Before submitting activity statement reports, they should be properly prepared and reconciled so that any errors can be identified or amendments made from bookkeeping entries.

As preparation to complete the required activity statements, there are many things you can do to ensure you are prepared with the latest information. Put yourself in the shoes of a BAS agent returning to the workforce...

The first step in preparation for submitting financial figures to the ATO is to reconcile all of your accounts in your bookkeeping system against what has happened at the bank, in real life.

Note: You can find out more on how to reconcile bank accounts using MYOB or Xero in subtopic 7.5.2 Generate reports that confirm that subsidiary ledgers and accounts reconcile with general ledger.

Spot the differences

This activity will reveal any transactions or activity that doesn't align between what your bank statements show (including credit cards) as truth versus what your books report as truth. Sometimes the variance is simply due to timing, i.e., a check that was issued and accounted for during one accounting period but deposited three months later so the bank recorded the transaction in the following period. We'll go over other reasons this happens a bit later in the topic.

Fix the problems

In order to get the books to balance, a bookkeeper needs to adjust the books to accommodate these variances that cause the two systems (banks and books) to be misaligned.

This involves a process of checking the bank account figures against the accounting figures to look for errors then fixing them before moving on to the next step. You'll be looking for a match between the transaction recorded in your books to the transaction appearing on the bank statement. If you are not familiar with the concept of matching bank transactions to those in accounting software, or manually in journals, visit this MYOB help page, Matching bank transactions, to learn the concepts.

Review extraordinary transactions

Transactions that are deemed extraordinary in an accounting system should be reviewed to ensure compliance. It can include transactions involving capital acquisitions and imports. For example GST errors can be on importing or exporting goods and services.

Reconciling the bank account manually

This activity is a process of preventing, finding, and fixing errors.

Start by watching the following video, which provides instructions to reconcile the bank account to the books without a computerised accounting system.

Note: a cash book is a financial journal that contains all cash receipts and disbursements, including bank deposits and withdrawals. Entries in the cash book are then posted into the general ledger.

The video points out the types of problems that could prevent the bank account from reconciling.

Activity

See if you remembered the seven steps from the video:

Here are three categories of common issues:

| Omissions | Timing differences | Error |

|---|---|---|

| Transactions on the bank statement, but not on the books, i.e., missing receipts, bank fees, and interest received. | When the bank and book transactions occur in different reporting periods. This could be deposits in transit (also called unrecorded deposits), outstanding, or bounced checques or electronic funds that have not been processed yet. | Look in the books for errors first as it is more likely there than in the bank statement. |

Now that you have an idea of how to reconcile from the video, follow these steps to the same destination.

- Trial balance vs General Ledger:

Confirm your asset, liability and equity accounts' prior ending balances are exactly equal to this period's opening balances in case a mistake was made transferring an opening balance for a new financial period.- It's a good idea to ensure your temporary revenue and expense accounts start at zero at the beginning of each accounting period.

- To compare beginning and ending account balances, look at your company's adjusted trial balance from the previous accounting period and the general ledger from this accounting period you are reporting.

- For asset, liability, and equity accounts, match the ending balance on the trial balance to the general ledger's beginning balance. Revenue and expense accounts should start with a zero balance.

- For example, for a quarterly reconciliation, compare the cash account balance from the trial balance report as at 30 September to the opening balance in the general ledger as at 1 October.

- Do this task for all of the accounts.

- Reconcile accounts to the general ledger:

- You may need to refer to source documents such as receipts, bills, invoices etc. to confirm dates, dollar amounts, and accounts.

- Match each transaction from the journal to the general ledger, and then to the bank statements using source documentation as necessary. Provide a tick each time you get a match between the cash account in the general ledger, and the bank statement.

- Investigate the items without ticks:

- Clerical errors, timing, a bounced cheque, bank fees, automatic bank fees (refer to the list of possible errors.)

- Create adjustment entries, or correcting entries:

- Record a balancing entry to account for the variance.

- For example, someone incorrectly recorded a payment from a customer as $49.00, however the bank showed the deposit was actually $490.00. There won't be a tick near either transaction because it doesn't match. Investigation will reveal the error. To fix it, you can reverse the incorrect entry by switching the accounts originally debited and credited first - which will essentially cancel it out. Then, record the correct entry.

- If the transaction was missing altogether rather than mis-entered, you would simply enter the transaction into a journal entry and the ledger as if you hadn't missed it to fix the error.

- Record a balancing entry to account for the variance.

- Prepare adjusting entries:

- such as depreciation

- You can now run the reports needed to report BAS (shown in the section below.)

Activity

Preparation activities to complete the BAS

The BAS form will be sent to the ABN holder according to the payment schedule the ATO has set up for the business.

The BAS form will clearly indicate the following information.

- Reporting period - Your business activity statement should clearly mention the reporting period on it. The start date as well as the end date of the reporting period should be stated.

- Document ID - This is a number that is unique to every business as well as unique to every statement. Hence, every BAS that you submit will have a different document ID. This ID helps to identify your BAS if and when required.

- Australian Business Number - The ABN is another mandatory requirement on a business activity statement. With the help of the ABN, the taxation authorities can determine which business the BAS is being submitted for.

- A deadline for submission - the BAS form will indicate the date of submission and payment, based on your submission schedule.

- In the event that the final submission date is a holiday or a weekend, the ATO allows businesses to submit the BAS on the first working day after the holidays.

- In case you do not submit the BAS and pay the tax by the deadline, your business may incur payment penalties.

Once it is complete, it must show:

- the date when the report was lodged

- the date when the relevant tax was paid (for credit)

- the mode of payment, such as cash, cheque, etc.

- details of the tax that is being reported and paid by the respective businesses

- a summarised version of the taxes being reported

- whether you have a pending tax liability or you are expecting a refund from the taxation office.

- an authorising signature

Note:It is mandatory to file a BAS for every tax period as specified by the ATO. Whether or not an organisation has done any business in that period is irrelevant. If no business has been transacted in that particular tax period, the BAS for that period will be referred to as a nil report.

Standard Business Reporting

Standard Business Reporting, or SBR, is a standard approach to online or digital record-keeping that was introduced by the government in 2010 to simplify business reporting obligations.

- SBR is built into business/accounting software such as MYOB, making it SBR-enabled.

- SBR incorporates standard terms that are used in government legislation and reporting. These terms are then linked to terms that are in the business/accounting software, creating consistency for business and government.

- SBR extracts information that has been recorded in business/accounting software as part of running your business and prefills this into the relevant government report. The report can then be checked for accuracy and submitted directly and securely to the government.

- Compared to other ways of lodging government reports, SBR can reduce preparation and submission time to a matter of seconds.

How it works

- Reports available within SBR-enabled software use a dictionary of standard terms needed for each report. These standard terms are used across government for multiple reporting requirements as well as for software development.

- When you select the relevant report to be completed, your SBR-enabled software knows what information is needed for that report and fills it out for you.

- If you agree with the information presented in the report, you can send it securely and directly to the relevant government agency. If you need to make changes, you can also do that in your business/accounting software and submit an updated report.

- You then receive immediate confirmation from the government agency saying the report was received.

You can find out more about SBR at the ATO.

There are many different forms the ATO may send the business based on the information provided to the ATO when it first registered.

The BAS form is separated into these sections:

- GST

- PAYG Instalments

- PAYG Withholding

- FBT, LCT, WET and FTC

- Summary section

The form you receive from the ATO may not have all of the sections on it. The sections included in the form are dependent on reporting requirements and determined when the business was first registered. Review the list of approved BAS forms at the ATO. The table shows what sections each form includes.

Completion instructions

- Check your reporting period

- Leave labels blank if they don’t apply to you unless otherwise instructed (don't use N/A or nil)

- Round down to whole dollars (don't show cents)

- Print clearly using a black pen

- Don’t report negative figures or use symbols such as +, −, ÷, $.

Download this Sample BAS form and keep it open in a browser window or tab, so you can refer to it as we explain how to complete the fields.

-

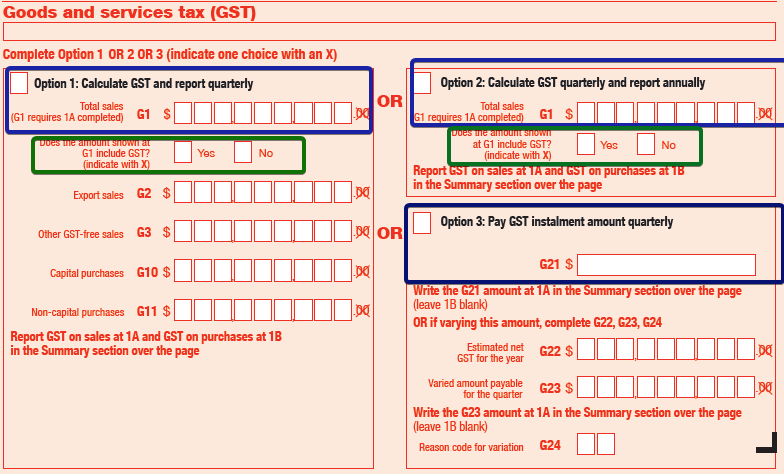

GST - The 'G' labels

The GST section of the BAS allows you to:

- report and pay the GST your business has collected

- claim GST credits.

There are two methods of completing the GST portion of the Activity Statement:

-

Accounts method

The accounts method is a way of completing an activity statement directly from accounting records. To use this method, the records must be able to:

- readily identify GST amounts for sales, purchases and importations

- separately record any purchases or importations that were for either private use or making input taxed sales

- identify any GST-free or input taxed sales.

If the records are set up in this way, the business can add the relevant GST amounts at the end of each reporting period and report them at the appropriate labels on your activity statement.

The amounts reported on the activity statement at G1 (total sales) can be GST inclusive or GST exclusive. It will need to be indicated whether the amounts include GST by marking either Yes or No with an “X” in the box under G1.

You can choose to exclude GST from G1 only if you are using the accounts method. You must include GST in amounts you report at all labels on your BAS if you are using the calculation worksheet method.

To use the accounts method, these amounts will need to be recorded from the accounting records and transferred to the activity statement. Depending on which reporting option is being used, not all of the GST labels indicated are required to be reported on each activity statement.

If you use the accounts method, you must complete labels G1, G2, G3, G10 and G11 for information purposes only. If necessary, you can estimate the amounts on a reasonably accurate basis from your accounts.

Include the GST on the taxable sales only if you have chosen to report amounts that include GST. If you have chosen to report GST-exclusive amounts, don't report the GST component on your taxable sales at G1.

Learn more about the Accounts method at the ATO.

-

Calculation worksheet method

This image shows a section of the interactive online calculation worksheet provided by the ATO. For some people, the worksheet does not perform. In that case, here it is in PDF format.

You don't need to complete a GST calculation worksheet if you lodge a paper activity statement or annual GST return, the sections where information is not needed can be left blank.

The calculation worksheet method is a step-by-step way of calculating the GST on your sales, purchases and importations using our GST calculation worksheet.

This involves:

- completing the worksheet using information from your accounts

- making calculations to report your amounts at 1A (GST on sales) and 1B (GST on purchases)

- following the instructions on the worksheet to transfer the amounts to the appropriate GST labels on your BAS.

You’ll need to complete up to 20 labels on the calculation worksheet to calculate the amounts to be reported at 1A (GST on sales) and 1B (GST on purchases) on your BAS. If you use this method, the amounts you report must include GST. That is, the amounts you report at all labels must take into account both:

- any GST you are liable to pay on sales

- the GST is included in the price of purchases and importations that you make.

You must indicate that your amounts include GST by marking the Yes box on your BAS at G1 (total sales, shown on the previous screenshot above.)

As a reminder, you can choose to exclude GST from G1 only if you are using the accounts method but you must include GST in amounts you report at all labels on your BAS if you are using the calculation worksheet method.

-

PAYG Withholding - The 'W' labels

-

PAYG Instalment - The 'T' labels

-

FBT - The 'F' labels

What is the fringe benefits tax?

This tax is paid by employers (or a third party on their behalf), for the taxable value of the fringe benefits that are given to their employees (or anyone on the employee's behalf.)The FBT financial year

The employer should be accounting for their FBT liability for the FBT year — 1 April to 31 March — and lodge an FBT return.Income tax deduction and GST credits

Employers can generally claim an income tax deduction for the cost of providing fringe benefits and for the FBT they pay. Employers can also generally claim GST credits for items provided as fringe benefits, though specific concessions apply to some non-profit organisations.- F1 – ATO instalment amount

- If you pay FBT quarterly, a pre-determined instalment will be shown at F1.

- The ATO calculates the amount at F1 based on the FBT payable on your most recent FBT assessment.

- If you think that using the amount displayed at F1 will result in you paying more (or less) than your expected FBT liability for the year, you can vary it.

- If you are not varying your instalment amount, copy the amount at F1 to 6A in the Summary section of your business activity statement (BAS).

- 6A – FBT instalment

- If you're using the FBT instalment amount displayed at F1, copy this amount to 6A.

- If you've varied your FBT instalment amount for the quarter, copy the FBT instalment amount you wrote at F3 to 6A.

- 6B - Credit from FBT instalment variation

- If you vary your estimated FBT for the year to an amount lower than the FBT you had to pay last year, you may get an FBT instalment credit. You should take this credit into account when working out any amount payable. The credit is only available where the calculation of the F3 amount gives a negative amount.

If you vary your FBT

Follow the links to the ATO to learn more about varying FBT requirements - F1 – ATO instalment amount

-

LCT, WET and FTC - Labels 1 and 7

Follow the links to the ATO to learn more about how to complete the activity statement labels for these taxes.

The accountants at e-BAS accounts have also provided instructions for completing the BAS sections for FBT, LCT, WET, and FTC.

Everyone makes mistakes and the ATO provides help when that happens.

To clarify, according to the ATO:

- A mistake is an error in reporting the information to the ATO at the time of lodgment.

- An adjustment is a change to the information since lodgment.

The ATO provides guidance for common mistakes on the import and export of goods.

Fixing mistakes

Despite all the work done to prepare information to report on the BAS, sometimes mistakes get through, such as:

- clerical or transposition errors

- classifying a GST-free sale or purchase as taxable and vice versa

- double counting some of your purchases.

Many mistakes relating to GST and fuel tax credit can be corrected in your next BAS. If you can't correct your mistake in your next BAS, you need to lodge a revision.

You cannot correct a credit or debit error on a later activity statement if any of the following apply:

- The GST error relates to a matter we have advised is subject to a compliance activity or the GST error was made in a reporting period that is subject to compliance activity.

- You have corrected the GST error in another reporting period.

- You are revising a lodged activity statement to correct an error from an earlier reporting period.

If you correct a GST error on a later activity statement, keep a note to record the reporting period when the error was made and the activity statement it was corrected on. You must also keep records and other relevant information to explain the correction.

Credit error

An error in working out your net GST amount that results in you reporting or paying too much GST for the reporting period is a credit error.

Examples:

- reporting a GST sale twice

- overstating the GST on sales (for example, reporting a larger figure for GST on sales than the correct amount)

- under-claiming a GST credit for your purchases

- omitting or understating a decreasing GST adjustment or overstating an increasing GST adjustment.

You can correct a credit error on a later activity statement if it is within the credit error time limit. Credit errors are not subject to value limits.

Credit error time limit

You can correct a credit error on a later activity statement that is lodged within the period of review of the earlier reporting period. The period of review starts on the day you lodge your activity statement and ends four years and one day later.

See the ATO for more information about time limits on GST credits and refunds.

Debit error

An error in working out your net GST amount that results in you reporting or paying too little GST for the reporting period is a debit error.

Examples of debit errors include:

- failing to include GST on a taxable sale

- understating the GST on sales (for example, reporting a lesser amount for GST on sales, rather than the correct amount)

- overstating GST credits (for example, claiming GST credits for a purchase twice)

- omitting or understating an increasing GST adjustment or overstating a decreasing GST adjustment.

You can correct a debit error on a later activity statement if:

- the debit error is within the Debit error time limit

- the net sum of the debit errors is within the Debit error value limit

- the debit error is not a result of recklessness or intentional disregard of a GST law.

Revised activity statement

If you need to correct information on an activity statement and you aren't eligible to correct it on a later statement, you may need to complete a revised activity statement.

The ATO treats a revised activity statement as an application to amend an assessment. You can do this either online or on paper.

If we accept your revised amount in full and the amendment is made within the period of review, the revised statement will be taken to be a notice of amended assessment. The date of effect is the day we adjust your running balance account.

If we don't accept your revised amounts in full, we will issue a notice of amended assessment.

Online revision

Registered users of the following online services can complete a revised activity statement online:

- Using ATO online services – individuals and sole traders

- Online services for business

- Online services for agents

- Practitioner lodgment service – amendments and provisions.

Using Online services for business

Go to: the ATO for instructions on how to sign up to online services.

Once you have registered and have access, you can follow the directions below.

- Select Lodgments and Activity statements.

- Select Revise next to the processed activity statement from the History list.

- Enter the revised values.

If the Revise button doesn't display, you can't revise the activity statement through the service.

Tax professionals

Registered tax and BAS agents can lodge a revision for their client using Online services for agents or the practitioner lodgment service.

See also:

- Online services for agents user guide – payment options

- Practitioner lodgment service user guide – amendments and provisions

Paper revision

Contact the ATO to get a paper version of the revised activity statement. Don't send them a copy or a version generated from a commercial software package.

Fill in the items that are to be revised and the revised amounts. If changing one item leads to a change to other items, update those items and values as well.

If you report pay as you go (PAYG) instalments using the rate method and you vary the rate, you need to write the new rate at T3.

Read more about sending in a paper revision on the ATO website including the address where to send the form.

Managing adjustments to the BAS

You may have to make changes on your current activity statement to increase or decrease the amount of GST you must pay for a reporting period. These changes are known as 'adjustments'.

There are two types of adjustments:

- increasing adjustments, which increase how much GST you must pay for a reporting period

- decreasing adjustments, which decrease how much GST you must pay for a reporting period.

As a reminder, making GST adjustments is different from correcting GST errors made on an earlier activity statement. A GST adjustment relates to a reported sale or purchase that was correct at the time of lodgment, whereas a GST error relates to an amount that was incorrect at the time of lodgment.

Reading

Read more about adjustments to the BAS at the ATO.

Activity

Handling errors on the BAS

Everyone makes mistakes and the ATO provides help when that happens.

To clarify, according to the ATO:

- A mistake is an error in reporting the information to the ATO at the time of lodgment.

- An adjustment is a change to the information since lodgment.

The ATO provides guidance for common mistakes on the import and export of goods.

Fixing mistakes

Despite all the work done to prepare information to report on the BAS, sometimes mistakes get through, such as:

- clerical or transposition errors

- classifying a GST-free sale or purchase as taxable and vice versa

- double counting some of your purchases.

Many mistakes relating to GST and fuel tax credit can be corrected in your next BAS. If you can't correct your mistake in your next BAS, you need to lodge a revision.

You cannot correct a credit or debit error on a later activity statement if any of the following apply:

- The GST error relates to a matter we have advised is subject to a compliance activity or the GST error was made in a reporting period that is subject to compliance activity.

- You have corrected the GST error in another reporting period.

- You are revising a lodged activity statement to correct an error from an earlier reporting period.

If you correct a GST error on a later activity statement, keep a note to record the reporting period when the error was made and the activity statement it was corrected on. You must also keep records and other relevant information to explain the correction.

Credit error

An error in working out your net GST amount that results in you reporting or paying too much GST for the reporting period is a credit error.

Examples:

- reporting a GST sale twice

- overstating the GST on sales (for example, reporting a larger figure for GST on sales than the correct amount)

- under-claiming a GST credit for your purchases

- omitting or understating a decreasing GST adjustment or overstating an increasing GST adjustment.

You can correct a credit error on a later activity statement if it is within the credit error time limit. Credit errors are not subject to value limits.

Credit error time limit

You can correct a credit error on a later activity statement that is lodged within the period of review of the earlier reporting period. The period of review starts on the day you lodge your activity statement and ends four years and one day later.

See the ATO for more information about time limits on GST credits and refunds.

Debit error

An error in working out your net GST amount that results in you reporting or paying too little GST for the reporting period is a debit error.

Examples of debit errors include:

- failing to include GST on a taxable sale

- understating the GST on sales (for example, reporting a lesser amount for GST on sales, rather than the correct amount)

- overstating GST credits (for example, claiming GST credits for a purchase twice)

- omitting or understating an increasing GST adjustment or overstating a decreasing GST adjustment.

You can correct a debit error on a later activity statement if:

- the debit error is within the Debit error time limit

- the net sum of the debit errors is within the Debit error value limit

- the debit error is not a result of recklessness or intentional disregard of a GST law.

Revised activity statement

If you need to correct information on an activity statement and you aren't eligible to correct it on a later statement, you may need to complete a revised activity statement.

The ATO treats a revised activity statement as an application to amend an assessment. You can do this either online or on paper.

If we accept your revised amount in full and the amendment is made within the period of review, the revised statement will be taken to be a notice of amended assessment. The date of effect is the day we adjust your running balance account.

If we don't accept your revised amounts in full, we will issue a notice of amended assessment.

Online revision

Registered users of the following online services can complete a revised activity statement online:

- Using ATO online services – individuals and sole traders

- Online services for business

- Online services for agents

- Practitioner lodgment service – amendments and provisions.

Using Online services for business

Go to: the ATO for instructions on how to sign up to online services.

Once you have registered and have access, you can follow the directions below.

- Select Lodgments and Activity statements.

- Select Revise next to the processed activity statement from the History list.

- Enter the revised values.

If the Revise button doesn't display, you can't revise the activity statement through the service.

Tax professionals

Registered tax and BAS agents can lodge a revision for their client using Online services for agents or the practitioner lodgment service.

See also:

- Online services for agents user guide – payment options

- Practitioner lodgment service user guide – amendments and provisions

Paper revision

Contact the ATO to get a paper version of the revised activity statement. Don't send them a copy or a version generated from a commercial software package.

Fill in the items that are to be revised and the revised amounts. If changing one item leads to a change to other items, update those items and values as well.

If you report pay as you go (PAYG) instalments using the rate method and you vary the rate, you need to write the new rate at T3.

Read more about sending in a paper revision on the ATO website including the address where to send the form.

Managing adjustments to the BAS

You may have to make changes on your current activity statement to increase or decrease the amount of GST you must pay for a reporting period. These changes are known as 'adjustments'.

There are two types of adjustments:

- increasing adjustments, which increase how much GST you must pay for a reporting period

- decreasing adjustments, which decrease how much GST you must pay for a reporting period.

As a reminder, making GST adjustments is different from correcting GST errors made on an earlier activity statement. A GST adjustment relates to a reported sale or purchase that was correct at the time of lodgment, whereas a GST error relates to an amount that was incorrect at the time of lodgment.

Reading

Read more about adjustments to the BAS at the ATO.

Activity

Handling errors on the BAS

Activities

Completing the BAS

- The Australian accounting practice, e-BAS Accounts. offers a great resource for BAS preparation. Download their checklist and review it.

- Answer the following questions

- Can you see where we are up to at this point in the course in terms of what needs to be done to prepare for BAS?

- Were there any surprises on that list?

- Is there anything you felt you needed more learning around?

- Discuss the checklist in the forum.

- Answer the following questions

- Review and bookmark the BAS Details page at the ATO.

- Review the material at the ATO on BAS and GST tips

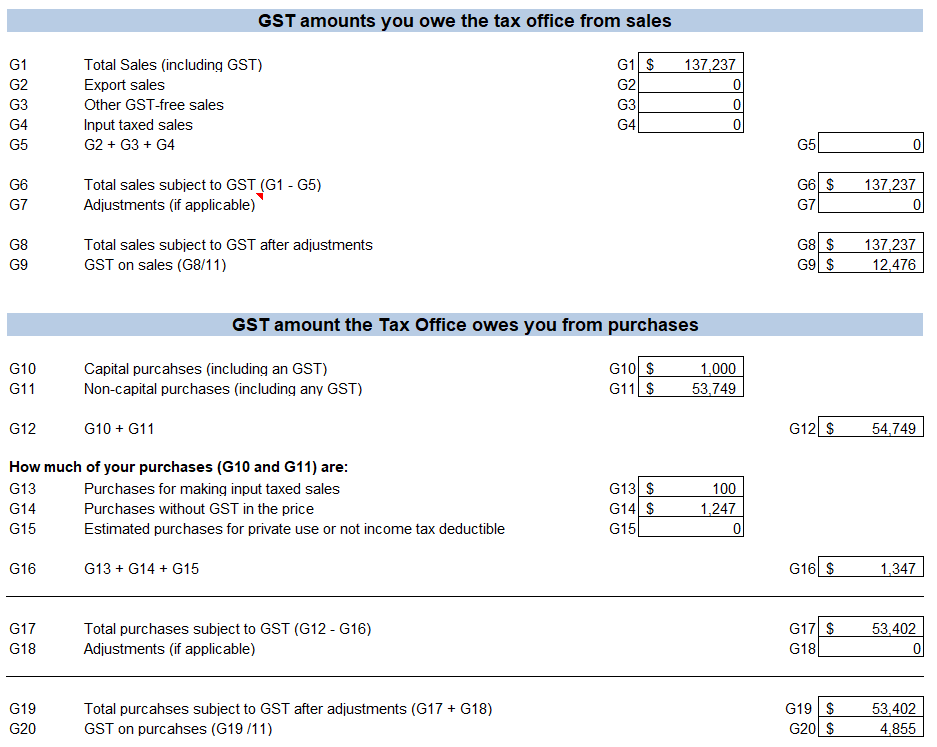

- Scenario + Activity: As the BAS agent for Crystal H2O Pty Ltd, you have just run the GST detail report so you can complete the GST portion of the BAS using the Calculation Worksheet method.

- Please complete the steps below.

- Download the GST detail report and Calculation Worksheet

- Note the tabs at the bottom for the data and worksheet

- Determine the values for all of the labels on the worksheet

- Compare your answer to ours by selecting the (+) sign below.

- Download the GST detail report and Calculation Worksheet

- Please complete the steps below.

Do your numbers match ours?

Download the document with the solution so you can see the figures that make up each of the totals.

To do this, as an example, look at the cells from the GST Report that make up label G1:

- Ensure you are on the worksheet tab

- Click on cell I5

- Look at the formula bar:

This means that the cell will calculate the total of G188 and G209 on the GST Report tab, and show a result that eliminates the cents using the function, ROUNDDOWN -

You can click on any of the cells to see the source data for the labels.