One of the crucial steps in the accounting cycle is to journalise (record) business transactions.

Transactions can be journalised in either a computerised or manual accounting system. A computer system records the transactions in a database, while a manual accounting system uses a series of books to record the transactions. Common computerised accounting systems include MYOB and Xero. The principles in accounting are the same whether you use a computer-based or manual system.

Before you continue, take a moment and write down on a sheet of paper why you think it would be important to record transactions at all. After you have your list, click the (+) on the right side to view the top five reasons.

- So financial reports can be run, which measure the health and performance of a business.

- To keep track of cash flow.

- The records help organise the financial history and activities of the business.

- It's crucial at tax time.

- So the business is prepared in case of an audit.

Did you think of others? if so, good job. They are likely important as well, as these are just the top five.

Throughout the module, we will refer to a fictitious business, North Park Stationery Supplies. We strongly suggest you work through the exercises with us as this will assist your understanding of how you account for fixed assets and depreciation in MYOB.

North Park Stationery Supplies Background Information

Marsha Bing is the sole proprietor of North Park Stationery Supplies, a GST-registered organisation. The company focuses solely on promoting Australian paper and stationery suppliers. They work with Australian vendors that promote sustainable practices. They have three retail outlets that each have an on-site manager. Since its formation, the company has been relatively profitable. Currently, the business uses a manual accounting system managed by an external accounting firm, Alex's Accounting Services, to manage its accounts.

Marsha has decided to install a trial version on MYOB to test its suitability as a computerised accounting system for the business.

During the course, you will be asked to complete activities to practice your knowledge and understanding of the topic. The practice exercises will be completed using MYOB Business™.

To complete the practice exercise you will need to create a business in MYOB for North Park Stationery Supplies.

If you have not done so already activate your MYOB Business Education trial now.

Use the arrows below to get a preview of the screens you will step through while signing up.

- Use the email address you use to access your Swinburne Open Education course, and when asked ‘How would you best describe your role?’ select ‘Student or teacher’.

- Create a new trial for North Park Stationery Supplies by adding your first name, last name, and phone number and setting your password.

- Access your software.

- Sign into MYOB and add:

- Name of the business - North Park Stationery Supplies

- ABN - 26008672179

- Answer yes when asked if the business is registered for GST and click next.

- Use Retail to describe the industry your business is in and use Student or teacher to describe your role.

Chart of Accounts

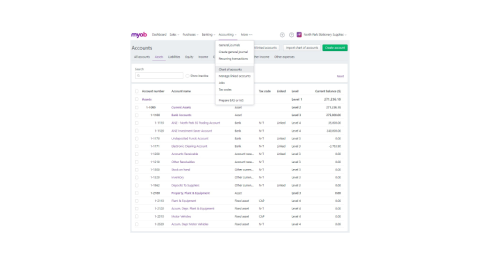

The chart of accounts is a list of every account in the general ledger of an accounting system. Each account is assigned a unique number based on the order it appears in the financial statements. Balance sheet accounts are usually presented first, followed by income statement accounts.

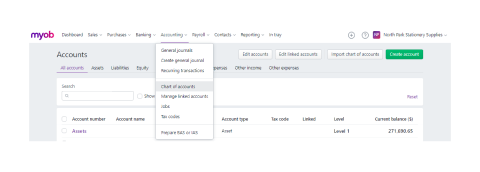

Most accounting software packages like MYOB have a default chart of accounts for different business and industry types. Bookkeepers can set up and customise their account structure to fit their business.

MYOB offers a default Chart of Accounts based on the type of business entered when the system is first set up.

General Ledgers

The general ledger lists all accounts in the accounting system’s chart of accounts. It is sorted by account number and organised into:

- balance sheet accounts

- assets

- liabilities

- owners equity

- income statement accounts

- revenue

- expenses

The general ledger is a "book" with a separate page or ledger sheet for each account in a manual accounting or bookkeeping system. When a significant amount of detailed information is needed for an account such as Accounts Receivable, a subsidiary ledger is often used.

In a computerised system, the general ledger will be an electronic file of all the needed accounts, facilitating the electronic preparation of the company's financial statements.

You may like to learn more about the general ledger's importance and uses at Accounting Coach.

What is a journal?

In accounting and bookkeeping, a journal is the company’s official book in which all transactions are recorded chronologically. A journal is often defined as the book of original entry. The definition was more appropriate when transactions were written in a journal before manually posting them to the accounts in the general or subsidiary ledger. Manual systems have a variety of journals such as a sales journal, purchases journal, cash receipts journal, cash disbursements journal, and a general journal. Double-entry bookkeeping is the method used to record journal entries.

| Date | Folio | Particulars | Debt | Credit |

|---|---|---|---|---|

| 1/05/2022 | 1-1000 | Cash | 30,000.00 | |

| 3-1000 | Capital | 30,000.00 | ||

| Owner contributes cash to the business | ||||

| 1/05/2022 | 6-1350 | Advertising | 2,500.00 | |

| 2-1200 | GST Paid | 250.00 | ||

| 1-1000 | Cash | 2,750.00 | ||

| Monthly advertising cost | ||||

| 1/05/2022 | 1-1000 | Cash | 5,500.00 | |

| 4-1000 | Sales | 5,000.00 | ||

| 2-1100 | GST collected | 500.00 | ||

| Cash sales 01/05/2022 | ||||

| 1/05/2022 | 6-2350 | Telephone | 325.00 | |

| 2-1200 | GST Paid | 32.50 | ||

| 1-1000 | Cash | 357.50 | ||

| Paid monthly mobile phone bill | ||||

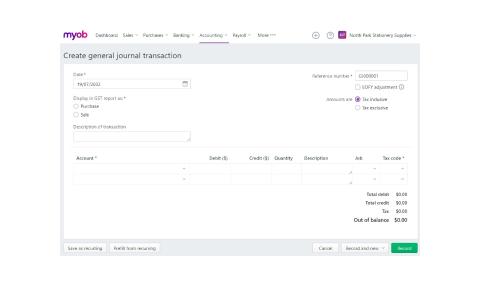

The accountant will enter general journal entries to track activities as your business conducts operations, which is the information that is used to create the General Journal.

This is the entry screen to record transactions and shows their linked accounts. As you can see, the double-entry system of applying credits and debits is used here.

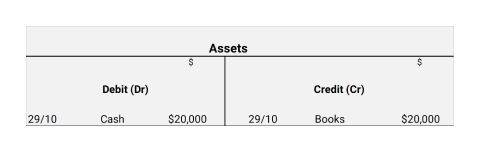

T-accounts

A T-account, also called a ledger account, is an informal term for a set of financial records that uses double-entry bookkeeping. The term describes the visual layout of the bookkeeping entries.

T-account basics

- A large letter T is drawn on a page

- The title of the account is then entered just above the top horizontal line

- Debits are listed underneath the line on the left, which can be denoted with DR and credits are recorded on the right with a CR

- They are separated by the vertical line of the letter T.

Watch this video to learn more about T-accounts and view examples of an entire month of transactions that balance debits and credits using this visual tool. In the next section, we will also review how to draw an account in detail.

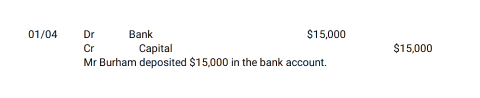

Drawing the T-account

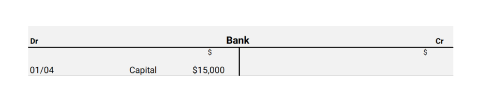

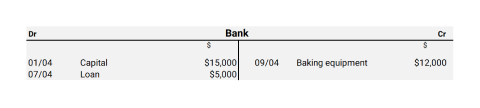

We'll look at transactions relating to the bank account (or cash) of George’s Catering and see how this would be applied in drawing up the bank T-account. The first transaction that involves the bank account occurred on the 1st of April when Mr Burnham invested $15,000 in the business. We would draw the T-account this way:

What happens to the bank account now? It is debited as it increases. Do the same to the T-account for the bank account.

You debit the bank account. (To debit an account means to make an entry on the left-hand side, and to credit an account means to make an entry on the right-hand side.)

Record the date of the transaction also. As a general rule, use the opposite or contra account (in this case, capital) to describe the source of this increase to the bank account. If you were to describe each transaction occurring within the T-account above as "bank", it would not adequately explain why our bank account increased or decreased. Using the opposite or contra(/em> account gives you a better description of the transaction.

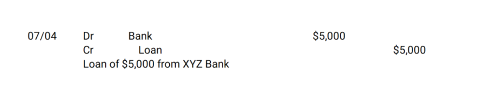

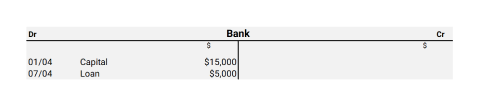

The following transaction relating to the bank account was on the 7th of April.

Let’s insert this in the bank account:

Once again, the journal entry relating to the bank was a debit. So you debit the bank account. The credit was to loan, so this is used to describe what has happened to the bank account above.

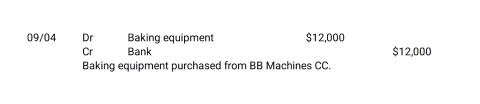

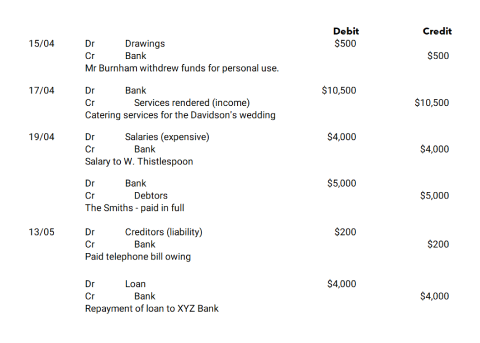

The third transaction was as follows:

This time bank was credited, do the same to the T-account:

This is the same as the previous transaction, just on the opposite side.

Here are the remainder of the journals relating to bank:

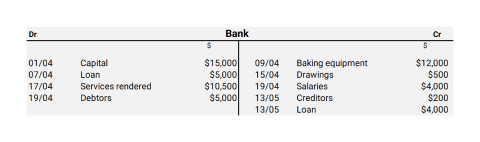

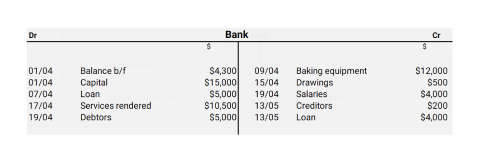

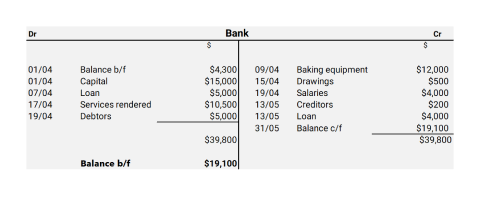

Now you can see what the bank account looks like after all the transactions above:

As previously mentioned, an account is the summary record of all transactions relating to a particular item in a business. A business owner can quickly look over T-accounts like the one above to extract information.

The nature of each transaction could also be quickly determined. For example, if one looked at the transaction on the 17th of April, one could ascertain that on this day, $10,500 was received due to "services rendered" (income was received immediately in cash).

If you examined the "creditors" entry on the 13th of May, you could quickly determine that $200 was paid to creditors. In this case, you could add the word "telephone" in brackets next to "creditors" to make the description even more useful — “the business paid the telephone company for the bill owing”.

Balance

An account’s balance is the item's amount at a particular time.

In a T-account, you show the balance of the item at the start of the period (month or year) and at the end of the period.

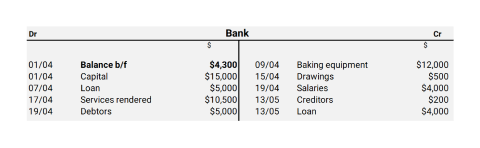

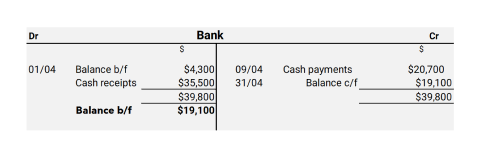

For our examples regarding George's Catering, let’s assume this was not the first period (year) covered. Let’s say George’s Catering had been operating for 3 years before this year, and the bank account had an opening balance (the balance at the beginning of a period) of $4,300.

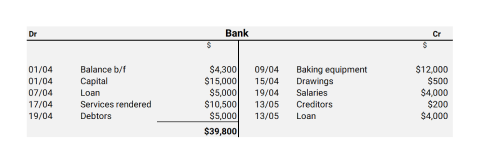

This would be shown as follows:

The "b/f" stands for "brought forward". Sometimes this is written as "b/d", which stands for "brought down".

At the end of the period (month or year), a brief calculation is done to work out the account's closing balance (the balance at the end of a period).

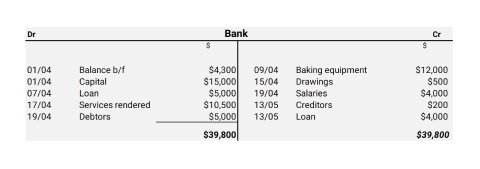

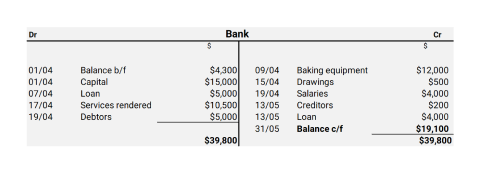

This is done as follows:

- Quickly look over the account to find the side of the account that has the bigger total.

It should be apparent that the debit side is the bigger side.

- Now add up the total of all the individual entries on this side and put it as a total below all the other amounts on this side.

- Put the same total on the other side below all the entries.

- Add up all the individual amounts on the smaller side.

This comes to $20,700 in this example. - Work out the difference between this amount and the total inserted at the bottom.

$39,800 – $20,700 = $19,100 - Put this amount in just above the total and describe it as "Balance c/f" or "Balance c/d", together with the date.

This will ensure that the smaller side also adds up to the total.

- Take this same amount ($19,100) and insert it on the opposite side below the total, and describe this as "Balance b/f" or "Balance b/d".

The "Balance b/f" is the actual closing balance of the bank account (a debit balance). "Balance c/f" is just an entry used in calculating that the closing balance is $19,100 on the debit side. The "Balance b/f" indicates that the debit side is greater than the credit side by $19,100 and that we have $19,100 in our bank account at the end of May (the closing balance of the account).

Indeed, one could merely have taken the total of the debit side ($39,800) and subtracted the total of the credit side ($20,700) from this. We would arrive at the same answer: the bank account has a balance of $19,100 on the debit side.

However, the steps taken above represent the system used in accounting to work out the closing balances and thus should be learned and practised so that one knows what is going on with one’s accounts when one examines them.

So, we have our opening balance (debit) of $4,300 and our closing balance (debit) of $19,100. Once again, this can be determined by a quick examination of the account.

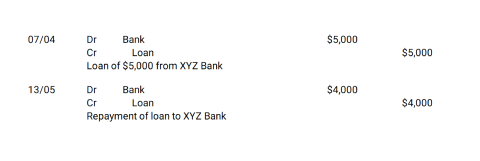

Let’s look at another account – the account "loan". There were two journals involving the loan:

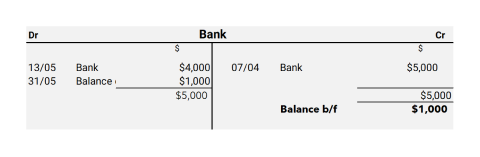

What would the T-account look like?

From this account, you can determine that $5,000 was loaned on the 7th of April (a credit to the loan, meaning more of a liability), then $4,000 was repaid on the 13th of May (a debit, meaning less of the liability), leaving us with an outstanding balance (credit) of $1,000.

You can easily cross-reference between two accounts because the contra account is used as the transaction description. In the "loan" account, "bank" is used as the description for the credit on the 7th of April. If you look in the "bank" account above, "loan" is inserted on the debit side of the T-account on the same date. We thus have an easy cross-reference.

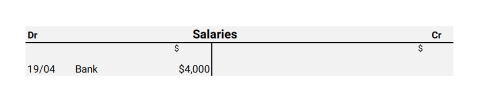

With an account with one entry on one side, do the following to show the closing balance:

Do not make any further entries to work out the closing balance – the $4,000 balance is self-evident from the single entry.

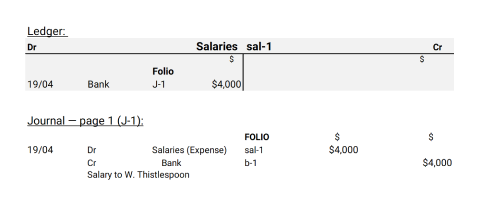

Remember, each account has its own code or number (called a folio number), which would typically be inserted next to the account name. So the final prepared T-account would look like this:

"Sal-1" is the code for the account "salaries" and would also be referred to in the journal entries relating to salaries. "J-1" is the code for "journal page 1". The folio number or code thus helps to trace information from the journal entry to the individual T-accounts or from the ledger (T-accounts) back to the journal entries.

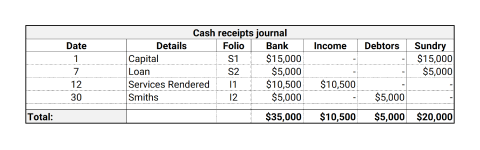

The third step is posting journals to the ledger (T-accounts).

What does this mean? Posting means transferring the information calculated in the journals to the various T-accounts in the ledger.

Let's see exactly how this transfer is done. Look through the journals and T-account below, then read on for the explanation:

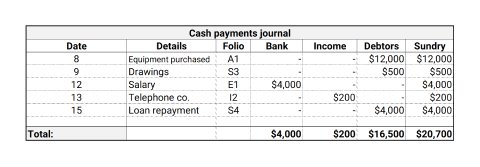

In practice, you would not put each individual transaction concerning bank into the "bank" T-account. Instead, you would simply take the total of cash receipts from the cash receipts journal (column "bank") and insert this on the debit side of the "bank" T-account. You would likewise take the total of cash payments from the cash payments journal (column "bank") and insert this on the credit side of the "bank" T-account.

This is the act of posting the journals to the ledger.

In conclusion, the T-account shows the opening and closing balances and the individual transactions during the period covered. The T-account is a summary record of everything that occurred with a specific accounting item during a certain period of time.

Beyond T-accounts: Journal Entries

James describes journal entries in this video, comparing them to T-accounts.

The main difference is that the General ledger is organised by account, and the general journal is a record of transactions.

Key differences:

- General ledgers can also be called T-accounts

- General ledgers track the business’s primary concerns:

- assets

- liabilities

- owner’s capital

- revenues

- expenses.

- The general journal is used to record low-volume transactions

- The general journal is a list of journal entries made over a specific period

Transactions are first entered into a journal before they are posted to the appropriate general ledger accounts. Then, the balances are transferred from the ledgers to a trial balance before appearing in the financial statements.

Let's return to James for an overview of the General Leger and posting journal entries to it

We will provide additional details about Journals and the General Ledger in Topic 12.6: Prepare final general ledger accounts.

Accountants also create special journals, which include transactions that general journal entry doesn't cover. They are used for repetitive journal entries that might overwhelm the general ledger. Periodically, the total amounts in special journals are transferred to the general ledger in summary form.

Special Journal Entries

- cash payments

- cash receipts

- payroll disbursements

- sales

- purchases

- sales returns

- purchase returns

General Journal Entries

- purchase of non-current assets

- prepayments

- Owner contributions (non-cash)

- Asset depreciation

- debt

- correction of errors

- closing entries

Subsidiary ledgers are created for some journals. The most common examples are:

- The Accounts Receivable Subsidiary Ledger

- The Accounts Payable Subsidiary Ledger

Essentially these two sub-ledgers will contain accounts for each of your accounts receivable and accounts payable. These will record individual transactions for your Accounts Receivable and Payable, which are then summarised and entered into the General Ledger. Let’s now look at an example of how this would work.

Let’s examine a small business with three main accounts receivable accounts; we will call these J Anderson, M Smith, and B Turner.

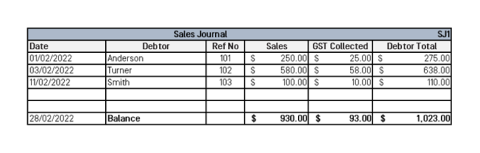

Over the course of a month, these three parties make the following transactions:

- Feb 1 - Anderson purchases $275.00 (inc GST) account Invoice 101

- Feb 3 - Turner purchases $638.00 (inc GST) on account Invoice 102

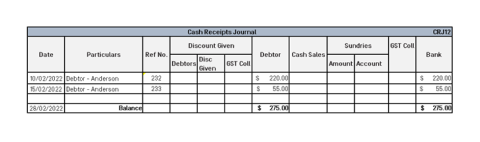

- Feb 10 - Anderson makes payment of $220

- Feb 11 - Smith purchases $110.00 (inc GST) on account Invoice 103

- Feb 15 - Anderson makes payment of $55

The journals for this example looks like this:

Please answer the question below, and then complete the activity requiring you to add opening balances to your MYOB Business software.

Activity: Use MYOB Business to complete the following tasks

Tasks

1. Set up Chart of Accounts:

Download this balance sheet report containing North Park Stationery Supplies' opening balances as of 31 May 2022. Enter the opening balances to the accounts in your MYOB Business system, as would be done in a real-life situation when a business is setting up its accounting software.

Notes:

- When adding capital assets into MYOB, such as plant and equipment, motor vehicles, land, and buildings, the tax code to use is CAP. To learn more, MYOB provides helpful information about tax codes.

- Depreciation has not been recorded for the 2022 financial year as of yet.

2. Set up Asset Registry.

Here is an example of a simple Excel Asset Registry template you can start from or create your own.

3. Log two purchases

North Park Stationery had two purchases using funds from the business bank account. Download the invoices and enter the new assets into the Asset Registry.

Notes:

- Depreciate Van using the Diminishing Value over five years at 40%

- Depreciate Shelving using the straight line method over five years at 20%. Scrap value is $150.00

4. Record the purchase of the assets in MYOB

You will need to use the spend money function. For step-by-step instructions, visit the article on MYOB's help centre.

5. Create the General Journal entry for the depreciation in MYOB

You will need to account for the depreciation of the existing and new assets (for just the month of June).

Notes:

- The depreciation amount for existing Furniture and fittings are depreciated at $18,250.00

- The depreciation amount for the automobile is depreciated at $15.200.00

- The depreciation amount for the Computers and Office Equipment is depreciated at $3,725.00