In this topic on managing and implementing operations plans, we will consider operational plan requirements.

This topic will cover how to explain the key indicators of organisational performance, and the approach for developing key performance indicators to meet business objectives.

You will also explore how to create an understanding of how budgeting works and cover methods for preparing operational plans and the records associated.

By the end of this topic, you will understand:

- Why monitoring and evaluating operational plans is crucial for ongoing success

- The meaning and purpose of a KPI, and how to develop them for the evaluation of plans

- How to identify resources required for specific tasks and how to plan for them in operational planning

- The importance of budgeting for operational planning.

Monitoring your operational plan for success

A key step in any planning process is to monitor and evaluate progress.

Just as you check the signs along a highway when taking a road trip, it is just as important to ensure that development is on the right track.

Before completing your plan, you need to agree on how and when it will be monitored and reviewed, plus what information everyone needs to receive to review progress.

The performance of machinery, services and employees should be documented and updated by managers. The information recorded pertaining to the performance of machinery and services should be made available to anyone within the organisation who would benefit from such information. This includes other departments who you are in contact with or departments who are searching for ideas.

The performance of employees is documented by managers and by the Human Resources department, if the company has one. Employee records are highly confidential and should be kept under lock and key, usually by Human Resources. The privacy law should be taken into account when storing information about individuals.

Documentation offers a history of the employee's improvement or failure to improve performance over time. It is a chronological and precise description of the employee's actions, the manager's actions, and events as they occur. Employees’ performance is usually assessed during performance review meetings when managers evaluate an employee’s accomplishments along with a data-based assessment of their strengths, weaknesses and areas for improvement. Performance evaluation is completed against performance requirements set based on an employee’s job description.

Identifying performance requirements

To identify performance requirements, you must ask yourself:

- How does an organisation know if the tasks that are being carried out according to the operational plan are accomplishing strategic goals?

Let’s start by discussing the importance of setting goals in an organisation:

Step 1: Goals

- It is crucial to have a goal; this provides you with something to work towards.

- To achieve goals, they should be broken down into steps that are achievable and offer guidance towards your end goal.

Step 2: Distribution of goals

- In an organisation, end goals and visions are agreed upon. These give staff a focus and motivation.

- When the goals are broken down and shared with specific departments, teams and then individuals, this offers a clear plan to staff.

- Achieving these goals will lead to achieving the company’s overall vision.

Step 3: Track and monitor goals

- One method to ensure that individuals are working towards the organisational goals is to check, monitor, constantly assess and update their tasks or responsibilities.

- The typical way to do this was for the managing director to lay out their expectations of each department and allow those expectations to trickle down to the lower levels.

- However, the flow of expectations and goals in this method is one-way, meaning high-level company goals are left open to interpretation by individual managers, creating too much risk of getting off track or misinterpretations to happen.

Step 4: Key performance indicators (KPIs)

- You can guarantee that operational plans fit with the company’s performance by ensuring everyone understands the direction they are going in and what they are aiming for.

- That is why many organisations set up Key Performance Indicators (KPIs) for their employees.

- KPIs are measurable data devised within operational plans.

We’ve got to use every piece of data and piece of information, and hopefully, that will help us be accurate with our player evaluation. For us, that’s our lifeblood.Billy Beane

Key performance indicators

Key performance indicators (KPIs) are the elements of your plan that express what you want to achieve and by when. They are the quantifiable, outcome-based statements you will use to measure whether or not you are on track to meet your goals or objectives.

Good plans use five to seven KPIs to manage and track the progress of their plan. They are an excellent measure of the contribution of a team or an individual to the organisation.

The purpose of a key performance indicator

KPIs offer an objective performance measure in a key task. This allows organisations to set and share their performance targets and assess whether they are being fulfilled.

Areas of improvement are identified and emphasised, therefore allowing for adjustments to be put in place that lead to measurable performance improvements.

Note

KPIs will vary according to the nature and objective of the organisation.

They will also vary in terms of the purpose, values and culture of the organisation.

It is crucial to be careful when choosing the KPIs of your team or organisation and make sure that they align with the business.

What could you use to create a KPI?

You should measure your performance against key business objectives; you can use these objectives to help create KPIs for individuals and across teams.

KPIs will be specific to different organisations and ultimately, will be connected to the core goals that business wants to achieve: from customer satisfaction to sales to quality administration.

The following are some examples of what you could potentially measure a KPI against:

- Customer satisfaction

- Sales

- Quality

- Unanswered calls

- Speed

- Delivery time

How to develop a KPI

In order to develop effective KPIs, you need to consider how they might relate to specific business objectives or desired outcomes. They need to be adapted to your business’s current situation and developed with the achievement of the organisation’s goals in mind.

There are different approaches to develop KPIs:

Resource

The following articles explain the different types of KPIs and how to write these effectively:

Writing a clear objective for your KPI is one of the most important—if not the most important—part of developing KPIs.

Other things you need to consider include:

- Making sure the KPI is actionable

- How you will share your KPI with stakeholders

- Creating a plan to review the KPI on a weekly or monthly basis

- Evolving your KPI to fit the changing needs of the business

Watch

Watch the following almost 7-minute video to learn more about developing effective KPIs:

KPIs should be S.M.A.R.T.

S.M.A.R.T. goal setting provides the goals and objectives you identify with structure, and allows for accountability through measurement of progress.

This type of goal setting enables you to take a vague, usually conceptual objective, and make it a tangible, achievable objective, with clear milestones and prospective timelines to satisfy the goal.

Each goal and objective, from the beginning of the process, should be thought through and planned in the S.M.A.R.T. format, to not only make it more realistic, but easier to grasp.

- Specific: specific to an objective

- Measurable: able to be measured somehow

- Achievable: realistic to the objective and resources available

- Relevant: reflects the goals of the organisation

- Time-related: sets when it must be achieved by

Check your understanding

How to identify resources for resource planning

An operations plan is meant to define how human, financial and physical resources will be allocated to achieve short-term goals that support your larger strategic objectives.

To develop an effective plan, you need to have a solid idea of what resources exactly you will need and how to structure your plan around these.

Identifying resources is a crucial step in creating a successful plan.

In this section, we will cover identifying resources and resource planning.

Four (4) types of resources to plan for

Think back to the tasks outlined in the Gantt Chart in Topic 1. Each task will require a specific set of resources and you will need to plan for all of these within an operational plan.

This may seem overwhelming, but there are effective ways to organise resources so that they align with your long-term objectives and aid a smooth delivery of the tasks within your plan.

- Labour (Employees and/or contractors)

- Equipment/Technology (Computers, software, tools and machinery)

- Materials (Stationery and consumables)

- Overheads (Gas, electricity, water, lease, rent and additional funding)

Resource planning

Resource planning is key to utilising an organisation’s time and people in the most effective manner. It is a systematic process defining how an organisation can get the most out of its resources.

By using skills in project management and timeliness, you will need to develop and maintain synergy and efficiency between projects, tasks, budgets, time, and departments or project teams.

Needless to say, it can be a tricky balancing act and you need to be careful when conducting the resource planning process. Taking care during the process can mean the difference between a successful operational plan, or a disastrously ineffective plan.

Watch

Watch the following 4-minute video to learn more about resource planning:

Check your understanding

True or False:

If resources aren’t planned effectively, it can result in overworked employees and projects not finishing by deadlines.

True.

If resources are not planned effectively, it can lead to overworked employees and projects not finishing by deadlines for several reasons, such as: workload imbalance, lack of skill alignment, resource scarcity, inefficient task sequencing, unrealistic deadlines, employee burnout.

Real leaders focus resources in areas that provide the greatest opportunity rather than making across-the-board decisions.Frank Sonnenberg

Managing risk within business planning

Within an operational plan, you will need to plan for risk. This could be in the form of a Contingency Plan.

A contingency plan is a plan devised for an outcome other than the usual (expected) plan. It is often used for risk management for an exceptional risk that, though unlikely, would have catastrophic consequences.

Contingency plans are often devised by governments or businesses.

In this section, we will be looking at risk management and contingency planning.

By the end, you will be able to:

- Outline why risk management is important in the framework of operational planning

- Explain what a contingency plan is and how to develop one

- Describe the risk management considerations for both operational and strategic planning.

Understanding risk management in planning

Risk is simply unavoidable in undertaking a project, whether large or small. How risk is managed can reduce the chance of serious issues.

A business risk management plan involves identifying, assessing and developing strategies to manage risks and monitor business performance. It’s an essential part of any business plan and will help you prepare for, and deal with risk factors that threaten your business’s future performance and viability. These risks can be quite diverse and can be anything that interrupts time-sensitive or critical business processes and operations. Your business should have a risk management framework in your business plan with preventative, investigative and remedial controls to mitigate these risks.

Example

An IT solutions company has developed an operational plan that involves hiring highly skilled engineers, but the company seems unable to hire the right people or lose existing engineers to higher-paying jobs.

'What potential risk is occurring here?'

This could be considered a resource risk.

'Who is responsible for managing risk?'

In this case, the human resources team is responsible for managing risk.

It is important to understand that there is a difference between strategic and operational risk management.

Watch

The following 3-minute video explains the difference between strategic and operational risk management:

There are risks and costs to action. But they are far less than the long-range risks of comfortable inaction.John F. Kennedy

The 11 standards of risk management

To create a business risk plan, organisations should understand and incorporate the principles behind the Australian Standard for risk into the business or project risk management plan. The Australian Standard ISO 31000:2018 defines risk as “the effect of uncertainty on objectives”.

Here are 11 principles to consider for a business risk management plan:

- It creates and protects value for the organisation.

- It is integral to the organisation’s processes.

- It is included in decision-making.

- It explicitly addresses uncertainty.

- It is systematic, timely and well thought out.

- It is based on the best available information.

- It is tailored to suit the organisation’s needs and goals.

- It takes human and cultural factors into account.

- It is clear and inclusive.

- It is dynamic. Ongoing and responsive to change.

- It encourages continuous improvement.

You can read more about best practice principles for undertaking risk management by clicking here.

Note

A business risk management plan involves identifying, assessing and developing strategies to manage risks and monitor business performance.

Contingency plans

Part of the risk management process is having alternatives when something goes wrong. These are called contingency plans.

Contingency planning focuses on the what if, of a situation that involves a level of risk the planner is unwilling to ignore. Having contingency plans ensures your preparedness for potential issues with well-considered and concise action steps if things go awry.

There are some effective contingency planning methods for strategic plans:

| Scenario analysis | Scenario analysis is a method that involves creating and exploring different possible futures based on various factors and assumptions. It helps you to anticipate and evaluate the implications of different situations and how they could affect your strategic plans. You can use scenario analysis to identify the best- and worst-case scenarios, as well as the most likely and desirable ones. You can also use it to test the robustness and flexibility of your plans and to identify opportunities and threats. |

| SWOT analysis | SWOT analysis is a method that involves identifying and analysing your strengths, weaknesses, opportunities, and threats. It helps you assess your internal and external environment and align your strategic plans with your resources and capabilities. You can use SWOT analysis to identify the factors that could enhance or hinder your performance, as well as the gaps and risks that need to be addressed. You can also use it to prioritise your actions and to leverage your competitive advantage. |

| PESTLE analysis | PESTLE analysis is a method that involves examining the political, economic, social, technological, legal, and environmental factors that could affect your strategic plans. It helps you to understand the macro-level context and trends that could influence your opportunities and challenges. You can use PESTLE analysis to identify the drivers and barriers of change, as well as the potential scenarios and impacts. You can also use it to adapt your plans to the changing conditions and to mitigate the risks. Click on this link to read a real-life case study in which PepsiCo, a beverage giant carried out the PESTLE analysis over its brands. |

| Pre-mortem analysis | Pre-mortem analysis is a method that involves imagining that your strategic plans have failed and working backwards to identify the causes and signs of failure. It helps you to overcome optimism bias and to anticipate the worst possible outcomes. You can use pre-mortem analysis to uncover the hidden assumptions, flaws, and vulnerabilities in your plans and to generate solutions and preventive measures. You can also use it to improve your decision-making and to increase your resilience. Click on this link to read more about post-mortem analysis. |

| Contingency matrix | Contingency matrix is a method that involves mapping out the possible events, their probability and impact, and your corresponding actions and resources. It helps you to organize and prioritize your contingency plans and to allocate your time and budget accordingly. You can use a contingency matrix to visualise and compare the different scenarios and their consequences and to assign roles and responsibilities. You can also use it to monitor and update your contingency plans and to communicate them effectively. Click here for an example contingency matrix. |

Example

A common contingency plan is an emergency drill, which follows the scenario-based approach. One example of an emergency drill is a fire drill.

Most buildings complete fire drills several times a year. This is a type of contingency plan, aimed at ensuring that if an unexpected event happens, people understand what to do and risk is minimised.

Watch

Watch the following 9-minute video to learn more about contingency planning:

Check your understanding

Creating budgets within operational planning

Budgets are used to develop plans for future growth and expansion.

Operational planning uses the operation budget to strategically map particular goals and objectives with the intent of increased profit.

An operational plan is routinely used to justify operating budget requests.

The importance of budgeting for business

Budgets are a way of planning and controlling. If you receive and spend money, then you need to have a budget.

A budget can take many forms. It might be outlined formally in an Excel spreadsheet, hastily scribbled on the back of a scrap piece of paper or held entirely in your head. Regardless, it is a budget.

Budgeting is part of everyday life

A budget is needed when you see notice an item that you want to buy (a new Smart TV) and check the price against the money that you currently have.

You may have the money already, but you must also consider, for example, that your rent and gas bill is due soon.

This way of planning ahead is known as budgeting.

However, some of us are more successful at budgeting than others; unfortunately, without proper planning, these same problems can translate to the business setting!

Budgets in operational planning

As we have explored, an operational plan is a practical document that outlines the key activities and targets an organisation will undertake during a period of time.

It is often linked to funding agreements as well as being linked overall to the organisation’s strategic plan.

Budgets are usually made for a year at a time. Longer predictions and plans tend to be less accurate.

There are several types of budgets that keep track of various things for different aims.

A budget within an operational plan is usually the numerical plan used for:

- Keeping track of revenue versus expenditure

- New clients and sales versus capital expenditure

- Advertising versus sales

- Directing activities

- Using time efficiently

- Using space efficiently.

Watch

Watch the following 16-minute video to learn more about budgeting, estimating costs and determining budgets:

The best budgets are simple and flexible. If circumstances change (as they do), your budget can flex to give you a clear picture of where you stand at all times.

Every good budget should include seven (7) components. (Click on the components to read more about each.)

The cost of salaries can fall under both fixed and variable costs. For example, your core in-house team is usually associated with fixed costs, while production or manufacturing teams—anything related to the production of goods—are treated as variable costs. Make sure you file your different salary costs in the correct area of your budget.

Cash flow is all money traveling into and out of a business. You have positive cash flow if there is more money coming into your business over a set period of time than going out. This is most easily calculated by subtracting the amount of money available at the beginning of a set period of time and at the end.

Since cash flow is the oxygen of every business, make sure you monitor this weekly, or at least monthly. You could be raking it in and still not have enough money on hand to pay your suppliers.

Profit is what you take home after deducting your expenses from your revenue. Growing profits mean a growing business. Here you’ll plan out how much profit you plan to make based on your projected revenue, expenses, and cost of goods sold. If the difference between revenue and expenses (aka “profit margins”) isn’t where you’d like them to be, you need to rethink your cost of goods sold and consider raising prices.

Or, if you think you can’t squeeze any more profit margin out of your business, consider boosting the Advertising and Promotions line in your budget to increase total sales.

A budget calculator can help you see exactly where you stand when it comes to your business budget planning. It might sound obvious, but getting all the numbers in your budget in one easy-to-read summary is really helpful.

You can read more about business budgets by clicking here.

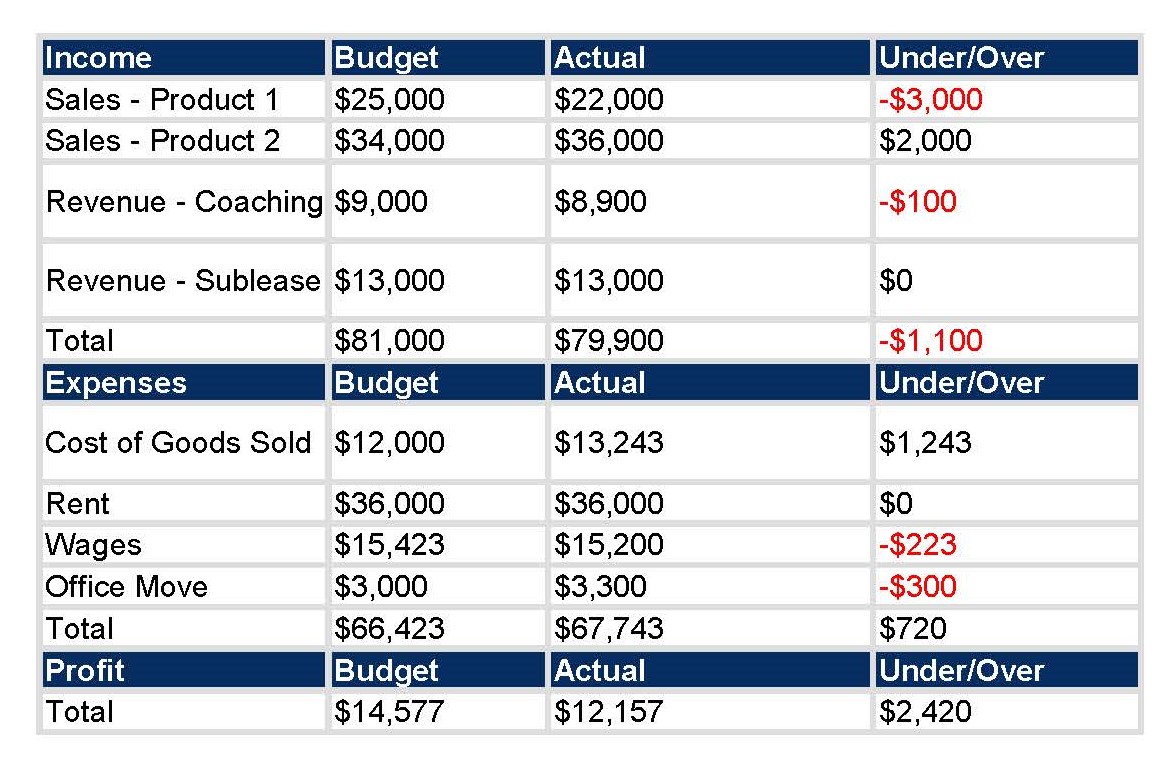

Here is an example of a business budget:

There are different budgeting processes. The following provides an overview of a four-stage budgeting process:

- Preparation - involves determining how much income and expenses are expected based on operational parameters and strategic objectives.

- Consultation and approval - involves consulting with those who will be impacted, and gaining approval from senior management to implement.

- Implement budget - involves implementing the budget.

- Monitoring and adjusting - involves monitoring how the budget is tracking and making changes as necessary to ensure the budget remains on track.

Check your understanding

True or false: Budgets that are made for five years in advance are very accurate.

False.

Budgets made for five years in advance are generally less accurate compared to shorter-term budgets. Several factors contribute to this reduced accuracy, such as uncertainty, market volatility, internal changes, assumptions and estimates, external events, technical advances or competitive landscape.

Next steps in implementing your operational plan

As we’ve covered, an operational plan typically refers to a one-year period. Your strategic plan should be complemented by annual operational plans.

These will often be developed by senior staff members (where there are paid staff) but must be approved by the management committee.

Once you have covered everything you need within your operational plan, the next crucial step is getting approved so you can begin to action it.

In this section, we will take a look at presenting the operational plan and gaining approval from stakeholders.

By the end, you will be able to:

- Explain the next steps in getting an operational plan approved and ready to action

- Describe key methods for effectively presenting an operational plan to stakeholders.

I much prefer the sharpest criticism of a single intelligent man to the thoughtless approval of the masses.Johannes Kepler

Presenting your plan

Once the operational plan is complete and budgeting has been planned, it is time to present the plan to the stakeholders for approval.

Stakeholders do not just look at documents; they must also have confidence in the ability of the people who will run the business to implement those plans. Therefore, assuming that stakeholders may also present the plan to others, a professional, smooth presentation is an essential element of gaining approval for it.

The presentation process could be as follows:

Key considerations when presenting your plan

However well-researched and supported your business plan is, personal credibility and assurance that you can put the plan into action are what investors desire.

A few things you should consider for success include. (Click on each heading to read more about them.)

Conclusion

When finishing up your presentation, you will need to confirm with stakeholders what the next steps will be, and ensure you record details for any follow-up meetings. You must also ensure you have provided all attendees with your contact details and a copy of your plan, and that you have their contact details also so you can follow up as required.

Gaining approval

When it comes to gaining approval:

- The first presentation of the business plan will typically lead to improvement suggestions and additional drafts rather than approval

- Even though you will have taken as much care as possible to cover all angles, stakeholders will very likely have questions in relation to your written operational plan

- If you can make the stakeholders’ jobs of assessing your plan easier, you will gain more support, and in turn gain approval more quickly

- Try to avoid answering questions with too much unnecessary detail, be simple, concise, and only provide relevant information unless asked for further detail

Use the following questions to check your knowledge. You can check the correct answer by clicking on the 'Answer' button:

Q1. What are two things you need to consider when developing a KPI?

- What you want to achieve

- By when you want to achieve it

Q2. True or false: Planning equipment resources is very different from planning human resources.

Q3. What is a budget within an operational plan?

Q4. Why do you need to present your operational plan?

Q5. True or false: Operational plans are presented to stakeholders for approval.