Standard Industry Banking Procedures and Guidelines

When processing financial transactions, particularly when it comes to processing banking documents and preparing deposit facilities and lodging flows, it is important to follow standard industry banking procedures and guidelines.

The Australian Bankers’ Association has published the Code of Banking Practice, which sets out obligations and good practices that banks must adhere to when dealing with customers. These obligations and practices cover the following:

- Account suitability

- Terms and conditions

- Direct debits and chargebacks

- Privacy and confidentiality

- Joint debtors

- Guarantees

- Provision of credit

- Financial difficulty and debt collection

- Dispute resolution

In addition to following standard banking procedures, individuals working in the accounting and bookkeeping industry also have to follow standard industry banking guidelines. Examples of these guidelines include:

- Australian Banking Association Financial Services Sector Guidelines

- Protecting vulnerable customers from potential financial abuse

- Promoting understanding about banks’ financial hardship programs

Following these standard banking procedures and guidelines includes ensuring that the corresponding proof of lodgement is obtained for each deposit method used. Examples of proof of lodgements for different deposit methods are found in the table below.

| Deposit method | Proof of lodgement |

|---|---|

| Online deposit |

Transaction list Email verification of transaction |

| Over-the-counter deposit |

Bank stamped deposit facility Tearaway part of a deposit slip |

Whenever the business receives cash and cheques, these will need to be physically taken to the branch of the financial institution for depositing. Your organisation will have policies and procedures relating to when and how this is to be done. These procedures are developed to ensure staff members remain safe and money is protected to the best of their ability.

Preparing accurate bank deposits involves entering and balancing all the different types of payments received.

Some financial institutions provide deposit books for businesses to do their banking which may also be pre-filled with the account name and number, as well as the bank-state-branch (BSB) number.

Deposit information recorded on the form will include:

- The name of the depositor/account holder and the account number

- The bank-state-branch number (BSB)

- The date of deposit

- A total of coin/ notes/ cash

- The total value of the deposit (cash and cheque transactions)

- A listing of the cheques showing drawer, bank and branch of each cheque

- The total of all cheques

- A signature of the person depositing/preparing the deposit

Like any other industry, the financial sector is regulated by legislation and mandatory policies, procedures and guidelines specific to the industry. All organisations and workers within the industry are required to comply with them.

It is important all policies and procedures are closely followed to maintain safety and reduce the risks associated with the task of transporting money to and from a bank.

Customers have a right to privacy. This is a legal right covered by the Privacy and Personal Information Act. This means keeping client's personal and sensitive information confidential. This Act requires financial sector employees to behave in a careful manner with regards to information.

A significant part of the relationship between customer and financial services supplier is based upon trust. Customers must be comfortable with the concept that their financial institution will always operate in an ethical and legally responsible manner.

If this trust breaks down, there are both legal and business growth consequences for the organisation. Where an employee fails to follow proper procedures, the consequences will impact on their employment and might also have consequences under law.

Threats to your computer

Each and every time you log onto the internet your computer is at risk of various threats with the aim of getting your personal details and accessing your money.

Behind the scenes we use various security measures to ensure that your transactions and personal information are protected. However, you as a customer can also play a big part in protecting your banking and personal information. The first step in that process is to understand the main threats to your computer.

Understanding how to protect yourself

Here we describe the main threats to your computer and how to protect yourself from them.

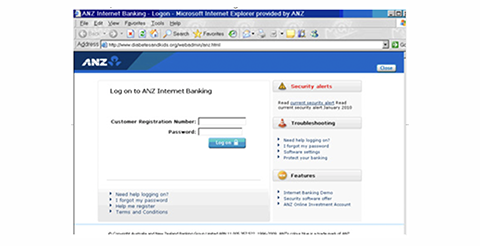

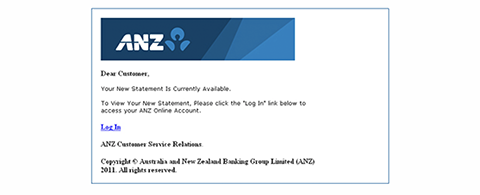

Phishing

Phishing is a scam where hackers 'fish' for your personal details by using hoax emails claiming to be from financial institutions. This method continues to be favoured by online thieves. An example of a hoax email is shown below:

Trojan

A Trojan is a destructive program that poses as a harmless application. Unlike viruses, Trojans do not replicate themselves and do not need a host program to attach to.

You can minimise your chances of unintentionally downloading Trojans by:

- Not opening emails or accepting attachments from unknown sources.

- Installing software from trusted sources only.

- Not clicking on links contained within emails of unknown sources.

- Regularly scanning your computer for Trojans and other malicious programs with up-to-date anti-virus software.

- Using a firewall to monitor traffic to and from your computer while connected to the Internet.

- Downloading and installing security patches for your operating system as soon as they are available.

- Keeping your anti-virus and firewalls up-to-date and perform regular scans of your computer

Worms and Viruses

A computer virus is software that affixes itself to another program like a spreadsheet or word document. Similar to a biological virus, it must attach itself to another program to survive and reproduce. Unlike Trojans, which are self-sufficient programs, viruses can only run if the infected program is running. While active, the virus attempts to reproduce and attach itself to other programs. This can tie up resources such as disk space and memory, causing problems on any home computer.

A worm is similar to a virus. It exploits computers in a network that contain security holes. Once a security hole is found, the worm will attempt to replicate itself from computer to computer. Like viruses, worms can be equally destructive.

You can increase your chances of ensuring your computer is free from worms and viruses by:

- Installing anti-virus software, and keeping it updated with the latest virus definitions.

- Downloading and installing security patches for your operating system as soon as they become available.

- Not accepting attachments from emails of unknown sources.

- Installing software from trusted sources only.

An example of a fake website mimicking the 'look and feel' of the ANZ Internet Banking site:

If you receive an email requesting you to re-register or re-enter sensitive details, delete it immediately and notify the Internet Banking Help Desk.

You can minimise your chances of being a victim of Phishing scams by:

- Typing 'www.anz.com' into your Internet browser to log onto Internet Banking.

- Treating all emails requesting personal log on information such as username, password or PIN with extreme caution. ANZ will not send you an email asking for your Account Details, Financial Details, or login details for ANZ Phone Banking, ANZ Mobile Banking or ANZ Internet Banking.

- Immediately deleting emails of unknown origin, no matter how innocent or provocative the subject headings sound.

- Changing your Internet banking password on a regular basis.

- Keeping your anti-virus and firewalls up-to-date and perform regular scans of your computer.

Spyware

Spyware is a type of software that covertly collects user information while on the Internet.

Find out more about scams www.scamwatch.com.au.

Banking Fraud

As a customer you may be seen as a potential target for fraudulent activities. However by arming yourself with information and tools you can protect yourself from becoming a victim of fraud.

Do you know the four biggest fraud threats you face?

- Electronic fraud

- Identity theft

- Credit/Debit card fraud

- Cheque fraud.

Credit card and debit card fraud

Credit card and debit card fraud is a crime whereby your credit or debit card can be reproduced in order to use the credit balance to obtain a financial advantage. The creation and/or alteration of a credit/debit card occurs when the information contained on the magnetic strip is reproduced. This type of crime is known as ‘skimming’.

Credit or debit card fraud can also occur when your card is lost or stolen and used by a third party to purchase goods with those cards or to remove cash from the cards.

Credit or debit cards can also be intercepted in transit while being sent to you. Your cards can also be compromised by a dishonest merchant who undertakes unauthorised duplicate transactions on your card.

Protect your credit/debit card:

- Memorise your personal identification number (PIN). Don't use the same PIN for all your cards, and don't choose your birth date or other easily identifiable numbers that might be on something else in your wallet.

- Check statements and call your credit card issuer immediately if you see anything suspicious on your bill. You could help the company uncover fraud—and save yourself from paying unauthorised charges.

- Do not let your credit card out of your sight at anytime – for example, at a restaurant – go with the card.

- Card fraud is not applicable in Australia only – be just as vigilant when travelling overseas, credit card skimming is an international crime.

- Always sign your card in ink as soon as you receive it.

- Keep track of when new and reissued cards should arrive, and call the credit card issuer if they don't come on time.

- Make sure your mailbox is secure, and that only you and the postal carrier have access to it.

- Tear up all credit card receipts and pre-approved credit card offers into small pieces before you throw them away. Keep your billing statements in a safe place.

- When you use your credit card online, make sure you are using a secure website. Look for a small key or lock symbol at the bottom right of your browser window.

- Never give your card number to strangers or telemarketers who call you on the phone. Don't give your card number unless you initiated the call.

Cheque Fraud

What is cheque fraud?

Cheque fraud is the use of a cheque to get financial advantage by:

- altering the cheque (payee/amount) without authority

- theft of legitimate cheques and then altering them

- duplication or counterfeiting of cheques

- using false invoices to get legitimate cheques

- depositing a cheque into a third party account without authority

- depositing a cheque for payment knowing that insufficient funds are in the account to cover the deposited cheque.

How to protect yourself from cheque fraud

- Reconcile your accounts promptly and regularly

- Never sign blank cheques, and only sign cheques after all details have been completed.

- Limit the number of signatures to your account to ensure control.

- Ensure that your signature is not with documents that can be accessed by the general public.

- Keep all cheques secure when not in use to deter theft.

- Don’t leave any gaps in the completion of the payee name, amount in words and in figures.

- If cheques are lost or stolen contact ANZ immediately and ask them to stop payment on the cheque.

- Ensure that any invoices are valid before payment.

- Consider using electronic means of payment (if possible) for high value payments.

- Ensure that your mailbox is secure to protect your inward cheques.

Electronic Fraud

Email scams and fake websites

A number of customers from Australian financial institutions have been targeted with hoax emails. These emails appear to be genuine bank emails.

Some emails inform the customer that their security details and passwords need to be updated by logging into an authentic looking, but fake website. The purpose of these websites is to obtain your log on details to access your bank accounts.

Others communicate security messages and advise you to install software from the email that checks and removes viruses. By downloading the software you are in fact tricked into downloading a virus.

ANZ will not send you an email asking for your Account Details, Financial Details, or login details for ANZ Phone Banking, ANZ Mobile Banking or ANZ Internet Banking.

This is an example only, the content and look of the emails change.

Identity Theft

Identity theft is where your personal details are obtained to get some sort of financial or other benefit, leaving you the owner of that identity often in large debt with a negative credit history and in some cases with legal implications.

Your information can be obtained in many ways:

- Theft, including theft of mail from your mailbox at home

- By going through your garbage bins

- Telephone, Fax and Mail scams

- Internet.

The following can be used to assume your identity:

- Date of birth

- Utilities bills (phone, gas, water and rates notices)

- Address.

The lodgement of items into a bank account consists of the cash and non-cash items to be deposited. These should be itemised on the deposit form, or deposit book, in line with the policies and procedures of the business and the financial institution.

When depositing in person it is normal practice to wait while the lodgement is processed at the financial institution. The deposit will be checked in detail to ensure the cash and non-cash items presented match the amounts stated on the deposit form. The other way deposits can be lodge is into a night safe where the items are placed in a secure vessel at the bank or financial institution. The following day the items are collected by bank staff and checked for accuracy.

When this has been verified, a receipt will be issued confirming the lodgement has been completed. In the case of a deposit book, the copy of the deposit or stub will be stamped and initialled.

Where there is a discrepancy between any of the items they will be counted and checked again. The advantage of waiting whilst the lodgement is verified is that any discrepancies can be checked while both parties are present.

The proof of lodgement is returned to the business and filed with the day's reconciliation forms as evidence the process has been completed.

Manual Instructions

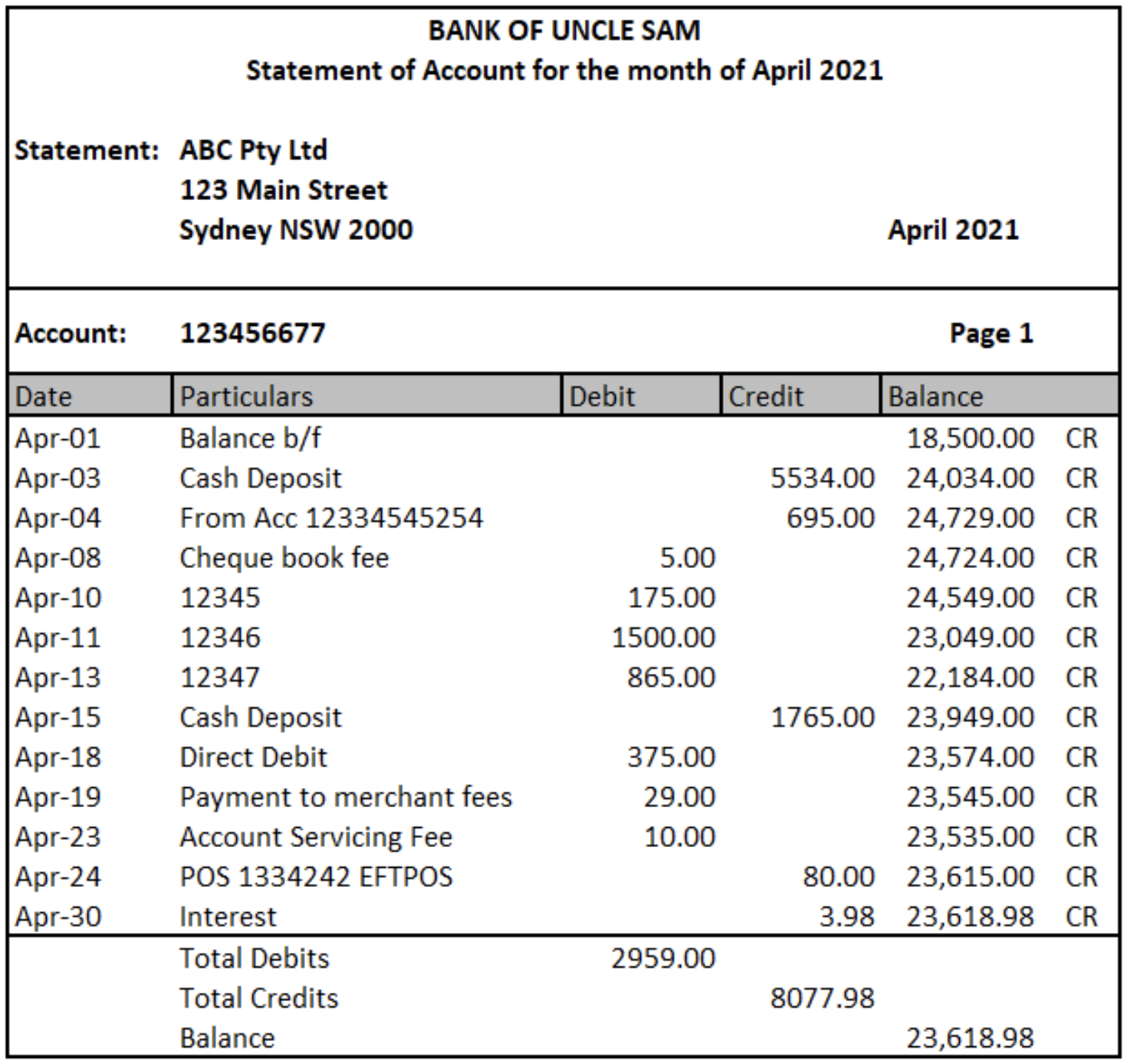

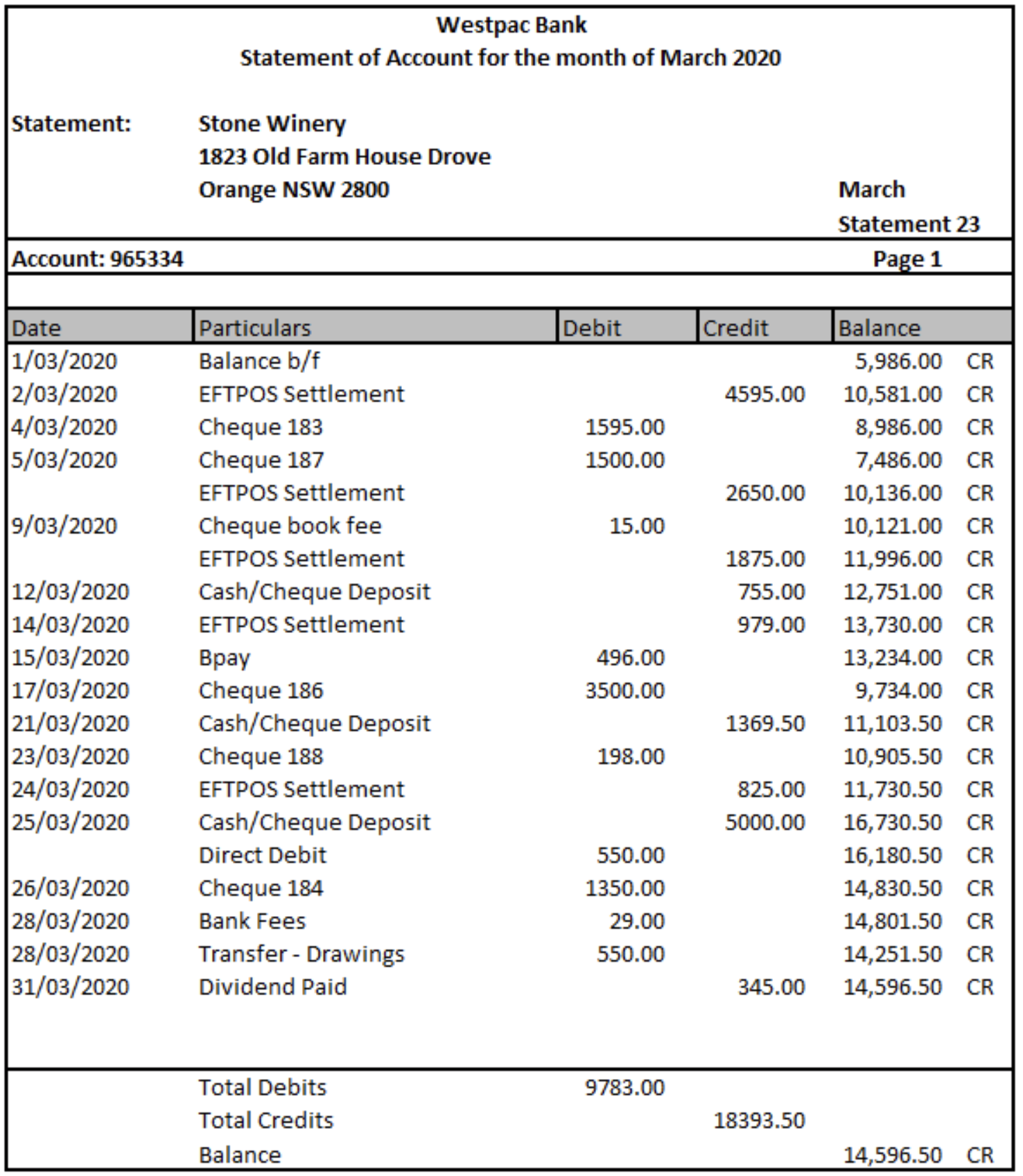

A bank statement is a ledger account maintained by a financial institution listing deposits and withdrawal transactions occurring within a given period for a bank account held by the business with a financial institution. Companies keep a similar general ledger account called 'Bank' or 'Cash at Bank', which is updated monthly by posting transactions from the cash receipts and cash payments journal.

Periodically, usually monthly but can be more or less often, a bank reconciliation is done comparing the cash records of the business with the financial institution's records. Because the financial institution and the company prepare the same records independently, any differences between the two records are identified.

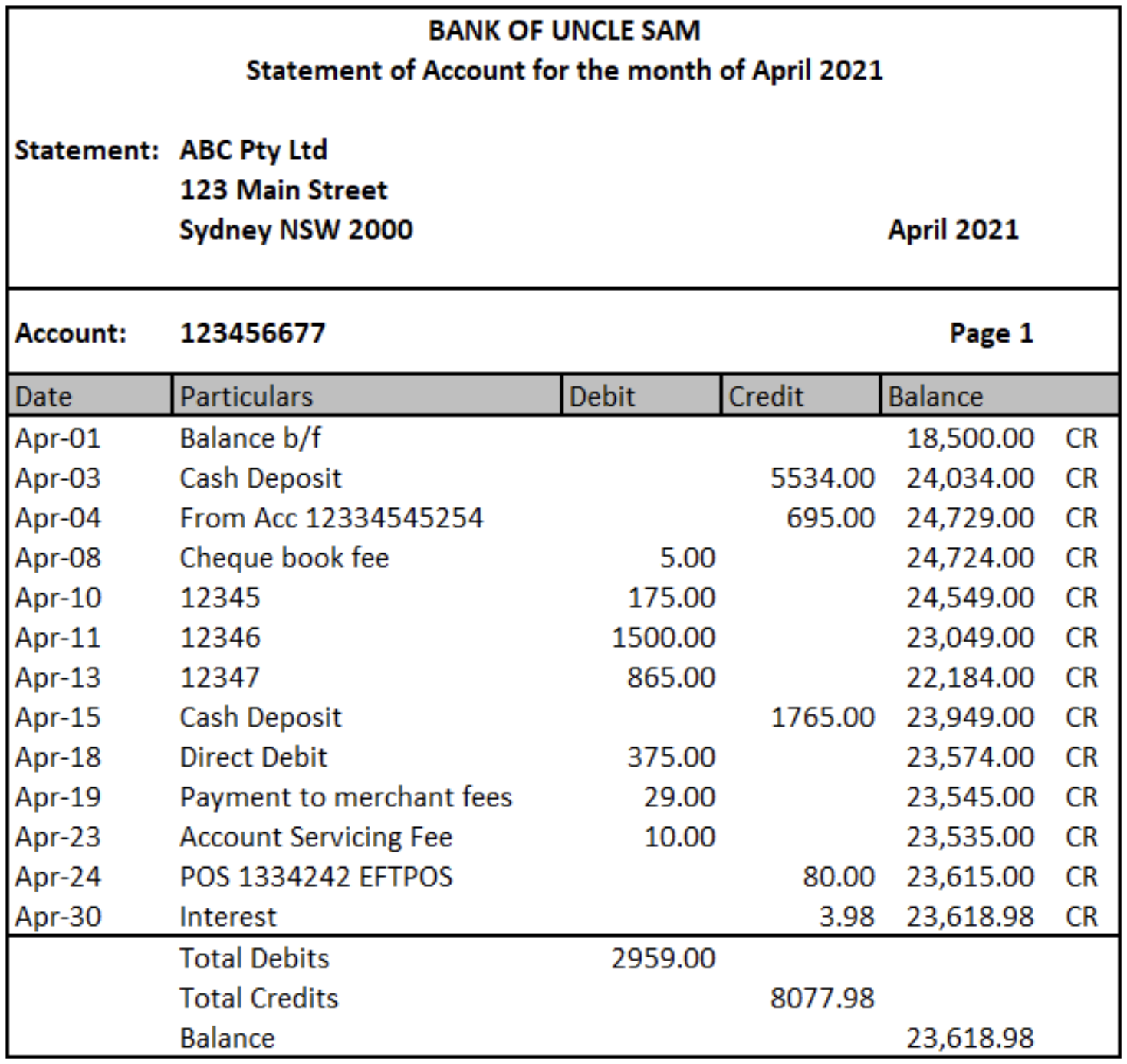

Below is a copy of the bank statement and Bank ledger of ABC Pty Ltd for the month of April 2021. You may expect that the bank statement balance and ABC's Bank ledger account match; however, this is not the case.

The bank statement balance of ABC Pty Ltd shows a credit closing balance of $23618.98. This amount is a liability to the bank as it is the amount the bank owes the business. ABC's Bank ledger account will have a debit balance as the cash held in the Bank of Uncle Sam is an asset for ABC Pty Ltd.

Some items in the bank's records do not appear in the business' records and vice versa. This is often due to a timing difference or fees and charges. It is the purpose of the bank reconciliation to pick up these differences.

Differences that may be picked up off the bank statement include:

- Bank Charges that are automatically deducted each month from the bank account.

- Interest received that is automatically deposited each month into the bank account.

- Bank transfers and direct deposits that the business may have instructed the bank to pay automatically: e.g. power bill, rent, credit card.

Differences that may appear in the business' records but not on the bank statement include:

- Unpresented cheques – Cheques that have been recorded in the business accounts but have not been presented at the bank for payment during the statement period

- Deposits not credited – Deposits that have been recorded in the cash receipts journal but do not appear on the bank statement yet.

A business usually does not record these transactions until it receives its bank statement and does a reconciliation. Consequently, the cash payments and cash receipts journal are not balanced and posted to the ledger until the bank statement has been checked, missing items identified and recorded in the journals.

Bank reconciliation procedure

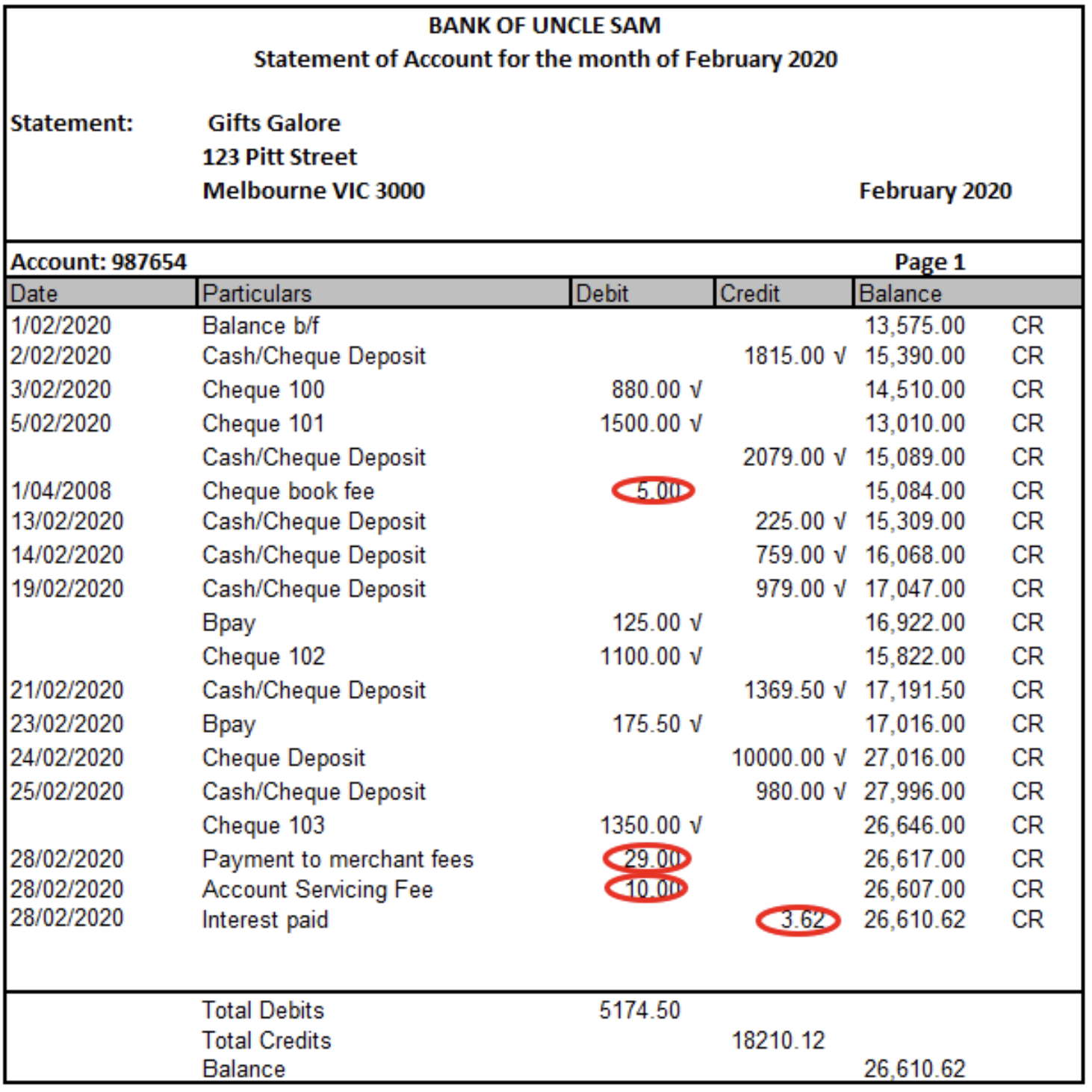

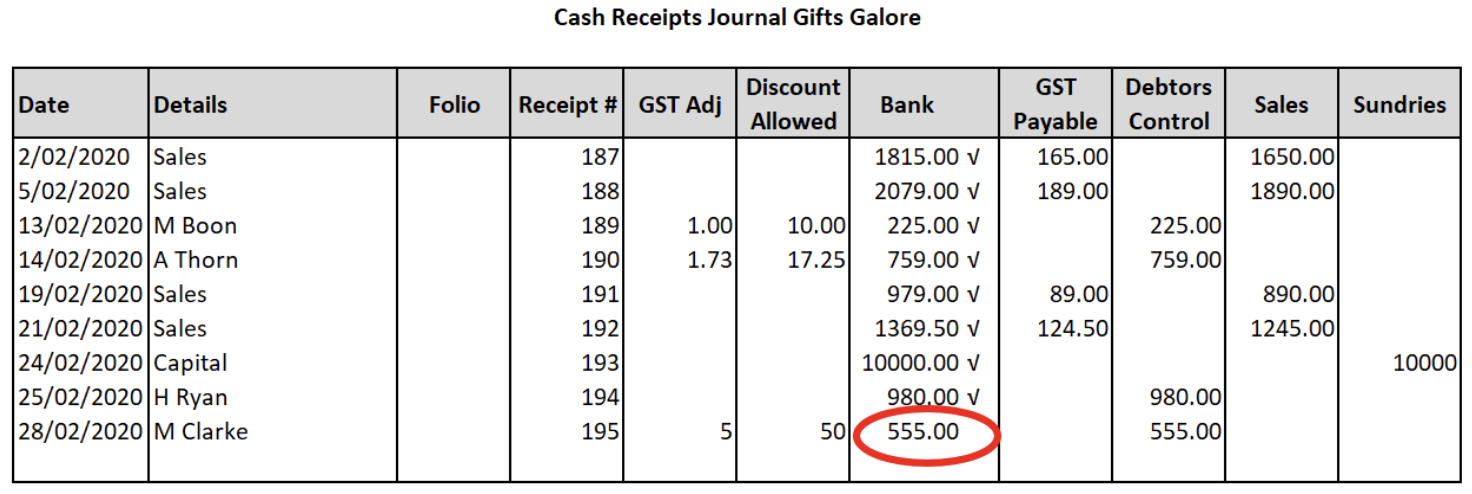

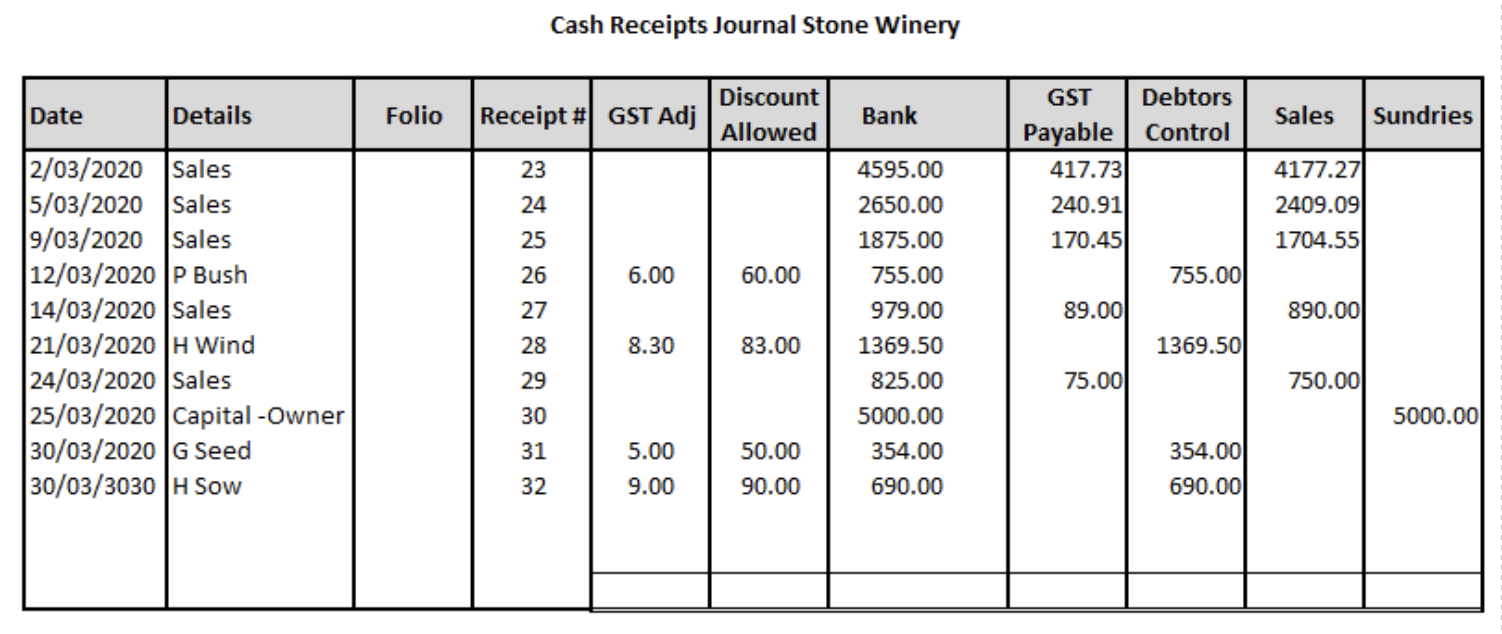

Compare the credit column of the bank statement with the bank column in the cash receipts journal. Tick off items that appear in both columns.

Highlight any item that appears only in one set of records

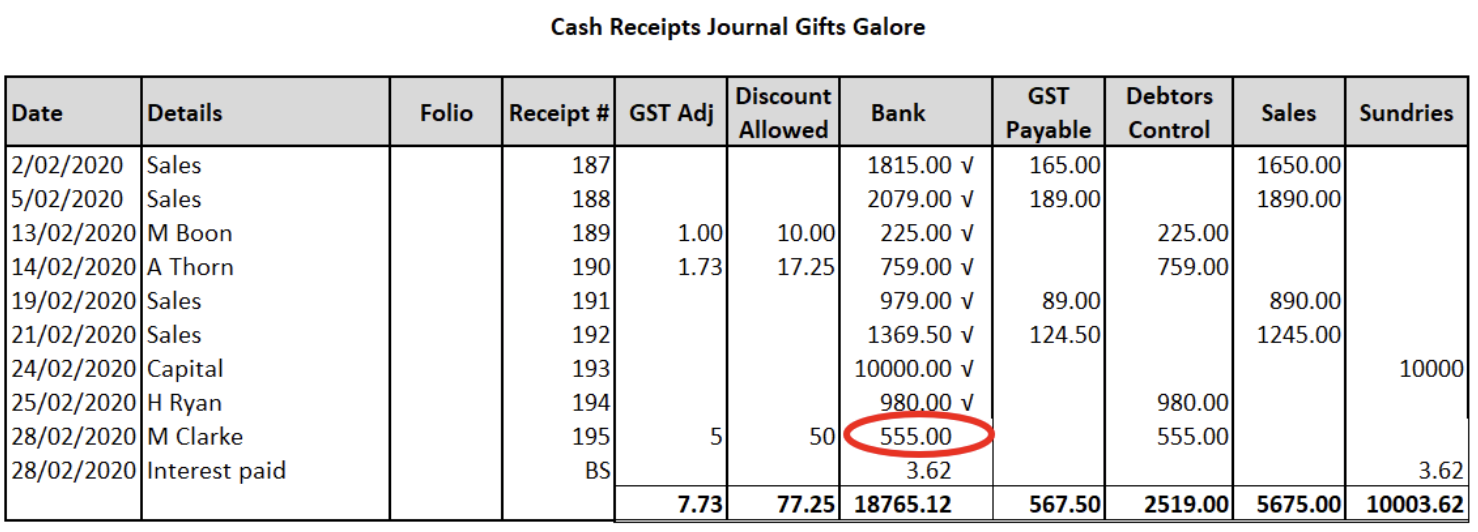

Cash Receipts Journal Gifts Galore

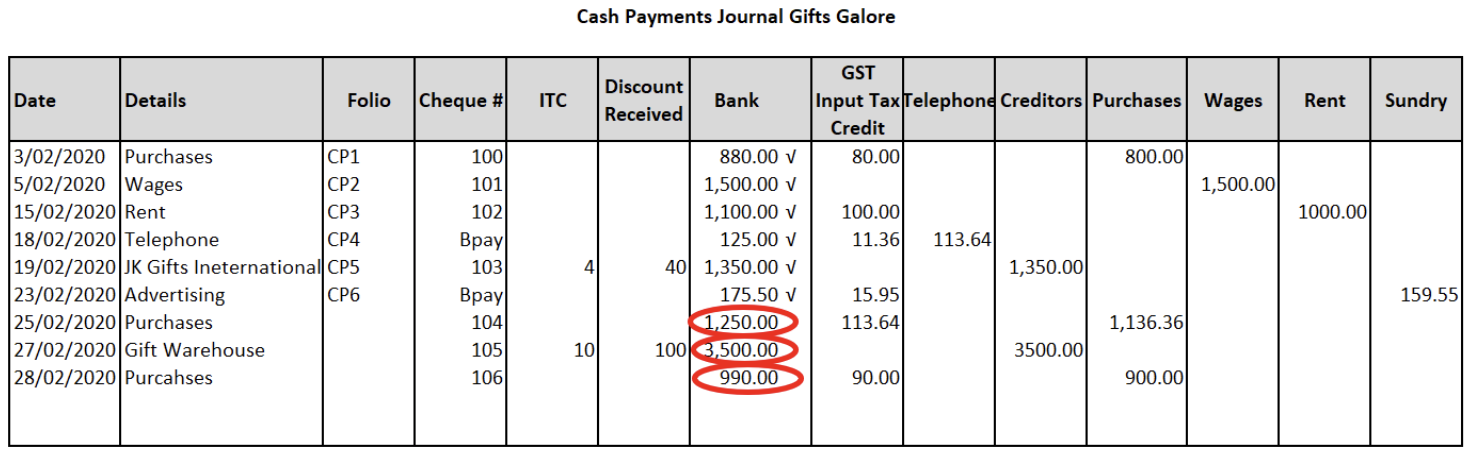

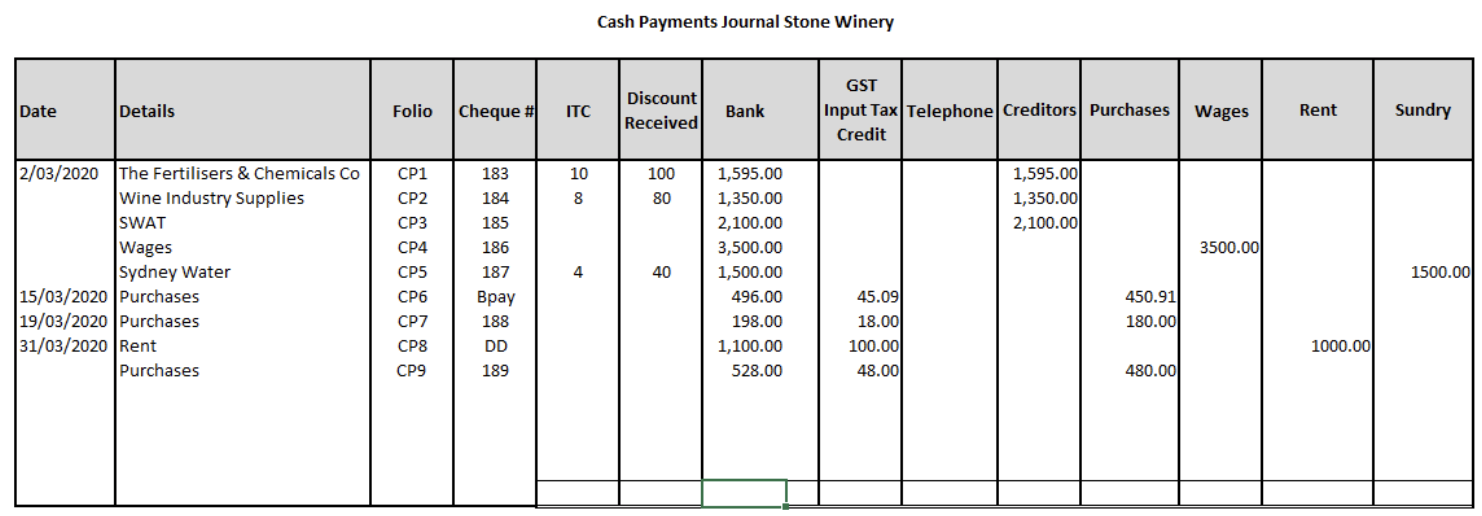

Compare the debit column in the bank statement with the bank column in the cash payments journal. Tick off items that appear in both columns.

Highlight any item that appears only in one set of records.

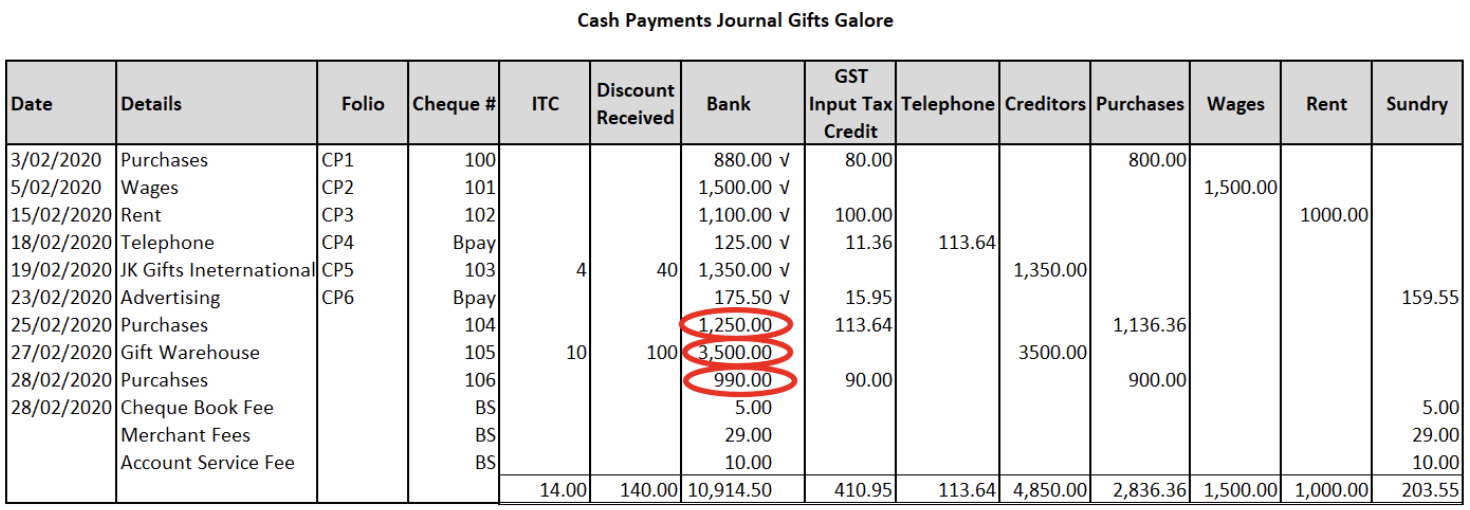

Cash Payments Journal Gifts Galore

Update the cash payments and cash receipts journal by recording any items that appear only on the bank statement and total the journals.

Cash Receipts Journal Gifts Galore

Cash Payments Journal Gifts Galore

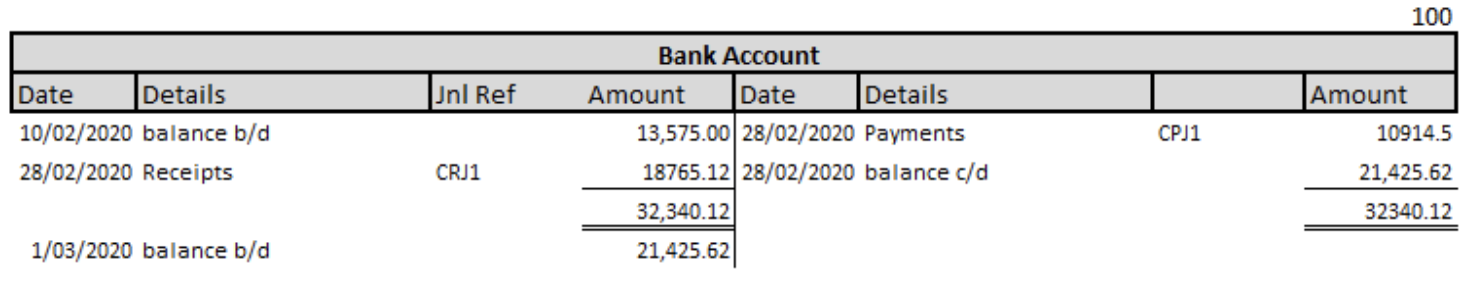

Post the cash receipts and cash payment journals to the ledgers.

Extract from General Ledger Account

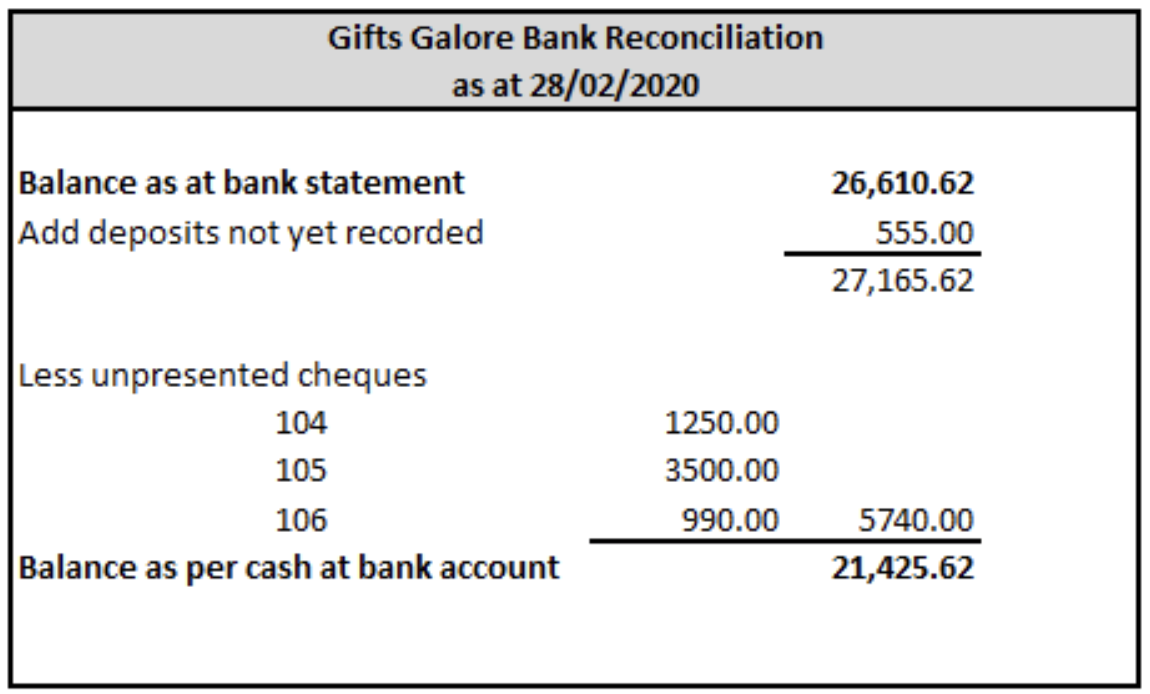

Prepare the bank reconciliation statement listing any transactions in the business records that do not appear on the bank statement.

Test your understanding

In this excel workbook, follow the instructions below using the documents provided by Stone Winery:

- Complete the cash journals

- Post to the Bank general ledger account

- Prepare the bank reconciliation statement as at 31/03/2020.

Cash Receipts Journal Stone Winery

Cash Payments Journal Stone Winery

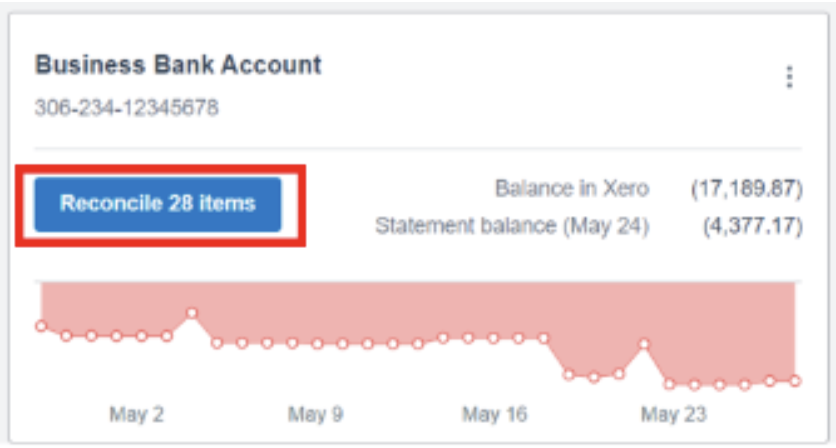

Xero Instructions

A bank reconciliation is the process to confirm that all the transactions in your bank accounts are recorded in your business accounting records. If you use a computerised accounting system like Xero, reconciling your bank accounts is a more straightforward process. Your bank sends transactions into Xero through a secure online connection. You then match the transactions to transactions you have entered into Xero.

Reconciling your bank statement to the general ledger

In Xero, this is done by selecting the 'Reconcile' button on the bank account panel on the dashboard. The 'Reconcile' button shows how many transactions on the bank statement are waiting to be reconciled. Transactions not in Xero can be recorded directly from the bank reconciliation as receive or spend money transactions.

Select the bank account > Reconcile items

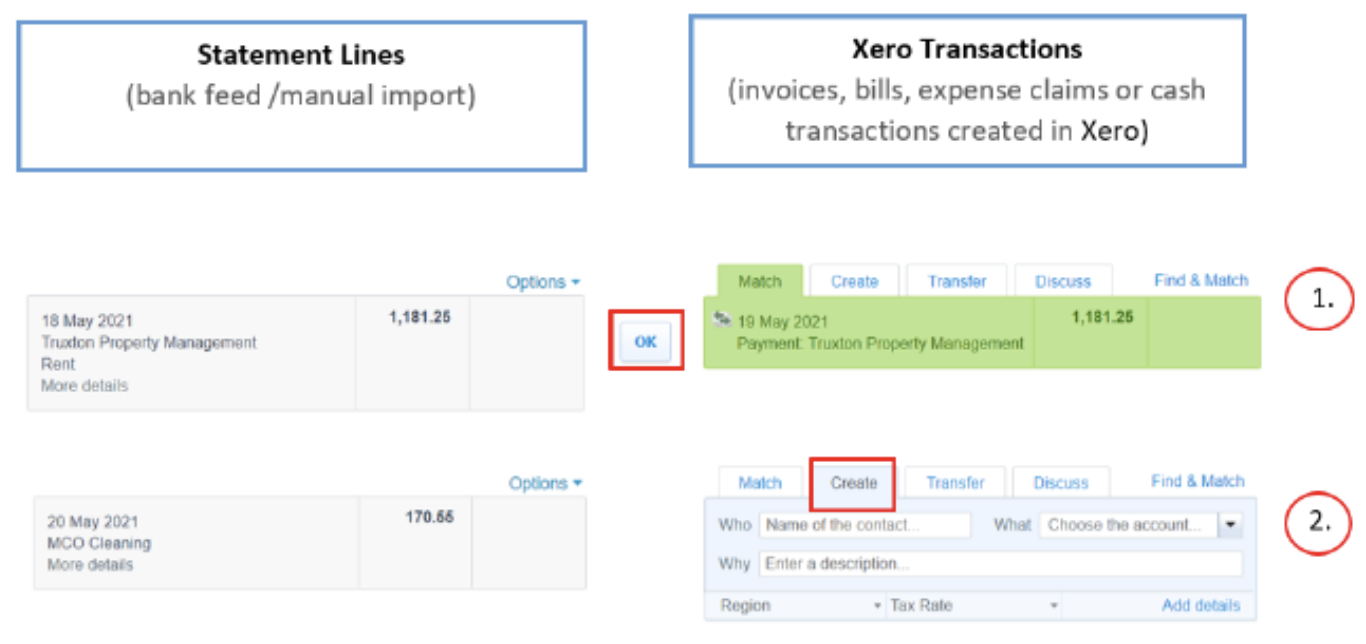

You will notice two columns of transactions.

The transactions in the left column are statement lines imported from your bank account via a bank feed or manually imported.

The transactions in the right column are transactions that have been created in Xero. These could be invoices, bills, expense claims or cash transactions.

The bank reconciliation in Xero matches each statement line in the bank account to an existing transaction in Xero or create a transaction during the reconciliation process.

- Xero will automatically suggest transactions to match against statement lines. If the correct transaction is suggested, click 'OK'.

- When a transaction does not already exist in Xero that matches the bank statement line, you can create this transaction using the 'Create' tab. Enter:

- 'Who' - who the payment is from

- 'Why' - description of the payment

- 'What' - account from the chart of accounts to allocate the payment to.

- 'Tax Rate' - select the correct tax rate

If you want to include more information about the transaction or attach a document, click 'Add details'. Click 'OK' once you have entered the details to reconcile the transaction.

This link will help you understand Bank reconciliation in Xero (force.com).

You can also get more information on reviewing imported bank statement lines and reconciling your bank account (force.com)

Test your understanding

Access your Xero Course.

Reconcile the Business Account and Savings Account for Surf & Skate Limited to 30/04/2021

- Assume all transactions are GST inclusive except for any bank fees which are GST free.

- Do not add any new general ledger codes. Use the description to allocate the transactions.

- All travel in National.

Print a reconciliation report for both bank accounts dated 30/04/2021.