Cheques need to be kept safe because they are used to transfer money to others. A cheque requisition is a document for keeping control of payments made by cheque. The cheque requisition is completed prior to signing the cheque and it is provided to the signatory with all supporting documentation attached. The signatory signs the cheque and the cheque requisition form. The cheque requisition is filed in cheque number order.

Cheque requisition forms serve the purpose to:

- Make payments for purchases of goods and services

- Request that a cheque be prepared and issued outside of the normal workflow for urgent payments

- obtain a signature and authority for an account on which those normally paying invoices do not have signing authorities

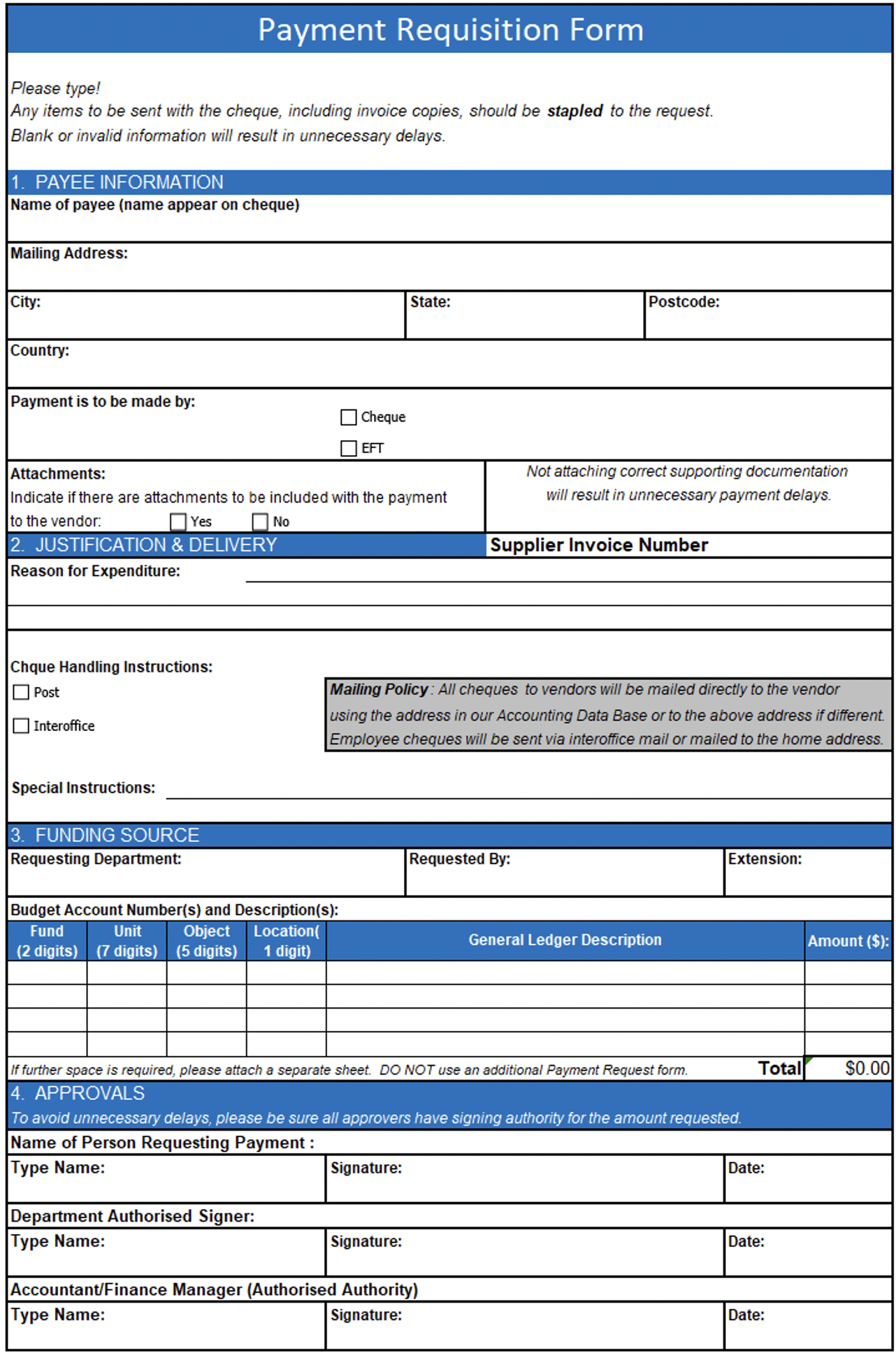

Completion of a payment requisition is an important part of the process for accounts payable. Cheque requisition forms include:

- Current date

- Payee-complete name and address of individual/ company to be paid

- Payment description-general description of what is being paid

- Account to be charged

- General ledger account number

- Invoice number

- Total

- Signature of employee generating cheque requisition

- Signature of authorised person within department but which must be someone other than the person who generated the cheque requisition

- Signature of person approving the payment.

All relevant parts of the form must be completed, and correct documentation must accompany the requisition form.

Today It is common for payment to be made by Electronic Funds Transfer (EFT) rather than cheque. In this case a EFT requisition form or payment requisition form is to be completed, following the same process as above.

Sample Payment Request Form

EFT payments

EFT payments require two parties to talk to each other electronically through a designated system. Wherever there is an electronic funds transfer, one source sends the money and another one receives it. During this process, there is also a connection with the sender’s bank or financial institution to confirm availability of funds.

Types of EFT Payments

Credit and debit cards - Every time you use a credit or debit card, you’re making an EFT payment. While the funds transferred might take a few days to clear, the EFT payment system automatically confirms that funds are available, essentially making the transfer/purchase valid instantly.

Direct deposit/bank transfer - Many businesses allow you to pay invoices using direct deposit. Funds transfer can take anywhere from seconds to 1-2 business days depending on the banking institution.

Internal controls are required to help ensure the safety and security of a company’s payments and mitigate the risk of fraud. Once your invoice is approved and put into the system, the bill needs to be paid. If a business is still using paper cheques and a manual process for payments, there are a number of controls that can be implemented to increase security.

Segregation of duties

Segregation of duties occurs when there is a one person initiating payments and another person authorising payments in the system. Similarly, if your business makes cheque payments, there should be one person who prepares the cheques and another person who signs the cheques. Segregation of duties mitigates fraud and theft by ensuring that no single person handles a transaction from beginning to end.

Track cheque numbers

Keep a log of all cheque numbers being issued and the amount. This helps to identify if any cheques are missing and ensures that any cheques written match the ones being deposited.

Manual cheque signing and double signing

It’s a best practice to manually sign a cheque rather than using a stamp or signature stamp. It’s also best practice to have more than one person sign a cheque especially if the payment exceeds a certain amount.

Secure cheque storage

All physical cheques should be securely stored to avoid fraud and all signature stamps should be stored in a secure location to eliminate the risk of unauthorized usage.

Supplier Payment Information Updates

When personal supplier information like bank account numbers and addresses, changes you should contact the vendor and confirm the accuracy of this can be an indicator of fraud.

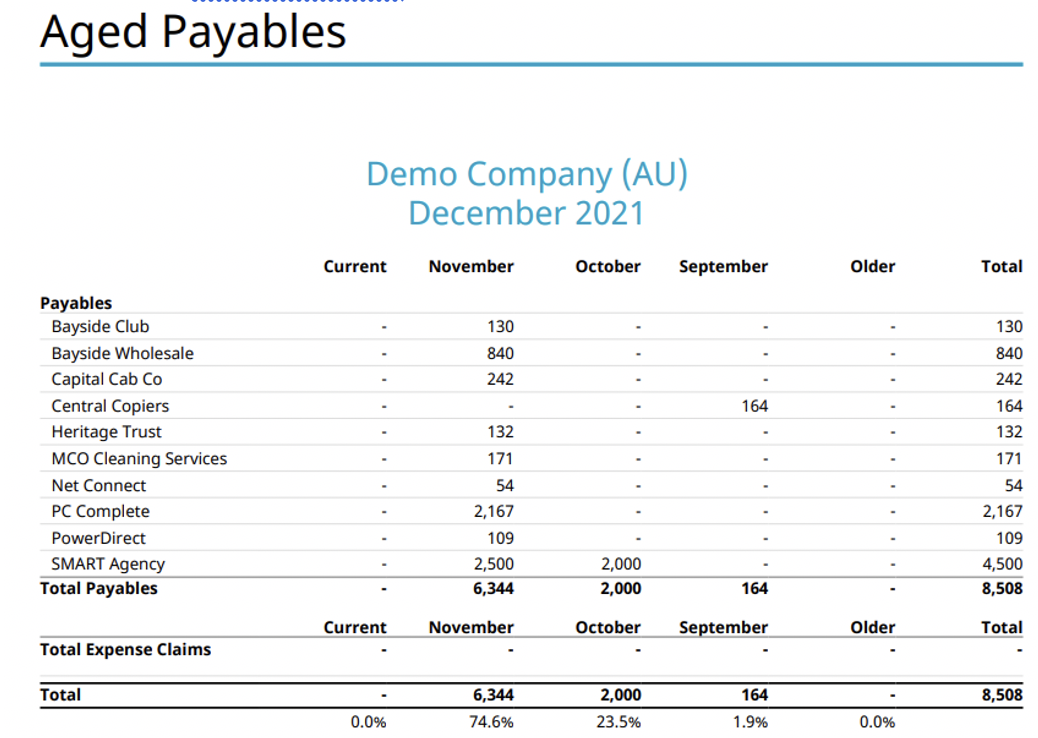

An accounts payable aging report provides a complete list of every unpaid AP invoice on the books

Components of the AP ageing report

The accounts payable ageing report has a few different components. Each vendor or supplier has their own row that includes the total you owe and how much the debt is past due, if applicable.

On accounts payable ageing report, there are typically various columns that categorize debt based on the age of the invoice. Each column represents a time frame after you receive a bill. Usually, the columns go by 30-day increments:

Current (0 – 30 days old) These are new balances of orders placed within the last 30 days. The other columns are invoices that are over 30 days old and are typically past due. They range in days depending on how past due the invoice is. For example, if a balance is under the 1 – 30 days column, it is 1 – 30 days past due.

- 1 – 30 days past due

- 31 – 60 days past due

- 61 – 90 days past due

- Over 90 days past due

The report keeps a running balance of the amount you owe suppliers. When you purchase goods or services on credit, you may wind up owing a supplier for several transactions. On your report, you can typically see the total you owe each supplier under a “Total Balance” column.

An Aged Payables report can help you see which payments are past due and determine which balances to pay off first.

Before paying a creditor, it is important to ensure that the creditor information you have is accurate. This includes the creditors name and address, bank account details and any other information or number that identifies the payee. In some cases, it may be necessary to create a new vendor file. Inaccuracies in any of these areas can cause you to pay the wrong creditor or sending a payment to an incorrect address.

Preparing creditor's payments in an accurate manner must be performed in a timely manner. Your organisation will have expectations regarding accuracy and timeliness of application to ensure a high level of satisfaction and to ensure that processing is carried out in an efficient and accurate manner.

Employees must ensure that they are competent in processing manual or electronic transactions within the necessary time requirements of their role within the business, and that they are always completed accurately.

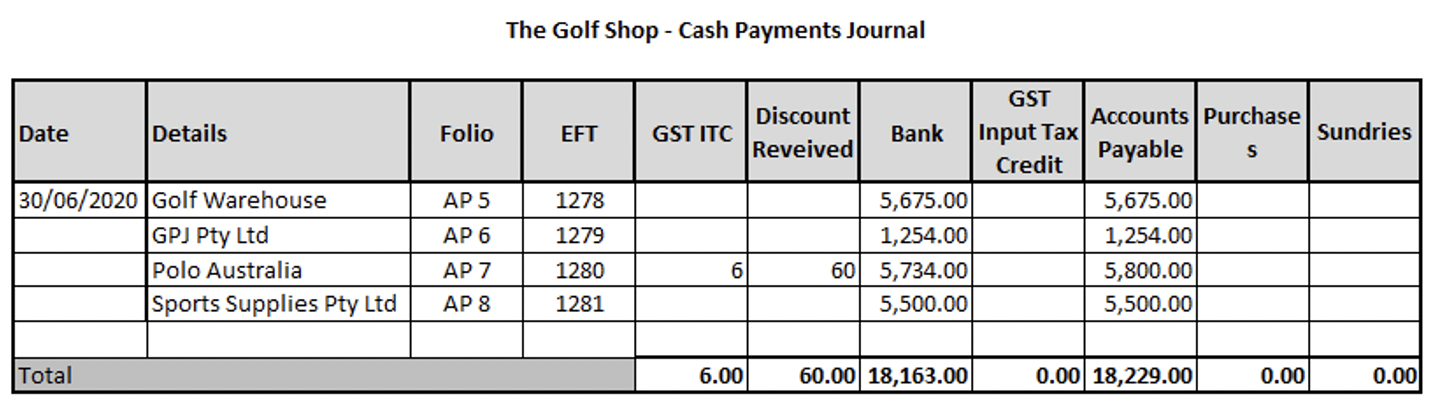

A cash payment journal, also known as a cash disbursement journal, is used to record all cash payments (or disbursements) made by the business.

Entering transactions in the Cash Payments Journal

The cash payments journal is a special journal used to record the payment of cash by a business. It is a chronological listing of all payments including cash, cheques and EFT payments, and is used to save time, eliminated clutter from the general ledger and to allow for segregation of duties. The cash payments journal format is usually multi-column. The information in the journal is taken from source documents such as cheque stubs, cash payments, EFT transaction reports etc.

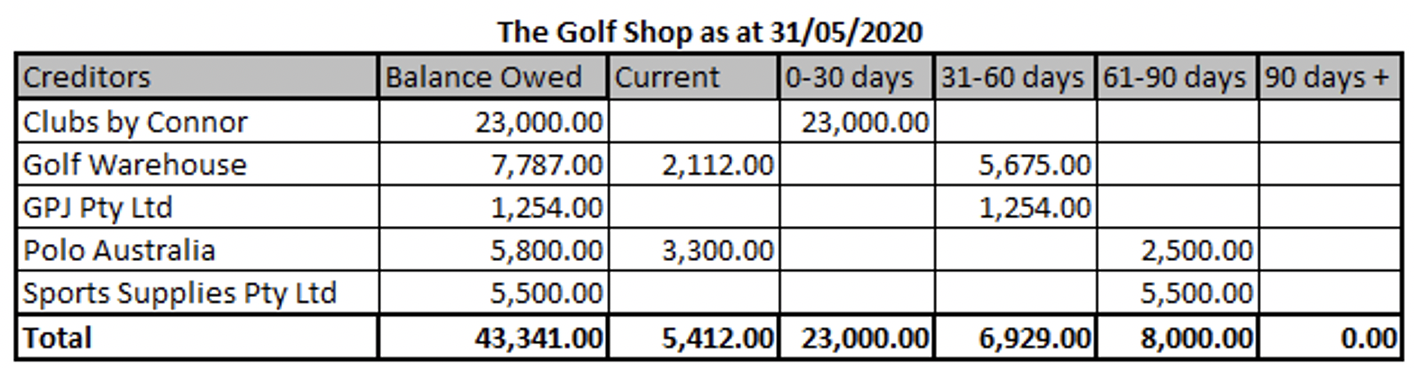

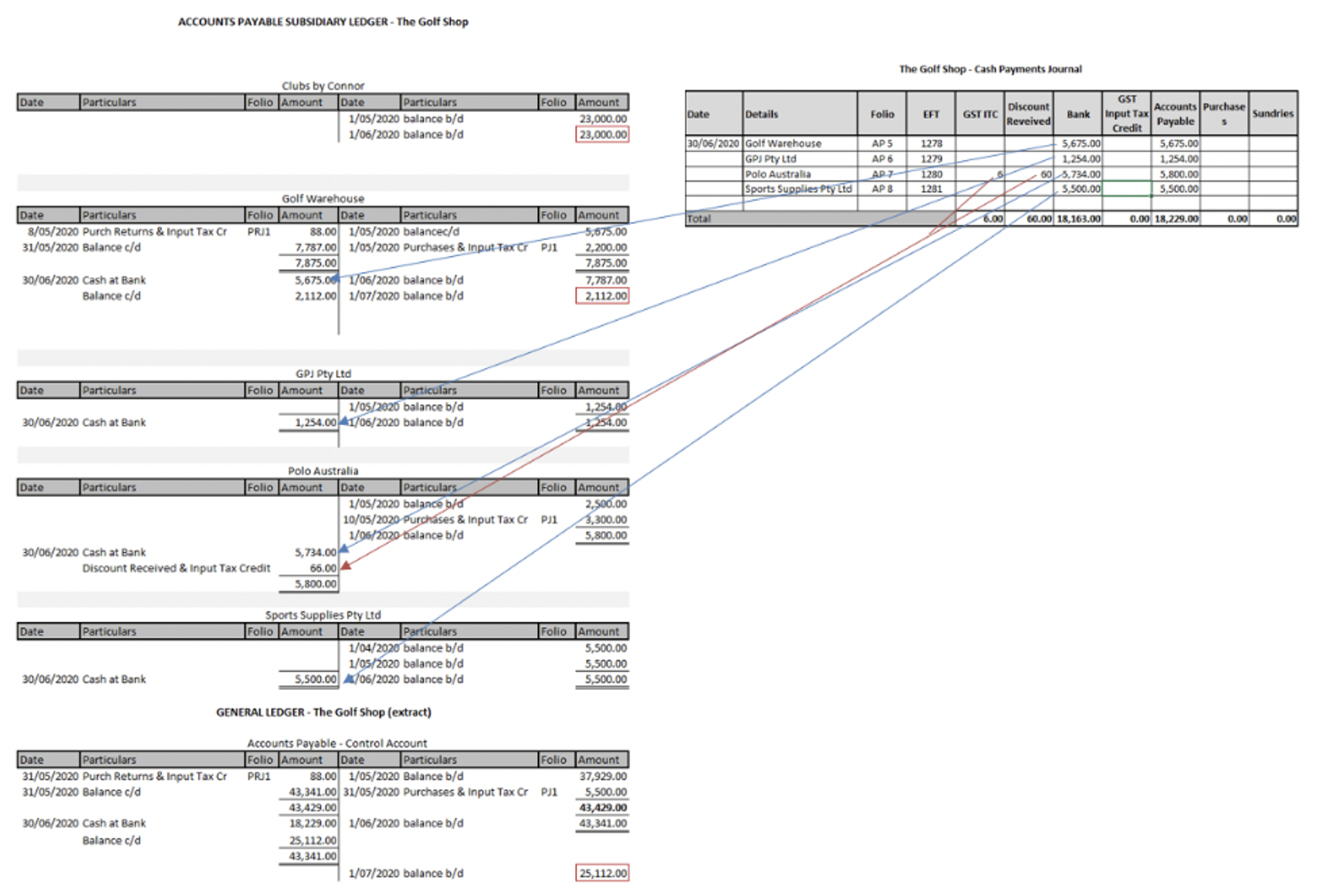

To demonstrate how entries are recorded in the cash payment journal we will use ‘The Golf Shop’ example used above.

The following amounts are outstanding as 31/05/2020. The organisations payments policy states:

- The Golf Shops default payment terms are all amounts over 30 days are paid at end of month.

- Electronic Funds Transfers is the preferred payment method for all payments.

All invoices over 31 days were paid on 30/06/2020.

The current invoice for Polo Australia was also paid and a 2% discount was taken.

Posting Cash Payment Journal to Ledger Accounts

The entries in the cash payment journal are entered sequentially as they occur.

The cash payment journal is posted in two stages. Entries to the Accounts Payable account should be posted daily to the subsidiary accounts payable ledger.

At the end of the month, all amount columns are summed. All the totals, except those in the other columns, are posted to the appropriate general ledger accounts. The accounts in the other columns must be posted individually.

There are two checks that can be made following the posting of the cash disbursement journal at the end of an accounting period to prove that the information has been correctly transferred to the ledgers:

The total of all the subsidiary ledger balances (in this case the supplier account balances in the accounts payable ledger) should be equal to the balance on the subsidiary ledger control account in the general ledger. This process is referred to as an accounts payable reconciliation.

The general ledger should be in balance, that is the total debits in the general ledger should equal the total credits. A trial balance is used to confirm that the total debit equals the total credits.

Accounts Payable Reconciliation Process

Accounts payable reconciliation should be performed at least monthly. The reconciliation process involves the following steps:

- Compare the accounts payable account in the general ledger (trial balance report) with the total of the individual accounts’ payable subsidiary ledger accounts (aged payable report). The comparison date must be the same for both reports.

- Identify the differences between the subsidiary ledger and general ledger, decide if an adjustment is necessary.

- Process adjusting entries and prepare the reconciliation statement.

- Compare the balance of the general ledger and the sub-ledger total. If there is still a difference, you will need to start again.

Reason for needing to do an adjustment.

There are many reasons why you may need to do an adjustment. This may include

- a purchase invoice or supplier payment has not been recorded

- a purchase invoice or supplier payment recorded twice

- a purchase invoice or supplier payment has been posted to the wrong amount

- a journal entry has been incorrectly recorded in the accounts payable account

- a payment to a supplier has incorrectly been allocated to an expense account.

Read the scenario below

Scenario: You work as a bookkeeper for The Cove B&B. The following information shows the general ledger balances for the B&B, along with purchases made in September.

General Ledger Balances (extract) Balances as at 01/09/2020

Bank $125,620

Inventory $ 45,070

Capital $43,000

| Date | Invoice Number | Detail | GST | Amount (inc GST) |

|---|---|---|---|---|

| 01/09/2020 | 10987 | Credit purchase from 123 cleaning | $850.00 | $2,850.00 |

| 04/09/2020 | CH456 | Credit sale to BFC | $180.00 | $1,980.00 |

| 10/09/2020 | 43 | Cash purchase sundry items - Woolies | $10.00 | $110.00 |

| 25/09/2020 | 001235 | Return to 123 cleaning | -$22.00 | -$242.00 |

| 26/09/2020 | 10999 | Credit purchase from 123 cleaning | $150.00 | $1,650.00 |

| 29/09/2020 | 56020SB | Credit purchase from Old Skool Brewery | $25.00 | $275.00 |

Task 1:Record transactions and reconcile

Record the transactions in the Purchases Journal, Purchases Returns and and Cash Payments

Record the transactions in the Accounts Payables Subsidiary Ledger and General Ledger

Reconcile Subsidiary Ledgers with Accounts Payable Control in the Reconciliation as at 30/09/2020

Task 2: Draft an email to the Accounts manager

It should give a summary of the account transactions, explain what actions you would take to ensure the invoices are correct and request permission for the accounts to be paid

Task 3: Cheque Request Form

Assume that you have been given authority to go ahead with payment. Old Skool Brewery prefers to be paid by cheque, complete the Cheque Request Form for approval. Once completed it will need to be approved for authorisation.

Task 4: Draft an email to the Accounts manager

Refer to the approval for payment to be made to Old Skool Brewery and ask the Accounts Manager to complete the cheque authorisation.