Some businesses post transactions involving accounts receivable account in the general ledger. This method works for a business that has a small number of customers. However, for businesses that have a large number of customers using the general ledger to manage accounts receivable is not practical as it is very difficult to identify:

- how much stock or what services individual customers have purchased

- which customers have paid their account

- which customers have balances outstanding at a point in time.

Instead of using a single general ledger account, a more efficient way for businesses to keep track of individual balances is by using a control account and subsidiary ledgers. The accounts receivable subsidiary ledger sits outside the general ledger. The individual account balances in the subsidiary ledger equal the total of the control account in the general ledger.

The advantages of using an accounts receivable subsidiary ledger include:

- removes excess detail from the general ledger

- provides an internal checking system

- reduces the likelihood of fraud as different staff maintain the control account and the subsidiary ledgers.

The Accounting Process Using Account Receivable Subsidiary Ledgers and Control Account

Every time a business transaction occurs, an audit trail is generated. This audit trail can be generated in paper or electronic format and is known in bookkeeping as a source document. Source documents are important to the bookkeeping process because they serve as physical evidence that a financial transaction has occurred. Let’s look at some of the source documents you will encounter through the accounts receivable process.

Purchase Orders

A purchase order is a document sent from a buyer to order goods or services from a seller. It includes the following information:

- identity of the buyer

- ABN of the buyer

- date

- a purchase order number

- identity of the seller

- description of the goods or services to be supplied

- how and when the goods or service will be delivered

- price from the supplier’s price list or agreed with the supplier

- signature of the authorised person

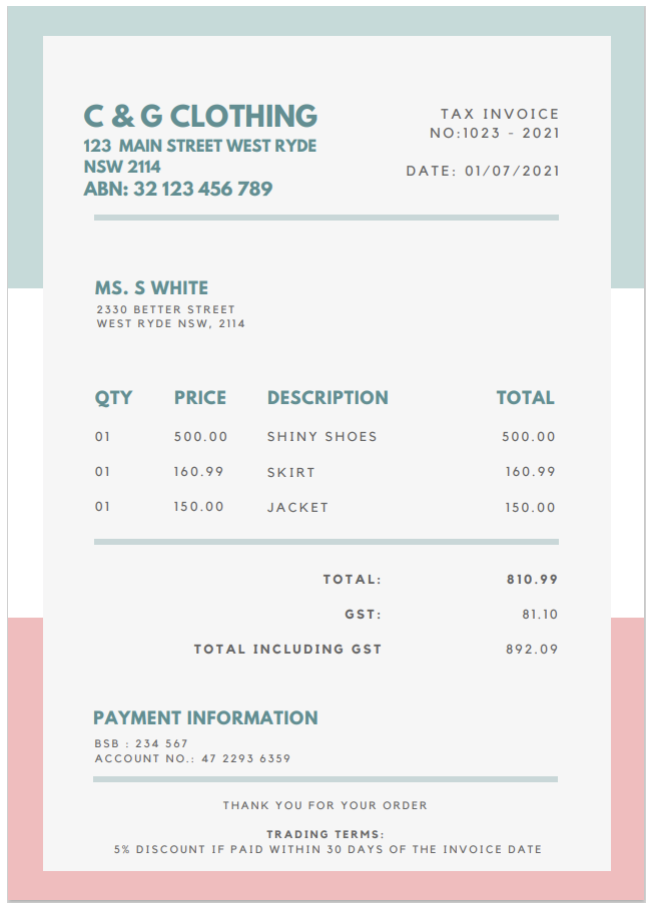

Tax Invoices

Whenever a seller provides goods or services on credit, a tax invoice is prepared and sent to the buyer requesting payment. A tax invoice is needed by the buyer to claim an input tax credit from the Australian Taxation Office (ATO). Both the purchase order and the sales invoice acts as an accounting source document for the transaction.

Once issued, a tax invoice becomes a legally binding contract that creates an obligation for the buyer to pay. Because of this, it cannot be cancelled or removed from sales records.

There are certain details that must be included on a valid tax invoice:

- Tax invoices for sales less than $1,000.00 must include:

- that the document is intended to be a tax invoice

- the identity of the seller

- the Australian Business Number (ABN) of the seller

- the date the invoice was issued

- a description of the goods or services sold, including quantity and price

- the GST amount (if any) payable

- the extent to which each sale on the invoice is a taxable sale (that is, the extent to which each sale includes GST)

- Tax invoices for sales over $1000.00 must also include:

- The buyer's identity or ABN

If a tax invoice is missing or contains incorrect information, it is not considered a valid tax invoice and needs to be replaced with a correct and valid tax invoice.

Where there is more than one taxable sale on a tax invoice, there are two rules that must be applied, the total invoice rule and the taxable supply rule. To read more about these rules and the requirements of tax invoices, click here.

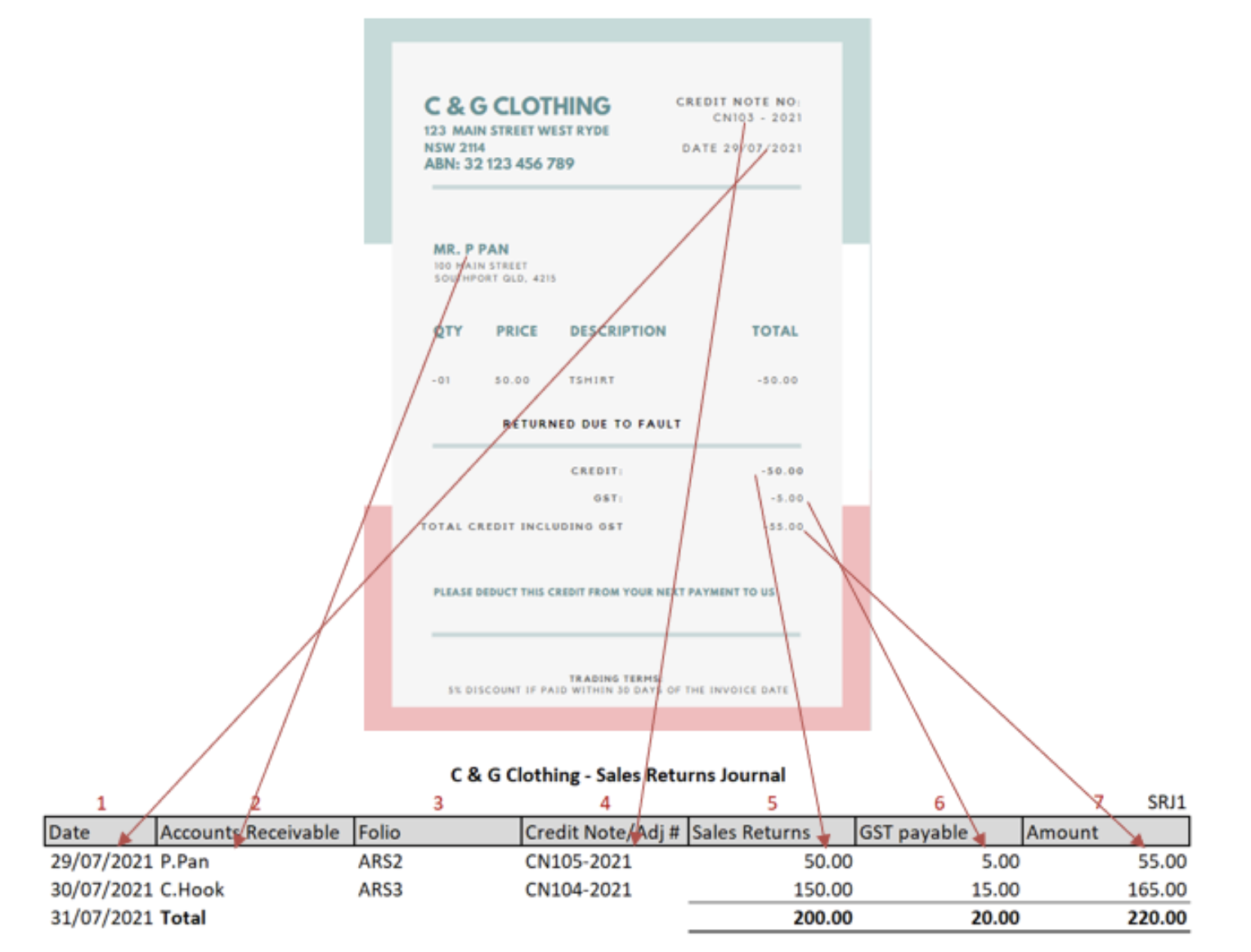

Credit Notes and Adjustment Notes

A credit note is a document issued by the seller to acknowledge goods have been returned by the buyer and the amount owing by the seller has been reduced. The goods may have been returned because they were faulty, damaged, did not meet the buyers’ expectations or did not match what was ordered.

Credit notes include the following information:

- document type - Credit Note

- the identity of the seller

- the ABN of the seller

- the date the credit note was issued

- a description of the goods or services being returned

- credit note number

- the amount of the adjustment

- details of any GST included in the credit note

- the identity of the buyer

An adjustment note is similar to a credit note. It is issued by the seller to acknowledge an agreed reduction in the amount still owing by the buyer. The reduction may be due to an incorrect price, incorrect invoice details or an order being short delivered.

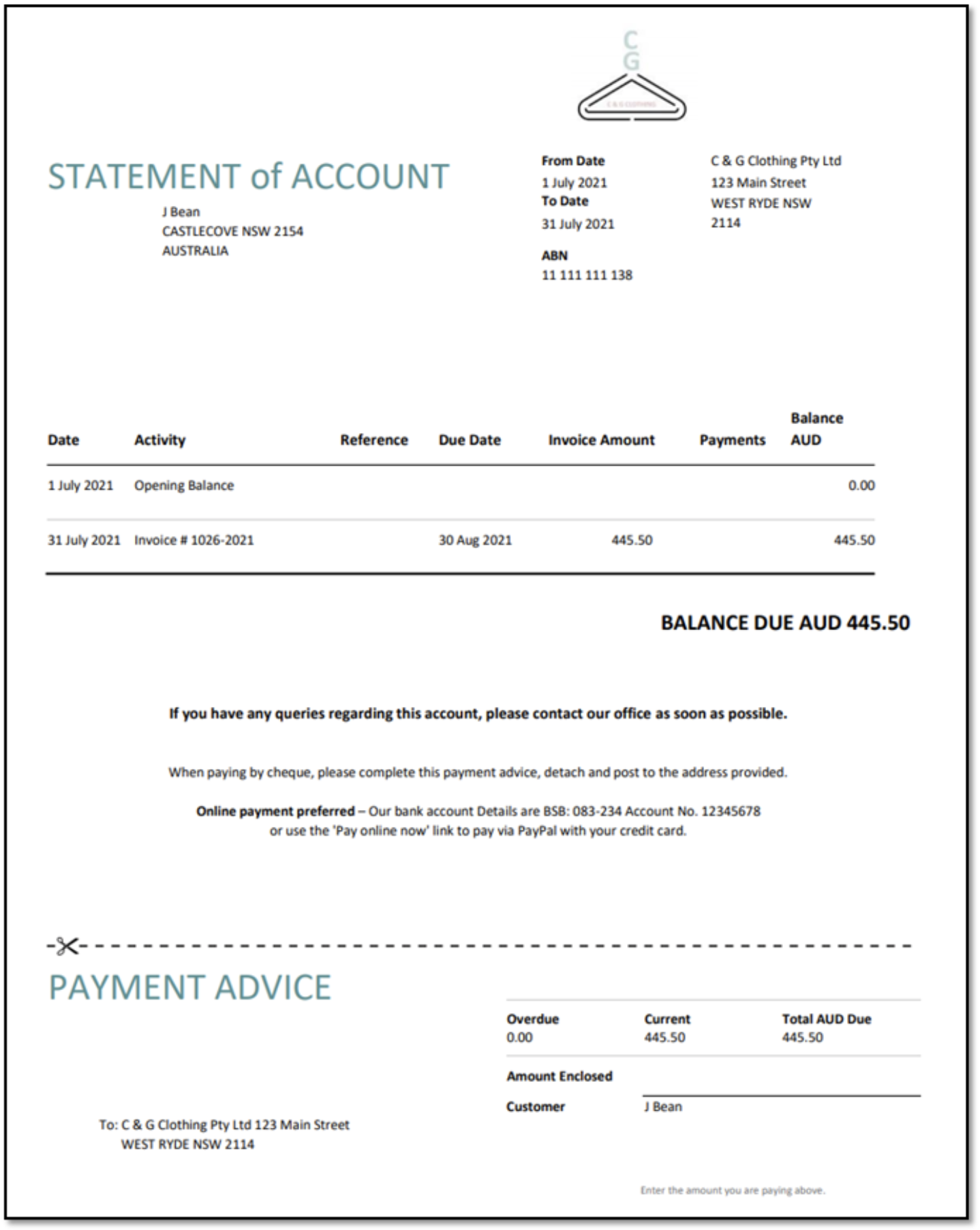

Statement of Account

A statement of account is a document issued by the seller to the buyer. It lists all the financial transactions between the buyer and the seller within a specified time period, usually a month and includes:

- the balance owing at the beginning of the month

- invoices, credit notes and adjustments notes issued by the seller during the month

- the payment date and amount of each payment received from the buyer during the month

- the balance owing at the end of the month

- a payment slip that can be remitted back to the seller with payment.

Often a Statement of Account will include a section that lists ‘time buckets’ highlighting how overdue a particular amount is. For example:

- Current: $85.00

- 0-30 days: $92.00

- 31-60 days: $0.00

- 61-90 days: $0.00

- 90 days+: $0.00

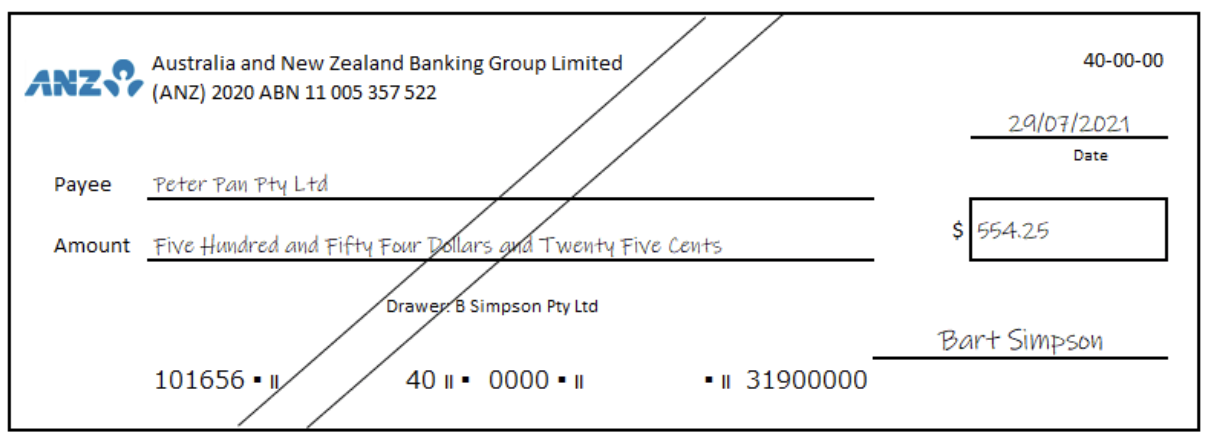

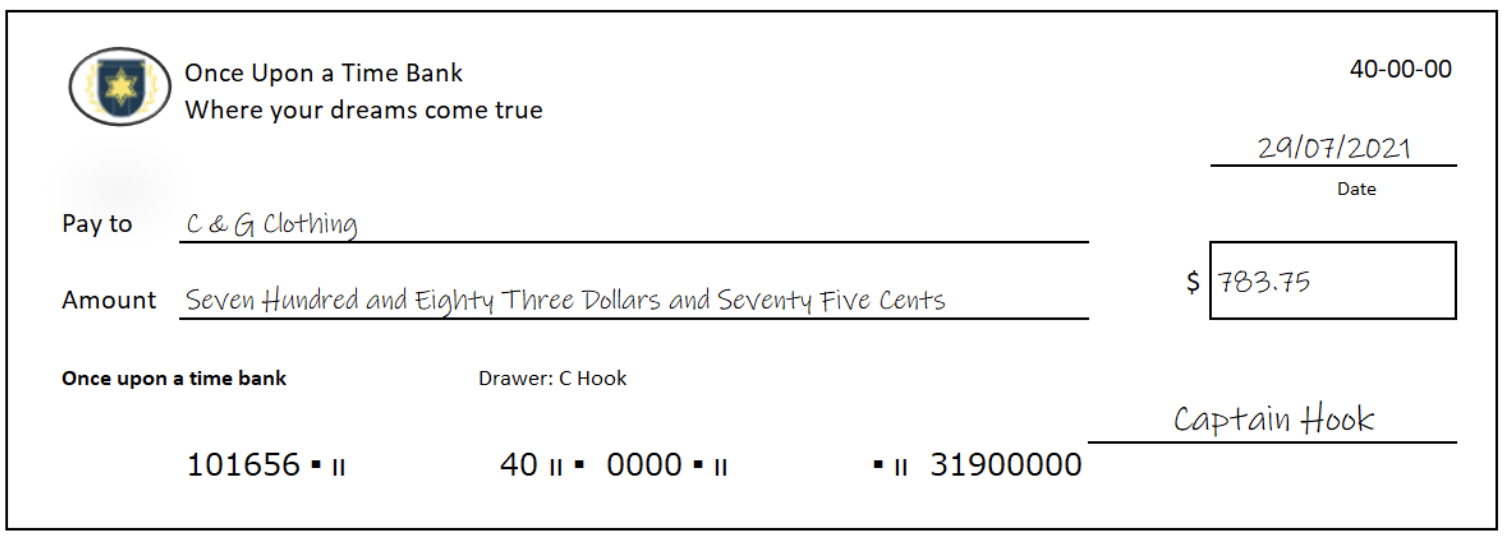

Cheque

A cheque is a form of payment that authorises the bank to transfer money from one account to another. The cheque butt remains in the cheque book as a record of:

- who the payment was made to

- the amount of the payment

- the date of the payment

- what the payment was for.

A cheque may be sent to a seller by a buyer as payment for the amount outstanding on a Statement of Account. Adding crossed lines to a cheque increases its security. It means that the cheque cannot be cashed by a bank teller but must be paid into an account of the payee.

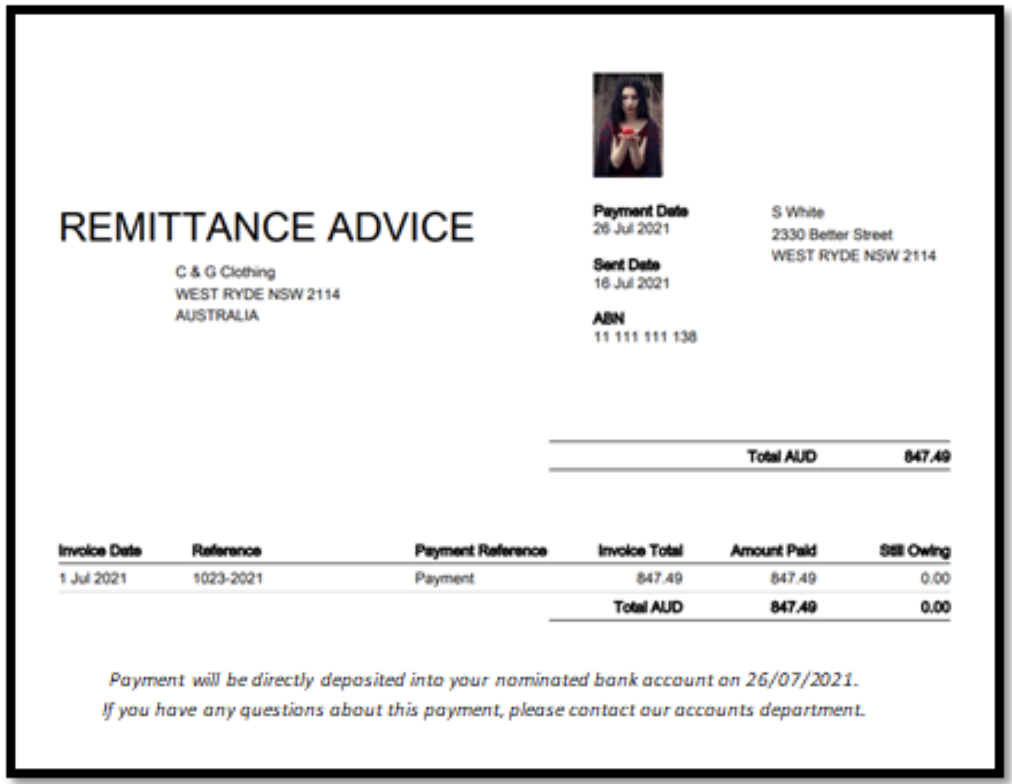

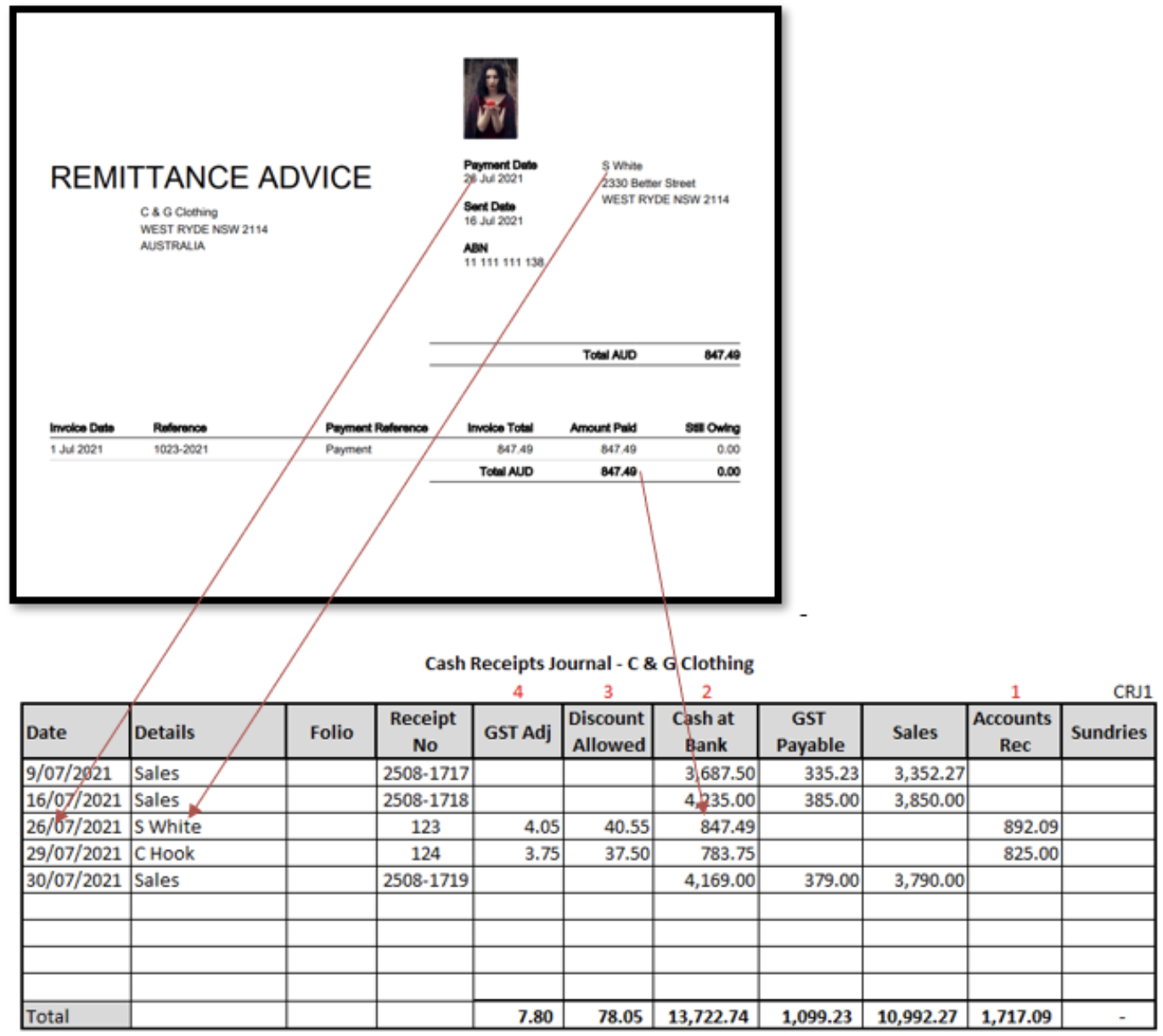

Remittance Advice

A remittance advice is documents sent by the buyer to the seller that advises the payment is being prepared and will be remitted by a certain date. Sometimes the payment will accompany the remittance advice.

Receipt

A receipt is a document sent to the buyer from the seller acknowledging payment has been received.

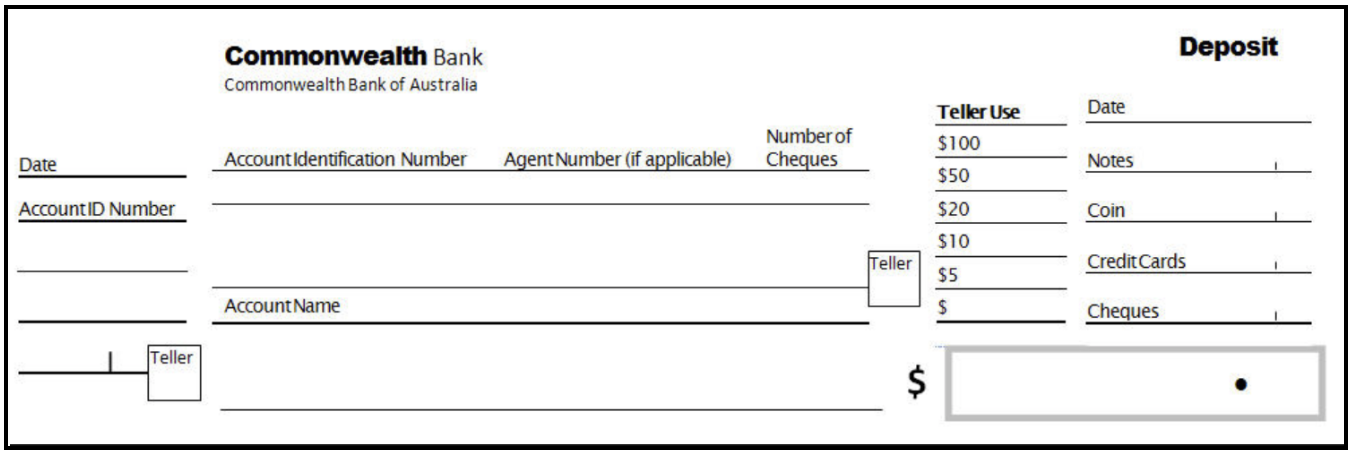

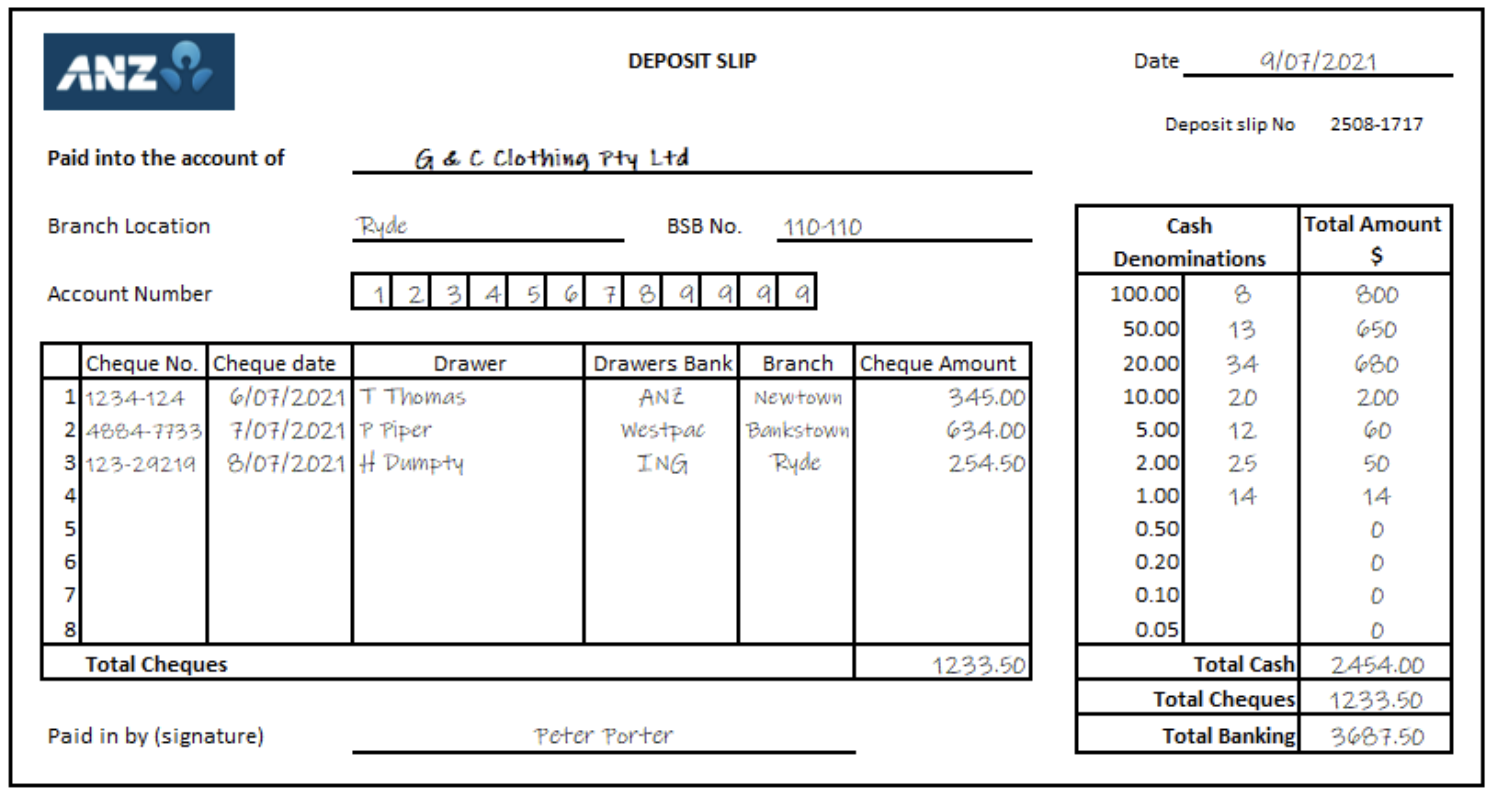

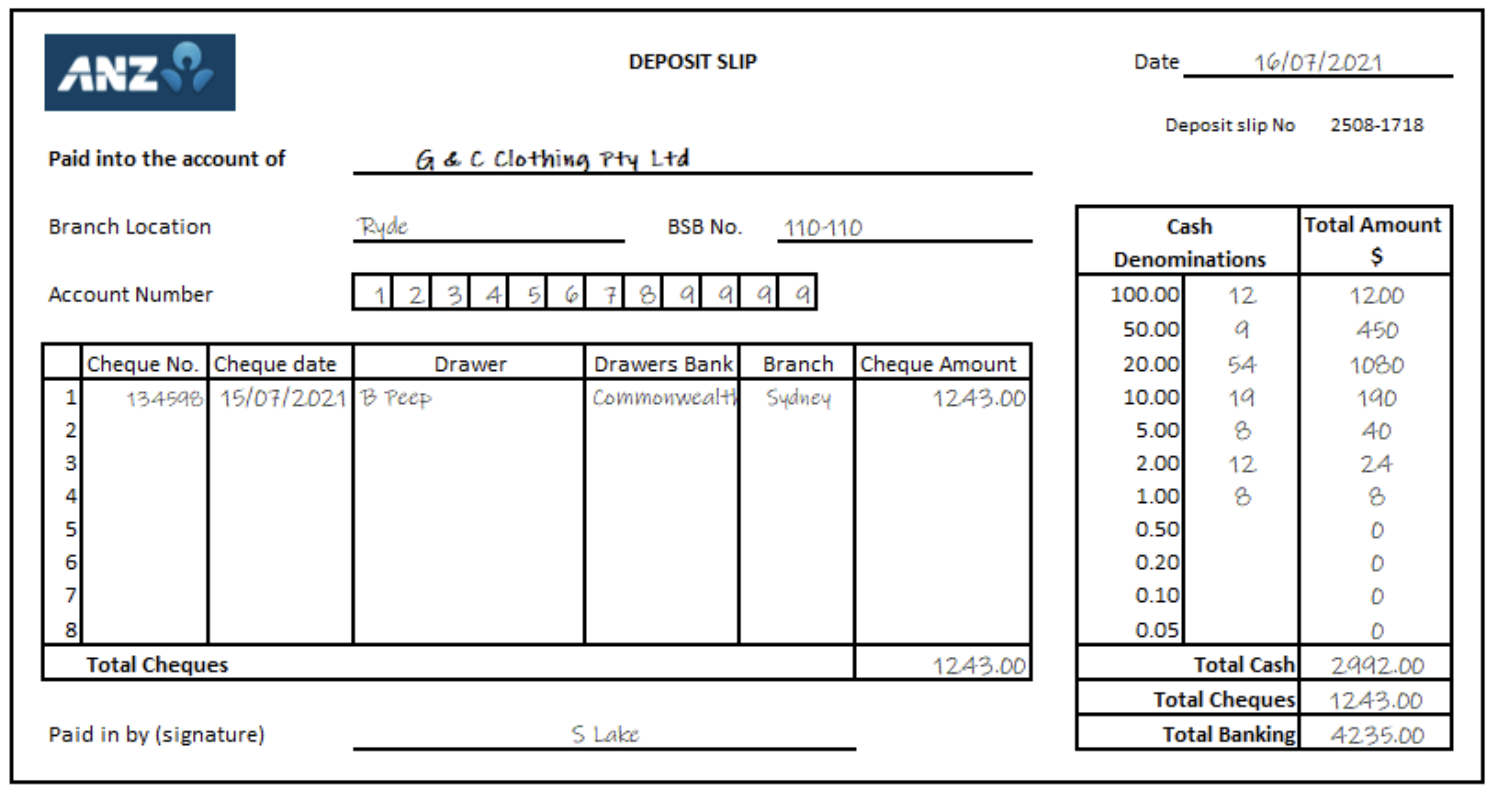

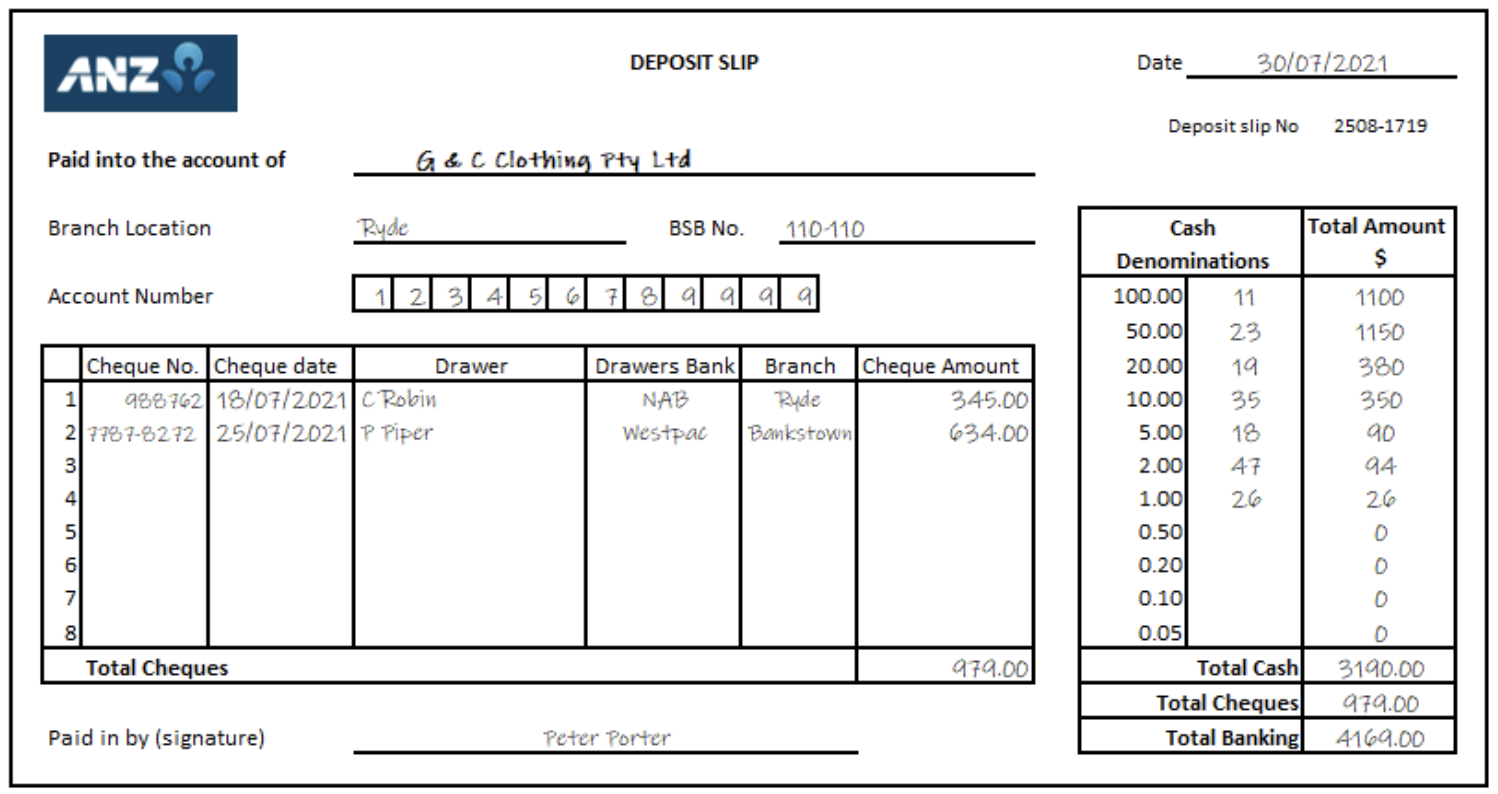

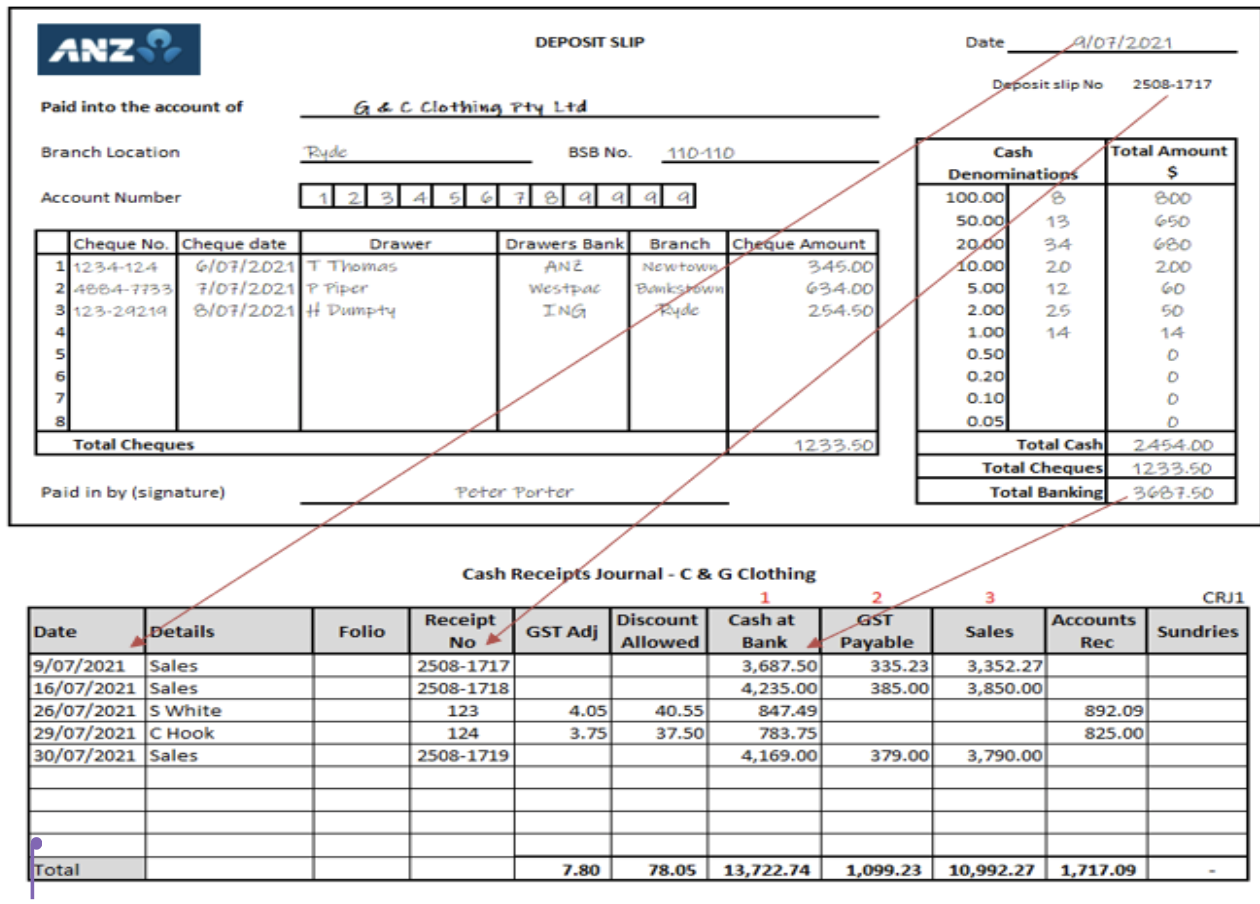

Bank Deposit Slip

If a business accepts cash or cheques as a form of payment, someone within the business has to physically bank the cash and cheques into the business bank account. A bank deposit slip is evidence money has been deposited into a bank account. The deposit slip includes the number and dollar amount of coins and notes and lists the cheques included in the total deposit. The bank teller counts the cash and cheques and confirms the totals agree with the amounts recorded on the deposit slip before entering the deposit into the bank's system.

Businesses today have the option of using a manual or computerised accounting system to present and organise their financial data.

A manual accounting system requires an accountant or bookkeeper to record and post business transactions to the general journal, general ledger and worksheets by hand. This process can be done using either paper journals and ledger sheets or in a computer program such as Excel.

Computerised accounting systems like Xero, MYOB or Quickbooks, are designed around modules, e.g. general ledger, accounts receivable, inventory, sales. Once a transaction is entered, it is automatically updated in all the accounts and modules to which it relates. For example, when a sale is entered into Xero, the system automatically updates the accounts receivable account in the General Ledger. This change is then carried through to the Balance Sheet and the Profit & Loss Statement.

Both manual and computerised accounting systems are based on the same accounting principles. They differ only in their mechanics. Throughout this module, we have used the terms accounts receivable and accounts payable. In many businesses, the term trade debtors is used in place of accounts receivable and trade creditors is used in place of accounts payable.

In this module, we will be processing transactions for a fictitious company, C & G Clothing Pty Ltd, using a manual accounting system. We will use Microsoft Excel to record the transactions and generate reports. C & G Clothing uses both an accounts receivable and accounts payable subsidiary ledger. Jo is the accounts receivable officer for the organisation.

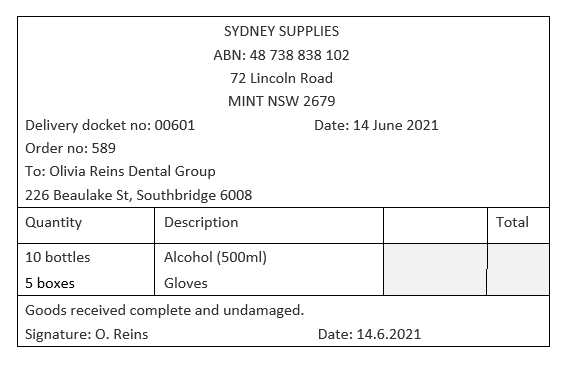

Different source documents may require specific processes for checking and are described below.

The invoice details should be checked by quantity, price and description against the original order. They should also be inspected against delivery dockets to ensure that the goods are in good order and in good condition.

For receipts, information such as receipt methods (e.g. cash, cheque or credit card) must be recorded.

Although it is the cheque butt that is the source document, the details on the cheque are also important. We discuss the importance of authorisation in relation to cheques elsewhere in this guide. The information recorded on the check must, however, be the same as the information recorded on the check stub (or counterfoil). It should also be in agreement with the details of the license document from which the check was prepared. One of the key control procedures for checks should be performed by the person who signs the check. You must ensure that the check, check butt and permission are all agreed upon before you sign the check.

If an examination of an invoice identifies an error, this should be resolved with the supplier as soon as possible. The reporting process for errors may differ depending on the organisation's policies and procedures. If the action required goes beyond the normal job description and the duties of the person who found the error, the matter should be referred to their supervisor in accordance with the policies and procedures of the organisation.

The following provides an example of how to identify and resolve a discrepancy within source documentation:

Example: Case 1: Delivery Docket

Example: Case 1: Tax Invoice

Example 1: Resolving a discrepancy between a delivery note and invoice

What should you do if an invoice has a discrepancy with a delivery docket?

The discrepancies in the source documents above are highlighted in red. In such cases, you should do the following:

- Send an internal memo to inform the supervisor of the department of the error

- Ask the supervisor to obtain a tax adjustment note from the supplier to rectify the problem.

Example: Case 2:

Example 2: Resolving a discrepancy between a delivery note and invoice

What should you do if a cheque predates the invoice?

The discrepancies in the source documents above are highlighted in green. In such cases, you should:

- Ask the issuer of the cheque to change the date and to initial the change.

Receipts can be from any of the following:

- Bankers orders

- cash

- cash journal entry

- cheques

- personal

- bank

- credit cards

- direct

- telephone

- direct debits

- direct drawing

- postal orders

All cash receipts must be cross-checked, proofread, and checked against the source documents.

When checking the accuracy of any source document, you should consider the following:

- Is the date correct?

- Are the details of the supplier or customer correct?

- Is the document mathematically correct? Are the calculations correct?

- Are there any other obvious errors? (This may include price or quantities and description of the goods or services.)

The validity of the document should also be verified. This may include:

- Does it represent a valid transaction? For example, does the invoice represent goods or services that the organisation has received? This includes instances where goods or services may not have been completely supplied.

- Has this document been received and/or processed previously?

Errors when receipting payments may occur because of:

- deduction of brokers or agents’ commissions

- incorrect account allocation

- key stroke errors

- overpayments

- part payments

- system errors

- underpayments.

While all errors should be resolved as soon as practicable, the processes for reporting errors may differ depending on the policies and procedures of the organisation. When the action required goes beyond the normal job description and duties of the person that located the error, they should refer the matter to their supervisor in accordance with the organisation’s policies and procedures.

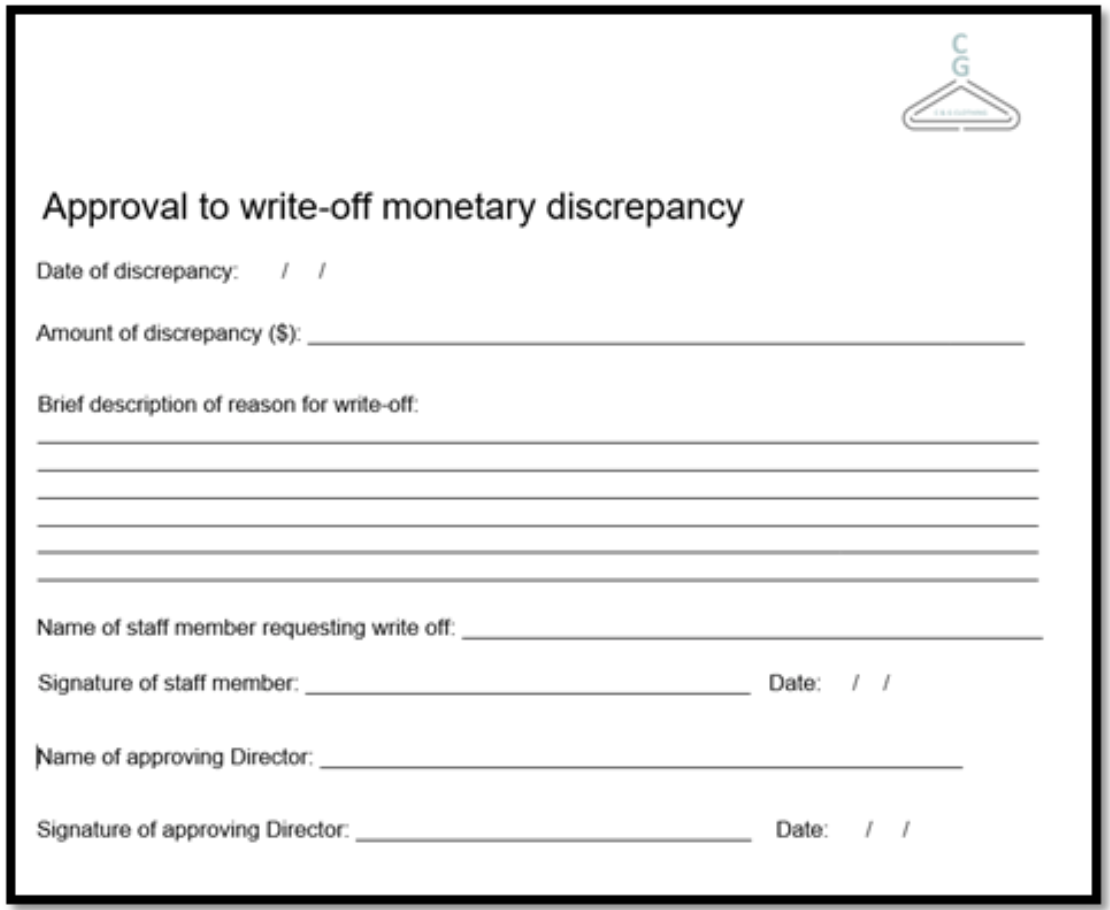

In the course of running a business, there is always the possibility that errors occur. It is essential to have checks to prevent errors from happening in the first place. When the errors are discovered, they should be quickly corrected.

Payment discrepancies can be handled in several ways for example:

- In some cases, a discrepancy might be ignored or written off. If a discrepancy is to be ignored or written off, it should be authorised by a nominated person within the organisation and be supported by appropriate documentation.

- Often small customer balances are written off when reviewing and cleaning up the accounts. When a business writes off small amounts from its accounts receivable the amounts need to be removed from the balance sheet.

Companies write off small balances when the time and money spent to collect the amount due exceeds the benefit realised by collecting the full balance. A company's policy and procedure for a small-balance write-off should be clear, and the company should review and update the policy and procedure so both continue to meet business needs.

- When a debtor pays an account with a cheque that the bank rejects when it is deposited the cheque is dishonoured. This usually occurs because the debtor has insufficient funds in their account to cover the amount of the cheque. Cheques can also be dishonoured if:

- The signature on the cheque has been forged.

- The cheque has been altered.

- The date is incorrect.

- A stop payment has been placed on the cheque.

- It is incomplete.

When a cheque is dishonoured, the bank charges a dishonour fee to the customer and added to their account. An adjustment needs to be made to correct the accounts and the payer needs to be contacted to request repayment.

- Some transactions recorded by the company during a specific period might not appear on the bank statement when it arrives, that is, un-presented cheques, unrecorded credit card transactions or deposits not credited. You will need to investigate each of these transactions. This may mean referring back to the source document and/or contacting the bank.

- Credit card payments made by the company in the statement period might not appear on the statement. Often this is a timing issue, and the funds appear on the first or second day of the next statement period. However, if payments do not appear on your statement within a few days, you should contact the payee to discuss missing payment.

- Deposits not credited are amounts deposited in the bank by the company but not entered by the time of preparation of the bank statement. They will not appear as a credit on the current bank statement. Once again this may be a timing issue and the deposit appears on the first or second day of the next statement period. If the deposit does not appear on the bank statement contact the bank to discuss this discrepancy.

Internal Controls when receipting money paid

- The receipt and appropriate recording of income from accounts receivable should be outlined in an organisations policy and procedure manual and act as an internal control to ensure the organisations physical and monetary assets are protected from fraud, theft and errors. CPA Australia has developed a guide to assist business owners in understanding the need for internal control and developing simple internal control systems. The guide includes checklists covering internal controls over accounts payable

Access the CPA Australia Internal controls for small businesses and answer the following question.

We will now build on the concepts we have look at in this module and apply them to a business scenario using the fictitious company C & G Clothing.

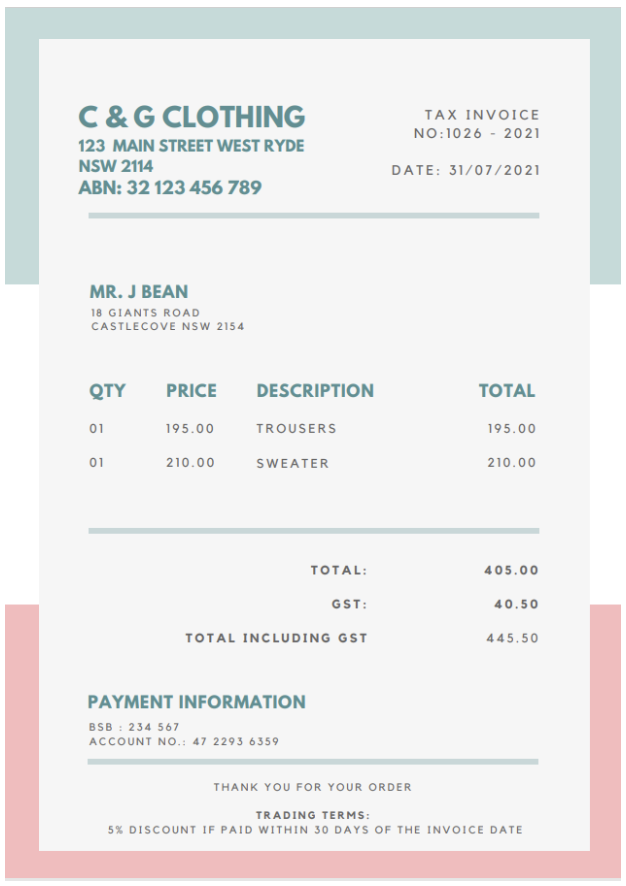

During July, C & G Clothing received four (4) purchase orders from the following customers:

- Ms S White

- Mr P Pan

- Mr C Hook

- Mr J Bean

Prior to fulfilling the orders, the sales manager contacted the accounts receivable department to check the status of each customer’s account and ensure they were not in breach of C & G Clothing’s credit terms. After receiving confirmation that there was no money outstanding, the sales department fulfilled the orders and manually generated two copies of each invoice. One copy was sent to the customer with the goods, and the second copy was sent to Jo, the accounts receivable officer, to record the sales in C & G Clothing’s accounting system.

On 29/07/2021, Mr P Pan returned a TShirt because it was faulty.

On 30/07/2021, Mr C Hook returned 1 pair of shorts and a TShirt because it was the wrong size and requested a refund.

The sales office issued a credit for both these items and forwarded copies to the accounts receivable department.

Analysing Transactions

Jo received the invoices and credit notes from the sales department and analysed them by:

- Identifying the accounts affected and the type of accounts

- Determining which accounts are increasing and decreasing

- Applying the rules of debits and credit to these accounts.

| Invoice / Credit Note No | Accounts Affected | Type of Account | Account ˄ or ˅ | Debit or Credit |

|---|---|---|---|---|

| 1023-2021 | Accounts Receivable | Asset | Increase | Debit |

| Sales | Revenue | Increase | Credit | |

| 1024-2021 | Accounts Receivable | Asset | Increase | Debit |

| Sales | Revenue | Increase | Credit | |

| 1025-2021 | Accounts Receivable | Asset | Increase | Debit |

| Sales | Revenue | Increase | Credit | |

| 1026-2021 | Accounts Receivable | Asset | Increase | Debit |

| Sales | Revenue | Increase | Credit | |

| CN103-2021 | Sales Returns | -Revenue* | Increase | Debit |

| Accounts Receivable | Asset | Decrease | Credit | |

| CN104-2021 | Sales Returns | -Revenue* | Increase | Debit |

| Accounts Receivable | Asset | Decrease | Credit |

*Sales return is considered a contra revenue account as it has an opposite effect on the net income of C & G Clothing. In other words, it reduces the net income.

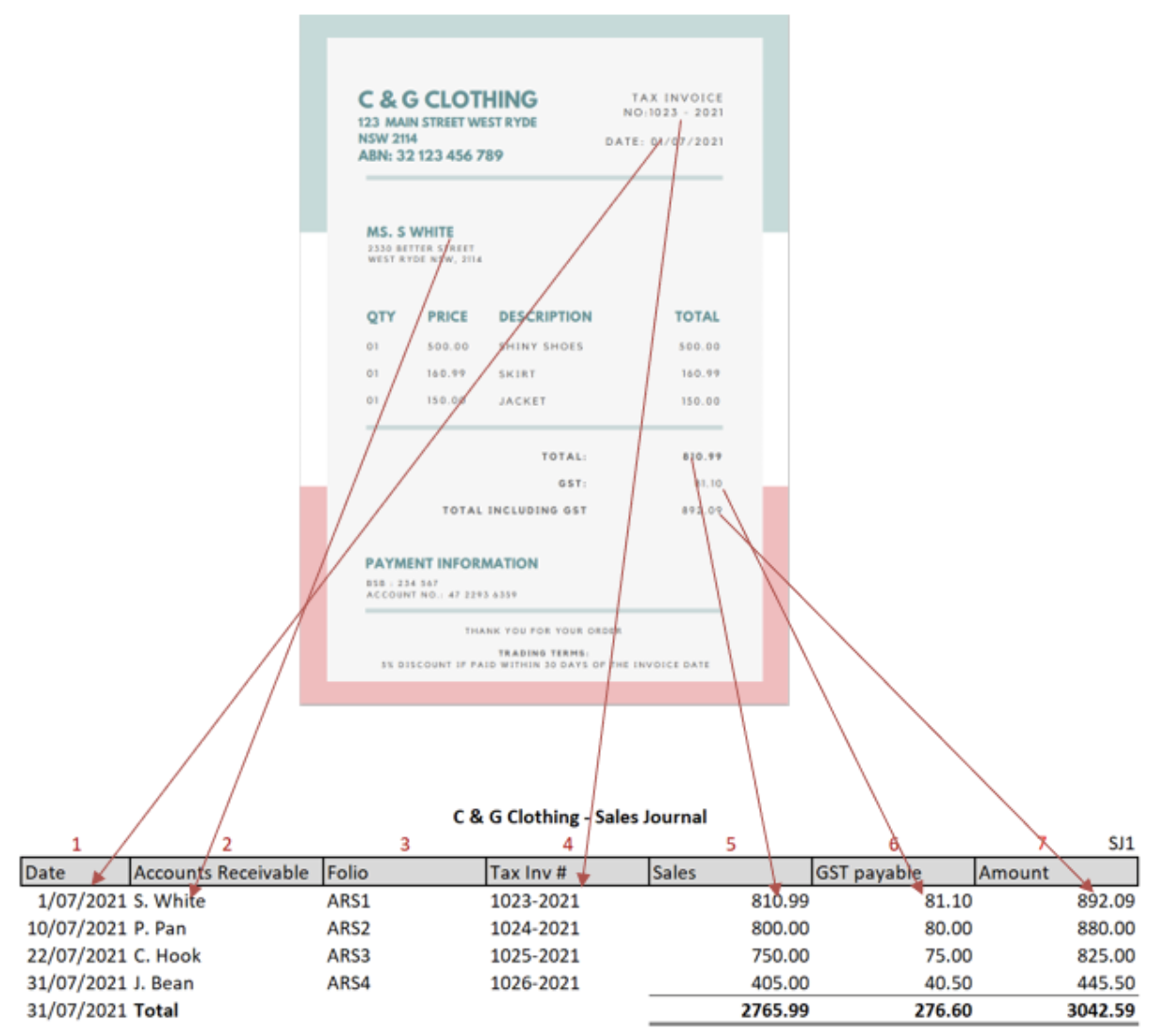

Once Jo completes his analysis of the transactions, he records them in the Sales and Sales Returns Journal.

Entering Tax Invoices into the Sales Journal

The sales journal is used to record the sale of goods and services on account. When recording transactions in the sales journal, it is good practice to record invoice numbers in sequential order to ensure that all transactions have been entered.

Information taken from the tax invoices is used to record the transactions in the sales journal. This includes:

- Transaction Date

- Customer

- Accounts Receivable ledger reference

- Sequential Tax invoice number

- Sales amount

- GST

- Total sale + GST amount

Entering Credit Notes and adjustments into the Sales Returns Journal

Information taken from credit notes or adjustments sent to customers by C & G Clothing is recorded in the sales returns journal. This includes:

- Transaction Date

- Customer

- Accounts Receivable ledger reference

- Sequential credit note/adjustment number

- Credit amount

- GST

- Total credit + GST amount

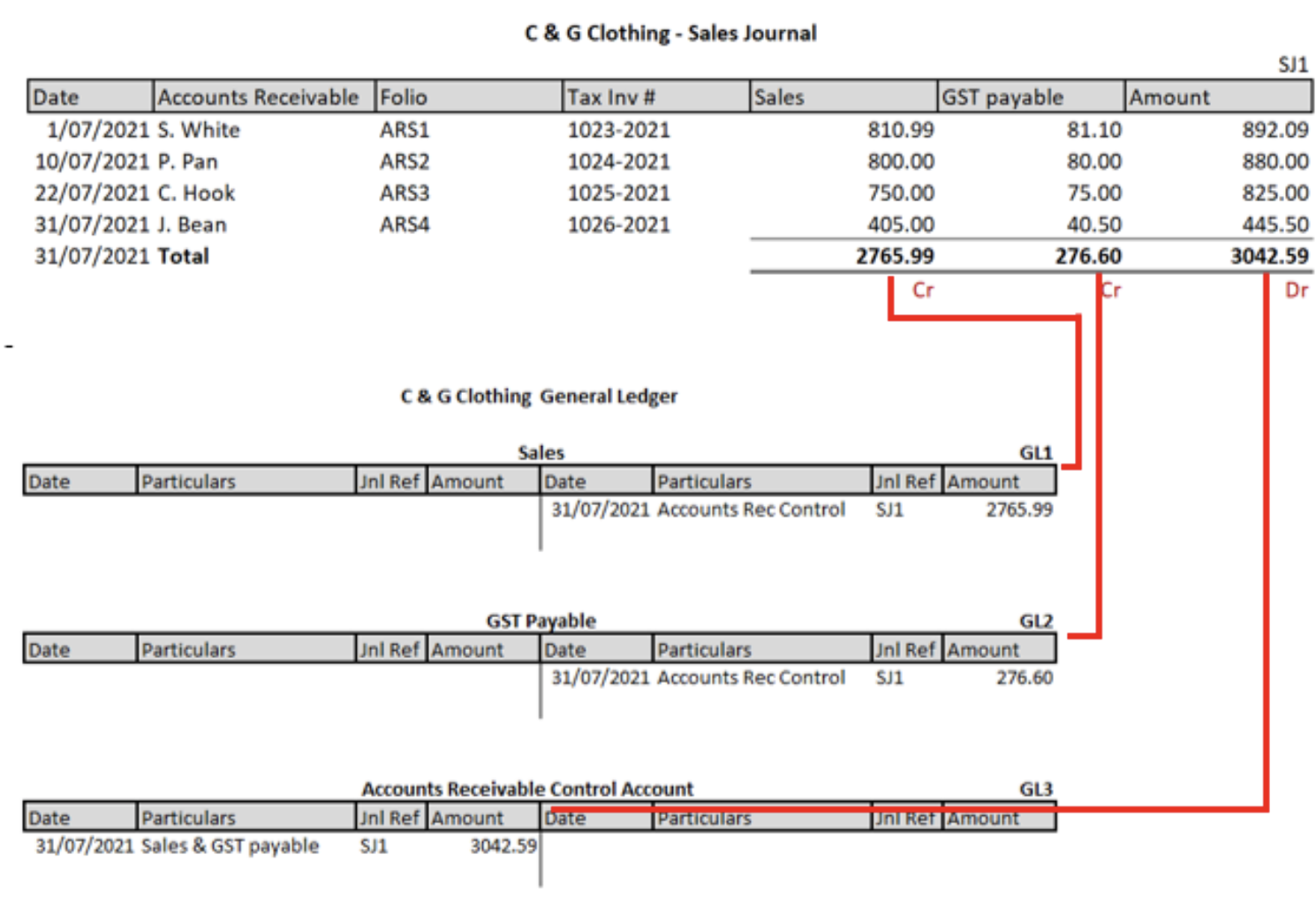

Posting from the Sales Journal to the General Ledger

On the last day of the month or period, the column totals of the sales journal are posted to the general ledger. For G & C Clothing, the column totals are:

- a debit of $3,042.59 (Amount column)

- a credit of $2,765.99 (Sales column)

- a credit of $276.60 (GST payable column)

The total of the Amount column is debited to the Accounts Receivable Control Account in the general ledger.

Note: This account is a control account and contains a summary of the total sales for the period.

The total of the Sales and GST payable columns are credited to the Sales and GST payable account in the general ledger.

The posting process from the sales journal to the general ledgers is illustrated below.

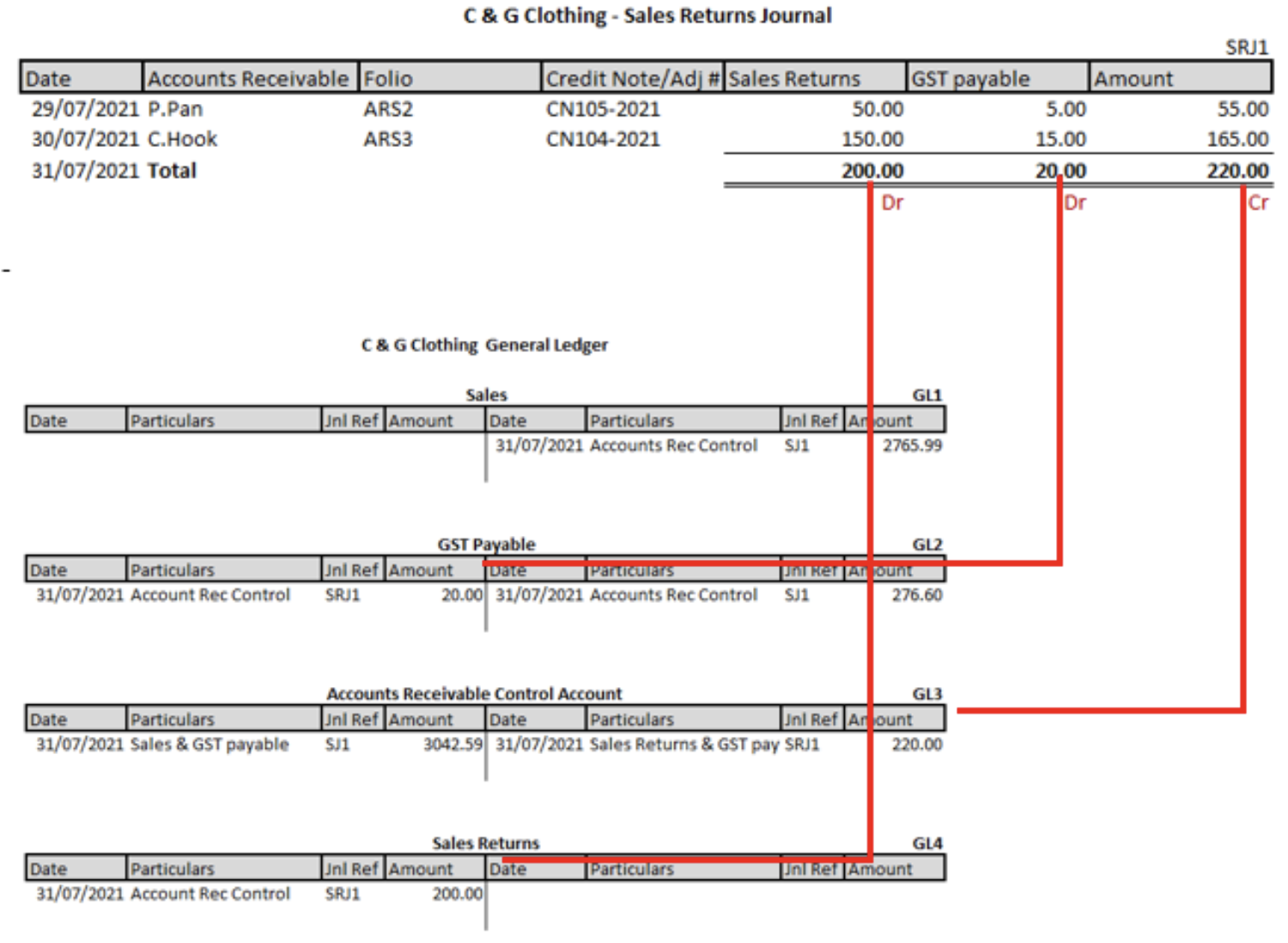

Posting from the Sales Returns Journal to the General ledger

Similar to the sales journal, on the last day of the month or period, the column totals of the sales returns journal are posted to the general ledger.

For G & C Clothing, the column totals are:

- a debit of $200.00 (Sales Returns column)

- a debit of $20.00 (GST payable column)

- a credit of $220.00 (Amount column)

The total of the Sales Returns and GST payable columns are debited to the Sales Returns and GST payable account in the general ledger.

The total of the Amount column is credited to the Accounts Receivable Control Account in the general ledger.

The posting process from the sales returns journal to the general ledgers is illustrated below.

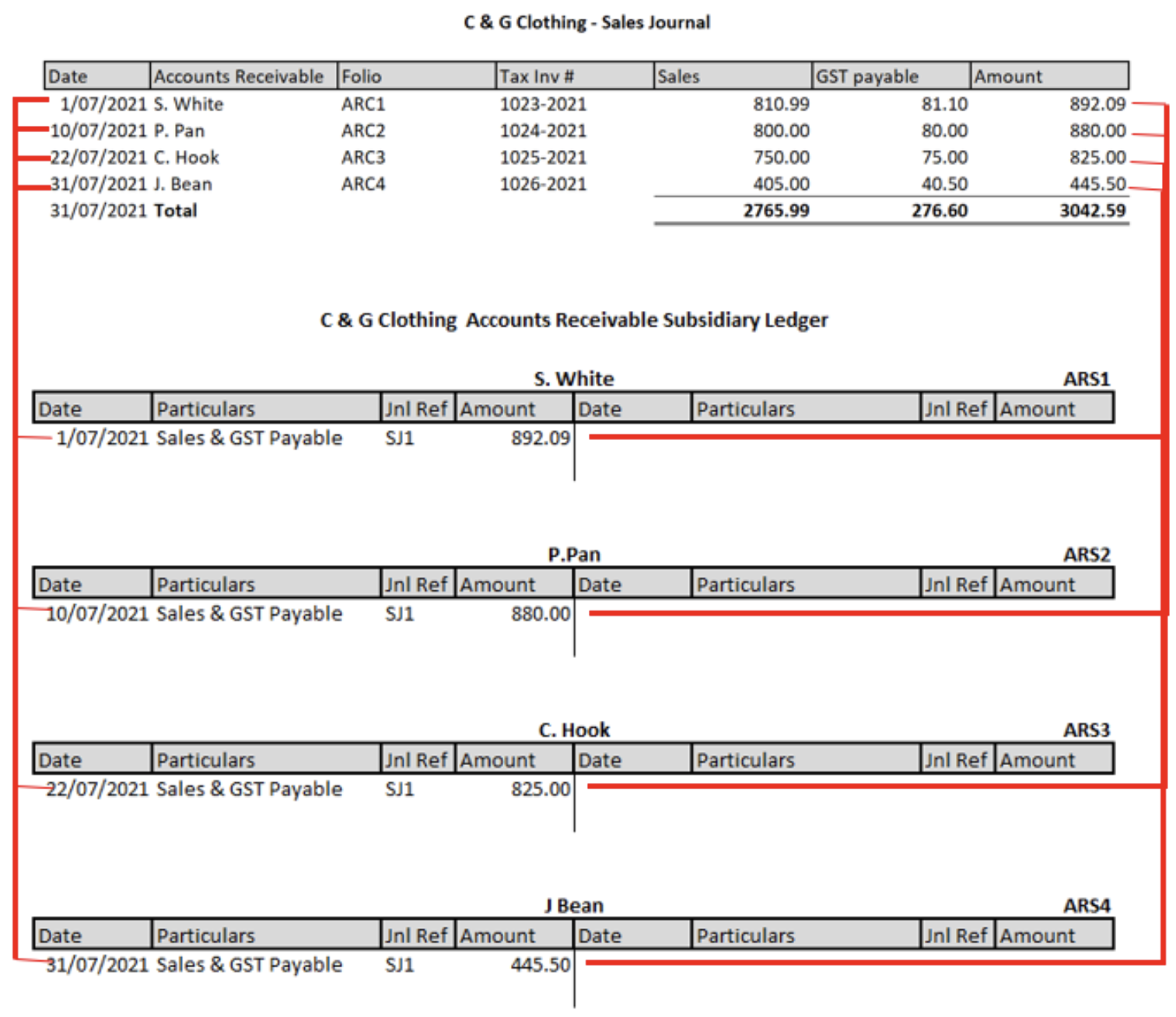

Posting from the Sales Journal to the Accounts Receivable Subsidiary Ledger

Unlike the general ledger, there is no double entry posting to subsidiary ledgers. Posting from the sales journal is done daily by debiting the individual accounts in the accounts receivable subsidiary ledger.

The posting process from C & G Clothing’s sales journal to their accounts receivable subsidiary ledger is illustrated below.

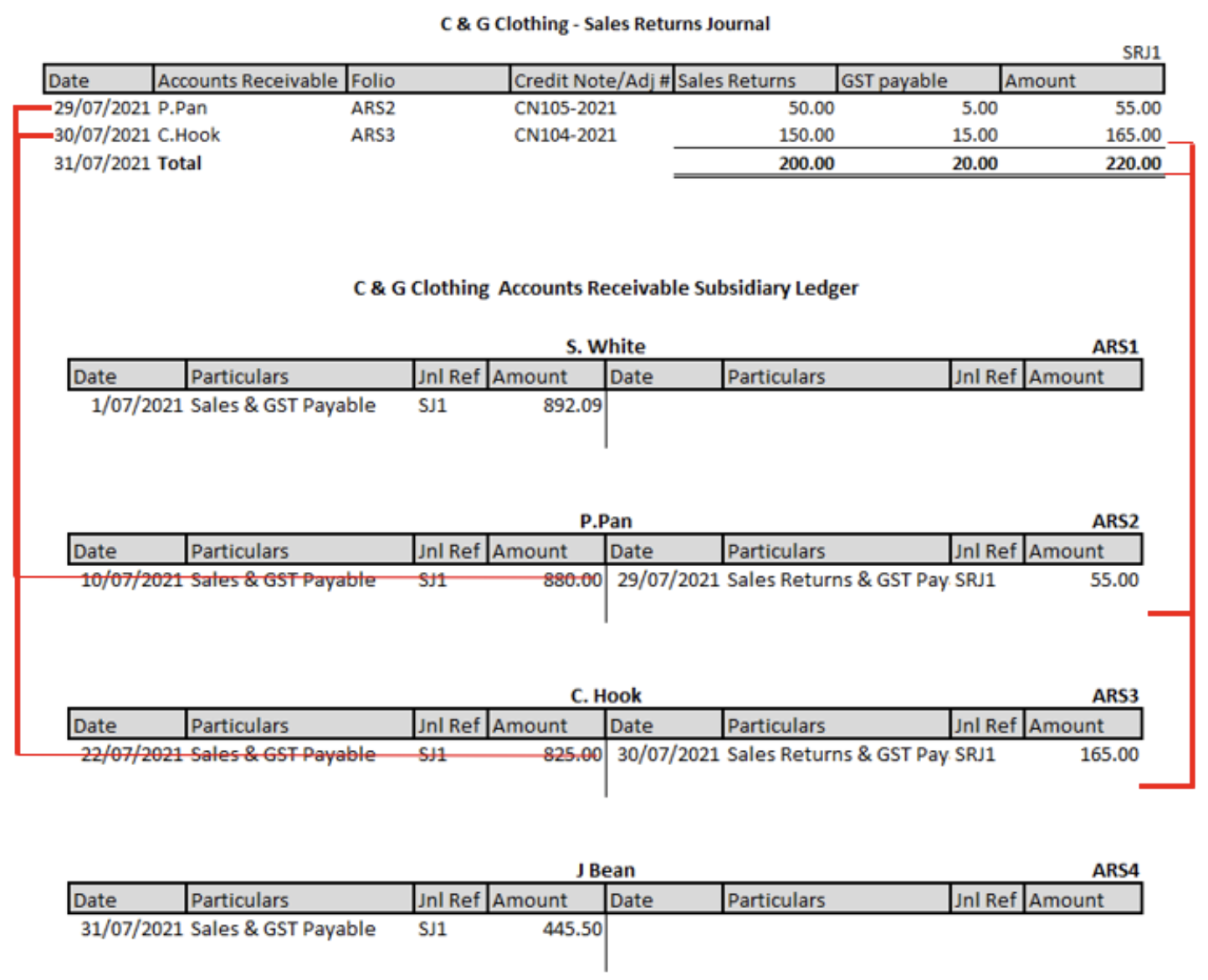

Posting from the Sales Returns Journal to the Accounts Receivable Subsidiary Ledger

Posting from the sales returns journal is done daily by crediting the individual accounts in accounts receivable subsidiary ledger.

The posting process from C & G Clothing’s sales returns journal to their accounts receivable subsidiary ledger is illustrated below.

The process of manually recording transactions in a journal and posting them to the ledger can be time-consuming and open to human error. Most businesses today use a computerised accounting system to record transactions. This reduces the need to enter information multiple times and the occurrence of human errors.

In a computerised accounting system, several steps in the accounting cycle are completed simultaneously.

In Xero and MYOB, when you create a new invoice, the system automatically generates a customer invoice, journalises the transaction and posts it to the ledger

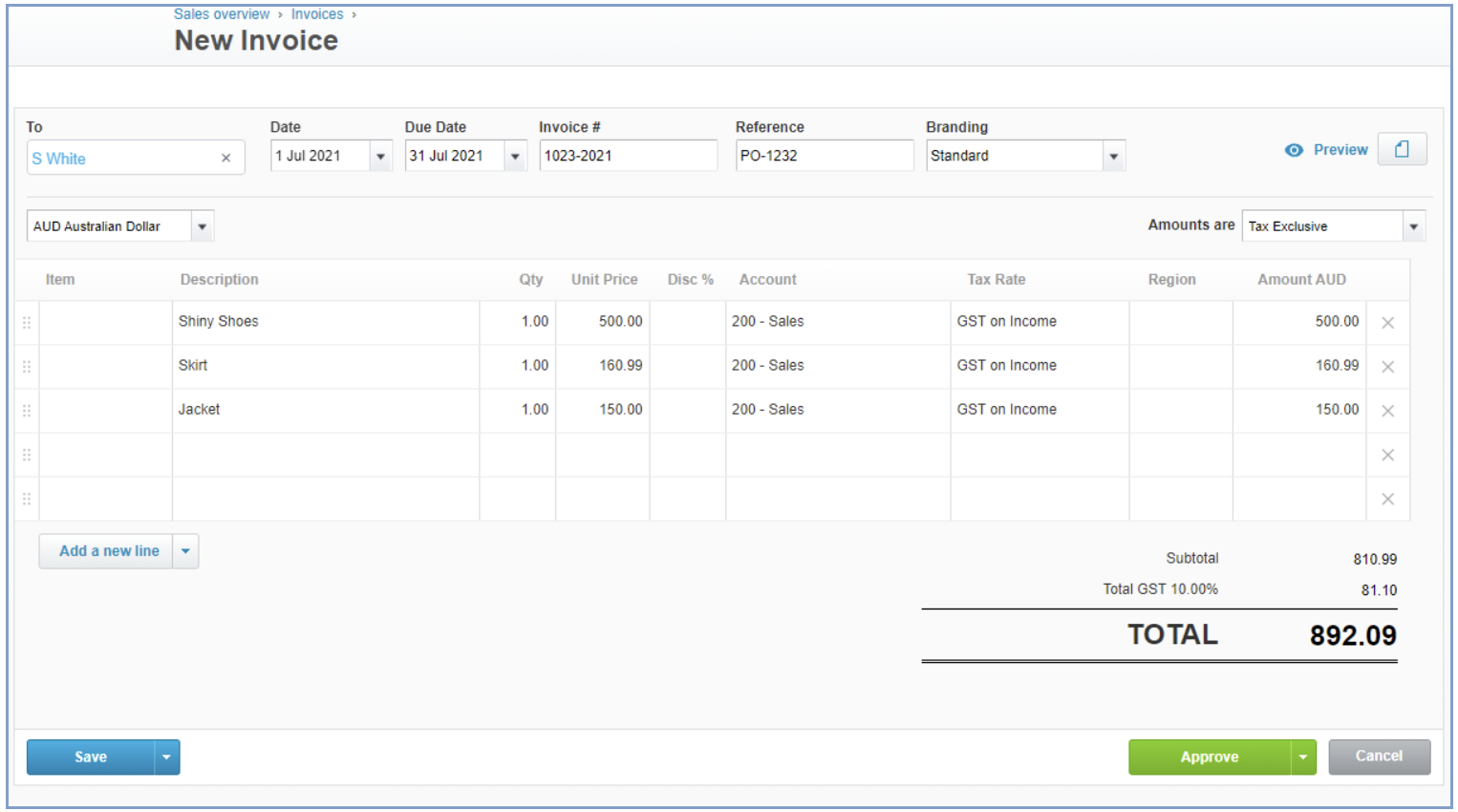

Looking at the example below:

- Adding the customer’s name ‘S White’ in the field marked ‘To’ automatically populates all the necessary customer information.

- The date is prepopulated with the current date, and the system automatically assigns an invoice number.

- When the invoice is approved, the system will automatically journalise the invoice and post it to the general ledger and the subsidiary ledger of S White.

The following video explains the invoicing process in Xero.

All payments of cash get recorded in the cash receipts journal.

C & G Clothing received the following payments during July and made three (3) bank deposits. We are going to follow these payments through the cash receipts journal and see how they impact on the accounts receivable subsidiary ledger and control account.

PAYMENT 1:

PAYMENT 2:

3 BANK DEPOSITS:

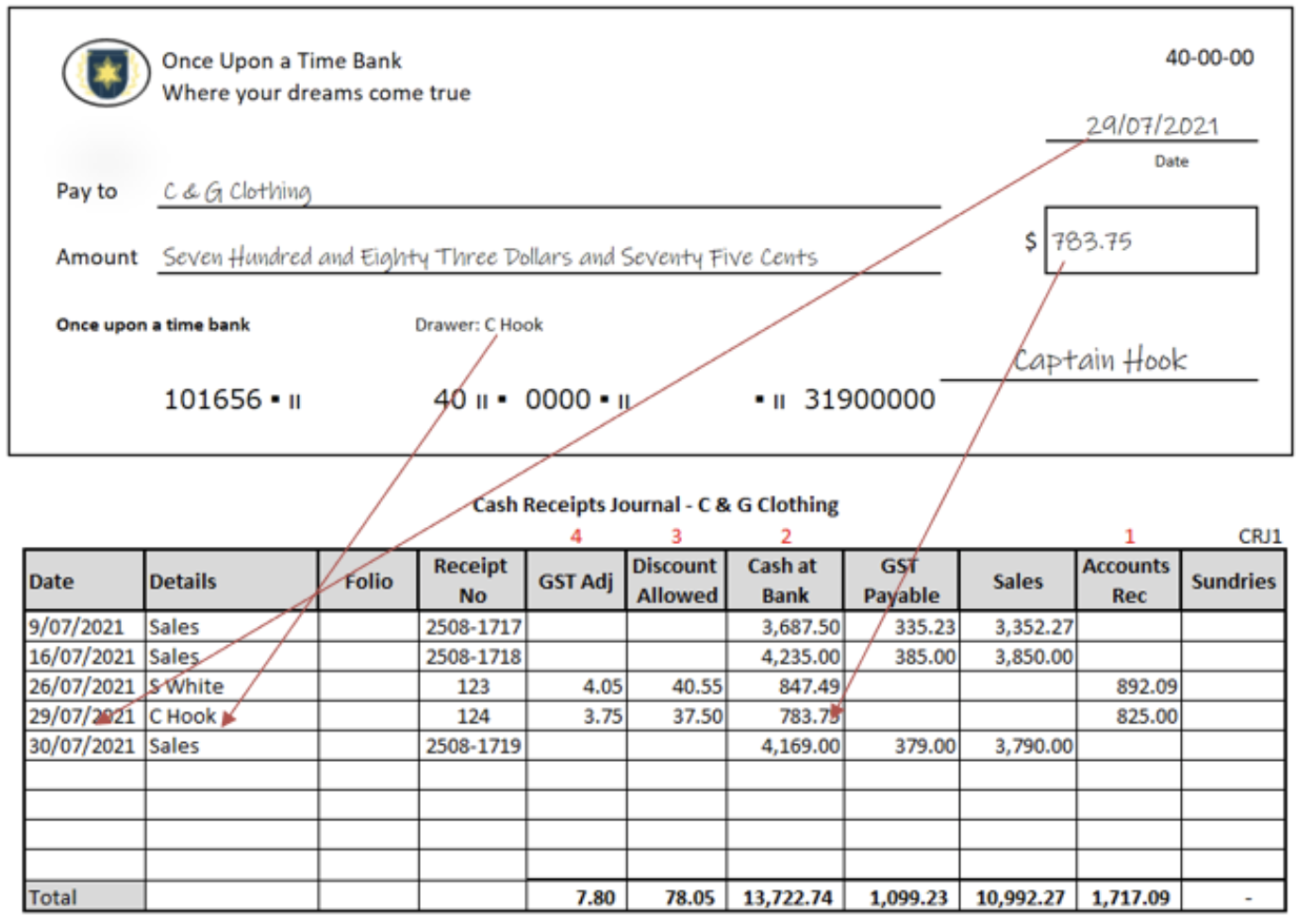

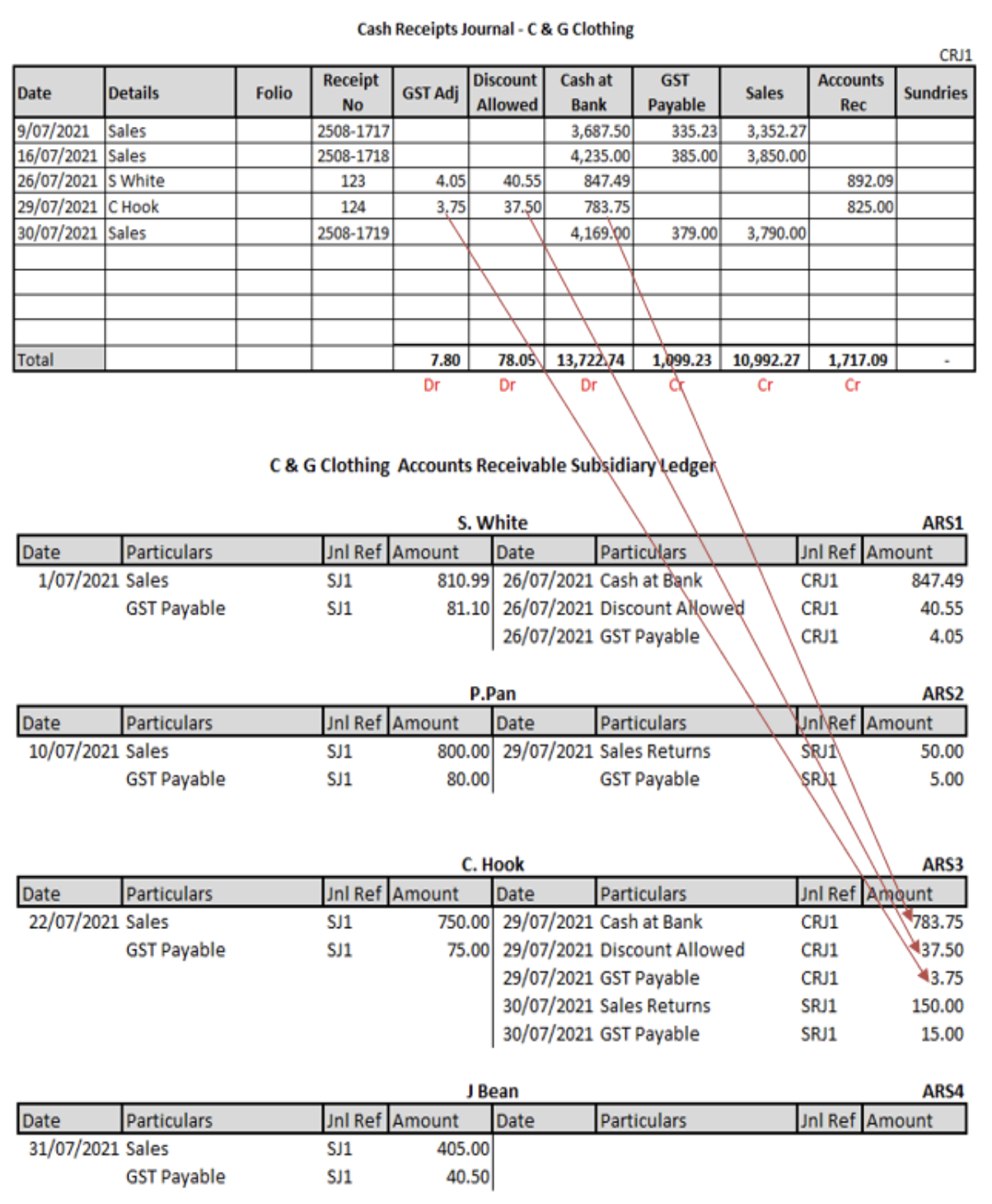

Cheque Payment > Cash Receipts Journal

C Hook owed C & G clothing $825.00 for stock sold to him on credit on 22/07/2021. On 29/07/2021, C Hook sent a cheque for $783.75 to C & G Clothing, who issued a receipt for his payment (receipt # 124).

- The $825.00 is recorded in the accounts receivable column of the cash receipts journal.

- The cheque amount $783.75 is recorded in the cash at bank column of the cash receipts journal.

- C Hook was allowed a 5% discount for prompt payment ($825 x 5%), which equalled $41.25. The discount is recorded in the discount allowed column.

- The discount included GST of $3.75 ($41.25/11), which was charged against the original sale. The discount is reduced by this amount and recorded as a GST adjustment.

On 30/07/2021, C Hook returned some items as they were the wrong size. C & G Clothing issued a credit note for the returned stock. As the full amount of the invoice has been paid, C Hook's account will show a credit balance which can be settled by either offering him a refund or applying it against a future invoice.

Remittance Advice > Cash Receipts Journal

S White owed C & G clothing $892.09 for stock sold to her on credit on 01/07/2021. S White sent a remittance advice advising the payment for invoice 1023-2021 will be directly deposited into C & G Clothing’s bank account on 26/07/2021. C & G Clothing received $847.49 in their bank account and issued a receipt (# 123). S White was allowed a 5% discount for prompt payment ($892.09 x 5%), which equalled $44.60. Because the discount includes GST, the discount is reduced by this amount.

In the cash receipts journal:

- $892.09 is recorded in the accounts receivable column

- $847.49 is recorded in the cash at bank column

- $40.55 is recorded in the discount allowed column

- $4.05 is recorded in the GST adj column.

Bank Deposits > Cash Receipts Journal

On 09/07/2021, Peter Porter banked the weekly takings of $3687.50. The deposit included $2,454.00 in cash and three (3) cheques totalling $1,233.50. C & G Clothing accept cheques as a form of payment for stock purchased through their retail outlet. $335.23 GST was included in the price of the items sold ($3687.50/11)

In the cash receipts journal:

- The total amount banked is recorded in the cash at bank column

- The amount of GST included in the sales is recorded in the GST payable column

- The sales amount (GST excluded) is recorded in the sales column.

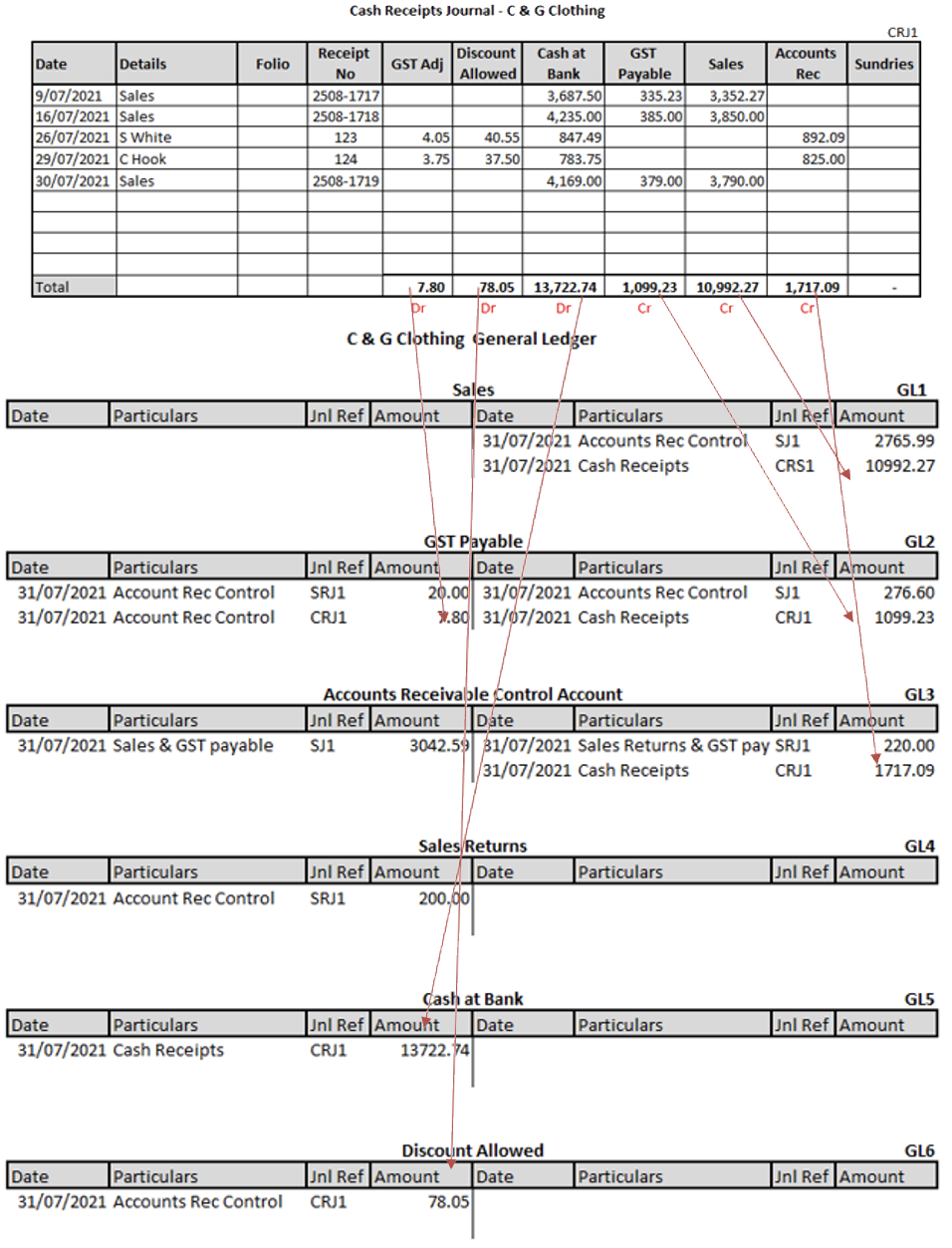

Posting Cash Receipts Journal > General ledger

At the end of each month, the cash receipts journal column totals are posted to relevant general ledger accounts.

- The last date of the month or period is used when posting to the general ledger.

- The totals of the sales and GST payable columns are credited to the sales and GST payable.

- The total of the accounts receivable column is credited to the accounts receivable control accounts in general ledger.

- The total of the cash at bank, discount allowed and GST adj columns are debited to the cash at bank discount allowed and GST account in the general ledger.

The posting process from the cash receipts journal to the general ledgers is illustrated below.

Posting Cash Receipts Journal >Accounts Receivable Subsidiary Ledger

Posting to the accounts receivable subsidiary ledgers occurs on the actual date of the transaction. At the end of each day, the individual entries are credited to the appropriate accounts in the accounts receivable subsidiary ledger.

The posting process from the cash receipts journal to the accounts receivable subsidiary ledger is illustrated below.

Management and interested parties rely on reports from the accounting system to make decisions. It is, therefore, essential end of month procedures ensure:

- Accuracy: there have been no errors posting transactions to the ledger or in preparing documents

- Consistency: Ensures that all similar transactions are recorded in the same way and using the same method from one accounting period to the next.

- Completeness: all business transactions recorded took place, and no transactions that should have been recorded have been omitted.

The format of the statement of accounts may vary depending on the business and their reporting requirements.

At the end of the month, C & G Clothing sends out a statement of account to each of its accounts receivable customers detailing the transactions for the month and the amount due at the end of the month. The statement of account lists all the transactions for the current month. Transactions from previous months have appeared on earlier statements, and the current statement of account only shows the opening balance from the earlier period.

Statement of Account for J Bean for the month of July.

Although S White has paid all amounts owing, a statement of account would be sent with a zero balance.

If a business has 100’s of customers, it would not send out a statement of accounts with a zero balance unless they wanted to show a payment was made during the period.

A reconciliation is prepared to check that the total of all the balances in the individual accounts receivable subsidiary ledger accounts equals the balance of the accounts receivable control account.

Accounts Receivable Subsidiary Ledger > Reconciliation Statement

.png)

.png)

_0.png)

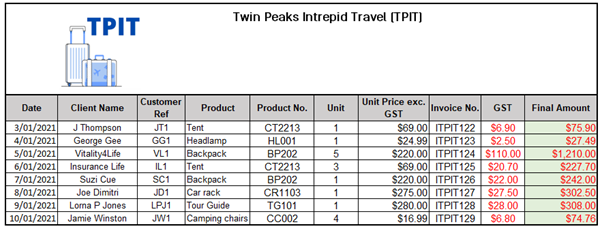

Check the table below to ensure you have correctly calculated the GST and Final Amount for Learning Checkpoint 6.1.

Complete the following for Twin Peaks Intrepid Travel (TPIT) in the attached Excel Workbook

- Using the information above, raise an invoice for each client. (Tab M6 LC6.2 - 1)

- Record each of the invoices in the Sales Journal (Tab M6 LC6.2 - 2)

- Post transactions to the Accounts Receivable Control Account in the general ledger and Accounts Receivable Subsidiary Ledgers. (Tab M6 LC6.2 – 3)

- Prepare an Accounts Receivable Reconciliation Statement as at 31/01/2021 (Tab M6 LC6.2 – 4)