Writing a business case is like producing a report. The purpose is to provide managers, and other decision-makers, the necessary information they require to make the right choice for the business. It needs to define the issue (ie. need for cloud computing) and provide the solutions to resolve it.

A business case should include:

- A summary of the issue/s. At this stage no opinions will be offered, just facts and an overview of the current situation.

- Benefits to be gained from initiating the proposed plan

- Disadvantages that may be encountered

- Cost-benefit analysis

- A budget outlining all the expenses that will be encountered

- An implementation strategy with a detailed timeline of events

- A recommendation that is justified based on business goals, needs, and budget capacity.

As with any formal business document, a business case should be typed and professionally presented in report format. This means having a cover page, executive summary, table of contents, and sub-headings.

Create a vision

- Be convincing about the benefits

- Focus on the goal being better than the present

- Involve everybody in the process, from investigation to testing and acceptance

- Include everybody in the communications about the status and progress

Share the vision

- Communicate in language everyone understands - images work best

- Live the vision

- Create short-term goals that can be reached

- Ensure the project vision is compatible with the organisation's vision, missions, values and culture

Communication rollout

- Describe how cloud services work and how it will be implemented and how it will benefit each person, including customers

- Detail the sequence of users that will be upgraded and when they might expect the migration

- Be honest about the possible problems and extra time if migration doesn't go according to plan

Review and revise

- Include input from all affected parties

- Focus on smooth migration and communication with employees and customers

- Revise implementation schedule based on new information from discussions and customer feedback

- Communicate revised plan

A SWOT analysis can be used to assist decision-making processes by clearly outlining some of the benefits and disadvantages, both internally and externally, of a project.

The acronym SWOT stands for:

- Strengths: Attributes of the business that will help achieve the project objective/s.

- Weaknesses: Attributes of the business that may potentially stop the achievement of the project objective/s.

- Opportunities: External factors that will help the project objective/s.

- Threats: External factors that may potentially disrupt the project objective/s.

In the case of Ace Finance's cloud computing project, a SWOT analysis may look like this:

- Data sharing

- Scalable storage space

- Enhanced availability of data and services

- Reduced costs (pay-per-user)

- Portability of application is possible allowing easier work from home and/or travel.

- Unknown location of servers

- Internet accessibility and bandwidth

- Difficulty in migrating legacy systems

- Ownership of data and processes

- Legislative concerns.

- Technical issues resolution via service provider help-desk personnel

- Adaptive to future needs

- Improved security and identity risks mitigation

- Expansion and growth

- Regular updates with newest versions of software and applications.

- Security issues, in particular privacy, authentication, malware, third-party access, data integrity, loss of data

- Data ownership

- Connectivity, speed, safety, and efficiency

- Legislative concerns

- Migration from one platform to another may be difficult

- Vendor shutdown.

A Cost-Benefit Analysis (CBA) is a tool used to determine which project has more benefits. This is done by preparing a comparison of the expected benefits and costs of each project. If more than one plan is available, the one with the greatest benefits is seen as more desirable.

The CBA collates all the planned costs for a project and then places a quantity on each of the tangible benefits of a project. Once done, key financial performance metrics are calculated such as:

- Return on Investment (ROI): Used to evaluate the efficiency of an investment or compart the efficiency of a number of different investments.

- Net Present Value (NPV): The difference between the present value of cash inflows and the present value of cash outflows over a period of time.

- Internal Rate of Return (IRR): A discount rate that makes the net present value of all cash flows equal to zero in a discounted cash flow analysis.

- Payback Period: The amount of time it takes to recover the cost of an investment or when it reaches a break-even point.

When all the calculations are finished, the costs associated with taking action are subtracted from the benefits which would be gained. The cost of a project should be less than 50% of the benefits and the payback period should be 12 months or less. This is the general rule when finding out if a project is viable.

To find out the best service provider or supplier, factors to be considered are the initial cost and ROI (Return on Investment). A thorough analysis that includes both tangible and intangible factors must be done in order to make an informed decision.

Step One - Identify Costs

Identify all costs, using the same value for time, both actual and potential.

- Make sure to include all implementation costs, consultancy fees, payroll, admin resources such as printing costs, time and additional software, hired machinery and maintenance.

- Find risks such as employee time lost due to being involved in specifying, testing and accepting the new application. Put monetary values into intangible actions.

- Add all costs to find out the total cost of the project or option.

Step Two - Identify Benefits & Opportunities

Identify benefits and opportunities, both tangible and intangible, as well as real and potential.

- Add payroll savings, environmental issues such as saving on energy and printing costs, improved health and safety, improved morale due to a better quality of life resulting from decentralised work, outsourcing of resources or intellectual property.

- Make sure to assign monetary values to each of these items.

- deduct all the monetary values to identify the total value of benefits.

Step Three - Compare Options

Compare all options to identify the most appropriate option for implementation.

- If the Costs are Higher than the Benefits, then the option/project is Not Viable.

- If the Benefits are Higher than the Costs, then the option/project is Viable.

- If the Benefits and Costs are the Same or Very Close Together, you may want to investigate further with more detailed calculations.

Andrew, at Ace Finance had to do a cost-benefit analysis of the new cloud computing system that the company is considering implementing. Take a look at the spreadsheet that he created.

| Cost-benefit analysis | ||||||

|---|---|---|---|---|---|---|

| 0 | 1 | 2 | 3 | 4 | 5 | |

| Benefits | $0.00 | $200,000.00 | $250,000.00 | $312,500.00 | $390,625.00 | $488,281.00 |

| Costs | ||||||

| Upfront | $75,200.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Ongoing | $0.00 | $29,000.00 | $29,000.00 | $29,000.00 | $29,000.00 | $29,000.00 |

| Total costs | $75,200.00 | $29,000.00 | $29,000.00 | $29,000.00 | $29,000.00 | $29,000.00 |

| Net cash flow | -($75,200.00) | $171,000.00 | $221,000.00 | $283,500.00 | $361,625.00 | $459,281.00 |

| Discount rate | 11% | |||||

| Discount factor | 100 | 90.09 | 81.16 | 73.12 | 65.87 | 59.35 |

| Discounted net cash flow | -($75,200.00) | $154,054.05 | $179,368.56 | $207,292.76 | $238,213.59 | $272,560.92 |

| NPV | $976,289.88 | |||||

| IRR | 220% | |||||

The Discount Factor, Disc net Cash Flow, NPV & IRR need to be changed. We also need to change the last two dot points to Assuming a discount rate of 11% to estimate the discounted net cash flow.

Given a discount factor of 100% in Year 0 to 59.35% in Year 5, he is able to calculate the discounted net cash flow which ranges between -$75,200 in Year 0 and $272,560.92 in Year 5. With everything considered, the net present value (NPV) of the project is $976,289.88.

The NPV is the sum of the discounted cash flows each year. Based on this, the Internal Rate of Return (IRR) of the project is 220%. The IRR identifies the annual growth rate earned by the project.

Flaws of Cost Benefit Analysis

Cost-Benefit Analysis struggles as an approach where a project has cash flows that come in over a number of periods of time, particularly where returns vary from period to period. In these cases, use Net Present Value (NPV) and Internal Rate of Return (IRR) calculations together to evaluate the project, rather than using Cost-Benefit Analysis.

Key Takeaways

- A cost-benefit analysis (CBA) is the process used to measure the benefits of a decision or taking action minus the costs associated with taking that action.

- A CBA involves measurable financial metrics such as revenue earned or costs saved as a result of the decision to pursue a project.

- A CBA can also include intangible benefits and costs or effects from a decision such as employee morale and customer satisfaction.

Example

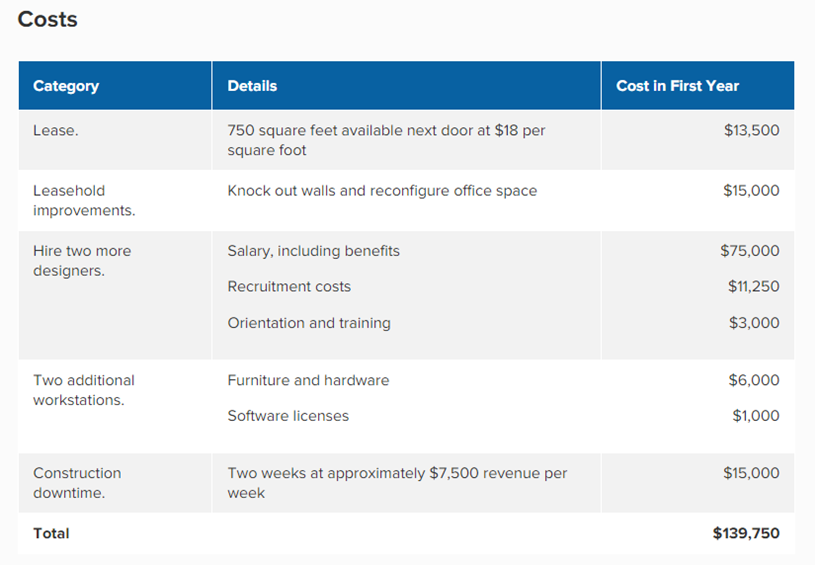

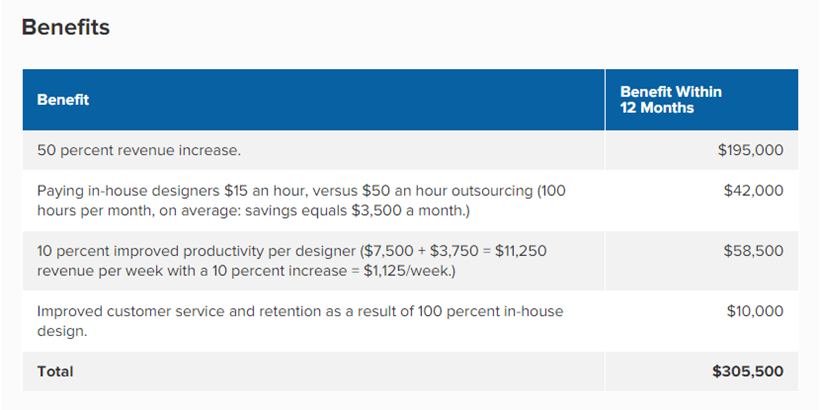

Custom Graphic Works has been operating for just over a year, and sales are exceeding targets. Currently, two designers are working full-time, and the owner is considering the increasing capacity to meet demand (This would involve leasing more space and hiring two new designers).

He decides to complete a Cost-Benefit Analysis to explore his choices.

Assumptions

- Currently, the owner of the company has more work than he can cope with, and he is outsourcing to other design firms at a cost of $50 an hour. The company outsources an average of 100 hours of work each month.

- He estimates that revenue will increase by 50 percent with increased capacity.

- Per-person production will increase by 10 percent with more working space.

- The analysis horizon is one year: that is, he expects benefits to accrue within the year.

He calculates the payback time as shown below:

$139,750 / $305,500 = 0.46 of a year, or approximately 5.5 months.

Inevitably, the estimates of the benefit are subjective, and there is a degree of uncertainty associated with the anticipated revenue increase. Despite this, the owner of Custom Graphic Works decides to go ahead with the expansion and hiring, given the extent to which the benefits outweigh the costs within the first year.

Including a budget in the business case allows business owners and managers to determine in advance whether there will be enough money to cover all expenses, meet obligations, and even expand the project in the future.

There are many types of budgets, ranging from ones that are organisation-wide operating right through to smaller departmental operational budgets and also individual project budgets. A business case requires a project budget to be developed and included.

A Project Budget, similar to a business' Master Budget, outlines the combined cost of all activities, tasks and milestones that a project must fulfil. This must then be approved by the stakeholders involved in a project.

The Project Budget aims to do two things:

- Secure funding

- Control costs.

A project budget starts at the kickoff of the project and continues through to completion. The Project Manager is usually responsible for keeping track of the budget. Like most budgets, the Project Budget is a dynamic document which can be updated within the project lifecycle. The project is also continuously measured against the Project Budget and adjustments are made when needed.

A Project Budget is broken down into tasks and milestones that need to be accomplished at a certain time. Estimated time and costs are attached to each task in order to see how much and how long it takes to accomplish it. Certain tasks may be assigned a priority category, identifying their importance in the timeline.

Below is an example of a Project Budget template:

| Project Budget Template | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Summary Cost of Project | Amount $ | Details of Project | ||||||||

| Total Budgeted Cost. | Name of the company | |||||||||

| Total Actual Cost. | Project Name or ID | |||||||||

| Total Variance. | Project Lead | |||||||||

| Start Date | ||||||||||

| Task no. | Particulars | Material | Labour | Fixed cost | Miscellaneous | Budgeted amount $ | Actual amount $ | Variance $ | ||

| Units | Cost per unit | Hours | Cost per hour | |||||||

| Task One | ||||||||||

| 1 | Sub-task 1 | |||||||||

| 2 | Sub-task 2 | |||||||||

| 3 | Sub-task 3 | |||||||||

| 4 | Sub-task 4 | |||||||||

| 5 | Sub-task 5 | |||||||||

| (A) | Totals Task One | |||||||||

| Task Two | ||||||||||

| 1 | Sub-task 1 | |||||||||

| 2 | Sub-task 2 | |||||||||

| 3 | Sub-task 3 | |||||||||

| (B) | Totals Task Two | |||||||||

| Task Three | ||||||||||

| 1 | Sub-task 1 | |||||||||

| 2 | Sub-task 2 | |||||||||

| 3 | Sub-task 3 | |||||||||

| 4 | Sub-task 4 | |||||||||

| (C) | Totals Task Three | |||||||||

| (D) | Total of Project (A + B + C) |

|||||||||

With any type of project implementation, there will be factors that the project manager is not overly familiar with, technical specifications and also legislative compliance are often areas that require the engagement of specialist advisors.

Research cloud computing specialists who have services which fit with what the business requires. For example, there are several major specialist suppliers of cloud-based accounting services such as Xero, MYOB, QuickBooks, Kashoo and Outright. Each of the specialists in accounting services mentioned above offers a range of products to cater for the basic needs of a sole proprietor to more complex services needed to manage the operations of large corporations.

When seeking out an appropriate specialist advisor, ensure the following business protocols are followed to determine if they are suitably qualified and experienced enough to provide advice for the business case and project as a whole.

Competency

Evaluate the provider's capabilities to deliver the service as advertised and compare it to the business needs. Consider the following:

- Are they qualified?

- Are they accredited by relevant industry associations (if applicable)?

If possible seek feedback or reviews from their existing customers to find out if they are happy with the service.

Capacity

Evaluate the capacity of the provider to offer the service and how quickly they can respond to market influences and the needs of your business. Consider the following:

- Are they a local, interstate, or international service provider?

- What are the hours of operation, do they provide an after-hours or 24/7 service?

- Do they provide training and ongoing support (if required)?

- Do they have adequate staff and appropriate resources to adequately provide a consistent service?

Commitment & Communication

Ensure that the provider is committed to providing high-quality levels of service throughout the project or service-agreement duration. Consider the following:

- Are they familiar with your business, its specific needs and personnel?

- Have they allocated a specific case manager or team member who is dedicated to your account?

- Do they maintain ongoing professional communication with clients via. newsletters, emails, phone calls, site-visits etc...?

- Do they demonstrate consistent enthusiasm towards your business, its goals, any specific projects or needs?

- Are they reliable, punctual, and professional?

Control

Establish and confirm the controls and who is responsible for managing certain components of the service. Consider the following:

- Who will lodge any necessary paperwork, reports, tax records, statistics etc... with appropriate agencies?

- Who will have access to confidential information and systems?

- What security is in place for limiting instances of fraud, mismanagement, unauthorised access etc...?

Financial Liquidity

Research and evaluate the financial health of the service provider (where possible). Consider the following:

- How many customers/clients do they have?

- How long have they been operating?

- Does their operation appear to be professional and appropriately staffed?

- Are there any negative reviews or warnings on community forums which indicate this provider is unethical or in financial difficulty?

Price

Research more than one service provider and conduct a cost-benefit analysis to determine if their services will benefit your business needs. Consider the following:

- Overall price

- Payment plans

- Discounts

- Inclusions

- Guarantees

Corporate Social Responsibility

Research if the service provider has a Corporate Social Responsibility policy. This will provide an indication of their ethical work practices. It is mainly applicable for larger companies and to a lesser degree small owner-operator service providers. This type of policy will cover factors such as:

- Economical investment in the local community: Do they support local or industry causes, infrastructure, or society through investment or sponsorship?

- Ethical treatment of employees: Do they respect their employees and abide by ethical working conditions/pay rates?

- Legal compliance: Do they acknowledge any applicable legislation, regulation, or industry guidelines and demonstrate active compliance?

- Philanthropy: Do they donate to charitable causes?

- Environmental consciousness: Do they support environmental causes and demonstrate sustainable work practices?

Larger corporations will have a Corporate Social Responsibility policy or statement on their website or published in a report or similar document. Smaller companies and self-employed consultants may not have this information publicly available, however, they may be willing to discuss their viewpoint or business focus with you as part of the service negotiation phase.

Be aware that not all of these factors will be applicable to every type of service provider, they provide a general guide to the various ethical work practices that companies may subscribe to. Further research into Corporate Social Responsibility may include reviewing any published feedback, reviews, or news items relating to any scandals or unethical behaviour that the service provider may have been involved in.

Research cloud computing specialists who have services which fit with what the business requires. For example, there are several major specialist suppliers of cloud-based accounting services such as Xero, MYOB, QuickBooks, Kashoo and Outright. Each of the specialists in accounting services mentioned above offers a range of products to cater for the basic needs of a sole proprietor to more complex services needed to manage the operations of large corporations.

Managers and decision-makers will need to see an overview of the proposed implementation process that would occur if they approve the business case. This will assist them to manage other business operations and projects, prepare personnel and determine if the project is being rolled out according to agreed time frames.

SMART Goals

The overall project should be broken down into a series of goals. The SMART goal method is a handy way of clearly outlining the different components of individual goals.

Below is an example of some questions to consider when developing a SMART goal.

- Specific: What is the project seeking to achieve? Where must it be executed? Who else is involved? Which barriers need to be overcome? Why is it considered a priority?

- Measurable: What indicates successful implementation? How will success be documented? How much will it cost? How much time needs to be invested?

- Achievable: What constraints are there? How realistic is the goal? Why might it not be achievable? Are smaller steps required?

- Relevant: Is the goal related to implementation? Are the goals relevant to the company's vision and mission? Were the goals discussed with other stakeholders?

- Time-bound: What is the deadline? What might influence completion? What are the immediate, short, medium, and long-term activities required to reach this goal?

Long Term and Short Term Goals

Goals then need to be prioritised and placed in order of what needs to be done first through to what needs to be completed last. When considering an overall project timeline there will be two types of goals, long-term and short-term goes.

It's impossible to achieve your long-term goals (what you want the future for the business to be) without achieving your short-term goals (the detailed actions behind the big plan). Neither can exist in isolation.

Long-term Goals

Require more planning and are often more expensive and/or time-consuming requiring approvals to be obtained and/or will impact on other stakeholders more significantly.

Short-term Goals

Accomplished quickly ie within a week or a month and focus on very specific tasks. The project is likely to have numerous short-term goals that help to keep the project streamlined, can be delegated to other personnel for completion, are often inexpensive tasks, and demonstrate steady progress as each one is completed.

Example

- The long-term goal is to implement a New Cloud Computing Software

- The short-term goal is to achieve this, including sourcing software for implementation.

Some of the key considerations which will need to be prioritised in the case of a cloud computing implementation project include:

- Negotiate a contract with a particular service provider

- Schedule a migration date and time

- Communicating information to stakeholders

- Conduct training sessions

- Back-up all existing data

- Migrate existing system to the new cloud computing system

- Provide ongoing technical support.