Before the availability of transaction processing systems and software, data gathered by a business from their various transactions had to be recorded manually. This manual recording of financial transactions involved a great deal of work output due to the different types of journals used, the sheer amount of information that had to be recorded, and the verification processes that had to be followed to ensure there were no errors in the data.

Today, there are accounting systems available that help businesses manage their financial transactions electronically including sales, purchases, assets, and liabilities. These are known as Accounting Information Systems (AIS).

The main functions of an AIS are:

- Store a large amount of financial data pertaining to the organisation's operations. This data comes from various source documents such as invoices, bank statements, receipts, cheques, purchase orders, or any other type of document that records a financial transaction.

- Producing a variety of reports and other statements that may assist employees and management to make strategic decisions, fulfil compliance requirements, and perform day-to-day operational activities.

- Ensure that data is maintained in accordance with established protocols and templates that help to maintain consistency, professionalism, compliance, and accurate data entry.

Examples of the type of information that an AIS can store and process includes:

- Revenue

- Expenses

- Equity

- Assets

- Liabilities

- Customer information

- Employee information

- Payroll information

- Tax information.

The statistical reports that can be produced from an AIS can be used internally by management or externally by other interested parties including investors, creditors, and tax authorities.

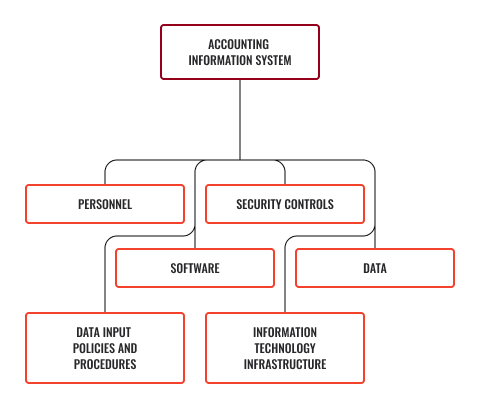

An accounting information system is more than just a computer program. It incorporates the following components, all of which need to be considered when implementing a new system.

- Personnel: Who operates the system, including accountants, bookkeepers, managers, business analysts, and office administrators.

- Information Technology Infrastructure: The hardware that constitutes the system, servers, desktop computers, laptop computers, hard drives etc...

- Software: The interface program that guides the user to input data and produce reports and documents.

- Data: The actual information that is inputted into the system and stored for later use. Obtained from various source documents.

- Data Input Policies and Procedures: Related to the operation of the system, including standards on how data is collected, stored, retrieved, and utilised.

- Security Controls: Mechanisms that work to protect data from unauthorised access and thus maintains the privacy of the business, its staff, vendors, and clients.

Operators of an AIS often have very varied job roles, but all have a responsibility to ensure that data is entered accurately, consistently, and in a timely manner. Depending on the size and nature of the business and the type of AIS that is implemented there may be one user or multiple.

Cloud-based accounting information systems make it very easy to have multiple users, especially if these operators are not all located within one geographical location. Local in-house servers or singular desktop systems usually require staff to be connected to the internal server or using a particular computer workstation.

Examples of personnel who may have access to the AIS are:

- Sales staff (if applicable to company structure): Develop quotes; enter customer orders; procure supplies.

- Administration/Financial officers: Set up customer accounts; generate invoices; process payments; produce receipts.

- Warehousing (if applicable to company structure): Updates delivery information; conducts stocktakes; receives inventory.

- Bookkeepers: Maintains accounts and ledgers; processes payroll; produces reports; reconciles financial accounts; undertakes debt collection.

- Accountants: Monitors cash flow; produces reports; manages accounts and ledgers; analyses financial information; Ensures compliance; maintains budgets.

- Management: Makes strategic decisions based on report data; authorises company budget; ultimately responsible for compliance.

- IT Staff/Business Analysts: Configuring software and infrastructure; setting privacy parameters; monitoring security; testing; fixing glitches.

- Auditors: Ensuring compliance; producing reports; monitoring user accounts.

It is essential that any person who has access to the AIS is properly trained in its use and understands the applicable policies and procedures relating to data entry and management of data. There is often a great deal of sensitive information stored within a computerised accounting system and if personnel are not aware of its significance or they do not know how to operate the system correctly there is a risk that confidential information may be leaked, corrupted, or deleted.

Access to the AIS should be limited to only those who require the system to undertake their job, and then privacy/access levels should be established to ensure they only have the ability to view or amend data relevant to their duties. Unnecessary access or editing rights only creates security risks.

It is important to regularly audit the number of users registered within the system to ensure it is up to date. Any staff member who no longer requires access must have their account disabled immediately to prevent any security issues.

Information technology infrastructure, also known as computer hardware, includes all the equipment required to operate the AIS. The equipment is not necessarily exclusively linked to the AIS as often it is generic computer hardware that is used for a variety of business needs.

Examples of IT Infrastructure includes:

- Computers (both desktop and laptop) and associated accessories

- Mobile devices

- Servers

- Printers

- Surge protectors

- Routers

- External hard drives

- Back-up power supplies (for businesses where consistent operation is critical).

All IT infrastructure will have to be bought or leased, regularly maintained, and updated regularly. It also must be compatible with any software programs that the business is currently running or plans to implement.

There are many different types of AIS software packages available for business use. The size and scope of the organisation will greatly affect which program is selected and which service package is then purchased/subscribed to.

AIS Software packages will often have similar functionality and report generation capabilities. Most programs allow for customisation of the platform, templates, and privacy settings.

Pricing and user numbers will vary depending on the business needs.

Two popular programs, utilised by many small to medium-sized organisations are:

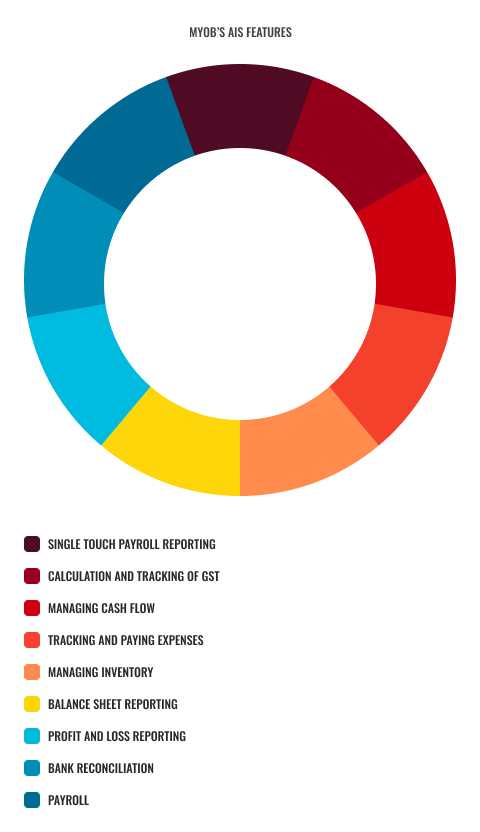

MYOB Accounting Software is an online accounting software program which provides businesses with an easier way of managing and performing different accounting functions.

MYOB has a wide range of AIS features such as:

- Single touch payroll reporting

- Calculation and tracking of GST

- Managing cash flow

- Tracking and paying expenses

- Managing inventory

- Balance sheet reporting

- Profit and loss reporting

- Bank reconciliation

- Payroll.

Here is an overview of MYOB Accounting software.

Xero is a cloud-based accounting software with features and tools built for small businesses, accountants, and bookkeepers. It provides a platform for easy collaboration, automation of tasks, and for accessing clients’ records at any time. It also makes compliance with policies and procedures like tax preparation, filing, and compliance easy and accurate.

Xero offers different plans on software for accounting essentials that are safe and secure and ready for single touch payroll. They also provide 24/7 customer support.

The key features of Xero accounting software include the following:

- Inventory: Manage inventory and keep track of what is in stock. Populate invoices and orders with details of items you buy and sell.

- Claim expenses: Simplify employee expense claims. Capture costs, submit, approve, and reimburse claims, and view spending.

- Bank connections: Connect the bank to Xero and set up bank feeds. Transactions flow securely straight into Xero each business day.

- Bank reconciliation: Keep financials in Xero up to date. Categorise bank transactions each day using our suggested matches.

- GST returns: Xero calculates GST and speeds up preparing business activity statements. Submit your BAS to the ATO from Xero.

- Capture data: Get copies of original documents and key data into Xero automatically without manual data entry.

- Files: Use Xero as your online filing system. Manage and share documents, contracts, bills, and receipts safely from anywhere.

- Reporting: Track the business' finances with accurate accounting reports. And collaborate with the advisor online in real-time.

Other features are:

- Multi-currency accounting

- Payroll

- Send Invoices

- Track projects

- Pay bills

- Purchase orders

- Quotes

- Accept payments.

Here is an overview of Xero Accounting software.

Other examples of AIS are QuickBooks, ProfitBooks, SAP, Zoho Books, Cashflow Manager; Sage Business Cloud.

AIS software is usually a type of database specifically configured to store financial transaction data. Data is entered into this system as Structured Query Language (SQL) however the front-end of the database or software program will not visibly show the SQL codes or settings. Information will mainly be entered into pre-determined fields or templates and will largely resemble standard alphanumeric data.

Certain personnel associated with the operation of the AIS may have a work-related need to configure the back-end of the system, in which case they may access the site settings and source code to make adjustments. It is highly recommended that only properly trained personnel attempt this particular activity as incorrect SQL or code may alter the structure of the system, its reports, data integrity, and compliance.

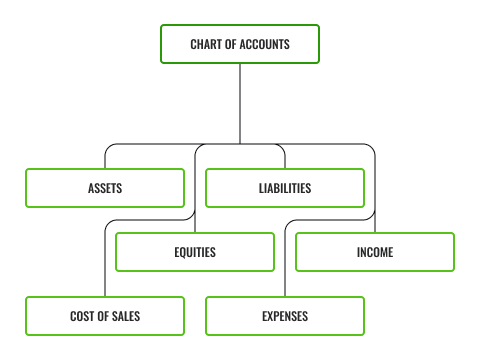

Most AIS software requires the establishment of a Chart of Accounts to be undertaken upon initial set up of the system. The chart of accounts is composed of a list of accounts used by the organisation to define each class of items for which money or the equivalent is spent or received.

A chart of accounts is typically arranged in a sequence of account groups.

Assets

Items, properties, and rights owned by the business which has financial value and can benefit the company in the future. These can be classified as short-term (current assets) or long-term (fixed assets), eg. cash on hand, inventory, building, and equipment.

Liabilities

Liabilities are monies owed by the business, eg. credit cards, bank loans, accounts payable, wages, and taxes.

Equities

These are also known as 'stocks' or 'shares' which can be bought from the company. When a stockholder buys stocks or equities, they start to own a part of the company's value. Equities can be classified as either owner's equity or stockholder's equity.

Income

The amount that the business receives or earns from goods or services provided.

Cost of sales

The total amount of goods sold by the business. The cost of sales includes the production cost relevant to the particular product sold.

Expenses

Amount spent on the business to generate income. eg. office supplies, advertising and promotion, and operating expenses.

In a computerised accounting system, a chart of accounts is adjustable so that other accounts can be added if necessary, such as new business needs and financial interests. Smaller businesses will typically have a simpler chart of accounts, whereas, larger businesses will have a more complex system.

Activity

Data that is inputted into an AIS is sourced from a variety of documents related to financial transactions. For example:

- Sales orders

- Customer billing statements

- Purchase requisitions

- Vendor invoices

- Receipts

- Payroll information

- Tax information

- Bank statements.

Source documents help to verify a transaction and assist with reconciliation. Therefore they should all contain some key information such as: date/s of transaction/s; specific amounts tendered; a purpose or description of the transaction; the parties involved in the transaction.

Once the data has been entered into the system it can then be used to prepare accounting statements and financial reports such as Accounts Receivable Ageing Schedules, Asset Depreciation Reports, Trial Balance, Profit and Loss Statements, Budgets, Customer Invoices and Receipts, and many other types of documents.

It is vital that a system is implemented whereby source documents are collected, verified, and attached/referenced to any applicable financial transaction whether it be hard copy or electronic. This is necessary for proving financial transaction legitimacy and is known as establishing an 'audit trail'. AIS systems allow for the digital upload and attaching of documents and it is permissible to use digital versions of source documents as evidence.

AIS personnel are required to follow organisational policies, procedures and data input standards when processing financial information. This helps in ensuring accuracy and consistency across all general journals and ledgers which will be used to generate financial reports.

Accounting or financial systems usually have a set of standards and templates used for preparing and administering journals and associated accounts, ledgers, and associated documents. This makes it easier for the operator to record financial information. Data can also be printed, exported, or emailed as required using the system designed templates.

When recording any sort of business transactions in the AIS there are some general guidelines that must be followed:

- Proper accounting terminology should always be used (i.e. Cash, Expense, Depreciation, Inventory, Capital, etc.) avoid the use of jargon and obscure acronyms where possible.

- Always double-check data entry prior to saving or processing information. AIS programs will often have automatic error-checking capabilities which help to prevent some human errors from occurring but these are not failsafe and proofreading is still highly recommended.

- Appropriate authorisation protocols of data inputs must be followed. Different organisations may have different procedures in preparing, entering, and approving or authorising journal entries and associated documents but the process should lead to properly prepared, reviewed, approved, and recorded financial transactions in accordance with audit requirements.

The following are examples of data input processes required for common AIS financial transactions:

All deposits, withdrawals, charges or fees, and other bank transactions should be recorded in the journal in a similar manner to recording cash transactions.

The bank account referred to in these journal entries is a separate account in the general ledger for a specific named bank account and would be shown under the balance sheet heading of cash and cash equivalents.

When a business transaction requires a journal entry, these standard rules must be followed:

- The entry must have at least 2 accounts with 1 DEBIT amount and at least 1 CREDIT amount.

- The DEBITS are listed first and then the CREDITS.

- The DEBIT amounts will always equal the CREDIT amounts.

- A journal entry may include the journal entry date and number, account name and number, debit, and credit. The recorder may also include a description or miscellaneous information about the entry.

Here are some examples of bank transaction journal entries.

| Example Company General Journal For the Year 2020 |

|||||

|---|---|---|---|---|---|

| Date | Account Title and Description | Debit | Credit | Reference | |

| Jan. 28, 2020 | Bank | $5,000 | B2020-001 | ||

| Accounts Receivable | $5,000 | ||||

| To record customer cheque payment deposited into bank | |||||

| Feb. 18, 2020 | Accounts Payable | $1,000 | B2020-002 | ||

| Bank | $1,000 | ||||

| To record cheque payment to supplier | |||||

| March 28, 2020 | Cash | $1,000 | B2018-003 | ||

| Bank | $1,000 | ||||

| To record cash withdrawal from bank | |||||

| Nov. 31, 2020 | Bank Charges | $100 | A2020-014 | ||

| Bank | $100 | ||||

| To record bank charges | |||||

| Dec. 25, 2020 | Drawings | $2,000 | B2020-006 | ||

| Bank | $2,000 | ||||

| To record cash withdrawal for personal use | |||||

Once data entry has been accurately undertaken, it is necessary to seek the appropriate authorisation of the various entries. This process may vary depending on organisational policy and procedures.

Here are the general steps for journal entry authorisation:

- Ensure that all required approvals related to the journal entry have been obtained and are supported by sufficient source documents.

- Complete entering journal entry request form, or similar form as prescribed in the organisation policy.

- Attach/Link/Reference all relevant source documents and other documentation to the journal entry.

- Review the journal entry to ensure the following:

-

There are no data entry errors

-

Correct terminology has been utilised

-

Debits and credits have not been reversed

-

Original dates have been used

-

Documents are referenced and/or attached

-

Amounts are correct. The numbers should be reasonable and consistent with any previous similar entries.

-

All applicable fields have been completed.

-

- Submit the completed journal entry for approval by the relevant authorised personnel.

- Follow up with authorising personnel to ensure that the journal is approved within the current month.

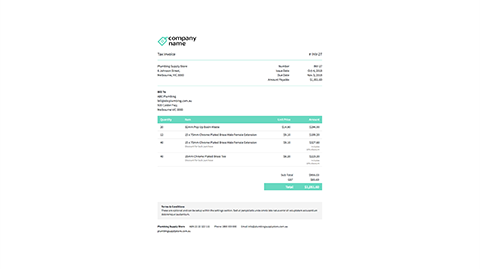

An invoice is a document prepared and given by the seller to the customer that requests payment for goods or services. It lists:

- An invoice date

- Identifying and contact details for the seller including business name, contact details (postal address, email address, and phone number), and the Australian Business Number (ABN) or Australian Company Number (ACN)

- Identifying and contact details for the purchaser including business name, contact person's name, ABN, delivery address and any relevant purchase order numbers

- A description of the goods and/or services that were provided

- An itemised list of costs and a total amount due, highlighting any applicable taxes such as GST along with the words ‘tax invoice’ if the business is GST registered

- Payment terms, including what forms of payment the seller accepts, banking details for direct deposit, and the due date when payment is required

- An identifying number or code to differentiate this invoice from others in the system

- Additional terms and conditions (optional).

Invoices are typically issued to a customer after they have received their goods or services, however, variations to this rule and split payments are also common.

Traditionally, invoices were printed and sent to a customer through the mail or via fax, but the advent of accounting and financial systems have enabled invoices to be sent electronically. Electronic invoices, also referred to as e-invoices, are now prevalent especially for e-commerce businesses.

Here are the general steps in preparing an invoice using an accounting information system:

- Make the invoice look professional by using a well-outlined and detailed template. This template should include the business logo, name, and contact details.

- Clearly mark the type of invoice by adding either “Invoice” or "Tax Invoice" to the top of the document. The differentiation is whether or not the business is registered for GST.

- Add the invoice preparation date.

- Add the name of the person or company that is being invoiced and include their address.

- Write an itemised description of the goods or services being issued to the customer, each with its own individual price.

- Write the total amount charged on the invoice and the applicable tax.

- Include the payment terms, including the due date, bank details (for direct deposit), types of credit cards accepted (if applicable), and any special conditions.

- Save the invoice within the system ensuring it is filed/named appropriately for future reference.

- Print or export the invoice so it can be distributed to the recipient.

Most Accounting Information Systems (AIS) like MYOB and Xero provide effective online invoice management that simplifies the process of preparing invoices.

Proper invoicing is essential in order to maintain records, meet tax obligations and protect the business’ cash flow, so it is important to know what type of invoice needs to be prepared and to do so accurately.

The two types of invoices are:

- Regular invoices: Businesses not registered for goods and service tax (GST) provides regular invoices. Regular invoices do not include a tax component so GST must be set to nil or zero and should not include the term “tax invoice”.

- Tax invoices: Businesses registered for GST must provide tax invoices. Tax invoices include the GST amount for each item along with other details and must include the term “tax invoice”. However, there are certain items which are exempt from GST and this must also be reflected on the invoice.

The Australian Taxation Office (ATO) set the guidelines of when to charge GST for items on invoices. They have developed best-practice standards relating to the layout of tax invoices and invoices. They also provide practical information regarding issuing tax invoices correctly.

An invoice template may vary from organisation to organisation. Invoice templates also vary depending on the template provided by the AIS.

This link provides some templates which can be viewed or downloaded for your reference: invoice templates

Here is an example invoice template:

Here is an overview of how to prepare invoice using the MYOB accounting system.

It is important to follow organisational security procedures when operating the AIS and performing associated duties (such as cash handling). All financial transactions must be recorded in the system.

Depending on the size and scope of the business there may be a variety of security controls in place related to the use of the AIS. These may include:

- Passwords and/or Personal Identification Numbers (PINs)

- Two-factor authentication in which users must first satisfy standard identification mechanisms but will also be issued with a code via a secondary device that must be entered into the AIS to gain entry

- Biometric identification such as fingerprint, voice, or facial recognition

- Encryption of data

- User access logs

- Video surveillance

- Firewalls and virus protection.

Accounting Information Systems can also act as a file repository for maintaining all financial documents in a central, secure, and organised manner. Accurate record-keeping is essential for maintaining ease of access and future reference, providing an audit trail, and maintaining compliance with legislative and regulatory requirements. In particular, the requirements of the Privacy Act (1988) and the associated Australian Privacy Principles must be adhered to.

Alternative or additional filing systems may include cabinets containing hardcopy paper records.

Regardless of the type of filing system that is maintained it is essential that business records and reports are filed away securely and in a structured system. Monitor the security of filing systems in protecting the records of the business:

- Keep electronic records password protected and potentially encrypted

- Store hardcopy documents in locked filing cabinets

- Limit access to only authorised personnel

- Ensure records that are removed from the filing area are accounted for and returned promptly.

There are requirements which have been established by the Australian Taxation Office (ATO) regarding the retention period for financial documents related to the preparation of financial statements and tax reporting. As a general rule, the retention period is 5 years, however, there are specific situations with different requirements. Refer to the information on the ATO's website for more detail.

Records can be maintained in paper or digital format. If copies are made, they must be a true and clear copy of the original. It is highly recommended that a back-up of all digital records is kept.

Documents must be in English unless the expense is incurred outside Australia.

Examples of the types of financial records which must be retained are:

- Receipts and other evidence of all sales and purchases

- Tax invoices, wage, and salary records

- GST documents

- Records of the purchase, sale, and other costs of any business assets, such as land, buildings, or office equipment

- All records relating to tax returns, activity statements, fringe benefits tax (FBT) and employee superannuation contributions.

Risk management is a proactive process that helps you respond to change and facilitate continuous improvement in your business. It should be planned, systematic and cover all reasonably foreseeable hazards and associated risks.

A risk assessment involves considering what could happen if exposed to a hazard and the likelihood of it happening. A risk assessment can help you to determine:

- how severe a risk is

- whether any existing control measures are effective

- what action you should take to control the risk, and

- how urgently the action needs to be taken.

Risk Matrix

A risk matrix is used during risk assessment to define the level of risk by considering the category of probability or likelihood against the category of consequence severity. This is a simple mechanism to increase the visibility of risks and assist management decision making.

Likelihood

Evaluate the likelihood of an incident occurring according to the ratings in the left-hand column.

| Descriptor | Level | Definition |

|---|---|---|

| Rare | 1 | May occur somewhere, sometime (“once in a lifetime / once in a hundred years”) |

| Unlikely | 2 | May occur somewhere within the Department over an extended period |

| Possible | 3 | May occur several times across the Department or a region over a period |

| Likely | 4 |

May be anticipated multiple times over a period of time May occur once every few repetitions of the activity or event |

| Almost Certain | 5 |

Prone to occur regularly It is anticipated for each repetition of the activity of event |

Risk Matrix

Use the matrix to calculate the level of risk by finding the intersection between the likelihood and the consequences.

| Likelihood | Consequence | ||||

|---|---|---|---|---|---|

| Insignificant | Minor | Moderate | Major | Severe | |

| Almost Certain | Medium | High | Extreme | Extreme | Extreme |

| Likely | Medium | Medium | High | Extreme | Extreme |

| Possible | Low | Medium | Medium | High | Extreme |

| Unlikely | Low | Low | Medium | Medium | High |

| Rare | Low | Low | Low | Medium | Medium |

Example Risk Assessment

| Scenario | Cloud Computing System | Level of Risk |

|---|---|---|

| Risks: | Loss of Data | Moderate |

| Security Systems | Low | |

| File Storage | Low | |

| Work, health and safety (WHS) of workers | Low |

There are different ways to process transactions using individual accounting systems. The following are some examples, of the steps in processing specific transactions through two accounting systems, Xero and MYOB.

How to pay your suppliers with Xero

How to process Credit Card transactions via Xero

How to record payments for credit card purchases on MYOB:

- Before being able to process credit card transactions, users will need to create a credit card liability account for each card to be used. Name the cards accordingly and the amount owed to the credit card provider will be tracked.

- To record payments for credit card purchases:

- Specify the account in the Pay Bills, Spend Money or Bank Register window.

- The method used to record a payment for a credit card purchase depends on whether you have entered a purchase transaction using the Purchases window.

- If it has been entered, record the payment in the Pay Bills window.

- If it has not been entered, record the credit card purchase in the Spend Money or Bank Register window.

- When a payment is recorded, the payment amount is assigned to your credit card liability amount.

How to record payments to credit card providers on MYOB:

- Go to the Banking command center and click Spend Money.

- In the Pay from Account field, type or select the bank account you want to use to make the payment.

- In the Card field, type or select the credit card provider's name.

- Type or select the payment date in the Date field.

- Type the amount to be paid.

- Type a comment in the Memo field to provide a brief description of the payment you are recording.

- In the scrolling area of the Spend Money window, type or select the liability account you've created to track purchases made with the card.

- Click Record to record the payment to the credit card provider.

How to process invoices in Xero

How to process invoices in MYOB

How to process Petty Cash in Xero

How to process Petty Cash in MYOB

How to process Direct Debit on MYOB

How to process Direct Debit in XERO

Payment services with Xero lets you set up direct debits with your customers to automatically collect payments for your Xero invoices, whether it's a one-off or recurring payment. Refer to GoCardless or Stripe.

How to process Cash Transactions on MYOB

How to process Cash Transactions in XERO

The way reports are created may differ in individual accounting systems. Here are the steps to generate commonly sourced business reports in MYOB and Xero.

How to generate GST Accrual Reports in MYOB:

- In the Business reports section of the Reports page, click GST detailed report. The GST detailed report page appears, displaying the report.

- To change the range of dates included in the report, select your new dates in the From and To fields, then click Update. The report is updated on-screen.

- Click the Report options link at the top of the page to set your report options.

- Choose whether to include transactions in this report as at the dates that money was received or paid (cash basis) or as at the dates that invoices or bills were issued (accrual basis). To change the basis, click change.

- Choose whether to sort the report by Date or Account.

- To view or edit the details of a particular transaction, click on its reference number to open the original transaction. When saving the changes, it’ll be returned to the GST detailed report. Or, when done viewing the transaction, click the GST Report link at the top of the page to return to the GST detailed report.

- To export the report as an Excel spreadsheet, click the XLS icon. A window appears which allowing to save or open the file. Note that there might be a need to enable editing of the spreadsheet from within Excel before it can be viewed properly. If editing is disabled, the spreadsheet may not display the totals calculated in the report.

- To print the report, click the PDF icon. The report appears as a PDF in a new window, where it can be saved or printed.