As a business owner, one of the key financial decisions made will be debt collection or debt recovery. Developing, monitoring, and maintaining client credit policies including contingencies for debtors in default, is vital to maximise cash flow and minimise financial risk.

A credit policy, if properly developed, can be a critical tool for maintaining alignment on credit issues throughout your company. It gives your team a process to follow to manage defaults and recover money owed.

Having a comprehensive and well-written credit policy will represent a consistent and reliable standard to your customers. It should document and support business goals, clarify authorisation levels, define expectations and responsibilities and enhance cross-functional cooperation, especially between the credit and sales departments. Once established, a credit policy will save you money and add to your bottom line. A written/documented policy is more useful because it can be a source of stability and continuity in your company. A clearly stated credit policy is also a valuable aid in training credit and sales personnel.

There are a number of considerations when developing, monitoring, and maintaining a client 'Credit Policy', and these include;

-

Credit limits - You'll establish dollar figures for the amount of credit you're willing to extend, and define the parameters or circumstances of extending that credit.

-

Credit terms - If you agree to bill a customer, you need to decide when the payment will be due. Your terms may also include early-payment discounts and late-payment penalties. Some lenders include 'collateral' terms into their credit policies. Collateral is an asset or property that a borrower has offered a lender to secure a loan. When the borrower stops processing the required loan repayments, the investor can relinquish the collateral to recover its losses. Collateral offers security to the lender in case the borrower fails to pay back the loan, loans that are secured by collateral typically have lower interest rates than unsecured loans.

-

Trading terms - Is the understanding between a buyer and a seller as to the terms relating to payment period, returns, discounts, delivery expenses and timing.

-

Deposits - You may require customers to pay a portion of the amount due in advance.

-

Customer information - This incorporates what you want to know about a client before making a credit decision. Typical points include years in business, length of time at present location, financial data, credit rating with other vendors and credit reporting agencies, information about the individual principals of the company, and how much they expect to purchase from you.

-

Documentation - This includes credit applications, sales agreements, contracts, purchase orders, bills of lading, delivery receipts, invoices, correspondence, and so on.

Here are six steps to create your own client credit policy;

1. Check out all customers before you extend credit to them.

Do you know the exact name and type of business? Can you verify that they exist? Is the company or its owners liable for any debts? Can you obtain credit references? Establish your credit standard. This describes the profile for an acceptable credit customer, including appropriate details and examples. Then benchmark your new potential customer to your profile. Is your profile acceptable best practice in your industry among your peers?

Credit references – can be a report or a letter from a business or an individual, which can confirm to the lender that the borrower (individual or business) is known as a good trusted client.

2. Set the credit amount.

Your credit policy should determine the total amount of credit your firm will allow. Next, calculate how much of this amount you will allow your customers to borrow from you. Arrange customers in bands according to their risk such as low, medium, high. The lower the risk, the more credit can be allowed and vice versa. 20% of total debt owed to the supplier is a common maximum limit to the amount of credit to be given to high risk debtors.

You should also consider individual circumstances when agreeing credit limits. Review your customer credit limits regularly, based on the information you should be regularly gathering about them through monitoring. This should be performed frequently for new and fast-growing customers. Remember, you can still sell to high risk customers, but consider less risky payment options such as ‘cash on delivery’ or advance payment.

3. Set payment terms.

You can only hold your customers to the terms that are agreed when an order is placed, so they need to be clearly communicated. You can do this by making sure that your standard terms and conditions of credit particularly 30 days from date of invoice are clearly stated in all pre-sale communications, including your website, quote, invoice or price list.

Submitting your terms and conditions with an invoice is usually too late in the event of a dispute. When writing your terms and conditions, state the penalty for late payment clearly, which should include your debt collection fees and/or legal fees incurred in the collection process.

Adding a penalty for late payment is usually a very effective way of encouraging speedy payment.

Payment options – it is simply just different ways to pay.

o Paying by cash.

o Paying by EFTPOS.

o Paying online.

o Paying by cheque.

o Paying by credit.

o Paying by lay-by.

o Gift cards.

o Paying by BPay, Applepay, etc.

o Digital currencies.

4. Enforcing your credit policy.

Make sure all staff, most importantly, the sales staff, are aware of your new credit policy. The goal of this process is to create a credit policy that is acceptable to everyone in your company, whilst also being fair and reasonable to existing and potential customers.

When it’s ready to go to print, make sure all terms and conditions are clearly written, in plain English, on all documentation such as websites, quotes, service agreements, contracts and invoices, so that your potential new customer is in no doubt about your terms. If the credit amount is large, then a face to face meeting with your potential customer, outlining your new credit policy, will be beneficial, so there are no areas of doubt for your new customer.

5. Have a follow-up system for past due accounts/accounts receivables. (refer Debt Collection Procedure)

You will need a system and procedure for following up past due accounts. Set reminders to follow up overdue invoices immediately.

6. Have a policy for outsourcing of past due accounts.

If an account is well past due, do not hesitate to outsource immediately to a debt collection expert. This policy will outline exactly when to outsource to a debt collection agent, how you would like your collection agency to conduct themselves and how you are going to monitor the performance of the debt collection agent. You should also have policies and procedures about when to litigate and who to outsource these legal matters to.

Debt collector - is a person or a company that is commonly hired to collect debts owed to a company or business. Debt collectors can include collection agencies or lawyers who collect debts as part of their business.

Source: https://debtrecoveries.com.au/create-credit-policy/

In any business, the most obvious example of a critical process includes getting paid by customers. This starts with sending invoices and includes follow-up for outstanding invoices. Companies usually have to follow-up in practice, because customers do not always pay on time.

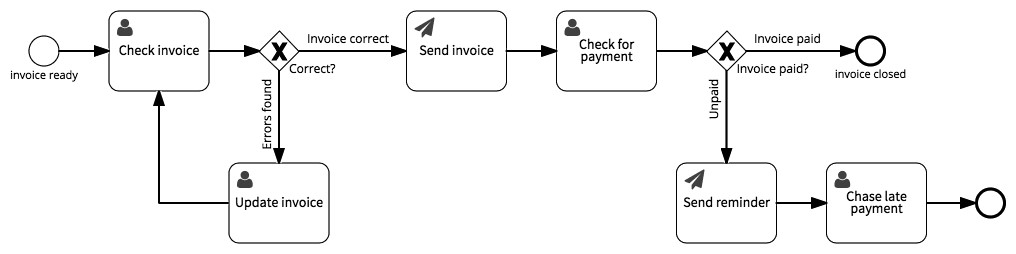

The process of sending invoices can be as follows; Invoice created. Check invoice. If correct, send invoice. If errors found, update invoice, check again, and if correct, send invoice. Check for payment. If paid, process payment and close invoice. If unpaid, send a reminder. If still unpaid, chase late payment by following debt collection or late payment follow up procedures.

This diagram illustrates the above process.

Source: https://www.signavio.com/

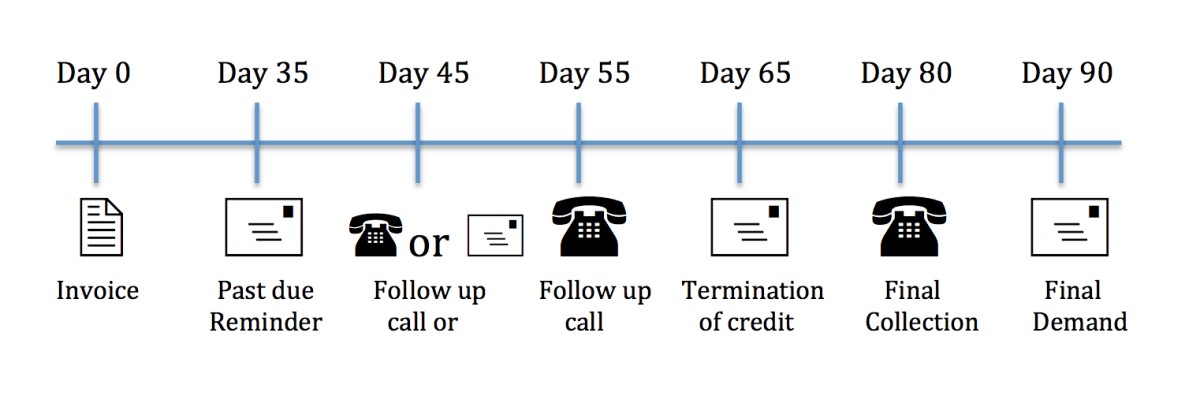

If a customer is late with their payment, this will need to be communicated effectively and in a timely manner to the customer. This process involves good old fashion communication via telephone, and email or formal letter. Your credit policy will specify the payment terms for each product or service supplied to the customer.

This diagram provides a simplified timeline of late payment communications in an unpaid invoice follow up process; (note that most businesses may request payment within 7-14 days and past due reminder letters and initial follow up call would be before Day 45).

Source: http://c2cresourcesblog.com/

In order to follow up invoices at the appropriate number of days past due, the accounting or finance department must provide relevant reports to the debt collector. Debt collections can include an inhouse collections manager, hired professional collection agencies, or lawyers who collect debts as part of their business.

If you are going to handle the debt collection internally, you can use dedicated software such as Xero, Debtor Daddy or Chaser, set reminders to follow up overdue invoices immediately, and have a dedicated Accounts Receivables manager to oversee these accounts.

Your follow up system should include:

-

Generation of monthly statements/invoices so your clients know where they are at.

-

Reports that show the age of your receivables, over credit limit customers, and bad debt write-offs.

-

Credit procedures to minimise bad debt losses.

-

Strictly enforced penalty payments and interest, plus a system for adding this data to the accounts and following them up.

Debt Collection Procedures Or Strategies

When you contact a client, you need to advise them of the actions that may be implemented where payment is not made. This is where your debt collection procedures come into play. Follow procedure to ensure you are collecting debt in the most appropriate and compliant way. There are a variety of ways that debt con be recovered.

Debt recovery actions may include;

-

Buying/selling debt

-

Debtor insurance

-

Enforcement of securitisation arrangements

-

Legal action

-

Liaison with client

-

Return of goods

-

Third party intervention

Organisational policy, procedures and guidelines relating to debt collection may include information on;

-

Accepting and rejecting credit applications.

-

Applying client payments to appropriate accounts.

-

Assistance to be provided to clients on billing and collection problems.

-

Collecting monies due to the organisation.

-

Fraud awareness.

-

Gathering and evaluating information.

-

Legal obligations and framework.

-

Maintenance of client account files.

-

Maintenance of security of invoice and other appropriate files.

-

Making billing adjustments to client accounts.

-

Overall organisation goals and objectives or business plan.

-

Recovery costs.

-

Reviewing and adjusting credit limits for established clients.

-

Setting credit limits or credit lines for applications.

-

Suspension of credit facilities.

-

Trading terms and credit limits.

An organisation's debt recovery procedures and customer records must show;

-

Consideration of client circumstances.

-

Ongoing support and negotiation with clients.

-

Referral to external organisations for advice and/or support.

-

Settlement schedules.

These records are important if legal action is to be taken against the client.

The following informercial video from 'Go To Court Lawyers' explains important terms of debt recovery in Australia.

When communicating with someone, you may be faced with objections. If this is the case, you will need to deal with those objections in line with your organisation's internal guidelines and procedures, and legislative requirements in your state, relating to dispute resolution. (Refer Complaint Handling And Dispute Resolution)

The complaint handling or dispute resolution procedures relate heavily to the debt collection process because of the sensitivity of parties involved in debt recovery proceedings. There are certain features that all complaints handling/dispute resolution procedures have in common. They include;

-

Procedure/process to make a complaint.

-

Timeframes.

-

Contact details.

-

A section regarding the content of the complaint.

-

Further information.

If your business engages directly with customers, it’s likely that you and your team will sometimes receive a customer complaint about products/services your business provides them. Most businesses may consider customer complaints a bad thing. However, if handled correctly, complaints are good opportunities for a business to grow and develop.

A proper procedure allows staff to handle customer complaints in a calm and professional manner. These procedures need to be accessible to everyone and easy to understand.

Note: If you don’t currently have a procedure in place, these 6 steps , provided by www.business.gov.au, will help you manage your customer complaints.

The complaints handling procedure below is provided by the Australian Financial Security Authority (AFSA). This is an example of a complaints procedure, and your organisation should have it's own procedures. It may not be exactly the same but should contain at least each section listed. This procedure should be given to the client at your earliest convenience so they can be guided in their complaint and know and understand the process that will be taken in order to resolve the dispute.

Source: https://www.afsa.gov.au/

Problems arise every day between businesses, their customers, suppliers and employees. Most of them are dealt with quickly and efficiently through common sense, but sometimes they turn into a dispute which needs further understanding to resolve it.

If a dispute or objection arises, you will need to quickly identify your organisation's complaint and dispute handling procedures.

In your organisation, there will be two types of handling processes. These will include:

• Internal dispute resolution (IDR)

• External dispute resolution (EDR)

In most cases the IDR procedures will suffice to resolve a customer complaint or dispute, but in some cases there may be a call to use external resolution methods to resolve problems.

There are five steps to resolve a dispute;

If you think something is unfair or not right, it is important to understand the problem and how it affects your relationship with the other party. This will help you to make informed decisions about the best way to resolve the dispute.

Now that you understand your dispute it is time to talk about it with the other party. If the issue is minor, a telephone conversation may be all that is needed, but for more complex disputes, a face-to-face meeting can be more successful.

If talking over the issue didn’t work, writing a polite and professional letter is the next step. Putting your concerns in writing provides the other party with a chance to fix the situation before further action is taken. It can also be used as evidence if the situation needs to be escalated. Additionally, written records of complaints or disputes must also be kept.

Alternative dispute resolution (ADR) is an alternative to going to court to resolve your dispute. ADR is generally quicker and cheaper than court and gives you more control over the outcome. Common types of ADR include facilitation, mediation and conciliation.

There are many dispute resolution services available to help resolve business disputes. Dispute Support is an online dispute resolution information and referral tool. It will help you to find the most appropriate low cost service to resolve your business dispute.

Taking the matter to court should be the last resort. Court is expensive, time consuming and the outcome is out of your control. Depending on the scale of the dispute or the amount owed to either party, engaging a lawyer may be your only resort.

There are services in each state and territory that can refer you to appropriate lawyers or law firms. Some states and territories also have free or subsidised initial advice services. Find out where to go for legal assistance in your state or territory.

Source: https://www.asbfeo.gov.au/