditure reports and invoices; mismatches between payments and invoice amounts; underpayment of GST instalments, etc.

Unusual features which may alert a tax agent may include incorrect report formats, absence of an auditable trail, etc.

Queries raised by tax agents may include reasons for significant variations from budget, reasons for inappropriate authorisations, etc.

Tax agents are required to discuss and resolve the discrepancies or unusual features with their clients. Clients may be required to rectify the discrepancies with external parties, for examples, banks, suppliers, ATO, etc. Tax agents may suggest improvements to the clients’ systems, policies, and procedures.

If clients refuse to rectify the discrepancies or refuse to answer the queries raised, tax agents need to explain to their clients that if reasonable care isn’t taken clients may be liable to different rates of penalty, based on the reasons for the error.

If tax agents lodge a fraudulent income tax return following their client’s instructions, they may breach the Code of Professional Conduct issued by Tax Practitioners Board.

Further Reading

Taxation Practitioners website

If tax agents fail to convince their clients to correct the fraud, the tax agent should consider resigning from the engagement with the client or should report the incident to the ATO.

Further Reading

Tax Office

Income Tax Rates

For more information on current tax rates always refer to the individual income tax rates on the website of the Australian taxation office.

Tax Practitioner Support and Guidance

There is a wide range of sources for tax agent to seek advice or guidance to evaluate and moderate decision processes:

If a tax agent is member of a professional body, he/she is able to obtain advice from peer group discussion, but he/she must be mindful of the confidentiality of client information.

Research the existing and updated tax legislation, case law or ATO tax rulings which may be applicable to current situations.

Tax agents are required to undertake continuing professional education according to the TPB’s Code of Professional Conduct. Thus, the tax agent may obtain updated guidance to resolve current issues.

Tax agents may apply for a private ruling to the Commissioner who will consider the way a tax law applies to his/her client in relation to a specified matter. However, tax agent may need to obtain prior approval from the client before applying for a private ruling.

The ATO’s Tax Agent Portal Help offers messaging facilities that allow tax agents to send enquiries and receive answers from the ATO.

The Tax Agent Portal Help provides answers to frequently asked questions. The answers may help Tax Agents to evaluate current situations.

Note: The Tax Agent Portal gives registered tax agents secure access to client information and online communication with the ATO.

Further Reading

Taxation Portal

Tax professionals 2022, Ato.gov.au, viewed 20 September 2022

What is Assessable Income?

Under ss6.5 and 6.10 of the ITAA97 “assessable income” consists of ordinary income and other amounts which are assessable, e.g., statutory income. It is not only necessary to consider whether an item is income but also whether it has been derived (s6.5(4) ITAA97). Section 6.5(4) describes derived income as follows:

s6.5(4) In working out whether you have derived an amount of ordinary income, and (if so) when you derived it, you are taken to have received the amount as soon as it is applied or dealt with in any way on your behalf or as you direct (Income tax Assessment Act 1997).

Examples of ordinary income include:

- Gross wages and salaries

- Interest

- Rental income

- Sales and services

Statutory income includes income such as dividends and royalties. The provisions with respect to ordinary income are set out in s6.5 of the ITAA97 as follows:

6.5 Income according to ordinary concepts (ordinary income)

- Your assessable income includes income according to ordinary concepts, which is called ordinary income.

- If you are an Australian resident, your assessable income includes the * ordinary income you * derived directly or indirectly from all sources, whether in or out of Australia, during the income year.

- If you are a foreign resident, your assessable income includes:

- the * ordinary income you * derived directly or indirectly from all * Australian sources during the income year; and

- other * ordinary income that a provision includes in your assessable income for the income year on some basis other than having an * Australian source.

- In working out whether you have derived an amount of * ordinary income, and (if so) when you derived it, you are taken to have received the amount as soon as it is applied or dealt with in any way on your behalf or as you direct.

The provisions for statutory income are set out in s6.10 of the ITAA97:

6.10 Other assessable income (statutory income)

- Your assessable income also includes some amounts that are not * ordinary income.

- Amounts that are not * ordinary income but are included in your assessable income by provisions about assessable income are called statutory income.

- If an amount would be * statutory income apart from the fact that you have not received it, it becomes statutory income as soon as it is applied or dealt with in any way on your behalf or as you direct.

- (If you are an Australian resident, your assessable income includes your * statutory income from all sources, whether in or out of Australia.

- If you are a foreign resident, your assessable income includes:

- your * statutory income from all * Australian sources; and

- other * statutory income that a provision includes in your assessable income on some basis other than having an * Australian source.

(Source: Income Tax Assessment Act 1997: Sections 6.1 and 6.10)

Methods for Calculating Assessable Income

For taxation purposes, there are two (2) different methods of calculating income. These are as follows:

- Cash or receipts basis

- Accruals or earnings basis

The cash basis means that assessable income is derived when cash is received by the taxpayer. The cash method applies to all wage and salary earners and for investment income. For a business using the cash basis, assessable income consists of the sum of cash received from cash sales, services, and debtors.

Under the accruals system, assessable income is derived when the right to receive income comes into existence. Under the accrual’s basis, assessable income will reflect any change in the accounts receivable balances over the income year in addition to income received from cash sales and services performed. Assessable income using the accruals basis can be calculated as follows:

Cash received during the year from cash sales and debtors plus debtors’ balance at the end of the income year (30 June) less debtors balance at beginning of the income year (1 July). 1

The following example sets out the differences in using the two methods of calculating income:

Example:

A business taxpayer had an opening debtors’ balance of $21,000 on 1 July. At the end of the financial year there was a closing balance of $16,000. Cash received from cash sales and debtors for the year was $189,000. All amounts are net of GST.

Calculate the assessable income for the year ended 30 June 2015 using the:

- Cash basis

- Accrual basis.

Using the cash basis, the assessable income is $189,000.

Using the accrual method, the assessable income is:1

Cash received from cash sales and from debt

+ Debtors' balance on 3o June (end of financial year)

- Debtors' balance on 1 July (beginning of financial year)

= Assessable income

The following are possible key sources of information that a tax practitioner may consult when calculating taxable income:

- ATO website

- Tax Practitioners Board website

- business.gov.au website

- Membership associations such as CPA and chartered accountants Australia

- Financial institution statements

- Loan records

- Order and supplier documentation

- Receipts

- Taxation and statutory returns

- Bills

- Cash received

Tax practitioners may also need to gather the following to calculate taxable income:

Payment summaries

Were documents given to employees by employers showing the gross amount of income they have earned from the employer. It also showed the amount of PAYG that has been withheld and lists any allowances or deductions that had been given to the employee or paid by the business on behalf of the employee. Normally issued in July.

Employers no longer need to provide their employees with payment summaries for information they report and finalise through Single Touch Payroll

Single Touch Payroll (STP)

The ATO introduced Single Touch Payroll to streamline the employer’s reporting from having several separate reporting processes. STP was intended to help employers achieve efficiencies of real-time reporting and help with compliance processes. In essence, it's a new way for employers to report tax and super information to the ATO every time they pay their employees.

The Australian Tax office (ATO) has required employers to report any salaries and wages paid, plus PAYG withholding and superannuation information, regularly throughout the year; under a reporting regime called Single Touch Payroll (STP), Since 1 July 2019.

Before this, only employers with 20+ employees were required to report through Single Touch Payroll, while smaller employers with 19 or fewer employees only had to report employee wages and superannuation to the ATO annually at the end of the financial year.

For more information on single touch payroll read this overview from H&R block:

What Is Single Touch Payroll (STP) and How It Works 2019, Hrblock.com.au, viewed 20 September 2022.

Also refer to the Australian taxation offices website on single touch payroll.

What is STP? 2022, Ato.gov.au, viewed 20 September 2022.

Statement of interest earned

Are documentation from the bank that lists any of the interest that has been accumulated on the bank account held with the bank. Also shows if any amounts have been withheld by the bank and remitted to the ATO because TFN or ABNs haven’t been notified to the bank.

Receipts

Receipts for the payment of expenses that the individual could possibly claim as a deduction.

Logbook

Includes the details of travel or the number of hours a home office is used to earn an income.

Diaries

Are used to record amount under $10 in value that could be used as a deduction on the income tax return, number of loads of uniform washing done that the taxpayer is claiming a deduction for.

Note that tax documentation must be kept for at least five (5) years from the date the tax return is lodged. For more information read the following from the ATO.

Records you Need to Keep 2022, Ato.gov.au, viewed 20 September 2022.

Taxable Income

Taxable income consists of total assessable income less deductions. For example:

- Gross income – exempt income = Assessable income

- Assessable income – deductions = Taxable income

Under s4.15(1) of the ITAA97, taxable income is calculated as follows:

s4.15(1) Method statement:

- Add up all your assessable income for the income year.

- Add up your deductions for the income year.

- Subtract your deductions from your assessable income (unless they exceed it). The result is your taxable income. (If the deductions equal or exceed the assessable income, you don’t have a taxable income)”.

Tax payable or refund due is calculated as follows:

Tax payable on taxable income – non-refundable tax offsets

= Net tax payable

[Net tax payable + Medicare levy +Medicare surcharge (as applicable)] – [tax credits + refundable tax offsets + PAYG payments]

= Refund due or balance payable

Medicare Levy

Under s251S of the ITAA36 most individual resident taxpayers are liable to pay a Medicare levy of 2% of their taxable income. Chickpea ATO website for up-to-date information on the Medicare levy.

(Source: Medicare Levy 2022, Ato.gov.au, viewed 20 September 2022.

Where a taxpayer either ceases to be a resident of Australia or becomes a resident for tax purposes during an income year, the Medicare levy is only charged on taxable income derived while the individual is an Australian resident.1

Medicare Levy Surcharge

Resident individuals and families on incomes above the surcharge threshold, who do not have an appropriate level of private patient hospital cover, may be liable to pay an additional Medicare levy surcharge. Single individual resident taxpayers without private patient hospital health insurance may be liable to pay a Medicare levy surcharge based on their income. The surcharge is paid in addition to the Medicare levy as set out below:

Medicare Levy Surcharge 2022, Ato.gov.au, viewed 27 September 2022.

Determining Assessability

In determining whether a receipt is assessable income the following factors need to be considered.

- Is the taxpayer a resident of Australia?

- What is the source of the taxpayer’s income?

- Has the income been derived?

- Is the receipt a capital receipt?

- Is the receipt exempt from tax?1

Generally, a benefit is not assessable unless it consists of money or is capable of being converted into money. Non-cash benefits may include fringe benefits which are subject to fringe benefits tax under the Fringe Benefits Tax Assessment Act 1986 (FBTA). Receipts which are capital in nature are not assessable under s6.5 of the ITAA97 as they are not ordinary income. They may, however, be assessable as statutory income.

Australian Residency

Under s7(2) of the Social Security Act 1991 an “Australian resident” is defined as follows:

s7(2) An Australian resident is a person who:

- resides in Australia; and

- is one of the following:

- an Australian citizen.

- the holder of a permanent visa.

- a special category visa holder who is a protected SCV holder.

Under s6(1) of the ITAA36 (Interpretation), a resident taxpayer is described as:

‘resident’ or ‘resident of Australia’ means:

- a person, other than a company, who resides in Australia and includes a person:

- whose domicile is in Australia, unless the Commissioner is satisfied that the person’s permanent place of abode is outside Australia.

- who has actually been in Australia, continuously or intermittently, during more than one-half of the year of income, unless the Commissioner is satisfied that the person’s usual place of abode is outside Australia, and that the person does not intend to take up residence in Australia; or

- who is:

- a member of the superannuation scheme established by deed under the Superannuation Act 1990; or

- an eligible employee for the purposes of the Superannuation Act 1976; or

- the spouse, or a child under 16, of a person covered by sub-subparagraph (A) or (B); and

- a company which is incorporated in Australia, or which, not being incorporated in Australia, carries on business in Australia, and has either its central management and control in Australia or its voting power controlled by shareholders who are residents of Australia.

The ATO considers a person to be an Australian resident for tax purposes if they have:

- have always lived in Australia or you have come to Australia and live here permanently

- have been in Australia continuously for six months or more, and for most of that time you worked in the one job and lived at the same place

- have been in Australia for more than six months of the year, unless your usual home is overseas, and you do not intend to live in Australia

- go overseas temporarily and you do not set up a permanent home in another country

- are an overseas student who has come to Australia to study and are enrolled in a course that is more than six months long.

The ATO sets out the tests undertaken to determine residency status on their website Residency - the resides test:

Taxation Ruling TR 98/17: Income tax: residency status of individuals entering Australia, outlines the circumstances in which an individual is considered as residing in Australia. It considers people entering Australia such as:

- Migrants

- Academics teaching or studying in Australia

- Students studying in Australia

- Tourists

- Those on pre-arranged employment contracts.

Temporary visas are distinguished from permanent visas which allow a person to live in Australia indefinitely. If an Australian resident goes overseas temporarily and does not set up a permanent home overseas, they will continue to be treated as a resident of Australia for tax purposes.

The ATO describes a person as a temporary resident if the person:

- Holds a temporary visa granted under the Migration Act 1958

- Is not an Australian resident within the meaning of the Social Security Act 1991

- Does not have a spouse who is an Australian resident within the meaning of the Social Security Act 1991.

If a person is a resident of Australia for tax purposes and meets the requirements to be a temporary resident, the temporary residency rules mean:

- Most of their foreign income is not taxed in Australia except income earned from employment performed overseas for short periods while they are a temporary resident.

- If a capital gains tax event occurs on or after 12 December 2006, a temporary resident is not liable to capital gains tax (nor is treated as having made a capital loss) unless the asset is taxable Australian property.

Overseas students coming to Australia to study who are enrolled in a course of study that is more than six (6) months in duration are generally treated as Australian residents for tax purposes. As a rule, an Australian resident taxpayer is assessed on their sources of income worldwide. 1

Income Received for Sales Performed

All remuneration for personal services received by a taxpayer as an employee or otherwise in connection with employment is classified as ordinary income and is assessable under s6.5(1) of the ITAA97, e.g., gross wages and salaries, fees, and commissions.1

Specific types of business receipts include:

- Profits from transactions entered for making a profit

- Bounties and subsidies under s15.10 of the ITAA97.

- Insurance payments received as compensation for loss of trading stock, income, or profits under ss6.5(1), 15.30 and 70.115 of the ITAA97.

- Illegal activities such as theft, drug dealing, insider trading or prostitution where the activities are carried on as a business.

- Foreign exchange gains.

- Refunds and recoveries of items of expenditure, e.g., bad debts that are written off and the amount subsequently recovered is assessable income.

- Remuneration in the form of an allowance paid to an employee by an employer is assessable under s15.2 of the ITAA97. Section 15.2(1) states as follows:

s15.2 Allowances and other things provided in respect of employment or services

(1) Your assessable income includes the value to you of all allowances, gratuities, compensation, benefits, bonuses, and premiums provided to you in respect of, or for or in relation directly or indirectly to, any employment of or services rendered by you (including any service as a member of the Defence Force).

This may include uniform, car, meal and travel allowances, tips, annual bonuses, and incentive payments.1

Compensation Payments

Periodical payments received as compensation for loss of wages are assessable under s6.5 (1) of the ITAA97. A fixed sum amount for loss of a limb, eye or other body part is not assessable. Lump sum damages received in a personal injury claim against an employer are not assessable. Periodical payments received under an insurance policy are assessable if paid to replace lost earnings.

A lump sum received from a life assurance policy is capital in nature and is not assessable as income. Reversionary bonuses received from life assurance policies are exempt from taxation where the policy has been held for ten (10) years or more (s26AH of the ITAA36). A reversionary bonus is a bonus added to the sum assured (or basic sum assured) of a “with profits life assurance policy” out of surplus profits usually on an annual basis. These bonuses are payable at the end of the term of the policy (that is, at maturity), or on the prior death of the life assured. Once allocated, their values are guaranteed provided premiums are paid up to maturity or death.

(Source: Income Tax Assessment Act (1936))

Where a life assurance policy has been held for less than ten (10) years the following is classified as assessable income:

- All the bonus amounts received during the first eight (8) years of the policy

- 2/3 of the bonus if received in the 9th year

- 1/3 of the bonus if received in the 10th year

Example:

A life insurance policy was surrendered in year 9 of the policy. The bonus incurred was $9,000. The amount of the reversionary bonus that is classified as assessable income is 2/3 of $9,000 e.g., = $6,0001

Income Received from Property

Examples of income derived from property are as follows:

- Interest

- Rental income

- Royalties

- Employee share schemes (ESS)

- Dividends 1

Under s6.5(1) of ITAA97 interest received by a resident is usually assessable irrespective of the source and is taxed when received. Rental income is classified as assessable income.

Under s15.20(1) of the ITAA97 assessable income includes any amount received as royalties e.g., patent, trademark, copyright, or franchise.

Employee share scheme (ESS)

An ESS is a scheme under which shares, stapled securities or rights to acquire them (ESS interests) in a company are provided to an employee or their associate in relation to the employee’s employment.

Generally, the difference between the market value of an ESS interest and what an employee pays for the interest is the amount that will be taxed up front. A $1,000 upfront tax concession is available to employees who are provided with ESS interests if the employee’s taxable income after adjustments is $180,000 or less.

An employee’s adjustable income includes:

- Taxable income

- Reportable fringe benefits

- Reportable superannuation contributions

- Total net investment losses

An employee must not hold more than 5% ownership of the company or control more than 5% of the voting rights of the company if they have acquired the ESS interest before the 01 July 2015. Where the ESS Interests were acquired after 30 June 2015 the employee interest must not exceed 10 % of the voting rights of the company.

Example:

Newt paid $800 for 800 shares under an ESS. The market value of the shares at the date of allotment was $2.45 per share. Newt’s adjustable income for the year was $100,000.

The amount assessable for the ESS is as follows:

(800 x $2.45(market value of shares) - $800 (amount paid) = $1,160

As Newt’s adjustable income is less than $180,000, she is entitled to an upfront tax concession of $1,000

$1,160 - $1,000 = $160 (amount assessable)1

Fringe Benefits (FBT)

The fringe benefit tax (FBT) was introduced in 1986 under the FBTA. FBT is a tax payable by an employer on the value of certain employment-related benefits provided to an employee or an associate of the employee apart from a salary, wage, or superannuation benefit.2

The most common benefits subject to FBT include motor vehicles, free or low-interest loans, car parking and payments of private expenses.

Under s66(1) of the FBTA, FBT becomes due and payable by an employer in four instalments at specified times during the tax year which begins 1 April and ends on 31 March (s102(b) FBTA). As the employer is liable for payments of FBT the employee or recipient is not taxed on the fringe benefits they receive.

For an individual taxpayer, individual amounts of less than $3,773 in fringe benefit payments are not shown or reported on the payment summary. The FBT law requires a taxpayer to keep certain records relating to the fringe benefits Amounts reported on your income statement or payment summary, ATO definitions and worked example:

Source: Amounts reported on your income statement or payment summary 2022, Ato.gov.au, viewed 20 September 2022.

Further Reading

For more information on how FBT is applied access the guide for employers here.

Fringe benefits tax – a guide for employers

Legal Database 2013, Ato.gov.au, viewed 20 September 2022.

Dividends

A dividend includes any amount made by a company to its shareholders whether in money or other form, e.g., shares (s6(1) ITAA36). Under s44(1) of the ITAA36, resident shareholders are assessed on all dividends paid to them by resident and non-resident companies out of profits. Individual shareholders who receive dividends from Australian resident companies are entitled to a franking credit on any tax paid by the company on that dividend. These dividends are called “franked dividends”.

A franked dividend is an arrangement in Australia that eliminates the effect of double taxation of dividends. Dividends are dispersed with tax imputations attached to them. The shareholder is able to reduce the tax paid on the dividend by an amount equal to the tax imputation credits. The taxation has been partially paid by the company issuing the dividend.

Under s207.20(1) of the ITAA97, a taxpayer’s assessable income is increased by the amount of company tax attributable to the dividend. This is called a “franking credit”.

A franked dividend is an arrangement in Australia that eliminates the double taxation of dividends. The shareholder is able to reduce the tax paid on the dividend by an amount equal to the tax imputation credits. An individual’s marginal tax rate and the tax rate for the company issuing the dividend affect how much tax an individual owes on a dividend.

207.20(1) General rule – gross-up and tax offset

If an entity makes a franked distribution to another entity, the assessable income of the receiving entity, for the income year in which the distribution is made, includes the amount of the franking credit on the distribution. This is in addition to any other amount included in the receiving entity’s assessable income in relation to the distribution under any other provision of this Act.

Dividends can be franked anywhere between 1% and 100%. The franking credit is calculated as follows:

Franked dividend amount x 30/70 = Franking credit

Dividends paid by companies that have not paid Australian company tax are referred to as “unfranked dividends” and are assessable under s44(1) of the ITAA36.

Example:

A taxpayer has a gross salary of $72,000, a fully franked dividend of $1,000, an unfranked dividend of $500 and a 50% franked dividend of $800. Tax withheld is $15,900. Calculate the amount of taxable income:

| Taxable income | $ |

| Gross salary | 72,000 |

| Fully franked dividend | 1,000 |

| Franking credit ($1,000 x 30/70) | 429 |

| Unfranked dividend | 500 |

| 50% franked dividend | 800 |

| Franking credit ($800 x 50% x 30/70) | 171 |

| Taxable income | 74,900 |

Under s207.20(2) of the ITAA97 a franking tax offset is allowed which is equal to the amount of the franking credits.

Example:

207.20(2) General rule – gross-up and tax offset

The receiving entity is entitled to a tax offset for the income year in which the distribution is made. The tax offset is equal to the franking credit on the distribution.”

Example:

Calculate tax offset amount and tax payable or refunded using figures from previous example:

| $ | |

| Tax on $74,900 | 15,890 |

| Less franking offset ($429 + $171) | 600 |

| 15,290 | |

| Plus, Medicare levy (2% of $74,900) | 1,498 |

| 16,788 | |

| Less PAYG tax withheld | 15,900 |

| Balance Payable | 888 |

Foreign Income

Foreign income and foreign tax are defined under s6AB (1) and (2) or the ITAA36.

6AB (1) and (2) Foreign income and foreign tax

- A reference in this Act to foreign income is a reference to income (including superannuation lump sums and employment termination payments) derived from sources in a foreign country or foreign countries and includes a reference to an amount included in assessable income.

- A reference in this Act to foreign tax is a reference to tax imposed by a law of a foreign country, being:

- tax upon income; or

- tax upon profits or gains, whether of an income or capital nature; or

- any other tax, being a tax that is subject to an agreement having the force of law under the International Tax Agreements Act 1953.

Example:

An Australian resident works for a continuous period of 80 days in Spain. The resident earns AU$12,000 and pays AU$2,0o0 in foreign tax. The foreign income of $12,000 is “grossed up” by the $2,000 foreign tax. Total assessable foreign income is $14,000.

To avoid the double taxation of foreign income, which is also included in Australian taxable income, a foreign income tax offset (FITO) is allowed for foreign tax paid under Division 770 of ITAA97.

Resident taxpayers are entitled to a non-refundable tax offset for foreign income tax paid on an amount included in their assessable income. The tax offset is limited to the less of foreign income tax paid and the foreign tax offset cap.

The formula to calculate the FITO is set out in s770.75 of the ITAA97 as follows:

s770.75 Foreign income tax offset limit

- There is a limit (the offset limit) on the amount of your tax offset for a year. If your tax offset exceeds the offset limit, reduce the offset by the amount of the excess.

- Your offset limit is the greater of:

- $1,000; and

- this amount:

- the amount of income tax payable by you for the income year, less

- he amount of income tax that would be payable by you for the income year if the assumptions in subsection (4) below were made. Note 1: If you do not intend to claim a foreign income tax offset of more than $1,000 for the year, you do not need to work out the amount under paragraph (b).

Note 2: The amount of the offset limit might be increased under section s770 80.

- For the purposes of paragraph (2)(b), work out the amount of income tax payable by you, or that would be payable by you, disregarding any tax offsets.

- Assume that:

- your assessable income did not include:

- so much of any amount included in your assessable income as represents an amount in respect of which you paid foreign income tax that counts towards the tax offset for the year; and

- any other amounts of ordinary income or statutory income from a source other than an Australian source; and

- you were not entitled to any deductions that:

- are debt deductions that are attributable to an overseas permanent establishment of yours; or

- are deductions (other than debt deductions) that are reasonably related to amounts covered by paragraph (a) for that year”.

- your assessable income did not include:

Where the foreign tax paid is no more than $1,000 no calculation of the FITO is required.

Example:

FITO is less than $1,000.

George, an Australia resident taxpayer derived $6,000 investment income from Iraq and paid $900 foreign tax. As the foreign tax paid is less than $1,000, the FITO to be claimed is $900.

In accordance with the assumptions set out in s770.75(4) where the foreign tax paid is more than $1,000 FITO is calculated as follows:

Example:

Mitchell is an Australian resident taxpayer who derived AU$6,000 net dividend income from Italy and paid AU$3,000 foreign tax. His Australian income is $80,000. He has AU$500 deductions relating to the income derived in Italy and $6,000 deductions relating to the income derived in Australia. Mitchell has private health insurance. Calculate the tax payable.

| $ | ||

| Assessable income –Australia | 80,000 | |

| Foreign income – Italy – grossed up | 9,000 | |

| 89,000 | ||

| Less deductions | ||

| Australian deductions | 6,000 | |

| Foreign deductions | 500 | 6,500 |

| Taxable income | $82,500 | |

| Tax payable on $82,500 is $18,472 |

Calculation of FITO:

Under ss770-75(2) and (4) of the ITAA97 disregarded assessable foreign income is:

$9,000 - $1,000 = $8,000

$82,500 - $8,000 = $74,500.

Tax payable on $74,500 is $15,760

FITO = $18,472 - $15,760 = $2,712

As the amount of foreign tax paid of $3,000 is greater than the FITO limit of $2,712, the available FITO is the calculated limit of $2,712. If the amount of foreign tax paid had been less than $2,712, the offset amount would have been the amount of foreign tax paid.

Example, continued:

Tax payable is as follows:

| $ | |

| Tax paid on $82,500 | $18,472 |

| Less FITO | $2,712 |

| $15,760 | |

| Plus, Medicare levy (2% of $82,500) | $1,650 |

| Tax payable | $17,410 |

Capital Gains Tax (CGT)

A capital gain can be described as the financial gain made from selling or otherwise disposing of assets such as land, buildings, residences, businesses, or securities at a profit over the original historic value. For CGT purposes, a capital gain is defined as the excess of the capital proceeds a taxpayer receives or is entitled to receive from a CGT event over the total costs associated with that event.2

A taxpayer’s assessable income includes any net capital gain for the income year. A net capital gain is the total of a taxpayer’s capital gains for an income year reduced by capital losses made by the taxpayer.

Under s102.20 of the ITAA97, a capital gain or loss only arises if a CGT event occurs. A list of CGT events is set out in s104.5 of the ITAA97.

Some of the principles of CGT can include, but are not limited to the following:

- Pre – CGT Assets Section 160ZZS

- CGT and Trusts

- CGT and Shares, rights, and options

- CGT and leases (short-term only)

- CGT and the loss or destruction of assets

- Discount Capital Gains – Subdivision 115-A

- Important CGT Exemptions

CGT assets

CGT only applies to assets that have been acquired or disposed of after 19 September 1985. Section 108 of the ITAA97 sets out the types of CGT assets namely:

- Goodwill

- Foreign currency

- Shares

- Collectables

Sections 108.10(2) and (3) of the ITAA97 define a “collectable” as follows:

s108.10(2) and (3)

(1) A collectable is:

- artwork, jewellery, an antique, or a coin or medallion; or

- a rare folio, manuscript, or book; or

- a postage stamp or first-day cover; that is used or kept mainly for your (or your associate’s) personal use or enjoyment.

(Source: Income Tax Assessment Act (1997))

(3) These are also collectables:

- an interest in any of the things covered by subsection (2); or

- a debt that arises from any of those things; or

- an option or right to acquire any of those things.

CGT assets as set out above are subject to CGT, however, collectables acquired for $500 or less are CGT exempt. Personal use assets which are kept by the taxpayer for their personal use and enjoyment, e.g., clothing, furniture, electrical appliances, and white goods are usually not subject to CGT.1

Division 118, s118 of the ITAA97 sets out the assets that are specifically exempt from CGT.

Implications of CGT

Under s102.5 of the ITAA97, any net capital gain must be included in a taxpayer’s assessable income in the year in which it occurs. A capital loss may be written off against other capital gains in the same year of income however if no capital gain occurs in that same year, the loss is carried forward and is offset against a future capital gain. A capital loss that arises on the disposal of a collectable asset can only be offset against a capital gain arising from the disposal of another collectable asset (s108.10 ITAA97).

Example:

In the current year collectables were disposed of which yielded a capital gain of $300 and a capital loss of $500. A capital gain of $600 was also made on shares in the current year.

The net capital gain on shares is $600. The capital loss on collectables of $200 cannot be offset against the net capital gain on shares but must be carried forward and offset against a future capital gain on collectables.1

Calculation of CGT

For assets acquired before 21 September 1999 and held for at least twelve (12) months and then disposed of, the CGT can be calculated using:

- The frozen indexation method

- The discount method

Where CGT is calculated using the frozen indexation method and CGT assets are acquired before 21 September 1999 and disposed of after 21 September 1999, the consumer price index (CPI) figure is for the quarter when CGT event occurs, e.g., quarter ending 30 September 1999.

For assets acquired and disposed of after 21 September 1999 and held for at least twelve (12) months and then disposed of, the capital gain is calculated using the discount method only.

Under the frozen indexation method, the indexed cost base of the CGT asset is calculated. The indexed cost base is the cost base of the CGT asset adjusted for the effects of inflation using CPI figures.

The cost base of the asset includes the capital costs of acquisition and disposal. This includes:

- Purchase price or market value of the asset if given.

- The cost of enhancements and improvements.

- Incidental costs of acquisition, e.g., transfer duty, fees for services of a valuer, surveyor, auctioneer, broker, accountant, borrowing expenses, advertising, and legal costs.

Non-capital costs such as rates, land tax, repairs and insurance can only be included in the cost base if the taxpayer cannot claim a tax deduction and the asset was acquired on or after 21 August 1991. Non-capital costs cannot be included in the cost base of collectables or personal use assets.1

The current consumer price index rates are as follows:

- Consumer price index (CPI) rates are published by the Australian Bureau of Statistics (ABS). We reproduce the rates here as these are relevant to the provision on tax and superannuation law.

The figures provided are the “All groups CPI weighted average of eight capital cities” which have been obtained from ABS. The ABS makes each figure available three to four weeks after the end of the quarter.

The following formula is used to calculate the indexation factor as set out in s114.1 of the ITAA97:

Indexation factor = CPI for quarter when CGT event occurred

CPI for quarter in which expenditure occurred

The indexation factor must be calculated to three (3) decimal places (round up as applicable) before being applied against the cost base of an asset.

Example:

Frozen indexation method

A block of land was purchased for $150,000 on 30 June 1997 and sold on 30 July 1999 for $220,000. Calculate the assessable amount of the capital gain.

Capital proceeds from disposal $220,000

Less indexed cost base

$150,000 x 68.7 (CPI quarter ending 30/09/1999) / 66.9 (CPI quarter ending 30/06/1997)

$150,000 x 1.027 $154,050

Capital gain $65,950 1

The discount method for calculating a capital gain may be used where:

- A taxpayer is an individual, a trust or complying superannuation entity.

- The CGT event happened either before or after 21 September 1999.

- The asset was acquired at least twelve (12) months before the CGT event occurred.

- The taxpayer did not choose to use the indexation method.

The method applies a discount percentage. The discount percentage for individuals and trusts is 50% and 33⅓ % respectively for complying superannuation entities and eligible life insurance companies. The capital gain is reduced by the discount percentage after capital losses have been applied.

Example:

Discount method

A block of land was purchased for $150,000 on 16 June 1997 and sold on 3 July 2006 for $220,000. Calculate the assessable amount of the capital gain.

($220,000 - $150,000) x 50%

Capital gain = $35,000

A further example showing where improvements have been made and selling costs incurred in the sale of the asset is set out below:

Example:

An investment property was acquired for $60,000 on 1 July 1988. Improvements costing $25,000 were carried out during August 1993. On 31 March 2012, the property was sold for $180,000. Selling costs incurred were $6,000. Calculate the capital gain using the frozen index method and the discount method.

Frozen indexation method:

| Capital proceeds from disposal | $180,000 | |

| Less indexed cost base | ||

| $60,000 x | 99.9 | $119,402 |

| 50.2 | ||

| Improvements | ||

| $25,000 x | 99.9 | $40,876 |

| 61.1 | ||

| Selling costs | $6,000 | $166,278 |

| Capital gain | $13,722 |

Discount method:

($180,000 – ($60,000 + $25,000 + $6000) x 50% $44,500

Where an asset is acquired and disposed of within twelve (12) months, the cost base of the asset is subtracted from the capital proceeds of disposal.1

Calculation of a Capital Loss

A capital loss cannot be used to reduce other types of assessable income but must be written off against other capital gains:

Capital loss = Reduced cost base – capital proceeds from disposal

Under s110.55 of the ITAA97, the reduced cost base is the historical cost-plus expenses less deductions. The reduced cost base contains the same elements as the cost base, but the elements are not indexed.

Example:

Chandra purchased 800 shares @$3 per share in July 2000. Brokerage and transfer duty costs were $100. In January 2015 Chandra sold all 800 shares for $2.50 per share and incurred brokerage costs of $75.

| Purchase price | $2,400 |

| Brokerage and transfer duty (January 1998) | $100 |

| Brokerage costs (August 2011) | $75 |

| Reduced cost base | $2,575 |

Capital loss = Reduced cost base – disposal cost

Capital loss: $2,575 – (800 x $2.50) = $5751

Section 121.20(1) of the ITAA97 requires any person who has acquired a CGT asset to keep records as follows:

121.20(1) What records you must keep

(1) You must keep records of every act, transaction, event, or circumstance that can reasonably be expected to be relevant to working out whether you have made a capital gain or capital loss from a CGT event. (It does not matter whether the CGT event has already happened or may happen in the future.).

Note 1: There are exceptions: see s121.30.

Example 1: Where you dispose of a CGT asset the records that are relevant to working out your capital gain or loss are records of:

- the date you acquired the asset.

- the date you disposed of it.

- each element of its cost base and reduced cost base and the effect of indexation on those elements.

- what you sold it for (the capital proceeds).

Main Residence Exemption

A taxpayer’s dwelling owned by an individual and normally occupied as the taxpayer’s main residence is usually exempt from CGT under s118.110 of ITAA97:

s118.110 Basic case

- A capital gain or capital loss you make from a CGT event that happens in relation to a CGT asset that is a dwelling or your ownership interest in it is disregarded if:

- you are an individual; and

- the dwelling was your main residence throughout your ownership period.

Note 1: You may make a capital gain or capital loss even though you comply with this section if the dwelling was used for the purpose of producing assessable income: see s118-190.

Under s118 of the ITAA97 a taxpayer who occupies a dwelling as a main residence and then ceases to occupy it can choose to have the dwelling treated as the main residence. The main residence exemption will continue to apply for a maximum of six (6) years if the dwelling is used to produce assessable income e.g., rental income. A taxpayer is entitled to another maximum period of six (6) years each time the dwelling becomes and ceases to become the main dwelling.

Note: The dwelling can only be treated as the taxpayer’s main residence provided the taxpayer does not have another main residence. Consider the following two (2) examples.

Example 1:

Patricia occupied a dwelling as her main residence for five (5) years. She was then transferred overseas for four (4) years. She rented out the dwelling in her absence. When she returned from overseas, she occupied the dwelling as her main residence.

Provided Patricia had no other main residence while overseas, the dwelling can be treated as her main residence and the main residence exemption applies. Any gain on the disposal of the property is CGT exempt.

Example 2:

Phillip occupied a home as his main residence for two (2) years and was then transferred interstate. He rented out the property for eight (8) consecutive years in his absence.

The full exemption is not applicable as Phillip was absent from the property for more than six (6) years. However, a partial exemption may apply.

Under s118.192 of the ITAA97, there is a special rule that applies where a main residence is first used for income producing purposes after 20 August 1996, the cost base for determining the capital gain will be the market value of the dwelling on the date that it was first used for income producing purposes.1

Worked example of CGT from ATO website: Calculating your CGT 2022, Ato.gov.au, viewed 20 September 2022.

Example:

Veronica purchased a dwelling on 4 September 2002. She occupied the dwelling for two (2) years and then rented the dwelling out for seven (7) years. She sold the dwelling on 5 September 2011 for $650,000. The market value of the dwelling when first used for income producing purposes was $510,000.

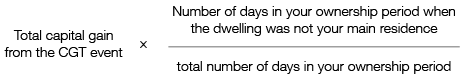

The full main residence exemption is not available as Veronica was absent from the dwelling for more than six (6) years. She is entitled to a partial exemption for this period. Calculate the assessable amount of the capital gain.

Capital gain = $650,000 - $510,000

=$140,000 x (7 years x 365 days) – (6 years x 365 days)

7 years x 365 days

= $140,000 x 365 = $20,000

2,555

Depreciating Assets

A depreciating asset is an asset that has a limited effective life and can reasonably be expected to decline in value over the time it is used. Depreciating assets include such items as computers, electric tools, furniture, and motor vehicles. Land and items of trading stock are excluded from the definition of a depreciating asset. Only the holder of a depreciating asset can claim a deduction for its decline in value.

The decline in value of a depreciating asset is worked out on the basis of its effective life. Generally, the effective life of a depreciating asset is how long it can be used for:

- A taxable purpose, or

- the purpose of producing exempt income, or non-assessable non-exempt income.

The two (2) methods of working out a deduction for the decline in value of a depreciating asset such as a computer, tools and equipment are the:

- Diminishing value method

- Prime cost method

The decline in value of a depreciating asset acquired on or after 1 July 2001 is calculated based on the effective life of the asset. The effective life of a depreciating asset is the total estimated period the asset can be used by an entity for the purpose of producing assessable income.

Under s40.95 of the ITAA97 a taxpayer can either:

- Work out their own estimate of the effective life of a depreciating asset; or

- rely on the ATO’S determination of effective life.

The ATO publishes rulings on recommended periods of effective life of depreciating assets which taxpayers may adopt.

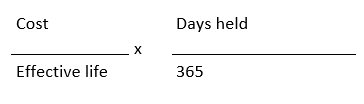

The prime cost method is calculated as follows:

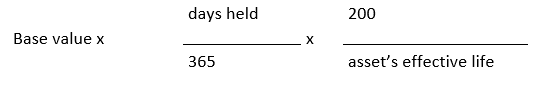

Under the diminishing value method, the decline in value of a depreciating asset is calculated as follows for assets acquired after 10 May 2006:

Days held can be 366 for a leap year

The base value is the cost of the asset. The number of months held can be used in lieu of days held if applicable.

For a later income year, the base value is the asset’s adjusted value at that time plus any improvements to the asset during the year.

Example – Diminishing value method

Laura purchased a photocopier on 1 July 2016 for $1,500 and she started using it that day. It has an effective life of five years.

Laura chose to use the diminishing value method to work out the decline in value of the photocopier. The decline in value for 2016–17 is $600, worked out as follows:

1,500 × (365 ÷ 365) × (200% ÷ 5)

If Laura used the photocopier wholly for taxable purposes in 2016–17, she is entitled to a deduction equal to the decline in value. The adjustable value of the asset on 30 June 2017 is $900. This is the cost of the asset ($1,500) less its decline in value to 30 June 2017 ($600).

Example: Prime cost method, ignoring any GST impact

Laura purchased a photocopier on 1 July 2016 for $1,500 and she started using it that day. It has an effective life of five years.

Laura chose to use the prime cost method to work out the decline in value of the photocopier. The decline in value for 2016–17 is $300, worked out as follows:

1500 × (365 ÷ 365) × (100% ÷ 5)

If Laura used the photocopier wholly for taxable purposes in 2016–17, she is entitled to a deduction equal to the decline in value. The adjustable value of the asset on 30 June 2017 is $1,200. This is the cost of the asset ($1,500) less its decline in value to 30 June 2017 ($300).

Tax Losses

A tax loss is made when the total deductions claimed for an income year exceed the total of assessable and net exempt income for the year. There are some deductions that cannot be used to create or increase a tax loss, e.g., donations, gifts, and personal super contributions.

A tax loss is different from a capital loss. A capital loss can only be offset against any capital gains in the same income year or carried forward to offset against future capital gains. Australian residents can calculate an overall tax loss based on worldwide income and deductions. Foreign residents can calculate a tax loss based on their Australian income and deductions incurred in earning that income.

A tax loss incurred in one year may be carried forward and deducted in a succeeding future year. Under Division 36 of the ITAA97, a tax loss can be carried forward indefinitely for deduction against taxable income until it is absorbed. As a general rule tax loss must be offset in the order in which they are incurred:

Exempt income (if any); and

assessable income which exceeds deductions for the current income year.1

Example

Jordan has a tax loss of $8,000 from the previous year which is carried forward to the current year. In 2014 2015 he has assessable income of $40,000, deductions of $8,000 and net exempt income of $5,000.

Calculate the taxable income for the year ended 30 June 2015:

| $ | |

| Assessable income | 40,000 |

| Less deductions | 8,000 |

| 32,000 | |

| Less loss carried forward from previous year | 8,000 |

| Less net exempt income |

5,000 3,000 |

| Taxable income | 29,000 |

Employment Termination Payments

Lump sum payments may be received by employees when they terminate their employment. An employment termination payment (ETP) is a lump sum paid to an employee when they terminate their employment.