It’s crucial for small businesses to comply with legal and regulatory requirements when they provide products and services to customers. This builds trust with customers, avoids legal issues and maintains a positive reputation.

For your business to meet its compliance obligations you’ll need to ensure that:

- Your business provides and promotes its products and services transparently and ethically in accordance with the Fair Trading Act 1986. Being transparent relates to being honest about what you’re selling or providing. Being ethical means you’re doing the right thing according to agreed or implied parameters or rules.

- Your products and services meet the quality and performance requirements of the Consumer Guarantees Act 1993, and you respond appropriately if they do not.

- Your business collects, stores, uses and shares customer information in accordance with the Privacy Act 2020. Even if the Privacy Act 2020 wasn’t in place, as a savvy business person, you would still regard customer information as worth protecting.

- Your business doesn’t engage in any anti-competitive behaviour as defined by the Commerce Act 1986. Even if the Commerce Act 1986 wasn’t in place a respected business person would be unlikely to engage in anti-competitive behaviour, such as price-fixing amongst others in the industry.

- Your business, products and services comply with any other relevant requirements such as product safety standards, or those to do with importing or exporting or your specific industry.

- You seek advice concerning any requirements you are unsure about as the consequences can be severe.

This topic covers each of these points, though you may need to delve further and seek advice to ensure your business is compliant.

While compliance with rules is important to keep you within the law, being an honest and respected business person means treating customers with respect and regard, even if these rules didn’t exist. In this way, where there is a lack of clarity about what you should do or while you are waiting for a legal opinion, for example, erring on the side of caution can guide you towards a safer and more customer-focused option.

Compliance with the law isn’t just about not getting caught – it’s about doing the right thing, because it’s the right thing to do.

“Even if you’re self-employed, you don’t need to — and shouldn’t — go it alone. Lean on the wide community of business advisors, consultants and support networks available to help you and your business.” (business.govt.nz, no date g)

Fair trading

The Fair Trading Act 1986 aims to promote fair and ethical trading practices, protect customers, and ensure that businesses operate with transparency and honesty.

Some fair trading practises your small business must follow:

- Ensure that pricing information is clear, accurate, and not likely to mislead customers. Be transparent about any additional fees or charges associated with your products or services.

- Provide accurate and truthful descriptions of your products or services. Avoid making false claims or representations about their features, benefits, or performance.

- Ensure that all advertising and promotional materials are truthful and not likely to deceive customers. Avoid bait advertising, where products are promoted at a certain price with no intention to supply them at that price.

- Review and ensure that your contract terms are fair and not unfairly biassed against customers.

Activity

The penalties can be severe for breaches of the Fair Trading Act 1986. Read this article about a record $3.675 million fine imposed on One NZ in relation to the company’s conduct between 2016 and 2018 and answer the following questions.

Product and service guarantees

While the Fair Trading Act 1986 addresses a broader range of trading practices and conduct, including advertising, pricing, and product safety, The Consumer Guarantees Act 1993 specifically addresses guarantees related to the quality and performance of goods and services. Under this Act, you must not knowingly offer a faulty product or substandard service.

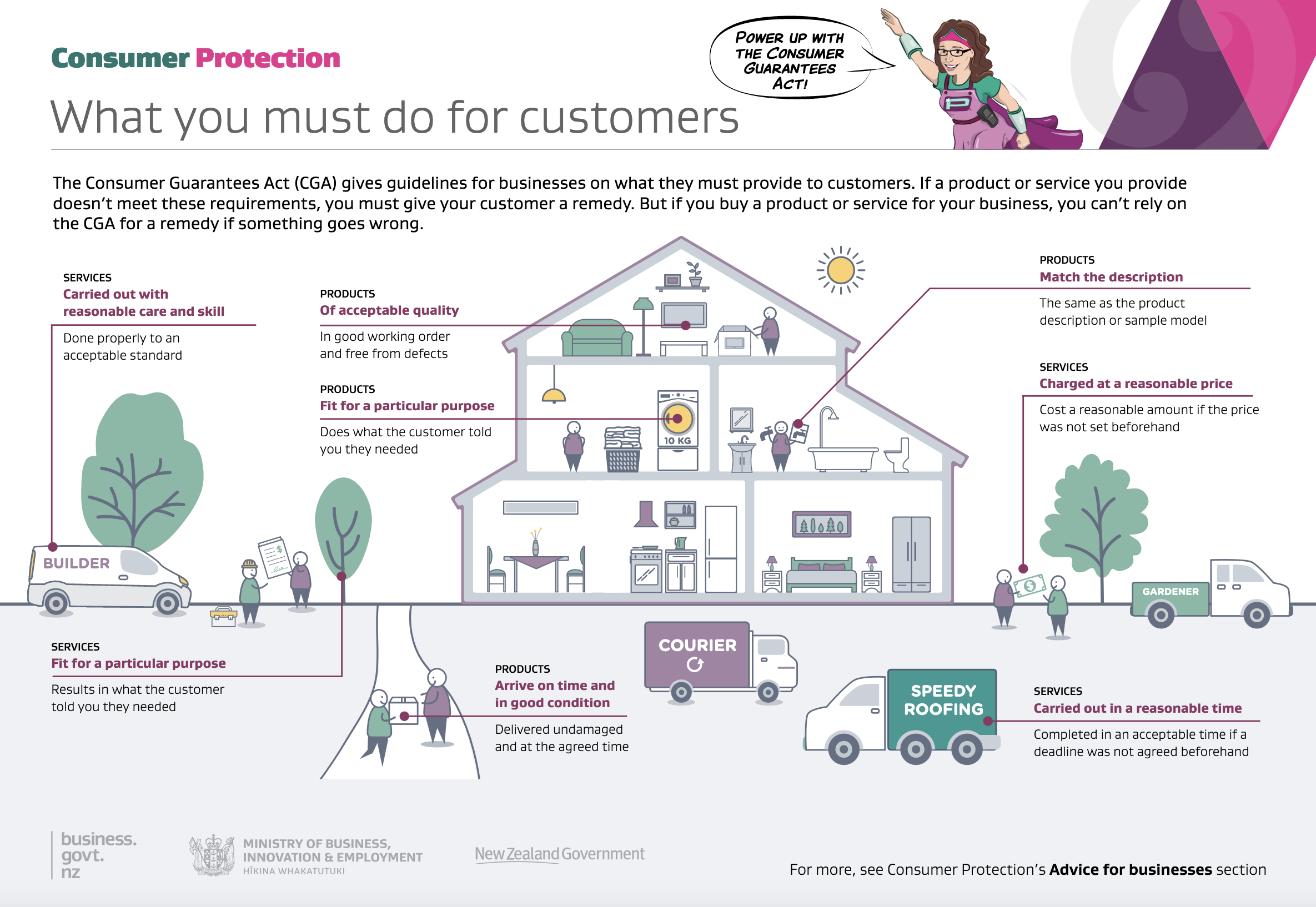

The image below provides an overview of what you must do for customers under the Consumer Guarantees Act 1993. You can download a copy here for future reference.

Note that while the Consumer Guarantees Act 1993 only refers to ‘consumers’, the guidance provided by the government agency, Consumer Protection, mainly uses the term ‘customer’ in its guidance for businesses. The definition for ‘consumer’ in the Act can be considered the same as a customer.

Failing to meet a guarantee

If any service or product does not meet a promised standard or guarantee, the customer has the right to request and receive a solution (referred to in law as a remedy). The nature of the remedy, and who it must be provided by, will depend on the nature of the issue.

If the issue is particularly serious, the customer is entitled to ask for a refund or a working replacement.

A serious problem could involve:

- an issue that would probably have prevented or stopped a customer from buying the item if they had been aware of it

- safety issue(s)

- significant differences in the item or service provided than the original example or description

- an item being unsuitable for the purpose it was intended to meet and cannot be repaired in a reasonable timeframe.

If the issue is minor, the customer is not able to cancel the transaction and immediately ask for their money back. They are obliged to give the vendor a reasonable opportunity to fix the issue at no extra charge to the customer and in a suitable time frame.

It is important for your business to have policies and procedures in place for many aspects of business operations, including how to respond to customer complaints. Policies and procedures are covered in the next module.

When these guarantees don’t apply

"You don’t have to give a remedy if the customer:

- Got what they asked for but simply changed their mind.

- Misused or altered a product in any way that caused the problem, e.g. not following instructions for use.

- Damaged, lost or disposed of the products after delivery.

- Knew about the fault before they bought the product.

- Asked for a service to be done in a certain way against your advice or was unclear about what they wanted.

- Took an unreasonable time to return the products or cancel the service.

- Experienced a service problem that was outside of your control, e.g. a natural disaster, or was caused by someone you are not responsible for.” (Consumer Protection, no date a)

Case Study

Refund Request for a Used Product

You run a small online electronics store specialising in refurbished smartphones. A customer recently purchased a refurbished smartphone from your store and used it for several weeks without any issues. However, the customer now claims that the phone has developed a fault and is demanding a full refund.

Analyse the scenario, considering the principles of the Consumer Guarantees Act 1993. (The following questions will help with your analysis of the situation)

- Why do you think the customer's request for a remedy may not apply in this situation?

- How could the business explain to the customer why a remedy may not be provided?

- What options could the business offer to resolve the situation fairly?

- How could the business communicate these options to the customer effectively?

- What considerations should the business take into account when deciding on a resolution?

- How could the business ensure that the customer understands the reasons behind the decision?

Resolution: Summarise your findings regarding the application of the Consumer Guarantees Act 1993 to the scenario. Then, propose a fair and reasonable resolution to the situation in 1-2 sentences. Your resolution should consider both the rights of the customer and the responsibilities of the business under the Act.

Product requirements

Product safety

The Consumer Guarantees Act 1993 requires that all products sold in New Zealand should be ‘safe’. The Fair Trading Act 1986 empowers the Commerce Commission to issue product safety standards. If your business is supplying products to customers, then they must meet certain standards to ensure they are safe.

Activity: Meeting product safety requirements

Read about Product safety requirements for all businesses and answer the questions that follow.

As you will have seen in Product safety requirements for all businesses, some products have specific legal requirements and there is a table outlining these. If you are considering providing any of these types of products as part of your business, note this down and the relevant agency and website where you can find out what is required.

Aside from the penalties and potential reputational damage from non-compliance product and service regulations in Aotearoa, there are the negative impacts on the customers. Read this article about the consequences of the sale of dangerous magnetic toys.

The ‘For businesses’ section of the Product Safety website is a good place to go for more information in general on product safety and can point you to where else you may need to look.

If you would like to manufacture products yourself or engage a manufacturer, it is recommended you seek out professional advice as it can be a complex undertaking.

Product weights and measures

If you sell goods by weight or measure or provide weighing or measuring equipment or services relating to such equipment, there are compliance requirements to be met under the Weights and Measures Act 1987.

“Goods sold by weight, volume, length or number must be:

- accurately weighed, measured or counted

- clearly labelled with the correct net quantity — this means the product itself, not product + packaging.

Equipment and processes used to weigh or measure goods must be accurate. The Act also specifies which measuring units, e.g. kilogram, metre, millilitre, must be used for certain types of goods.” (Consumer Protection, no date b)

If you are considering providing products by weight or measure or equipment related to this then the ‘Trade measurement for business’ section of the Trading Standards website is a good place to get more information.

Some measuring devices require regular checking and verification to show that they are fit for purpose or safe to use. This requires that they are ‘calibrated’ against the weight or measure they’re supposed to be accurate for and tested by a specialist. Examples are some types of electrical equipment in a Bed and Breakfast (BnB) establishment, or health equipment or devices, such as autoclaves and sterilisers. In some contexts these must be checked annually and clearly ‘tagged’ by a reputable specialist to show they are accurate and comply.

Industry-specific requirements

There are other industry-specific compliance obligations when it comes to providing products and services. For example, your business may need to join a national register, such as with motor vehicle traders under the Motor Vehicle Sales Act 2003 or financial providers under the Financial Service Providers (Registration and Dispute Resolution) Act 2008. Another example is the requirement for food businesses to declare allergens on food labels. If any of these examples apply to your business, click on the relevant linked text to find out more information.

As mentioned earlier in this module, when trying to find information about the industry-specific compliance obligations of your business, using the Compliance Matters tool is a good place to start. Mentors who know your industry and organisations that represent your industry or sector can also be a valuable source of information about legislation.

Customer information

It is likely that your business will gather information from its customers. Only collect the information that you need and keep this safe and secure. This is to prevent other people from accessing sensitive data or misrepresenting a person. The Privacy Act 2020 governs how your business can collect, store, use and share customer information. The Act has 13 privacy principles:

- Purpose for collection

- Source of information - collection from the individual

- What to tell the individual about collection

- Manner of collection

- Storage and security of information

- Providing people access to their information

- Correction of personal information

- Ensure accuracy before using information

- Limits on retention of personal information

- Use of personal information

- Disclosing personal information

- Disclosure outside New Zealand

- Unique identifiers

Download A quick tour of the privacy principles for future reference. This document provides an overview of each of the privacy principles.

Some industries and types of personal information have codes of practice which change how the Act applies to them. You can find out more about the Privacy Act 2020 and how it interacts with these codes and other laws at the Te Mana Mātāpono Matapu Privacy Commissioner website.

Case Study

Netflix

Netflix is a global streaming service that provides a wide variety of TV shows, movies, anime, documentaries, and more. Over the years, Netflix has revolutionised the entertainment industry by introducing the concept of binge-watching and producing original content.

Netflix regularly gathers feedback from its customers through various channels, including surveys, ratings, and viewing data analysis. This feedback is crucial for understanding customer preferences, improving the user experience, and making decisions about content creation and acquisition.

- Research and identify at least two methods Netflix uses to gather feedback from its customers.

- Briefly discuss the importance of customer feedback for a business like Netflix.

- What are some of the challenges businesses might face in gathering and interpreting customer feedback?

- Reflect on the impact of customer feedback on your own experiences as a consumer.

- Consider how Netflix might ensure the ethical collection and use of customer data.

- Reflect on whether you would implement a customer feedback system in your future business.

Importing advice

You may be considering importing products for your business due to cheaper prices or for better range or quality of products. This can be a more involved process compared to sourcing products from within Aotearoa.

Business.govt.nz provides 10 tips and questions to consider before you import:

- Is there a local market for the goods you want to import?

- Are you legally able to import these items into New Zealand?

- The costs of importing

- Is importing actually cost effective?

- Can you afford to import?

- The risks of importing

- Dealing with exchange rate fluctuations

- Choosing a reliable overseas supplier

- Dealing with overseas suppliers

- Trading terms and customs requirements

These are elaborated on further in this Business.govt.nz page called 10 tips before you import. Make sure to expand each tip by clicking on the ‘Read full’ arrows.

If you are considering having your goods manufactured for you overseas – as opposed to importing existing goods – read this webpage called Manufacturing overseas for an overview of this subject.

Exporting advice

Exporting doesn’t only apply to physical products. For example, you could provide knowledge through consultation services to someone living in Denmark or have developed an app that is also available to Australian customers, and both would be considered exporting.

Exporting offers various benefits to businesses, such as increased sales in new markets, cost efficiency through production scale-up, risk diversification across countries, and exposure to new ideas and technologies. However, it also comes with challenges, including new costs for customs and compliance, navigating complex regulations, handling legal and political risks in foreign markets, and addressing issues like war or foreign exchange restrictions.

International logistics, shipping and freight-forwarding, and the associated documentation and compliance can also be significant hurdles for a new entrant into a market or industry.

Successful management of these challenges involves obtaining expert advice and strategic planning, including the development of effective export and risk management plans.

There are several government agencies that can help you with your exporting journey:

- Te Tai Ōhunga New Zealand Export Credit (NZEC)

- Manatū Ahu Matua Ministry for Primary Industries (MPI)

- Te Mana Ārai o Aotearoa New Zealand Customs Service (Customs)

- Te Taurapa Tūhono New Zealand Trade & Enterprise (NZTE)

- Manatū Aorere Ministry of Foreign Affairs & Trade (MFAT)

Take a look at this webpage that contains a series of short videos you can watch to introduce you to each of these agencies and how they can help. You can scroll below the videos for further information.

The Regional Business Partner (RPB) Network has been mentioned earlier in this module. The RPB Network is a government initiative that aims to support the growth and development of small and medium-sized businesses across the country.

Watch this video case study about The Herb Farm in Manawatu, some of the challenges they’ve faced, and how the RPB Network has helped them in several aspects of their business – including getting started with exporting.

Importing and exporting obligations

Read this page on the Business.govt.nz website called Importing and exporting laws to get a better idea of your obligations in your area of interest, whether it is importing, exporting or both. When you have done so, complete the relevant activity or activities below.

Activity: Importing

If you are interested in importing, read the Importing and exporting laws webpage above, and answer the following questions.

Activity: Exporting

If you are interested in exporting, read the Importing and exporting laws webpage above, and answer the following questions.

The Commerce Act 1986 promotes competition and regulates anti-competitive behaviour in the business sector for the benefit of customers.

Here are some reasons why competition is good for business, customers and economic growth:

- Competition drives businesses to innovate in order to gain a competitive edge. Businesses are motivated to develop new products, services, and processes to differentiate themselves and attract customers.

- Competition encourages businesses to operate more efficiently. Companies strive to reduce costs, improve productivity, and enhance their overall operations to stay competitive.

- To stand out in a competitive environment, businesses focus on improving the quality of their products and services. This results in better overall quality for customers.

- Competition offers customers a variety of choices. When businesses compete, customers have the freedom to choose products or services that best meet their needs, preferences, and budget.

- In a competitive market, businesses often lower their prices to attract customers. This benefits customers by providing them with more choices at lower costs.

Watch the three videos below which each cover a type of anti-competitive behaviour:

- Dividing up and sharing markets (1:31 minutes)

- Bid rigging and discussing tenders (1:36 minutes)

- Price-fixing (1:17 minutes)

Download the Commerce Commission’s flyer Competing in business for easy reference. Note that the flyer contains links to the videos above.

Other anti-competitive situations are monopolies and duopolies. A monopoly is where one supplier dominates the market for a product or service. A duopoly is where two suppliers dominate the market. Both situations make it difficult for new businesses to enter the market and bring about true competition.

A recent example of a duopoly is Aotearoa’s grocery industry, where Foodstuffs and Woolworths control the vast majority of grocery stores. Between 2020 and 2022 the Commerce Commission carried out a market study into the grocery sector and found that the grocery sector does not provide true competition and as a result, customers are paying too much for their groceries. Read this one-page summary of the findings.

This brought about the Grocery Industry Competition Act 2023. Read the following RNZ article and listen to the audio which explains why this Act is important and the key measure the Act provides: Bill tackling supermarket duopoly to become law. (A Bill is the name given to an Act before it is passed into law).

Cartel conduct

A cartel is where two or more businesses agree not to compete with each other. Price-fixing, bid-rigging and market sharing (explained in the videos above) are all types of cartel conduct. Restricting the output or acquisition of goods and services is also considered a cartel activity.

“Cartel conduct can result in higher prices and a reduction of choice and quality for consumers. Under the Commerce Act, businesses and individuals can face large fines if they have been part of a cartel or attempted to be part of a cartel. Individuals can be banned from running a company and face jail time of up to 7 years.” (Commerce Commission, 2023)

Activity

Article: Penalty imposed on freight forwarders for cartel agreements.

Read this article about two international freight forwarding companies that engaged in longstanding cartel agreements with their competitors.

Further information concerning avoiding anti-competitive behaviour can be found in this section of the Commerce Commission’s website.

Summary

In this topic we’ve covered the key legislation that all businesses must comply with as well as pointing to those which may only be relevant to some businesses, depending on their type of products and services and how they provide or source these. We’ve also pointed out some of the consequences of non-compliance and that it is important to seek help to ensure compliance when you are unsure or considering a complex undertaking such as manufacturing. The legal requirements covered in this topic are, of course, not the only ones to comply with when starting or running a small business; other legislation has been raised earlier in this module and will continue to be throughout the rest of the module and programme.

As mentioned earlier in this module, taking notes of the relevant legislation as they are brought to your attention will help you keep on top of these for your assessments and the success of your business.