Welcome to the world of Accounting and Bookkeeping.

Both accounting and bookkeeping serve crucial roles in financial management. Bookkeeping focuses on recording and organising financial data, while accounting encompasses analysing and presenting this data to business owners and investors.

Let’s go and explore this further.

Before we begin to learn about accounting and bookkeeping, let’s explore what these jobs entail. What are the differences between the two roles? What are some of the tasks you may need to complete if working in these roles?

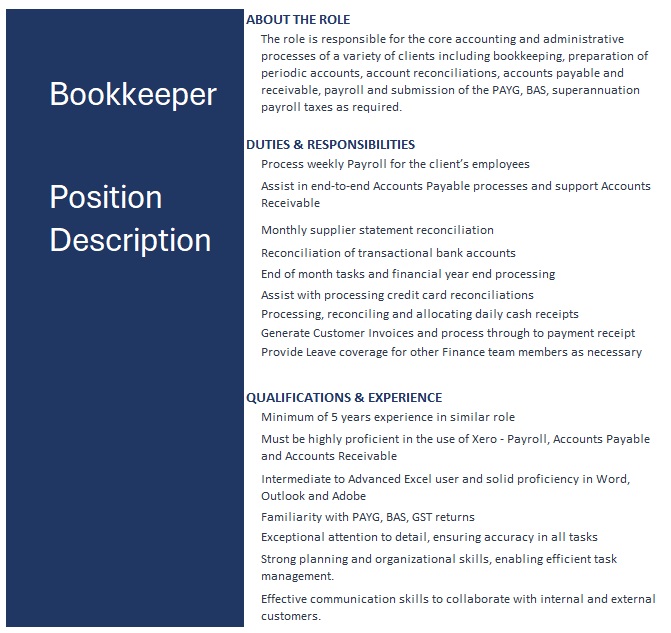

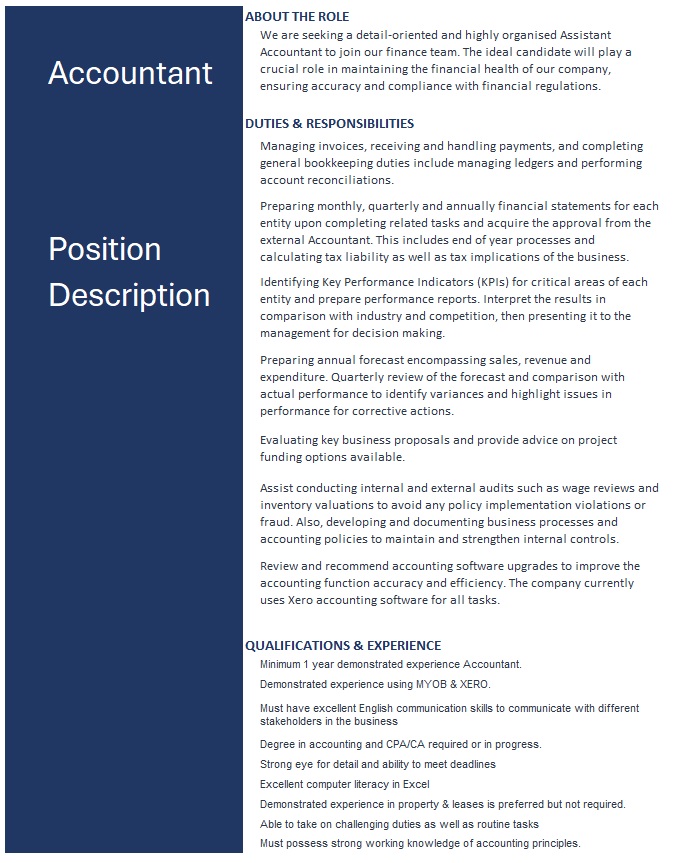

Below, we have compiled a job description outlining the responsibilities and tasks of both a bookkeeper and an accountant. Read through each position description and identify the similarities and differences.

Bookkeeper Position Description

Although bookkeepers and accountants have similar aspects of their jobs, there are some distinctive differences. Let’s have a look at the difference.

| Bookkeepers | Accountants | |

|---|---|---|

| Scope of work | Bookkeepers focus primarily on the day-to-day financial transactions of a business. They record financial data such as sales, purchases, receipts, and payments into the accounting software, reconcile bank statements, manage payroll, accounts payable and accounts receivable, and produce basic financial reports. | Accountants have a broader scope of work compared to bookkeepers. They analyse financial data, prepare financial statements (such as income statements, balance sheets, and cash flow statements), provide financial advice, perform audits, manage taxation matters, and help businesses with strategic financial planning. |

| Qualifications | In Australia, bookkeepers are not required to have formal qualifications. Still, many choose to pursue certifications such as the Certificate IV in Accounting and Bookkeeping or the Diploma of Accounting to enhance their skills and credibility. | Accountants typically hold higher qualifications, such as a bachelor's degree or higher in accounting, finance, or a related field. They may also pursue professional certifications such as Certified Practicing Accountant (CPA) or Chartered Accountant (CA) to demonstrate their expertise. |

| Regulation | There is no specific regulatory body overseeing bookkeepers in Australia. However, bookkeepers who provide BAS (Business Activity Statement) services for a fee must register with the Tax Practitioners Board (TPB) and comply with their Code of Professional Conduct. | Accountants are regulated by various professional bodies such as CPA Australia, Chartered Accountants Australia and New Zealand (CA ANZ), and the Institute of Public Accountants (IPA). These bodies establish standards of professional conduct, continuing education requirements, and ethical guidelines for accountants. |

| Responsibility & Decision Making | Bookkeepers are primarily responsible for accurately recording financial transactions and maintaining organised financial records. They provide data and reports to accountants and business owners for decision-making purposes. | Accountants have a higher level of responsibility and are involved in interpreting financial data, providing strategic advice, and making recommendations to improve financial performance. They often have a more significant role in decision-making processes within a business. |

In 2024, the landscape for accountants and bookkeepers continues to offer promising opportunities despite the tumultuous events of recent years.

With the resilience demonstrated during the challenges of the COVID-19 pandemic, these professions have adapted and thrived. Job security remains a notable feature, with a steady demand for accounting professionals evident in the sustained number of job advertisements. The flexibility of remote work has become increasingly prevalent, facilitated by the digital nature of core accounting systems and the growing acceptance of remote or hybrid work models by employers. Moreover, the diversity of industries served by accountants and bookkeepers ensures a breadth of job opportunities, mitigating the impact of industry-specific disruptions. Additionally, there's a heightened demand for compliance expertise, particularly in assisting businesses in navigating government support programs. As the workforce continues to evolve, pursuing a career or transition within accounting and bookkeeping offers a pathway to stability and growth in 2024.

Below is a list of some of the largest accounting firms in Australia and New Zealand. They are well regarded and a popular choice for graduates due to their global reach, professional development opportunities, career progression and opportunities for travel.