PLEASE NOTE: In this module you will notice lodgement is spelt two different ways:

- lodgement

- lodgment

The ATO website adopts the spelling of ‘lodgment’ from related legislation that has received Royal Assent by the Queen and/or her representative. This is reflected in any laws enacted since 2 June 1953 adopted by the ATO and referenced in this module.

Taxation requirements are the provisions laid out in statutory guidelines. The primary way to identify an entity's taxation recording and reporting requirements is to go by the provisions of the statutes themselves. Different legal entities will have different taxation requirements for their returns and the lodgement of these returns.

A tax return is a formal document you file with the appropriate tax authority. You prepare it to report your income, expenses and other relevant financial information. It shows the basis for computing your taxable income and tax obligations. Lodgement refers to filing statutory requirements with the appropriate authority. In the context of this unit, it involves filing your tax returns with the Australian Taxation Office. You may file it online or in physical form.

Most of the knowledge you will gain from this unit is based on the statutory requirements of different tax legislation. Your principal goal in reading this legislation must be to be able to answer the following questions:

- What is being taxed?

- Who bears the burden of tax?

- How is the tax assessed?

In this topic you will be introduced to different types of business structures and the different taxation requirements imposed upon these business structures.

In this topic, you will learn how to:

- Identify and confirm the suitability of legal entities

- Identify and establish compliance requirements

- Determine the client's tax documentation preparation requirements.

A legal entity pertains to an individual, company, or organisation who has rights and obligations under certain legislation. Legal entities may include the following:

- Sole trader

- Partnership

- Company

- Trust.

These will be discussed in detail later in this topic.

An organisational structure refers to the hierarchical framework of the organisation's roles, positions, teams, and employees. It explains what the employees do and to whom they report. It outlines the decision-making authorities across the business.

Having understood what legal entities and organisational structures are, you need to identify the legal entity's suitability for your client's business. Given below is the process you may follow:

1. Understand the business of your client.

This means that you must know the following:

- Who the owners of the business are, and how they intend to manage the control over the business

- How the business intends to raise revenue

- The costs of operating the business.

You must obtain this understanding based on your discussions with the right persons in the organisation. To know whether you are talking to the right person, you must refer to their organisational structure. The person from whom you should obtain the confirmation must have the authority to represent the organisation in matters concerning taxation.

2. Gather relevant information.

- Understand the advantages and disadvantages of establishing each legal entity with regard to the following:

- Ease in raising capital

- Registration and set-up requirements

- Liability to third-party creditors

- Dissolution

- Reporting requirements

- Know how each legal entity is taxed

Access business.gov.au to learn more about the suitability of different legal entities.

3. Arrive at a considered opinion.

After you have understood the business and gathered all relevant information, you must provide your client with your professional opinion on what legal entity best suits their business.

You may provide this confirmation by:

- Preparing a detailed report with an executive summary outlining changes, if any being recommended

- Seeking a meeting with the appropriate authorities within the organisation to present the same

- Presenting your professional opinion with the reasons supporting your recommendations

- Answering the client's questions and clarify doubts, if any

The appropriate authority will depend on the organisational structure of the client.

When you confirm the suitability of the legal entities to your clients, you must ensure that:

- You have correctly analysed how the business works

- Your client is aware of their current obligations

- Your client understands other implications of establishing the legal entity

Types of Legal Entities

Sole Trader

This is a business structure where only one individual controls and manages the business. Here are the common indications that the taxpayer is engaging as a sole trader:

- The taxpayer is the sole owner of the business

- The taxpayer bears all the risks and losses alone

- The taxpayer has unlimited personal liability for the debts incurred by the business

- The taxpayer is not an employee of the business.

For a taxpayer to be considered a sole trader, it must be presumed that they are engaging in activities intended for commercial purposes. Additionally, these activities should not merely be a hobby. Case laws have determined a way of identifying whether an activity is to be considered a conduct of business or a hobby. The core indications considered by the courts in determining whether activities amount to carrying on a business are the following:

- Whether the activities are intended for commercial purposes

- Whether these activities are carried out in a business-like manner

- The profitability of the activities

- Whether the activities are conducted regularly

- Size and scale of the activities

- If the activity is better described as a hobby.

Differences in tax implications between a business and a hobby are given below:

| Business | Hobby |

|---|---|

| The taxpayer needs to declare their income to the Australian Taxation Office (ATO) in their annual return. | The taxpayer does not need to declare the income amounts gained from a hobby to the ATO. |

| The taxpayer can claim deductions on the expenses incurred by his business. | The taxpayer cannot claim any losses from an activity if it is only a hobby. |

| The taxpayer needs to keep records of business transactions for tax and other obligations. | There is no record-keeping required in undertaking activities considered a hobby. |

Learning Exercise

Business vs Hobby – Horse Racing

Your client is the only owner of a horse syndicate. They had determined specific provisions relating to the activities of the syndicate:

- As the owner, they will have to lease a horse with an option to buy.

- As the owner, they may exercise their option to buy the horse if such a horse demonstrates its ability to earn a profit.

- As the owner, they shall terminate the lease of the horse upon determining that the horse is no longer profitable.

Required: Determine if your client is engaged in a business or a hobby.

The conduct of your client relating to horse racing activities is merely a hobby. Explanation: ATO's view on this is that these horse racing activities cannot be classified as a conduct of business if it does not involve the following:

- Breeding activities

- Training activities

ATO also recognises that it is difficult to profit from horse racing activities. Thus, it is hard to identify horse racing activities as part of the operations of a business. Furthermore, these activities seem to have failed the commercial basis test when it failed to demonstrate that the profitability of these activities relies on the owner's business acumen and not on mere chance.

To conclude, classifying horse racing activities as a conduct of business may be difficult if such activities do not involve breeding and training activities.

To know more about how the Commissioner determined that an entity is conducting a business, refer to TR 2019/1.

Partnership

- Partnership as defined under partnership laws

A partnership is a relationship between persons carrying on a business with a common view of profit. A partnership, under the partnership laws, has three essential elements:- In common

The parties in a partnership should have a valid agreement to act with mutual agency and to contribute money, property, or service to a common fund. - View to profit

The primary purpose of a partnership should be to generate profits. - Carrying on business

The concept of carrying on a business may be understood in different contexts, and the application of its related interpretations may be specific to each ruling. Generally, an entity may be deemed to be carrying on a business depending on its intention, size, scale and the regularity of the activities being conducted for business dealings.

- In common

- Partnership as defined under taxation laws

According to Section 995-1 of the Income Tax Assessment Act 1997, the general definition of a Partnership is extended as being:- Any association of persons that is not a company carrying on a business as partners

- Any association of persons that is not a company, in receipt of ordinary income or statutory income jointly.

To further understand how the Commissioner interprets the definition of partnership under tax laws refer to TR94/8

The types of partnership can be classified based on the obligation of the partners to third persons:

- General partnership

A general partnership consists of all general partners who are to have unlimited liability for the debts and obligations of the business. - Limited partnership

A limited partnership is a partnership that consists of at least one limited partner who is said to have limited liability for the debts and obligations of the business and whose participation in the management of the business should be limited. - Incorporated limited partnership

An incorporated limited partnership has all the elements to be classified as a limited partnership but was simultaneously incorporated for the purpose of venturing into high-risk capital projects. Different state laws have their own regulations for the registration of limited corporate partnerships.

This table explains some of the advantages and disadvantages of having a partnership as a business structure:

| Advantages | Disadvantages |

|---|---|

As compared to a company:

|

A partnership:

|

Learning Exercise

Existence of a Partnership

Scenario 1:

John and Stephen operate a car repair shop. They both agreed to contribute money to the business to cover its daily operating expenses.

Required: Determine if a partnership exists

Scenario 2:

Pau and Nica are jointly holding a share portfolio. Every income year, the portfolio yields dividends income.

Required: Determine if a partnership exists

Answer: In this case, John and Stephen were deemed to be engaging as a partnership under tax and partnership laws since they both seem to be jointly carrying on a business. Thus, they would be required to lodge a partnership tax return.

Answer: In this case, there is no existence of a partnership under partnership law since Pau and Nica did not jointly hold the portfolio in view of carrying on a business. Although Pau and Nica don't have to lodge a partnership tax return, they are still recognised as partners in a partnership under tax laws, and their share of the dividend income should be declared in their individual tax returns, nonetheless.

A written partnership agreement is not necessary for a partnership to exist.

Company

Generally, a company is formed by operation of law and is recognised as a separate legal entity. A company has the same rights as a natural person. It can incur debt, sue, and be sued. A company is run by its directors and owned by its shareholders. It is regulated by the Australian Securities and Investments Commission (ASIC). For tax purposes, a company is broadly defined as ‘all bodies or associations corporate or incorporated but does not include a partnership’.

- Public and private companies

Determining whether a company is public or private is important for income tax purposes. This is because certain payments made by private companies may be disallowed by ATO to be treated as deductions.

Income Tax Assessment Act (1936) defines a public company as a company that is either of the following:- Listed company

- Mutual life assurance company

- A company in which a government or an authority of a government has a controlling interest o A company that is a 100% subsidiary of a company classified as either of the abovementioned companies.

The table explains some of the disadvantages and advantages of having a company as a business structure:

| Advantages | Disadvantages |

|---|---|

|

|

Trust

In legal terms, trust is a mere relationship established to manage the properties of the settlor (donor/grantor) for a particular purpose and for the benefit of others, i.e. beneficiaries. However, for tax purposes, trusts are considered taxpayer entities. A trustee, an individual or a company, is responsible for managing the trust's affairs, including its tax obligations. Most of the terms and conditions relating to the trust's affairs are set out in a written document referred to as the trust deed. Superannuation funds have a trust structure. They are a special type of trust set up to provide retirement benefits to its members.

Various types of trusts are presented in the table below:

| Type of Trust | Brief Description |

|---|---|

| Discretionary Trust | The trustee has the discretion to vary income and capital distributions to be made to the beneficiaries. |

| Fixed Trust | The trustee cannot vary the income and capital distributions to be made to the beneficiaries because it is already fixed under the provisions of the trust deed. |

| Unit Trust | It is a variation of fixed trusts where the ownership in the trust is divided into units. |

| Family Trust | It is a type of discretionary trust generally established for the benefit of a group of family members. |

| Testamentary Trust | It is a trust established in conjunction with a will. |

| Deceased Estate Trust | A deceased estate trust arises from the death of an individual. |

Parties to a trust include the following:

- Settlor – The party who established the trust.

- Trustee – The party in whom the trust to administer the property for the beneficiary's benefit was placed. Some of the responsibilities of a trustee may include the following:

- Managing the tax affairs of the trust

- Registering trust in the tax system.

- Beneficiary – The party who will gain benefit from the property held in trust.

Some relevant terminologies include the following:

- Trust deed – A trust deed is a written document containing the terms and conditions related to establishing and maintaining the trust

- Trust property – Trust property refers to all assets included in a trust which may consist of money, real estate, shares, or personal property.

- Trust income – This may refer to either of the following:

- Income

- Determined per the trust deed

- Net trust income

- Determined under the tax law

- Income

- Trust estate – Trust estate pertains to the aggregate of all trust properties.

- Corpus – This is the portion of the trust property allotted to produce income for the beneficiaries.

- Present entitlement – The beneficiary is said to have a 'present entitlement' of the income produced by the trust if he has the present right to demand payment from the trustee. The terms related to the present entitlement of a beneficiary can be found in the trust deed.

Australian Taxation and the Legal System

Australian Taxation

Taxation is the process of levying and collecting taxes from individuals, businesses, and other entities by the government for the purpose of raising revenues. Taxes are a way for the government to finance its operations, invest in infrastructure, provide social services, and address societal problems, such as poverty, inequality, and environmental issues. Here are some important things to remember about Australian Taxation:

- Taxes are levied on a Commonwealth, state, and local level.

- The power of the Commonwealth to impose taxes was vested by the Constitution, with the following primary restrictions:

- Commonwealth taxes imposed must not be discriminative against any state or territory.

- Excise tax may only be imposed by the Commonwealth.

- Taxes imposed on a Commonwealth level are based on tax laws enacted by the Federal Parliament and administered by the Australian Taxation Office (ATO).

- The revenue office of the relevant state or territory administers state taxes.

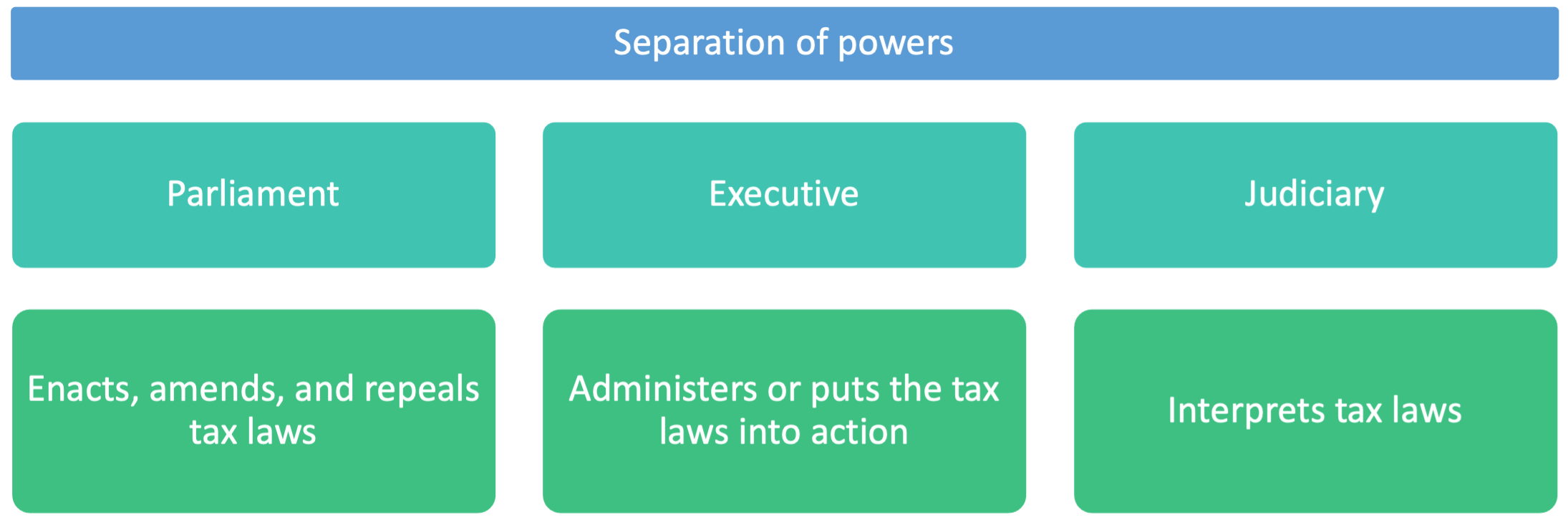

The role of each power in Australian taxation is summarised in a simple illustration below:

Constitutional consideration refers to the power of the constitution. All legislation, statutes, other rulings, and decisions regarding taxation are applicable only as long as they align with the various constitutional rights and requirements.

Separation of powers refers to dividing government responsibilities into distinct branches to limit any branch from exercising the core functions of another. This separation is done to prevent power concentration and provide balance.

The Legal System and the Australian Taxation

A taxpayer dissenting from the decision from the Australian Taxation Office has a legal option to initiate an action to appeal in either the Administrative Appeals Tribunal (AAT) or the Federal Court. Suppose the decision of the AAT or the Federal Court is not favorable to the taxpayer. In that case, the taxpayer may continue with the litigation and bring his appeal to (in order):

- Full federal court

- High court

Court and administrative appeals tribunal (AAT) decisions act as legal requirements which can be referred to for taxation purposes. While preparing tax documents, court and administrative appeals tribunal decisions can be considered statutes and complied with to complete the tax documentation. These are helpful in special cases where the law is not clear.

Principles of Australian Tax Law

The Australian Taxation Office has defined seven principles for effective tax governance under Australian law. These ensure that legal entities have clear processes and procedures in a corporate governance framework to support decision-making. They also ensure that they meet their tax and super obligations.

The following are the seven principles:

- Accountable management and oversight

- Recognise tax risk

- Seek advice

- Integrity in reporting

- Professional and productive working relationship

- Timely lodgements and payments

- Ethical and responsible behaviour

To learn more about ATO's seven principles of effective tax governance, refer to the Seven principles of effective tax governance.

Income Tax

Income tax is the tax imposed on income earned. The following legislation governs the income tax in Australia:

- Income Tax Assessment Act 1936 (ITAA36)

- Income Tax Assessment Act 1997 (ITAA97)

Not all income earned by an individual or a legal entity will be subject to income tax. Only the income that is assessable as determined by the relevant income tax laws may be subject to income tax. This is known as assessable income.

According to Sec. 6.5 and Sec. 6.10 of ITAA97, assessable income consists of ordinary income and other amounts which are assessable, e.g. statutory income.

- Ordinary income

Australian taxation office defines ordinary income as the ‘income according to ordinary concepts’. Examples of ordinary income include:- Wages and salaries

- Interest income

- Rental revenue

- Revenue earned from sales and services.

- Statutory income

ITAA97 only provides a residual definition for statutory income as below: 'Amounts that are not ordinary income but are included in your assessable income by provisions about assessable income are called statutory income.' You can look at statutory income as those earnings or gains that are considered assessable only by virtue of tax legislation. The most common example of statutory income includes capital gains.

Income is derived either from within Australia or outside Australia. You must identify the source of the income to know whether or not it should be included as an assessable income.

Residency

This indicates if the legal entity's income will be taxable in Australia. Each type of legal entity has different criteria for being considered a resident. An entity resident of Australia will generally be assessable on ordinary and statutory income earned from all sources, whether in or out of Australia.

Source

This is used to determine if the income has been generated within Australia or outside Australia. Non-resident companies are generally subject to Australian income tax on Australian-sourced income only. However, suppose a company is a resident in a country with which Australia has concluded a double taxation agreement (DTA). In that case, Australia's right to tax business profits is generally limited to profits attributable to a permanent establishment (PE) in Australia.

Here is how you identify when to include an income as assessable according to its source:

| Type of Taxpayer | Ordinary Income | Statutory Income |

|---|---|---|

| Australian Resident | Ordinary income derived from within and outside Australia will be included as assessable income. | Statutory income derived from within and outside Australia will be included as assessable income. |

| Foreign Resident | Only income derived from within Australia will be included as assessable income. | Only income derived from within Australia will be included as assessable income. |

International Tax

Taxation of foreign resident taxpayers and resident taxpayers who earn income outside of Australia is subject to tax treaties. A tax treaty is an agreement between two jurisdictions regarding how they want specific tax treatments. It is also often referred to as a tax convention or double tax agreement (DTA). The objectives of these tax treaties are to prevent double taxation and somehow coordinate international taxation laws with Australian taxation laws. In general, the matters addressed in a tax treaty include the following:

- Income types that are assessed solely based on the jurisdiction of residence and those by both the jurisdiction of residence and source:

- Jurisdiction of residence – The country where the taxpayer is a resident of

- Jurisdiction of source – The country where the income was derived

- The jurisdiction over business profits

- Tax reliefs

Reviews, the Treasury, and the Board of Taxation routinely issue government tax policy documents. A legislative requirement of the treasury is to declare foreign income according to applicable tax treaties. Declaration of the source of income according to requirements of tax treaties helps determine which income is taxable in Australia and which income is exempted from tax in Australia. This helps ensure that double taxation is avoided.

Allowable Deductions

When computing the taxpayer's taxable income, allowable deductions pertain to those items that can be deducted from the assessable income.

The total allowable deductions include the following:

- General deductions

To be considered as a general deduction, the expense should have been incurred in either of the following:- Producing an assessable income, e.g. cost of goods sold

- Carrying on the business that produced the assessable income, e.g. advertising expense

- A capital, or of a capital nature

- Of private or domestic nature

- Incurred in relation to exempt income or a non-assessable non-exempt income (NANE)

- Prevented under a tax legislation

- Specific deductions

These expenses were explicitly identified in ITAA97 AND ITAA36 as allowable deductions. Examples of specific deductions include the following:- Tax-related expenses

- Repairs

- Lease document expenses

- Borrowing expenses

- Discharge of mortgage expenses

- Bad debts

- Loss through theft or embezzlement of employees

- Subscriptions to associations

- Election expenses

According to the Income Tax Assessment Act 1997, a legislative requirement is to deduct any loss or outgoing from your assessable income to the extent incurred in gaining or producing your assessable income. While preparing tax documentation, calculating assessable income is one of the primary steps. The legislative requirements of statutes help identify and compute the assessable income on which tax obligation will be computed.

Tax Offsets

Tax offsets, also known as rebates, refer to the specific items that can reduce the payable tax of the taxpayer. Most tax offsets, however, are only available for individual taxpayers, which can be of use to sole traders and partners in the partnership. Some examples of tax offsets available for other legal entities include research and development tax offset, franking credit tax offset, foreign income tax offset, and small business entity tax offset.

Overview of Income Taxation for Different Legal Entities

Below is an overview of how income tax works for legal entities:

| Legal Entity | How is the Entity Taxed? | Income Tax Rate |

|---|---|---|

| Sole Trader | The owner is taxed as an individual. The sole trader reports its income from the business on the individual tax return under the supplementary section of the return. | The income tax rate for a resident or non-resident individual |

| Partnership | Each partner is taxed as an individual reports their share in the partnership income to their individual tax return. | The income Tax rate for a resident or non-resident individual |

| Company | Taxed as a separate legal entity | At either 30% or 25% |

| Trust | The general law governing the taxation of trusts is contained in Division 6 of ITAA36. Either the trustee or the beneficiary is taxed in their individual capacity |

Adult and company beneficiaries pay tax on their share of the trust's net income at the tax rates that apply to them. The trustee is generally taxed on the trust income at the highest marginal rate that applies to individuals except for some types of trusts (including deceased estates), which are taxed at modified individual rates. To learn more about trusts and how they are taxed, refer to Trusts on the ATO website. |

Capital Gains Tax

A capital gain is a financial gain made from selling or disposing of assets such as land and buildings. A capital gain or loss only arises if a CGT event occurs. CGT events only involve CGT assets.

- Real Estate

- Foreign currency

- Shares

- Collectables

To learn more about the different types of CGT assets, refer to Capital gains tax on the ATO website.

A capital loss may be written off against other capital gains in the same income year. However, suppose no capital gain occurs in that same year. In that case, the loss is carried forward and is offset against a future capital gain. A capital loss that arises on the disposal of a collectable asset can only be offset against a capital gain arising from the disposal of another collectable asset.

A taxpayer's assessable income includes any net capital gain for the income year. A net capital gain is a total difference between the taxpayer's capital gains and capital losses.

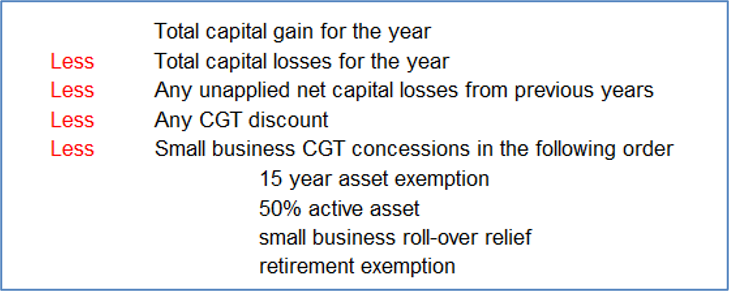

There are four CGT concessions specifically for small businesses with an aggregated annual turnover of less than $10 million.

- 15 year asset exemption

- Small business 15-year exemption | Australian Taxation Office (ato.gov.au)

- 50% active asset reduction

- Small business 50% active asset reduction | Australian Taxation Office (ato.gov.au)

- Small business roll-over relief

- Small business rollover | Australian Taxation Office (ato.gov.au)

- Retirement option

- Small business retirement exemption | Australian Taxation Office (ato.gov.au)

To understand how to calculate capital gains tax, refer to Calculating your CGT on the ATO website.

When a taxpayer is eligible for any of the small business CGT concessions their net capital gain is calculated as follows:

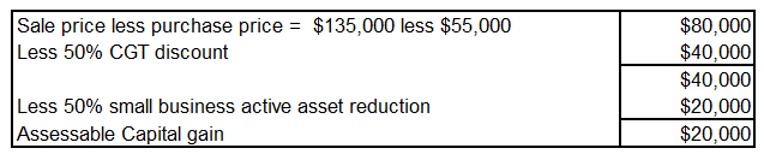

Worked Example

Alice Page purchased a florist shop on 28 June 2017 for $55,000. She sold it on 31 March 2022 for $135,000. Alice’s Flowers is a small business.

Required: Calculate the capital gain.

The assessable capital gain could be reduced further by the small business retirement exemption or small business roll-over or both if applicable.

Fringe Benefit Tax (FBT)

Fringe benefits are benefits granted by an employer in respect of the employment of his employees, in addition to their basic salaries, which may either be in cash or in kind. Fringe Benefits Tax is the tax imposed on the fringe benefits provided by employers to their employees.

To further understand FBT click on the link to watch this video from the ATO. How fringe benefits tax works | Australian Taxation Office (ato.gov.au)

There are different types of fringe benefits. They can be categorised as follows:

- Car fringe benefits

- Entertainment-related fringe benefits

- Loan and debt waiver fringe benefits

- Living-away-from-home allowance fringe benefits

- Board fringe benefits

- Car parking fringe benefits

- Expense payment fringe benefits

- Housing fringe benefits

- Airline transport fringe benefit

- Property fringe benefits

- Residual fringe benefits

Calculating FBT Payable

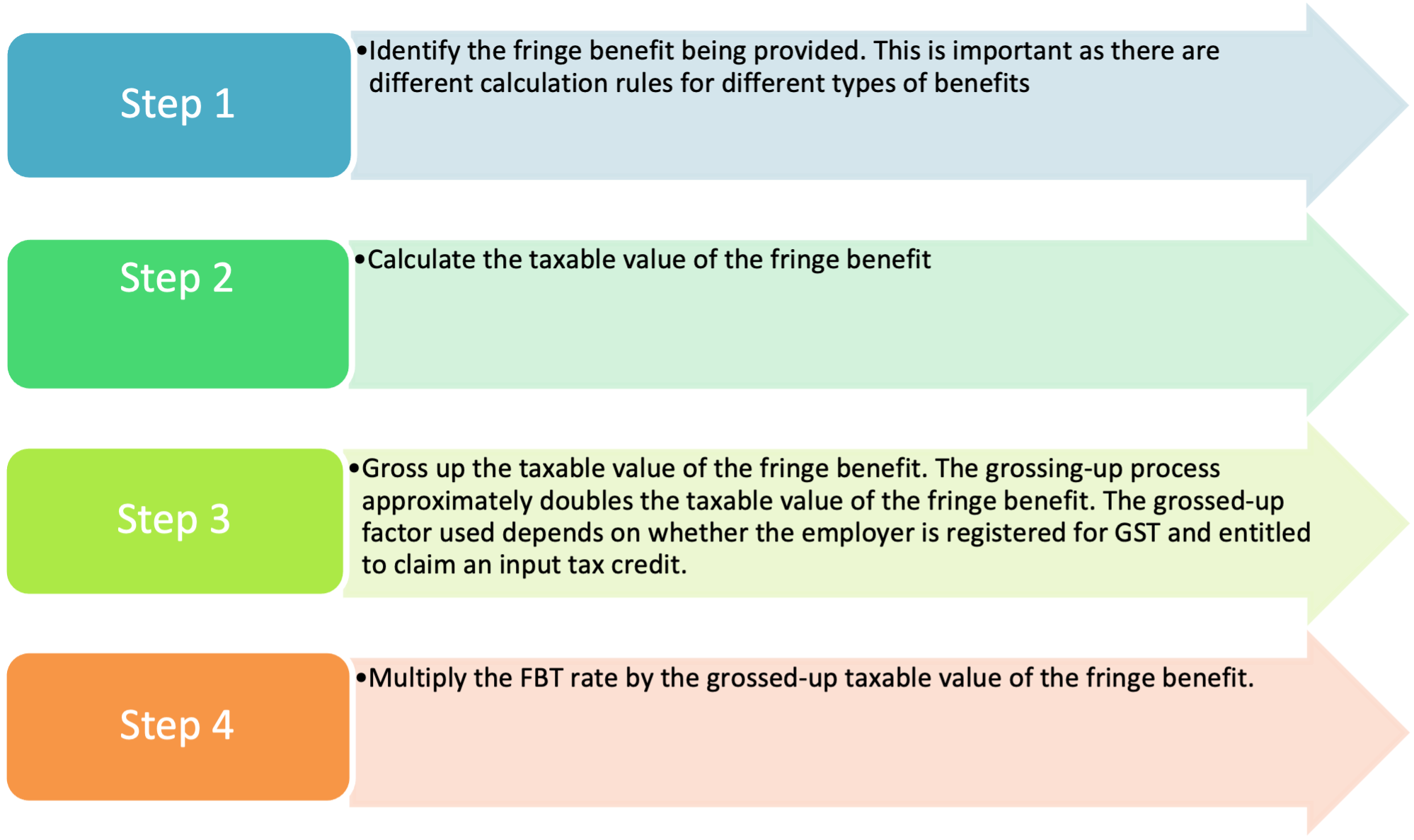

To calculate the FBT payable follow the four steps below.

Worked Example

An employer provides an employee with a gym membership costing $1,100.00 (Inclusive of GST).

Required - Calculate the FBT payable.

Step 1 Expense payment fringe benefit.

Step 2 The amount of the fringe benefit is $1,100.00.

Step 3 The benefit is a Type 1 fringe benefit as the employer can claim an input tax credit for the GST.

$1,100 x 2.0802 = $2,288 (ignoring cents)

Step 4 FBT payable is:

$2,288 x 47% = $1,075.36

The ATO has a range of resources to help employees learn more about the different types of fringe benefits, how the taxable value is calculated for each type of benefit and what constitutes these benefits. These include Fringe benefits tax – a guide for employers and Fringe benefits tax.

Not all benefits received by an employee are considered fringe benefits. Examples of benefits not regarded as fringe benefits for tax purposes include the following:

| Benefits | Explanation |

|---|---|

| Salary or Wages | Payments of salary or wages are not fringe benefits. |

| Employee Share Schemes | Benefits provided to employees from the acquisition of shares or rights to acquire shares are not fringe benefits if the share acquisition scheme conforms to the necessary income tax requirements. This exemption extends to relatives of an employee. |

| Superannuation |

The following superannuation contributions are not fringe benefits:

The employer's super contributions for an employee's associate shall be subject to FBT. |

| Employment Termination Benefit | Broadly, termination payments are made because of terminating an employee's employment, e.g. a lump sum paid on retirement. |

| Payments of a Capital Nature | Payments of a capital nature for a legally enforceable contract in restraint of trade or personal injury to a person are not fringe benefits. |

| Dividends | Payments made to distribute dividends are not fringe benefits. |

Learning Exercise

Benefits Provided in Respect of Employment

Scenario 1:

Your client operates a hotel and management business. Your client provides free monthly access to his hotel's entertainment areas to David, his employee. Your client told you the benefit would not have been granted to him if David were not an employee.

Required:

Determine if your client has provided a fringe benefit to David.

Scenario 2:

Your client has employed the services of his daughter, Jenny, as a sales agent in his business. Jenny just got married, and so your client gave Jenny a new car as a wedding gift. You enquired with your client whether such a gift was given because Jenny was an employee of his company. Your client replied that the wedding gift would still have been given to Jenny. This was regardless of her employment at the company because of their family relationship.

Required:

Determine if your client has provided a fringe benefit to Jenny.

This subtopic will familiarise you with compliance, recording and reporting requirements. Additionally, it will explain how you can conduct research to identify updates or additions to these requirements. Research is conducted by reviewing the legislation and obligations. The requirements should be relevant to the client's circumstances. To be able to do the above, first, you must also understand the tax-related legal system. Finally, you will understand how to establish these compliance requirements.

Compliance requirements are the legal obligations laid out by legislation and regulations. The compliance requirements of a taxpayer are set out in different statutes, case laws, and precedential views of the Australian Taxation Office (ATO). These include the recording and reporting requirements too.

Record-keeping is a critical aspect of running any business. Recording requirements are the requirements for record-keeping stipulated by regulatory bodies. Your clients may be legally required to keep records of all their tax and superannuation transactions.

To learn more about the ATO’s Record keeping requirements access Index - Record keeping for business.

Reporting requirements refer to the submission of information to the appropriate authority. This submission is to show compliance with stipulated regulatory provisions.

The client's circumstance includes the size, structure and nature of the client's business. It will also depend on the stage your client's business is in. Records your client needs to keep and the reporting they must do will be based on the client's circumstances. Your client's tax obligations will differ according to the legal entity, employee strength, size and scale of business and the fringe benefits offered to their employees.

Tax-Related Legislative System

This subtopic will familiarise you with the legislative system relating to taxation. Understanding and interpreting this system is imperative for understanding the compliance requirements relating to your client's legal entity.

Statutes are laws written and passed by a legislative body that have legal enforceability upon persons and entities under their jurisdiction. These statutes can either be Commonwealth laws or state laws.

It is important to note that the Australian Constitution has stipulated that the laws concerning the imposition of taxes shall deal with only one subject of tax. This subject of tax may pertain to either of the following:

- Income tax

- Excise duties

- Customs duties

- Goods and services tax

- Fringe benefits tax

- Luxury car tax

- Wine equalisation tax

- Other indirect taxes

Here are some of the primary commonwealth laws that govern Australian Taxation:

| Commonwealth Laws | Description |

|---|---|

| Income Tax Assessment Act 1936 | ITAA36 provides a foundation for the computation of income tax for individuals and businesses. Some of its provisions were already replaced by ITAA97. However, some of the provisions in ITAA36 still operate concurrently with other income tax laws. |

| Income Tax Assessment Act 1997 | ITAA97 was enacted to restructure the then-existing income tax law. Although ITAA97 also deals with capital gains tax, it is not treated as a violation of the Constitution since, in substance, capital gains are considered a form of income. |

| Fringe Benefits Tax Assessment Act 1986 | A fringe benefits tax is a tax burden imposed on the benefits received by employees aside from their salaries or wages. Employers bear this tax. |

| A New Tax System (Goods and Services Tax) Act 1999 | GST is the tax imposed on the sale of goods, services, and other items in Australia. |

The states and territories of Australia also have the power to enact tax laws. However, the same is limited to the power vested by the Australian Constitution. The specific taxes imposed by each state and territory must be enforced and administered by the particular revenue authorities specified in the related legislation.

Presented below are the revenue authorities for each state and some of the tax laws they administer. It also details some of their related publications:

| State | Revenue Authority | Tax Laws and Guidance |

|---|---|---|

| Australian Capital Territory | ACT Revenue Office | |

| New South Wales | Revenue NSW | |

| Northern Territory | Territory Revenue Office (TRO) | |

| Queensland | Queensland Revenue Office | |

| South Australia | Welcome to RevenueSA | |

| Tasmania | State Revenue Office of Tasmania | |

| Victoria | Home | State Revenue Office | |

| Western Australia | Welcome to Revenue Online |

Case laws are also referred to as common laws. They pertain to the decisions of law courts that become legally binding within its jurisdiction upon its declaration. Common laws must be followed or, at least considered, by other courts.

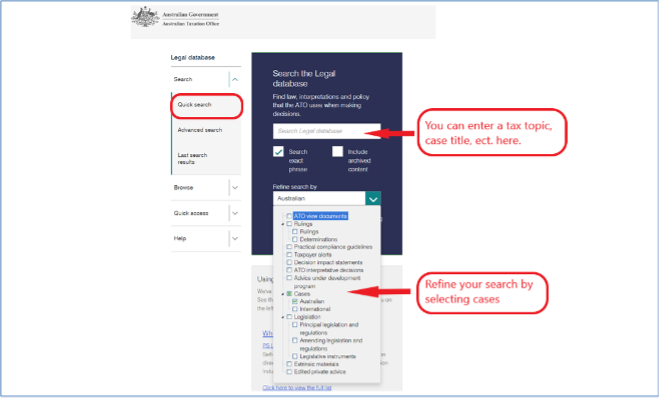

The Australian Taxation Office provides a legal database on its website. You can browse recent case law decisions involving different tax matters on this database.

The Decision Impact Statements (DIS) published by ATO are meant to inform the public of the implications of court decisions involving the interpretation of tax laws. These statements provide guidance as to how these case laws will be administered and how they will affect the current regulations of ATO.

Treasury, Review and the Board of Taxation

The Treasury is a central policy agency in Australia. It provides economic analysis and advice to the Australian Government. They foresee and analyse various policy issues to respond to fast-changing events. The Treasury looks at issues both from the government and stakeholder perspectives. They also work with state and territory governments.

The issues that the Treasury provides advice and analysis on may include:

- Budget

- Economy

- Financial sector

- Foreign Investments

- Housing affordability

- International economic policies

- Small business

- Structural policy

- Superannuation

- Taxation

The Treasury's role is to advise on effective tax and retirement income arrangements that contribute to the overall financial outcome and influence sustainable economic growth for the good of the Australian people. The Treasury is responsible for assessing and advising on the general design of the tax system and its components and retirement income policy concerning economic efficiency, equity, income distribution, budgetary requirements and economic feasibility.

For more information on the Treasury’s role in the design of the tax system refer to Taxation.

The Board of Taxation is a non-statutory advisory body responsible for providing a business and community perspective to improving the design of taxation laws and their operations. The main function of the Board of Taxation is to advise the Treasurer on:

- The quality and effectiveness of tax legislation and the processes for its development, including the processes of community consultation and other aspects of tax design

- Improvements to the general integrity and functioning of the taxation system

- Research and other studies commissioned by the Board on topics approved or referred by the Treasurer

- Other taxation matters referred to the Board by the Treasurer

The Board undertakes detailed reviews as and when requested by the Treasury Ministers. It provides real-time input on tax policy and law design matters as decisions are made. The Board works closely with businesses and the tax community to make recommendations.

Understanding and Interpreting Taxation Laws

The Australian Taxation Office, headed by the Commissioner of Taxation, publishes documents and resources to help taxpayers meet their compliance requirements and interpret tax laws. These resources set out the precedential views of ATO on certain tax matters, including the following:

- Rulings/ATO advice products

- ATO guidance products

The ATO also published explanatory materials concerning legislation. A legislative requirement under explanatory paper TPB(EP) 08/2022 is that a tax agent must apply taxation laws correctly to the circumstances in which they are providing advice to a client. Ensuring taxation laws are applied during the preparation of tax documentation is essential to avoid penalties to the client during an audit.

Rulings/ATO Advice Products

An overview of ATO advice products is presented below:

| ATO Advice Products (Rulings) | |

|---|---|

| What | ATO advice products are also referred to as rulings. They are resources that contain the point of view of ATO regarding certain tax matters and how certain tax provisions should be applied. |

| Effect | Rulings have a binding effect between ATO and the relevant taxpayer. Suppose a taxpayer followed the applicable ruling of ATO in interpreting the law. Such a taxpayer cannot later be penalised by ATO shall any later conflict surface between ATO's interpretation and the court's decision. Briefly speaking, these rulings are strictly enforceable between the commissioner and the relevant taxpayers. |

| When will these rulings have a binding effect? |

|

| Where can you access these rulings? | You can access these rulings through the legal database of ATO—just like searching for case law. |

Relying on ATO Rulings

The Commissioner of Taxation's interpretive guidance in Rulings and Determinations can be relied upon by tax professionals in the preparation of tax documentation. Taxpayers who relied on an ATO ruling in good faith are protected from penalties and interest if such a ruling is later found by a Court to be incorrect.

Learning Exercise

Relying on ATO Rulings in Good Faith

The Commissioner issues an information sheet that is identified to be that of a public ruling. It was mentioned that the provisions of this public ruling would have a binding effect upon entities who:

- Are sole traders

- Have acted in good faith

- Reasonably relied on the ruling

Read the following examples:

- Peter, a sole trader, relied on the provisions of this public ruling in good faith.

- Gale, also a sole trader, relied on the provisions of this public ruling too. But he had chosen to rely only on specific provisions rather than the whole ruling itself because it serves his own interest.

Months after the publication of the ruling, a court declared that ATO's opinions in this ruling were inconsistent with the law.

Required:

Determine what is the effect of the conflict between ATO's interpretation and the court's decision?

Peter may use it as a defence that he only relied on the rulings of ATO and that he acted in good faith. Therefore the, ATO cannot impose penalties against Peter if Peter appropriately applies the ruling.

On the other hand, Gale cannot use the same defence because he acted in bad faith when he interpreted the ruling in a biased manner. He chose to interpret the ruling based solely on specific provisions and not the entirety of the ruling.

Types of Rulings

Rulings may include the following:

- Public ruling

Its provisions may apply to most taxpayers or a class of entities. A class of entities may be defined by reference to specific characteristics, e.g. employees of a particular entity. The provisions of a public ruling shall take effect at the time specified in the ruling or, if there is no specified time, at the time it was published. An ATO publication cannot be treated as a public ruling unless such is explicitly stated to be that of a public ruling. To learn more about how public rulings are being administered by the ATO refer to Taxation ruling - Private ruling

The difference between a private and a public ruling is that a private ruling must be related to a scheme affecting specific taxpayers. A scheme in this context may refer to any arrangements or agreements between ATO and a taxpayer. These arrangements or agreements may be expressed or implied. They may or may not be enforceable by legal proceedings. It is important to note, however, that a private ruling may later be made public in certain circumstances. Private rulings are published ordinarily for the benefit of specific taxpayers to address their particular circumstances. Suppose you think you are dealing with certain tax matters not yet addressed in other rulings. This may be because of their unique circumstances or because they involve complex transactions.Apply for a Private Ruling Before applying for a private ruling Make sure that the scheme or circumstance subjected to the ruling is not hypothetically, speculatively, or insufficiently developed. Otherwise, ATO may decline to establish a ruling. If you are unsure whether there are reasonable grounds to apply for a private ruling, request a callback from an ATO representative. How to apply for a private ruling ATO have posted different application forms for your convenience. Certain tax issues are to be addressed through a specific application form. Choose the one that best suits your circumstance. - Oral ruling

An oral ruling is a form of legally binding advice to an individual taxpayer obtained through a phone call. Oral rulings usually cater to individuals needing advice on personal income tax or Medicare levies. to learn more about the advice and guidance the ATO provides refer to Oral rulings

Tax Reporting Requirements

This subtopic will explain the reporting requirements relating to the following taxes:

- Income tax

- Goods and services tax

- Fringe benefits tax

Income tax

The main reporting requirement relating to the taxable income of a legal entity is the lodgement of an income tax return. Taxpayers use this tax return to present details of their total taxable income for the income year, including capital gains. Tax returns are to be lodged annually soon after 30 June but not later than 31 October of the income year. This should be the usual timeframe for taxpayers with an income year ending on 30 June. The reporting requirements for the income taxation of each type of taxpayer are summarised in the table below:

| Reporting Requirements | Usual Due Date | |

|---|---|---|

| Sole Trader | Completion of Individual Tax Returns, Tax Returns for Individuals, supplementary sections, and other related schedules | 31 October |

| Partnership | Completion of Partnership Tax Return along with the Statement of Distribution and other related schedules | |

| Company | Completion of Company Tax Return and other related schedules | |

| Trust | The trustee has to lodge a Trust Tax Return, while the beneficiaries have to complete their Individual Tax Return along with the supplementary section and all other related schedules | |

There are three basic legal requirements of Australian tax law relevant to tax documentation for legal entities. These are as follows:

- All ordinary and statutory income must be declared

- Tax documents must be filed before the required dates

- Tax obligation must be computed as per legal guidelines

Here are some other important reminders:

- If you are lodging on behalf of a sole trader, lodging of the individual tax return is required regardless if the business earned an income or incurred a loss for the year.

- Suppose you are lodging on behalf of a partnership. Then the lodgement of the partnership tax return will only be required if the partnership was deemed to be carrying on a business. You should not lodge a partnership tax return if the partners in the partnership are merely deriving income jointly. That is, the partners are deriving income only through the jointly owned property or jointly owned shares. You also do not have to lodge if the partnership was a subsidiary member of a consolidated group for the full income year.

- A trust is not a separate taxable entity. However, the trustee must lodge a tax return for the trust. The trust's beneficiaries declare the amount of their entitlement to the trust's income in their tax returns.

Do You Need to Lodge a Partnership Tax Return?

Risa and Kyle are jointly holding a share portfolio. Every income year, the portfolio yields dividends income. In this case, Risa and Kyle do not have to lodge a partnership tax return. Even though the relation between them is recognised as a partnership under tax law, they still derived income merely from a jointly held property. They are not carrying on a business. In any case, the income derived by partners in the partnership should be reported in their individual tax returns.

In determining whether the taxpayer needs to lodge an income tax return, the taxpayer may use the ‘Do I need to lodge a tax return?’ tool. You may also access this tool on behalf of your clients. To access the tool, follow the pathway below:

- Login into myGov

- From your services, select 'ATO'

- From the menu, select 'tax'

- Then, select 'lodgements'

- Then, select 'income tax'

- From the not lodged tab, select the relevant income year

- Then, select 'do I need to lodge'

Based on Do I need to lodge a tax return? © Australian Taxation Office for the Commonwealth of Australia

If, after using the tool, the taxpayer learns that he does not have to lodge a tax return. In that case, the taxpayer must let ATO know by lodging non-lodgement advice. This non-lodgement advice may be lodged through ATO's online services or the mail. If the taxpayer chooses to lodge the non-lodgement advice through ATO's online services, he may follow the pathway below:

- Login into myGov

- Select 'ATO' from 'your services'

- From the menu, select 'tax'

- Then, select 'lodgements'

- Then, select 'non-lodgement advice'

Based on Lodge a non-lodgment advice. © Australian Taxation Office for the Commonwealth of Australia

To learn more about how to work out if the taxpayer needs to lodge a tax return refer to Do I need to lodge a tax return?

Goods and services tax

As discussed in the previous subtopic, GST is a broad-based consumption tax levied on goods, services and other items. The main reporting requirement relating to the GST for a legal entity is the lodgement of a business activity statement (BAS). This form is lodged by registered businesses to ATO to report details on GST and other tax obligations, such as the following:

- Pay as you go instalments

- Fringe benefits tax instalments

- Luxury car taxes

- Wine equalisation taxes

- Fuel tax credits

Here is the general process involved in lodging BAS:

- Receive the fillable form of BAS from ATO.

- Fill out the document and report all the necessary information.

- Simultaneously lodge the BAS and settle payments to ATO.

To learn more about BAS reporting refer to How to lodge your BAS.

Fringe benefits tax

- The entity does not have an FBT liability for the past years, and the current reporting period

- The entity has been registered as an FBT liability payer:

- But does not have FBT liability for the current reporting period

- But does not pay FBT liability in instalments

Record Keeping

Record-keeping is a critical aspect of running any business. If your client maintains records according to legislative requirements, it will help the client and you, as their tax agent, to:

- Prepare tax returns

- Provide evidence for income and expenses

- Claim deductions and entitlements

- Respond to queries from ATO

- Reduce the risk of tax audits and adjustments

- Resolve issues in case of disputes

- Avoid penalties

Keeping good records reduces the cost of managing your client’s tax affairs. If your client meets record-keeping requirements, you can reduce the time spent sorting and preparing your client's tax documentation.

Some guidelines for record-keeping, as provided by ATO, include the following:,

- These records may be kept in digital or physical form.

- If they are maintained digitally, ensure your client keeps a backup of the digital records.

- The documents must be in English unless they relate to transactions outside Australia.

- The necessary supporting records to show the computation must be maintained for claiming deductions. For instance, receipts from the supplier of the goods and services clearly indicate the supplier's name, amount, nature of the goods and services, date of payment and the document.

The ATO provide a Record keeping evaluation tool that may help you assess how well your clients are keeping their business records.

Identifying Updates and Additions to Taxation Requirements

Whenever a client’s taxation requirements are identified, the method of identifying updates and addition to them is by researching the laws and the regulations surrounding them. As part of your role, you are to ensure that your knowledge of taxation is current and up-to-date.

Here are some of the ways how you can conduct your research to remain up-to-date with the recent changes in taxation laws:

- Visit government websites regularly

- Follow legal news

- Attend seminars and industry body meetings

- Appoint a compliance officer

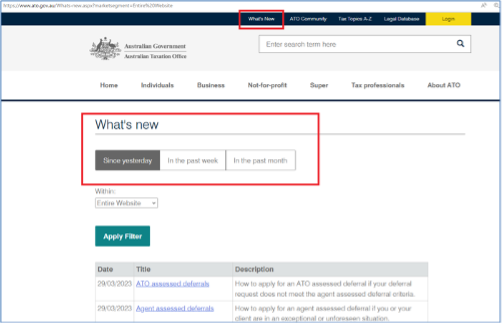

You can browse through the official website of ATO and access the ‘What’s New’ section on its homepage to access recent publications from ATO within the past month.

If you have many clients, appointing or designating one team member as a compliance officer may be worthwhile. The compliance officer’s main responsibility will be to track all taxation-related legislative changes.

Establishing Recording and Reporting Requirements

The process for establishing recording and reporting requirements based on the client’s circumstances includes the following:

- Obtain and collect all relevant information

- Study all relevant sections and rules

- Identify additional or changed requirements relating to the clients

- Understand implications keeping in mind the clients' circumstances

- Seek clarification if required from ATO

- Prepare a final updated listing of recording and reporting compliance requirements

After obtaining information, you must read all relevant sections and rules. This will help you identify the additional or changed compliance requirements, including the recording and reporting requirements. You should understand the impact, keeping in mind the client’s circumstances. In case you need clarification, you can also get guidance from the Australian Taxation Office (ATO). Here is how ATO helps taxpayers when there are updates in taxation law:

- ATO provides practical compliance guidelines (PCG) for the new tax legislation. Practical compliance guidelines provide broad law administration guidance, addressing the practical implications of taxation laws. It primarily outlines ATO’s administrative approach to certain tax provisions.

- ATO provides pieces of advice to taxpayers as to the anticipated effects of the changes in the taxation law.

Once all this is done, you can prepare a final updated listing of requirements related to recording and reporting.

After understanding the suitability of the legal entities and the compliance requirements for your clients, you must ascertain the specific requirements for preparing the tax documents for your clients.

Tax documentation includes the relevant tax forms that must be lodged with the taxation authority. It also consists of all documents specified by ATO showing the computation of taxation and supporting the information contained in the forms. These forms and documents will vary depending on the taxes applicable to your client’s business and legal entity. These are pivotal to determining tax liability and identifying whether your clients tax liability assessed by you is fair or not in the eyes of ATO.

Tax documentation preparation involves the following:

- Computing the tax liability of your client

- Ensuring required records are maintained by the client

- Completing the applicable tax forms required by ATO

To prepare the taxation documentation, you will need to determine what documents, information and records you will need to access from your clients. These can include source records, other accounting records, accounting reports and tax working papers.

You can determine the specific requirements based on the type of taxes you have identified as applicable to your clients. The requirements will also vary according to the kind of legal entity of the client.

Each tax form that needs to be prepared and lodged with the ATO specifies the information required on the form and any further information, statement or document required. Additional information may be submitted along with the form. The tax documents required would differ for each client category, be it an individual, sole-trader, partnership or company. This is because every such person's income sources, either natural or artificial, are different. The form within which they account for their income in the income tax return is also different.

To access a list of approved forms refer to the ATO’s Consolidated list of approved forms by tax topic.

Prepare tax documentation

To prepare this documentation, you must ensure the following requirements are available:

- Tak file number

- Australian business number

Tax file number

A tax file number (TFN) is a unique nine-digit number issued by ATO to individuals and other entities. TFN serves as the unique identifier of each taxpayer. That is why it is relevant to your client’s tax documentation requirements.

ATO uses TFNs to:

- Facilitate file tracking

- Match data easily

Sole traders do not need a separate TFN for their business if they already have an individual TFN.

Ways you can locate the TFN for your clients.

- Check a notice of assessment received from the ATO. Your client’s TFN will be found in the top right corner of the assessment.

- Check through myGov.

- Contact the ATO.

If your client does not have an existing TFN, you may apply on their behalf through the Australian Business Register (ABR) official website. Applying for an ABN | ABR

Australian business number

The Australian Business Number (ABN) is an 11-digit number used to identify your client’s business from other businesses. You require your client’s ABN for the following reasons:

- For applying for other kinds of registrations and applications

- E.g. getting an Australian domain name, claiming goods and services tax credits, etc.

- For identification of various source documents

- E.g. invoices

ABN entitlement refers to the right of an entity to have and apply for an ABN. Not all entities are entitled to have an ABN.

The table below shows the entities entitled to an ABN:

| Entities Who are Entitled to an ABN | |

|---|---|

| Any entity carrying on business or starting an enterprise in Australia |

In this context, an enterprise does not only include activities done in the conduct of business but also those activities connected with the following:

|

| Foreign businesses operating in Australia |

Foreign businesses operating in Australia are business entities located outside Australia but are carrying on an enterprise:

The indirect tax zone encompasses all of Australia but excludes external territories and certain offshore areas. |

Based on ABN entitlement. © Australian Business Register (ABR) for the Commonwealth of Australia.

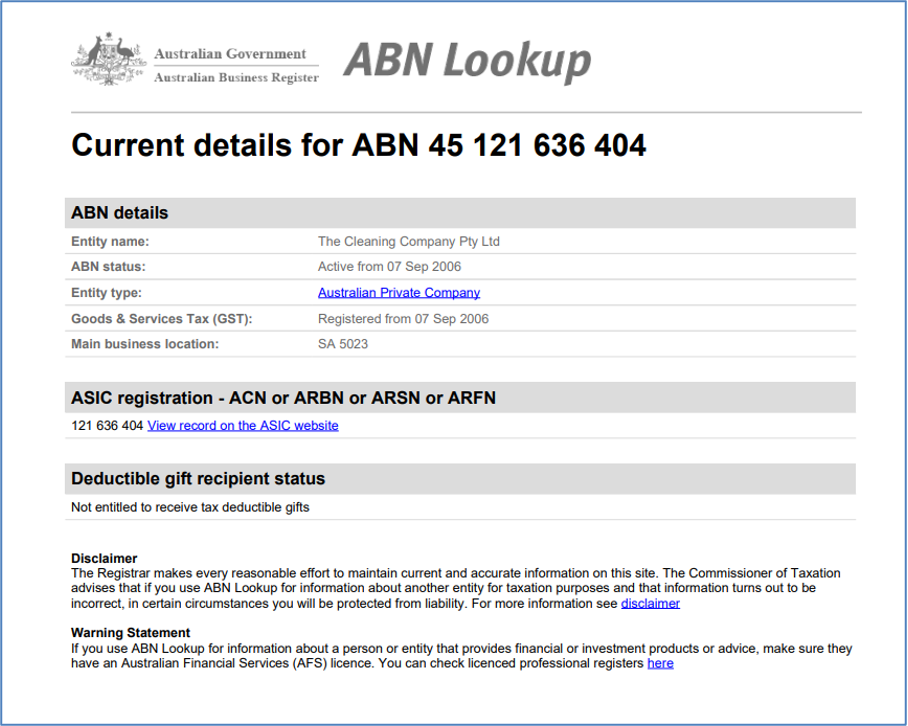

ABN Lookup is the free public view of the Australian Business Register (ABR). It provides access to publicly available information supplied by businesses when they register for an Australian Business Number (ABN).

ABN Lookup allows you to search by Name, ABN or ACN.

Learning Exercise

Australian Business Register

Access the Australian Business Register www.abr.gov.au

Required:

Identify the tax agents can provide on behalf of on behalf of clients using the tax professional's services.

Identify other requirements tax agents need to use the tax professional's services.

You can do the following activities on behalf of your clients using the tax professional's services:

Apply for an ABN

Apply for GST, PAYG and business name for your client

Apply for a TFN for your client's business

Update your client's ABN details

Cancel your client's ABN

You will need a myGovID External link linked to your Australian business number (ABN) through Relationship Authorisation Manager to use the tax professional's services.