In the previous topic, you understood the suitability of the legal entities and the compliance requirements for your clients. You also learnt how to ascertain the specific requirements for preparing tax documents for your clients. You now need to gather data relevant to your client’s tax affairs. After collecting the data, you should analyse it to extract information for computing the tax liability. Your analysis may help you identify discrepancies that require verification. These discrepancies may require you to conduct further research to resolve them. Seeking a specialist's advice and guidance will help you assess and moderate decision processes.

In this topic you will learn how to gather and analyse your client’s data as a tax practitioner. This topic will also cover your responsibilities as a tax agent, including your obligations under the code of professional conduct and managing a conflict of interest.

In this topic, you will learn how to:

- Identify and collect client data relevant to tax documentation requirements

- Analyse data to extract relevant tax information and identify discrepancies

- Obtain advice and guidance from specialists.

In the previous topic, you covered how to determine the taxes applicable to your client based on its circumstances and legal entity. You now need to identify the client’s data required for its tax documentation.

Client Data for Tax Documentation Requirements

The client’s data comprises the financial information necessary for the computation of the tax liability and the supporting documents that will serve as evidence. While the specific data may depend on the type of taxes applicable, as a general rule, the client’s data is available in the following:

- Source records

- Other accounting records

- Tax working papers

- Accounting reports

Source records

Different financial data relevant to tax calculation and documentation are collected from source records. Source records capture important transaction information like the names of the parties to the transaction, amounts paid (if any), the date, and other details of the transaction.

Here are some examples of source records:

- Sales invoice

- Purchase invoice

- Purchase order

- Deposit slip

- Sales receipt

- Timecard

Source records are frequently identified with a unique number so they can be differentiated in the accounting system. The pre-numbering of these documents allows entities to monitor and track them effectively, especially when some are missing.

Other accounting records

Accounting records are the documents that describe accounting transactions. They are used to prepare financial statements and reports for the client’s business. Financial statements include the balance sheet and the income statement of the company. You will prepare the tax documentation for your client based on the client’s financial statements.

Records help comply with all the necessary disclosures relevant to your client’s (i.e. taxpayer) tax reporting requirements. These records contain the information required for coming up with the figures you report in your client’s tax returns and ascertaining the business’s income and expenditures. Likewise, estimates and other calculations related to the details declared in tax returns should be adequately documented (s. 262A (2) of ITAA 1936).

These accounting records may include the following:

- Payment summaries - These are the records that your client must provide to each payee showing the amount you paid them for the financial year. It must also show how much you withheld from the payments.

- Accounting ledgers - These include the accounts used to record the bookkeeping entries for all transactions needed to prepare the balance sheet and income statement. These accounts may consist of cash, accounts receivable, accounts payable, accrued expenses and inventory, to name a few.

- Trial balance - This statement shows the closing balances of all accounts in the accounting ledger at a given time.

- Worksheets - These are checklists and spreadsheets that help compute the tax liability. They may include reconciliation worksheets or worksheets that may help compute net income, capital gains, and foreign income. They may also comprise tables to help calculate dividends, interest, and income distribution from partnerships or the share of income from trusts.

- Schedules - These are checklists and spreadsheets that help compute the tax liability. They may include reconciliation worksheets or worksheets that may help compute net income, capital gains, and foreign income. They may also comprise tables to help calculate dividends, interest, and income distribution from partnerships or the share of income from trusts.

- Journals - These are detailed accounts that record all financial transactions for a business. These journals are used to assist in future accounting reconciliations. Information flows from the journals to the ledgers.

Tax working papers

These include any documents used to assemble the information required for preparing the taxation documentation. These may be compiled while preparing the trial balance and reconciliation statements. They are treated as an extension of the taxpayer's records by the ATO. This is because they help reconcile the information in the tax returns and the client's accounting records.

These may include the following reports:

- Depreciation schedules - Depreciation is a non-cash expense. It reduces the book value of fixed assets held by an organisation over its estimated useful life. The depreciation schedules help calculate the fixed asset's current book value at the end of the financial year. The fixed asset’s current value is calculated by reducing the book value at the start of the financial year by the depreciation charged during the year.

- Cash flow statements - The cash flow statement provides data on an organisation's cash inflows and outflows. It shows the cash flows on account of the organisation's operating, investing and financing activities.

- Financial expenses - This report details the operating expenses of the organisation.

- Payroll - Payroll reports contain the gross and net salaries and wages paid to employees. It may also include information about withholdings against the payments. Withholdings will include regulatory tax withholdings and voluntary contributions made by the employees.

- Statements of financial - It is also known as the income statement or profit and loss statement. It provides a summary of the organisation’s performance in the financial year. It has details of the revenue, gross profit, cost of goods sold, operating expenses and profit before taxes. performance

- Statements of financial position - It is also known as the balance sheet. It is a snapshot of the organisation’s financial situation at a point in time. It reports what the organisation owns (assets) and what it owes (liabilities).

- Other reports that relate to assessable income and allowable deductions

While accounting records and reports document the details of business transactions, they are insufficient to substantiate figures reported in the tax return. Source records serve as the basis of the evidence of these accounting records. The ATO considers tax working papers as a kind of source document too.

Records and reports are useful in complying with all the necessary disclosures relevant to your client’s (i.e. taxpayer) tax reporting requirements. They contain the information required to compute the figures you report in your client’s tax returns and ascertain the business’s income and expenditures. Likewise, estimates and other calculations related to the details declared in tax returns should be adequately documented (s. 262A (2) of ITAA 1936).

Identifying Relevant Data

Taxes that will apply to your client depend on the client’s legal entity and type of business. This section will help you identify the client’s data required for tax documentation preparation.

The records required for determining the taxpayer’s assessable income may include the following:

| Accounting Records | Source Records |

|---|---|

|

|

Income Tax – Allowable Deductions

Your client’s expenditures may only be claimed as an allowable deduction provided:

- They are substantiated with complete and accurate records

- They relate to the business’s use

The records relevant to the taxpayer’s expenditures may include the following:

| Accounting Books | Source Documents |

|---|---|

|

|

Goods and Services Tax – Client Data

ATO recommends businesses have a separate ledger for GST recording purposes. This will make record-keeping and calculations relating to GST transactions easier. Every GST transaction the entity records should be accompanied by relevant supporting documents (e.g. receipts, tax invoices, sale invoices). The ATO can make necessary adjustments to your client’s claims if the supporting documents provided by your client are deemed insufficient.

A tax invoice is one of the most relevant records that your client must keep concerning GST. GST credits from a taxable sale of more than $82.50 can only be claimed if a tax invoice has been issued for such a sale.

To learn about the requirements relating to tax invoices and other information relating to GST record-keeping refer to Tax Invoices

Fringe Benefits Tax – Client Data

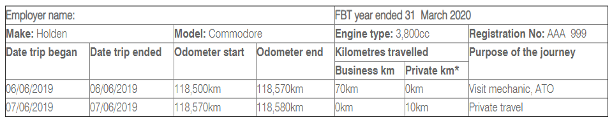

The taxable value of fringe benefits provided by an employer must be ascertained with sufficient source records, such as invoices, receipts, logbooks, odometer records, employee declarations, etc. Estimates and other agreements made concerning fringe benefits should likewise be documented appropriately. Suppose an associate of the entity was the one who provided the FBT (fringe benefits tax). In that case, the associate should document the transaction accordingly and send copies of such documentation to the entity within 21 days of the FBT year.

Here is a sample car logbook record provided by ATO:

Sourced from Fringe benefits tax - a guide for employers. © Australian Taxation Office for the Commonwealth of Australia

To learn more about the record-keeping requirements for fringe benefits tax refer to Fringe benefits tax recordkeeping.

Collecting Client Data

After you have identified the required data based on the applicable taxes, you need to for from the client. You may collect the data by requesting the client, its bookkeeper or the accounts department for the relevant reports. If the client manually maintains its books of accounts, you may ask for the physical books. Today most businesses use a cloud accounting system, and the required reports can be directly downloaded.

You may also request the source records if the scope of work you have contracted with the client involves verifying accounting records against the source. In other cases, collecting all the source records from your clients is not mandatory. However, it is recommended that you collect a sample of the source records if it is a new client. You may also seek sample source records if the client’s records show an inordinately large volume of cash transactions.

In the previous subtopic, you learnt how to collect all relevant records and reports from your client pertinent to the applicable taxes. The next step towards taxation documentation preparation is analysing the data. This is to help you extract the relevant tax information and identify discrepancies in the data.

Extracting Relevant Tax information

After obtaining all the required records and reports from your client, you must analyse the same. This will help you extract the information needed for the computation of tax liability and preparation of taxation documentation. Analysing data to extract relevant tax information entails identifying the requirements from the client’s reports and records to compute the tax liability and complete the taxation documentation. For instance, you will analyse the capital expenditure and depreciation schedules to calculate your client's tax deduction for depreciating assets and other capital expenses. You may review the purchase report to determine the GST credit and the income tax deduction for your clients.

Analysing Client Data to Extract Tax Information

Missy Ori, a registered tax agent, is required to file the tax documentation for Alice Springs, her client. She obtains the purchase report from her client in order to get the necessary data for filing the returns. She studied the purchase report and the related tax invoices to analyse the transactions. She saw that Alice had purchased stationery for her business at $2,200 and parts at $1,100. The tax invoices show that GST was included in the purchase value at $200 and $100, respectively.

Missy will extract this information as under:

- GST credit in BAS of $300 (i.e. $200+$100)

- Income tax deduction in Alice’s tax return of $3,000 (i.e. $2,000+$1,000)

You need to analyse the client’s data to identify the information that needs to be used. Once you have determined the required information for each lodgement, you may extract it in the following ways:

Manually

You may manually transcribe the required information from the records and reports. You may maintain internal formats for taking note of the data required for computing figures to complete tax documentation. You may even complete the information in simple lodgements cases directly in the prescribed taxation documentation. This is suitable for smaller clients with simple and few transactions and employees.

Using spreadsheets

You may maintain spreadsheets to automate the calculations and computations required to prepare taxation documentation. Spreadsheets are computer programmes used to capture, present and compute data arranged in rows and columns. You need to identify the relevant data from the records and reports and input them into these spreadsheets.

Using tax preparation software

You may use specialised software that integrates seamlessly with your client's accounting software. This is particularly helpful for practitioners and agents with large clients with numerous or complex transactions. The advantage of using this software is that they help you centralise your client data. They improve productivity and reduce risk by providing automated workflows from bookkeeping to accounts finalisation and tax preparation. They assist in data analytics and help you gain valuable insights from large amounts of client data.

Click on the following links to learn more about some tax preparation software available in Australia:

- GovReports

- Access

- Xero Tax

Identifying Discrepancies

Generally, tax practitioners are not required to verify the accuracy or completeness of the information provided by their clients. This is provided that the information seems reasonable. Also, the client should have declared the reliability of these records in writing. However, suppose the tax practitioner notices that there are outright discrepancies in the data provided by the client. In that case, the tax practitioner should have the diligence to seek further clarification to ascertain the reliability and completeness of the data. When you analyse the data to extract taxation information, you may also be able to identify any discrepancies in the data.

You can additionally identify discrepancies by the following:

- Benchmarking against other clients

- You can identify the usual expenses and income reported by certain entities. You then use it as a benchmark in analysing whether the information provided by your client is complete and accurate.

- Comparing to previous years’ tax documentation

- Any significant variation without a corresponding change in activity levels should be investigated further.

- Investigating items not in line with business activity

- Any item that is not justified by the size and scale of the business activity may point towards a discrepancy.

- Running reconciliation reports

- You may conduct reconciliation by using different reports to ensure no discrepancies in the data.

- Checking the industry benchmarks that the ATO uses

- The ATO arrives at industry benchmarks from the information provided to them on the tax returns and activity statements. They can be used to analyse business performance and activity. They can also help identify businesses that show significant variance from the industry averages.

ATO identifies that an entity is paying less tax by looking at the following:

- Cost of goods sold turnover

- Labour to turnover

- Rent to turnover

- GST-free sales to turnover

- Motor vehicle expenses to turnover

To learn more about industry benchmarks to identify discrepancies and resolve them refer to Small business benchmarks.

Discrepancies may arise due to accounting or clerical errors while inputting data, carelessness or system errors. They may also be caused by incorrect classification of expenses, assets or workers of the organisation.

Common discrepancies may include:

- Under or overpayment of superannuation guarantee to the employee’s superannuation fund

This could be caused by the incorrect application of ordinary time earnings (OTE). OTE is the amount paid to employees for ordinary work hours, including commissions and shifts. - Workers not correctly classified as employees or contractors

It is important to classify your workers accurately to apply the correct tax treatment. If you classify workers who are contractors as employees or visa versa, your fringe benefit tax calculations will be discrepant. - Errors in the fixed assets register

Fully depreciated assets with written-down value may not be removed from the fixed asset register, causing additional depreciation to be claimed. - Errors in manual data input

Discrepancies may creep in if there are errors in capturing the GST component of purchases made or fringe benefits data like entertainment, taxi travel or subscriptions.

Once you have identified discrepancies, you will need to:

- Check the discrepancy against the source records for input, clerical or accounting errors. You may discuss with the client to verify the details and understand the reasons for the issues identified.

- Conduct research for their resolution. Some discrepancies may involve looking at other reports to identify the reasons for the discrepancy. You may need to search for applicable provisions in the taxation requirements to understand how to resolve them. You may also search for previous rulings on similar instances. Lastly, seeking specialists' advice and guidance may also help resolve them.

Taxation is a complex process. The calculations may be challenging, and the laws are not as straightforward as expected. You may often find yourself at a roadblock where you are not fully confident about your decisions. Some of the information you have may not be enough or is confusing. You may have come across discrepancies that you need help resolving. You may wish to have someone more experienced in the field evaluate and moderate your decisions and the process you followed.

In any such situation, the best way out is to approach a specialist who might be able to give answers to all your queries.

Knowing where to obtain advice and guidance when situations arise is important. In this subtopic, you will learn how advice can be taken from specialists and how they can be approached for guidance.

Specialists

A tax specialist is a financial expert who has received additional training and has a thorough understanding of tax accounting and legislation. In complex financial situations, the services of a tax specialist are generally employed to minimise taxes payable while keeping compliant with the law. Examples of tax experts are tax attorneys, enrolled agents and some financial counsellors.

A specialist is someone who:

- Has an advanced level degree in the field of tax

- Has been working in the field of taxation in Australia for a considerable period, not anytime less than 5 years

- Is a coveted person in the field of taxation

- Has good reviews by people who have availed of their services

Specialists may be tax agents themselves. They may also be tax professionals who only specialise in a particular area of taxation.

Tax Agents

Tax agents are the only people authorised to charge a fee for rendering tax services to a client. To be a tax agent in Australia, one must be registered with the Tax Practitioners Board (TPB).

The following table outlines the legislation governing the practice of tax agents in Australia:

| Legislation | Description |

|---|---|

| Tax Agent Services Act 2009 | Establishes the Tax Practitioners Board and provides for the registration and regulation of tax agents, BAS agents and tax (financial) advisers |

| Tax Agent Services Regulations 2022 (TASR) |

Contains:

|

| Tax Agent Services (Transitional Provisions and Consequential Amendments) Act 2009 | Contains the transitional and consequential matters arising from the enactment of the TASA |

| Tax Laws Amendment (2013 Measures No. 2) Act 2013 | Creates a regulatory framework for tax (financial) advice services and contains the transitional provisions for registration as a tax (financial) adviser |

There are specified qualification requirements for tax agents. An applicant may register as a tax agent through one of the following options:

- Tertiary qualifications in accountancy

- Diploma or higher award in accountancy

- Work experience

- Tertiary qualification in another discipline

- Tertiary qualification in law

- Membership of a professional association

An ethical requirement of tax agents included in TASR is that they must have the minimum required qualification and experience to act as individual tax agents.

A tax agents must have completed the required courses and certifications to:

- Prepare tax documentation for legal entities

- Lodge the documents on their behalf

- Act as tax specialists

Tax Practitioners Board

The key functions of the Tax Practitioners Board (TPB) include:

- Administering the registration of tax and BAS agents

- Administering the code of conduct for tax and BAS agents

- Enforcing all legislation relevant to the practice of tax and BAS agents and impose an appropriate sanction in case of non-compliance.

Code of conduct

Registered tax and BAS agents must adhere to principles in their code of professional conduct. The code of conduct for tax agents is grouped into the following categories:

- Honesty and integrity

- Independence

- Confidentiality

- Competence

- Other responsibilities

To learn more about the TPB’s Code of professional conduct refer to Code of Professional Conduct

Continuing professional education

An ethical requirement for tax agents included in the Code of Professional Conduct obligations under TASA is to maintain knowledge and skills relevant to the tax agent services they provide. To prepare tax documentation for legal entities, knowledge and skills are required to compute tax, advise clients, determine what is considered part of taxable income and allowable deductions.

To learn more about the TPB’s requirement for continuing professional education refer to Continuing professional education.

Professional indemnity insurance

All registered tax and BAS agents are required to have adequate indemnity insurance to cover any loss that the agent’s clients may suffer due to their conduct concerning the tax services they provided as tax agents.

To learn more about the TPB’s requirement for Professional in refer to Professional indemnity insurance.

Penalties for unregistered conducts

Only registered tax and BAS agents can charge or receive a fee or other compensation for providing tax agent, BAS or tax (financial) advice services. The TPB Register contains details of registered, suspended and deregistered tax and BAS agents and penalties for breaching civil penalty provisions in the TASA.

To learn more about the full provisions regarding civil penalties for tax agents refer to Civil penalty provisions.

Managing conflict of interest

A conflict of interest may arise when your personal interest conflicts with your duty as professional providing tax services. Most types of conflict of interest are financial in nature. This means that a financial gain or loss may be perceived. For example, a situation where a tax agent is asked to manipulate the information of his client’s tax return in exchange for additional compensation will pose a conflict of interest that is financial in nature. The conflict lies between the agent's interest in earning more and his duty to provide complete and accurate tax information to the taxing authorities.

The Tax Practitioners Board has provided three mechanisms on how you can manage conflict of interest.

- Avoid

- Control

- Disclose

Avoid - You may choose to decline an engagement where a conflict of interest is inevitable, or you may have difficulty managing a conflict of interest.

Control - To control conflict of interest, you need to identify the risks, assess the risks, and implement measures to mitigate these risks. For example, a tax agent should be assigned to another client if the tax agent is a close friend of the competitor of the client currently assigned to him.

Disclose - Immediately inform stakeholders of any possible conflict of interest. Disclosure of potential conflicts of interest to the client is essential while preparing tax documentation. This will enable them to decide which information to disclose to you for preparing tax documentation. For example, suppose you also prepare tax documentation for a competitor. In that case, the client may provide you with purchase information without disclosing the names of service providers and suppliers to avoid a conflict of interest.

To learn more about how you tax agents can manage a conflict of interest refer to Manage conflicts of interest.

Decision Process

The decision process refers to the chain of command that follows whenever a decision needs to be made concerning preparing and lodging your clients’ tax returns. The final decision falls on the client as they are the person on whom the liability is imposed. However, registered tax agents must ask the client for all the relevant documents required for preparing a return and compile them so that the taxable income and the deductible expenses are clearly identified.

- Tax Agent

- Advises what income needs to be included and what deductions need to be considered for calculating the assessable income, as per the law.

- Client

- Given estimates of the taxable income and deductible expenses.

- Client

- Decides what deductions they want to claim

- Tax Agent

- Checks for any errors of amissions

- repepares the final return for lodgement

The first decision point in the process falls on the tax agent. They must decide which income needs to be included and what deductions need to be considered for calculating the assessable income, as per the law.

The next person in the decision-making chain is the client, who is given the estimates of the taxable income and deductible expenses along with the final tax obligation falling on them. They are also advised on what income and expenses are included and how to reduce tax liability.

In the third stage, the client decides what deductions they want to claim, as they must show all the income they have earned and declared. Once this is finalised, the tax advisor revisits the return to see any errors or omissions and prepares the return for final lodgement.

Decision Process

Dan Jones Pty Ltd is a company that has appointed B Admen as its tax agent.

- Dan Jones Pty Ltd will provide all the required documents to B Admen in this case.

- Then, B Admen will make a draft return by deciding what incomes will be included and what deductions need to be claimed.

- B Admen then shows this draft return to Dan Jones Pty Ltd, who then finalises it as per their understanding and advice given by B Admen.

- Once this is done, Dan Jones Pty Ltd allows B Admen to proceed with filing the return.

- B Admen then prepares the final return.

- He then runs it through Dan Jones Pty Ltd and gets the requisite signatures.

- Finally, B Admen files it with ATO.

Learning Exercise

Decision Process

Sitting by the Sea Pty Ltd owner, James Jackson has appointed Trained for Tax to complete his business tax return. Order the decision process for preparing Sitting by the Sea Pty Ltd's tax return by placing 1 to 7 against each task.

| Trained for Tax then shows this draft return to Sitting by the Sea Pty Ltd, who then finalises it as per their understanding and advice given by Trained for Tax. | |

| He then runs it through Sitting by the Sea Pty Ltd and gets the requisite signatures | |

| Once this is done, Sitting by the Sea Pty Ltd allows Trained for Tax to proceed with filing the return. | |

| Sitting by the Sea Pty Ltd will provide all the required documents to Trained for Tax in this case. | |

| Finally, Trained for Tax files the return with ATO. | |

| Trained for Tax, then prepares the final return. | |

| Then, Trained for Tax will make a draft return by deciding what incomes will be included and what deductions need to be claimed. |

3. Trained for Tax then shows this draft return to Sitting by the Sea Pty Ltd, who then finalises it as per their understanding and advice given by Trained for Tax.

6. He then runs it through Sitting by the Sea Pty Ltd and gets the requisite signatures

4. Once this is done, Sitting by the Sea Pty Ltd allows Trained for Tax to proceed with filing the return.

1. Sitting by the Sea Pty Ltd will provide all the required documents to Trained for Tax in this case.

7. Finally, Trained for Tax files the return with ATO.

5. Trained for Tax, then prepares the final return.

2. Then, Trained for Tax will make a draft return by deciding what incomes will be included and what deductions need to be claimed.

Evaluating and Moderating Decision Process

Changes in tax law are frequent, and these changes also affect the decision process. Additionally, as per the changing requirements and client’s profile, these processes might require changes. Therefore, it becomes essential to evaluate these processes regularly.

When evaluation, the client and the tax agent should sit together before the start of the financial year to finalise how the decision-making process will happen and who will be a part of it. If it is decided in advance, later hassles can be avoided.

The most effective way to evaluate the success of a decision process is to identify if it led to smooth drafting and lodgement of a return during the financial year when it was employed. If so, the same approach should be retained with the changes required as per law. Otherwise, a new system should be devised.

To moderate the decision process, the tax agent must ensure that the tax returns are lodged on time. This requires maintaining constant contact with all involved. They should also ensure that the data is reviewed, and decisions are taken within the established timelines. Any delay could affect the return filing date and result in late penalties for the client.