Performing financial calculations is underpinned by data. Data is defined as a group of facts and statistics from which conclusions may be drawn together for reference or calculation. Data is used by internal management to analyse business performance and determine whether tactics and strategies must be altered. People and organisations outside a business will also use data reported by the business to judge its creditworthiness, decide whether to invest in the business and determine whether it complies with government regulations.

The saying “garbage in, garbage out” illustrates that reliable and accurate data is critical when performing financial calculations based on input data.

Sources Of Financial Data

Financial data is obtained from a variety of sources. While the list below is not exhaustive, it will give you an understanding of the diversity of options available for collecting financial data.

Source documents are evidence that transactions have occurred. They are sometimes referred to as the “paper trail”. A source document includes some basic facts about the transaction, including the date it occurred, to whom the transaction was made, the purpose and the amount. Most business use accounting software to collate and total information from source documents to provide the summary data necessary to perform financial calculations. Examples of source documents include:

- Total daily sales figures from the Point of Sale (POS) system or invoices to customers

- Receipts, invoices and credit notes from suppliers

- Price lists from suppliers

- Timesheet for payroll calculations

- Tax tables

- Bank statements, loan documents and interest payments

A business may also use information from government, industry bodies or financial institutions to prepare financial calculations. For example:

- Business benchmarking is a process undertaken to determine how an organisation performs compared to other similar businesses within the same industry. It involves obtaining high-quality data from actual companies and then undertaking a detailed analysis to determine a range of best practice indicators.

- Consumer price index: The Consumer Price Index (CPI) measures household inflation and includes statistics about price change for categories of household expenditure. A business may use CPI to understand why costs are going up and analyse if it is reasonable to pass costs on to customers or negotiate a lease on a business premise where the annual cost increases by CPI.

- Australian Bureau of Statistics: The Australian Bureau of Statistics (ABS) collects statistics on a range of topics, including indicators that provide an up-to-date snapshot of the state of the economy as well as information on specific industries and business activities. Businesses may use data from the ABS for bench marketing or developing a business or marketing plan.

- Financial institutions: Provide calculators, tools, and resources to assist businesses in making decisions on financing and investing.

Some benefits that signify how high-quality data can improve businesses may include:

- Reduce cost/increased revenue

- Improved customer experience

- Proficient operations

Data verification is a procedure where data is checked for inconsistencies and accuracy. It is a critical process that underlines the importance of data quality. Without validating data, you risk basing decisions on incorrect data that may not accurately represent the current situation.

Data verification occurs on different types of data, but it is particularly significant for financial data.

Both the structure and content of data files will dictate what exactly you can do with data. Using validation rules to cleanse data before use helps mitigate “garbage in = garbage out” scenarios. Ensuring the integrity of data helps to ensure the legitimacy of your conclusions.

Data validation is a common control in an accounting system. Validation verifies that a transaction is correct; for example, an error message is generated if you are posting a general journal entry and the debits don’t equal the credits.

Accounting software allows you to take data entered in other software and incorporate it into your accounting software. This process is called importing data. Whenever data is imported, the format of the data must meet a set of validation rules. The following video discusses the format, preparation and importation of financial data for the accounting software Xero.

Even though our brains are remarkably resourceful, it is hard to calculate large numbers in our heads. This is because we can only store a certain amount of figures. According to research by the famous psychologist George Miller, in the 1950s, our brain can typically only remember 5–9 digits (“the magical number seven, plus or minus two”). This is why people have been using aids to help them calculate since ancient times.

Specific equipment and resources are required that are relevant to the task at hand to perform calculations efficiently.

The different resources and equipment that might be used include:

- Handheld calculators

- Computers

- Financial services software

- Spreadsheets

When calculating small amounts, you might do that in your head or quickly work out quantities on paper. However, when you need to calculate large quantities or the process involves several steps, it is better to use a calculator.

Advantages and disadvantages of using calculators

Advantages:

- builds comfort with technology

- promotes accuracy

- reduces the occurrence of human error

- requires minimal training

- solves complicated problems quickly and efficiently.

Disadvantages:

- dependency

- no understanding of the underlying concepts

- false sense of confidence with people not checking the answers.

- information entered needs to be accurate to get the correct answer.

Calculators

The calculator is a small, portable electronic device used to perform both basic operations of arithmetic and complex mathematical operations. The word calculator comes from the Latin ‘calculate’, which means to count up.

Calculators vary from cheap, credit-card-sized models to sturdy desktop models with built-in printers. They became widespread in the mid-1970s as integrated circuits made their size and cost small. Calculator prices reduced to a point where a basic calculator was affordable to most, and they became common in schools by the end of that decade.

Calculators are everywhere and often included as part of other equipment. Most smartphones also have a calculator function that you might be quite familiar with, and as long as you are carrying out fairly basic functions, it might be all you need. However, some register terminals have keyboards with numeric keys which you can use when the register is in calculator mode, while other computer terminals have a separate numeric keypad or you may have a dedicated calculator provided for you to use.

The functions of most basic calculators are addition (+), subtraction (-), multiplication (x or *) and division (/ or the traditional two dots separated by a horizontal line ÷). After you've pressed the numbers and the function buttons, press the equal sign (=) for the answer.

If your calculator has the percentage button (%), you can use this to find the result of a calculation as a percentage. For example, if you need to know what 10 times 10 percent was, you would press 10 * 10 %, and you would receive the answer “1”

Press M to save a number to the calculator's memory. Press M+ to add another number to any previous numbers stored. Press MR to retrieve a number in the memory and press MC to clear a number that was stored. Saving to memory varies from calculator to calculator, so if you need to do this, it would be worthwhile reading the manual or searching the help site for assistance with using calculators provided with software.

Using the memory function of the calculator helps you to preserve subtotals as you work through your calculations. Subtotals can help you to keep a check on your calculations. If you are adding prices together, you would call that total a sub-total if a tax was required to be added to the amount.

Most Android and iPhones have a calculator app that allows you to perform basic arithmetic calculations with the standard calculator. You can also use the scientific calculator for exponential, logarithmic, and trigonometric functions.

iPhone calculator tutorial

Use Calculator on iPhone - Apple Support

Android calculator tutorial

Computer calculator tutorial

Computer

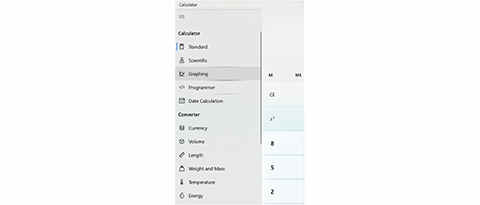

Windows Calculator is a software calculator developed by Microsoft and included in Windows. To access the calculator on your computer:

- Select the Start button, and then select the calculator in the list of apps.

- Select the three bars in the top left-hand corner to switch modes. Use Standard mode for basic math, Scientific for advanced calculations, Graphing to graph data, Programmer for binary code, Date calculation for working with dates, and options under Converter for converting units of measurement.

Financial software

Financial service software is a broad category of software specifically designed to automate, assist and store financial information of a personal or business nature. Financial software often includes payroll, accounts receivables and payables, general ledger, spreadsheets, financial planning, check writing and portfolio management.

Examples of financial software

- Xero: Xero is an accounting tool that lets you create recurring invoices, reconcile bank and credit card statements. It also helps businesses with purchase and sales orders, contact management, payroll and inventory management.

- Quickbooks: QuickBooks is a standard comprehensive financial management tool geared towards small and medium businesses and accountants. It helps you with bank reconciliation, invoices, tracking expenses, payroll, and advanced reporting. There are both cloud and on-premise solutions.

- Kissflow Finance & Ops Cloud: Kissflow assists businesses to develop a system of approval workflows for finance processes. There are pre-built apps for purchase orders, invoices, expense reimbursements, or you can create your own, depending on your requirements

- Tiller Money: Tiller Money lets you see all your money in one place by automatically updating your bank, credit card, loan, investment, and other account data into a customisable Google Sheet or Excel template.

Financial software allows you to download and import financial data into a spreadsheet to provide useful insights into a businesses performance.

Online special purpose calculators

Organisations have developed Online special-purpose calculators to assist their customers in making financial decisions.

For example, the Commonwealth Bank has developed a number of calculators and tools for their customers.

Go to the Commbank website to view the calculators & tools that they have developed. They cover everything from personal loans, home loans, insurance and investments.

Another example is Moneysmart, a website developed by the Australian Securities and Investments Commission (ASIC), the corporate, markets, financial services and consumer credit regulator in Australia. It provides information and tools to assist people to understand finances and increase their financial wellbeing.

Spreadsheets

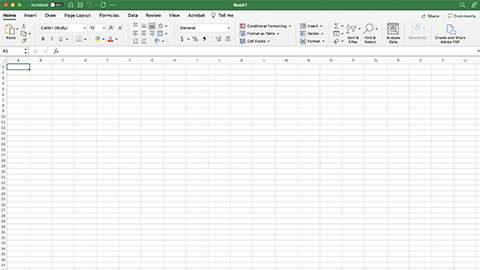

Spreadsheets such as Microsoft Excel take out the tedious nature of manual calculations, which gives the developer more time to spend on analysing & interpreting the results.

Microsoft Excel is a software program included in the Microsoft Office suite. It is used to create spreadsheets, which are documents in which data is laid out in rows and columns like a big table.

Spreadsheets offer a range of advantages, particularly to bookkeepers and accountants. You can use a spreadsheet not only to store data but also to manage it, perform analytical processing on it and present it. Spreadsheets provide complex processing in ways that even people with little technical experience can access.

Using Spreadsheet

Accountants and bookkeepers use spreadsheets to:

- Organise data in a logical way to make sense to interested stakeholders.

- Carry out complex calculations quickly through the use of cell functions. This is particularly helpful if the data in a column continually changes because it saves time. If a formula is already plugged in with cell numbers, the final figure updates automatically.

- Make forecasts based on predicted data by adding in different numbers to see how costs or revenue change based on new data.

- Show data visually through charts and graphs, which are more useful for presentations than tables of data.

- Share and collaborate on workbooks using cloud computing. People can work together, see each other changes and keep the file saved and up to date from different locations.

- Protect the security of the data by locking numbers and formulas, so they are not accidentally erased during data entry and hiding individual cells securing sensitive data.

Microsoft Excel is the most popular and widely used spreadsheet program, but there are also many alternatives. Below is a list of other spreadsheet programs that can be used to create a spreadsheet:

- iWork Numbers - Apple Office Suite

- Lotus 1-2-3

- OpenOffice - Calc

- Lotus Symphony Spreadsheets

- VisiCalc

Even though spreadsheets are typically used with anything containing numbers, the uses of a spreadsheet are almost endless. Spreadsheets are great for any financial data such as checking account information, budgets, transactions, billing, invoices, receipts, forecasts, and any payment system.

Advantages and disadvantages of spreadsheets

| Advantages of spreadsheets | Disadvantages of spreadsheets |

|---|---|

| They make it easy to do instant calculations. | It takes time to learn the formulas, and training can be expensive. |

| Keep data organised efficiently. | Calculation errors may not be recognised as the software has no way of checking for human errors. |

| Data is easy to change and manipulate, and errors can be easily corrected. | It takes time to enter data into each cell. |

| Spreadsheet programs can sometimes be costly. | |

| Can create multiple workbooks in one file. | Some spreadsheet files may be incompatible. |

| Figures can be updated automatically using formulas. | Incorrect formulas will result in errors |

Accounting systems like Xero and MYOB allow you to export reports into various file formats, including excel. This is particularly useful if you want to analyse or manipulate the data in the reports.