The Chartered Accountants Australia & New Zealand published the NZ Framework. It gives a set of fundamental principles to help people prepare financial reports. These fundamental principles are based on keywords and phrases that best describe the basic ideas on which accounting is based. These ideas are called concepts. In other words, the concepts of accounting are a set of basic ideas on how accounting standards and reports should be prepared.

Imagine you own a business, and you give a set of your accounting records to five different accountants. You ask them to calculate your profit for the year. Each of the five accountants comes up with a different profit figure; which one is correct?

To prevent this from happening, a ‘set of rules’ or an ‘accepted way of doing accounting’ has been developed, i.e. the concepts of accounting.

The concepts of accounting are outlined below.

Entity

An entity is described as “something that has separate and distinct existence” to something else. In our case, this would be the business.

The financial affairs of the business should be kept separate from the financial affairs of the owner(s). The business is treated as a separate ‘entity’.

For example: Bob is a sole trader

- He buys a new van for work – this is a business transaction and should be recorded in the accounting system.

- He buys a new car for his family – this is a personal transaction and should not be recorded in the accounting system.

It is important to keep business and personal affairs separate for the following reasons:

- correct calculation of taxes

- valuation of the business for sale purposes

- the raising of finance

- the calculation of profits

- ensuring private funds do not get spent in the business and vice versa.

Important

In New Zealand, there are different types of legal entities. The main types are:

- Sole Trader – this is where the owner operates the business in his or her name. The owner will have very little legal protection of their private assets if things go wrong. The business can have a different trading name.

- Partnership – where two or more owners operate the same business together. Again, the owners would have very little legal protection over their private assets.

- Company – a company is a separate legal entity with ‘Ltd’ or ‘Limited’ after the name. The business can have a different trading name. There is a lot more legal compliance but there is some legal protection for the owner.

- Trust – this is a separate legal entity which again has a high compliance cost. It provides a lot of protection for the ‘beneficiary’ of the trust.

Going Concern

The business (entity) will continue to operate as normal for the foreseeable future. It is assumed that there is no intention or need to stop the business from operating. As a result, the financial statements are prepared in a certain way.

For example, the expected selling price is not relevant when valuing assets (such as vehicles and machinery) in the balance sheet (we will study this in detail later) because there is no plan to sell them now; the business is not closing down, and these assets are expected to provide future economic benefits.

If the business was not going to operate as normal, i.e. if it was going to be sold or closed down then this assumption would not apply. As a result, the financial statements would be prepared differently. The going concern assumption is not very useful when it comes to measuring the results of business activities and making business decisions.

Learning Activity: Going Concerns

Open the following document that forms the basis for the following two tasks.

Firstly, read the section, "Going Concern Example 1" and answer these questions in the first part of the task:

- What does it mean, that Line 7 will hopefully be sold as a going concern?

- What is the alternative?

- What are the reasons for this happening?

- What assets does Line 7 have – either from the article or not?

Next, read the section "Going Concern Example 2", and answer these questions in the second part of the task. Read more about the case study here:

- Will Whitcoulls be operated as a going concern?

- What gives you this impression?

- What would likely happen with the financial statements if Whitcoulls was not a going concern?

- How would being a ‘going concern’ affect the preparation of the financial statements?

Upload your responses to each set of questions to the Forum, Going Concerns.

Accounting Period

Users of accounting need information regularly, so, for this reason, the business activities are divided into set ‘periods’, usually of equal length of time, and reports are prepared for that period.

The length of time for which the accounting information is prepared is called the accounting period. The accounting period can vary from business to business; however, it should be at regular intervals (every month, quarter [3 months], half year, or year).

Monetary

All transactions are measured in a common monetary unit (currency) and only events that can be recorded in monetary units are reported in the financial statements. In the case of New Zealand, we record all transactions in New Zealand dollars (NZD).

For example, if Bob has a work van and Roger has two work vans, who has the most assets? We must calculate the value of each van in dollars and then make the comparison.

Historical Cost

All transactions are recorded at their actual (original) cost to the entity. For example, every year Bob records the value of his work van as the price he originally paid for it on the day he bought it, not today’s market value. Technically, the van is not worth as much today because it has been used and is older. To account for this loss in value we use a concept called ‘depreciation’ (we will study this later).

Accruals Basis

Transactions are recorded in the period in which they physically occur, not when the money is exchanged (received or paid). Accrual accounting attempts to record the financial effects of transactions relating to the accounting periods for which those transactions occur. Financial statements are prepared using accrual accounting.

The day the invoice is given is the day you put it in your books for that month, and the month you pay for an item/service is when it goes in, not when you get/use it.

Accrual accounting involves:

- Recording revenue when it is earned and expenses when they are incurred.

- Adjusting the accounts to ensure that transactions are identified appropriately, according to the specific accounting period.

For example, if Bob buys a new work van in March, on credit, even though he doesn’t pay for it at the time, he will still record this transaction (purchase) in the March period. Similarly, if Bob makes a sale in April but does not receive the money at the time, he will still record this transaction (sale) in the April period.

Qualitative Characteristics

The quality of the information produced as a result of accounting will determine how useful it is to the users.

The components of the qualitative characteristics are described below:

Relevance

Information is relevant when it helps users evaluate past, present, and future events by confirming or correcting their past evaluations.

The relevance of information is also affected by the time in which it was produced. If the information is not available when it is needed, or it becomes available after it is needed, then it lacks relevance. Timeliness does not make information relevant, but the lack of timeliness can remove relevance from information.

Understandability

Accountants must prepare the information in a way that is easy for the users to understand.

Information should be clearly explained and presented. Where necessary, the information should be in a summarised form that takes into account the intended reader/user.

However, users are assumed to have reasonable knowledge of business, economic activities, and accounting. If they do not understand accounting information that is properly presented, then it is presumed that they would hire an expert to help them.

Reliability

To be reliable the information must:

- Achieve faithful representation – the presentation of transactions and events corresponds with the actual transactions and events.

- Be verifiable – an auditor can check its accuracy.

- Be free of any bias on the part of the preparer – ‘neutrality’; not trying to influence a user.

For example, often in accounting there is a need for estimates, such is the case for the valuation of assets:

- How much is the inventory worth? (Inventory can also be called stock or supplies.)

- How much is the house worth that the business has owned for three years?

The preparer of the financial statements should consult with experts and get evidence to support estimates.

Comparability

This refers to the need for users to compare the information with benchmarks, such as:

- Comparing similar companies in the same industry group.

- Comparing one business over different periods of time.

If there are any changes in the way the information is prepared, then this should be made known so fair comparisons can be made.

Check Your Knowledge

When recording accounting transactions, they must be ‘classified’ correctly. This means they must be organised or categorised into appropriate groups. Accounting transactions are classified under ‘accounting elements'. There are five accounting elements.

Assets

An asset is anything owned by a business that has some value; the resources the business uses in its operations. They are the ‘service potential’ or ‘future economic benefits’ controlled by a business as a result of past transactions.

Example of assets relating to Bob’s Tennis Tours Ltd (BTT):

- Past - BTT Ltd received some cash from a customer (who bought a tennis racket).

- Future - BTT Ltd will use the money to pay for expenses in running the business.

- Current - Now BTT Ltd has control over the money in the bank account.

There are two types of assets:

Current Assets can be turned into cash easily, or will be used up soon:

- Money in the bank

- Accounts receivable/debtors

- Supplies/inventory/stock

- Prepayments.

Non-Current Assets (most are called fixed assets) are kept in the business for a longer time:

- Land/plant/buildings

- Motor vehicles

- Equipment/machinery

- Furniture.

Non-current assets can also include intangible assets such as trademarks and goodwill.

Reflect

What assets do you own? Are they current or non-current?

Depreciation

As we have already learned, fixed assets provide future service potential or economic benefits. However, over time fixed assets sometimes lose their value. For example, they may wear out or become out of date. They lose their ability to be useful and provide income for the business. For this reason, we need to use depreciation.

Depreciation is an expense used to spread the cost of a fixed asset over the useful life of the asset; this may take several years. The depreciation of the asset’s life every year is added up, this is called accumulated depreciation. When we take away the accumulated depreciation value from the historical cost of the fixed asset, we get the current value or Book Value (which is an estimate of how much it is worth today) of the asset. The current value of the fixed asset will most likely be not equal to the actual market value.

It is really important to understand the relationship between non-current assets and accumulated depreciation. Make sure you are able to explain why it’s necessary to deduct accumulated depreciation from Non-current assets. “Depreciation is the method of accounting used to allocate the cost of a fixed asset over its useful life and is used to account for declines in value. It helps companies avoid major losses in the year they purchase the fixed assets by spreading the cost over several years.” Source: Freshbooks

For example, Trading Tours Company bought a Yellow Tour Bus in 2015 for $100,000. The value of the bus has depreciated every year and the accumulated depreciation value to date is $67,232. Therefore, the Book Value of the bus on 31 December 2019 is $32,768.

The depreciation rate is the IRD Depreciation of 20% pa diminishing value. This means the value of the bus has depreciated by 20% every year. Notice how with the ‘diminishing value’ means of calculating depreciation, the expense in the first year is higher than the expense in year 5. The other method is ‘Straight Line’ which is (for buses) 13% of the original cost every year (i.e. $13,000 pa).

View them both in the table below. (Please note that BV is the Book Value, and DV stands for Diminishing Value).

| Bus Price (2015) $100,000 (DV) | 2016 | 2017 | 2018 | 2019 | 2020 |

| Method 1 IRD Depreciation (BV) | $80,000 | $64,000 | $51,200 | $40,960 | $32,768 |

| Method 2 Straight Line (13%) (BV) | $87,000 | $74,000 | $61,000 | $48,000 | $35,000 |

Consider Your Mobile Phone

- Take your phone. How much did you pay for it when you bought it?

- If you were to sell it today how much do you think it would sell for, i.e. how much is it worth today?

- As a result, what is the value of depreciation? (Original price – today’s value.)

- Convert this to a yearly percentage.

Example One:

- (Loss of value divided by cost price) = total % loss.

- Then, divide this figure (from #1) by the number of years owned (i.e. 2 years or 0.5 years).

iPhone 7 Bought @ $1200

Sell today @ $700

DV Year 1 $500

Total loss as a % (Loss of value / cost price)

$500 / $1200 = 0.416 rounded up to 0.42 x 100 = 42%

Example Two:

iPhone SE Bought @ $1500

Sell today @ $1200

DV Year 1 $300

Total loss as a % (Loss of value / Cost price)

$300 / $1500 = 0.2 x 100 = 20%

If you were to use depreciation of 20% pa diminishing value over three years:

Year 1 $1200 $1200 x 80% = $960

Year 2 $960 $960 x 80% = $768

Year 3 $768

Liabilities

If a business didn’t make enough money to pay staff wages for the month, the organisation may have to take out a loan. A sacrifice of service means that if they didn’t, the business would not have anyone to work for them.

Economic benefits:

Buy a courier van, and put in on credit so it becomes a liability. But the business now delivers twice as many deliveries so more money = more economic benefits.

Liabilities are amounts that the business owes to other people or businesses, for things like loans or goods bought on credit. They are future ‘sacrifices of service potential’ or of ‘economic benefits’ that the business has to make as a result of past transactions.

Example of liabilities relating to Bob’s Tennis Tours Store Ltd (BTT).

- Past – BTT Ltd will pay the bill using the money in the bank.

- Present – now BTT Ltd has an obligation to the bill; it owes money.

- Future – BTT Ltd bought new Tennis Rackets last month, on credit.

There are two types of liabilities. (Click on the links to find out more information about the terms associated with current liabilities.)

Current Liabilities are due to be paid soon, within a year:

Note: Definition of Revenue Received in Advance. “Under the accrual basis of accounting, revenues received in advance of being earned are reported as a liability. If they will be earned within one year, they should be listed as a current liability.” – Source: Accounting Coach

Non-Current Liabilities will take a longer time to be paid:

Reflection

What liabilities do you have at the moment? Are they current or non-current?

Learning Activity: Fresh Fruits

Review the following case study about Fresh Fruits.

Scenario (adapted from bized.co.uk)

Assume that you have decided to set yourself up in a business selling fruit. You have borrowed $100 from your parents, which you have agreed to pay back at the end of the school year. Also, three of you have each put in $20 to the project. You have agreed to split the profits (assuming you make any) equally between yourselves. You have called your business 'Fresh Fruits'.

Your tutor has permitted you to be able to operate and has agreed to some premises that you can use to sell your products. There is a small, secure, storeroom which has been cleaned out and modified, that you are going to use. This acts as your market stall. You have agreed to buy this room and have paid your tutor $30. There is, however, a cleaning cost to be paid for the room, which works out at $5 per week. You have also bought 10 wooden boxes in which to display the fruit, a large secure money box in which to keep your cash and you have bought three new uniforms.

You are in a position to buy your fruit, as you have an uncle who is a greengrocer. He goes to fruit markets every morning to buy his stock and has agreed to supply you with fruit from his stock. You provide him with a list of things you want, and he delivers them to the school first thing in the morning, in return for a small fee to cover his delivery costs.

You arrive at the school and, along with your two friends, unload the fruit and put it onto the display stands ready for business. You sell the fruit for half an hour before school, during break, lunch, and then after school for another half an hour.

Based on the above scenario, consider:

- All the things that you have had to buy to get the business up and running. (Make a list)

- Now try to categorise the things in your list into either fixed assets (FA) or current assets (CA)

- Determine all the liabilities you have in your business.

Upload your responses to these questions in the Forum, Fresh Fruits.

Tip

Remember!

- Assets – all the things that the business 'owns'.

- Fixed assets – all the things a business owns but which are not used up in production.

- Current assets – all the things a business owns that are used up in production.

- Having now identified all the things that you have had to buy, there are also things that you will have to pay out to set up and run the business.

- Liabilities – refers to the money the business owes to other people.

Owner's Equity

In this module, we may use the terms Owner’s Equity and Capital, both mean the same thing. You will see both references stated. The term “Drawings” is a term that is used throughout the module, especially so, when you cover Financial Statements later on.

Also known as capital, it is the ‘net worth’ of the assets of the business after the liabilities have been subtracted.

Capital = Assets - Liabilities

Capital can be in the form of cash or assets which the owner has contributed to the business.

The owner can also take items out of the business. We call this a ‘withdrawal’ or ‘drawings’.

Put simply, owner’s equity is the amount that the owners have invested in their business and includes any profit (or loss) that the company has earnt.

Profit = Revenue - Expenses

Revenue (Income)

Revenue is a word used to describe the income coming into the business; gross income earned from doing business. Money can be earned from selling goods (sales) or providing a service (service revenue).

In other words, revenue is inflows of ‘service potential’ or ‘future economic benefits’ in the form of increases in assets or reductions in liabilities of the business.

Expenses

Expenses are things the business has to pay for. Money will/is going out of the business, and includes the day-to-day costs of running the business. Business expenses may include but are not limited to: Rent, electricity, insurance, telephone, cleaning, wages, repairs, maintenance, office supplies, fuel, parking, and travel.

In other words, expenses are the 'consumption or loss of service potential’ or ‘future economic benefits’ in the form of reductions in assets or increases in liabilities of the business. The following table shows how expenses are in specific categories for businesses.

| Headings | Keywords |

|---|---|

| Current Assets |

|

| Fixed (Non-Current) Assets |

|

| Current Liabilities |

|

| Non-Current Liabilities |

|

| Expenses |

|

| Revenue |

|

| Owner's Equity |

|

| Depreciation |

|

The next table classifies the following accounts:

- Assets (A)

- Liabilities (L)

- Owner's Equity (OE)

- Revenue (R), or

- Expenses (E)

| Account | A, L, OE, R or E |

|---|---|

| Accounting Fees | E |

| Accounts Payable | L |

| Accounts Receivable | A |

| Bank Account | A |

| Bank Fees | E |

| Capital | OE |

| Cash at Bank | A |

| Cleaning | E |

| Computer | A |

| Drawings | OE |

| Electricity | E |

| Equipment | A |

| Interest Paid | E |

| Insurance | E |

| Loan | L |

| Machinery | A |

| Mortgage | L |

| Overdraft | L |

| Plant | A |

| Petrol | E |

| Printing and Stationery | E |

| Rent | E |

| Revenue | E |

| Sales | R |

| Salaries | E |

| Service Revenue | R |

| Telephone | E |

| Wages | E |

As we have discussed already. Bob owns a Tennis Tours Business called BTT Ltd. Here is a list of items in his business. Match the account name to the correct item, and the relevant accounting element (A=Assets, L=Liabilities, OE=Owners Equity, R= Revenue, and E=Expenses).

Chart of Accounts

The chart of accounts is a list of all the business’ financial description accounts. A table of codes (numbers or letters) is used to classify individual transactions into accounts so they can be identified easily. Similar accounts are grouped using the elements of the accounting equation.

Here is an example:

| 100 | ASSETS | |

|---|---|---|

| 101 | Bank | |

| 102 | Stock (or Supplies) | |

| 200 | EXPENSES | |

| 201 | Electricity | |

| 202 | Rent | |

| 300 | LIABILITIES | |

| 301 | Loan | |

| 400 | OWNER'S EQUITY | |

| 401 | Capital | |

| 500 | REVENUE | |

| 501 | Sales | |

No two businesses will have the same chart of accounts because they will design one to suit their particular business needs. Bigger businesses will need a more detailed chart of accounts. The use of a chart of accounts is very important because businesses carry out thousands of transactions every day. We need to be able to record each transaction, find the information quickly and easily and store it for use later on.

Check Your Knowledge

The Accounting Equation

Assets + Expenses = Liabilities + Owner’s Equity + Revenue

The important point to note in relation to the accounting equation is that it must always balance. This means that both sides should be the same (equal).

The Double Entry System

- The double-entry system is used to record accounting transactions in a way that keeps the equality of the accounting equation.

- A transaction is an exchange; there will be something of value coming into the business while something is going out.

- Each business transaction is entered twice, once as a debit, and then as a credit.

| Assets + Expenses | = | Liabilities + Owner's Equity + Revenue | |

|---|---|---|---|

| Debit (DR) balance Debit to increase Credit to decrease |

Credit (CR) balance Credit to increase Debit to decrease |

The double entry system is used because it acknowledges that the ‘benefit’ value of assets and resources is exactly matched by an equivalent ‘obligation’ value in liabilities to creditors and owner’s equity.

In the table below are the benefits and obligations associated with each transaction associated with the purchase of a computer.

| TRANSACTION | TRANSACTION ONE (Benefits) | TRANSACTION 2 (Obligations) |

|---|---|---|

| Buy a new computer, paying in cash | Computer (increase asset, DR) which can be used to operate the business | Have to pay for it, so less cash than before (decrease asset, CR) |

| Buy a new computer on credit | Computer (increase asset, DR) which can be used to operate the business | Have to pay for it in the future (increase liability, CR); owe someone money |

| Pay off the account when you receive the invoice | Don’t owe the money anymore (decrease liability, DR) | Less money in the bank (decrease asset, CR) |

| Sell the computer | Money in the bank (increase asset, DR) | No computer anymore (decrease asset, CR) |

| Sell goods to a customer for cash | Money in the bank (increase asset, DR) | Have to give the goods to the customer once sold (increase revenue - CR) |

| Sell goods to a customer on credit | Account receivable (asset); someone owes you money in the future (DR) | You have to give them the goods, less stock (asset) than before (CR) |

Explore

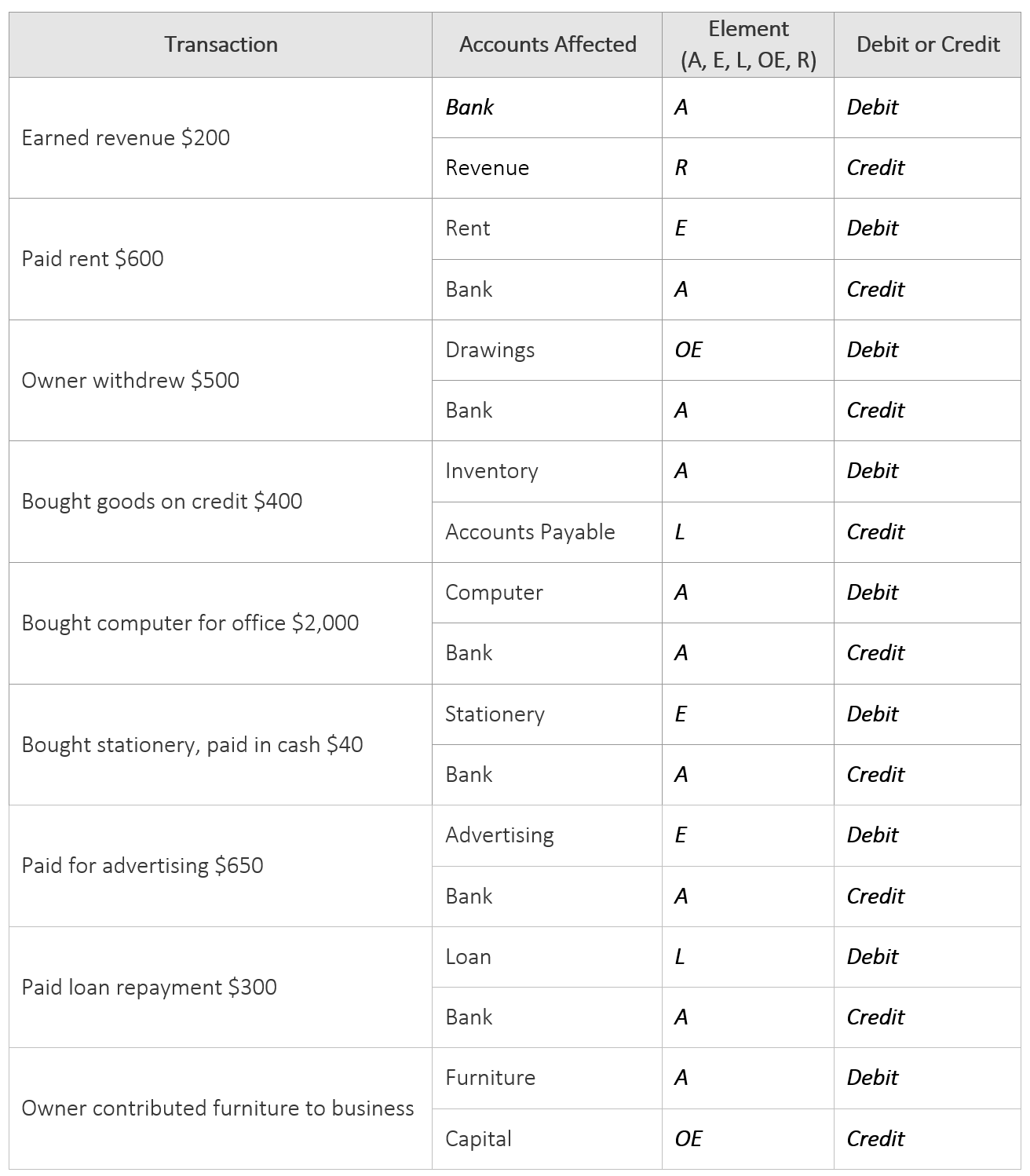

Review these examples of transactions. Notice all transactions have both a debit and credit side.

Explore

Here is an example of the accounting equation. It is also available as a downloadable PDF here.

(Example-ABC Ltd, which is a company owned by Joe).

Working Example of the Accounting Equation & Double Entry

Here is a list of some transactions that Bob carried out:

- Paid $1,000 for advertising.

- Made cash sales of $2,500.

- Contributed $2,000 of personal cash (capital) into the business bank account.

- Bought a mobile phone for $500, paying by EFTPOS, from the business account.

- Borrowed a loan of $5,000 from the bank.

Here is the effect of each transaction on Bob’s accounting equation:

Explore

The example explained:

- The advertising decreases (credits) the bank account and increases (debits) the expenses account.

- The cash sales increase (debits) the bank account and increase (credits) the revenue account.

- The money contributed increases (debits) the bank account and increases (credits) the owner’s equity account.

- The purchase of the mobile phone increases (debits) one asset (the mobile phone) and decreases (credits) another asset (the bank account).

- The loan increases (debits) the bank account and increases (credits) the loan account.

Important

Remember:

- For each transaction, there must be two entries: one debit, and one credit.

- The debit value must be equal to the credit value.

- The accounting equation must balance.

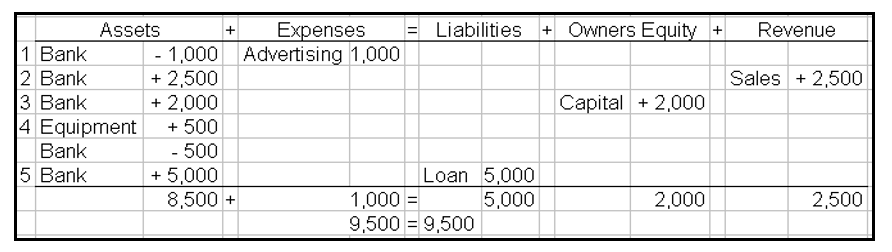

Learning Activity: Transaction 2

Complete the table that has been provided for you as an attachment in the Forum, or you can download the Word document here.

(Only complete the Element, and the Debit or Credit columns only). The rest of the information has been provided for you.

Post your completed table to the Forum, Transaction 2.

| Transaction | Accounts Affected | Element (A, E, L, OE, R) | Debit or Credit |

|---|---|---|---|

|

Pauline started a SPA and Beauty business and introduced some cash |

Bank | ||

| Capital | |||

| The business bought some salon furniture on credit | Furniture | ||

| Accounts payable | |||

| The SPA & Beauty business charged a client for last night (unpaid) | Accounts receivable | ||

| Revenue | |||

| A supplier paid money into the SPA and Beauty business account | Bank | ||

| Accounts receivable | |||

| The SPA & Beauty business bought branded stationery/merchandise on credit | Stationery | ||

| Accounts payable | |||

| The SPA & Beauty business bought a vehicle on credit | Vehicle | ||

| Accounts payable | |||

| The SPA & Beauty business received cash for a customer who visited last night | Bank | ||

| Revenue | |||

| Pauline took some branded SPA & Beauty products home | Drawings | ||

| Spa & Beauty products | |||

| Pauline took out a loan from the bank to buy a computer for the business | Bank | ||

| Loan | |||

| The business paid for the electricity | Electricity | ||

| Bank |