We'll start by clarifying that the term accounts, for our purposes, refers to:

- Bank Accounts with a bank, such as Bank of Queensland. MYOB provides efficiency tools to help with the task of matching transactions that happen in real life to the tracking of those transactions within the MYOB system. The process is made easy with the Bank Feeds function and is beyond the scope of this course but very useful for business owners who do their own books.

- General Ledger Accounts provide a means for grouping similar transactions within each financial aspect of the business, such as assets, liabilities, income, expense, and capital accounts. The Chart of Accounts is a listing of all such accounts and sub-accounts that are used for the business in the system. MYOB provides the function for header accounts, which describe the group and show monetary totals for the detail accounts beneath them, which hold the actual transactions.

- Linked Accounts are detail accounts that are linked to specific system features and transactions.

This section will explain how information is posted and transferred between accounts.

Chart of Accounts

The chart of accounts is a list of every account in the general ledger of an accounting system. Each account is assigned a unique number based on the order it appears in the financial statements. Balance sheet accounts are usually presented first, followed by income statement accounts.11

Most accounting software packages like MYOB have a default chart of accounts for different business and industry types. Bookkeepers can set up and customise their account structure to fit their business goals and reporting requirements.

MYOB offers a default Chart of Accounts based on the type of business entered when the system is first set up.

Watch this video to see how the Chart of Accounts is used in MYOB.

General Ledgers12

The general ledger lists all accounts in the accounting system’s chart of accounts. It is sorted by account number and organised into:

- balance sheet accounts

- assets

- liabilities

- owners equity

- income statement accounts

- revenue

- expenses

The general ledger is a "book" with a separate page or ledger sheet for each account in a manual accounting or bookkeeping system. When a significant amount of detailed information is needed for an account such as Accounts Receivable, a subsidiary ledger is often used.

In a computerised system, the general ledger is a report that shows a list of all the selected accounts, usually done in preparation to run the company's financial statements. You may like to learn more about the general ledger's importance and uses at Accounting Coach.

Accounts List

Managing your business by recording transactions in specific accounts makes it possible to see the impact of your business strategies. As a reminder of what these types of accounts are used for, imagine your business pays rent for the use of its commercial premises. To track that expense, you would create a rent expense account and then allocate all rent payments to that account.

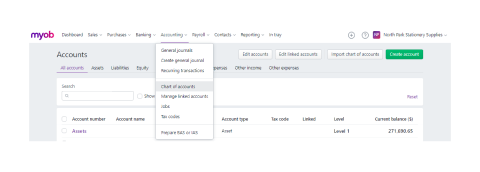

To view the default accounts set up for your fictitious business, go to the Accounting menu and choose Chart of Accounts.

Account Numbers

Each account is identified by a unique five-digit number. The first digit indicates the account’s classification (for example, accounts starting with 1 are asset accounts). The remaining four digits determine its location within the classification. The lower the number, the higher up in the list it appears. For example, account 1-1100 appears above 1-1200.

| Classification | Type | Description |

|---|---|---|

| Asset (1-xxxx) |

Bank | Money in the bank, for example, in a cheque or savings account. |

| Accounts Receivable | Money owed to you by your customers. | |

| Other Current Asset | Assets that, if required, can be turned into cash within a year. These may include your term deposits. | |

| Fixed Asset | Assets which have a long life, for example, buildings, cars and computers. Fixed assets are usually depreciated. | |

| Other Asset | Other assets you own such as loans made to others and goodwill. | |

| Liability (2-xxxx) |

Credit Card | Repayments required to service credit card debt |

| Accounts Payable | Money owed by you to your suppliers. | |

| Other Current Liability | Money owed by you that is due in less than a year, for example, GST. | |

| Long Term Liability | Money owed by you that is due in more than one year, for example, a business loan. | |

| Other Liability | Other money you owe. | |

| Equity (3-xxxx) |

Equity | The business’s net worth, that is, its assets minus its liabilities. Common equity accounts are current year earnings, retained earnings and shareholders’ equity. |

| Income (4-xxxx) |

Income | Revenue from the sale of goods and services. |

| Cost of Sales (5-xxxx) |

Cost of Sales | The direct cost of selling your goods and providing services, for example, purchase costs and freight charges. |

| Expense (6-xxxx) |

Expense | The day-to-day expenses of running your business, for example, utility bills, employee wages and cleaning. |

| Other Income (8-xxxx) |

Other Income | Other revenues, for example, interest earned on savings and dividends paid from shares. |

| Other Expense (9-xxxx) |

Other Expense | Other expenses, for example, interest charged. |

Note: How you group your accounts can affect how totals and subtotals are calculated on reports.

Your accounts list consists of:

- Detail accounts - sometimes called sub-accounts, these are the accounts to which you allocate transactions.

- Header accounts - these accounts group related detail accounts to help you organise your accounts list.

- You cannot allocate transactions to a header account.

- The balance of the header account is the sum of the detail accounts indented directly below it.

- You can have up to three header account levels.

- Top level header accounts, such as 2-0000 cannot be edited.

For example, you could group your telephone, electricity and gas expense accounts using a Utilities header account. This makes it easier to locate the utility expense accounts in the accounts list and see your combined utility expenses.

You group accounts by indenting the detail accounts located directly below a header account, as shown in this snippet of the Chart of Accounts for North Park Stationery Supplies.

Adding | Editing | Deleting Accounts in MYOB

To get started, MYOB provides a default set of accounts. It's important to know how to interact with the list.

Adding Accounts

- Go to the Accounting menu and choose Chart of accounts. The Accounts page appears.

- Click Create account. The Create account page appears.

- Select whether you're creating a Detail account or Header account.

- Choose the Account type.

- Choose the applicable Parent header. This determines where the account will sit in your accounts list.

- Enter a unique 4-digit Account number after the dash. The prefix (the number before the dash) is based on the Account type and can't be changed.

- Enter the Account name.

- (Optional) Enter Notes about this account, such as a description of the account and its purpose.

- (Header accounts only) If you want to show a subtotal on reports for the accounts under this header, select the option Show a subtotal for this section on reports.

- If you're creating a header account, click Save. Otherwise, continue with the following steps.

For new detail accounts only:

- (Optional) Enter the account's Opening balance. (The following section describes this in more detail.)

- Choose the Tax code that you'll use most often with transactions posted to this account. You can choose a different tax code when entering transactions.

- If you're creating an asset, liability or equity account (other than the account type of Bank), choose the Classification for statements of cash flow.

- Classifying the accounts allows you to generate a statement of cash flows. This report shows how your cash position has changed over time, profit earned and where your cash was spent.

Classification for statements of cash flow Classification Example Financing Balance sheet items that are to do with borrowing money or the repayment on borrowings. For example, hire purchase, leases, and bank loans. In some cases, this may also include directors' or shareholders' loans. Investing Balance sheet items that are used for the acquisition of fixed assets, plant and equipment, and investments. The sale of these assets or the redemption of investments into cash is also an investing activity. Operating All other balance sheet items where it is effectively a timing issue that creates the transaction, for example, accruals and prepayments. Accumulated depreciation is classified as operating so that it offsets the depreciation expense in the profit and loss report.

- Classifying the accounts allows you to generate a statement of cash flows. This report shows how your cash position has changed over time, profit earned and where your cash was spent.

- (Bank or Credit card account types only) If you'll make electronic payments from this account:

- enter the bank account details, and

- select the option I create ABA files for this account. For more details, see Paying employees into their bank accounts.

- When you're done, click Save.

Opening Balances

When starting to use a computerised accounting system, at the beginning of a period (e.g. a new financial year) or when you add a new account, the set up has to include a dollar value for each account, known as an opening balance.

You need to assign opening balances to your detail accounts to track your business performance accurately.

The opening balances you enter should be as at the Opening balance date specified in the Financial year setting of your Business settings. This date was set when you first set up MYOB for this course and cannot be changed.

At the end of this topic, you will get a chance to create opening balances, enter transactions and record depreciation so your MYOB is all set up to run fictional reports.

To enter an opening balance:

- Go to the Accounting menu and choose Chart of accounts.

- Click Edit accounts.

- Enter amounts in the Opening balance column.

- Enter opening balances as positive numbers

Don’t, for example, enter your liability account balances as negative numbers. Enter negative amounts only if accounts truly have negative balances. As a rule, these will be asset accounts that record accumulated depreciation.

- Enter opening balances as positive numbers

-

After entering all of your opening balances, check that the remaining balance amount shows $0.00. If this displays an amount other than $0.00, check your opening balances again because they are either incomplete or incorrect.

However, you can continue the set up process if there is a remaining balance amount. The amount will be assigned to a special equity account called Historical Balancing.If, when entering your opening balances, you don't enter all the figures, or there's an error in one of the balances, then the Balance Sheet won't balance. To overcome this temporary issue, MYOB enters the balancing amount in the Historical Balancing account. When you eventually enter all the asset, liability and equity amounts (or find the incorrect values), the Historical Balancing account's balance will return to zero.

So if you're seeing an amount in the Historical Balancing account, don't panic. Just check that you've entered all the assets, liability and equity balances correctly as at your conversion date.

- When you're done, click Save.

Editing accounts

You can edit some account information in detail accounts, for example, the Account name, Account number, the Opening balance, Tax code and banking details.

You can't edit the Account type if you have transactions posted to the account. You also can't edit the Account type or Account number of top level header accounts.

If an account's information can't be changed, the field will be locked or you'll see a warning message when trying to save your changes.

To edit accounts:

- Go to the Accounting menu and choose Chart of accounts to open the Accounts page.

- Click Edit accounts.

- Make your changes.

- Click Save.

Changing the order of accounts

You can edit the Account number of detail accounts to change the order they appear in. Each account is identified by a unique five-digit number. The first digit (the prefix) indicates the account’s classification (for example, accounts starting with 1 are asset accounts). The remaining four digits determine its location within the classification. The lower the number, the higher up in the list it appears. For example, account 1-1100 appears above 1-1200.

You can also move accounts up or down account levels.

To move accounts up or down

- Go to the Accounting menu and choose Chart of accounts to open the Accounts page.

- Click the applicable tab for the account you want to move, e.g. Assets, Liabilities, Equity, etc.

- Select the account to move.

- Use the buttons above your accounts list to move the account up or down a level. You'll only be able to move an account up or down if it's possible to do so.

- Click Save.

Deleting accounts

You'll be able to delete an account if it:

- has never been used in a transaction

- has no journal entries

- has a zero balance

- is not a linked account (this will be discussed further later in the course)

- is not linked to a pay item (this will be discussed further later in the course)

Instead of deleting an account, you can deactivate it (see below).

To delete accounts

- Go to the Accounting menu and choose Chart of accounts. The Accounts page appears.

- Select one or more accounts to be deleted. The Delete accounts button appears.

- Click Delete accounts.

- Click Delete to the confirmation message. If the account can't be deleted, a message will appear explaining why.

You would use general journal transactions to track business activity that you would not want to track with other kinds of transactions, such as deposits or payments.

In a computerised system, usually, journal entries are used for special situations only, such as when you need to record the depreciation of your assets, or when you need to enter year-end adjustments. Some businesses use it for recurring transactions as well. Common expenses and income are recorded using spend and receive money and will be covered in the Purchases and Sales topics.

Creating General Journal Entries

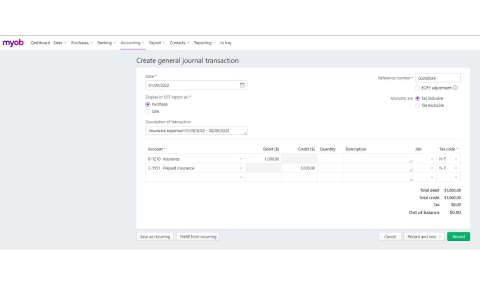

General journal entries are recorded chronologically in MYOB's Create general journal transaction screen to track activities as your business conducts operations. This information is used to create the General Journal.

When recording transactions to the general journal, the transaction must indicate both debit and credit linked accounts.

Example

On 01/07/2022 North Park Stationery Supplies paid $12,000 for a one-year insurance policy. The policy covered the period 01/07/2022 - 30/06/2023. The amount paid was recorded as a prepaid expense in their balance sheet. Over the course of the year, North Park Stationery Supplies will recognize $1,000 of that expense each month ($12,000 / 12 months) in their income statement by recording a general journal transaction.

Each row of information in a journal entry is called a line item. You can enter as many line items in a general journal as you like, but you must have at least two line items—a debit line item and a credit line item to offset it. The total debits and credits in a general journal must balance before it can be recorded. For example, if there are $100 in credits, there must also be $100 in debits.

For a detailed review of adding journal entries in MYOB, view their step-by-step instructions.

The general journal in MYOB is simply a 'Find Transactions' report that indicates what journal entries have been recorded in a specific time period. Note that it does not include spend and receive money transactions, which will be discussed in the Purchases and Sales topics.

Some journals are created for specific purposes, such as tracking money received and spent and petty cash.

Special Journals

Accountants also create special journals, which include transactions that general journal entry doesn't cover. They are used for repetitive journal entries that might overwhelm the general ledger. Periodically, the total amounts in special journals are transferred to the general ledger in summary form.

Special Journal Entries

- Cash payments

- Cash receipts

- Payroll disbursements

- Sales

- Purchases

- Sales returns

- Purchase returns

General Journal Entries

- Purchase of non-current assets

- Prepayments

- Owner contributions (non-cash)

- Asset depreciation

- Correction of errors

- Balance day adjustments

MYOB refers to some of the journals as Source Journals for when you need to find transaction by narrowing the journal it came from.

| In this journal... | ...are these transaction types |

|---|---|

| General | depreciation of assets, year-end adjustments, income distributions |

| Sales | sales made on credit |

| Purchases | purchases made on credit |

| Payroll | employee payments |

| Cash payments | money paid out, for example, purchase receipts, cheque stubs |

| Cash receipts | money received, for example, cash register sales, receipts |

| Inventory | adjustments to the quantity or value of your inventory items |

Subsidiary ledgers

These are created for some journals, such as sales and purchases, which use an:

- accounts receivable subsidiary ledger

- The MYOB default account number for this is 1-1200

- It's a level 3 account, under Current Assets (Level 2), which is under Assets (Level 1 Header account).

- accounts payable subsidiary ledger

- The MYOB default account number for this is 2-1140

- It's a Level 3 account, under Current Liabilities (Level 2), which is under Liabilities (Level 1).

Essentially these two sub-ledgers contain accounts for each of your accounts receivable and accounts payable. These will record individual transactions for your Accounts Receivable and Payable, which are then summarised and entered into the General Ledger.

Petty cash Subsidiary Ledger

Most businesses require petty cash for things like stamps, stationery, or even coffees for the team. Petty cash purchases are managed similarly to a bank account: you deposit money into a petty cash account, record expenses against it and top it up with another transfer from a bank account (which could be an ATM withdrawal).

Activity: Petty Cash account

Take a moment and check if your MYOB Chart of Accounts includes a Petty Cash account. (Hint, check the Accounting > Chart of Accounts.)

If it doesn't, go ahead and Create one. You may like to review the topic Adding | Editing | Deleting Accounts in MYOB for a reminder of the steps to add an account.

Are you struggling to determine what type of account it should be? Click the plus sign to reveal the answer.

For the purposes of reporting and decision-making, the life of the business is broken down into reporting periods, for example, months, quarters, six months, and a year. These reporting periods do not necessarily match the life of the business as all transactions will not fall neatly within each reporting period. In order for the balance sheet to accurately reflect the business finances for the period, you may need to make adjustments or to ensure the accounting of a transaction is reflected in the correct time period.

In many situations, this involves the business's accountant. Before doing any adjustments, you'll need to reconcile your real-world bank accounts to the accounts in your accounting system so you are working with the most current information. We will provide instructions for how to do that in MYOB in the Banking topic.

Adjust Expense Accounts and Revenue Accounts for Prepayments and Accruals

As a reminder, the primary financial statements used are the profit and loss statement, balance sheet and statement of cash flows. The balance sheet or statement of financial position reports the assets, liabilities, and owner’s (stockholders’) equity at a specific time, such as 30 June. The statement of cash flows reports the sources and uses of cash by operating activities, investing activities, financing activities, and certain supplemental information for the period specified in the statement's heading.13

The profit and loss (P&L) statement is of great importance because it indicates, for a specified time period, whether the business has been profitable (good news) or has spent more than it generated, which indicates the business ran at a loss during the selected dates. This statement may be kept for any period of time. For example, at start-up, they may be produced monthly. Annual P&L statements are produced at the end of the year to prepare income tax.

The P&L only shows revenues, expenses, gains and losses. It will not display money you receive, or money paid out in an accrual-based system.

It isn’t unusual to adjust accounts, which is done commonly to:

- record one-off situations

- make edits after the initial recording

- adjust what period will reflect an expense or profit.

You may classify adjustment entries as prepayments (revenue/expense) or accruals (revenue/expense).

Most small businesses will not have many balance day adjustments to make, as accounts such as insurance are usually paid on a monthly basis, and most computerised payroll systems calculate leave liabilities with each pay calculation.

The most common balance day adjustments used in small businesses are:

- Writing off bad debts

- Correction of errors

- Calculating depreciation

- Prepaid expenses

In determining what balance day adjustments need to be made at the end of an accounting period, the issue of materiality needs to be considered.14

AASB 1031 Materiality accounting doctrine states that only material of significant information should be revealed in the preparation of financial reports.

For further detail, go to the AASB website and look at the Table of Standards. This contains links to further information on each of the standards.

If your business is registered for GST, you'll use tax codes in MYOB to keep track of the tax you've paid and collected. Each tax code represents a particular type of tax.

A reminder that you would indicate that you are registered for GST in your business settings. To check or change these settings for all future items, click your business name and choose Business settings > GST settings tab.

MYOB has an extensive list of codes that can be used in a variety of situations—for example, when doing business with overseas customers, when tracking capital acquisitions, and so on.

To access MYOB's tax codes, go to Accounting > Tax codes. From this screen, you can edit tax codes, create new tax codes (except consolidated tax codes), delete some tax codes, combine some tax codes and assign tax codes to items or accounts. This will be discussed below the tables shown here.

As of August 2022, here is a summary of the default tax codes in an Australian business.

| Tax code | Name | Description | Default tax type |

|---|---|---|---|

| GST | Goods & Services Tax | General tax of 10% on most goods, services, and other items sold or consumed in Australia | Goods & Services Tax |

| FRE | GST-Free | Sales that are GST-free sales other than export sales, such as fresh food purchases, medical services and products, and educational courses | Goods & Services Tax |

| EXP | Export Sales | Used when exporting goods, which are usually GST-Free | Goods & Services Tax |

| CAP | Capital Purchase | Amounts paid for capital assets, such as plant and equipment, motor vehicles, land and buildings | Goods & Services Tax |

| INP | Input Taxed Purchases | Used for the purchase of input taxed supplies or supplies on which no GST is added to the final purchase price, such as residential rents or unit trusts | Input Taxed |

| ITS | Input Taxed Sales | Used for the sale of input taxed supplies or supplies that don't include GST in the sale price, such as financial supplies, interest income and residential income | Goods & Services Tax |

| LCT | Luxury Car Tax | Used to handle special tax considerations which accompany the sale of luxury cars | Luxury Car Tax |

| LCG | Consolidated LCT & GST | This tax code combines GST and LCT to calculate and track both taxes. | Consolidated |

| GNR | GST Not Registered | Used to record purchases from suppliers who have an ABN but are not registered to collect GST | Input Taxed |

| ABN | No ABN Withholding | Used for suppliers that have not quoted ABNs on their invoices or for amounts that are withheld from investment income because no tax file number was quoted. | No ABN/TFN |

| N-T | No-Tax | Used to record sales that carry no GST, such as depreciation and cash transfers. | Goods & Services Tax |

| WEG | GST on Wine Equalisation Tax | Used to record GST on WET | Goods & Services Tax |

| WET | Wine Equalisation Tax | Tax on wine consumed in Australia based on the value of the wine | Sales Tax |

| GW | Consolidated WEG and WET | Combines the Wine Equalisation GST (WEG) and Wine Equalisation Tax (WET) codes | Consolidated |

| VWH | Voluntary Withholdings | Used for contractor payments where a voluntary agreement is in place. | Voluntary Withholdings |

The tax types are:

| Type | Description |

|---|---|

| Consolidated | This tax type is used for taxes that are made up of two or more tax codes or sub-taxes. |

| Import Duty | Importers, who are bringing goods into Australia from other countries, should use this tax type. Tax codes with this tax type are used to record the import duty payable on a purchase order without changing the total amount of the purchase order. (The import duty is treated as a separate transaction since the duty is payable to the ATO, not to the company supplying the goods.) |

| Sales Tax | This tax type is associated with the Wine Equalisation Tax. |

| Goods & Services Tax | This tax type is associated with the Goods & Services Tax assigned to sales and purchases. This tax type also is used for GST-free goods and GST on Wine Equalisation Tax. |

| Input Taxed | This tax type should be used by organisations, such as suppliers of financial services, that must pay GST on the purchases they make but don't collect GST from their clients or customers. The Input Taxed tax type also should be used by businesses that haven't registered for GST. |

| Luxury Car Tax | This tax type is used by the Automotive industry to handle the luxury car tax. |

| Voluntary withholdings | This tax type should be used for the PAYG voluntary withholdings scheme. |

| No ABN/TFN |

This tax type should be used for suppliers that have not quoted ABNs on their invoices or for amounts that are withheld from investment income because no tax file number was quoted. This type indicates that the tax code is a PAYG Withholding tax type and will always be rounded down to the nearest dollar. You should use a No ABN/TFN tax code of 47% for suppliers who do not quote an ABN on invoices for more than $75 tax exclusive or where amounts are withheld from investment income because no tax file number was quoted. If both situations apply to your company, you will need to create two tax codes to handle them separately. |

The tables above can be found on MYOB's Tax Codes help centre page. You may like to bookmark it as a tax resource.

Managing tax codes

There may be times when your business would be simplified by removing tax codes.

How to delete a tax code

You can delete a tax code if it has never been used in a transaction or has not been assigned to an account, contact or item. If the tax code has been used in a transaction, you will not be able to delete it, even after deleting any associated transactions, which ensures you keep a history of records used in transactions for auditing reports. If it has never been used, make sure it isn't assigned to an account, contact, or item before you delete it.

You are also not able to delete the GST or N-T tax codes.

- Go to the Accounting menu and click Tax codes to open the Tax codes list.

- Click the tax code you want to delete.

- Click Delete.

- Click Delete again in the confirmation message that appears.

Combine tax codes

You may want to merge two tax codes to remove any unused codes or if you are moving to Simpler BAS.

To do this, you can select the tax code to delete and which tax code to move the deleted tax code's history to. All contacts, accounts and other records update to the new tax code.

You can only combine tax codes that have the same:

- rate

- linked accounts

- linked contacts (if a linked contact has been chosen)

- are not consolidated tax codes.

To combine tax codes:

- Go to the Accounting menu and click Tax codes to open the Tax codes list.

- Click Combine Tax Codes.

- Choose the tax code you want to keep from the Move transaction history to list. This is the code the deleted code’s history moves to.

- Choose the tax code to delete from the Delete this tax code list.

- You can also edit some details of the combined tax code, such as the name, rate or linked accounts.

- You can also edit some details of the combined tax code, such as the name, rate or linked accounts.

- Click Combine

Assign a tax code to an Account

You can assign a tax code to any detail account in your accounts list. The tax code you assign will appear as the default tax code when you post a transaction to this account.

For example, you have assigned the GST tax code to your electricity expense account. When you settle your electricity bill in the Spend Money window and allocate it to this account, the GST tax code will appear in this window by default.

To do this, go to the Accounting menu > Chart of accounts, and click the account name of the required account then alter or assign the tax code.

Assign tax codes to inventory Items

When you set up an Item, you must assign a tax code to use when buying or selling the item. We will provide more information about setting up inventoried items in the Sales section of this course.

Once they have been assigned, the item tax codes will appear by default when buying and selling your items unless you have specified that the customer or supplier tax code is to be used instead.

Compliance

Maintenance of tax codes in MYOB is important. When compliance updates happen, ensure you are across the changes and check your MYOB Business settings to ensure your system reflects current legislation. While some level of updates happen behind the scenes with a cloud-based system, nothing should be assumed in terms of compliance.

Activity: Use MYOB Business to complete the following tasks

Tasks

- Answer this question:

- Refer to or set up an asset registry if you have not done that yet.

- Here is an example of a simple excel Asset Registry template.

- Here are some example assets for you to enter into it.

- On the first of July, 2022, the following assets were purchased:

- (Depreciation has not been recorded for the 2022 financial year as of yet.)

Item Total Cost

(GST excl)Life of asset

(years)Depreciation (method) Depreciation (%) Office equipment $111,350.00 10 straight line 10 Computers $16,250.00 3 straight line 33.3 Delivery van $73,000.00 5 diminishing value 40

- Create the General Journal entry for the depreciation in MYOB as at December 31, 2022. (Hint: Consider how many months to apply depreciation for 2022.)

- Discuss any challenges or confusion you had while doing these activities in the forum.