The previous topic discussed the various aspects of client data requirements required for preparing taxation documentation. Another important aspect is understanding how to prepare and present tax documentation. Several legislative requirements and industry standards must be followed while preparing the tax documentation of your client.

Tax accounting refers to the branch of accounting that is focused on the preparation of tax returns and tax payments. Accounting practice involves recording an organisation's day-to-day financial operations necessary to produce the legally required financial statements.

To prepare and present tax documentation for your clients, you must know the elements of Australian tax law as it relates to tax documentation for legal entities. This topic will discuss the relevant calculations you must know about as a tax practitioner for entities. It will briefly discuss the main aspects relating to the calculations of Income Tax, Capital Gains Tax, Goods and Services Tax, and Fringe Benefits Tax for these entities. It will also cover the taxation aspect of superannuation law.

This topic will also guide you in preparing the relevant tax returns efficiently. It will guide you in preparing tax documentation that complies with taxation laws, rulings, lodgement schedules, accounting practices and principles per organisational policy and procedures.

Lastly, it will familiarise you with obtaining the appropriate client declarations relevant to lodging these tax returns.

In this topic, you will learn how to:

- Calculate the client's tax obligations

- Prepare tax documentation

- Present and confirm documentation with clients

One of the essential aspects of preparing tax documentation is ensuring that the client’s tax obligations are calculated according to legislative requirements. The taxable amount and the final tax charged from the client's income are calculated per Australian legislative requirements. In addition, industry-accepted information-gathering practices should be followed while calculating these obligations.

Tax obligations for legal entities include tax liabilities, documentation, withholdings and reporting requirements. These obligations may include the following:

- Keeping or retaining required records

- Retaining and producing required declarations

- Providing access and reasonable facilities to authorised tax officers

- Applying for or cancelling GST registration as required

- Issuing required tax invoices or adjustment notes

- Lodging activity statements

- Paying amounts electronically when required

Legislative requirements are the requirements by the government or its agencies in the form of rules, regulations, Acts and legislation to inform the residents and citizens about their duties, rights and responsibilities. You must strictly follow the letter of the law while calculating your clients’ tax obligations. This is to ensure that clients do not face penalties or litigation due to an error or mistake of law. Information-gathering practices are industry-accepted methods put in place in a particular industry. They may not always be in written form but are customary by usage. These standard methods of gathering information for taxation purposes should be followed unless a legal provision contradicts them.

This subtopic will cover how to calculate your clients’ tax obligations. You will also understand how to do so while following legislative requirements and information-gathering practices.

You must calculate your client's tax obligations according to legislative requirements and information-gathering practices. Legislative requirements are laid out in the following:

- Primary legislation

- Acts of parliaments or statutes

- Secondary legislation

- Contained in rules, regulations, codes or orders

The legislative requirements of statutes help identify and compute the assessable income on which tax obligation will be computed.

Here are some references to the relevant legislation and ATO views that you might want to check out when complying with the tax documentation requirements of your client:

| Item | Related Tax Provision | ATO References |

|---|---|---|

| Assessable Income | Division 6 | Assessable income for business |

| Deductions | Division 8 | Business tax deductions |

| Taxable Income | Division 4 | Work out your business's taxable income |

| Tax Offsets | Division 13 | Business concessions, offsets and rebates |

For every industry, certain practices are widely followed by all or most of its members. Though they are not written-down standards and codes of conduct, following them makes them a convention. Industry-accepted practices for gathering information for computing tax obligations can be divided mainly into two methods:

- Formal

These industry-accepted information-gathering practices refer to approaching formal sources to get the information. The formal method allows the organisation to get the best information for fulfilling its tax obligation. Financial statements and bank statements are the most common formal sources of information for calculating the tax obligation of legal entities. For instance, when calculating bank interest, getting the information formally from the bank in the form of an interest statement is best practice. - Informal

These practices refer to getting the information for fulfilling tax obligations from informal sources. These sources might not act as clear evidence for fulfilling tax obligations in audit but act as good sources to calculate tax obligations. For instance, when calculating allowable deductions, the receipt from the insurance provider for the premium paid is an informal source of information.

The following subtopics will explain how to calculate tax obligations for different legal entities and the legislative requirements you must adhere to in arriving at the tax obligation.

Income tax is imposed on the income earned within the financial year by individuals, companies, trusts, and other entities.

The general formula for computing Net Income Tax Payable is:

Gross Income – Exempt Income = Assessable Income

Assessable Income – Deductions = Taxable Income

Taxable Income × Tax Rate % = Tax Payable

Tax Payable – Tax Offset = Net Income Tax Payable

In actual practice, the taxable income is calculated by adjusting the accounting profit (i.e. profit reported in conformance with accounting standards). See the formula below:

Accounting Profit ± Reconciling Items = Taxable Income

Unless otherwise stated, all legislative references in this section are to the Income Tax Assessment 1997.

The main difference between the accounting profit and taxable income is outlined in the table below.

| Accounting Profit | Taxable Income |

|---|---|

| This is the profit before tax reported on the profit or loss statement (income statement) of the entity. | This is the assessable income less allowable deductions reported on the entity’s tax return. |

The amount of the accounting profit still needs to be adjusted accordingly because this amount was computed based on AASB (Australian Accounting Standards Board) standards. In contrast, the taxable income is calculated based on taxation laws. The table below explains the main difference between AASB standards and Australian taxation laws concerning their approach to income and expenses.

| AASB Standards | Taxation Laws |

|---|---|

| Generally, revenues are recognised when earned, while expenses are recognised when incurred. | As a rule of thumb, income is assessable regardless of if there is a receipt of cash or none. Expenses can only be deducted if there is an actual outflow of cash. |

Reconciling items are those amounts that are either added to or deducted from the accounting profit to arrive at the correct taxable income of the entity. Some of these reconciling items are outlined in the table below.

| Reconciling Item | Effect |

|---|---|

| Assessable income not included in the income statement (e.g. net capital gain and franking credits) | Add |

| Non-deductible expenses (e.g. R&D expenditure subject to R&D tax incentive) | Add |

| Other allowable deductions not included in the income statement (e.g. tax loss) | Less |

| Income not included for tax purposes but is included in the income statement (e.g. exempt income) | Less |

Based on 7. Reconciliation to taxable income or loss. © Australian Taxation Office for the Commonwealth of Australia

Accounting methods refer to how an entity records its revenues and expenses. The accounting method that the entity employs may dictate whether the reconciling item is added to or deducted from the accounting profit to arrive at the correct taxable income. Entities may use either a cash based or accrual base accounting method.

To learn more about different accounting methods refer to Accounting methods for business income.

Learning Exercise

Cash Basis vs Accrual Basis

Your client, David, engaged in a manufacturing business, sold 10,000 units of product A in May 2022 worth $8,000. 50% of this sale was paid in cash the following month, and the remaining was paid on 10 July 2023.

Required: How much income would your client recognise in his books for 2022–2023 tax year?

If the cash basis accounting method is used:

The $4,000 worth of income will be recognised in the financial year 2022–2023 because it is the cash received from 1 July 2022 to 30 June 2023.

If the accrual basis accounting method is used:

The total amount of $8,000 will be recognised as income in 2022–2023 because it is the total amount earned from the sale of goods from 1 July 2021 to 30 June 2022. The sale of goods made in the financial year 2022–2023, worth $8,000, has given your client the right to obtain consideration because he had already incurred the related expenses in that financial year. Thus, under the accrual basis accounting method, you should recognise the amount of $8,000 in the financial year 2022–2023.

Here are some definitions of taxable transaction data and its source documents:

| Taxable Transaction Data | Definition | Source of Information | Definition |

|---|---|---|---|

| Allowable Deductions | This refers to the expenses or purchases that can be subtracted from the assessable income for tax purposes. | Purchase invoice | This commercial document is issued to record the purchase of goods or services in exchange for a fixed amount of money. |

| Capital Gains | This refers to the profit generated from the sale of assets such as property, shares and so on. | Sales deed of land | This legal document showcases the transfer of title, rights, and ownership of a property from a seller to a buyer. |

| Financial Adjustments Such as Write-Offs and Revaluations | Financial adjustments refer to special financial transactions that are needed to compute taxation. | Tax rebate receipt | This written document contains details of the tax offsets. |

| Income | This refers to all income generated by conducting business activities on which tax needs to be paid. It includes income from sales, foreign income, capital gains and other profit-making transactions. | Tax invoice | This is a commercial document issued to record the transaction of the sale of goods or services in exchange for a fixed amount of money. |

| Payments | This refers to all spending of the business. | Payment receipt | This document shows proof of monetary transfer in exchange for purchasing goods or services. |

| Purchases | This refers to all the procurement transactions done for capital and non-capital expenses. | Supplier invoice | This is a commercial document issued to record the purchase of goods or services in exchange for a fixed amount of money. |

| Superannuation Payments | These refer to payment contributions for employees’ retirement. These are deductible from taxable income. | Super receipt | These are issued by super funds to acknowledge receipt of super contributions by employers. |

Calculating a company's taxable income is generally the same as shown in the above sub topic above. However, the accounting profit of a company is reconciled with the correct taxable income. Although most general income tax regulations apply to companies, some matters will require your attention if you calculate a company's taxable income. These are discussed in this subtopic.

Tax Loss

A tax loss arises when the total amount of deductions the company can claim for an income year exceeds its total assessable income for the year. A company may only carry over its tax losses if it satisfies either of these tests (s. 165-A):

- Ownership test

- Business continuity test

Ownership test

Generally, a company may be able to meet the ownership test if all times during the ownership test period, there are persons within the company who hold more than 50% of the following (s. 165-12):

- Voting power

- Rights to dividends

- Rights to capital distributions

The ownership test period is the period that starts from the beginning of the loss year and ends on the last day of the year of recovery (s. 165-12). The loss year is the year in which the tax loss was incurred. If the company is only in existence after the beginning of the year, the starting point would be on the first day that the company came into existence. On the other hand, if the company ceases to exist before the end of the year, then the ending point of the ownership test period would be the day that the company ceases to exist (s. 165-255).

Learning Exercise

Ownership Test

Great Place Pty Ltd incurred tax losses of $5,000 and $8,000 in 2019–2020 and 2020–2021, respectively. In 2021–2022, the company reported a taxable income of $20,000.

Its shareholding structure is as follows:

| Financial Year | Jason | Tahali | Chadi | Mike | Ellie |

|---|---|---|---|---|---|

| 2019–2020 | 30% | 50% | 20% | - | - |

| 2020–2021 | 30% | 25% | 20% | 25% | - |

| 2021–2022 | 40% | 20% | - | 20% | 20% |

Required:

- Determine the ownership test period if the company wants to carry over its tax loss from 2019-2020 to 2021-2022.

- Did the company satisfy the ownership test during 2019-2020 to 2021-2022?

The ownership test period is from the start of 2019–2021 up to the end of 2021–2022. The company satisfied the ownership test during 2019-2020 to 2021-2022.

2019–2020 – Jason, Tahali, and Chadi, together own more than 50% of the shareholdings at the start of the ownership test period.

2020–2021 – Jason, Tahali, and Chadi, together remain to own more than 50% of the shareholdings

2021–2022 – Jason and Tahali, who were among the persons who held an aggregate ownership of more than 50% during the loss year, remain to own an aggregate ownership of more than 50% at the end of the ownership test period.

Learning Exercise

Assume instead that the shareholding structure of The Great Place Pty Ltd is as follows:

| Financial Year | Jason | Tahali | Chadi | Mike | Ellie |

|---|---|---|---|---|---|

| 2019–2020 | 30% | 50% | 20% | - | - |

| 2020–2021 | 30% | 25% | 20% | 25% | - |

| 2021–2022 | 20% | 20% | - | 20% | 40% |

Required:

Determine if the company satisfied the ownership test during 2019-2020 to 2021-2022?

In this case, the company did not satisfy the ownership test during 2019–2020 to 2021–2022. This is because, by the end of the ownership test period, neither Jason’s, Tahali’s or Chadi’s individual share in shareholdings nor their aggregate ownership amounted to more than 50% of the total shareholdings.

Business continuity test

If a company fails to satisfy the Ownership Test, it must pass the Business Continuity Test to carry over its previous tax losses. A company meets the Business Continuity Test if it carries on at all times during the period of recoupment the same business as the business it carried on at the change-over (TR 1999/9).

Here are some of the reasons why a company may fail the Business Continuity Test.

- It started a business that it did not carry on before the test time (s. 165–210).

- It entered into a kind of transaction that it had not entered into in the course of its business operations before the test time (s. 165–210).

- It derived assessable income from (a) and (b) (s. 165–210).

Learning Exercise

Test for Previous Losses

Umbreally Pty Ltd commenced its business of retailing school supplies on 1 July 2020. At the end of the 2020–2021 financial year, the company reported a tax loss of $5,000. On 10 September 2021, 70% of its shares were sold to new shareholders. On 20 May 2022, the company started selling gadgets and electronics in addition to school supplies to expand its market. The company continues to operate unaltered and reported a taxable income of $20,000 by the end of the 2021–2022 financial year.

Required

Can Umbreally Pty Ltd carry over its tax loss incurred during the 2020–2021 to 2021–2022 financial year?

Umbreally Pty Ltd will not be able to carry over its tax loss.

Ownership test – The company could not pass the ownership test during the ownership test period. This is because new owners own more than 50% of the shareholdings.

Business continuity test – The company was also unable to satisfy the Business Continuity Test. This is because the company did not carry on the same business during the period of recoupment, which is in the 2021–2022 financial year.

Bad Debts

Bad debts are expenses that a business incurs once the repayment of a credit extended to a customer is found to be uncollectible. Bad debts of a company are allowed as a deduction for income tax purposes when:

- The bad debts are written off

- The company satisfies either the Ownership Test (s.165-123) or Business Continuity Test (s.165-126)

- The deduction was not disallowed by the Commissioner (s.165-120)

The calculation of taxable income should only include those bad debts that are allowed as a deduction for income tax purposes. Adjustments must be made if necessary.

Learning Exercise

Reconciliation to Taxable Income – Bad Debts

The income statement of GHJ Pty Ltd presented the following information:

| Income | ||

|---|---|---|

| Gross Profit | $600,000 | |

| Expenses | ||

| Deductible expenditures | $200,000 | |

| Allowance for doubtful accounts (note 1) | $20,000 | |

| Bad debts actually written off (note 2) | $40,000 | $260,000 |

| Net Profit | $340,000 | |

NOTE 1: The bad expense charged represents the establishment of the bad debt provision.

NOTE 2: $5,000 of this amount was not previously included as assessable income.

Other information: There have not been any changes in company shareholdings.

Required: Calculate the taxable income of GHJ Pty Ltd.

| Net Profit | $340,000 | |

| Add Allowance for doubtful accounts – Note 1 |

$20,000 | |

| Bad debts written off – Note 2 | $5,000 | $25,000 |

| Taxable Income | $365,000 |

To learn more about deductions for bad debts refer to Deductions for unrecoverable income (bad debts)

Research and Development Expenditures

Companies engaged in research and development (R&D) activities may be granted a tax incentive upon meeting certain conditions. The incentive allows these companies to claim a tax offset on their research and development expenditures if it meets the eligibility requirements under Division 355 of ITAA 1997. The purpose of this incentive is to encourage entities to conduct research and development activities.

The steps to claiming research and development incentive are listed by ATO as follows:

- Check that you meet the four initial eligibility requirements.

- Work out if you are controlled by any exempt entities

- Calculate your aggregated turnover

- Work out which tax offset you can claim

- Calculate your tax offset

- Lodge your claim

To learn more about R & D tax offsets refer to Steps for claiming R & D tax offset.

As per ATO, the four eligibility requirements are:

- The taxpayer should have carried out eligible R&D activities.

- The taxpayer should be an R&D entity.

- The taxpayer has registered its R&D activities with AusIndustry.

- The taxpayer has qualified for notional deductions of more than $20,000.

An eligible R&D activity is either a core R&D activity or a supporting R&D activity.

- Core R&D activities (see s. 355-25)

- Supporting R&D activities (see s. 355-30)

An entity is an R&D entity if it is a corporation incorporated under(s. 355-55):

- Australian law

- Foreign law but is classified as an Australian resident for income tax purposes.

- Foreign law but is:

- A resident of a foreign country that has a double tax agreement with Australia

- Carrying on a business in Australia within the definition of permanent establishment set out in the relevant double tax agreement.

Notional deductions are determined to calculate the amount of tax offset an entity may claim. However, although the term is referred to as a deduction, ATO states that notional deductions are not treated as general deductions under Section 8-1 of ITAA 1997. Reference to relevant provisions of ITAA 1997 for each notional deduction are set out in the table below:

| Notional Deductions | Other Relevant Provisions |

|---|---|

| R&D expenditures | s. 355-205 |

| Decline in value | s. 355-305 |

| Balancing adjustment | s. 355-315 |

The expenditures which are not to be included as notional deductions are set out in s. 355-225 of the Act.

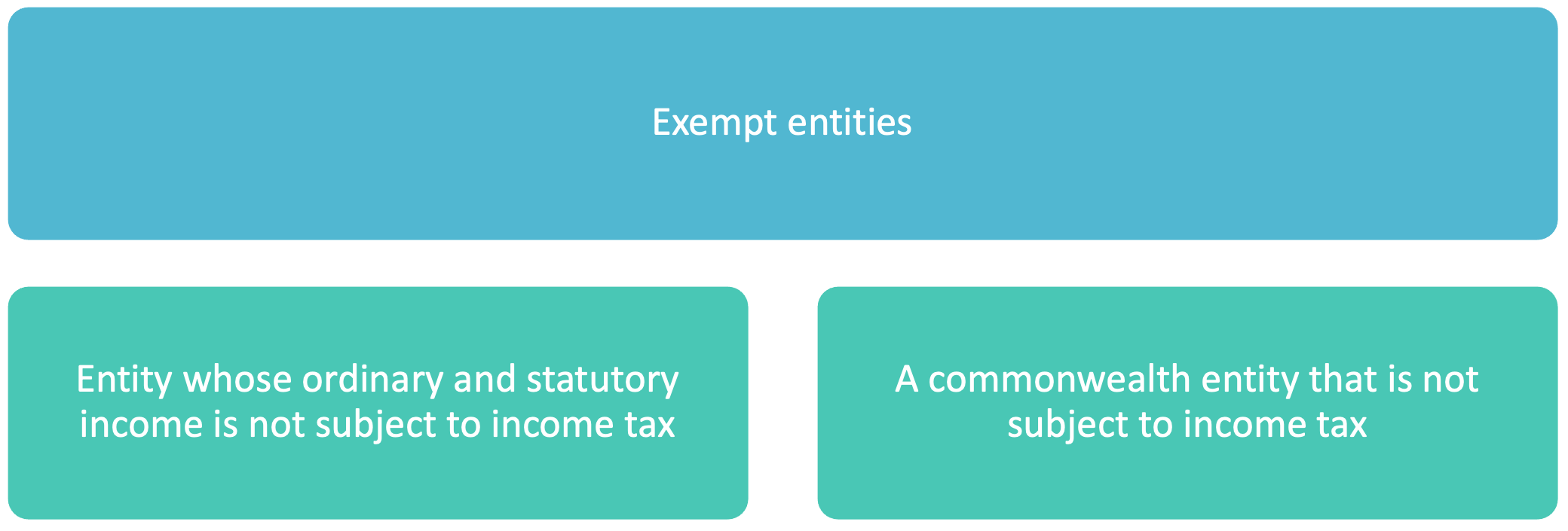

Exempt entities include the following:

The R&D entity is said to be controlled by exempt entities if the exempt entities and their affiliates hold at least 50% of the following:

- The voting power in the R&D entity

- Rights to income or capital distributions in the R&D entity.

If exempt entities control the R&D entity, step 3 should be skipped. R&D entities controlled by exempt entities may only claim 38.5% of their total notional deductions as a non-refundable tax offset, regardless of the amount of their aggregate annual turnover.

As per ATO, the amount of tax offset that an entity can claim varies depending on certain circumstances. See the table below:

| If: | Claimable Tax Offset | |

|---|---|---|

| The R&D entity (both should be true) | It is not controlled by an exempt entity | 43.5% of the notional deduction will be claimable as a refundable tax offset |

| It has aggregated turnover of less than $20 million | ||

| The R&D entity (either applies) | It is controlled by an exempt entity | 38.5% of the notional deduction will be claimable as a non-refundable tax offset |

| It has aggregated turnover of less than $20 million |

Learning Exercise

Research and Development – Tax Offset

Company ABC is an R&D entity entitled to notional deductions of $150,000,000 on its R&D expenditures. Company ABC's aggregated R&D turnover for the income year is $70,000,000.

Calculate the amount of tax offset on R&D expenditures.

Explanation:

Company ABC's turnover is higher than $20,000,000, so the company can claim the 38.5% non-refundable.

Since R&D tax offset on notional deductions may only be claimed up to $100,000,000, the balance, which amounted to $50,000,000, shall be claimed at the company tax rate of 30%.

Learning Exercise

Research and Development – Tax Payable

Company EFG is an R&D entity that had an aggregate turnover of $45,000,000. It incurred an accounting net loss of $300,000 in the 2019/2020 income year. This comprises $40,000,000 as assessable income, $3,000,000 as eligible R&D expenses, and $36,700,000 as other expenses.

Required:

- Calculate the taxable income

- Calculate the taxable offset

- Calculate the tax payable

| Calculate the taxable income | ||

| Accounting net loss | $300,000 | |

| Add: Reconciliation - R&D expenses | $3,000,000 | |

| Taxable Income | 2,700,000 | |

| Calculate the taxable offset | ||

| Assessable Income | $3,000,000 | |

| X 38.5% | ||

| Taxable Offset | $1,155,000 | |

| Calculate the tax payable | ||

| Taxable income × 30% | $810,000 | |

| Less: R&D tax offset | $1,155,000 | |

| Tax Payable | Nil | |

Dividends

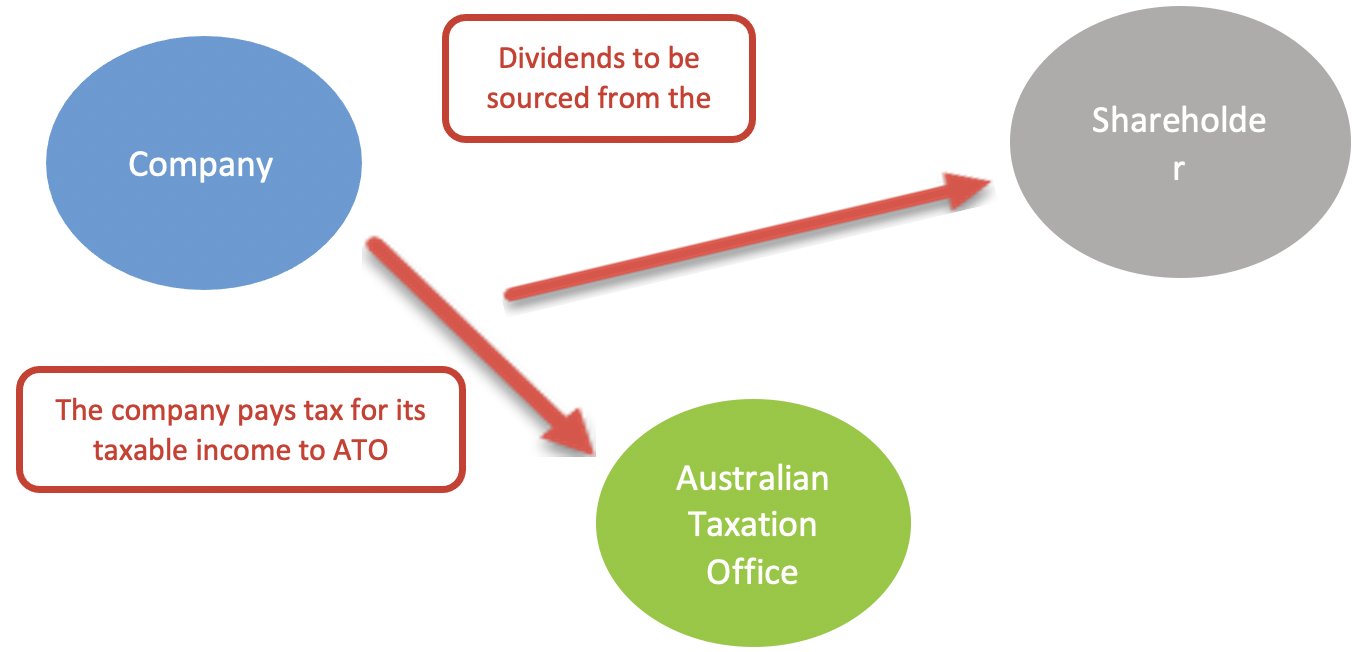

A dividend is a company's profit distribution to its shareholders, which may also be in other forms besides cash. The distribution is from the company’s after-tax profit. The basic concept of dividends may be illustrated as follows:

You must remember that what is being paid as dividends to shareholders are portions of the company’s profit, net of income tax. Therefore, it is only logical to make appropriate adjustments when taxing the shareholders' dividend income to avoid double taxation.

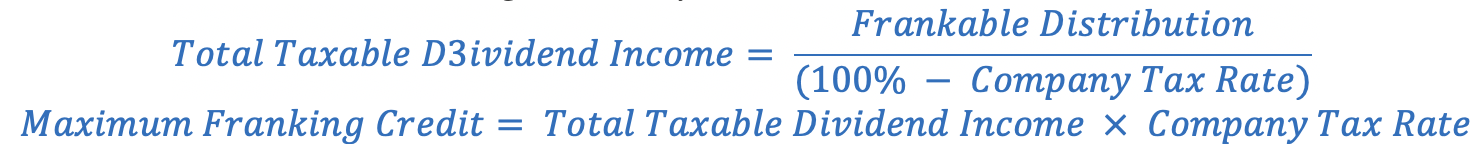

The dividend imputation system (Parts 3–6 of ITAA97) was implemented to address this issue. Under the dividend imputation system, companies can attribute the income tax already paid on their profit to the dividend distribution made to their shareholders by franking the distribution. The shareholders earn the right to claim a tax offset through this system. This tax offset is appropriately referred to as the franking tax offset. A franking tax offset may only be claimed if a franking credit is imputed to the dividend distribution. A franking credit is the portion of the company income tax attributed to the particular dividend distribution. A franking credit attributed to a specific distribution should not exceed the maximum franking credit for that distribution.

Here is how the maximum franking credit may be calculated:

Learning Exercise

Franking Credit (Shareholder’s Perspective)

Valerie is a shareholder of ABCX company. During the year, she received a dividend income amounting to $1,400. Assume that the dividend she received is a fully franked distribution. Also, assume that ABCX company applies a company tax rate of 30% and that Valerie’s applicable individual tax rate is 21%.

Required deternine:

- How much is taxable income of Valerie in relation to the franked distribution?

- How much is the maximum franking credit?

- How much is the tax payable to Valerie?

- How much is the excess of the franking tax offset over the tax payable by Valerie (if any)?

- How much is the net tax payable to Valerie?

$1,400 ÷ (100% - 30%) = $2,000

$2,000 × 30% = $600

$2,000 × 21 % = $420

$420 - $600 = ($180)

0

Any excess of the franking tax offset over the tax payable of the shareholder may be either claimed as a tax offset on other income or a refund. However, a shareholder who is a company is not allowed to claim a refund for this excess. Alternatively, the company may treat this excess as a tax loss.

Shareholders may choose to check the dividend distribution statement to see the number of franking credits imputed on the dividends they received. This dividend distribution statement may serve as evidence of the allocation of franking credits made to the dividend distribution.

A franking credit may also be referred to as imputed tax credit, imputed credit, imputation tax credit, Class C imputation credit, Class C imputed credit, and Australian imputed tax credit at the rate of 30%.

A corporate tax entity has the responsibility of maintaining a franking account. A franking account is a record that corporate tax entities shall maintain to track how much franking credits may be imputed on their dividend distributions (s. 200-15). The account is created just for tax purposes. It shall be appropriately utilised to account for franking credit and debit transactions.

The transactions to be debited or credited in the franking account are:

| Transaction | Treatment | Amount |

|---|---|---|

| The company paid income tax | Credit the franking account | Amount of tax paid |

| The company received a franked dividend | Credit the franking account | Franked dividend ÷ (100% - Company tax rate) × Company tax rate |

| The company received a tax refund | Debit the franking account | Amount of tax refund |

| The company made franked distributions | Debit the franking account | Franked dividend ÷ (100% - Company tax rate) × Company tax rate |

ITAA97 details the different kinds of transactions that may give rise to either a franking debit or credit entry. The table below may serve as your reference:

| Transaction | Read |

|---|---|

| Transactions that give rise to a franking credit | s. 205-15 of ITAA97 |

| Transactions that give rise to a franking debit | s. 205-30 of ITAA97 |

Learning Exercise

Franking Account

Janix Pty Ltd, a corporate tax entity, has the following transactions for the income year.

| Date | Transaction | Amount |

|---|---|---|

| 1 Jul | Opening balance | 0 |

| 1 Oct | The entity pays a PAYG instalment | $10,000 |

| 30 Dec | Paid a fully franked dividend | $4,900 |

| 20 Mar | Received a fully franked dividend | $210 |

| 20 May | Received a tax refund | $2,000 |

Required:

Prepare the franking account. Assume that the applicable tax rate is 30%.

| Date | Transaction | Debit | Credit | Balance |

| 1 Jul | Opening balance | 0 | ||

| 1 Oct | The entity pays a PAYG instalment | $10,000 | $10,000 cr | |

| 30 Dec | Paid a fully franked dividend ( $4,900 ÷ 70% × 30%) | $2,100 | 7,900 cr | |

| 20 Mar | Received a fully franked dividend ($210 ÷ 70% × 30%) | $90 | 7,990 cr | |

| 20 May | Received a tax refund | $2,000 | 5,990 cr |

Suppose the franking account has a debit ending balance at the end of the period. This means there has been an over-imputation of franking credits during the period. A Franking Deficit Tax (FDT) shall be imposed in such cases. FDT is imposed on entities(s. 205-45):

- With a debit ending balance on their frank account

- Who cease to be franking entities

Suppose a company chooses to pay franked distributions even before it ascertained that there would be enough franking credits by the end of the period. In that case, the franking account will have a debit ending balance.

To determine the FDT to be paid, the franking deficit shown in the franking account at the end of the period should be adjusted to include only the franking debits arising from items 1, 3, 5 or 6 in section 205-30 or item 2 under certain circumstances. This adjusted franking deficit is the amount of FDT to be paid. All those transactions that give rise to a franking debit but are nonetheless uncontrollable by the company should be disregarded in accounting for the franking deficit.

The amount of the FDT paid may later be claimed as a tax offset for the relevant income year under certain circumstances (s. 205-70). The amount of claimable tax offset for the related FDT paid depends on whether there was an excessive over-franking or not. Excessive over-franking is when the franking deficit exceeds 10% of all franking credits accounted in the company’s franking account during the franking period.

The table below summarises how much tax offset may be claimed in certain instances:

| Circumstance | Amount of Claimable Tax Offset |

|---|---|

| There was no excessive over-franking | The whole amount of the tax deficit may be claimed as a tax offset. |

| There was an excessive over-franking | Only 70% of the tax deficit may be claimed as a tax offset. |

Based on © Australian Taxation Office for the Commonwealth of Australia

Learning Exercise

Franking Tax Deficit

Yuminess Pty Ltd, a corporate tax entity, has the following transactions for the 2019/2020 income year:

| Date | Transaction | Amount |

|---|---|---|

| 30/06/19 | Balance | $200 |

| 12/20/19 | Received unfranked dividend | $3,700 |

| 12/31/19 | 2018/19 Balance of company tax paid | $7,900 |

| 20/03/20 | Paid fully franked dividend | $6,300 |

| 17/04/20 | Received a 2017/18 tax refund | $4,200 |

| 20/04/20 | Paid fully franked dividend | $4,900 |

| 15/05/20 | The commissioner made a determination that there should be a franking debit for a specific distribution made during the year. | $1,200 |

Additional Information: Yuminess Pty Ltd reported a taxable income of $70,000 for the 2019/2020 income year.

Required: Assume that the applicable company tax rate is 30%.

- What is the amount of franking deficit tax?

- How much is the claimable tax offset?

- How much is the net tax payable to Yumminess Pty Ltd?

$200 + $7,900 - ($6,300 ÷ 70% × 30%) - $4,200 - ($4,900 ÷ 70% × 30%) = $900

Ignore the transaction relating to the unfranked dividend and the last transaction because the happening of this transaction is uncontrollable by the entity.

$7,900 × 10% = 790

$900 > $790

Claimable tax offset = $900 × 70% = $630

($70,000 × 30%) - $630 = $20,370

The benchmark rule states that all frankable distributions made within the franking period must be franked to the same extent (s. 200-30). The franking period for a private company is the same as its income year (s. 200-45). On the other hand, a public company’s franking period shall be the period of six months beginning at the start of the entity’s income year and the remainder of the income year (s. 203-40).

As per the benchmark rule, the franking percentage for the first distribution in the franking period shall serve as the benchmark for all the succeeding distributions made during the franking period (s. 203-30).

The franking percentage is calculated as follows (s. 203-35):

Learning Exercise

Benchmark Rule

At the start of the income year, Delicious Pty Ltd made its first frankable distribution in the amount of $21,000. An amount of $4,500 was allocated to this distribution.

Required:

Assume that the applicable company tax rate is 30%.

- What is the maximum franking credit for this distribution?

- What is the franking percentage for the distribution made during the start of the income year?

- What is the franking period?

- What is the benchmark franking percentage during the franking period?

$21,000 ÷ (100% - 30%) × 30% = $9,000

$4,500 ÷ $9,000 = 50%

The franking period is 12 months because Delicious Pty Ltd is a private company. 50%

The consequences of not adhering to the benchmark rule may be summarised as follows:

| Breach | What Will Happen |

|---|---|

| Over-franking | The entity will become liable to pay an over‑franking tax. |

| Under-franking | The related shortfall will be deemed forfeited as a consequence of the breach, and a franking debit related to the forfeiture shall be accordingly recorded in the franking account. |

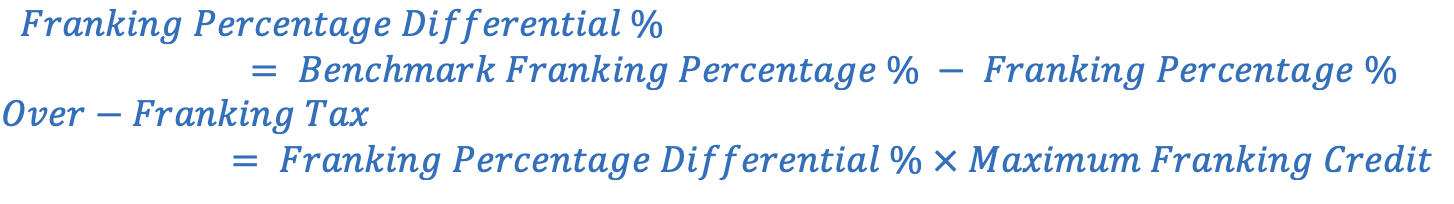

The amount of over-franking tax is calculated as given below:

In practice, the partnership income or loss is computed as follows:

Net income or loss=Accounting profit ±Reconciliations

The main difference between partnerships and corporates is that the income is taxed in the hands of the corporate body. However, the net taxable income made by the partnership firms is distributed to the partners. It is then taxable in the hands of the partners. The basic concepts in reconciling the accounting profit with the taxable income are the same as all other entities. See the table below:

| Reconciling Item | Effect |

|---|---|

| Assessable income not included in the income statement | Add |

| Non-deductible expenses | Add |

| Other allowable deductions not included in the income statement | Less |

| Income not included for tax purposes but included in the income statement | Less |

Appropriate reconciliations should be made to reflect that prior year losses (Division 36 ITAA 1997) and each partner’s personal superannuation (s. 290-150 ITAA 1997) were not included in the computation of the partnership’s net income or loss.

Given below are some of the possible reconciliations done to the net income or loss of a partnership:

- Salaries of the partners

- Drawings

- Interest on capital

- Partnership advances from and to partners

- Capital gains and losses

- Superannuation and insurance premium

Salaries of the partners

These are the salaries paid to the partners, usually as a consideration for the efforts and services these partners render in managing the partnership. However, the partners of the partnership are not employees of the partnership. What the partners receive from the partnership does not particularly pertain to the salaries or wages of an employee; rather, what they receive is a form of distribution of partnership profit (See Ellis v. Joseph Ellis & Co TR2005/7).

Salaries should not be treated as an expense in the net income or loss computation. A partner’s salary, however, should be appropriately accounted for upon the distribution of the partnership’s profit.

Drawings

Drawing is the act of a partner taking out a certain sum of money from the business. Drawings should not be treated as an expense in the computation of the partnership’s net income or loss.

Interest on capital

Interest on capital is the consideration paid to certain partners for the amount of capital the partner maintains in the partnership. Interest on capital is also not to be treated as an expense in the computation of the partnership’s net income or loss.

Partnership advances from and to partners

Advances are some form of a loan which may be either of the following partnership advances:

- Made by the partners, which may incur interest expense

- Made to the partners, which may earn interest income

The interest income and expense on these advances should be accounted for in the computation of the partnership’s net income or loss.

Capital gains and losses

Capital gains and losses are not accounted for in the computation of the partnership’s net income or loss. Capital gains and losses are apportioned separately in accordance with the partnership agreement or, in its absence, the partnership law (s. 106-5(1)).

Superannuation and insurance premium

Superannuation contributions made to the partners and the insurance premium paid for the partner are not considered allowable deductions in calculating the partnership income.

Learning Exercise

Calculation of Partnership Income

Your client operates as a partnership in the retail industry. Maya and Peter are both partners in this partnership.

The partnership’s report on its income and expense presented the following information:

| Income | |

|---|---|

| Sales | $500,000 |

| Interest income – Advances to Peter | $2,000 |

| Profit on disposal of shares (capital gain) | $6,500 |

| Expenses | |

| Cost of goods sold | $275,000 |

| Salary – Maya | $20,000 |

| Salary – Employees | $60,000 |

| Superannuation – Maya | $14,000 |

| Superannuation – Peter | $14,000 |

| Superannuation – Employees | $25,000 |

| Interest in the capital – Peter | $5,000 |

| Interest expense – Advances from Maya | $3,000 |

| Interest expense – ABC Bank | $15,000 |

| Non-deductible entertainment expense | $1,500 |

| Other allowable business expenses | $25,000 |

| Accounting Profit Before Tax | $51,000 |

Required:

Calculate the partnership’s net income or loss.

| Accounting Profit | $51,000 |

| Reconciliations | |

| Less: Profit on disposal of shares (capital gain) | $6,500 |

| Add: Salary – Maya | $20,000 |

| Superannuation – Maya | $14,000 |

| Superannuation – Peter | $14,000 |

| Interest in the capital – Peter | $5,000 |

| Non-deductible entertainment expense | $1,500 |

| Partnership Net Income | $99,000 |

After calculating the partnership net income or loss, you will have to allocate this profit to each partner. This is because the income is taxed in the hands of the partners and not the partnership firm. As you allocate, you will need to know their profit or loss ratio. The profit or loss ratio is normally found in the partnership agreement. If there are no provisions in the partnership agreement relating to their profit or loss ratio, the profit income or loss should be allocated equally to each partner.

Accordingly, a schedule of distribution should be prepared to properly present how the partnership net income or loss was allocated to each partner. The distribution to each partner and the allocation of partnership net income or loss may be presented as illustrated below:

| Distribution | Partner A | Partner B | Total |

|---|---|---|---|

| Salaries (to be prioritised in the distribution) | xxx | xxx | xxx |

| Interest on capital | xxx | xxx | xxx |

| Interest on drawing | xxx | xxx | xxx |

| Allocation of net income or loss | xxx | xxx | xxx |

| Total | xxx | xxx | xxx |

Learning Exercise

Partnership Distribution and Allocation of Partnership Net Income or Loss

Refer to the previous illustration and assume that Maya and Peter’s profit or loss ratio is 3:5, respectively.

Required:

Show how the income is to be allocated to each partner.

| Distribution | Maya | Peter | Total |

| Salaries | $20,000 | $0 | $20,000 |

| Interest on Capital | $0 | $5,000 | $5,000 |

| Allocation of net income or loss | $27,750 | $46,250 | $74,000 |

| Total | $47,750 | $51,250 | $99,000 (the amount of income left after distributing salaries and interest on capital) |

The general rules for computing the net income of a trust are set out in Division 6 of ITAA 1936. However, some trusts will be required to work out their net income in distinct ways under Division 266 of ITAA 1936 or Division 275 of ITAA 1997.

The net income of a trust may be computed as follows (s.95(1) of ITAA 1936):

Net Income or Loss=Assessable Income - Allowable Deductions

Necessary reconciliations shall be made if you are to work out the amount of net income (taxable income) from the amount of the trust’s income presented in its financial statements. Also, as per section 95 of ITAA 1936, the trust's net income is generally calculated as if the trust were a resident taxpayer.

Given below are the treatment to be applied for specific components:

Given below are the treatment to be applied for specific components:

Suppose the interest expense arises from a borrowing made to settle monetary distributions to the beneficiaries of a trust. In that case, the interest expense shall not be allowed as a deduction (Para 6 of TR 2005/12).

The interest expense incurred by the trustee shall only be allowed as a deduction if this interest expense is sufficiently connected with an assessable income arising from an income-generating activity carried on by the trustee (Para 7 of TR 2005/12).

To see sample situations illustrating the correct treatment for interest expense incurred by a trustee, check para 30-80 TR of 2005/12

Treatment for tax losses

The trust may use tax losses to reduce its net income if it satisfies certain conditions. These conditions will vary depending on the type of trust. Therefore, it is essential to categorise the trusts by their types appropriately. Depending on the kind of trust, the deductibility of a trust loss may be affected by events, such as: (s. 265-10):

- Abnormal trading

- Change in ownership of the trust

- Change in control of the trust

This table below will help you determine which tests apply to each specific type of trust.

| Type of Trust | |||||

|---|---|---|---|---|---|

| Non-fixed trust | ✓ | - | ✓ | ✓ | ✓ |

| Listed widely held trust | ✓ | ✓ | - | - | ✓ |

| Unlisted widely held trust | ✓ | - | - | - | ✓ |

| Unlisted very widely held trust | ✓ | - | - | - | ✓ |

| Wholesale widely held trust | ✓ | - | - | - | ✓ |

| Fixed trust other than a widely held unit trust | ✓ | - | - | - | ✓ |

| Excepted trusts | - | - | - | - | - |

| Family trust | - | - | - | - | ✓ |

| Excepted trust (other than a family trust) | - | - | - | - | - |

To further understand how ATO expects you to apply the different tests relating to Trust Losses refer to How to apply the trust loss test.

Treatment for franking credits and refunds

Franking credits on a franked dividend also form part of a trust’s assessable income. Accordingly, Trusts are entitled to claim for franking tax offsets. However, trustees may only claim refunds from excess franking credits if:

- The trustee of a resident trust estate is liable to be assessed under s. 99 of ITAA 1936 on undistributed trust income (i.e. not on s.98 of ss.99(A))

- The undistributed income includes franked dividends paid on or after 1 July 2000

- The total franking credits on these dividends, plus any other tax offsets, exceeded the trustee’s basic income tax liability for the income year

If the trusts incurred loss under tax purposes, the refund on the excess franking credits cannot be claimed.

Franking Credit Refund

The ABC trusts incurred a loss for tax purposes $56,789. This amount included a franking credit of $500. In this case, the amount of franking credits cannot be refunded since the trusts incurred trust loss during the year.

Treatment for capital gains and losses

Capital gains and losses also form part of the trust's net income. Trusts may either employ the 50% CGT (Capital Gains Tax) discount method or the small business entity capital gains tax concession where applicable. Suppose the beneficiaries have to include their share from the trust's capital gains. In that case, the amount should be first grossed up before the beneficiaries can finally apply the 50% CGT discount method.

Learning Exercise

Trust Capital Gains or Losses

ABC Trust reported a net trust income of $70,000 for the financial year 2019/2020. This included a capital gain of $30,000 net of 50% CGT discount and $40,000 in other assessable income.

Apolo is entitled to a 30% share of the net trust income. In addition, Apolo declared $50,000 in gross wages and a capital loss of $2,000.

Required:

Calculate Apolo’s taxable income.

| Gross wages | $50,000 |

| Share from trusts (other income) (40,000 × 30%) | $12,000 |

| Net capital gain ((30,000 ÷ 50% × 30%)-(2,000)) × 50% | $8,000 |

| Taxable Income | $70,000 |

General taxation on the net income of the trust

The tax payable on the trust's net income is either a liability of the trustee or the beneficiary. If the tax is to be paid by its beneficiaries, a methodology, commonly referred to as the proportional approach shall be applied (see TD 2012/22).

Under this approach, if the beneficiary is to have a 40% share of the trust’s income, then the portion of the trust’s net income assessable on the individual capacity of the beneficiary is also 40%.

Learning Exercise

Taxation on the Net Income of the Trust

The beneficiaries of a family trust are the following:

| Beneficiary | Share in the Trust Income |

|---|---|

| Maya, aged 27, and married | 40% |

| Paul, aged 30, and currently serving a prison sentence | 40% |

| Residue | 20% |

The trust’s net income amounted to $70,000.

Required:

- How will Maya’s share in the trust income be assessed?

- How will Paul’s share in the trust income be assessed?

- How is the residue assessed?

| How will Maya’s share in the trust income be assessed? | ||

| Maya will have to report this share from trust income in her individual tax return. | ||

| How will Paul’s share in the trust income be assessed? | ||

| Tax on 40% share | ($28,000 - $18,200) × 0.19 | $1,862 |

| Less: Low-income tax offset | $450 | |

| Less: Medicare levy | $28,000 × 2% | $560 |

| Net Payable | $852 | |

| How is the residue assessed? | ||

The trustee of the trust will be liable to pay income tax on Paul's share of the trust income. (The calculation for Paul’s share will be the same as for Maya.)

The residue should be a liability of the trustee, taxed at 45% plus the Medicare levy.

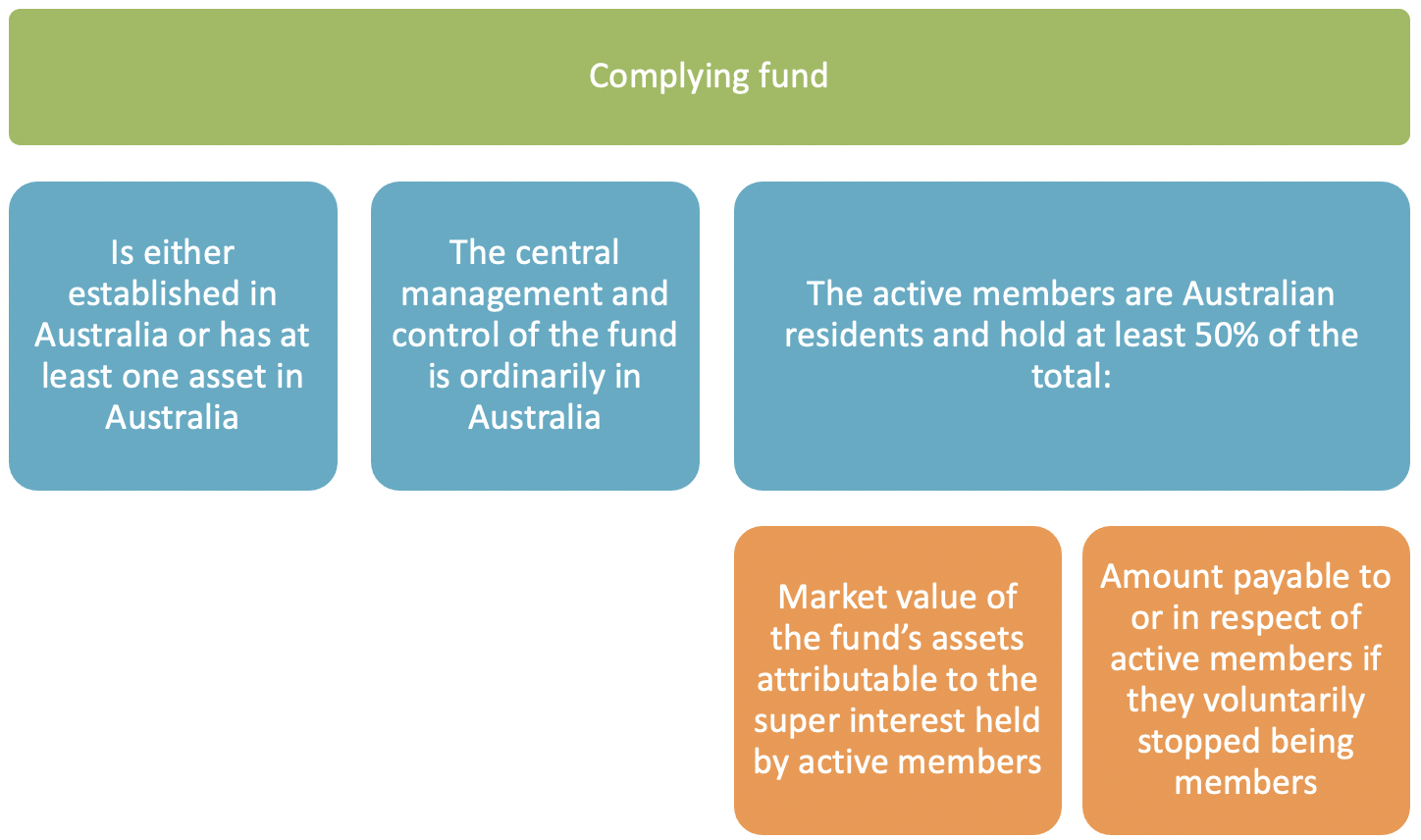

The business structure of superannuation funds is that of a trust. However, special taxation laws apply to superannuation funds. These are referred to as superannuation laws in this subtopic and they need to be examined separately. You must understand what complying funds are before progressing further.

A superannuation fund is a complying fund if it satisfies all three tests listed below at any point in the income year:

The taxable income of the superannuation fund may be calculated as follows:

Taxable Income= Assessable Income – Allowable Deductions

Assessable income

Generally, the assessable income of both complying and non-complying superannuation funds is composed of the contributions made by its members during the year. It also includes the other income derived from various investment sources (e.g. interest income, dividend income, capital gains, rental income, etc.).

- Exempt income

Income derived by a complying superannuation fund from segregated assets held to pay current pension liability is exempt from tax. - Contributions

These are assessable income for a complying superannuation fund if any of the following conditions are met: Contributions made on behalf of a spouse, government co-contributions, contributions made on behalf of a person who is a temporary resident of Australia, and contributions for which no deduction was claimed do not form part of the assessable income of a complying superannuation fund.

Contributions are to be included as assessable income during the income year when the contribution amount was received (i.e. cash basis).- It was made by a contributor on behalf of the member, e.g. superannuation guarantee paid by the employer for the employee

- It was made by a self-employed individual, and the person notified the fund that a deduction would be claimed

- It is an amount transferred from a foreign superannuation fund to an Australian superannuation fund

- Capital gains

The capital gains of both complying and non-complying superannuation funds are calculated similarly to how you would typically calculate capital gains.

The capital gains of a superannuation fund may be reduced either through:- indexed cost base method

- CGT discount method.

- Franked dividends

The franking credit on a franked dividend derived by a superannuation fund should be included in the fund’s total assessable income. All superannuation funds are entitled to a franking tax offset. However, non-complying funds cannot claim a refund from excess franking credits.

Allowable deductions

Like any other taxpayers, superannuation funds are entitled to claim deductions for losses and outgoings incurred to produce assessable income and carry on a business. Only the portion of the total expenditures incurred to produce assessable income may be claimed as a deduction. Examples of the usual expenses incurred by a superannuation fund are as follows:

- General management expenses (e.g. trustee remuneration)

- Administrative expenses (e.g. costs incurred in collecting contributions)

- Marketing (e.g. advertising costs)

- Expenses incurred in complying with super law obligations (e.g. obtaining actuarial or legal advice)

As per s.295-495 of ITAA 1997, all superannuation funds are disallowed to claim deductions from the benefits they paid to their members.

The following ATO Interpretative Decisions (ID) provide guidance on some of the issues regarding the calculation of the deduction of superannuation funds:

| ATO ID | Topic |

|---|---|

| ATO ID 2007/219 | Deduction for an increased amount of superannuation lump sum death benefit |

| ATO ID 2008/111 | Deduction for an increased amount of superannuation lump sum death benefit—earnings foregone |

| ATO ID 2008/112 | Deduction for an increased amount of superannuation lump sum death benefit |

| ATO ID 2010/5 | Deduction for an increased amount of superannuation lump sum death benefit |

| ATO ID 2012/10 | Anti-detriment payments by a complying superannuation fund to a trustee of a deceased estate |

Learning Exercise

Calculation of Taxable Income and Tax Payable

ABC Superplus is a superannuation fund. The relevant financial information of the fund for the 2019/2020 income year is presented below:

| Receipts | |

|---|---|

| Contributions from the employers | $200,000 |

| Interest income | $9,000 |

| Unfranked dividends | $7,000 |

| Franked Dividends (franking credits $2,000) | $20,000 |

| Proceeds from the sale of a CGT asset | $956,000 |

| Disbursements | |

| Cost incurred in collecting distributions | $30,000 |

| Premiums to provide death cover for members | $12,000 |

| Benefits paid to the members | $35,000 |

- The unfranked dividend was deemed derived from a non-arm’s length transaction.

- Half of the interest income was derived from a segregated asset held to pay current pension liabilities.

- The CGT asset was acquired on 30 June 2015 for $656,000.

Required:

Calculate the fund's taxable income and tax payable, assuming ABC Superplus is a complying superannuation fund.

| Assessable Income | |

| Contributions from the employers | $200,000 |

| Interest income (9,000 ÷ 2) | $4,500 |

| Unfranked dividends | $7,000 |

| Franked dividends | $20,000 |

| Franking credit | $2,000 |

| Capital gains (300,000) × (100% - 33 1/3%) | $200,000 |

| $233,500 | |

| Allowable Deductions | |

| Cost incurred in collecting distributions (233,500 ÷ 238,000) × 30,000 | $29,433 |

| Premiums to provide death cover for members | $12,000 |

| $41,433 | |

| Taxable Income | $192,067 |

| Tax Payable | Taxable Income | Tax Rate | Tax Payable |

|---|---|---|---|

| Non-arm's length component | $7,000 | 45% | $3,150 |

| Low tax component | $226,500 | 15% | $33,975 |

| Total | $233,500 | $37,125 | |

| Less tax franking offset | $2,000 | ||

| Net Tax Payable | $35,125 | ||

Contributions Made to Superannuation Funds

These may be categorised into the following:

- Concessional

- Non-concessional

Concessional contributions are contributions made from before-tax income. On the other hand, non-concessional contributions are made from after-tax income. See the table below for some examples of concessional and non-concessional contributions:

| Concessional | Non-concessional |

|---|---|

|

|

Super guarantees are the contributions employers must make to their eligible employees' superannuation fund. For the year ending 30 June 2023, the compulsory contribution is equivalent to 10.5% of the employee’s ordinary time earnings. A contribution is made every quarter. All other contributions that are not super guarantees are generally classified as non-mandated contributions. Concessional contributions are taxed at 15% after the fund receives the contributions. Concessional contributions have a cap amount every financial year. The annual cap amount for the 2022–2023 financial year is $27,500, regardless of the member's age. The excess is taxed at the effective marginal rate plus the Medicare levy of the individual. Still, such tax payable can be offset against the amount of the excess multiplied by 15%.

Non-concessional contributions are from after-tax income and not taxed by the super fund. From 1 July 2021, the non-concessional contributions cap was increased to $110,000, and the excess is taxed at 47%.

To further understand concessional and non-concessional contributions refer to Growing your super.

Learning Exercise

Tax on Superannuation Contributions

Miko is working as a part-timer for ABC company. ABC company made concessional contributions of $17,000 to a complying superannuation fund for the year ending 30 June 2022 on behalf of Miko.

Required

Determine:

- How much is the employee’s unused cap amount?

- How much is the allowable deduction that Miko can claim from these contributions?

- Calculate the tax payable on the concessional contribution.

- How much is the superannuation's assessable income based only on the given information?

The unused cap amount of Miko amounts to $8,000 ($25,000 - $17,000). $17,000

$2,550 ($17,000 × 15%)

$17,000

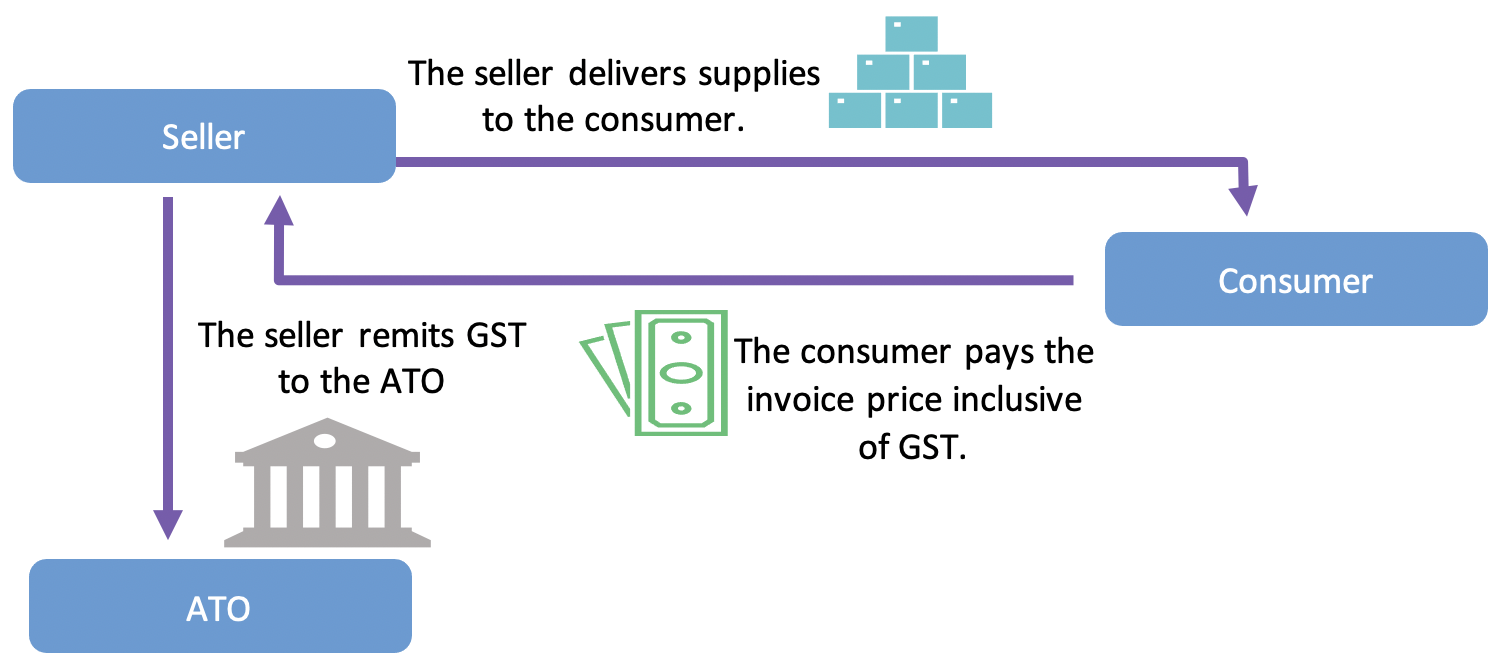

GST is a tax imposed upon the goods and services offered by a business. The consumer ultimately bears the final burden of GST. It is based on a New Tax System (Goods and Services Tax) Act 1999.

Currently, the GST rate for goods and services is at 10%. The seller is the one to charge and collect GST for taxable supplies.

GST Turnover

Calculating the GST turnover of your client is crucial in determining whether your client must register for GST or not. GST turnover refers to both the following:

- Current GST turnover

The turnover for this month + turnover for the past 11 months - Projected GST turnover

Turnover for this month + turnover for the following 11 months

GST turnover is gross income excluding the following:

- GST included in the sales

- Input-taxed sales

- Sales that are not made for consideration

- Sales not connected with the business

- Sales not connected with Australia

GST is only payable on taxable supplies. You only consider taxable supplies in your calculation of gross income for GST turnover calculation purposes. A supply may only be regarded as a taxable supply when the following conditions are met (s.9-5):

- The supply is made in exchange for a consideration

- The supply is in the course of carrying on business

- The supply relates to the indirect tax zone. The indirect tax zone means Australia, excluding external territories and certain offshore areas. Supply relates to the indirect tax zone when either of the following conditions is met:

- The supply was delivered or made available within the indirect tax zone

- The supply was exported from or imported to within the indirect tax zone

- The business that produces the supply is required to be registered with GST

- The supply is neither GST-free nor input-taxed

GST Exemptions

The exemptions from charging GST include the following:

- Input-taxed sales

These include the sale of certain types of products that are not subject to GST, although GST was included in the price of the inputs. If your client makes an input-taxed sale, they are not entitled to the credit for GST in the price of their input. Input here refers to the goods or services that they used to make the goods or services they sold. Input-taxed sales or supplies are set out in Div 40 (sec 9-5) and may include the following:- Financial sales or supplies, e.g. loans

- Supply of residential premises for rentals or sale

- Certain fundraising activities of charities

- GST-free supplies

These are products or services that are also not subject to GST. However, the input-taxed credits related to these supplies are claimable. Part 3-1 Division 38 of the Act sets out what supplies are considered GST-free. Examples of these include the following:- Education

- Vehicles for the disabled

- Religious services

- Supplies outside the GST system

GST does not apply to supplies made before 1 July 2000. Nor does it apply to supplies made by unregistered entities or transactions without connection with Australia. It also doesn’t apply to gifts.

After calculating your client’s GST turnover, you can determine if your client must register for GST by checking if your client’s GST turnover reached the threshold or went beyond it. The business should register for GST if the current or projected GST turnovers reach or go beyond the threshold.

GST Net Amount

When determining whether your client has a GST liability or a tax refund, you must calculate the net amount for the tax period. The formula for the net amount is as follows:

Net amount=Amount of GST-Input tax credit

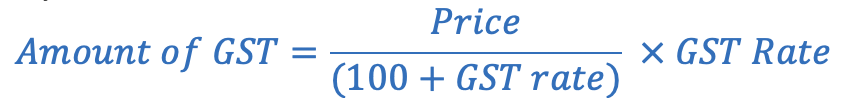

The manner of calculating the amount of GST depends on whether the amount of the taxable supply or importation is inclusive of GST or not.

- The value of the taxable supply is exclusive of GST if it is only the value that is readily available. The formula for the amount of GST is as follows:

Amount of GST=Value ×GST Rate

- The price of the taxable supply is already inclusive of GST if it is only the price that is readily given. First, you will determine the value and then the amount of GST as shown below:

Value=Price ÷(100+GST Rate)

Amount of GST=Value ×GST Rate

Alternatively, you may calculate the amount of GST as follows:

As the current GST rate is 10%, the amount of GST works out to price divided by 11. Suppose your client made a taxable supply to an associate for a price less than the market price. In that case, the amount of GST is calculated based on the market price of the supply.

Learning Exercise

Amount of GST

Agamus Pty Ltd is engaged in retailing art supplies. During the tax period, the company sold acrylic paints for $110,000.

Required:

Calculate the amount of GST charged in this sale transaction?

Input Tax Credit

Input tax credits may only be claimed from the following (s.7-1):

- Creditable acquisition

You make a creditable acquisition when (s.11-5): The terms acquisition and creditable purpose are defined in s.11-10 and s.11-15 of the Act, respectively.- The acquisition is solely or partly for a creditable purpose

- The supply acquired is a taxable supply

- The acquisition is for a consideration

- Your client who is claiming an input tax credit is GST-registered or at least required to be registered

- Creditable importation

You make a creditable importation if (s.15-5):- The importation is solely or partly for a creditable purpose

- The importation is a taxable importation

- Your client who is claiming an input tax credit is GST-registered or at least required to be registered

The amount of input tax credit equals the GST charged on the supply acquired or imported. However, this amount shall be accordingly reduced if the related acquisition or importation is only partly creditable (s.11–25).

The amount of Input tax credit is calculated as shown below:

- Fully creditable

- The amount of GST

- Partly creditable – Acquisition

- Full input tax credit × extent of creditable purpose × extent of consideration

- Partly creditable – Importation

- Full input tax credit × extent of creditable purpose

The full input tax credit is the amount of GST charged on the supply assuming the acquisition or importation is solely for a creditable purpose.

The extent of creditable purpose represents how much of the purchase is creditable. This means used for business. The extent of consideration represents how much of the consideration was paid in relation to the purchase with an attributable full input tax credit. The conditions giving rise to partly creditable acquisitions and importations are provided in Sections 11–30 and 15–25 of the Act, respectively.

Learning Exercise

Input Tax Credit

Agamus Pty Ltd is engaged in retailing art supplies. During the tax period, the company purchased 10,000 paint brushes for $22,000. Nine thousand of these brushes will form part of the business’s inventory, and the remaining will be used for private purposes.

Required:

Calculate the input tax credit the company can claim for this transaction (if any)?

| Full input tax credit | $22,000 ÷ 11= $2,000 |

| × Extent of creditable purpose | 9000 ÷ 10,000= 90% |

| × Extent of consideration | 100% |

| Input Tax Credit | $1,800 |

Some non-deductible expenses identified under ITAA97 will not give rise to a creditable acquisition or a creditable importation. Hence, there will be no input tax credit claimable from these expenses. These non-deductible expenses are enumerated below (s. 69-5):

- Penalties

- Relative’s travel expenses

- Family maintenance expenses

- Recreational club expenses

- Leisure facility expenses

- Entertainment expenses

- Non-compulsory uniforms

- Agreements for the provision of non‑deductible non‑cash business benefits

Input tax credits on meal entertainment and entertainment facilities may only be claimable to the extent of their amounts subject to fringe benefits tax. The creditable portion for this matter depends upon the elections made by your client under fringe benefits tax law.

GST Period

You have an option to report your client’s GST liability every quarter if (s.27-5):

- Your client has a GST turnover of less than $20,000,000

- The ATO did not specifically require your client to do monthly reporting

You will have to calculate your client’s GST liability every month if (s. 27-15):

- Your client voluntarily elects to do monthly reporting

- Your client has a GST turnover of $20,000,000 or more

- The ATO explicitly requires your client to do monthly reporting probably for reasons such as the following:

- History of failing to comply with tax obligations

- Carrying on business in the indirect tax zone for only less than three months

You may calculate your client’s GST liability only every year if:

- Your client only volunteered to be registered for GST

To correctly work out your client’s GST liability, you must know how to attribute each GST transaction to correct tax periods. This concept is called attribution. Most taxable supplies are attributed based on the taxpayer's accounting method. The accounting method can either be a cash basis or accrual basis.

Cash basis

Your client may employ this method if one of the following conditions is satisfied (s. 29-4):

- Your client is classified as a small business entity (SBE) under income tax legislation

- Your client’s annual turnover is below $10 million

- Your client is eligible to employ cash basis of accounting method under income tax legislation

- The commissioner expressed in writing that your client may employ cash basis for GST accounting

Special rules on the use of cash basis for GST accounting may be found in Divisions 157 and 158 of the Act.

| Accounting for GST Using the Cash Basis | |

|---|---|

| When will the amount of GST charged on the taxable supply sold be attributed? | When will the input tax credit be attributed? |

|

|

Accrual basis

Large businesses commonly employ an accrual basis of GST accounting. Your client may use the accrual basis of GST accounting if ATO does not provide otherwise.

| Accounting for GST Using the Accrual Basis | |

|---|---|

| When will the amount of GST charged on the taxable supply sold be attributed? | When will the input tax credit be attributed? |

| The charged GST may be accounted for immediately on the period when the invoice for the related taxable supply was issued or on the period when the consideration was received (whichever comes first). | On the tax period when the invoice for the related taxable supply was issued or on the period when the consideration was paid (whichever comes first) |

Aside from the rules mentioned above, you may only attribute input tax credits if:

- A tax invoice has already been received

- A tax invoice is not required to be issued for the related creditable acquisition or importation

The cash and accrual method of GST attribution may be modified by:

- Specific provisions in the Act (see s.29-39)

- The Commissioner’s determination (s.29-25)

The Commissioner may only determine attribution rules that are not in conflict with the general rules and special rules already set out in the Act (s. 29-5).

Learning Exercise

GST Attribution

JKL Pty Ltd operates a retail business in Melbourne. The following transactions occurred in the December 2020 quarter:

| Cash sales | $66,000 |

| Credit sales | $110,000 |

| Collection from credit sales | $99,000 |

| Cash purchases | $55,000 |

| Credit purchases | $66,000 |

| Settlement of credit purchases | $22,000 |

| Wages paid to employees | $25,000 |

| Interest received | $620 |

| Interest paid | $380 |

Required:

- Compute the net amount using the cash basis.

- Compute the net amount using the accrual basis.

| Wages paid to employees | $25,000 | These items are not taxable supplies. Therefore, they have to be ignored in both methods. |

| Interest received | $620 | |

| Interest paid | $380 |

| Cash Basis | |

|---|---|

| Cash sales | $6,000 |

| Collection from credit sales | $9,000 |

| Amount of GST | $15,000 |

| Cash purchases | $5,000 |

| Settlement of credit purchases | $2,000 |

| Input tax credits | $7,000 |

| Net GST Amount | $8,000 |

| Accrual basis | |

|---|---|

| Cash sales | $6,000 |

| Credit sales | $10,000 |

| Amount of GST | $16,000 |

| Cash purchases | $5,000 |

| Credit purchases | $6,000 |

| Input tax credits | $11,000 |

| Net GST Amount | $5,000 |

Adjustments to Net Amount

The net amount for a specific tax period may either be increased or decreased (s.17-5):

- Under Subdivision 21‑A of the Wine Tax Act

- Under Subdivision 13‑A of the Luxury Car Tax Act 1999

- By any adjustments you may have during the tax period. These adjustments normally arise from what are called adjustment events.

The provisions relating to adjustment events are in Division 19 and Division 21 of the Act.

Learning Exercise

Adjustments

ABC Pty Ltd sold some furniture to XYZ company worth $2,200 (inclusive of GST). XYZ paid the amount in the same tax period and claimed an input tax credit of $200. Five months later, ABC’s accountant noticed that the price charged on the furniture sold to XYZ was overstated by $220. Consequently, ABC paid XYZ a refund of $220.

Required:

- What adjustments should be made by ABC?

- What adjustments should be made by XYZ?

Decreasing adjustment of $20 ($220 ÷ 11)

Increasing adjustment of $20 ($220 ÷ 11)

Some adjustments will require the issuance of an ‘adjustment note’. Adjustment notes are issued by suppliers to a business entity when the consideration amounts for taxable supplies change. The entity requires this documentation to claim more or less GST that was originally claimed.

One of the critical aspects of your role as a registered tax agent is filling out tax returns for your clients. When preparing tax documentation for your clients, you should ensure that you comply with all legal and organisational recording and reporting requirements. Identifying and establishing these requirements based on your client’s circumstances and the legal entity was discussed earlier in the module. The next section will discuss the legislative, regulatory and organisational requirements.

Tax returns must be in an approved form and should contain complete and reliable information. ATO publishes procedural instructions on how each part of different tax returns should be completed. This is to help taxpayers complete these tax returns and comply with other related lodgements. The instructions are classified based on the type of return and for which income year the instruction is applicable. You must ensure that you follow these instructions to avoid compliance issues.

Given below are some of the forms and related instructions published by the ATO:

These are only representative forms and instructions. You must access the forms relevant to the tax obligations that you had previously identified.

Below are guidelines you may follow when you prepare your client’s tax documentation:

- Access the latest form available on the ATO website.

- Ensure you have accessed the correct form applicable to the kind of tax documentation you are preparing and your client’s legal entity.

- Refer to all the recording and reporting requirements that you had established earlier based on your client’s circumstances.

- Read the latest instructions published by the authorities when completing the form.

- Seek clarifications from the client, ATO or specialists as required in case of need.

- Check and cross-check your computations and transcriptions.

- Prepare the tax documentation within established timeframes.

- Retain your tax working papers for use in case of a tax audit, query or dispute.

Legislative, ATO and Organisational Requirements

Parliament passes legislation in the form of the Act. This Act is the law that lays out the legal and policy principles about a subject, e.g. taxation. It describes the requirements and includes punishments and penalties for not adhering to the law. Legislation drives regulations. Regulations define and control how the regulatory authority, in this case, the Australian Taxation Office (ATO), operates to implement the law.

Organisational policies and procedures are the requirements applicable within the organisational framework. Organisational requirements include the accounting process, values, ethics, control, and responsibilities. These organisational policies, procedures and processes or practices provide protocols and guidelines for conducting a particular activity within the organisation and when dealing with stakeholders. Policies and procedures are crafted based on the organisation's objectives, purpose and mission and the external environment in which it operates. External factors, such as legislation, statutory requirements and competition, are considered when framing them.

The graphic below briefly explains these organisational requirements:

- Policies

- These cover broad principles and set a directional tone within which an organisation or department must operate to meet business objectives.

- Procedures

- These elaborate the policies into routine functions and job activities which need to be performed to meet the policy requirements.

- Practices

- These are the processes contained within procedures and provide explanations on how to perform functions and detail standard functions, key control elements which need monitoring and reporting.

In simple terms, policies and procedures tell what the organisation or activity of a department aims to achieve and detail the steps to go about it. Practices are the series of actions or processes used in the organisation.

Apart from elaborating on what and how objectives are to be achieved, organisational policies and procedures cover mandatory regulatory requirements applicable to the organisation. They generally set more stringent norms to ensure strict compliance with regulatory parameters while achieving business objectives.

Business entities must incorporate the legislative and regulatory requirements in their policies and procedures to ensure compliance with the requirements of the law. The policies and procedures of the organisation will detail how to comply with these taxation recording and reporting requirements. These policies and procedures should be updated regularly to remain current.

The table below outlines some organisational policies and procedures and their key features applicable to preparing taxation documentation for legal entities:

| Requirement | Key Features | |

|---|---|---|

| Policy | Organisational policy for collecting information for the preparation of tax documents |

This policy may outline the following:

|

| Procedures | Procedure for computing tax obligation |

This procedure may include the following:

|

| Procedure for verifying financial data |

This procedure may include the following:

|

You covered the tax recording and reporting requirements in Topic 1. Some additional regulatory requirements have also been discussed in Topic 2, too. When preparing the tax documentation for your client review and sign-off, you must keep these requirements in mind. Some of the broad requirements are summarised below for the following types of taxes and reporting:

- Income tax

The financial year in Australia is from 1 July to 30 June. All business entities need to lodge their income tax return for this period. Companies need to file their tax return and pay their tax. While trusts and partnerships need to file their tax returns, the income is taxable in the hands of the beneficiaries/trustees and partners. Sole traders can declare their business income along with their personal tax returns. - Payroll reporting

All businesses that employ staff need to report the details of the payments, including salaries, superannuation and PAYG withholding, to the regulators. This reporting must be done through the Single Touch Payroll (STP) software. This was commenced on 1 July 2018, initially for employers with 20 or more employees. From 1 July 2018, it became mandatory for all businesses, including those employing less than 20 employees. A critical point to remember is that payroll tax is not paid to the ATO but to the state revenue offices. - Goods and services tax

The main reporting requirement relating to the GST for a legal entity is the lodgement of a business activity statement (BAS). This form is lodged by registered businesses to ATO to report details on GST. It is also used to report details on other tax obligations such as PAYG and FBT instalments, luxury car and wine equalisation and fuel tax credits.