Payroll requirements in Australia are designed to ensure all businesses are providing and reporting employee compensation according to a set of legislation that governs current and future financial considerations that benefit the employee.

Calculating salaries, wages, and other payments for a reporting period to enter onto a BAS can be done on integrated accounting packages, spreadsheet software, or other financial software.

Employers have an obligation to pay employees the correct rate and provide any entitlements they are eligible for, such as sick leave, overtime, or parental leave. They are also required to report this information to the ATO.

Wages and entitlements are dependent upon:

- work duties and responsibilities

- the industry

- state in which they work

- age

- qualifications.

Superannuation (super) is money set aside during a person's working life for when they retire. For most people, super begins when they start work and an employer starts paying a super guarantee and a portion of their salary or wages into a super fund.

Most people can choose the fund that their employer pays super into. Super payments will stay in the nominated super fund until the age of retirement. Super can only be accessed before retirement in very limited circumstances.

Research:

On the ATO website:

- search for "new to" and check out all of the results in the search field pulldown. Take note that this is a good way to get an overview of the topics listed in the search field pulldown.

- select new to tax and super and review the information provided.

- search for 'paying workers' and review the information on the requirements and expectations for paying employees.

The ATO introduced Single Touch Payroll (July 2018), which changes how certain businesses report on tax and super to the ATO. We will provide more information about that later in this topic.

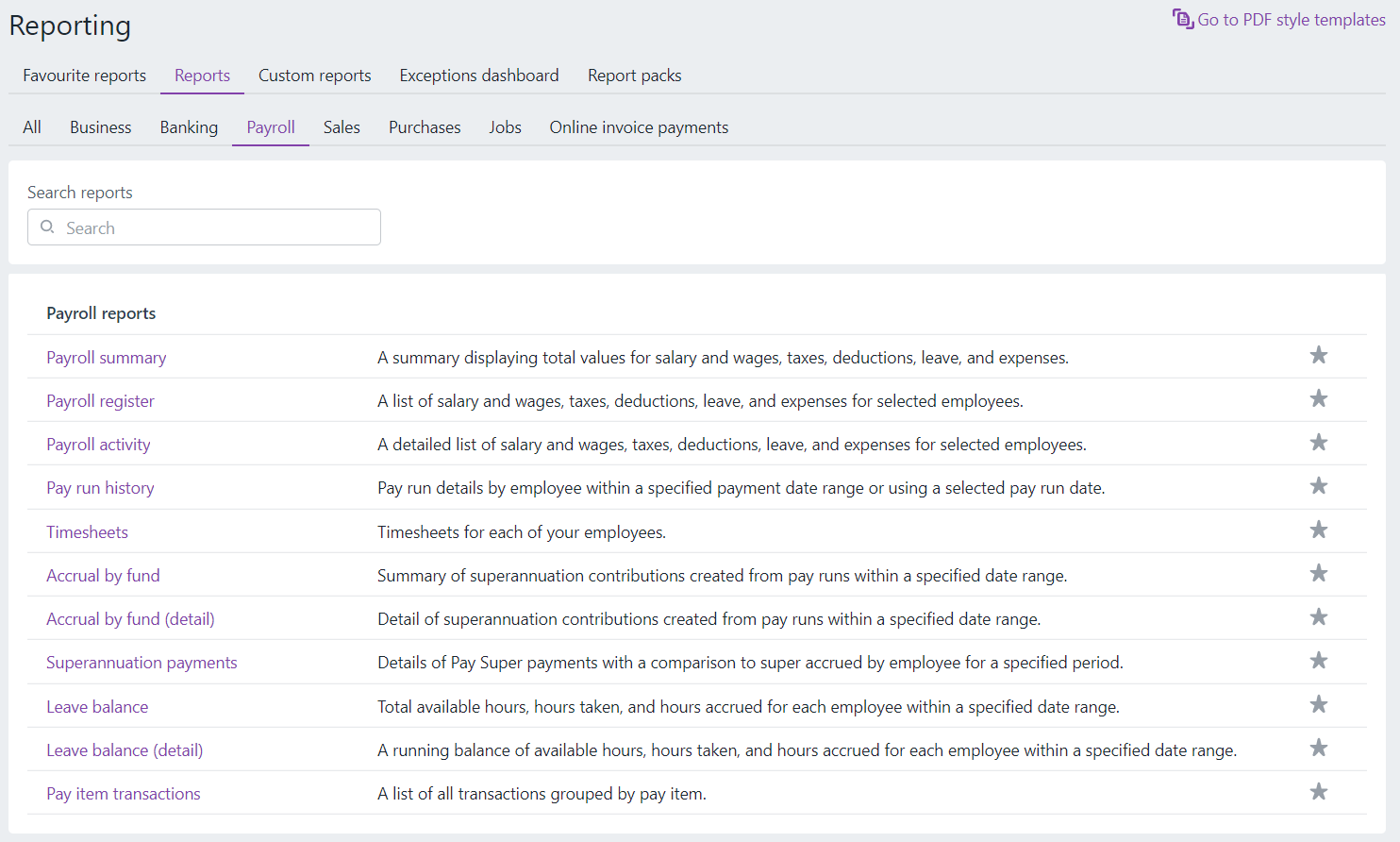

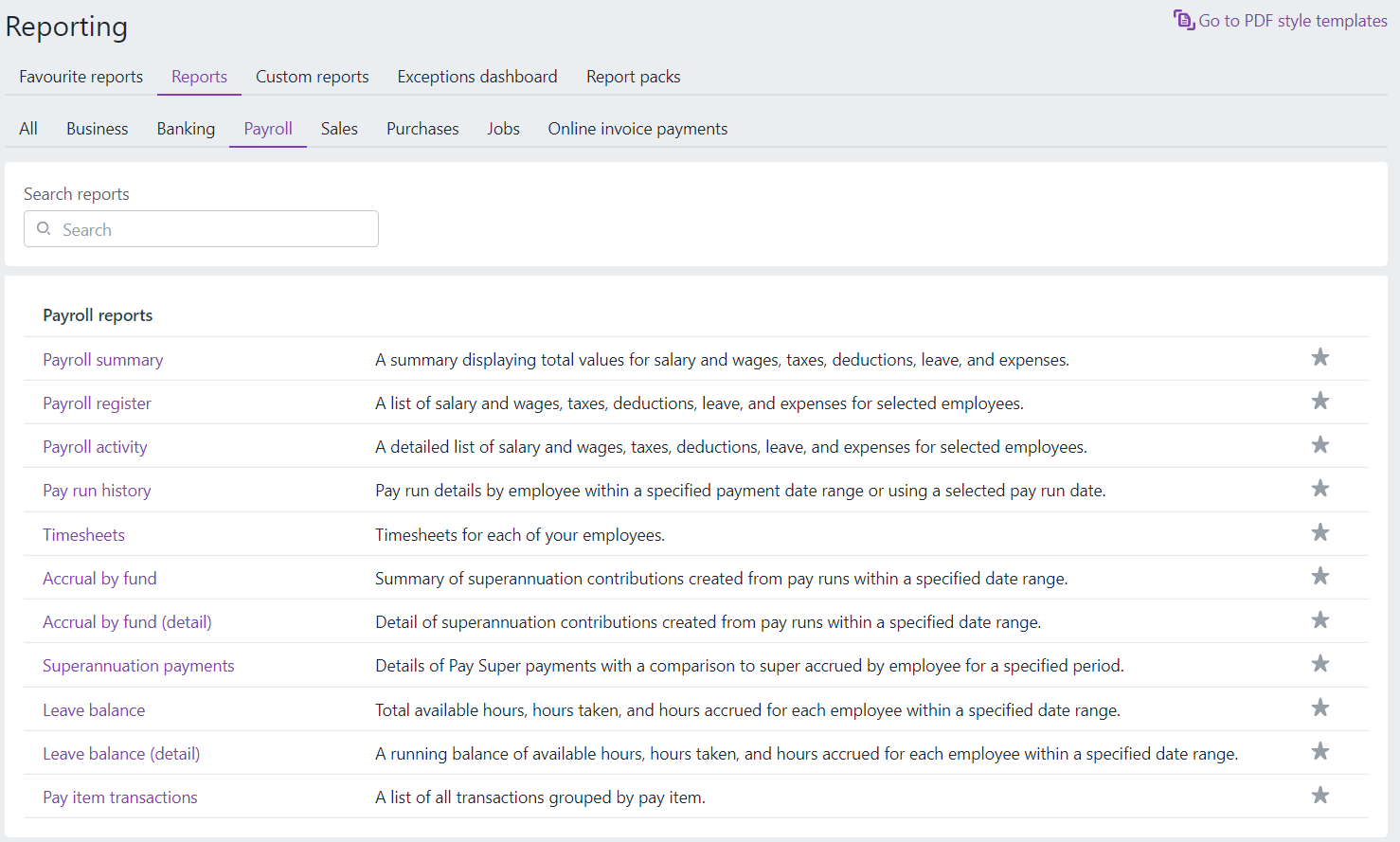

In addition to payment summaries, which were introduced previously, as a bookkeeper, there are other reports to run to manage payroll activity.

This is the list of payroll reports from MYOB:

Employee's income tax deductions

There are times when employees can reduce their own tax burden. Employers can help their workers understand their tax rights.

An employee may be able to claim a deduction for:

Work-related expenses

- Car expenses

- Travel expenses

- Uniform, clothing and laundry expenses

- Self-education expenses

- Other work-related expenses

Other deductions

- Interest deductions

- Dividend deductions

- Gifts or donations

- Cost of managing tax affairs

- Undeducted purchase price (UPP) of a foreign pension or annuity

- Personal super contributions

- Project pool

- Forestry managed investment scheme deduction

- Low-value pool

- Other deductions

- Tax losses of earlier income years

To look at the details of each of these types and categories, review the ATO's page about individual deductions.

Pay as you go (PAYG)

PAYG is Australia’s system for collecting income tax deductions taken from each salary or wage payment received by an employee. These income tax deductions are referred to as withholding from wage payments or simply withholdings.48

There are two types of tax payments under PAYG:

- PAYG Withholding System: Tax withheld from employee wages, voluntary agreements and no ABN;

- PAYG Instalment System: Paying tax on business and investment income earned during the year.

PAYG Withholding System49

Under the PAYG withholding system, the individual or business making the payment is referred to as the payer and the individual or business receiving the payment is called the payee.

Employer's responsibility

Employers help their payees meet end-of-year tax liabilities by collecting PAYG withholding amounts from payments made to:

- employees, company directors, and officeholders

- workers under labour hire agreements

- workers under voluntary agreements

- employees for a business where an Australian business number (ABN) has not been quoted in relation to supply.

The employee's actual tax liability is calculated when the annual income tax return is assessed. PAYG for the year is credited against the employee's assessment to determine whether they owe more tax or are owed a refund.

Businesses that have made payments to company principles or directors' fees are considered wages and hold the same responsibility to withhold amounts from these payments and send the withheld amounts to the ATO.

If the owner(s) operate(s) the business as a sole trader or a partnership and draws amounts from the business, the money is not a wage, and there is no need to withhold from these drawings. They'll need to make provisions for their income tax liability through the PAYG instalments system. However, if they have other employees, the company must withhold amounts from payments made to them under the PAYG withholding system.

Review the Statement of formulas for calculating amounts to be withheld NAT 3252.

Responsibilities around hiring:

In addition to PAYG Withholding, paying super, and paying a wage, employers are required to make considerations and perform several activities when hiring.

- Consider the type of employee they need(i.e., permanent, casual, contract)

- Provide adequate induction training that includes policy information

- Collect source information for reporting and payment

- Provide payment in a timely manner

- Manage end-of-employment tasks and activities

This checklist, published by Business.gov.au provides a comprehensive look at those responsibilities. Please study the list.

When bringing on an employee, an employer should request the Tax File Number (TFN). While the employee is not required to provide one, if they choose not to, the employer will be obliged to make PAYG withholdings at the top marginal income tax rate.

Working out the status of workers

Withholding obligations differ depending on whether the worker is an employee or a contractor.

Employees

Employees are the workers employed in your business. You have to withhold amounts from payments made to them and send the withheld amounts to the ATO.

You should also withhold amounts from payments made to household employees, such as nannies, cleaners, and gardeners, even if you pay them under a private arrangement.

Contractors

Contractors are self-employed and have a contract with you to provide services. You only withhold amounts from payments to contractors if the contractor does not quote their ABN.

Contractors meet their own tax obligations; however, if they enter into a voluntary agreement with you, you must withhold an amount from each payment made to them and remit it to the ATO.

As part of the taxable payments reporting system (TPRS), many businesses lodge a Taxable payments annual report (TPAR) to report payments made to contractors for providing the following services:

- building and construction

- courier

- cleaning

- information technology (IT)

- road freight

- security, investigation or surveillance.50

The ATO provides information on working out if your worker is an employee or contractor on their website.

Getting started

Employers who make payments subject to withholding must perform the following activities.

- Register for PAYG withholding

- Work out the status of your workers

- Become familiar with the types of payments you need to withhold from

- Work out the amount to withhold

- Report and pay withheld amounts to the ATO

- Provide payment summaries and lodge an annual report after the end of each income year.

Employer's additional responsibilities:

- Pay super: Under super law, you must pay super contributions to the correct super fund by the cut-off dates for all your eligible employees. You may also have to offer a choice of super fund to your eligible employees.

- You must pass on your employees’ tax file numbers (TFN), provided in their Tax file number declaration (NAT 3092), to their super funds.

- Fringe Benefits Tax (FBT): If you provide a fringe benefit to an employee or someone else on their behalf because they are employed with the business, you may be liable for FBT. Benefits include rights, privileges, or services. For example, you provide a fringe benefit when you allow an employee to use a work car for private purposes or pay an employee’s private health insurance costs.49

Other payments that may need tax withheld

Payments other than income from employment may also need tax withheld, including:

- investment income to someone who does not provide their TFN

- dividends, interest and royalties paid to non-residents of Australia

- payments to certain foreign residents for activities related to gaming, entertainment and sports, and construction

- payments to Australian residents working overseas

- super income streams and annuities

- payments made to beneficiaries of closely held trusts.51

The amount to withhold

There are many variations to work out the correct amount to withhold as each employee's financial and personal situation plays a part.

Tax File Number Declarations

Each employee should complete a tax file number declaration. The employer must complete the payer section of the declaration, send the original to the ATO within 14 days and keep a copy for their records.

An employee’s TFN declaration gives certain information to determine the amount an employer should withhold from payments made to that employee. This will depend upon whether they:

- are claiming the tax-free threshold

- are an Australian resident for tax purposes

or - have a Higher Education Loan Programme (HELP) debt or a Financial Supplement debt.

TFNs to super funds

The employer must pass their employees' TFN declarations onto their super fund or retirement savings account if they make contributions for them within 14 days of receiving the declaration and TFN. Take note of the ATO penalties if this does not happen.

If the business does not have to make super contributions for an employee, they only need to pass their TFN onto their super fund or retirement savings account when they start making contributions.

In case the business employs a third party or a clearing house to manage payroll, the contracts should allow them to pass TFNs to funds or retirement savings accounts on the employee's behalf and ensure that they actually do so.

It is important for employers to include the sharing of TFN numbers to super funds in their privacy policy to ensure employers are protected.

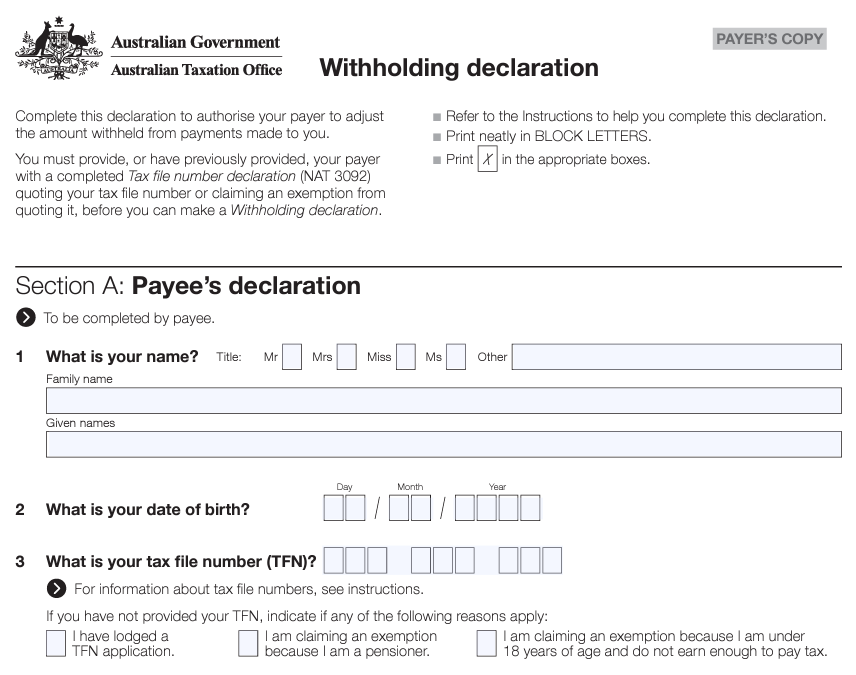

Withholding declarations

Withholding declarations tell the business what adjustments to make to the standard withholding rate.

Employees must give their employer a completed withholding declaration if they want to:

- claim their entitlement to tax offsets by having a reduced amount withheld from payments made to them

- increase the amount the business withholds

- advise the business of changes to their:

- tax-free threshold

- residency status

- accumulated HELP debt or accumulated Financial Supplement debt.49

View and download the complete form here, and spend time reviewing the rest at the ATO:

- PAYG Withholding declarations

- Voluntary agreements

- Variations (there are forms for upwards variation and downwards)

Tax calculator52

To determine the rates for withholdings, the ATO provides calculators as well as information about how to use them. We recommend reviewing the entire page.

The tax withheld for individuals calculator can help you work out the tax you need to withhold from payments you make to employees and other workers and takes into account:

- Income tax rates

- Medicare levy

- Study and training support loan contributions

- Worker status

- Resident

- Non-resident

- Working holiday maker

Registration of employers of working holiday makers:

- Tax-free threshold

- Tax offset entitlements.

Note: When paying the ATO, you will need to round the PAYG amount to the nearest whole number. After the payment, don't forget to adjust the PAYG withholding and GST balance accounts to clear out the cents in your accounting records.

Before the advent of Single Touch Payroll, and for all businesses not yet signed up, the employer was required to provide the employee with a payment summary that shows the income earned and tax withheld during the year. Most employees can now review their own payment history through their myGov account.

Registering for PAYG Withholding

How often you report and pay amounts depends on whether you are a small, medium or large withholder. The following are examples.

- A small withholder has withheld < $25,000 in the payroll year.

- PAYG can be reported and paid quarterly.

- The business may choose to report and pay monthly to assist with cash flow.

- A medium withholder has withheld > $25,000 but less than $1,000,000 in the payroll year.

- PAYG must be reported and paid monthly.

- A large withholder is an enterprise that withheld more than $1 million in the previous year.

- A large withholder must pay the amounts withheld electronically.

If the business has an ABN

They can register for PAYG withholding:

- online through the Business Portal (you will need an ATO digital certificate)

- by contacting the ATO directly by phone

- by completing an Add a New Business Account (NAT 2954) form, which is available from www.ato.gov.au (send your completed form to the address shown on the form).

If you do not already have an ABN, you can register for PAYG withholding at the ATO at the same time as you apply for an ABN, using the same form.

If the business does not have an ABN

If a business supplies another business or an individual with goods or services, that business should quote their ABN. If they don’t, generally the buyer must withhold 47% of the payment made to them and send the withheld amount to the ATO.

A business does not have to withhold from payments if any of the following apply.

- The total payment made to the supplier is $75 or less, excluding Goods and Services Tax (GST).

- The supplier is an individual under 18 years of age and the business' payments to that person are $120 or less each week.

- The goods or services are supplied through an agent who has quoted their ABN on an invoice or some other document relating to the supply.

- The goods or services supplied are wholly input taxed under GST.

- The entire payment you make is exempt income for the supplier.

- The supplier is not entitled to an ABN as they are not carrying on an enterprise in Australia.53

Also, a business should not withhold from the payment if the supplier states in writing that the supply is either of the following:

- made in the course or furtherance of an activity done as a private recreational pursuit or hobby

or - wholly of a private or domestic nature.53

Reporting and paying withheld amounts

If a business has withheld tax amounts from payments made to payees, they need to:

- provide the withheld amounts to the ATO

- report those amounts to the ATO regularly on activity statements

- lodge an annual report confirming your total withholding

- provide payment summaries detailing total payments and withholding to each of your payees unless you reported and finalised through Single Touch Payroll (STP).54

When the payment is due is dependent on whether the business is a large, medium or small withholder. Please review each withholder type on the ATO website for current requirements.

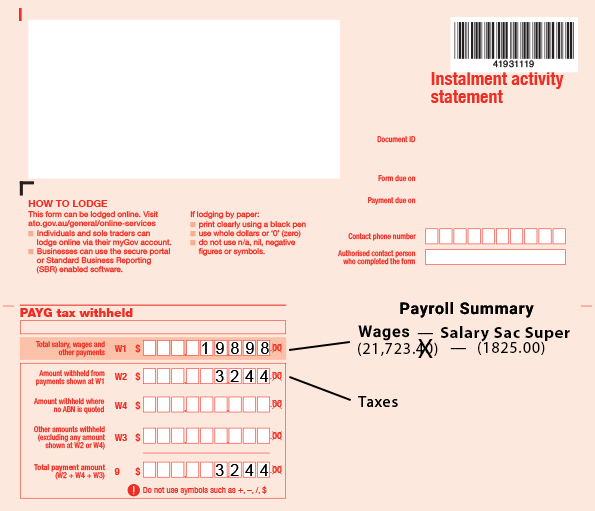

You report and pay amounts you withhold to the ATO by completing an activity statement. The ATO will send you an activity statement, and you report your PAYG withholding obligations at the applicable W label. We will cover more about submitting your activity statements later in this module. BAS labels will be discussed in the next Topic, Reconcile and Prepare Activity Statement.

If you have not withheld any amount for a reporting period, you don’t have to report amounts at labels W2 to W5. However, you must still report any other obligations you have, sign and date your activity statement, and return it to the ATO by the due date printed in the top right-hand corner.49

Keeping records

Under tax law, you must keep all records that explain your PAYG withholding transactions for five years from the date you filed the income tax return. Records must be in English or in a form that can be converted into English.

If your records are not in a written form (for example, in an electronic form on a computer system), they must be in a form that is readily accessible and easily converted into English.49

Storing paper records electronically49

Regardless of whether you use a manual or an electronic record keeping system, you may want to store and keep paper records electronically.

The ATO accepts the imaging of business paper records onto an electronic storage medium, as long as the electronic copies:

- are a true and clear reproduction of the original paper records

- can be retrieved and read by tax officers at all times.

You do not have to keep original paper records once they have been imaged onto an electronic storage medium. You must keep your business records for at least five years.

PAYG withholding records you must keep:

- Wages records, including payment records

- Voluntary agreements

- Employment declarations (for employees working for you before 1 July 2000), tax file number declarations and withholding declarations

- Copies of payment summaries and payment summary statements, or electronic annual reports if applicable

- Employment termination payment records

- Records of personal services income you have attributed

- Statements by a supplier where no ABN was quoted

- Records of amounts you withheld where no ABN was quoted

- Annual reports of PAYG withholding where no ABN was quoted.54

PAYG Instalment System

Businesses use pay as you go (PAYG) instalments to make regular prepayments of the tax on business and investment income.

Entry to the system may be automatic when the organisation earns enough income, or they can voluntarily start PAYG instalments.

The following are organisations that could pay a PAYG Instalment:

- Individuals including sole traders and investors

- Partners in a partnership

- Beneficiaries of a trust

- Trustee of a trust

- Superannuation funds

- Companies

- Other entities taxed like companies.

Individuals

An individual has to pay PAYG instalments if the Tax Office notifies them of an instalment rate or amount. As a general rule, individuals who have shown gross business or investment income of $2,000 or more in their latest income tax return will be notified of an instalment rate, unless:

- the tax payable on their most recent notice of assessment is less than $500

- their notional (estimated) tax is less than $250

or - they are entitled to the Senior Australian’s tax offset or pension tax offset.

Under the PAYG system, an individual may be subject to PAYG instalment tax payments if they received investment or business income in their last income tax return of $4,000 or more. Wages and salary income are not included for PAYG instalment purposes. The instalments are payable either annually or quarterly.

An individual will not be obliged to pay PAYG instalments unless notified by the ATO to do so.

Companies

Generally, companies and superannuation funds will be notified of an instalment rate if:

- their Tax Office instalment rate is greater than 0%

or - their notional tax is greater than $250.

However, if the gross business and investment income are greater than $2 million, companies and superannuation funds may only have the instalment rate option available to them.

To make sure your income tax assessment takes into account the instalments you’ve paid through the year, you need to finalise your PAYG instalments before you lodge your income tax return.

Getting Started

You can generally choose between two options for calculating and paying your PAYG instalments, which will apply for the remainder of the income year.

In some cases, the ATO may send you an instalment notice rather than a BAS. If you do not want to vary the instalment amount shown on your instalment notice, you only need to pay the amount shown by the due date and you do not need to lodge the notice.55

| Option 1: Instalment amount | Option 2: Instalment rate |

|---|---|

| This option is an amount calculated by the ATO using the business and investment income from your most recently assessed income tax return. The benefit of this method is that you will know the amount of your instalment each quarter, which may help you plan and budget for the payment. | This option allows you to calculate your PAYG instalment amount based on your actual income multiplied by a rate that we provide to you. The benefit of this method is that the amount you pay reflects your business and investment income for the quarter. You may prefer this method if your income fluctuates.56 |

Instalment income includes the following:

- Gross sales and fees charged for services (including fuel tax credit)

- Total interest received

- Total gross rent received

- Total dividends received (excluding imputation credits)

- Foreign pensions and other foreign income

- Share of income as a beneficiary of any trusts

- Royalties

- Partnership income.

Instalment income excludes the following:

- Salaries and wages

- Any GST in the price of goods and services sold

- Capital gains unless you are a superannuation fund

- Exempt income such as social security payments, fringe benefits, pay and allowances for part-time members of the Defence Force Reserves, private health payments, and maintenance received.

Examples of written evidence that one needs to claim income tax deductions include:

- invoices

- receipts

- bank statements

- payment summaries

- statutory declarations

- dividend notices, etc.

For example:

Justin runs his surfing shop as a sole trader. He estimates he will earn a business income of $100,000 for the financial year, with allowable business tax deductions of $10,000.

Justin uses the PAYG instalments individuals calculator and enters his:

- estimated business income of $100,000

- estimated taxable income of $90,000 (business income less business tax deductions).

The calculator estimates his PAYG instalment amount to be $20,437 per year.

Justin divides his estimated instalment amount by 52 to work out how much to put aside each week for PAYG instalments: $20,437 ÷ 52 weeks = $393.02

Justin is diligent and plans for his tax liabilities, so that when he receives his quarterly business activity statement (BAS) he has enough money put aside to pay his PAYG instalment for the quarter.

When he lodges his tax return, the PAYG instalments he has paid throughout the year will be offset against his tax liability, meaning he has little or no extra tax to pay.

Taxes included in PAYG:

Tax tables at the ATO website help employers work out how much to withhold from payments made, which can be downloaded. There is also an online tax withheld calculator to help businesses learn their tax expectations.

Payroll tax is a state tax on wages and calculated on the amount of wages paid per month. Payroll reporting includes dates of payments made, wages, taxes, deductions and expenses. This is managed through Single Touch Payroll now, which will be covered a bit later in this topic.

Luxury Car Tax for cars that are imported or sold with a GST-inclusive value above these LCT thresholds, you must pay LCT except in certain circumstances.

Fuel Tax Credits information can also be found on the ATO website to help determine whether an employee is eligible to get the credit and a tool to identify how much to pay.

- Eligibility tool – check if you can claim fuel tax credits

- Calculator – work out the amount you can claim

- This video explains who is eligible to claim fuel tax credits and what to do if you are eligible57

Wine Equalisation Tax is a tax paid by anyone that makes wine, imports wine into Australia, or sells it wholesale

Fringe Benefits tax is a tax payable by employers for benefits paid to employees instead of salary or wages. For example, fringe benefits tax for a car or private expenses. The ATO website has further information about Fringe Benefit Tax, including how to calculate and register.

Employee compensation

All employees in Australia are entitled to:

- a minimum wage

- the 11 National Employment Standards (NES).

The National Employment Standards (NES) are 11 minimum employment entitlements that have to be provided to all employees. It's best to collect the specific details directly from the government in case changes are made after this course is published.

The NES entitlements are:

- maximum weekly hours

- requests for flexible working arrangements

- offers and requests to convert from casual to permanent employment

- parental leave and related entitlements

- annual leave

- personal/carer's leave, compassionate leave and unpaid family and domestic violence leave

- community service leave

- long service leave

- public holidays

- notice of termination and redundancy pay

- provision of Fair Work Information Statement and Casual Employment Information Statement.

Casual employees only get some NES entitlements, like unpaid carer's leave. They must be provided with a Casual Employment Information Statement- external site and have a right to convert to permanent employment in some circumstances.

To learn more about pay leave and entitlements, read Employees pay, leave and entitlements on business.gov.au.

Payslips

Your employer must give you a payslip within one working day of your payday, even if you are on leave. It should be sent to you electronically or provided as a paper copy.

The Fair Work Act 2009 and the Fair Work Regulations 2009 sets out that payslips must include the:

- employer’s name and ABN (if any)

- payee's name

- date of the payment

- pay period

- gross (before tax) and net (after tax) amount of payment

- loadings, allowances, bonuses, penalty rates or other payments

- deductions made from payment.

There are other payslip requirements depending on your employment type and entitlements, including:

- If your employer is required to pay superannuation contributions:

- The amount of the contribution

- The name, or name and number, of the superannuation fund the contributions were made

- If you are paid at an hourly rate:

- What the ordinary hourly pay rate is

- The number of hours paid at that rate

- The amount of payment made at that rate

- If you are paid an annual rate of pay (salary), what the rate of pay was on the last day of the pay period.

Managing payroll with MYOB

MYOB offers many reports to manage payroll activities. You can access them from Reporting on the main nav, and selecting the Payroll tab. Notice the payroll activity report provides all of the information required on (a) selected employee(s).

Payroll legislation

Income Tax Assessment Act 1936 (Cth) and Income Tax Assessment Regulations 1997 (Cth)

Generally, these regulations prescribe how certain parts of ITAA36 and ITAA97 are to be implemented. The Taxation Administration Act 1953 (Cth) (TAA), and the regulations made under it, contain provisions dealing with the administration of the tax laws by, and the powers of, the Australian Taxation Office (ATO).

Other Commonwealth Acts also impose tax in special circumstances, which include the:

- New Tax System (Ultimate Beneficiary Non-Disclosure Tax) Act (No 1) 1999 (Cth)

- General Interest Charge (Imposition) Act 1999 (Cth)

- Family Trust Distribution Tax (Primary Liability) Act 1998 (Cth)

- Income Tax (Franking Deficit) Act 1987 (Cth)

- Income Tax (Deferred Interest Securities) (Tax File Number Withholding Tax) Act 1991 (Cth)

- Superannuation Contributions Tax Imposition Act 1997 (Cth)

- Termination Payments Tax Imposition Act 1997 (Cth).

Superannuation Guarantee Act

The Superannuation Guarantee (Administration) Act 1992 (Cth) is the primary legislation affecting employers and details the administrative arrangements for the operation of the Superannuation Guarantee (SG) scheme, including:

- assessment of the employer’s liability

- calculation of the SG charge

- payment of the charge

- distribution of payments received.

The Superannuation Guarantee Charge Act 1992 (Cth) imposes a charge on employers who do not provide the required level of superannuation payments for employees.

Taxation Administration Act

Taxation Administration Act 1953 (Cth) - PAYG Withholding, which provides for a variation of withholding for personal services income, was made on 15 March 2013 and registered on the Federal Register of Legislative Instruments on 21 March 2013 as Select Instrument 2013 No F2013L00522.

PAYG Withholding - PAYG Withholding Variation: Allowances

Taxation Administration Act 1953 (Cth) - PAYG Withholding - PAYG Withholding Variation: Allowances was made on 15 March 2013 and registered on the Federal Register of Legislative Instruments on 21 March 2013 as Select Instrument 2013 No F2013L00521.

This act enables a variation in the amount of withholding required by a payer under the pay-as-you-go withholding system for allowance payments in a certain class of cases specified in the legislation. It is required to support ATO policy regarding reporting of deductible expenses. The policy is based on the substantiation rules for car expense payments covered in s 28-35 of the ITAA 1997.

Activity: Download

Download this summary of withholding payments according to the Taxation Administration Act 1953 (Cth)

Take note of the exceptions beneath the table.

Payment summaries

The ATO requires that employers provide each payee with a payment summary showing how much the business paid them for the financial year and how much was withheld from the payments.

You may have to complete various types of payment summaries depending on the types of payments you've made throughout the financial year.

You do not need to provide your employees with payment summaries for pay runs you report and finalise through Single Touch Payroll because those employees can access the information through myGov. Given the requirement for nearly all businesses to be signed up to STP to manage their payroll activities, the need for payment summaries to be reported is being phased out.

End of financial year payments to employees

If salary and wages are accrued in the current financial year (prior to 30 June) but paid in the following financial year (on or after 1 July), the full amount of the payment will be taxed at the following financial year's tax rates and included in the following financial year's payment summary.

There are several types of payment summaries and you need to ensure the correct one is used for the situation.

The ATO provides forms for:

- Payment summaries for workers

- Payment summaries where no ABN was quoted

- Electronic payment summaries

- Part-year payment summaries

- Paper payment summaries.

The first in the list of payment summaries is for workers, and is broken down further as shown here:

- PAYG payment summary – individual non-business (NAT 0046)

- PAYG payment summary – business and personal services income (NAT 72545)

- PAYG payment summary – superannuation lump sum (NAT 70947)

- PAYG payment summary – employment termination payment (NAT 70868)

Activity - review payment summaries

- Learn the details of each type of payment summary on the ATO website.

- View and download this example Payment summary PDF - individual non-business.

Did you know that up until the mid-1980s, less than 40% of the working population had superannuation? That figure was even less for blue collar workers and women (only around 25% in fact!)— Industry SuperFunds

The Superannuation Guarantee (SG) is a compulsory system of superannuation support for employees, paid for by employers. The system was introduced in 1992 with the Superannuation Guarantee (Administration) Act 1992 (Cth).

It's the primary legislation affecting employers and details the administrative arrangements for the operation of the Superannuation Guarantee (SG) scheme, including:

- assessment of the employer’s liability

- calculation of the SG charge

- payment of the charge

- distribution of payments received.

The Superannuation Guarantee Charge Act 1992 (Cth) imposes a charge on employers who do not provide the required level of superannuation payments for employees.

The Commissioner of Taxation is responsible for the day-to-day administration of the SG Act, and the role of the Australian Taxation Office (ATO) is to 'support employers to comply with their superannuation guarantee obligations and identify and deal with those who do not.’

You may already be familiar with how super works, but this video provides a good explanation of why it was brought in and the benefit to Australian employees.

The super story

The video does a good job of explaining the reasons the government enacted this legislation. From it's inception, until 1 July 2013, employers paid 9% of the ordinary time earnings of their employees (including part-time and casual employees) who are aged over 18, and who are paid $450 (before tax) a month, into a complying superannuation fund or retirement savings account. This rate increased to 9.25% for 2013/14 and to 9.5% for 2014/15. It has and will continue to rise.

At the time of writing, the rate is 10.5%.

Employers with fewer than 20 employees have been able to discharge their SG obligations by paying their superannuation contributions to the Small Business Superannuation Clearing House. The clearing house distributes the contributions to the various superannuation funds chosen by their employees.

Employers who do not pay the correct superannuation contributions by the due date must pay the superannuation guarantee (SG) charge.

Superannuation guarantee charge (SG)

SGC is payable by employers if they fail, in relation to each employee, to contribute the current super rate of the employee’s ordinary time earnings. If the employer does not pay an employee's super guarantee (SG) to the right fund on or before the due date, they must lodge a superannuation guarantee charge (SGC) statement and pay the SGC to the ATO.

A business can use this handy checklist from the ATO to ensure they are in compliance.

Small Business Superannuation Clearing House

Since 1 July 2010, businesses are able to access the Small Business Superannuation Clearing House — a free service for:

- businesses with 19 or fewer employees

- or

- have an annual aggregated turnover of $10 million or less.

You can make your super guarantee (SG) contributions as a single electronic payment to the Clearing House. It will then distribute the payments to employees' funds.

If you register to use this service:

- Your SG contributions count as paid on the date the Clearing House accepts them (providing the fund does not reject them)

- You have 21 days to pass an employee’s choice of fund on to the Clearing House.

Read additional details on the ATO website.

Self-managed super funds

Self-managed super funds (SMSFs) are a way employees can save for retirement.

The difference between an SMSF and other types of funds is that the members of an SMSF are usually also the trustees. This means the members of the SMSF run it for their benefit and are responsible for complying with the super and tax laws.

There are minimum standards for accepting contributions into a self-managed super fund (SMSF), and the trust deed of the fund may have more rules. Read about contributions you can accept on the ATO.

Contribution caps

Employees are not able to contribute an unlimited amount of money to their SMSFs or they could be liable for the tax on the excess. Contribution caps have various rules and requirements that you should be familiar with.

Contribution caps apply to all super funds. If you have more than one super fund, all your contributions are added up and count towards your caps.

Concessional contributions

There are 2 types of contributions you (or others) can make into your super fund:

- Concessional – These contributions come from income that has not yet been taxed. They are also called 'before tax' contributions. Once the concessional contributions are in your super fund, they are taxed at a rate of 15%. You may need to pay extra tax if you exceed the concessional contribution cap.

- Non-concessional – These contributions come from income that has already been taxed. They are also called 'after tax' contributions. These contributions are not taxed once received by your super fund. However, you may pay tax on them if you exceed your non-concessional contribution cap.

Additional detail about concessional contributions can be found on the ATO website.

Activity: Super knowledge

Payday is a good day for everyone. But with the addition of Single Touch Payroll, BAS agents and the ATO are happy too.

Single Touch Payroll (STP) is an Australian Government initiative to streamline employers' reporting responsibilities to government agencies.

STP is a mandatory obligation that started on 1 July 2018 for employers with 20 or more employees and 1 July 2019 for employers with 19 or fewer employees. A business that is not yet paying through STP risks penalties.

STP-enabled software reports employees' payroll information to the ATO each time the business creates a pay run. MYOB, Xero, Quickbooks and most other accounting packages have all integrated this key functionality into their payroll features, which generally include:

- setting up salaries and wages

- timesheets

- leave

- liabilities

- PAYG withholding

- superannuation

- can be linked to the ATO, banks, and other agencies.

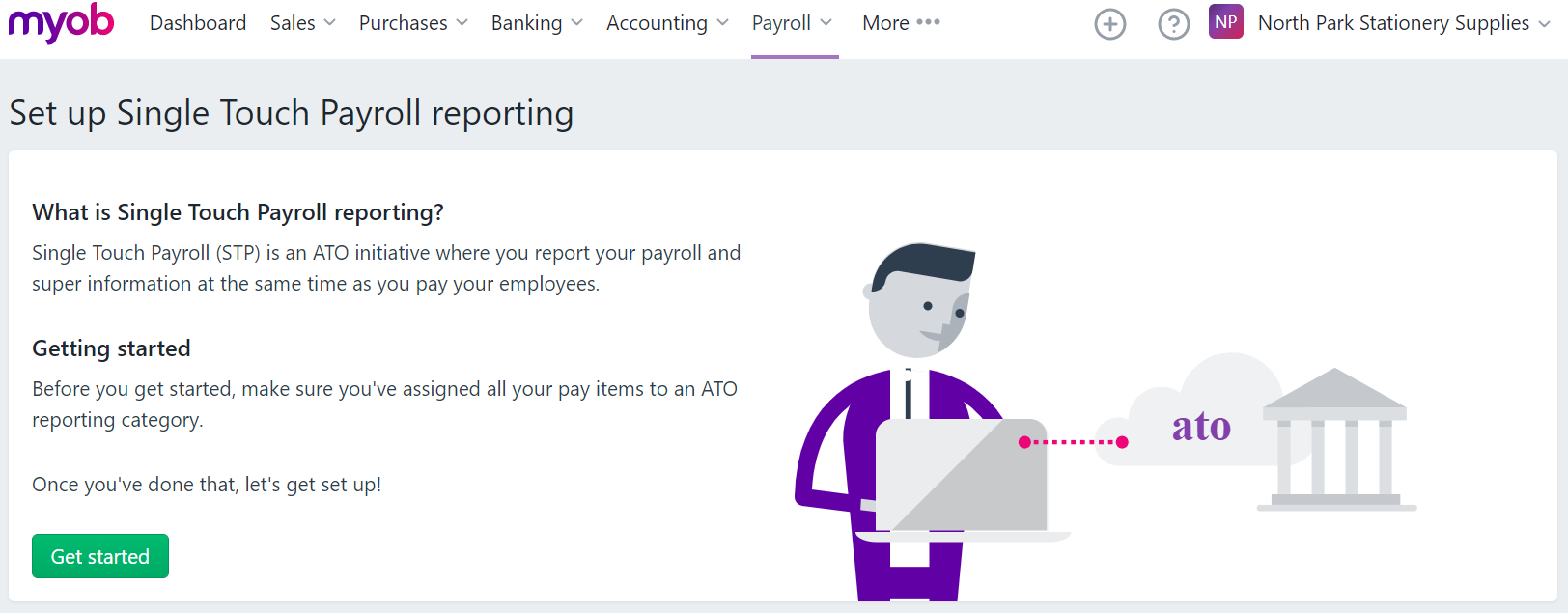

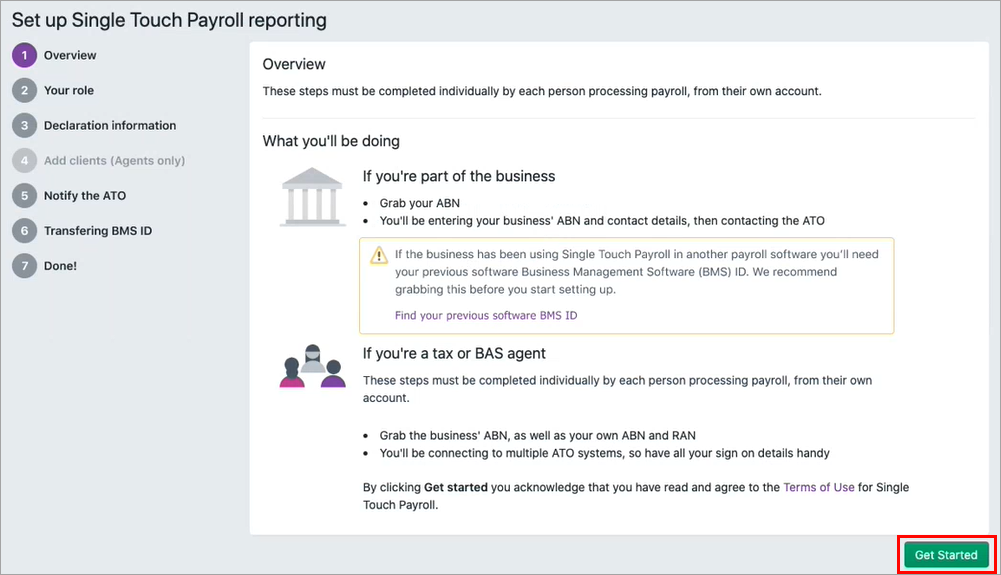

Single Touch Payroll in MYOB

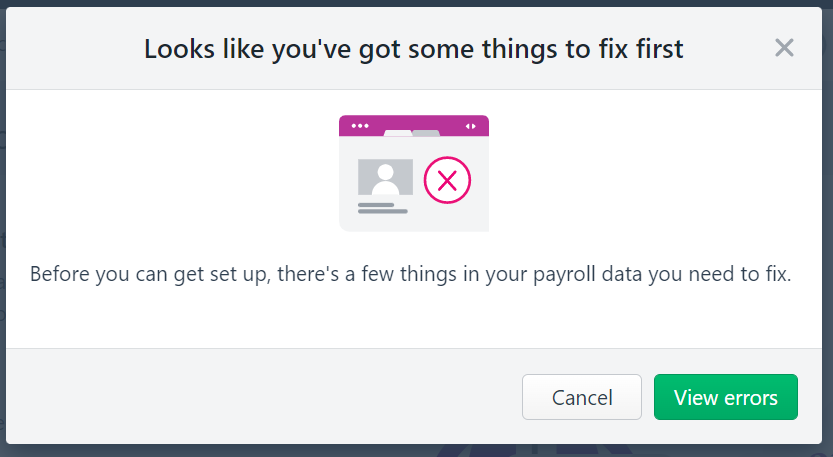

When getting started with STP in MYOB, the first thing is the system will prompt you to add any required details to your system before continuing. Simply click the 'View errors' button to see a list of items missing information.

Once the information has been entered, click the getting started button as shown here.

You'll need:

- the business's ABN and contact details (if working on behalf)

- your own ABN, RAN and Access Manager login details

- If you previously used a different payroll system to report STP, you will need the BMSID from that. The link provides additional information.

To complete the setup steps, select the links below to view MYOB's help information.

- BAS agent completing the STP setup process

- An owner or employee of the business completing the STP setup process

What's next?

The short answer is you'll keep paying your employees as normal – there'll just be a step to send your payroll info to the ATO after a pay run. Learning how to do that is out of the scope of this course, but you can learn more at the MYOB help centre.

When a mistake happens during setup

After setting up Single Touch Payroll (STP), there are some business and contact details you can update yourself.

Other details, like your ABN and Software ID, were recorded when you set up Single Touch Payroll. To update these details you'll need to go through the STP setup steps again. MYOB help centre provides the step-by-step instructions to do this.

When a mistake happens in a pay run

Mistakes happen and in MYOB they're easy to fix. Depending on what needs fixing, you might be able to adjust the employee's next pay or undo the pay and record it again.

With STP, your employees' year to date (YTD) figures are sent to the ATO after each pay run. So if changing an employee's pay affects their YTD figures, the updated figures will be sent to the ATO as part of the next pay run.

If a pay has been accepted by the ATO and you need to undo it, you'll need to reverse the pay and report the reversal to the ATO.

If the pay you need to change is in a payroll year that's been finalised with the ATO, see Changing a pay after finalising with Single Touch Payroll.

ATO reporting categories

You need to assign an ATO reporting category to each of the wage, deduction and superannuation pay items you use. This lets the ATO know how to treat each type of payment you're reporting through STP.

Pay items, in MYOB, are the additional earnings and deductions in an employee's pay, on top of their normal salary or wages. This includes payments for things like overtime, allowances, bonuses, and penalty rates, or deductions like union fees, child support payments or salary sacrifice.

These are the default super pay items that can be assigned to employees:

The following screenshot shows the pulldown with the ATO's reporting categories for this superannuation pay item:

STP is now in its second iteration, STP Phase 2. The ATO put out this video, Single Touch Payroll Webinar Series, to explain what's new and important for STP.

View STP reports

When you do a pay run, you'll report it to the ATO for Single Touch Payroll (STP) reporting. You can view your submitted payroll reports in the STP reporting centre (Payroll menu > Single Touch Payroll reporting > STP reports tab).

You won't see the STP reports tab until you have successfully completed the STP setup.

Activities

Activity 1: An employee reporting BAS has different requirements to a BAS agent working on behalf of an agency or providing their own service contract.

Activity 2: Mistakes happen

Activity 3: Scenario

As the payroll officer of a small firm, you have been asked to complete an instalment activity statement (IAS). Download this wages summary spreadsheet and determine the information you would need to complete this section of the IAS form. Either print the image below, or simply note the labels (W1, W2, W4, W3, and 9.) and your answers. You can check your work below the image.