Learning objectives

After you have completed this topic, you should have knowledge of:

- The General Journal

- Cash Receipts and Cash Payments Journal

- Sales Journal and Sales Returns and Allowances Journal

- Purchases and Purchases Returns and Allowances Journal

The second step in the accounting cycle is recording business transactions.

What is a journal?

In accounting and bookkeeping, a journal is the company’s official book in which all transactions are recorded in chronological order. A journal is often defined as the book of original entry. The definition was more appropriate when transactions were written in a physical journal prior to manually posting them to the accounts in the general ledger. Business may use various kinds of journals to record transactions. These will be explored later in the topic.

Every business uses at least the most basic form of journal known as the General Journal. Double-entry bookkeeping is the method used to record journal entries in the General Journal, and all journals follow the same debit and credit format.

The General Journal provides a chronological record of transactions, and it shows the effect the transaction has on the general ledger accounts.

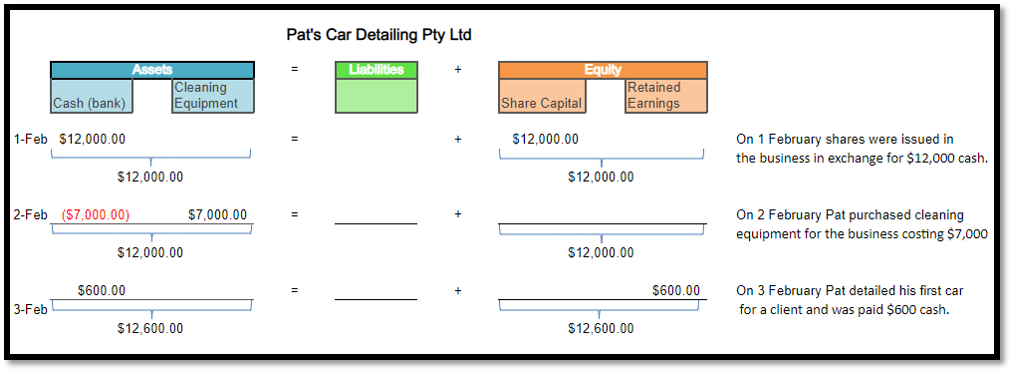

Pat started a new business, Pat’s Car Detailing Pty Ltd. To illustrate how transactions are entered in the general journal, lets examine the following transactions for Pat’s car detailing business.

- On 1 February, shares were issued in the business in exchange for $12,000 cash.

- On 2 February, Pat purchased cleaning equipment for the business costing $7,000

- On 3 February, Pat detailed his first car for a client and was paid $600 cash.

Using the accounting equation, we can analyse these transaction as follows:

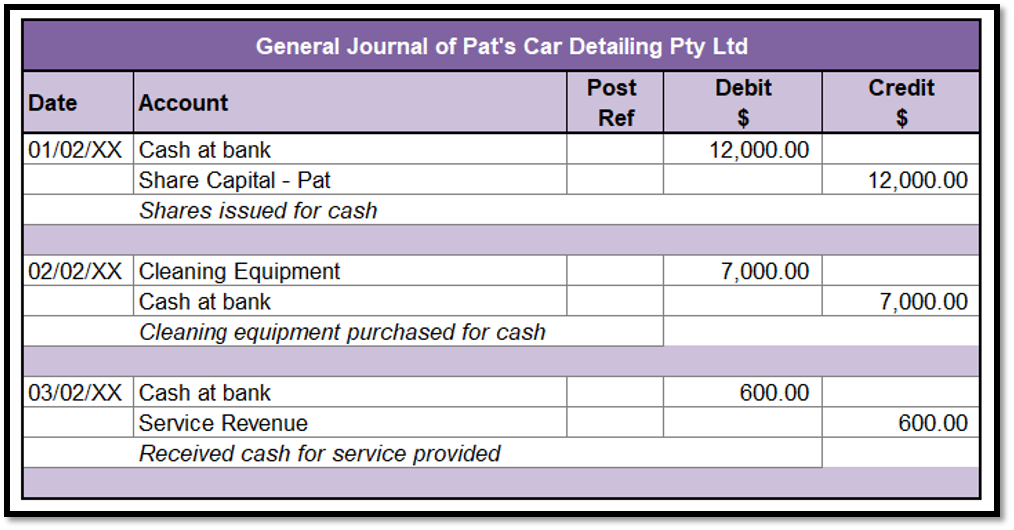

Separate journal entries are made for each transaction. The entry includes the date of the transaction, the account and amount to be debited and credited and a brief explanation of the transaction. The Post Ref column is used when posting the transaction to the ledger. (This will be covered later in the learning). The transactions for Pat’s Car Detailing Pty Ltd are journalised as follows:

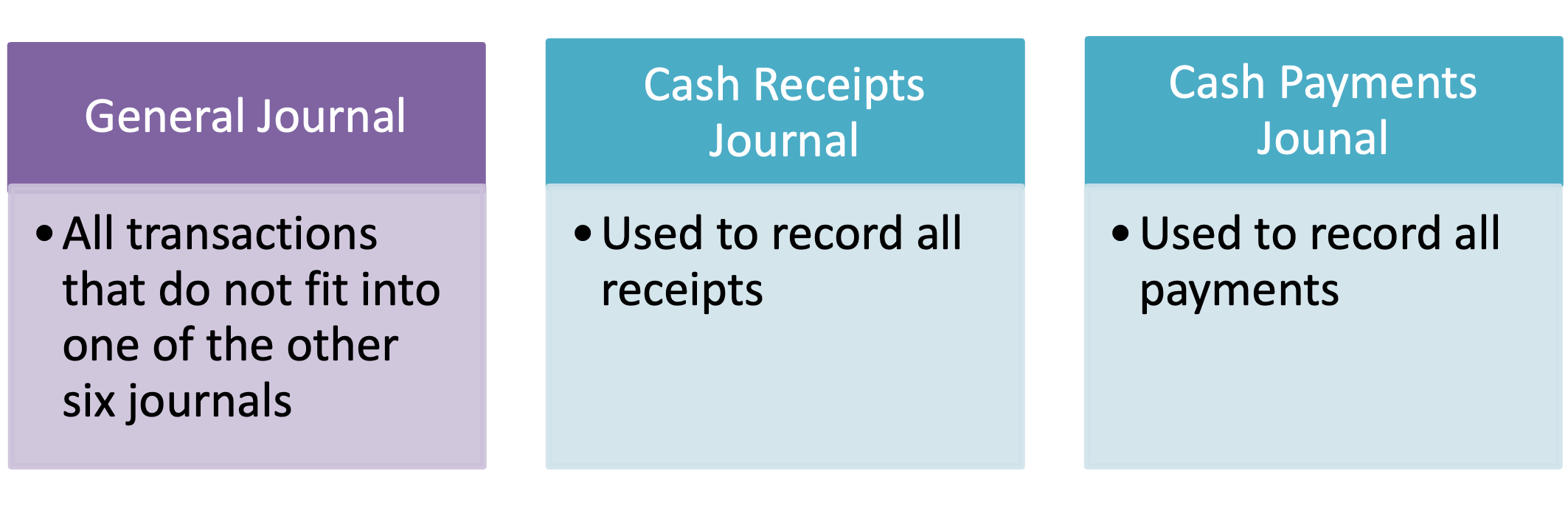

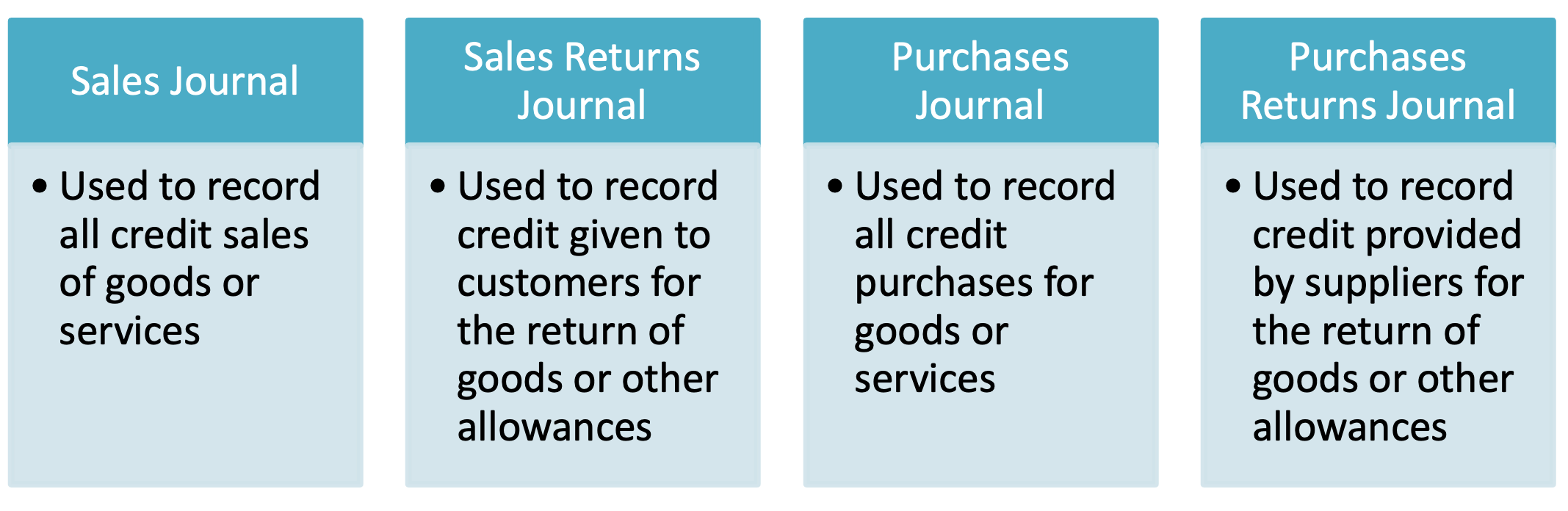

While small businesses and startups might not have difficulty fitting all their entries in the general journal, that is not the case for larger businesses. For larger businesses, other journals, called special journals, are necessary. Special Journals group and record transactions of a specific type. Special journals include Cash Receipts Journal, Cash Payments Journal, Sales Journal, Sales Returns Journal, Purchases Journal, Purchases Returns Journal.

To understand the process of journalising, watch the following video.

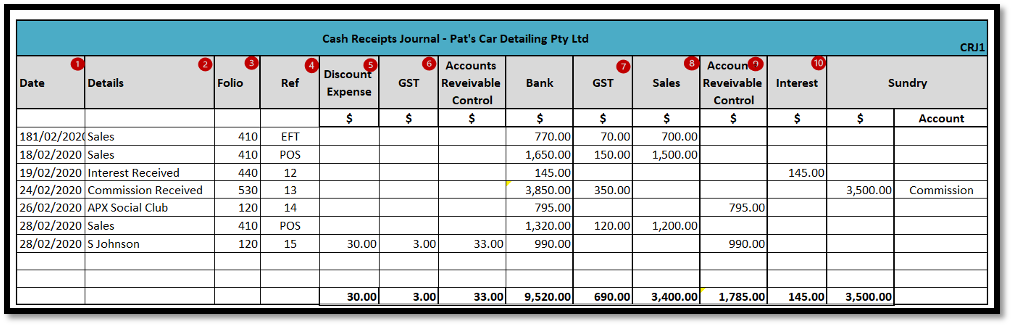

The recording of cash requires the use of two special journals, the cash receipts journal and the cash payments journal. Most businesses customise their cash receipts and cash payments journal to suit their business needs.

The cash receipts journal records all receipts of cash, EFT and cheques that have been received by the business. This most common types of receipts are:

- Cash sales

- Cash received for payments of accounts receivable

The cash receipts journal can also include:

- Money received from bank loans

- Bank Interest

- Cash received from selling equipment assets

- Commission received

- Cash received from dividends.

Written receipts, cheques, cash register rolls and, point of sale system receipts (POS), bank statements are all source document for the cash receipts journal.

Recording transactions in the cash receipts journal

- Transactions are recorded in date order in the Date column.

- The Details column records a description of the transaction or the name of the person from whom the amount was received from.

- The Folio column is used when the journals are posted to the ledger.

- The Ref column contains a reference to the source of the transaction.

- Discount expense is the situation where the seller offers the buyers a discount in the form of a trade, settlement, or volume discounts. The Discount Expense column in the Cash Receipts Journal records the amount of the discount less GST.

- The GST column records the GST on the discounts allowed to the customer, which represents an adjustment (reduction) to GST collected on sales. The Accounts Receivable Control column is the amount of the discount expense plus the GST amount.

- The GST column records the GST collected on cash sales.

- The Sales column records all-cash sales. EFT and PSO transactions need to be added separately in the Sales column as the bank credit these amounts individually to the business’s bank account.

- The Accounts Receivable Control control account records all receipts from debtors (accounts receivable).

- The Interest column is used to record interest received on money invested.

Where there is no special column provided for a transaction, the Sundry column is used. The name of the appropriate ledger account applicable to each of these transactions should be recorded in the Account column.

At the end of a period, a line is drawn under the Discount Expense, GST, Accounts Receivable Control, Bank, Sales, Interest and Sundry columns. The columns are totalled, and a double line is drawn.

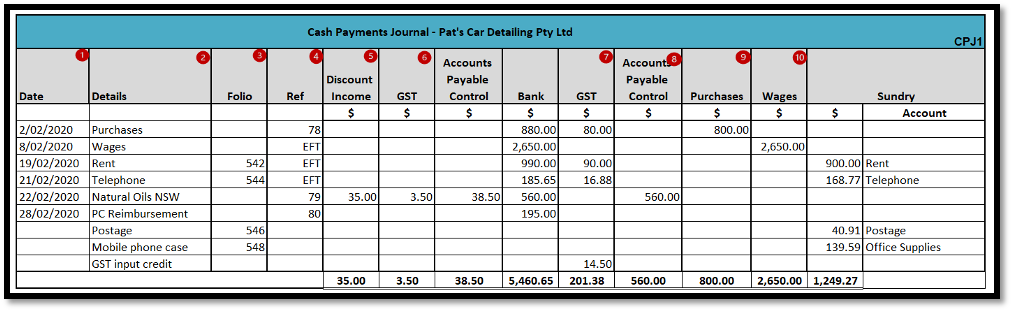

The cash payments journal is used to record all cash going out of the business. It demonstrates how the Cash at bank account is decreasing. Cash payments include:

- Payment of cash for cash purchases.

- Payment of cash for previous credit purchases, e.g. payment to accounts payable or creditors.

- Payment of cash for various expenses, e.g. rent, advertisement, wages and salaries.

- Payment of cash for the purchase of an asset.

- Bank charges automatically deducted from the account by the bank or financial institution

- Payment of cash for donations.

Written receipts, cheque butts, bank statements and a remittance advice are all source document for the cash receipts journal. These documents prove that the transaction took place.

At the end of a period, a line is drawn under the GST Input tax credit Adj; Discount Received, Creditors Purchases, GST Input tax credit, Sundries and Bank columns. The columns are totalled, and a double line is drawn.

Recording transactions in the cash payments journal:

- Transactions are recorded in date order in the Date column.

- The Details column records a description of the transaction or the name of the person from whom the amount was paid.

- The Folio column is used when the journals are posted to the ledger

- The Ref column contains a reference to the source of the transaction. For example, the cheque number or EFT payment.

- Discount Income is the situation where the supplier offers the business a discount in the form of a trade, settlement, or volume discounts. The Discount Income column in the Cash Payments Journal records the amount of the discount less GST.

- The GST column records the GST amount on the discount offered by the supplier. Which represents an adjustment (reduction) to GST paid on purchases. This represents an adjustment (reduction) to GST paid on business inputs. The Accounts Payable Control column is the amount of the discount expense plus the GST amount.

- The GST column records the GST paid by the business, which it can claim a GST input credit for.

- The Purchases column records all cash purchases.

- The Accounts Payable Control account record all payments to creditors (accounts payable).

- The Wages column is used to record all wages paid to staff.

Where there is no special column provided for a transaction, the Sundry column is used. The name of the appropriate ledger account applicable to each of these transactions should be recorded in the Account column.

At the end of a period, a line is drawn under the Discount Income, GST, Accounts Payable Control, Bank, GST Purchases, Wages and Sundry columns. The columns are totalled, and a double line is drawn.

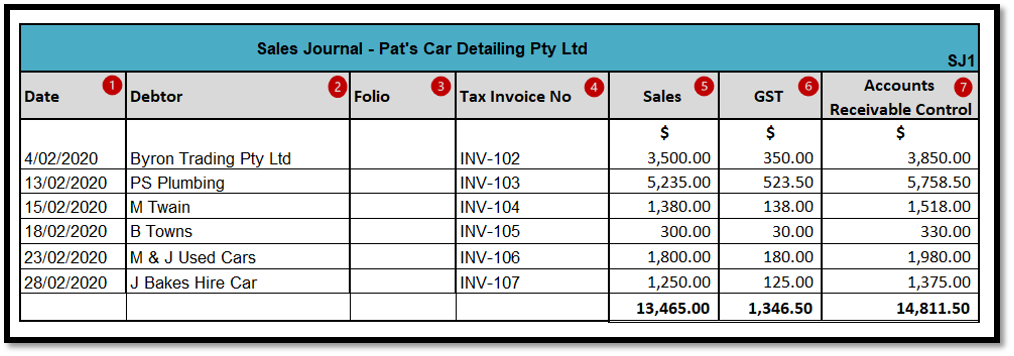

When a business sells trading stock or provides a service on credit, the transaction is recorded in the Sales Journal. No Cash sales are recorded in the Sales Journal. Tax invoices are source document for the Sales Journal.

Recording transactions in the Sales Journal

Below are the February credit sales that were processed through the Sales Journal for Pat’s Car Detailing Pty Ltd. An explanation of the columns in the Sales Journal follows.

- Transactions are recorded in date order in the Date column.

- The Debtor column records the name of the debtor involved in the transaction.

- The Folio column is used when posting the transaction to the ledger. (This will be covered later in the learning).

- The invoice number is recorded in the Tax Invoice No column.

- The amount recorded in the Sales column is the total amount recorded on the invoice before the 10% GST is added.

- The GST amount recorded on the invoice is recorded in the GST column.

- The total invoiced amount, including GST, is recorded in the Accounts Receivable Control column. The sales and GST payable column should equal the accounts receivable control column.

At the end of the period, the Sales, GST and Accounts Receivable Control columns are totalled.

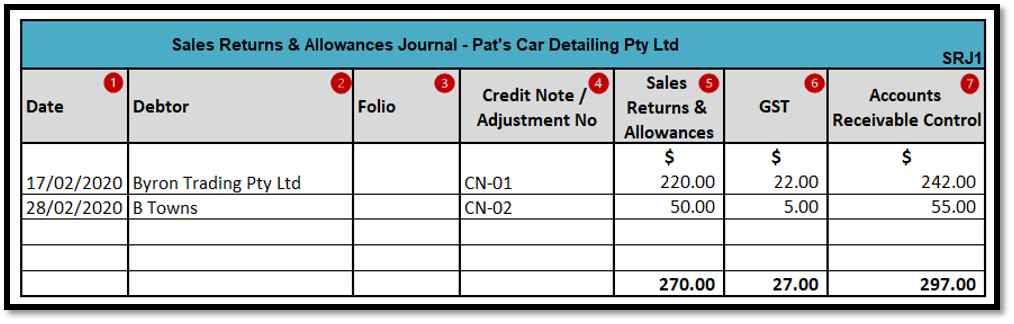

When a customer returns goods sold on credit, or the business makes an allowance because the customer is dissatisfied with a service provided on credit, the transaction is recorded in the Sales Returns and Allowance Journal.

Credit notes and adjustment notes are source documents for the Sales Returns and Allowances Journal. The Sales Returns and Allowance Journal only records returns or allowances for credit sales.

Recording transactions in the Sales Returns and Allowances Journal

Below are the February sales returns and allowance transactions that were processed through the Sales Returns and Allowances Journal for Pat’s Car Detailing Pty Ltd. An explanation of the columns in the Sales Returns and Allowances Journal follows.

- Transactions are recorded in date order in the Date column.

- The Debtor column records the name of the debtor involved in the transaction.

- The Folio column is used when posting the transaction to the ledger. (This will be covered later in the learning).

- The credit note/adjustment number is recorded in the Credit Note / Adjustment No column.

- The amount recorded in the Sales Returns & Allowances column is the total amount recorded on the credit note/adjustment number before the 10% GST is added.

- The GST amount recorded on the credit note/adjustment number is recorded in the GST column.

- The total credited amount, including GST, is recorded in the Accounts Receivable Control column. The sales returns and allowances and GST column should equal the accounts receivable control column.

At the end of the period, the Sales Returns & Allowances, GST and Accounts Receivable Control columns are totalled.

When a business buys trading stock or a service on credit, the transaction is recorded in the Purchases Journal. Supplier tax invoices are source documents for the purchases journal. No Cash purchases are recorded in the Purchases Journal.

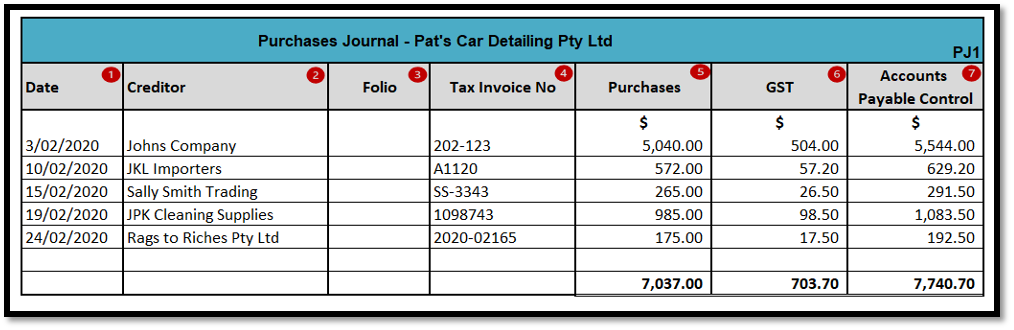

Recording transactions in the Purchases Journal

Below are the February credit purchases that were processed through the Purchases Journal for Pat’s Car Detailing Pty Ltd. The journalising of transactions is similar to that used in the Sales Journal. An explanation of the columns in the Purchases Journal follows.

- Transactions are recorded in date order in the Date column.

- The Creditor column records the name of the creditor involved in the transaction.

- The Folio column is used when posting the transaction to the ledger. (This will be covered later in the learning).

- The supplier invoice number is recorded in the Tax Invoice No column. The invoices will not be sequential as they are from different suppliers.

- The amount recorded in the Purchases column is the total amount recorded on the supplier invoice before the 10% GST is added.

- The GST amount recorded on the supplier invoice is recorded in the GST column.

- The total invoiced amount, including GST, is recorded in the Accounts Payable Control column. The purchases and GST payable column should equal the accounts payable control column.

At the end of the period, the Purchases, GST and Accounts Payable Control columns are totalled.

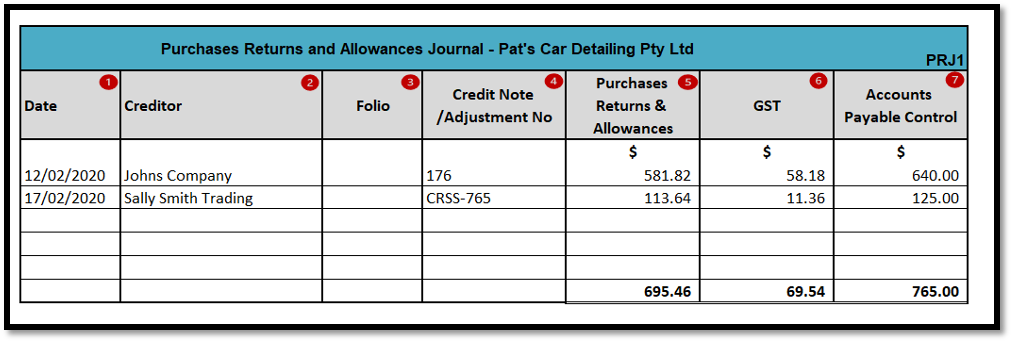

Sometimes a business who has purchased goods on credit is dissatisfied with the goods they receive, and they return the stock to the supplier or keep the stock and request a credit. Similarly, a business that pays for a service on credit may be dissatisfied with the quality of the service and request a reduction in the amount they pay. When this happens, a credit note or adjustment is issued by the supplier. This transaction is recorded in the businesses Purchases Returns and Allowances Journal. The purchases returns and allowances journal only records goods or services previously purchased on credit.

Recording transactions in the Purchases Returns and Allowances Journal

Below are the February credit purchase returns and allowances that were processed through the Purchases Returns and Allowances Journal for Pat’s Car Detailing Pty Ltd. The journalising of transactions is similar to that used in the Sales Returns and Allowances Journal. An explanation of the columns in the Purchases Returns and Allowances Journal follows.

- Transactions are recorded in date order in the Date column.

- The Creditor column records the name of the creditor involved in the transaction.

- The Folio column is used when posting the transaction to the ledger. (This will be covered later in the learning).

- The Credit Note / Adjustment No number is recorded in the Credit Note / Adjustment No column. The Credit Note / Adjustment No will not be sequential as they are from different suppliers.

- The amount recorded in the Purchases Returns column is the total amount recorded on the supplier Credit Note / Adjustment No before the 10% GST is added.

- The GST amount recorded on the supplier invoice is recorded in the GST column.

- The total invoiced amount, including GST, is recorded in the Accounts Payable Control column. The purchases returns and GST column should equal the accounts payable control column.

At the end of the period, the Purchases Returns, GST and Accounts Payable Control columns are totalled.

Test your understanding.

Using the attached excel workbook, record the following receipts for Greg's Golf Shop.

- Add 10% GST to all cash sales.

- Total the journals.

- Post to the general ledger.

- Generate a Trial Balance as at 28/02/2020.

Test your understanding.

Using the attached excel workbook, record the following payments for Ken's Candy Shop

- Total the journals.

- Post to the general ledger.

- Generate a Trial Balance as at 28/02/2020.

Test your understanding

Sales Journal & Sales Returns & Allowances Journal Manual

Using the attached excel workbook:

- Enter the following transactions for the ABC Book Company in the sales and sales returns journals.

- ABC’s trading terms are 14 days from the end of the month.

- Calculate and add 10% GST to each of the invoices.

- Total the journal at the end of May 2020.

- Post to the ledger.

- Generate a trial balance as at 31/05/2020.

Test your understanding

Purchases Journal & Purchase Returns & Allowances Journal Manual

Using the attached excel workbook:

- Enter the following transactions in ABC Book Company’s purchases and purchase returns and allowances journal.

- Calculate the GST amount for each transaction.

- Total the journals at the end of May 2020.

- Post to the ledger.

- Generate a trial balance as at 31/05/2020.