In the last topic, we introduced the concept of the Accounting Equation. In this topic, we are going to look at the accounting equation in more detail.

First, let’s watch a video that explains the accounting equation, known as the formula: Assets = Liabilities + Equity.

This concept is fundamental to accounting and double-entry bookkeeping

The accounting equation can be represented in three (3) ways:

- Assets = Liabilities + Equity

- Double-entry accounting - For every credit entry, there must be a corresponding debit entry.

- The balance sheet – The balance sheet reflects the accounting equation. In the Freshwater Pty Ltd example above, we can see that:

Total Assets of $306,630,86 = Total Liabilities $206,190.37 + Equity $100,440.49

Let’s examine the three ways the accounting equation can be represented by analysing the following transactions for New Business IT.

In March 2021, Craig started a new business called New Business IT. The following business transactions occurred during March.

| Date | Business Transaction |

|---|---|

| 01/03/2021 | Craig deposits $10,000 into the business bank account. |

| 02/03/2021 | Craig took out a $15,000 business loan with the NAB. |

| 03/03/2021 | Craig purchased office equipment valued at $8,000 and computer equipment valued at $10,500 in cash. |

| 04/03/2021 | Craig leased office space and paid $3,000 rent in cash. |

| 05/03/2021 | Craig provides IT consultancy services to a client and is paid $4,500 in cash. |

Accounting Equation - Assets = Liabilities + Equity

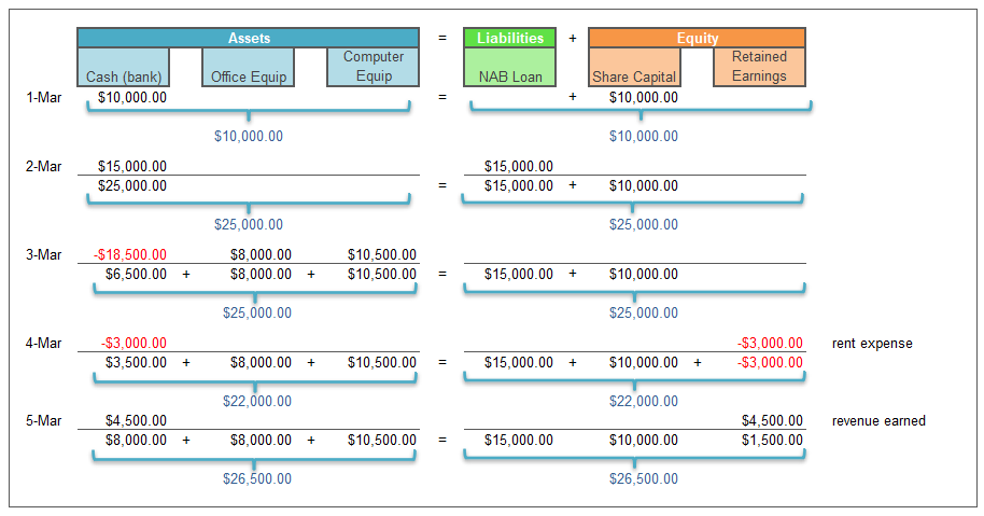

Image 1- Column System

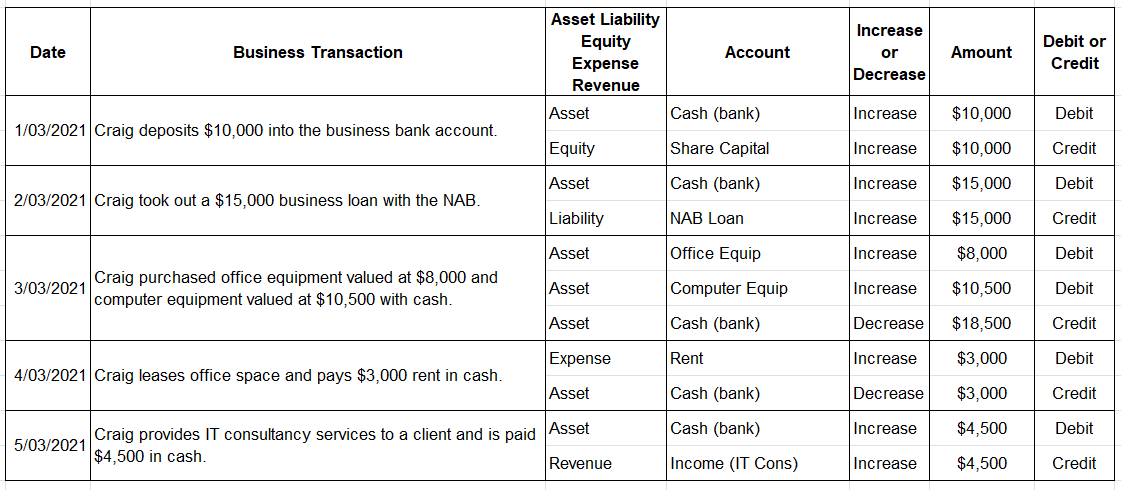

Below is an analysis of the effect the transactions have on the accounting equation Assets = Liabilities + Equity as shown using the Column System – (Image 1).

Transaction 1.

New Business IT issues share to Craig in exchange for $10,000 cash. This results in both an increase in cash in the business bank account (asset) and an increase in share capital (equity). The accounting equation remains in balance.

Asset ($10,000) = Liabilities + Equity ($10,000)

Transaction 2.

Craig was successful in applying for a business loan for his new business. The loan was not a personal loan for Craig. The loan belongs to New Business IT. This results in an increase in cash in the business bank account (asset) and an increase in NAB loan (liability). The cumulative effect of the two transactions is:

Asset ($25,000) = Liabilities ($15,000) + Equity ($10,000)

Transaction 3.

Craig used cash to purchase office and computer equipment for his new business. This transaction affects three asset accounts. The business bank account decreases by $18,500, office equipment increased by $8,000 and computer equipment increases by $10,500. Note the cumulative effect of this transaction has not changed the accounting equation because assets have increased and decreased by corresponding amounts.

Asset ($25,000) = Liabilities ($15,000) + Equity ($10,000)

Transaction 4.

Craig leased office space and paid $3,000 rent in cash. Rent is an expense incurred by New Business IT in the course of earning revenue. Expenses decrease retained earnings (equity). This transaction decreases cash (asset) and increases rent expense, which decreases equity. The cumulative effect of these four transactions is:

Asset ($22,000) = Liabilities ($15,000) + Equity ($7,000)

Note: We will discuss expenses and revenue in more detail later in training.

Transaction 5.

Craig provides consultancy services to a client and is paid $4,500 in cash. The cash paid for his services is revenue for New Business IT. Revenue increases retained earnings (equity). This transaction increases cash (asset) and revenue, which increases equity. The cumulative effect of these five transactions is:

Asset ($26,500) = Liabilities ($15,000) + Equity ($11,500)

Note: We will discuss expenses and revenue in more detail later in training.

Task

The accounting equation is the foundation formula for double-entry bookkeeping. It is based on the dual aspect concept:

Dual aspect concept: For every credit, a corresponding debit is made. The recording of a transaction is complete only with this dual aspect.

Accounts

Rather than the column system (Image 1) above to track the effect transactions have on the accounting equation, accountants and bookkeepers use accounts. An account is a record of an increase or decrease in a specific asset, liability or equity item. For example, New Business IT has separate accounts for Cash (bank), Office Equipment, Computer Equipment, NAB Loan, Share Capital, and Retained Earnings.

Accounts can be presented in a T account format or running balance format. All accounts have three components:

- The name of the account

- A left side, known as a debit (Dr)

- A right-side, known as a credit (Cr)

Making an entry on the left side is referred to as debiting the account; making an entry on the right side is referred to as crediting the account. At the end of a period, the debit and credit sides are totalled. If the debit side exceeds the credit side, the account will have a debit balance. If the credit side exceeds the debit side, the account will have a credit balance.

Watch the video to understand debits and credits further.

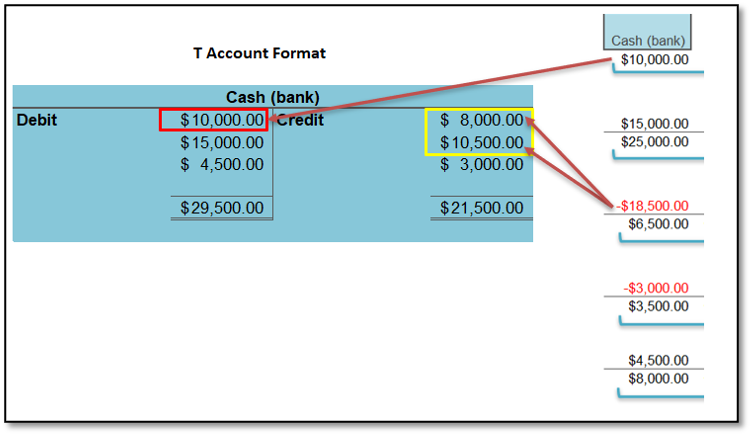

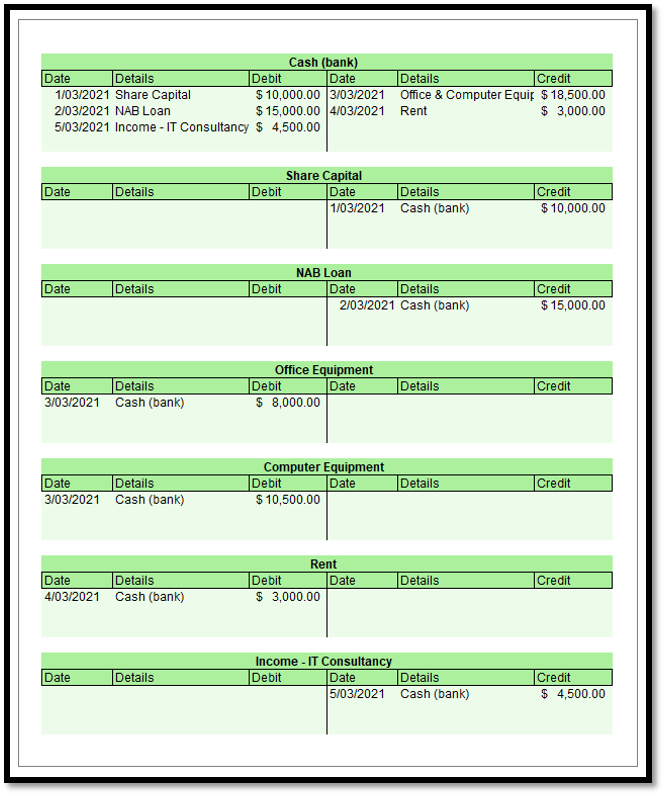

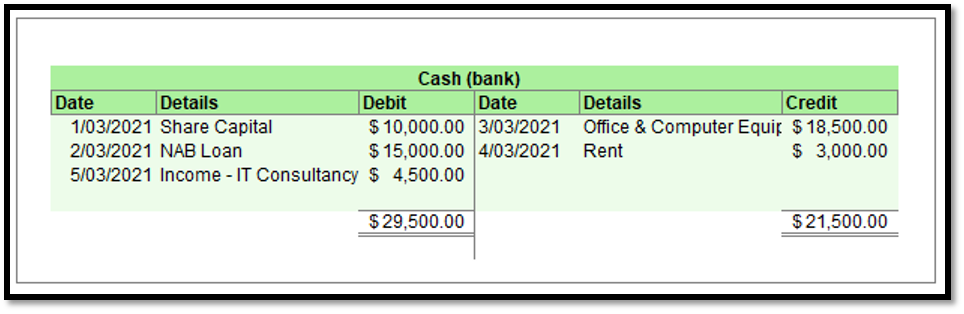

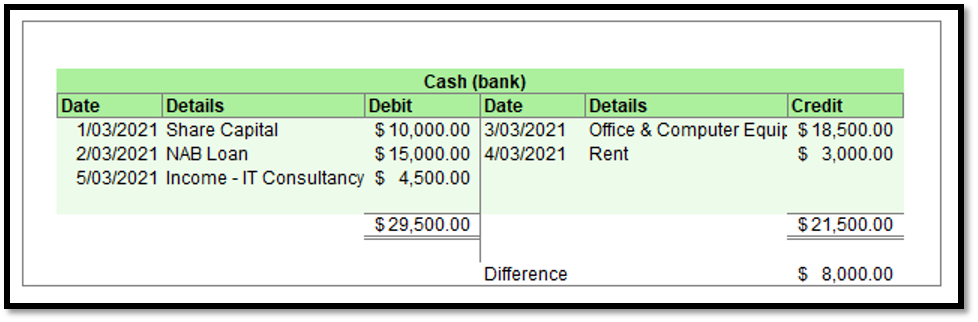

The process of recording the debit and credits in an account is illustrated below for the transactions affecting the cash account of New Business IT. The process has been illustrated using both the T account format (Image 2) and the running balance format (Image 3).

Image 2 – T Account Format

Every debit amount in the T account represents a receipt of cash, and every credit amount in the T account represents a withdrawal of cash from the bank account.

The balance of the T Account is $8000.00 Dr as the Debit side of the accounts exceeds the credit side by $8000.00.

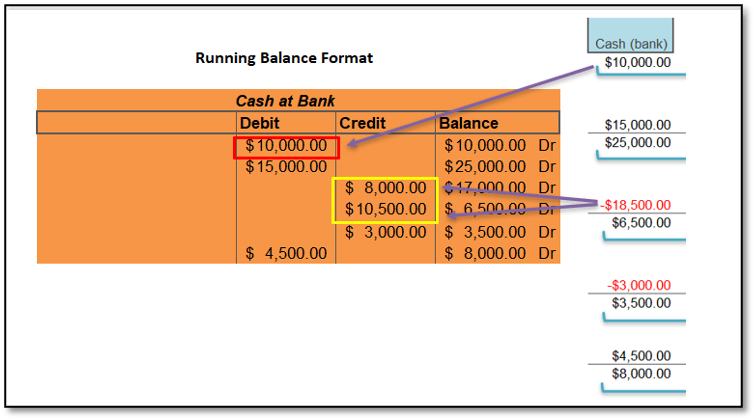

Image 3 – Running Balance Format

The running balance format calculates the balance after each transaction is recorded.

With double-entry accounting, every transaction is recorded in at least two accounts. to keep the accounting equation in balance, the total of all debit entries must match the total of all credit entries. When this happens, the transaction is said to be "in balance." If the totals do not agree, the transaction is said to be "out of balance,"

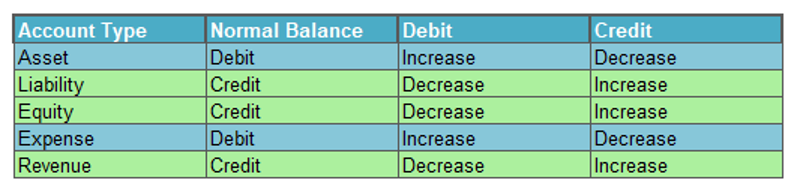

Rules for Debits and Credits

When recording transactions into the accounts, there are rules that need to be followed.

Debit Rules:

- Recorded on the left of a T account

- Increase an asset account or decrease an equity or liability account

- Decrease revenue

- Increase expense accounts

Credits Rules:

- Recorded on the right of the T account

- Decrease an asset account or increase an equity or liability account

- Increase revenue

- Decrease expense accounts

When processing the New Business IT transactions above, we touched on how we recorded money going out of the business (expenses) and money coming into the business (income). We will discuss this in more detail later on in the training. However, it is important to remember expenses decrease retained earnings (equity) and revenue increases retained earnings (equity) when recording transactions.

Below is a cheat sheet to help you remember the debit and credit rules:

Let’s record the transactions of New Business IT in the T accounts using double-entry bookkeeping.

| Date | Business Transaction |

|---|---|

| 01/03/2021 | Craig deposits $10,000 into the business bank account. |

| 02/03/2021 | Craig took out a $15,000 business loan with the NAB. |

| 03/03/2021 | Craig purchased office equipment valued at $8,000 and computer equipment valued at $10,500 with cash. |

| 04/03/2021 | Craig leased office space and paid $3,000 rent in cash. |

| 05/03/2021 | Craig provides IT consultancy services to a client and is paid $4,500 in cash. |

To do this, we first need to refer to the rules for debit and credits and ask the following questions:

- Which accounts are affected by the business transaction?

- Is the item (account) affected by an Asset, Liability, Equity, Income or Expense?

- Does the account increase or decrease?

- By what amount does the account increase or decrease?

- Do I need to Debit or Credit the account?

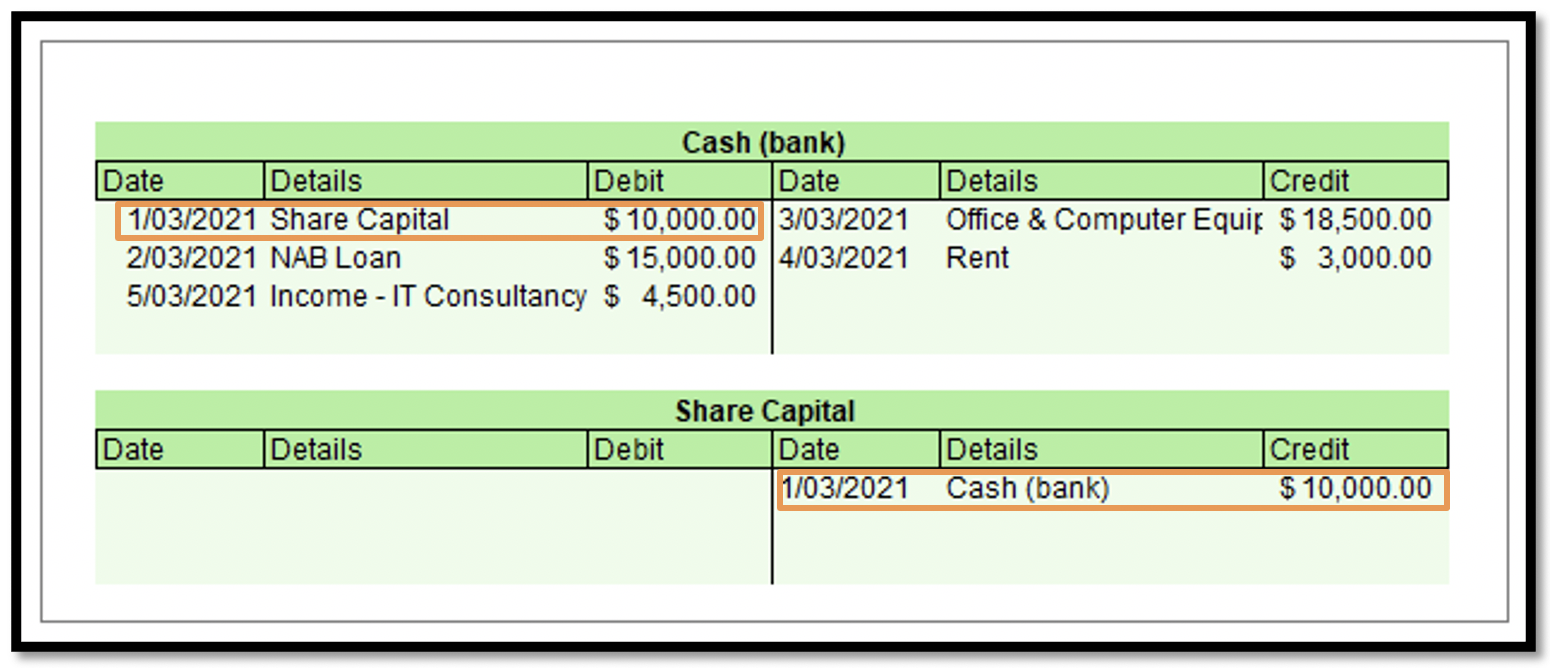

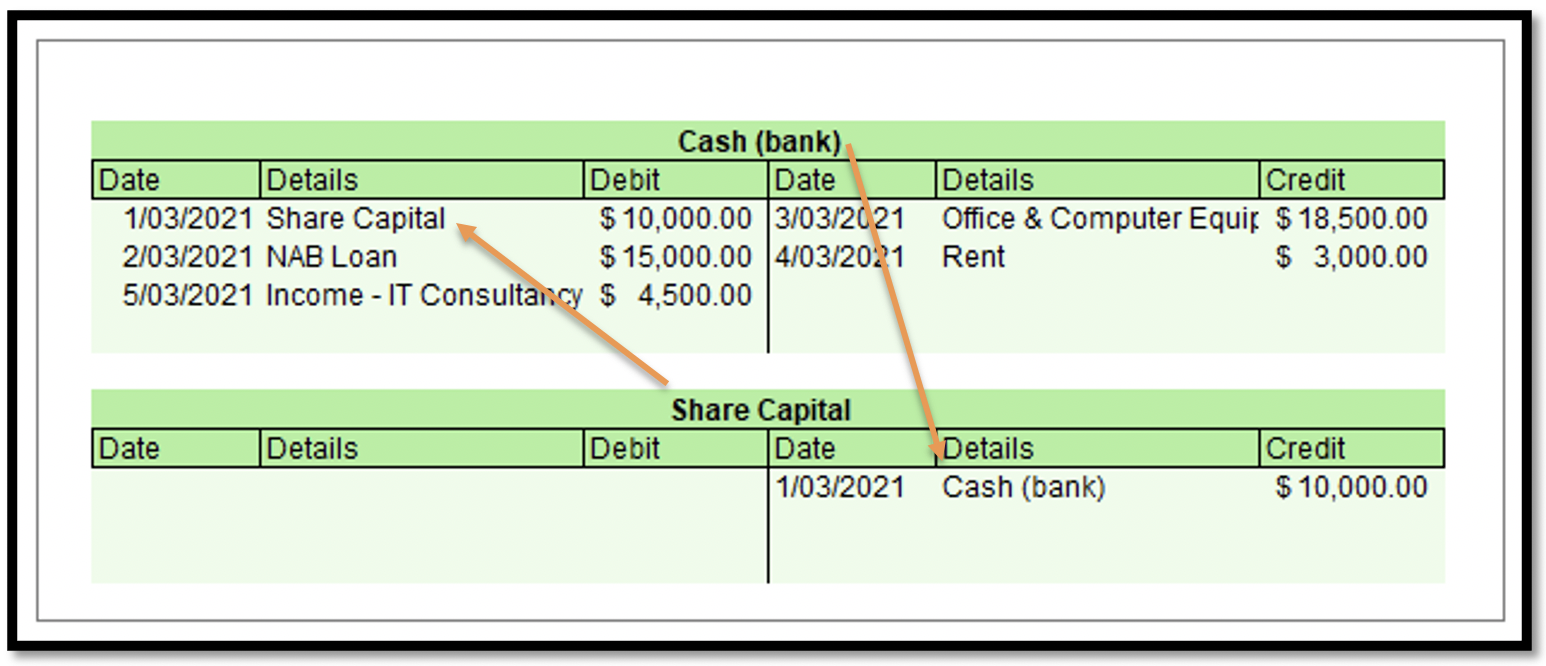

Once we have answered the questions above, we can prepare an analysis of the transactions. In the analysis table below, you will notice for each debit amount; there is a corresponding credit amount. Once we establish which accounts are affected by the business transactions, we can create our T accounts.

T Accounts

When recording transactions in T accounts, each transaction recorded has an equal debit and credit amount.

The debit entry is cross-referenced to the credit entry, with the name of the account appearing in the details column of the account debited (and vice versa).

In the example below, the introduction of cash into the business has been recorded as:

- a debit in the Cash (bank) account and cross-referenced to the credit entry in the Share Capital account

- a credit in the Share Capital and cross-referenced to the debit entry in the Cash (bank) account.

Each account is only created once. In the example below, all the transactions that affect the Cash (bank) account have been recorded in one account.

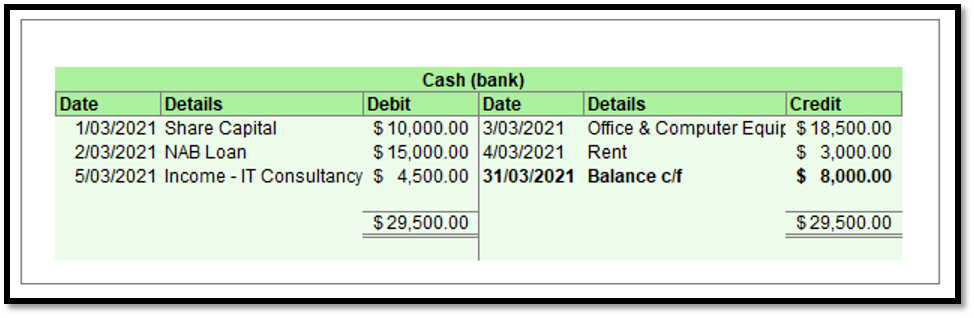

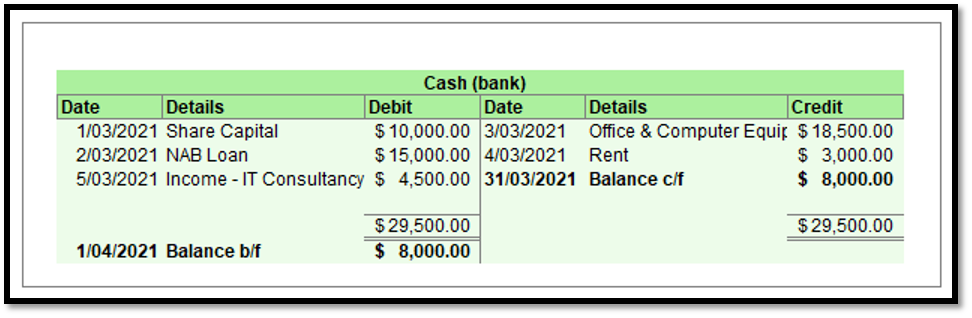

Balancing T Accounts

At the end of an accounting period (usually a month or year), a brief calculation is done to work out the closing balance of the T account. This is done by completing the following steps:

1. Calculate the totals of both the debit and credit columns of the T account.

2. Calculate the difference between the debit and credit columns.

3. Enter the difference amount in the column of the ledger with the smaller amount so that both sides are made equal. This is to be the balance c/f (carried forward). The date used is the last day in the period. In the example below, it is 31/03/2021.

4. That amount of the balance c/f should be written in the column with the greater total. The term for it is the balance b/f (brought forward). The date the balance is brought forward is the first day of the next period. The example below is 01/04/2021.

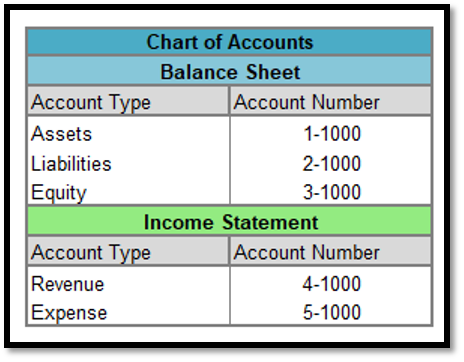

The Chart of Accounts

The individual accounts of a business are grouped together in the chart of accounts. Each account is assigned a unique number based on the order in which it appears in the financial statements. Balance sheet accounts are usually presented first, followed by income statement accounts.

When setting up a chart of accounts, the accounts that are listed will depend on the nature of the business. A numbering system is used to list accounts in the chart of accounts for easy identification. Numbering also makes it easy to record a transaction.

Small businesses commonly use three-digit numbers, while large businesses use four-digit numbers to allow room for additional numbers as the business grows.

The chart of accounts is essentially an index to the general ledger.

Example Chart of Accounts

The General Ledger

The general ledger is a business’s master account book listing of all the accounts in the chart of accounts.

In a manual accounting or bookkeeping system, the general ledger is a "book" with a separate page or ledger sheet for each account.

In a computerised system, such as Xero or MYOB, the general ledger will be an electronic file of all the needed accounts.

The balance sheet and the general ledger include similar information. However, the balance sheet does not include as much detail as a general ledger. It is a snapshot of a company’s financial health in terms of assets, liabilities and equity at a certain point in time. It is sorted by account number and organised into:

- Balance Sheet accounts

- assets

- liabilities

- equity

- Income Statement accounts

- revenue

- expenses

The balance sheet is another way the double-entry and the accounting equation Assets = Liabilities + Equity can be represented.

To further understand the balance sheet and how it works watch the video.

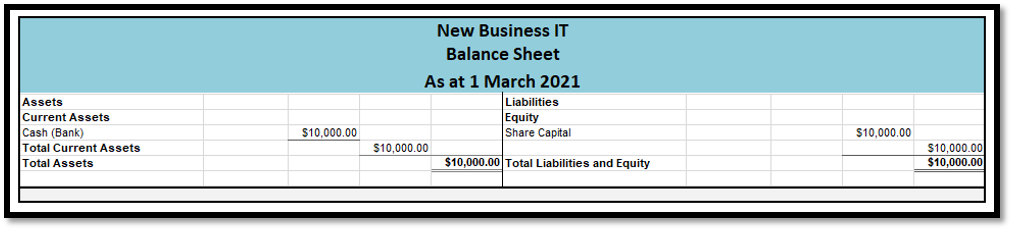

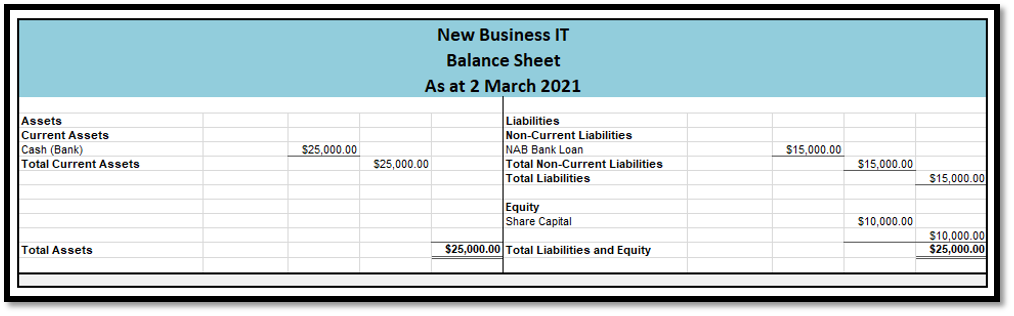

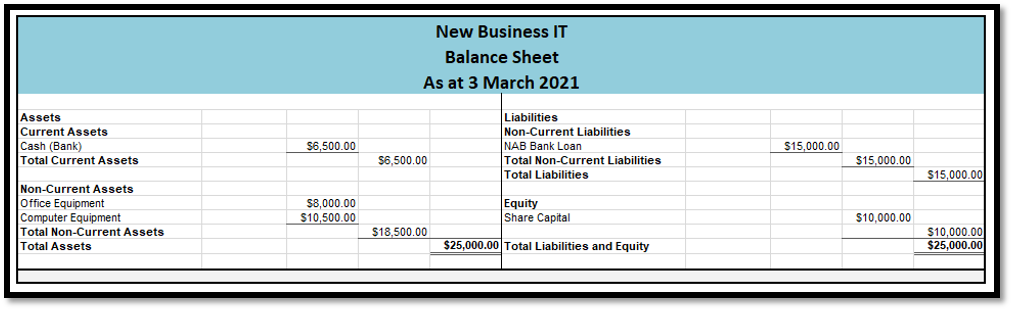

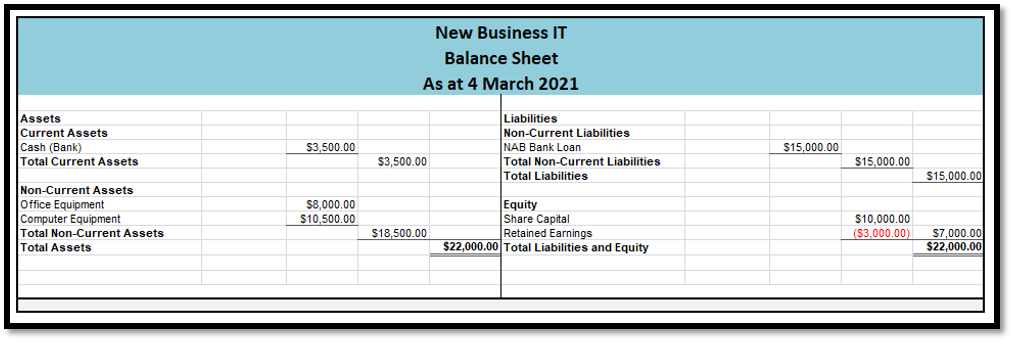

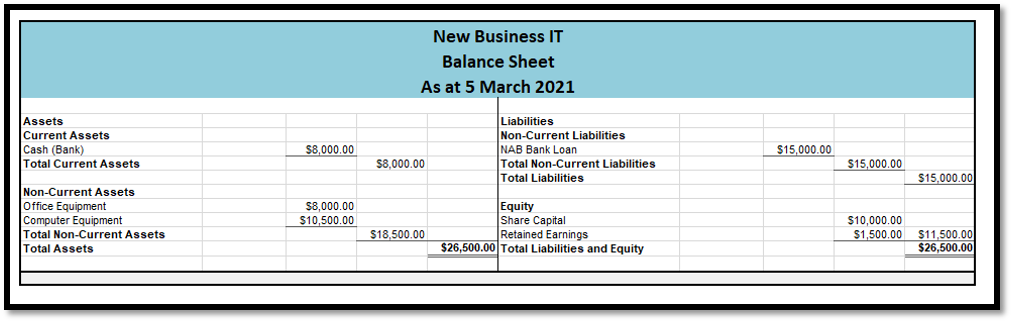

Let’s track the changes that occur in the balance sheet when we process the for New Business IT.

| Date | Business Transaction |

|---|---|

| 01/03/2021 | Craig deposits $10,000 into the business bank account. |

| 02/03/2021 | Craig took out a $15,000 business loan with the NAB. |

| 03/03/2021 | Craig purchased office equipment valued at $8,000 and computer equipment valued at $10,500 in cash. |

| 04/03/2021 | Craig leases office space and paid $3,000 rent in cash. |

| 05/03/2021 | Craig provides IT consultancy services to a client and is paid $4,500 in cash. |

As explained above, the balance sheet is a snapshot of a business's financial position at a point in time. It reports the business’s assets and the claims against those assets.

On 1 March 2021, New Business IT had assets of $10,000. The claim against those assets was Craig’s shareholding in the business.

On 2 March 2021, New Business IT had assets of $25,000. The claim against those assets was:

- Craig’s shareholding in the business ($10,000)

- NAB ($15,000)

On March 3, 2021, New Business IT still had assets of $25,000; however, the split of the assets changed. Craig used some of the business's cash to purchase office and computer equipment. The assets were split between:

- Cash (bank) ($6,500)

- Office Equipment ($8,000)

- Computer Equipment ($10,500)

The claim against those assets did not change:

- Craig’s shareholding in the business ($10,000)

- NAB ($15,000)

On 4 March 2021, New Business IT assets were reduced to $22,000 after Craig paid $3,000 to rent an office space. The claim against those assets are:

- Craig’s shareholding in the business Share Capital $10,000

- Retained Earnings of -$3000

- NAB ($15,000)

On 5 March 2021, New Business IT assets increased to $26,500 after Craig was paid by a client for consultancy work. The claim on those assets is now:

- Craig’s shareholding in the business Share Capital $10,000

- Retained Earnings of $1500

- NAB ($15,000)

Retained earnings are the accumulated portion of a business’s profits or losses that are not distributed as dividends to shareholders but instead are reserved for reinvestment back into the business. In the next topic, we will examine the profit & loss statement and the interrelationship between the balance sheet and the profit & loss statement.

Before you attempt the learning checkpoint. Watch the debit and credit practice questions video to further understand how to work out which accounts are to be debited or credited when processing transactions.

It’s now time to test your understanding of double-entry bookkeeping.

To begin down load this Excel workbook.

Robin started a retail business on the 1st of March 2021. Below is a list of transactions that happened in Robin’s business throughout March. In the Excel workbook record which accounts are affected by each of the transactions, the account type (Asset, Liability, Owner’s equity, Expenses or Revenue), and if the account is debited or credited. The first one has been completed for you as an example.

1 March 2021 Robin started a business and deposited $500,000 in a business bank account.

2 March 2021 Brought premises for $240,000 paying by cheque

3 March 2021 Purchased goods costing $25,000 from Bradley on credit

4 March 2021 Bought a delivery van from Crazy Cars for $15,000 cash

5 March 2021 Purchased goods costing $5,000 by cheque

8 March 2021 Sold goods for $8,000 for cash

10 March 2021 Purchased more goods from Bradley on credit costing $8,000

12 March 2021 Sold $7,000 worth of goods on credit to Sam

19 March 2021 Received a cheque from Sam for $7,000

23 March 2021 Purchase an office computer costing $2,500 from Officeworks on a business credit card

29 March 2021 Sent Bradley a cheque for $23,500

| Date | Account | Account Type | Debit | Credit |

|---|---|---|---|---|

| 01/03/2021 | Bank | Asset | $500,000 | |

| Capital - Robin | Owners’ Equity | $500,000 | ||

| Money contributed by Robin to start a business | ||||