This topic provides the tools and knowledge to build a financial plan to help you succeed in your new business venture.

By the end of this topic, you will understand:

- The legislative and regulatory requirements

- Basic financial terminology

- Financial tools for a new business

- How to:

- identify the costs associated with the production and delivery of your products and services

- decide on a profit target for the business

- estimate your operating expenses

- establish a mark-up for your product or service

- establish a break-even sales point to help you determine the viability of a business venture

- select a pricing strategy for your product or service

- prepare a projected profit statement.

Important

Before you start any business, you must know what the regulatory requirements are for businesses in Australia, as well as the particular industry in which your business operates.

Managing your finances also means managing the legal and regulatory risks that may impact your business's financial viability and sustainability.

Under the Competition and Consumer Act 2010 and a range of additional legislation enforced by the Australian Competition and Consumer Commission (ACCC), businesses have been forced to pay hefty fines of millions of dollars for failing to comply. Here, individuals are not exempt from this rule. They can be fined at least $500,000 for immoral conduct, making false or misleading representations, supplying consumer goods or certain services that do not comply with safety standards, or selling banned products.

Consequently, before you start any business, you must know the regulatory requirements for businesses in Australia, as well as the particular industry in which your business operates.

A brief outline follows:

Fair Work Act 2009

The Fair Work Act outlines the rights and responsibilities of workers and employers. It covers workplace protections such as minimum working conditions and protections for workers against discrimination and unfair dismissal.

If you are considering employing others in your business, read the Fair Work Ombudsman Fact Sheets and provide it to all employees.

Read

Read about the 'Protections at Work' resource by the Fair Work Ombudsman, a branch of the Australian government, to learn more.

Fair Trade

The Competition and Consumer Act 2010 supports fair trading between competitors while ensuring that consumers are treated fairly. The Australian Competition and Consumer Commission's (ACCC) purpose is to enforce the Competition and Consumer Act 2010 and a range of additional legislation, promoting competition, fair trading and regulating national infrastructure for the benefit of all Australians.

New businesses particularly need to be aware of regulations around:

- Product Safety

- Product Labelling

- Price Monitoring

Businesses must be aware they must sell goods that are fit for purpose. Knowingly selling a defective product that does not meet Australian standards can lead to the company being fined or to criminal charges if the product causes injury or death.

Read

- Read about the fair trading laws for your state or territory to learn more.

- Also, please read this guide written by the ACCC, which was designed to assist small businesses in understanding what their essential rights and responsibilities are under the Competition and Consumer Act 2010 and the Australian Consumer Law.

Industry Regulations and Codes of Conduct

Are you considering starting a micro-brewery business or baking healthy foods to sell at your local coffee shop? Or maybe you are thinking of making designer shoes or starting a print shop? Selling apparel or cosmetics? Starting a B&B or a coffee shop? Starting your own window-washing business or pet care? Or maybe a real estate business?

All these businesses have something in common – they are in industries covered by regulations and industry codes of conduct. If you set up and run a business in one of these industries, you must follow their rules and codes of conduct.

The industries covered by regulations are as follows:

- Accommodation and food industry

- Administrative services

- Agriculture

- Arts and recreational services

- Building and Construction

- Financial and insurance services

- Fisheries industry

- Forestry industry

- Information and media

- Manufacturing industry

- Professional, scientific and technical services industry

- Rental hiring and real estate services

- Wholesale and retail

- Tourism

- Transport, postal and warehousing

Read

Visit business.gov.au/Planning/Industry-information for more information about the regulations that may apply to your business.

Franchising, Licensing and Other Contractual Agreements

Those who decide to purchase a franchise, bid for an agency agreement or license a product or service also need to be aware they must comply with the contractual agreement and the organisational policies of the master franchisor or corporation they are joining or whose services they are supplying. Overseas suppliers often have policies you must comply with. For example, selling a product only within a designated geographical area is usually a good idea to seek legal assistance to understand your contractual obligations clearly.

Example

The social media platform Parler is a high-profile example of a company whose policies conflicted with a major supplier and their contractual agreement. In early January 2021, Amazon suspended Parler from its hosting service for failing to comply with its terms of service after multiple warnings. However, Parler responded by suing Amazon for cutting off its hosting. Withdrawal of its service effectively closed the business down momentarily. Parler is now up and running again. Check out this article to learn more.

Taxation registration

All taxpayers (individuals and companies) must apply to the Australian Taxation Office (ATO) for a tax file number. Income Tax Assessment Act 1997 requires businesses to submit an income tax return each financial year. The business tax file number is required to lodge income tax returns and receive notice of assessments from the ATO.2 Business entities (sole traders, partnerships, companies, etc.) must have an Australian Business Number (ABN). A business will require an ABN to:

- Register for GST and lodge business activity statements (BAS)

- Withhold income tax from employee payments under the Pay As You Go (PAYG) system

- Pay income tax

An ABN is also required to register a business name. This can be applied for online via www.business.gov.au or abr.gov.au.

A New Tax System (Goods and Services Tax) Act 1999

Goods and services tax (GST) is a broad-based tax of 10% on most goods, services and other items sold or consumed in Australia.

Within Australia, you must register for GST if:

- Your business or enterprise has a GST turnover (gross income minus GST) of $75,000 or more

- Your non-profit organisation has a GST turnover of $150,000 per year or more

- You provide taxi or limousine travel for passengers in exchange for a fare as part of your business, regardless of your GST turnover – this applies to both owner drivers and if you lease or rent a taxi.

- You want to claim fuel tax credits for your business or enterprise

Read about registering for GST to learn more.

Generally, businesses and other organisations registered for GST will:

- Include GST in the price they charge for their goods and services

- Claim credits for GST are included in the price of goods and services they buy for their business.

Read about how GST works to learn more.

Data protection and Privacy laws

Businesses that collect and store customer data must adhere to the Privacy Act 1988, including the Australian Privacy Principles (APPs), concerning collecting, using, and disclosing personal information.

Read

Read about the Privacy Act 1988 to learn more.

Read about Australian Privacy Principles and how to apply them to learn more.

Assets and Liabilities

Assets describe everything that your business owns and uses to operate, including:

- Inventory (goods to be sold)

- Equipment ranging from machinery and motor vehicles to office equipment such as 3D printers, computers, etc.

- Real estate or properties that the business owns

- Cash in the bank, including loans that can be drawn on

- Money that is owed to the business (debtors or accounts receivable)

Liabilities include:

- All outstanding debts that your business owes, including the loans you need to pay back that were included in assets

- Monthly rental expenses, including warehousing fees

- Credit card debt

- Utility bills such as telephone, internet, water, gas, electricity and waste disposal

- Contracted monthly subscriptions to use essential services such as your accounting, web services and e-store

- Taxes owed

- Interest owed on loans

- Leasing costs for vehicles and equipment

- Franchise fees

Break-Even

If you are breaking even, your income is equivalent to your costs. It is where no profit or loss is made. Every dollar above this is profit. Every dollar below this is a loss. Consequently, understanding how to conduct a break-even analysis on a product or the business itself is critical to knowing how to price a product or service.

Burn Rate

Burn rate refers to how much money the business spends monthly before generating positive cash flows. It is usually quoted in terms of cash spent each month, and it is important to monitor how much your initial venture capital will last.

Capital Expenditures (CapEx)

Anything you buy for your business that is of significant value and will be utilised for a long time is included as capital expenditure. It is money used to buy or upgrade assets such as machinery, computers and real estate. Therefore, such costs must be separated from your operating expenses to understand how your company can be profitable. Operating expenses are recorded in your income statement, and capital expenditures are in your balance sheet.

Because they are legitimate tax deductions, your accountant will advise on how to claim capital expenditure either as an instant write-off or over the lifetime of the equipment against your business income. Alternatively, you can visit the Australian Tax Office website for information.

Read

Read about how and what can be deducted as CapEx in this article 'Depreciation and capital expenses and allowances' by the Australian Tax Office to learn more.

Concentration

Will you be running a business that relies on a few big clients? Concentration describes how much of your revenue comes from a specific customer.

It is riskier to rely on a handful of customers or partners to generate revenue because losing one customer could greatly affect your earnings and the value of a business if the owner wants to sell it. Businesses with high concentration also find it more difficult to find finance.

Cost of Goods Sold (COGS)

This term refers to the total cost of all labour and materials (direct costs) required to provide the products or services that your customers buy. The following should also be considered:

- Payments to contractors

- Salaries

- Materials for use in creating products or delivering services for sale

- Cost of products purchased for resale

- The customs fees for goods purchased from overseas

Credit Management

This refers to how you process and control payments and what services, such as credit cards, PayPal, AfterPay and so on, you intend to use. You can learn more about the merchant fees charged for these services on your provider’s website.

Read

Read about surcharges you can apply to customer transactions by the Australian Competition and Consumer Commission to learn more.

Financial Plan

Establishing a business requires a lot of research and planning. Ultimately, your research builds into the business plan you will use to guide your activities and determine what you must show to the bank or investors when applying for finance.

The Financial Plan is a vital part of the Business Plan. It includes your financial goals and strategies (such as how you intend to finance the business) as well as calculations covering:

- Business establishment costs

- Borrowing requirements

- Operating expenses forecast

- Cost of Goods (COGs)

- Sales Forecast

- Cash flow forecast

- Profit and Loss statement

- Break-even analysis

- Credit management

The three financial reports you will have to develop for your business are:

-

Cash Flow Statement

You may have heard the expression, “Cash is king.” Watching your cash flow is important in any business to be sure you can pay your bills. Your cash flow includes the cash you have in your accounts, plus all the money coming in minus all the money going out.

-

Profit and Loss (Income Statement)

The Profit and Loss Statement (P&L) lists all your sales (including invoices that might not have been paid yet) and all expenses. It is the statement that you use to help establish your markup and profit margins.

-

The Balance Sheet (Statement of Financial Position)

This statement summarises all the assets (what the business owns) and all the liabilities (what the business owes) at a particular time.

What is left when the liabilities are subtracted from the assets is called Owner’s Equity. It is what you would be left with if you had to sell everything and pay all debts then. Consequently, this statement is important in revealing the financial health of a business.

Sometimes, the profit and loss statement and the balance sheet are a company’s financial statements.

Financial Reports

Financial reports (financial statements or finance reports) provide detailed information about the business. Financial reports contain the business's income, cash flow, and balance sheets. The Income statement informs the reader about the business’s ability to generate a profit. The Balance Sheet informs the reader about the business's debt position, funding and liquidity. The Cash Flow statement informs the reader how cash flows in and out of the business. Financial reports make lending, investment, taxation and staff union decisions.3

Fixed and Variable Costs

Fixed Costs

These are all the costs to run your business regardless of whether you sell anything. It includes rent, leasing of vehicles, payment of licence fees, etc.

Variable Costs

These are the direct costs of making or selling your product or service. To calculate the total variable cost, you multiply the cost to make or deliver one unit of your product (variable per unit) by the number of products you have developed.

For example, if it costs $20 to produce one product/unit, and you have made 20 units, your total variable cost is $20 x 20, or $400.

It is a bit different with services. If it costs you $380 to keep your beauty salon open for a day (labour costs), your costs per service will vary on whether every appointment slot is taken, and the type of service provided. However, the variable cost of keeping the salon open for a day remains at $380, whether you deliver one service or 20 services. This is one of the reasons that some businesses decide to close during slow periods.

Margin

Gross Margin

Gross Margin is the percentage of your total revenue that ends up as net income (what is left when you subtract the direct costs) over a certain time. Let's say your company’s revenue is $100,000 in one quarter, and net income is $25,000. Here, your gross margin is 25 per cent. The higher your gross margin, the more sales revenue you retain to cover your overheads or keep as profit.

Profit Margin

The profit margin is calculated differently from the gross margin. Profit margin is calculated by subtracting overhead expenses and direct costs from sales amounts and dividing the remaining amount from the total revenue.

Because a business can take a while to become profitable, this figure should not indicate your company’s financial health for new businesses. However, business owners must show a healthy profit margin to attract investment or sell the business as the business matures.

Mark-up

This figure is the amount added to the direct costs of your product or service (the unit cost) to cover additional (overheard) expenses and make a profit. For example, if your business sells custom-designed caps for $35, the cost of the blank caps is $5, the labour cost to customise caps is $8, and your markup is $22. If you run a nail salon and charge $35 for a manicure and you pay your nail artist $21, the cost of nail files, nail polish, etc., is $3, and your mark-up is $11,

Note

Your markup is not a profit because you still need to cover all the indirect/overhead costs of running the business.

Net Income and Net Profit

Both these terms refer to the amount of money you are left with at the end of the year. While net income is your total sales income minus your direct costs, net profit subtracts marketing, administrative expenses, and other overhead costs from direct costs.

Business owners sometimes refer to these figures as their bottom line because they are the last line on the balance sheet.

Unit Cost

The unit cost refers to the cost of making or buying one product unit. It is determined by combining variable and fixed costs and dividing by the total number of units produced. For example, assume total fixed costs are $40,000, variable costs are $20,000, and you produced 600 product units. The unit cost would be $100.

It is important to know your unit cost to decide on a price that will lead to a profit.

As explained earlier, a Profit and Loss Statement (sometimes called an Income Statement) tells you how much sales and other revenue (for example, commissions) is coming into the business, less the cost of the goods being sold, and how much you spend on expenses. What is left is your profit.

Before opening your doors, ensuring a profit at the end of the month, the quarter and the year is a good idea.

To do this, you take all the information you have gained from your research and calculations, starting with how many units you expect to sell multiplied by the price you intend to charge. This is your revenue. From this, you subtract the expected expenses.

Usually, this is done every month because it is quite possible that some months will be slower than others, particularly if you run a seasonal business. For example, if you are selling ski gear, you will have low sales in the Summer: your boom time will start at the beginning of Winter. It is then consolidated into an annual statement.

A simple annual profit projection for a start-up can be developed on a spreadsheet.

In the following example, the beauty business owner has decided to pay herself a salary, has no employees, and has rented out a small space. If the profit projection looks small, keep in mind many new businesses make no profit in the start-up phase. Any profit made will be used to repay the cost of establishing the business.

| Projected Profit and Loss 202X | ||

|---|---|---|

| Lara's Lashes and Nails | ||

| Projected Profit and Loss 202X | ||

| Sales Revenue | $100,000.00 | |

| Cost of Goods Sold | $12,000.00 | |

| Gross Profit | $88,000.00 | |

| Operating Expenses | Marketing | $5,000.00 |

| Rent | $16,000.00 | |

| Accounting and Legal Fees | $2,000.00 | |

| Salary Expenses | $55,000.00 | |

| Total Operating Expenses | $78,000.00 | |

| Net Profit | $10,000.00 | |

Website

Business.gov.au has provided a step-by-step guide on preparing your Profit and Loss and a template you can use.

If you plan a new business venture, you must use Excel or a similar spreadsheet such as Google Sheets to quickly and easily keep track of your financial situation and make accurate calculations.

While you will probably move to a more sophisticated application that your bookkeeper or accountant will recommend as your business matures, a simple easy-to use application, such as Excel or Google Sheets. will take you through the start-up stage.

Many government websites for business provide Excel templates to get you started, and you will find links to these websites and the templates in this guide. Excel and Google Sheets also provide templates for many of the necessary statements and calculations.

Watch

If you have the Office suite of applications on your computer (Word, Outlook, etc.), you can also access Excel. If you have never used the application before, watch the following YouTube videos:

- Balance sheet template

- Break-even analysis calculator

- Cost of Goods Sold (COGS) Calculator

- Financial plan template

- Financial statements template

- Initial start-up cost calculator

- Operating expenses calculator

- Profit and loss statement template

- Start-up costing template

- Guide to starting a business provided by business.gov.au

- How to start a business guide provided by Xero.

Activity

Use the template on the business.gov.au website to develop a projected Profit & Loss statement for your new business.

As you begin your business venture, many questions are probably going through your mind, including:

- Will your business idea make money?

- How much of your product or service must you sell or provide to sustain the business?

- What price should you charge?

The first step in answering these questions is identifying the direct costs of delivering your product or service. These are your variable costs or Costs of Goods Sold (COGS).

Buying Products to Assemble for Resale

With this business model, you buy the product components from elsewhere. You then assemble them and install or deliver them to the customer. This is a common business model for those providing window shutters, kitchens, other construction materials, electronics, etc.

Note

The Small Business Development Corporation in Western Australia provides an excellent Cost of Goods Sold (COGS) template to help you identify all of the costs associated with purchasing or making a product or delivering a service. You only need to put in the costs you know when you download it, and the calculations are done for you.

Identifying the Cost of Delivering a Service

Are you considering a service business that provides bookkeeping, handyman services, graphic design or IT services, beautician services, etc.? Assuming you are hiring labour, your calculations for the cost of service will look like the following:

A beautician who charges $35 for a half-leg wax may pay the beauty consultant $15 for their time and $6 for the wax and strips (the consumables). Because they use Google Adwords to acquire customers, they may also keep track of customer acquisition costs in this way. (This is done by dividing the monthly cost by the number of services provided). But there will be no travel costs since they are in the salon.

However, travel is a direct cost for someone running a computer consultancy or on-the-job training business. And they may or may not have to pay a sales company or website for the lead.

The Cost of Working for Yourself

Your time is worth money, and paying yourself the salary you would expect to be paid when doing the same job is good practice. Put this cost into your spreadsheet by calculating your hourly rate.

Key Point

At this stage, you are only trying to capture the costs when you make a sale, not the cost of running the business itself. So, include the cost of your time spent creating or delivering your products/services into your COGS or COS. Do not include the cost of your time spent managing the business's day-to-day operations; these will be included as operating expenses. This will assist you in deciding on the mark-up and the final price you will charge.

ACTIVITY:

Using the template from the Western Australian Small Business Development Corporation website and the information below, calculate what the total cost is to deliver the following three products for Sunshine Surf Shop:

|

|

Sunglasses | Beach Towel | Board Shorts |

|---|---|---|---|

| Frames |

$1.00 |

||

| Lenses | $0.50 | ||

| Towelling matreial per unit | $5.00 | ||

| Board shorts | $3.00 | ||

| Labelling | $0.20 | $0.50 | $0.65 |

| Freight | $0.20 |

$0.40 |

$0.20 |

| Direct labour | $1.00 | $1.00 | $0.50 |

| Sales commissions | $1.00 | $1.00 | $2.00 |

| TOTAL COGS | ? | ? | ? |

- Sunglasses: $3.90

- Beach towel: $7.90

- Board shorts: $6.35

What kind of profit do you want to make on your business? When establishing a target, you need to keep in mind several things, including:

- the interest rates being charged on any loans

- a return on the capital you have applied to the business

- a return for the risk you are taking

- the return for future growth

- what you want as annual income if you are not paying yourself a direct salary

- the business overheads

- the variable costs

- the cost of goods sold.

As a rule of thumb, if you can make five per cent by keeping your cash in fixed interest with little to no risk, you will want to set a profit target for the business well above that measure to make the risk and effort worthwhile. If you fund the company using a loan with an interest rate of seven per cent, you need to increase the profit margin even further to cover that.

Your business (loss) is the difference between your income and expenses.

Formula: Profit = Income - Expenses

The profit you make depends on your income and your business's expenses.

The process for setting target profit is in the following steps:

- Determine a realistic level of income the business can achieve in the next 12 months

- Calculate the Cost of Goods Sold associated with the sales revenue target

- Calculate Operating / overhead expenses required to deliver this revenue target

- Determine the income/salary you want from the business

- Income target less COGS – Operating Expenses – Desired Income = Target Profit

Calculating sales revenue is essential in setting up a business, as the sales generated are directly linked to the company's profits.

Website

Business Queensland has a handy return on equity calculator on its website that allows you to do this in minutes. Scroll down to the ''getting a profit goal section.

Now that you know the unit cost of delivering your product or service (your variable costs), you must calculate the costs of running your business to start working out what markup you need to make a profit.

These are also called your operating or fixed costs, usually calculated monthly or quarterly, depending on the business.

Note: Your variable and fixed costs will be used to calculate your breakeven point and inform profit target setting. We will explore this in more detail further on.

Website

The Small Business Development Corporation in Western Australia has an excellent Excel template covering most business costs.

ACTIVITY:

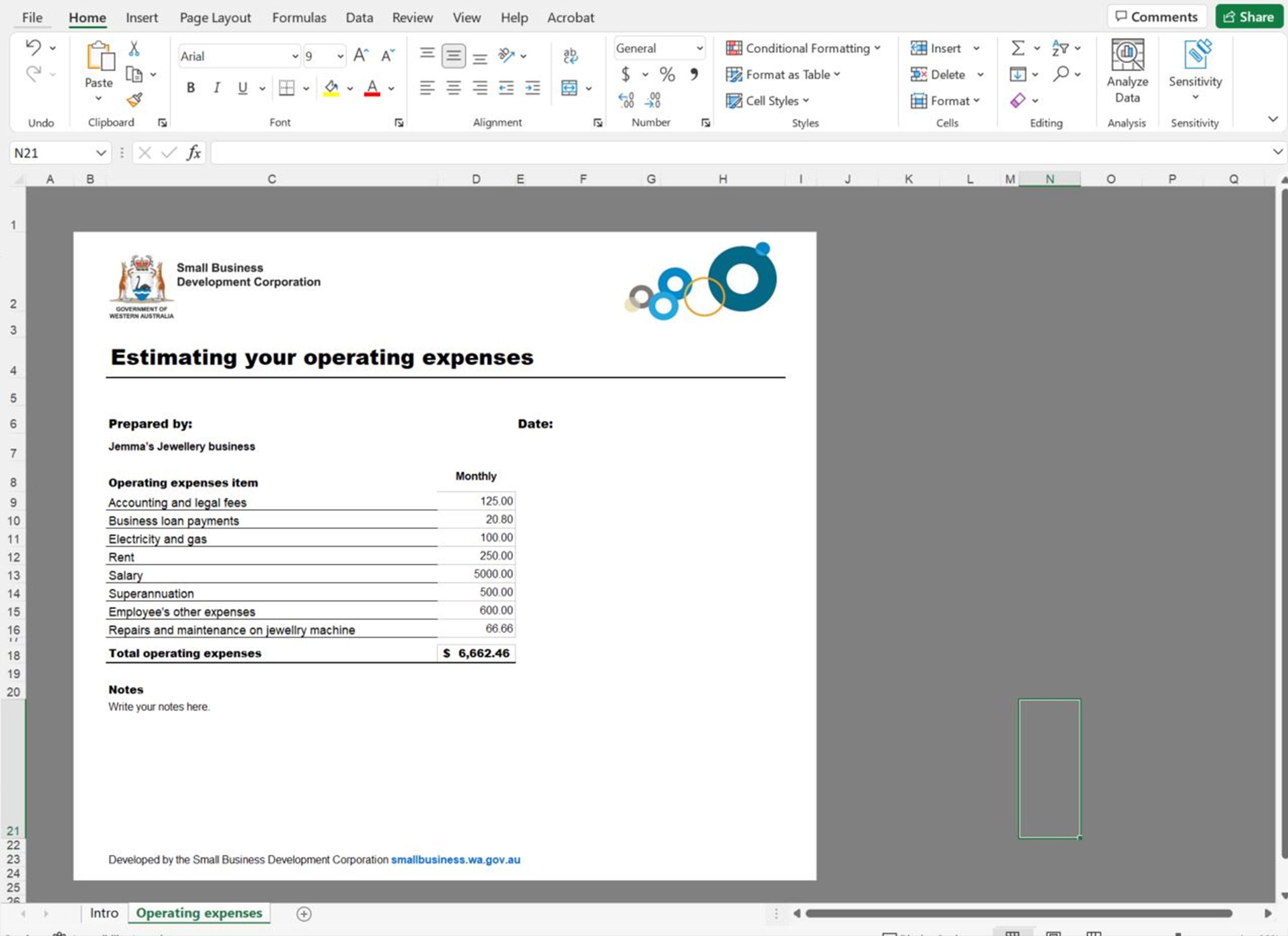

Download the 'Estimating your operating expenses' template to calculate the monthly cost of running Jemma's Jewellery business. Use the following information to complete this activity:

- Accounting and legal fees: $1,500 per year ($125 per month)

- Business loan: $5,000, 5% per year, paid monthly ($20.80 per month)

- Electricity and gas: $300 per quarter ($100 per month)

- Rent: $250 per month

- Salary: $60,000 per year ($5,000 per month)

- Superannuation $6,000 per year ($500 per month)

- Employee's other expenses: $600 per month ($600 per month)

- Repairs and maintenance on jewellery machinery: $200 per quarter ($66.66 per month)

Total Operating expenses: $6,662.46 per month.

When pricing your product or service, you want to ensure that the markup will cover your variable and fixed costs and, ideally, leave some leftovers to cover your startup costs and future investment. It is typically expressed as a percentage.

This is not always easy with products because it depends on how many products you think you can sell and the price. A 10 per cent markup may be more than adequate for a highly priced product of $5,000 or more if you can sell 50 or more a month, but it is entirely inadequate for a product that sells 50 units for $50 each. This is why you will find that the markup on apparel at your local boutique is often 200% or more.

So, where do you start?

- Begin by researching competitors and pricing strategies. This will give you a benchmark/ market price for your product or service.

- Calculate your gross profit = revenue – COGS.

- Divide gross profit by COGS.

- Multiply the markup by 100

For example, if you own a coffee shop and you want to calculate the markup of a chai latte:

If your chai lattes bring in $4,000 in revenue each month and the ingredients cost $2,000 per month, selling 1100 chai lattes, you would calculate the markup using the steps above in the following way:

- Average Chai Latte Cost = $4.00 (your current price is $4,000 / 1 100 = $3.64)

- Calculate your gross profit = revenue – COGS = $4,000 - $2,000 = $2,000 is the Gross Profit of the chai latte

- Divide gross profit by COGS = $2,000 / $2,000 = 1

- Multiply the markup by 100 = 100, and your chai lattes are marked up by 100%.

Note: Markup is used to calculate your product's price. The profit margin indicates how much revenue your business makes by deducting costs.

Then, do some scenario planning to see how your costs and margins might align. You may find that your cost structure is lower, and you feel you can be more competitive in price.

Case study example

Tony's Tidy Homes (handyman service)

Tony has calculated the hourly cost of his labour, superannuation, petrol and mobile phone to be $40 per hour. He projects he will get 120 hours of work a month, with the rest of his time spent on marketing, quoting jobs, and administration.

He works from a home office and has calculated his monthly operating costs for the lease of his truck, maintenance, bookkeeping, internet and website costs, insurance and so on as $1,200.

To cover these costs, his markup would have to be $10 per hour ($1,200 divided by 120), and his charge-out rate would be $50 (variable cost to deliver service $40 + markup $10 = $50). However, to recoup his startup posts and meet his profit target, he decides on a charge-out rate of $57 per hour.

One of the most common questions amongst small business owners is how much they should charge per hour for their services.

To calculate your charge-out rate, there are many important steps to take:

- Calculate total income-producing/billable hours per year (don't forget to include time off for holidays, admin, personal development, etc)

- Calculate the total operating/overhead costs of the business

- Determine desired profit and salary

- Divide total operating/overhead costs + desired profit + desired salary by the total billable hours = your hourly rate.

Read the Small Business Development Corporation article for more examples and tips.

On the Western Australian government's website, you can also find a helpful calculator to help you work out your hourly rate.

Now, having determined the variable costs (COGs or COS) and operating/overhead costs of your business, you can calculate the total unit cost of your products and services.

The unit cost is calculated using the following formula and process:

Cost per unit = variable + fixed costs to produce product/service / total units produced / services delivered

- Determine the variable cost of your product/service

- Determine the fixed costs to produce product/service

- Add variable and fixed costs together = total cost

- Divide the total costs of the product/service by the total units produced or delivered

There are various ways to decide what price to charge for your products and services. These are:

- Cost-plus pricing is a strategy that uses the cost of the product or service plus adding a markup, usually a percentage you believe will cover your fixed expenses and meet your profit target.

- Market pricing is pricing your product or service to ensure it meets the market price of similar products or services. This ensures you are competitive.

- Value-based pricing is setting a price according to what your customers think the product or service is worth. This may be based on how scarce the product is or how difficult it may be to replicate.

- Price skimming is setting a high price initially but lowering it as the market matures.

- Penetration pricing is establishing a low price to enter a market, then raising the price as customers become committed or develop loyalty to the brand.

Not all strategies are suitable for a new business. Price skimming and penetration pricing tend to be strategies better suited to established brands, although a very innovative product may initially use price skimming when entering the market.

Read about developing a pricing strategy by Business.gov.au to learn more.

Think

What pricing strategy will work best for your business? Consider what you might charge.

How much the customer is willing to pay for the product has very little to do with cost and has very much to do with how much they value the product or service they’re buying.Eric Dolansky (Associate Professor of Marketing, Brock University)

From the case example in the previous section, what would happen if Tony does not achieve his goal of delivering 120 paid hours of handyman work a month? Or, if you were an owner of a business selling electronic gear, are you not sure how many units of product you would sell?

Working out your breakeven point is essential to ensure your business is viable. The breakeven analysis will tell you the profitability of a product line, how far sales can decline before you start making a loss and what effect price and sales volume will have on your profitability.

You can calculate a business's breakeven point in sales dollars and units. This allows you to know the level of sales ($) required to break even and the number of units that need to be sold to achieve this level of sales.

The sales income of the business must be enough to cover the variable (COGS) and fixed costs (operating expenses), as well as the required profit.

There are five steps in calculating your breakeven point (dollar value) – the learning has already touched on the first two steps:

- Determine variable unit costs (Topic 2, subtopic 4)

- Determine fixed costs (Topic 2, subtopic 6)

- Work out the unit selling price. (Note – this price may change after determining your breakeven point.) (Topic 2, subtopic 8)

- Determine sales volumes: The breakeven point will change as the sales volume for this product and the unit price change.

- To calculate the breakeven in dollars and units, use the following formulas:

- Breakeven ($) = Fixed costs (operating expenses) divided by (1 – (COGS divided by total sales))

- Breakeven (units) = Fixed costs (operating expenses) divided by (selling price per unit – cost per unit)

You can use a free template like the one from Small Business Development Corporation WA.

Activity: Joe's Motorbike Tyres

| Profit and Loss Statement | |||

| For the Period Ended Year One | |||

| Income | |||

|---|---|---|---|

| Sales | $52,000 | (1,000 tyres @ $52 each) | |

| Total sales | $52,000 | ||

| Cost of Goods Sold | |||

| Opening stock | $ - | ||

| Stock purchases | $34,320 | ||

| Less closing stock | $3,120 | ||

| Total cost of Goods Sold (COGS) | $31,200 | (See notes at the end of the table) | |

| Gross Profit | $20,800 | ||

| Expenses | |||

| Advertising | $500 | ||

| Bank service charges | $120 | ||

| Insurance | $500 | ||

| Payroll | $13,000 | ||

| Professional fees (legal, accounting) | $200 | ||

| Utilities and telephone | $800 | ||

| Other: Computer software | $480 | ||

| Expenses total | $15,600 | ||

| Net Profit Before Tax | $5,200 | ||

| Note: | COGS = 100 tyres @ $31.20 each | ||

Task: Calculate the breakeven (dollar value) and breakeven (units to sell) before net profit.

Calculation:

- Break-even (dollar value): Break-even ($) = $15,600 / (1 – ($31 200/$52 000); Break-even ($) = $15,600 / (1 – 0.6); Break-even ($) = $39,000

- Breakeven (units): Breakeven (units) = $15,600 / ($52 - $31.20); Breakeven (units) = $15,600 / $20.80; Breakeven (units) = 750 units

Answer: Joe's tyres must sell 750 units or $39,000 worth of stock before the business earns any profit. Here's a detailed explanation.

You can input your sales and cost information into a spreadsheet to model the breakeven analysis and create a graph. Your graph should resemble the following:

Watch

If you prefer to see how it is done, watch this simple video, 'How to Conduct a Breakeven Analysis' by Alanis Business Academy:

As explained earlier, a Profit and Loss Statement (sometimes called an Income Statement) tells you how much sales and other revenue (for example, commissions) is coming into the business, less the cost of the goods being sold, and how much you spend on expenses. What is left is your profit.

Before opening your doors, ensuring a profit at the end of the month, the quarter and the year is a good idea.

To do this, you take all the information you have gained from your research and calculations, starting with how many units you expect to sell multiplied by the price you intend to charge. This is your revenue. From this, you subtract the expected expenses.

Usually, this is done every month because some months may be slower than others, particularly if you run a seasonal business. For example, if you are selling ski gear, you will have low sales in the Summer: your boom time will start at the beginning of Winter. It is then consolidated into an annual statement.

A simple annual profit projection for a start-up can be developed on a spreadsheet.

In the following example, the beauty business owner has decided to pay herself a salary, has no employees, and has rented a small space. If the profit projection looks small, keep in mind many new businesses make no profit in the start-up phase. Any profit made will be used to repay the cost of establishing the business.

| Projected Profit and Loss 202X | ||

|---|---|---|

| Lara's Lashes and Nails | ||

| Projected Profit and Loss 202X | ||

| Sales Revenue | $100,000.00 | |

| Cost of Goods Sold | $12,000.00 | |

| Gross Profit | $88,000.00 | |

| Operating Expenses | Marketing | $5,000.00 |

| Rent | $16,000.00 | |

| Accounting and Legal Fees | $2,000.00 | |

| Salary Expenses | $55,000.00 | |

| Total Operating Expenses | $78,000.00 | |

| Net Profit | $10,000.00 | |

Website

Business.gov.au has provided a step-by-step guide on preparing your Profit and Loss and a template you can use.

Activity

Use the template on the business.gov.au website to develop a projected Profit & Loss statement for your new business.

Use the following questions to check your knowledge:

-

What's the difference between gross margin and a mark-up?

Gross Margin = sales less COGS and Mark-up = variable cost + mark-up = selling price

-

Identify the THREE financial statements that a business requires.

Cash flow statement, Profit and Loss (Income Statement) and Balance Sheet (Statement of Financial Position)

-

Why is it important to understand your business's cash flow?

Understanding and managing your business's cash flow ensures you can pay your bills and repay business loans.

-

How do you calculate your unit costs?

Calculate the total variable costs by completing a COGS schedule and dividing total COGS by the number of units sold.

-

Should your office rent be considered a variable cost or a fixed cost?

It should be considered a fixed cost as it is constant rather than variable. The cost of rent does not change when sales volumes change.