Learning objectives

After you have completed this topic, you should have knowledge of:

- What is an unadjusted Trial Balance

- Fixing errors in the trial balance

- Adjusting journal entries

- Depreciation

- Adjusting bad and doubtful debts

- Adjusted Trial Balance

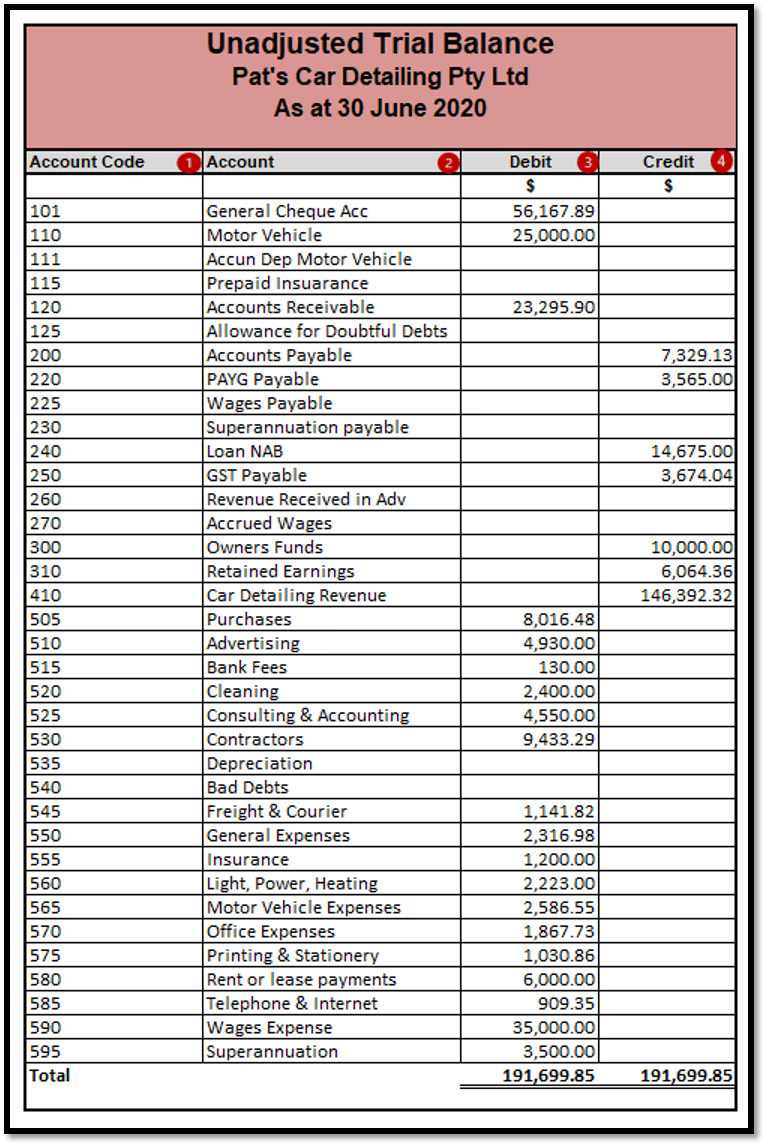

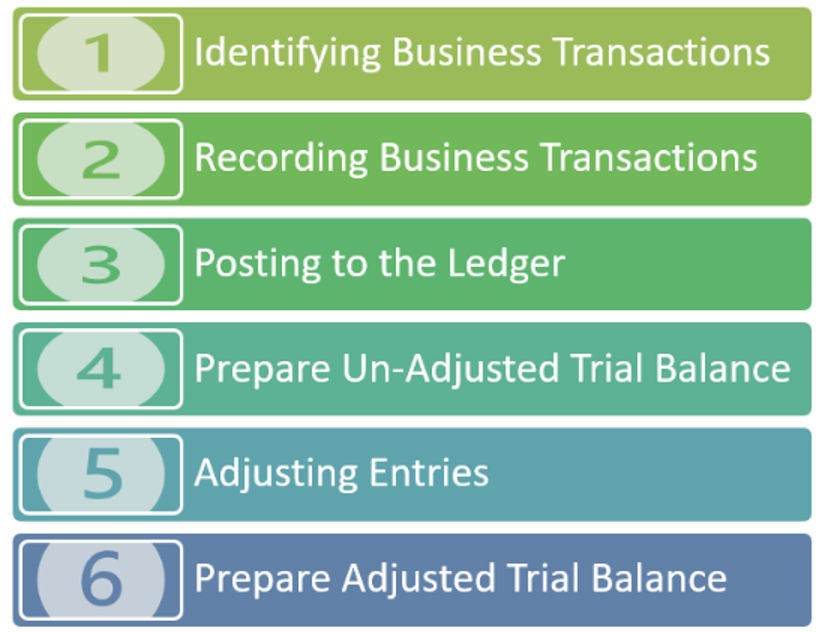

An unadjusted trial balance is the fourth step in the accounting cycle. It is a listing of all the business accounts that are going to appear in the financial statements before year-end adjusting journal entries are made. After all the journal entries are posted to the ledger accounts, the unadjusted trial balance can be prepared.

The Trial balance is prepared with a heading that includes the name of the business, the name of the trial balance and the date it was prepared. To create a trial balance, each of the accounts in the general ledger is listed. Accounts are usually listed in account number order.

- The account code appears in the Account Code column

- The name of the account appears in the Account column

- Accounts with a debit balance are listed in the Debit Column

- Accounts with a credit balance are listed in the Credit Column.

Both the debit and credit columns are calculated at the bottom of a trial balance. For the accounts to be in balance with the accounting equation, the debits and credit totals must always be equal. If they are not equal, the trial balance was prepared incorrectly, or the journal entries weren’t transferred to the ledger accounts accurately.

Sometimes a trial balance will not be in balance. If this happens, the irregularities preventing balance should be identified and remedied.

Fixing an Incorrect Trial Balance

Depending on what format you use to keep your general ledger, fixing an incorrect trial balance can be a simple matter of changing a single number or, if you are using a handwritten ledger, retracting your steps to try and locate the errors.If your trial balance does not balance, try these steps:

- Check to see if the debit and credit columns balance. Sometimes it may be a simple addition error.

- Check for entries that may have been included in the wrong column. For example, you would not expect to see GST payable as a debit.

- Count the number of accounts listed in your trial balance and compare to the number of ledger accounts. You may have omitted a balance.

- Check that you have not transposed any numbers when you have carried the balance across from the ledger to the trial balance.

- Calculate the difference between the debit and credit columns and see if you can find that amount in your general ledger

- Divide the difference between the debit and credit columns totals by two and look for that amount in the trial balance. You may have included a balance in the wrong column.

- Review each ledger account. Pay special attention to amounts, rather than descriptions, which can be entered incorrectly, contain transposed numbers or contain an addition or subtraction error.

- Check your posting from the journal to the ledger. You may have transposed a number.

- Change any incorrect ledger entries in your documents once you have found them and you have determined that your trial balance will be correct once you make the changes.

If the trial balance cannot be made to balance, then it will have to be referred to a responsible person in the organisation. The organisation will have a process in place for resolving irregularities with trial balances.

Adjusting journal entries are journal entries made at the end of an accounting period before the financial statements are prepared to recognise revenue and expenses in the period they were incurred. It is the result of accrual accounting and follows the matching concept.

Adjusting entries can be classified into either prepayments or accruals and are used to adjust revenue and expenses to match the current period usage. We do this by dividing revenue and expenses into the amounts that were used in the current accounting period and deferring the amounts that are going to be used in future accounting periods.

Prepayments are either prepaid expenses or revenue received in advance.

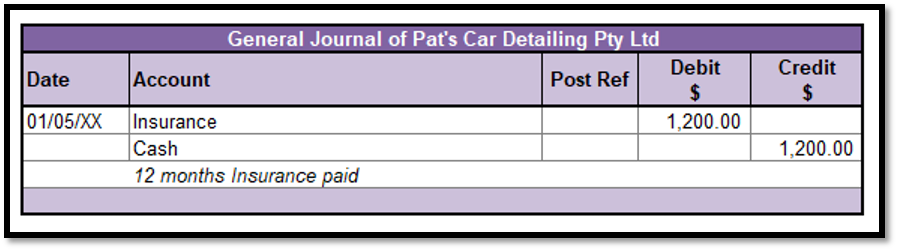

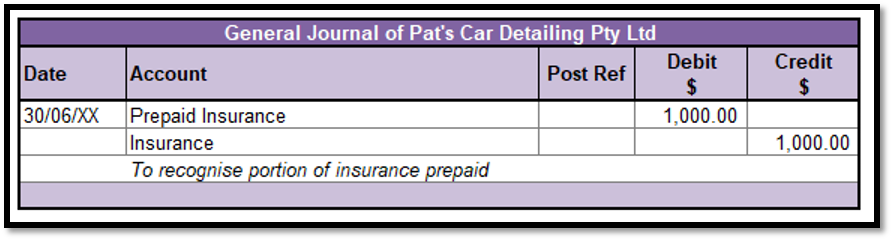

Prepaid expenses are amounts paid for in cash and recorded as assets but have not yet been consumed. Using the example of Pat’s Car Detailing Pty Ltd, Pat pays his insurance premium on 1 May for 12 months. The premium costs him $1,200. This means the business pays for the insurance but does not realise the full benefit of the insurance contract until the 30 April the following year. Prepaid expenses expire as the service is provided with the passing of time. At the end of each reporting period, adjusting entries are made to record the expense applicable to the current accounting period.

Only the proportion of the expense ($200) that is incurred in the current accounting period to 30 June is recorded in the accounts. The remainder of the expense is journaled as a prepaid expense.

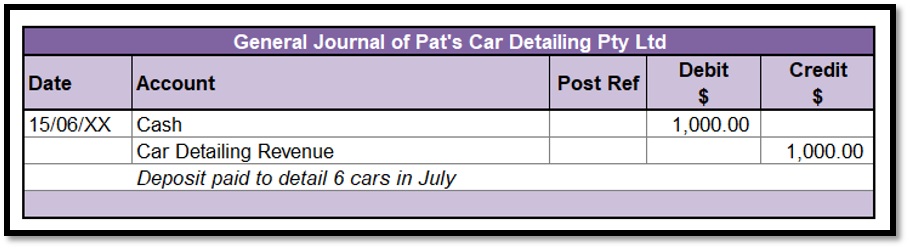

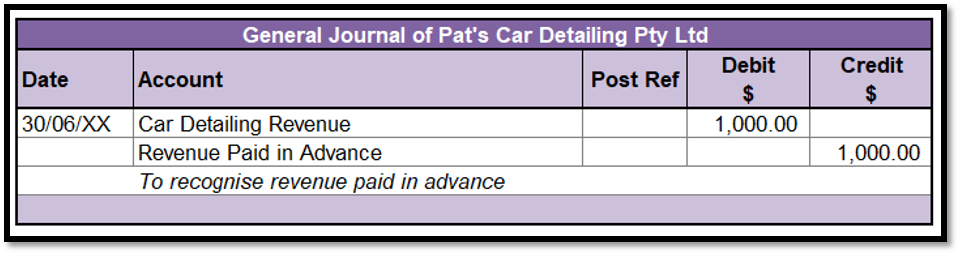

Revenue received in advance are amounts received from customers where the goods or services have not been provided to them yet. Using the example of Pat’s Car Detailing Pty Ltd, Pat received $1,000 on the 15th of June as a deposit from a client to detail six cars on the 10th of July.

Pat has an obligation to provide the service in the next accounting period; therefore, an adjusting journal entry must be created to recognise the amount as a liability.

Revenue received in advance is subsequently recognised as revenue when Pat provides the service.

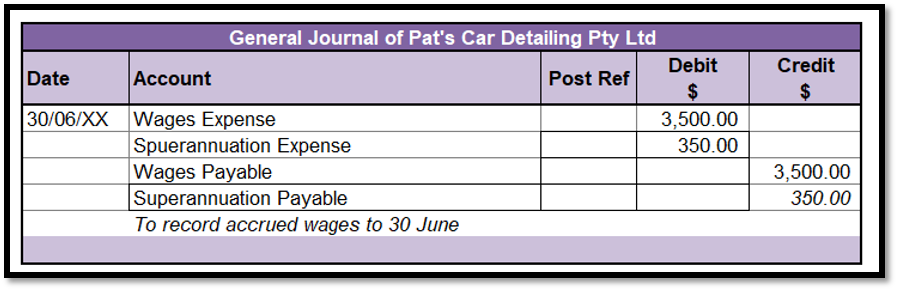

An accrued expense is an expense that has been incurred but not yet paid. Since the expense is incurred the current financial year, it must be recorded in the current financial year accounts regardless of whether it has been paid or not. The expense is accrued and shown as a liability until it is paid.

Payroll is the most common expense that needs an adjusting entry at the end of the month, particularly if employees are paid fortnightly. Any hours worked in the current month that will not be paid until the following month must be accrued as an expense.

Using the example of Pat’s Car Detailing Pty Ltd, Pat has one employee he pays fortnightly. In June, pay dates for his employees are June 14 and June 28. His employee will work two additional days in June (29 & 30 June) that are not included in the June 28 payroll. Pat will have to accrue 2 days wages and superannuation as his employees will not be paid for those two days until July.

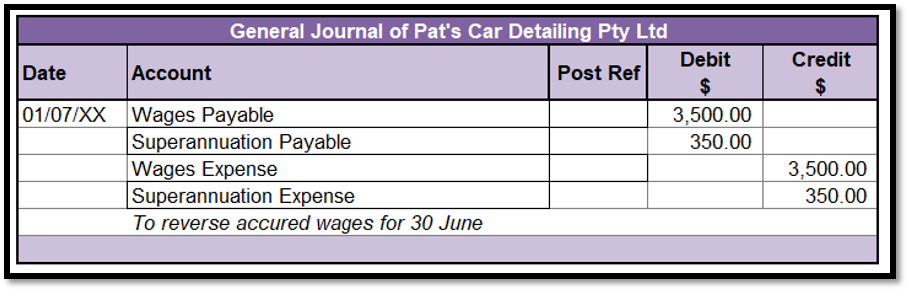

Accrued expenses must be reversed when the actual expense is paid. If the accrued wages expense is not reversed, the financial statements for Pat’s Car Detailing Pty Ltd will reflect an abnormally high wages and superannuation expense in July.

Accrued revenue are revenue amounts not yet received for which goods or services have been provided.

Accrued revenue is particularly common in service-related businesses since services can be performed up to several months prior to a customer being invoiced. An adjusting journal entry is needed to show the receivables that exist at the end of a period and record the revenue for the period.

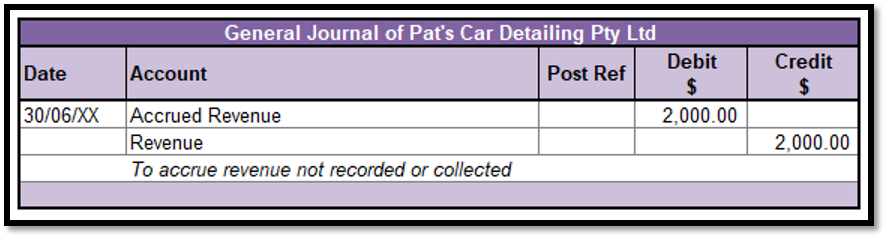

Using the example of Pat’s Car Detailing Pty Ltd, Pat invoices a client $2,000 a month for a month of services at the beginning of the following month.

His invoice is for June is $2,000, but since he won’t be billing until 1 July, he has to make an adjusting entry to accrue the $2,000 in revenue he earned for the month of June.

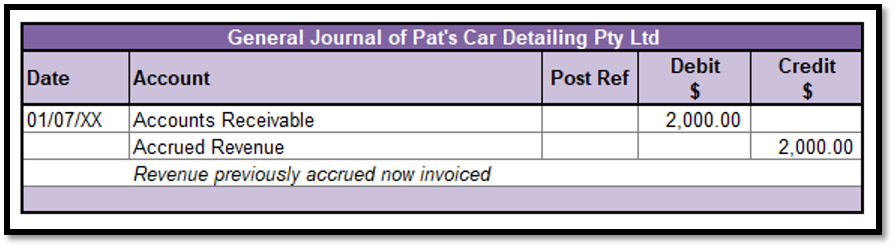

When Pat invoices his client on 1 July, he will make the following entry:

If Pat did not reverse his original entry, his revenue account would be overstated in the next period.

Other adjusting journal entries

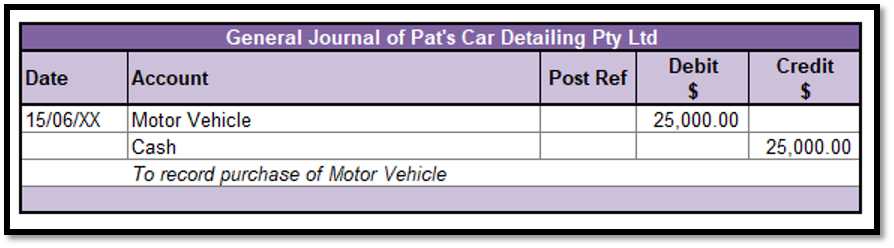

Depreciation is the reduction in the value of an asset over time. Rather than realising the entire cost of the asset in one-year, businesses use depreciation to spread the cost of the asset over its useful life.

When an asset is purchased, it is written into the accounts at the purchase cost.

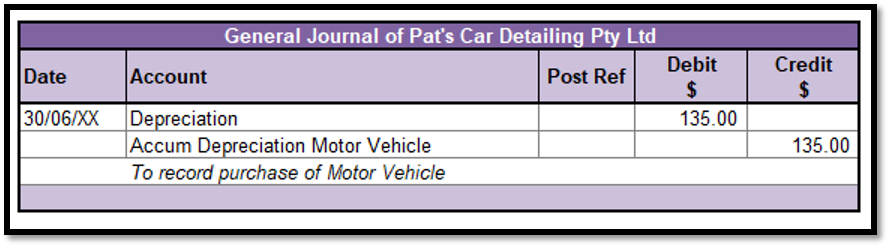

At the end of an accounting period, an adjusting journal entry for depreciation expense and accumulated depreciation are posted in order to properly expense the useful life of any fixed asset. Depreciation moves the cost of an asset from the balance sheet to the profit and loss statement.

A contra asset account must exist prior to recording the journal entry for the accumulated depreciation.

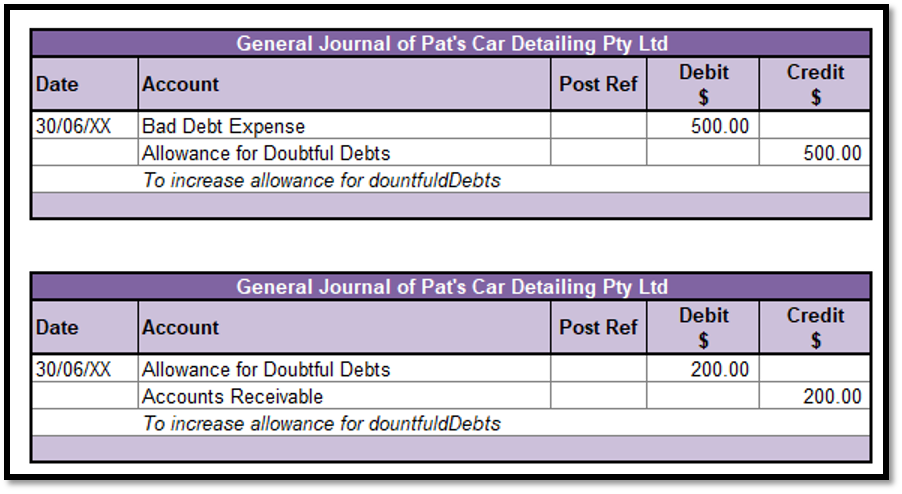

Accounting for bad & doubtful debts

Every time a business generates a tax invoice, there is a risk the invoice will not be paid. Bad debt is an account that will not be paid. A doubtful debt is an account that may not be paid. The following video explains the direct write-off and allowance method of accounting for bad debts at the end of an accounting period.

Insert Learning Checkpoint here.

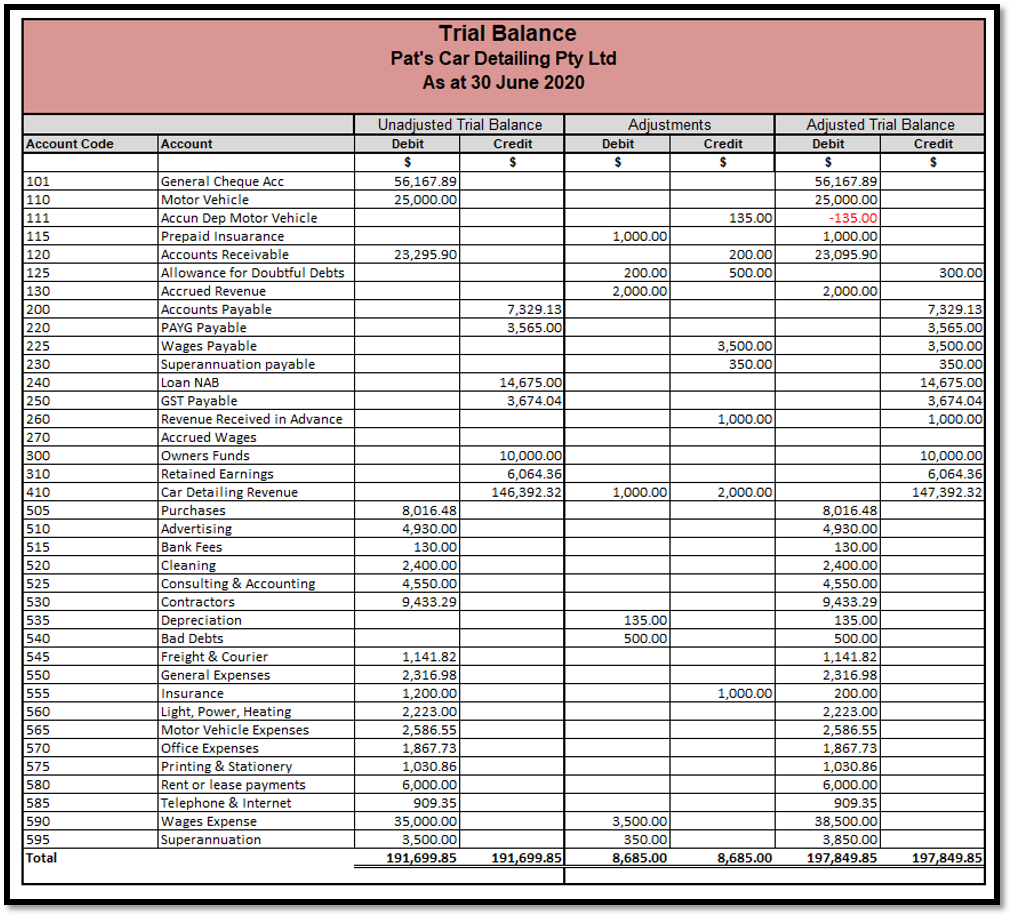

After posting the adjusting journal entries, the balance of some accounts in the unadjusted trial balance changed. An adjusted trial balance is a listing of the ending balances in all accounts after adjusting entries have been prepared. The intent of adding these entries is to correct errors in the initial version of the trial balance and to bring the entity's financial statements into compliance with GAAP.

Below is an example of an adjusted trial balance for Pat’s Car Detailing Pty Ltd.