Welcome to FNS50222 Diploma of Accounting

Becoming an Accountant requires a unique skill set designed to manage and evaluate financial transactions as well as to help maximise the financial position of businesses. How do you acquire the skill set? Through the Diploma of Accounting!

The Diploma of Accounting is the perfect course where you can study online, at your own pace, on your own time, and from anywhere you want.

This course will cover all the bases required to equip you with the skills to effectively manage, prepare and evaluate financial documents, analyse business data and apply strategies to maximise efficiency in all practices.

Registration as a Tax Agent

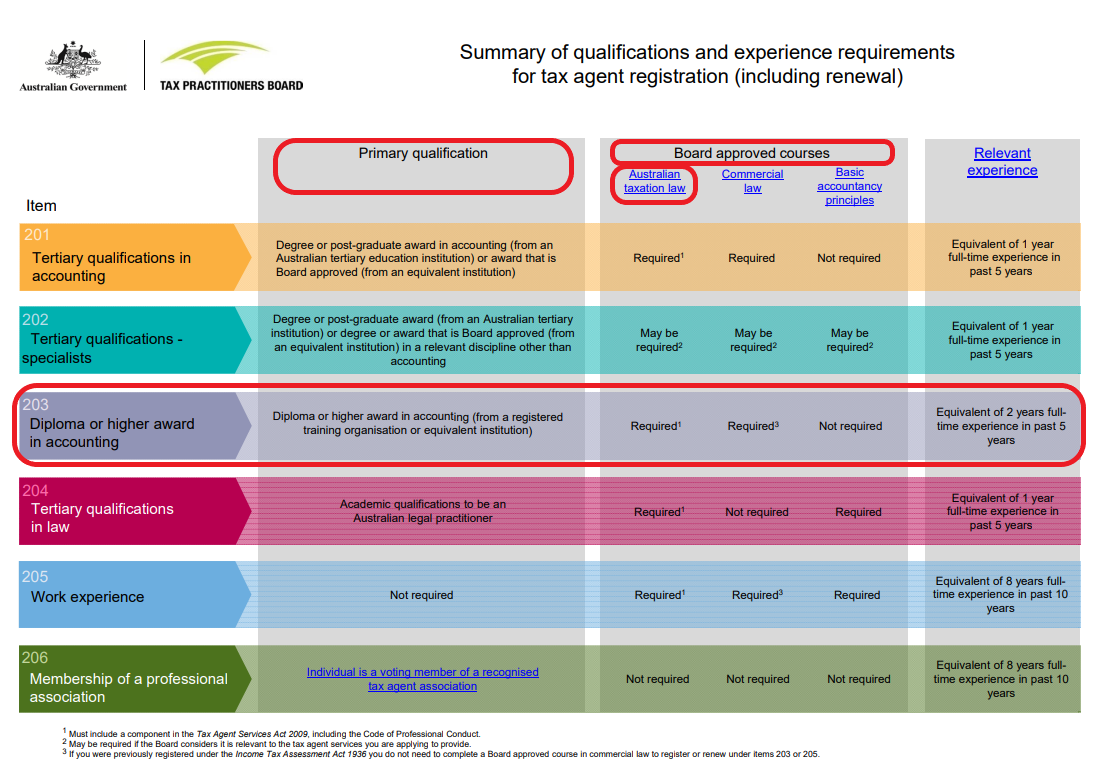

To become a registered tax agent, you must meet the requirements as set out by the Tax Agent Services Regulations and register with the Tax Practitioners Board (TPB).

This Diploma of Accounting meets the Primary qualification requirements and includes the following two modules that together meet the Tax Practitioner Board (TPB), board approved course in Australian taxation law:

• FNSACC522 – Prepare tax documentation for individuals

• FNSACC601 - Prepare and administer tax documents for legal entities.

To become a registered tax agent, you must also complete three additional commercial law units and demonstrate the equivalent of 2 years of full-time experience.

Persons seeking registration with the TPB should check current registration requirements with the TPB, as registration requirements are reviewed regularly and may change.