Studies indicate, one out of four small businesses experience difficulties in managing their accounts receivable because of clients either short paying them, pay outside of the credit terms set, or are simply unable to pay due to financial reasons.

Businesses need good internal control procedures for accounts receivable to minimise the risk of losses due to unpaid accounts. These procedures are usually documented in the businesses accounting policies. They ensure that sales invoices are properly recorded and that customers pay promptly in accordance with the agreed terms of business.

It is important for management to receive regular reports on accounts receivable because of the significance of these accounts. Problems of bad or doubtful debts should be highlighted and the success of collection efforts should be part of the reporting cycle. Reports are generally provided on a monthly or weekly basis depending on the size of the organisation.

The first step in identifying customers and clients who may be in default of trading terms is to understand the trading terms of your organisation.

Credit Policy

A businesses trading terms are contained in their credit policy. A credit policies will be different for every business. However it typically address the following:

- Credit terms - The payment terms that the business offers its customers, and the circumstances under which alternative terms are allowed. This section may include early payment discounts.

- Payment in Advance - Circumstances in which the business requires payment in advance. This is common with custom order.

- Credit limits - The amount of credit that will be offered to customers. For example, all new customer are automatically granted a $300 credit limit. Once credit worthiness is established or they demonstrate a good credit history the limit is increased to $3,000.

- Information required - The information the customer needs to provide before credit is granted. This may include credit report, personal guarantee, copies of the businesses financial statements, bank guarantee.

- Collection process - The order in which staff will engage in collection activities. For example reminder notices, followup phone calls, progressing through to collection agencies and legal action.

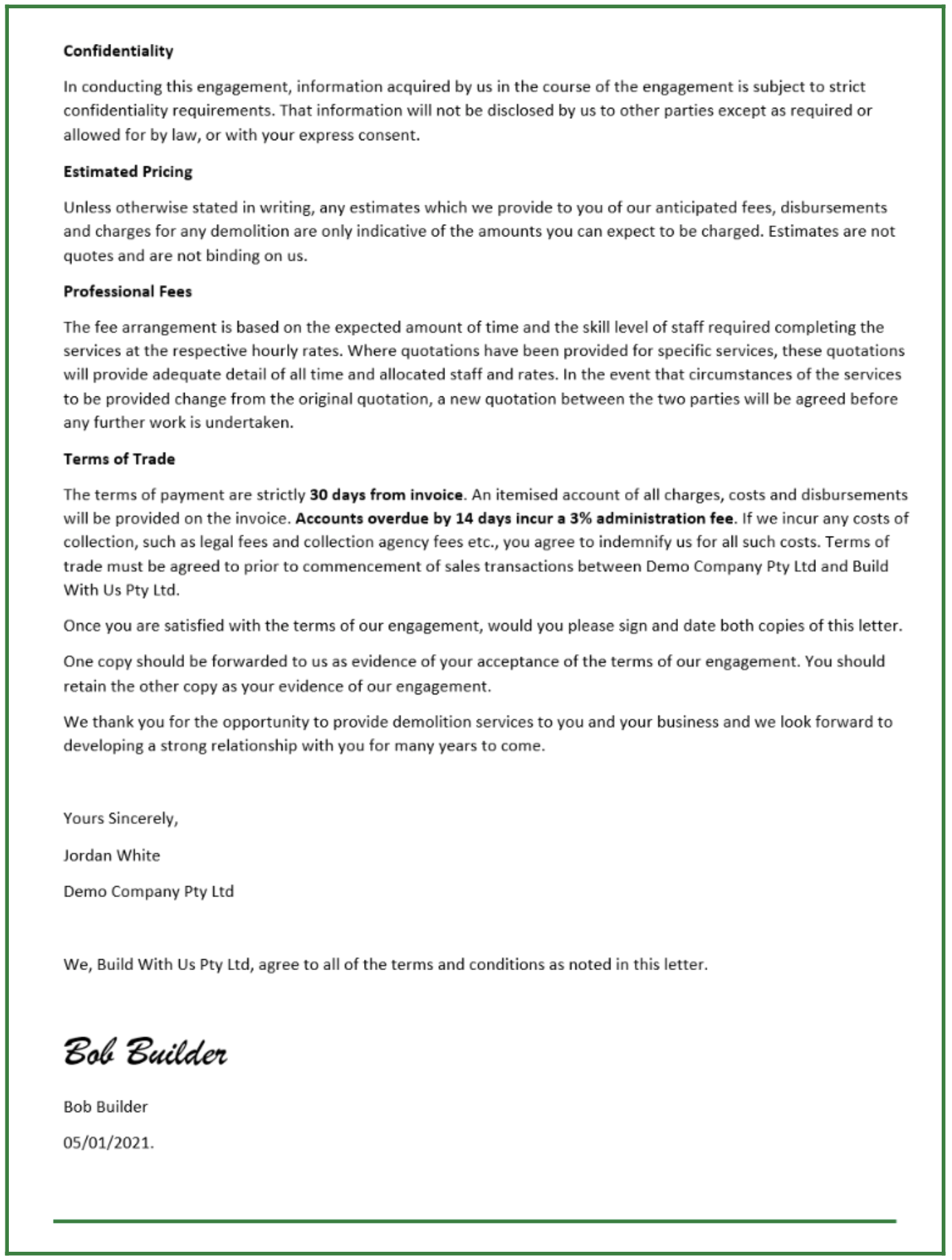

New customer engagement letter

When providing credit to a new customers its important that they understands your trading terms so they do not breach them. Trading terms should be communicated and understood by new customers before any sales take place. Below is a example of a new customer engagement letter.

The letter explicitly set out Demo Company’s trading terms which include:

- The terms of payment are strictly 30 days from invoice

- An itemised account of all charges, costs and disbursements will be provided on the invoice

- Accounts overdue by 14 days incur a 3% administration fee

- Customer wiil be responsible for any costs of collection, such as legal fees and collection agency fees etc.

- Terms of trade must be agreed to prior to commencement of sales transactions with Demo Company Pty Ltd.

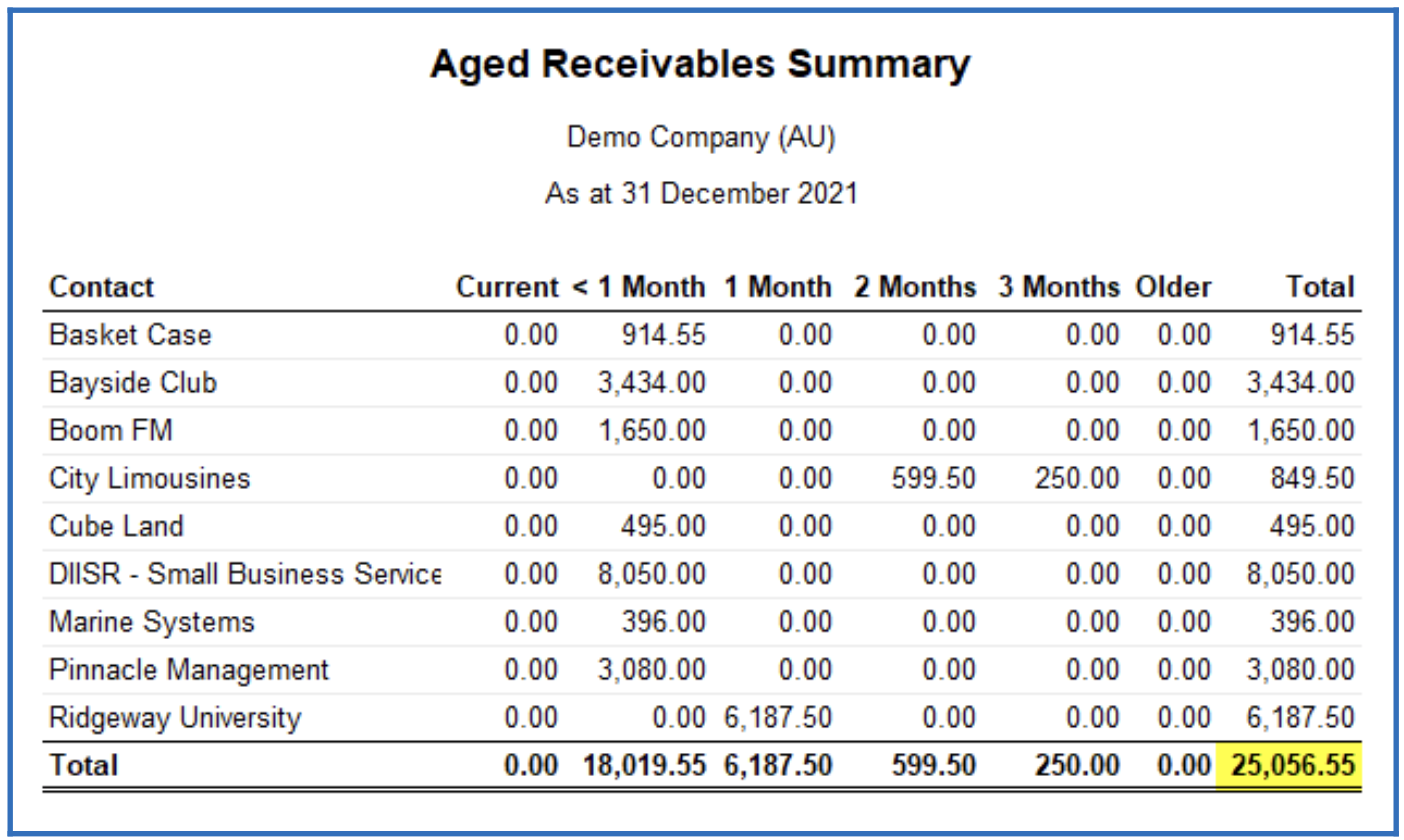

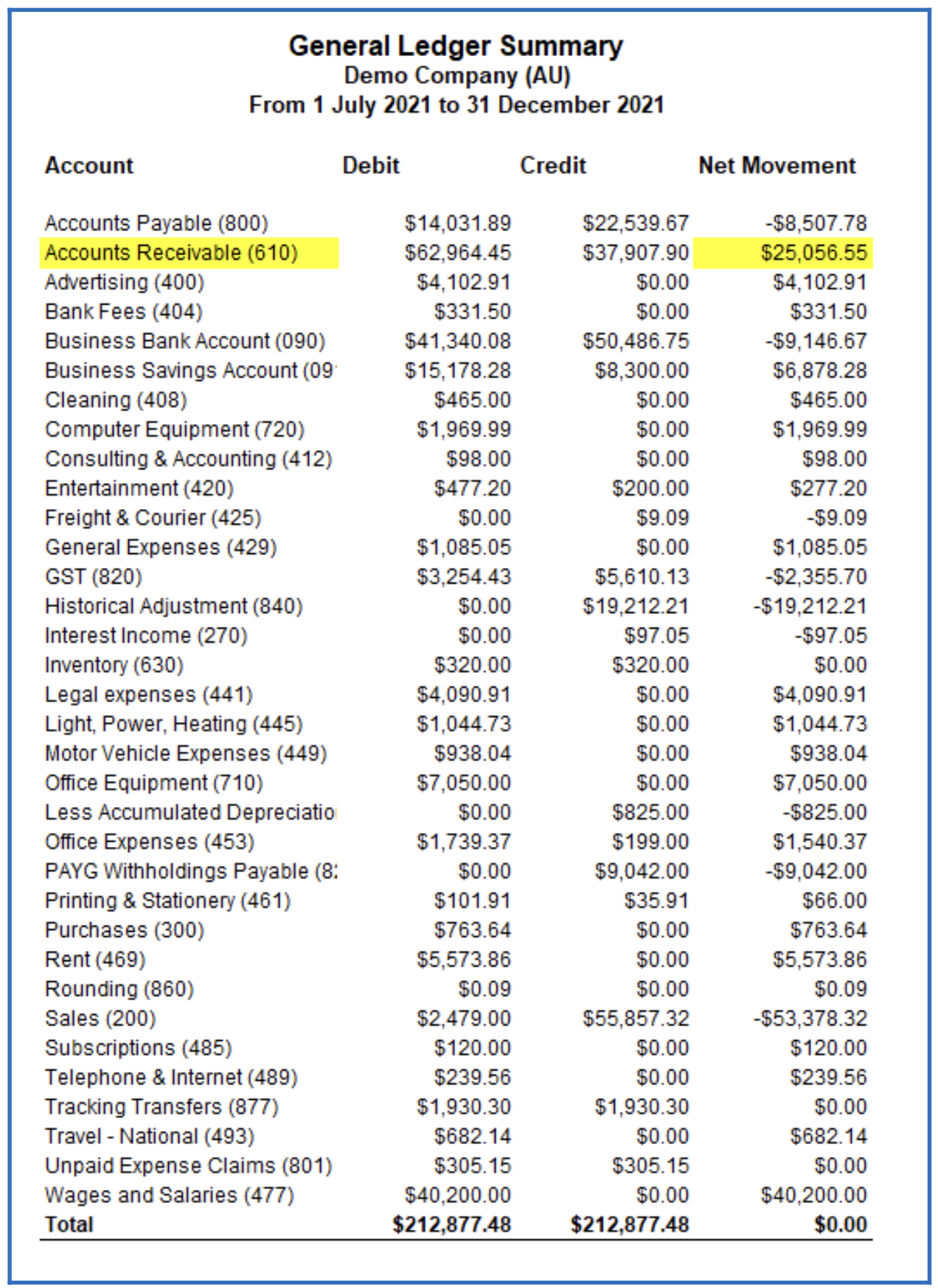

Before contacting clients to discuss any unpaid invoices which breach trading terms an accounts receivable reconciliation should be completed. The reconciliation process can be done manually or through an automated program if using a computerised accounting system and is typically conducted as part of the month-end closing activities prior to generating the financial statements.

The reconciliation process follows these steps:

- Update all transactions for the period of the reconciliation by ensuring all invoices and payments for the period have been recorded

- Ensure all the subsidiary ledger balances are up to date

- Generate an aged receivables report. This report will show the unpaid balances as of the last day of the period. Usually the end of the period is the last day of the month.

- Generate a general ledger report for the same period on the last day.

- Identify and investigate any differences between the amount due on the AR report to the AR balance in the general ledger.

- Make adjustments for any errors so that the AR report to the AR balance in the general ledger agree.

Reasons why there may be differences between the AR report amounts and the AR balance in the general ledger could include:

- A journal entry was posted to the general ledger account but not to the subsidiary ledger.

- The aged receivables report was run as of a different date to the general ledger report.

- An payment was accidentally posted to an account other than the accounts receivables account.

At some stage you will have to contact a customer with a question as to why their account is overdue. They might have a number of concerns or issues they would like to discuss. Part of your role is to provide for them reliable, current, accurate and relevant information and to respond appropriately to their responses and questions.

Prior to making contact you should always familiarise yourself with:

- Payment history of the customer

- Amounts outstanding

- Records of any previous calls/conversations regarding the debt

Providing good customer service includes making sure your facts are accurate, being aware of the laws and regulations governing collections and being sensitive to the customer's situation. The customer is always entitled to courteous customer service.

You can expect that debtors always give reasons or excuses for not paying their account. You must have a system to keep track of all the reasons they provide for not paying. These should not be noted just as a comment on the aged debtor file, but instead recorded electronically for easy access and analysis at a later stage. When you call a debtor, always extract a promise as to when they expect to pay, how much they promise to pay and always follow-up.

Debt collecting is often one of the largest problems that small businesses face and it can be a threat to the ongoing survival of the company. As a consequence, small business owners should focus some attention on the process of debt collection as this is a crucial aspect of their business.

Communication and active listening skills

During a collection conversation you will be required to apply excellent communication skills in terms of active listening, questioning and providing the customer with feedback to clarify the exact nature of the company's concerns and determine the reasons for non-payment.

It is important when talking to a customer, that you use your questioning techniques to find out exactly what the customer's issues are, so there are no miscommunications, and the issue is dealt with correctly the first time around.

There are standards that you will need to adhere to:

- Company policy and procedures must be followed at all times

- Legislative guidelines and codes of practice must be followed

- EFT (electronic funds transfer) code of conduct (ATM access, debit or credit cards)

- Privacy act

- Relevant code of practice (banking, credit union, building society or insurance)

Whilst good interpersonal skills must be applied at all times when working with your customers, it is very important they are applied in the case of a customer failing to pay.

Good customer service requires that you listen to the customer's story. Sometimes the customer is not at fault. Your records might show that the customer is in arrears with their account. However, there could be several reasons for that, some of which are not within the customer's control. Always verify the facts of the situation before taking action. Always make sure that you are following company policy and procedure when handling debt collection and contacting customers.

Section 60 of the Trade Practices Act outlines the following provision with regard to debt collection:

- 'A corporation shall not use physical force, undue harassment or coercion in connection with the supply or possible supply of goods or services to a consumer or the payment of goods or services by a consumer.'

To find out more about a customer's reasons for non-payment of accounts you need to utilise a range of questioning processes using open, closed, probing and hypothetical questions. Do not use leading or loaded questions. Give the customer time to answer before asking the next question. Make sure that customers know that the information they give you will be treated confidentially.

You might ask questions in order to:

- Encourage disclosure

- Reassure the customer that you are listening properly

- Verify details about concerns or issues

- Indicate and reinforce your interest in the client's welfare

- Pick up on information you might have misheard

- Clarify any information you misunderstood or that was not complete

- Add background or detail to what has been said

- Verify the meaning of what has been said so that you and the customer agree on meaning

Types of questioning

- Open-ended questions are questions which cannot be answered with a single word answer. They ask for answers related to when, why, where, what, how.

- Closed questions are those which can be answered with a yes, no, or single word answer. These are used to confirm understanding, or to gain important pieces of information.

- Probing questions are open-ended questions that ask for more information or encourage more input.

- Hypothetical questions are ones that are answered only in terms of validity, not soundness. Thus the question is designed to make a number of assumptions, and be answered as if those assumptions are true.

When chasing unpaid debts from customers or other businesses there are steps you can take to recover the money and measures you can put in place to reduce the chance of it happening again. Usually, sending a friendly reminder or making a telephone call is enough to prompt the customer to pay. If however the customer does not respond you may need to escalate the situation.

The following steps are a guide on how to recover and overdue payment from a customer:

Friendly payment reminder

When payment first becomes overdue, give your customer a courtesy reminder by phoning, emailing or sending them a letter.

Contacting them may be enough to get the invoice paid – they might have forgotten about the bill, paid the money into the wrong bank account, or there could be another minor issue that's easily and quickly resolved.

Include payment options, banking details and contact information in the reminder to make it easier for the customer to pay you quickly.

It’s important not to attack the customer, just inquire politely about the unpaid income. You’ll want to avoid the customer becoming defensive.

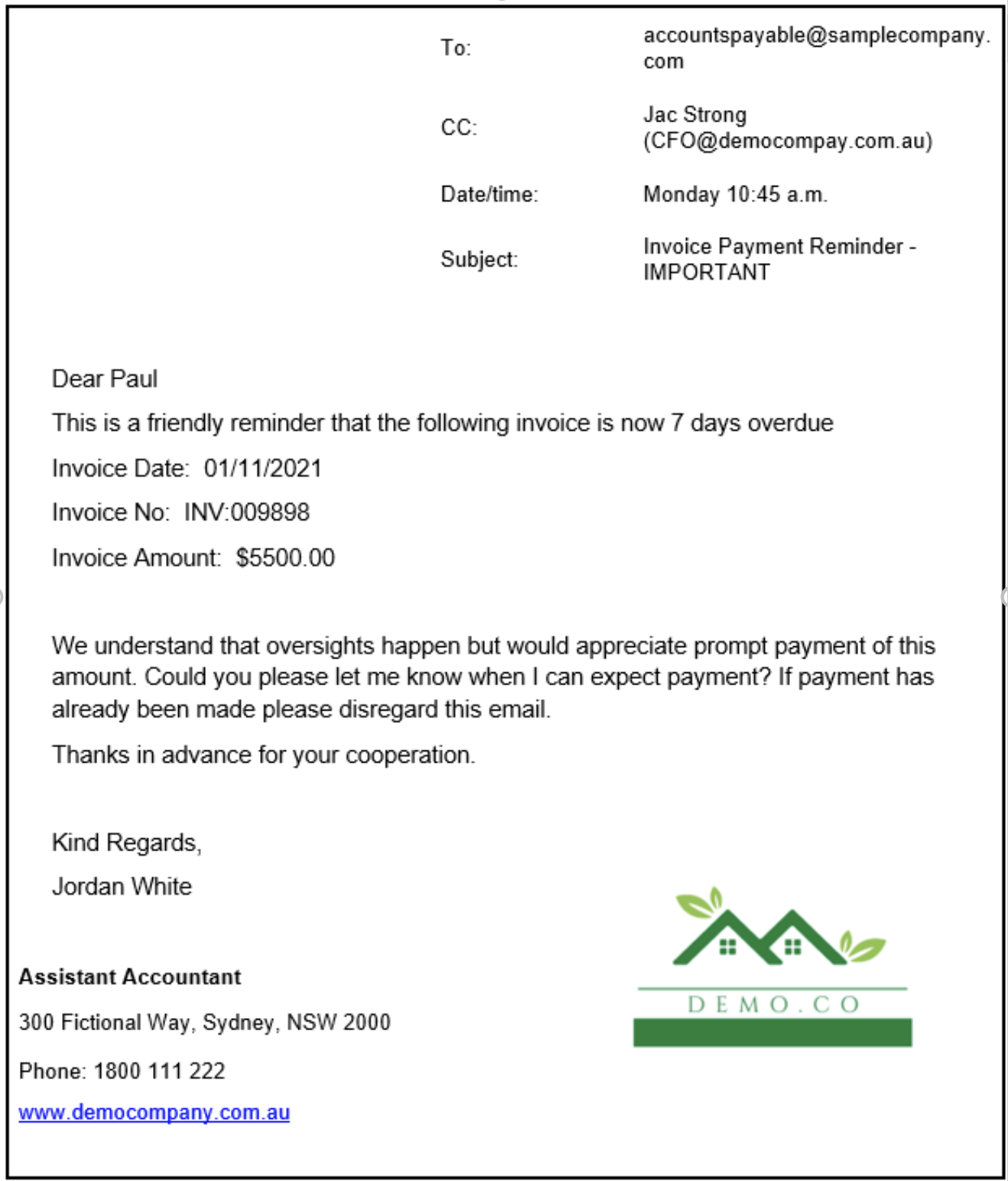

Example - Friendly reminder email

Note: When sending a reminder email it is best if you use the persons name as it makes it more personal.

Overdue payment reminder

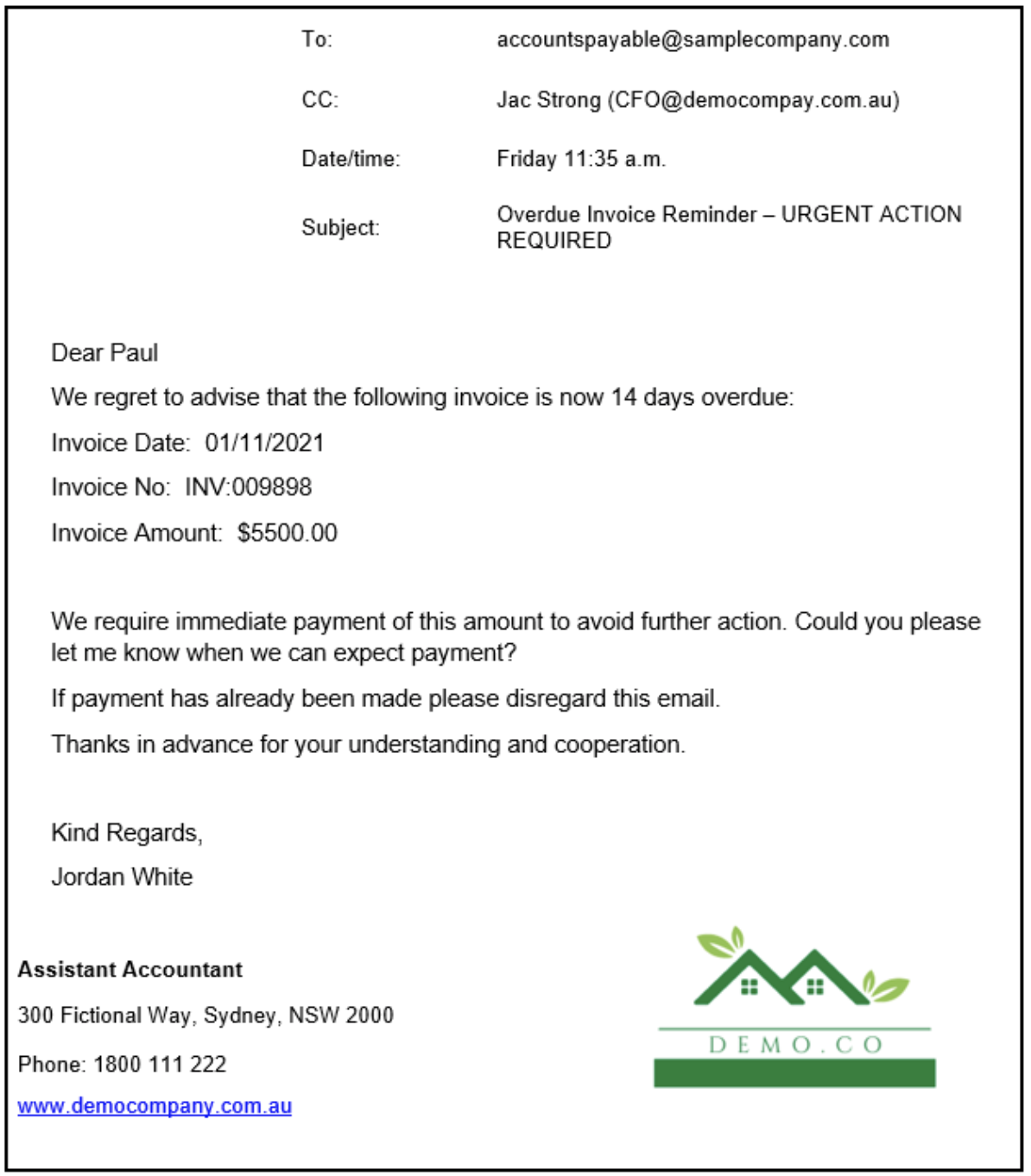

If the payment remains outstanding and the customer has missed the next agreed payment date, or there's been no contact at all, give the customer another call or send another email or letter reminder of the money owing, and request payment.

Throughout the debt collection process, it’s important to remain polite to your customer. Whether you intend of having them as a client again, or not, to avoid further legal battles, stick to alternative means of communication, not aggression.

Example – Overdue email

Direct contact

If there's still no payment or response, consider visiting the customer in person or phoning them if previous contact has been via email to ask for payment.

This could help facilitate a personal relationship with the customer that could be useful for future payments.

Follow up contact script

Hi Paul, it's Jordan White from Demo Company calling. I am contacting you to follow up an overdue invoice. I have sent you a few emails and just really need to know when we can expect this to be paid. The invoice is now more than 30 days overdue and this is really impacting our business.

The payment I am chasing is for invoice number 009898 for the amount of $5,500.00 which was due on 1/11/2021.

I'd really appreciate immediate payment or a call back to discuss. My number is 0404 000 111. Looking forward to hearing from you. Good bye.

Try and get a commitment to get the invoice paid that day. If they cannot pay it that day ask when it will be paid. If there still isn’t a response consider visiting the customer in person to ask for payment. This sometimes helps create a personal relationship with the customer.Ensure you follow up on the day that they say it is going to be paid and if it is still unpaid then move to the formal letter of demand.

Often customers choose not to contact an organisation when they cannot pay because they have no faith in the ability of the person to whom they are speaking to actually help resolve the issues, or because they believe that their problem will be met with either a hostile reaction or with indifference. It is important to demonstrate to your customers that this is not the case.

In your conversation it is useful to establish your payment terms up-front, be firm, but if you are uncertain about the customer's ability to pay then try to get some payment out of them

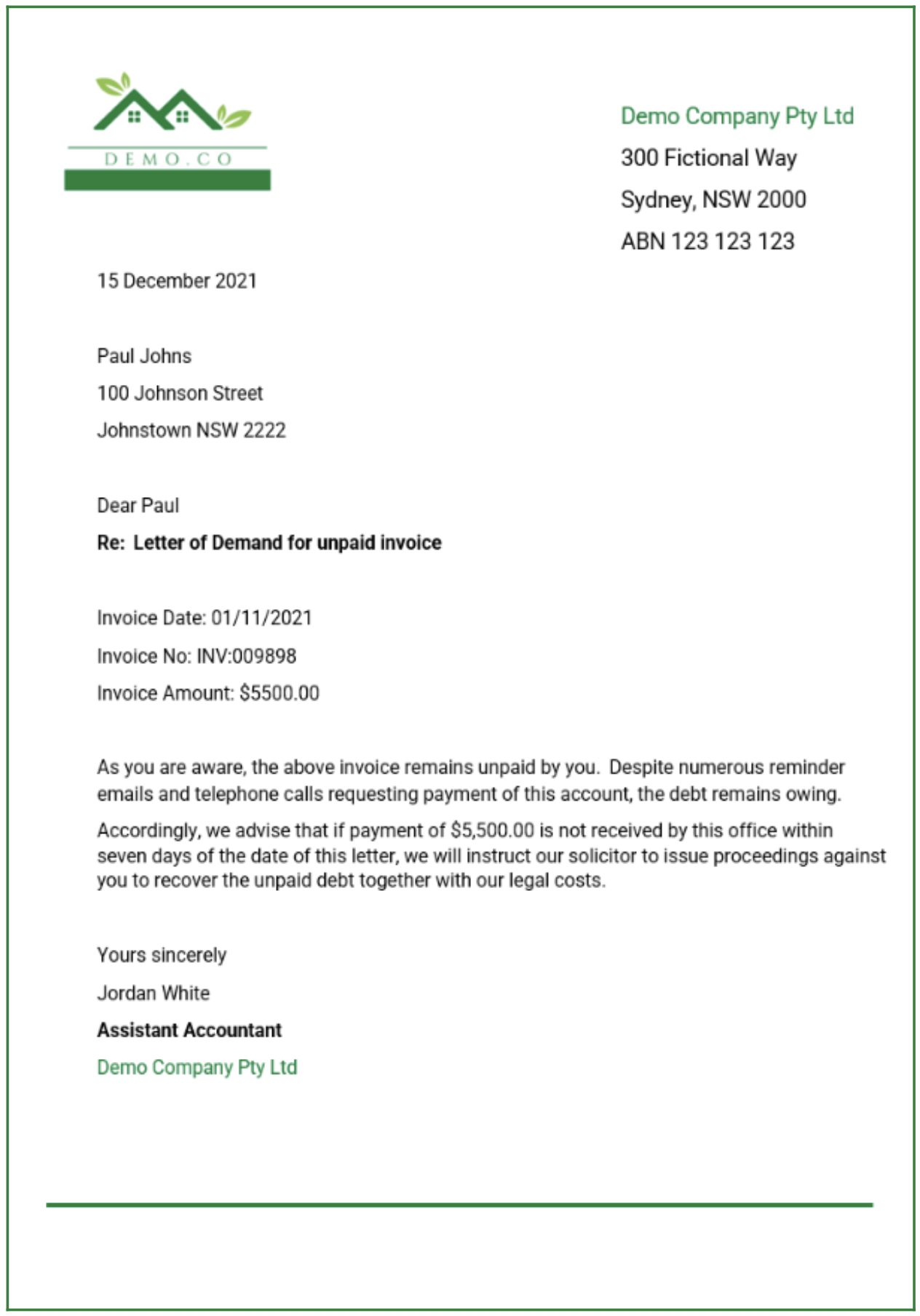

Formal letter of demand

If all your attempts to contact them and receive payment have failed consider sending a letter of demand. Keep in mind this procedure should only be done as a last resort. It has the potential to damage the business relationship established with the customer.

Business.gov.au is a great website for small businesses. They provide template emails to recover debts.

Click here for more information

Repayment negotiations

Consider working with the debtor to adopt a flexible and realistic approach to repayment arrangements, which could includes the following:

- Making reasonable allowances for the debtors ongoing living expenses.

- Considering if the debtor is on a fixed low income (for example a disability pension or other welfare payments) and there are no prospects of their income increasing in the future.

- Recognising that debtors experiencing financial difficulties will often have a number of debts owing to different creditors.

- Ensuring that payment arrangements are meaningful and sustainable.

Mediation

Mediation is a voluntary, alternative form of dispute resolution and facilitated discussion where parties in a debt dispute can discuss the problem with the assistance of a neutral person who assists them in reaching an adequate settlement. This person is know as the mediator. If you come to an agreement, it is put in writing and it becomes legally binding.

Consider using a debt collecting agency

If an agreement with a customer cannot be reached, or if agreement appears to be reached but the customer continues to default, you may decide to take further action.

Using a debt collection agency can take the stress of dealing with the debt off you. However you will need to consider if the debt collection fee is worth the cost of recovering the debt as you will forgo a percentage of the amount owed as a commission.

Both the ACCC and the Australian Securities and Investments Commission (ASIC) enforce Commonwealth consumer protection laws relevant to debt collection. They have produced a guideline which aims to assist creditors, collectors and debtors understand their rights and obligations, and ensure that debt collection activity is undertaken in a way that is consistent with consumer protection laws. It's useful to check a list of fair debt collection practices so you understand the boundaries of debt collection.

To access this guide click here

Under the Australian Consumer Law, a debt collector(Bookkeeper/ Accountant) must not:

- use physical force or coercion (forcing or compelling you to do something)

- harass or hassle you to an unreasonable extent

- mislead or deceive you (or try to do so)

- discuss you debt with someone else without your permission

- take unfair advantage of any vulnerability, disability or other similar circumstances affecting you (this may amount to unconscionable conduct).

- These laws also apply to a debt collector’s conduct towards your spouse, partner, family member or someone else connected with you.

Should I take Legal action?

Legal action is the last resort available to your company to recover outstanding money and it needs careful consideration before it is undertaken. You need to let the customer know, either verbally or in writing, that you have offered all the solutions within your realm of responsibility and advise the customer of any action you intend to take. This may include forwarding the debt to a collection agency, consulting with a lawyer, mediation or cancelling a service.

There are several questions that you should ask yourself before you take legal action. These include:

- Is the debtor in a position to pay?

- Is the evidence to support your claim strong?

- Is there another way to resolve the dispute?

Court action can be costly and if the debtor does not have the money to pay you, you may well find it has cost you a lot of money and time and you still will not receive payment.

You may be entitled to take your complaint to your local state or territory small claims tribunal. The advantage of using the small claims court system is they are simple, inexpensive, and fairly quick to deal with claims. However they only deal with small claims.

In the table below is list of the small claims courts which can apply to recover debts in the different states of Australia and their jurisdiction.

| State or Territory | Small claims tribunals | Small Claims Jurisdiction |

|---|---|---|

| Australian Capital Territory | ACT Civil and Administrative Tribunal |

ACAT can hear civil claims up to $25,000. ACAT can consider and resolve a range of civil disputes about:

|

| New South Wales | New South Wales Civil and Administrative Tribunal |

|

| Northern Territory | Northern Territory Civil and Administrative Tribunal |

NTCAT has jurisdiction to deal with a claim includes the following:

For a full list of NTCAT jurisdiction click here |

| Queensland | Queensland Civil and Administrative Tribunal |

|

| South Australia | South Australia Magistrates Court |

The Magistrates Court of South Australia is divided into:

|

| Tasmania | Magistrates Court of Tasmania |

The Civil Court deals with disputes involving amounts:

|

| Victoria | Victorian Civil and Administrative Tribunal |

VCAT deals with goods and services disputes about products and services bought or sold. This includes:

|

| Western Australia | Magistrates Court of Western Australia |

The Magistrates Court of Western Australia deals with civil matters that involve:

|

Debt recovery through the courts usually involves two processes:

- The courts must make a judgement in your favour, or the debtor comes to an agreement for repayment with you after you commence legal action.

- You recover the money from the debtor. This might involve taking enforcement action such as a writ of execution against the debtor's property or garnishing the debtor's bank accounts.

County, district and supreme courts decide on disputes where the amount owed is too high for a small claims tribunal or lower court. You should consider engaging a lawyer if you take a case to one of the higher courts as the process is more complicated and formal.

For each of the customers above, in the workbook identify:

- the amount outstanding

- length of time it has been outstanding

- what action you would take to recover the outstanding money based on TPIT’s Credit Policy and Procedure.

Assume the role the accountant for TPIT. Using the email templates available on the Business.gov.au website, draft an email to all the customers who have amounts outstanding for 3 months or more based on TPIT’s Credit Policy and Procedure. Use the the following information

- To – Account Name

- Select date – Work backwards from March to calculate when the invoice was due and issued

- Describe services – the supply of camping goods

- Describe payment terms and instructions - Payment is due within 30 days of invoice being sent

- Documents included – Copy of the invoice, Credit policy

Communicate clearly why they are being contacted, outline the terms of the policy and find out if there is a reason for the situation that they are currently in. For each customer suggest a plan that they can consider for repayment of monies outstanding. Your email must be professional, non-harrassing and seeking a mutual arrangement to suit both parties.

Use the Include a copy of your email in the workbook. Ensure your actions are inline with ASIC’s debt recovery advice for small businesses. Link: Debt recovery for small business ASIC.