Before submitting activity statement reports, they should be properly prepared and reconciled so that any errors can be identified or amendments made from bookkeeping entries.

As preparation to complete the required activity statements, there are many things you can do to ensure you are prepared with the latest information. Put yourself in the shoes of a BAS agent returning to the workforce...

The first step in preparation for submitting financial figures to the ATO is to reconcile all of your accounts in your bookkeeping system against what has happened at the bank, in real life.

Spot the differences

This activity will reveal any transactions or activity that doesn't align between what your bank statements show (including credit cards) as truth versus what your books report as truth. Sometimes the variance is simply due to timing, i.e., a check that was issued and accounted for during one accounting period but deposited three months later so the bank recorded the transaction in the following period. We'll go over other reasons this happens a bit later in the topic.

Fix the problems

In order to get the books to balance, a bookkeeper needs to adjust the books to accommodate these variances that cause the two systems (banks and books) to be misaligned.

This involves a process of checking the bank account figures against the accounting figures to look for errors then fixing them before moving on to the next step. You'll be looking for a match between the transaction recorded in your books to the transaction appearing on the bank statement. If you are not familiar with the concept of matching bank transactions to those in accounting software, or manually in journals, visit this MYOB help page, Matching bank transactions, to learn the concepts.

Review extraordinary transactions

Transactions that are deemed extraordinary in an accounting system should be reviewed to ensure compliance. It can include transactions involving capital acquisitions and imports. For example GST errors can be on importing or exporting goods and services.

Here is an example of an MYOB community post concerning the reporting of the Capital Acquisitions correctly.

MYOB Community member, Mandy: Good afternoon all

We recently purchased some assets and financed it. I have raised the entries in Myob, but when I run my GST report to complete the BAS, the Capital Acquisitions come up as a negative sale, with negative tax collected. I am new to Myob, and didn't set up any of the tax codes etc. Does anyone know how to fix this?

MYOB Community member (former staff of MYOB), Liam: Hello

How were the acquisitions recorded? Was it done using a general journal entry. If so, then please open that transaction by clicking the arrow next to it on the transaction journal. At the top of the screen you'll see the text 'display in GST [BAS] reports as.' Here you'll have the options Sale and Purchase. Make sure purchase is selected. Also make sure that the tax code CAP is on the debit line of the transaction, rather than the credit.

MYOB Community member, Mandy: Thank you so much Liam. I can't believe it was as simple as that!

MYOB also offers assistance to help recording overseas purchases and import costs and a more generalized help page, prevent common errors on the BAS. Study those at MYOB in order to help you understand the concepts so you can apply them to any accounting system.

Reconciling the bank account manually

This activity is a process of preventing, finding, and fixing errors.

Start by watching the following video, which provides instructions to reconcile the bank account to the books without a computerised accounting system.

Note: a cash book is a financial journal that contains all cash receipts and disbursements, including bank deposits and withdrawals. Entries in the cash book are then posted into the general ledger.

The video points out the types of problems that could prevent the bank account from reconciling.

Here are three categories of common issues:

- Omissions - transactions on the bank statement, but not on the books, i.e., missing receipts, bank fees, and interest received.

- Timing differences - when the bank and book transactions occur in different reporting periods. This could be deposits in transit (also called unrecorded deposits), outstanding, or bounced checques or electronic funds that have not been processed yet.

- Errors - look in the books for errors first as it is more likely there than in the bank statement.

Now that you have an idea of how to reconcile from the video, follow these steps to the same destination.

- Trial balance vs General Ledger:

Confirm your asset, liability and equity accounts' prior ending balances are exactly equal to this period's opening balances in case a mistake was made transferring an opening balance for a new financial period.- It's a good idea to ensure your temporary revenue and expense accounts start at zero at the beginning of each accounting period.

- To compare beginning and ending account balances, look at your company's adjusted trial balance from the previous accounting period and the general ledger from this accounting period you are reporting.60

- For asset, liability, and equity accounts, match the ending balance on the trial balance to the general ledger's beginning balance. Revenue and expense accounts should start with a zero balance.60

- For example, for a quarterly reconciliation, compare the cash account balance from the trial balance report as at 30 September to the opening balance in the general ledger as at 1 October.

- Do this task for all of the accounts.

- Reconcile accounts to the general ledger:

- You may need to refer to source documents such as receipts, bills, invoices etc. to confirm dates, dollar amounts, and accounts.

- Match each transaction from the journal to the general ledger, and then to the bank statements using source documentation as necessary. Provide a tick each time you get a match between the cash account in the general ledger, and the bank statement.

- Investigate the items without ticks:

- Clerical errors, timing, a bounced cheque, bank fees, automatic bank fees (refer to the list of possible errors.)

- Create adjustment entries, or correcting entries:

- Record a balancing entry to account for the variance.

- For example, someone incorrectly recorded a payment from a customer as $49.00, however the bank showed the deposit was actually $490.00. There won't be a tick near either transaction because it doesn't match. Investigation will reveal the error. To fix it, you can reverse the incorrect entry by switching the accounts originally debited and credited first - which will essentially cancel it out. Then, record the correct entry.

- If the transaction was missing altogether rather than mis-entered, you would simply enter the transaction into a journal entry and the ledger as if you hadn't missed it to fix the error.

- Record a balancing entry to account for the variance.

- Prepare adjusting entries:

- such as depreciation

- You can now run the reports needed to report BAS (shown in the section below.)

Activity: See if you remembered the seven steps from the video:

Reconciliation activities to prepare to complete the BAS using MYOB

It's best to do them in the order presented.

- Reconcile all of your bank accounts.

- Reconciling ensures that the bank account balances in your accounting system (or spreadsheets) match your bank’s records. It may not balance because of bank fees and other fees that have been automatically deducted from your account but have not been entered into the system yet.

- If you are not using an accounting system, you will need to do this entirely by hand.

- MYOB help provides this video to show how it's done in MYOB if you have Bank Feeds set up. Bank feeds provides a link between your bank and your accounts on MYOB. Directions are provided below for doing this task manually.

- How to manually reconcile bank accounts in MYOB without bank feeds or imported bank statements.

- Go to the Banking menu and choose Reconcile accounts.

- In the Account field, enter the account you want to reconcile. The Last reconciled date for this account is shown.

- For the Statement date, choose the closing date that appears on your bank statement. Only unreconciled transactions dated on or before that date will appear. If you're reconciling as at the end of a week or month, and your statement has transactions dated later, choose the last day of the period you’re reconciling.

- In the Closing bank statement balance ($) field, type the closing balance that appears on the statement your bank sent you. If you're reconciling as at the end of the week or month, and your statement has transactions dated after that date, type the closing balance for the last day of the period you’re reconciling.

- For each entry on your bank statement, select the corresponding transaction on the Reconcile accounts page. The Calculated closing balance will update to show the expected closing balance of the statement, based on the transactions marked as cleared in the list.

- If a transaction on your bank statement hasn't yet been recorded in MYOB, record it now then come back and complete the reconciliation.

Note: If want to save what you're doing and complete reconciliation later, click Save progress (at the top right). Any transaction selections you've made in Reconcile accounts are saved when you go to other pages. - When the Calculated closing balance equals the Closing bank statement balance and there is no Out of balance shown, click Reconcile.

- If you want a PDF version of the reconciliation, click Export

- Reconcile the Accounts Receivable and Payable

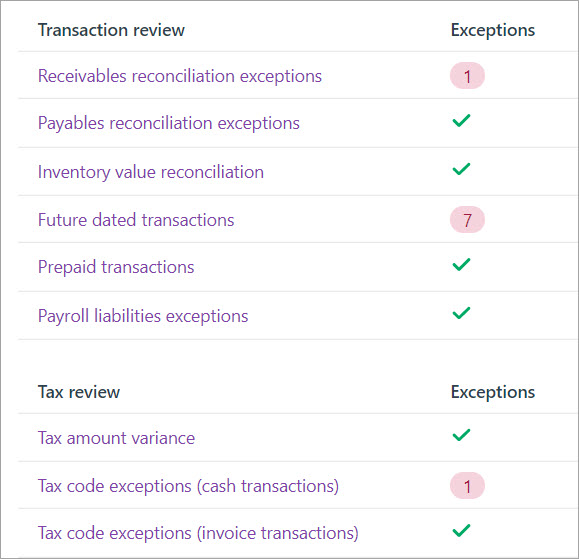

- In MYOB, this means going to the exceptions dashboard. (Reports on the main menu > Exceptions dashboard tab)

- Check the dates

- Click Run review to start the review. If a review finds any exceptions, the number of exceptions will be shown for that review. A green tick means no exceptions were found, as shown above.

- A different set of books shown below, indicates there were a total of nine exceptions. The exceptions may not represent errors, but you need to investigate if you are unsure of why it appeared.

- MYOB provides the table below for finding and fixing exceptions. We've included links to MYOB help centre to provide additional MYOB support:

What to look for Possible cause Solution Wrong account used on a sale The receivables linked account (sometimes called the Trade Debtors account) has been incorrectly used on a sale.

Remember to never post directly to the receivables linked account, otherwise it won’t update the individual customer accounts.

Delete the sale and enter it again using the correct allocation account. This is typically an income account. Wrong feature used to record a sale Recording a customer payment using receive money instead of an invoice payment. Delete the transaction and record it again using the correct feature.

If the payment relates to an invoice, record it using an invoice payment.

Incorrectly allocated journal entry A journal entry allocated to the receivables linked account.

Remember to never post directly to the receivables linked account, otherwise it won’t update the individual customer accounts.

Delete the general journal entry and enter the transactions correctly as an invoice or customer payment. Timing issue A customer payment or credit may be dated earlier than the invoice to which it has been applied.

This will create a false out of balance.

To check if you have a false out of balance run the Receivables reconciliation exceptions report at a future date. For example "31/12/9998". If the report balances on this date look for any transactions dated in the future by mistake. You may need to delete the transaction and enter it again using the correct date.

- MYOB provides the table below for finding and fixing exceptions. We've included links to MYOB help centre to provide additional MYOB support:

- In MYOB, this means going to the exceptions dashboard. (Reports on the main menu > Exceptions dashboard tab)

- Once you have investigated all of your exceptions and corrected actual errors, you are ready to prepare the reports that you will use to complete the BAS statement, or provide to an advisor.

BAS specific reports in MYOB

The following reports are required to prepare the BAS form, or give to the BAS agent or advisor that is helping. The names of the reports are specific to MYOB, but there should be equivalents in all accounting systems and practices.

- GST Detail report first, then fix any errors

- GST Report for exceptions

- GST Return – note that this has Payroll figures showing as well, but if you haven’t set up payroll yet, it won’t be the complete picture for your BAS. In this case, you also run the Payroll Summary report.

- Balance Sheet

- Reconcile the GST Balance to what's in the balances sheet

- Payroll summary

- Total wages and salaries

- Salary sacrifices get deducted from above before the BAS

- Reconcile total wages against Wages in P&L for period

- PAYGW Summary Report reconcile to PAYGW payable in the balance sheet.

Further assistance in finding out of balance issues in MYOB

Follow the steps below to determine if your out of balance is caused by your current reconciliation or a previous reconciliation.

- Go to the Banking menu and choose Reconcile accounts.

- Enter the Bank statement closing date as the same date as your Last reconciled date.

- Enter your Closing bank statement balance as the closing balance on your Last reconciled date (you might need to check your previous bank statement for this).

- Deselect all transactions on the Reconcile account page.

- If there is no Out of balance, the problem is with your current reconciliation. If there is an Out of balance you'll need to check your previous reconciliations as a previously reconciled transaction may have been changed or deleted.

Check these possible issues with the current reconciliation

- If this is your first reconciliation, check that your account opening balance doesn't include any uncleared transactions. If it does include uncleared transactions, change the account opening balance.

- Did you type the correct figure in the Closing bank statement balance field? You need to type the closing balance from your bank statement, not the opening balance.

- Did you enter the correct date (that of the closing balance from your bank statement) in the Bank statement closing date field? An incorrect date may prevent some transactions from appearing in the list.

- Did you select all the transactions that appear on the bank statement? If not, some transactions might not have been accounted for in the reconciled balance.

- Did you select, by mistake, a transaction that didn’t appear on your bank statement? If yes, you need to deselect this transaction.

Perform these tasks to check previous reconciliations

- Go to the Reporting menu and choose Reports.

- From the Banking section click to run the Banking reconciliation report.

- For the Bank statement date, enter or select the date of your previously reconciled bank reconciliation. If you're not sure of the dates, check the Banking reconciliation report (Reporting menu > Reports > Banking tab > Banking reconciliation).

- Work back until you find a month where the out of balance is zero ($0.00). This identifies that the suspect transaction(s) will have occurred in the following month.

- Identify which transaction(s) are causing the out of balance by comparing the Banking reconciliation report with the corresponding bank statement.

- Correct the transaction(s) causing the out of balance. You can open a transaction to edit or delete it by clicking its reference number. See Editing bills, Editing invoices or Deleting transactions.

- Re-reconcile the corrected transaction(s).

- Repeat with each subsequent reconciliation until no more out of balances are found.

- If no reports balance it is possible you have changed your account opening balance.

Undoing a reconciliation

If your issue relates to a previous reconciliation (perhaps a transaction was incorrectly reconciled, or a wrong date was used) and you haven't been able to fix these issues, try undoing the last reconciliation. All transactions for that period will return to an unreconciled state, and you'll need to reconcile them again using the previous bank statement.

- From the Banking menu choose Reconcile accounts.

- If you only want to show reconciliations you've completed on a particular account, choose that account from the Account dropdown list.

- Click Undo last reconciliation.

- Click Yes to the confirmation message.

Activity: Preparation activities to complete the BAS

The BAS form will be sent to the ABN holder according to the payment schedule the ATO has set up for the business.

The BAS form will clearly indicate the following information.

- Reporting period - Your business activity statement should clearly mention the reporting period on it. The start date as well as the end date of the reporting period should be stated.

- Document ID - This is a number that is unique to every business as well as unique to every statement. Hence, every BAS that you submit will have a different document ID. This ID helps to identify your BAS if and when required.

- Australian Business Number - The ABN is another mandatory requirement on a business activity statement. With the help of the ABN, the taxation authorities can determine which business the BAS is being submitted for.

- A deadline for submission - the BAS form will indicate the date of submission and payment, based on your submission schedule.

- In the event that the final submission date is a holiday or a weekend, the ATO allows businesses to submit the BAS on the first working day after the holidays.

- In case you do not submit the BAS and pay the tax by the deadline, your business may incur payment penalties.

Once it is complete, it must show:

- the date when the report was lodged

- the date when the relevant tax was paid (for credit)

- the mode of payment, such as cash, cheque, etc.

- details of the tax that is being reported and paid by the respective businesses

- a summarised version of the taxes being reported

- whether you have a pending tax liability or you are expecting a refund from the taxation office.

- an authorising signature

Note: It is mandatory to file a BAS for every tax period as specified by the ATO. Whether or not an organisation has done any business in that period is irrelevant. If no business has been transacted in that particular tax period, the BAS for that period will be referred to as a nil report.

Standard Business Reporting61

Standard Business Reporting or SBR is a standard approach to online or digital record-keeping that was introduced by the government in 2010 to simplify business reporting obligations.

- SBR is built into business/accounting software such as MYOB making it SBR-enabled.

- SBR incorporates standard terms that are used in government legislation and reporting. These terms are then linked to terms that are in the business/accounting software, creating consistency for business and government.

- SBR extracts information that has been recorded in business/accounting software as part of running your business and prefills this into the relevant government report. The report can then be checked for accuracy and submitted directly and securely to the government.

- Compared to other ways of lodging government reports, SBR can reduce preparation and submission time to a matter of seconds.

How it works

- Reports available within SBR-enabled software use a dictionary of standard terms needed for each report. These standard terms are used across government for multiple reporting requirements as well as for software development.

- When you select the relevant report to be completed, your SBR-enabled software knows what information is needed for that report and fills it out for you.

- If you agree with the information presented in the report, you can send it securely and directly to the relevant government agency. If you need to make changes, you can also do that in your business/accounting software and submit an updated report.

- You then receive immediate confirmation from the government agency saying the report was received.

You can find out more about SBR at the ATO.

There are many different forms the ATO may send the business based on the information provided to the ATO when it first registered.

The BAS form is separated into these sections:

- GST

- PAYG Instalments

- PAYG Withholding

- FBT, LCT, WET and FTC

- Summary section

The form you receive from the ATO may not have all of the sections on it. The sections included in the form are dependent on reporting requirements and determined when the business was first registered. Review the list of approved BAS forms at the ATO. The table shows what sections each form includes.

Completion instructions

- Check your reporting period

- Leave labels blank if they don’t apply to you unless otherwise instructed (don't use N/A or nil)

- Round down to whole dollars (don't show cents)

- Print clearly using a black pen

- Don’t report negative figures or use symbols such as +, −, ÷, $.

Download this Sample BAS form and keep it open in a browser window or tab, so you can refer to it as we explain how to complete the fields.

- GST - The 'G' labels

- PAYG Withholding - The 'W' labels

- PAYG Instalment - The 'T' labels

- FBT - The 'F' labels

- LCT, WET and FTC - Labels 1 and 7

1. GST - The 'G' labels

The GST section of the BAS allows you to:

- report and pay the GST your business has collected

- claim GST credits.

There are two methods of completing the GST portion of the Activity Statement:

- Accounts method

- Calculation worksheet method

1. Accounts method62

The accounts method is a way of completing an activity statement directly from accounting records. To use this method, the records must be able to:

- readily identify GST amounts for sales, purchases and importations

- separately record any purchases or importations that were for either private use or making input taxed sales

- identify any GST-free or input taxed sales.

If the records are set up in this way, the business can add the relevant GST amounts at the end of each reporting period and report them at the appropriate labels on your activity statement.

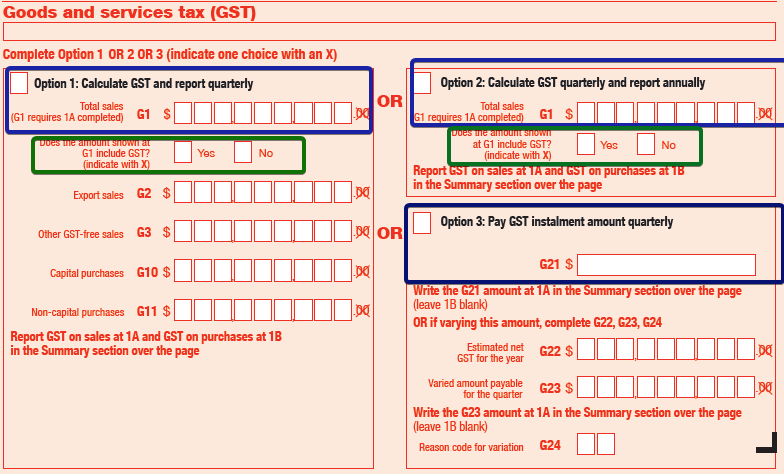

The amounts reported on the activity statement at G1 (total sales) can be GST inclusive or GST exclusive. It will need to be indicated whether the amounts include GST by marking either Yes or No with an “X” in the box under G1.

You can choose to exclude GST from G1 only if you are using the accounts method. You must include GST in amounts you report at all labels on your BAS if you are using the calculation worksheet method.

To use the accounts method, these amounts will need to be recorded from the accounting records and transferred to the activity statement. Depending on which reporting option is being used, not all of the GST labels indicated are required to be reported on each activity statement.

If you use the accounts method, you must complete labels G1, G2, G3, G10 and G11 for information purposes only. If necessary, you can estimate the amounts on a reasonably accurate basis from your accounts.

Include the GST on the taxable sales only if you have chosen to report amounts that include GST. If you have chosen to report GST-exclusive amounts, don't report the GST component on your taxable sales at G1.

Learn more about the Accounts method at the ATO.

2. Calculation worksheet method

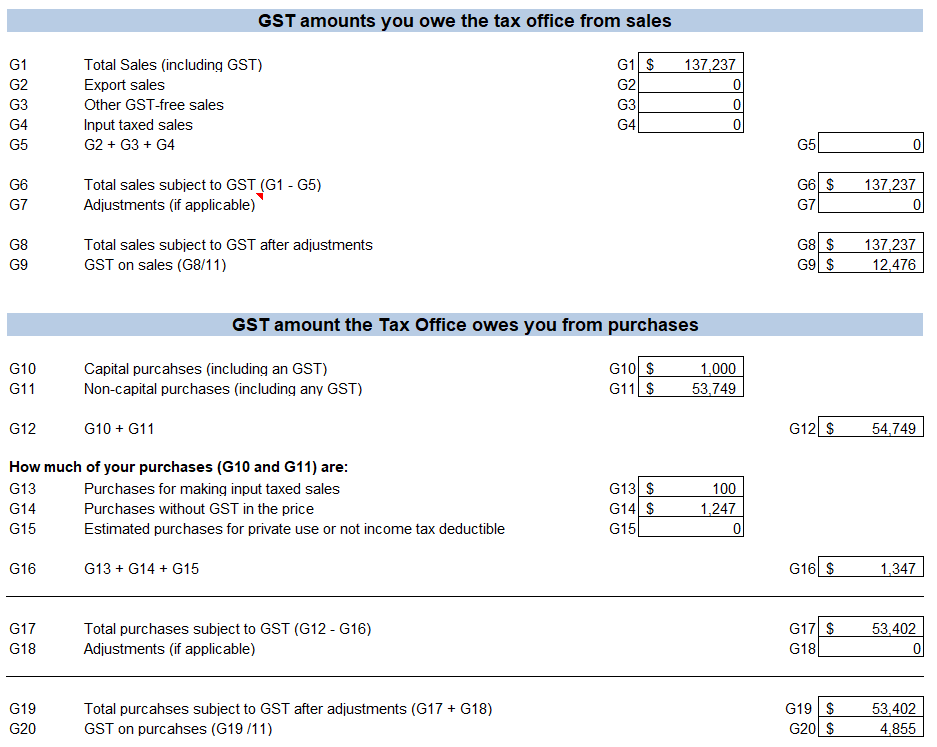

This image shows a section of the interactive online calculation worksheet provided by the ATO. For some people, the worksheet does not perform. In that case, here it is in PDF format.

You don't need to complete a GST calculation worksheet if you lodge a paper activity statement or annual GST return, the sections where information is not needed can be left blank.63

The calculation worksheet method is a step-by-step way of calculating the GST on your sales, purchases and importations using our GST calculation worksheet.

This involves:

- completing the worksheet using information from your accounts

- making calculations to report your amounts at 1A (GST on sales) and 1B (GST on purchases)

- following the instructions on the worksheet to transfer the amounts to the appropriate GST labels on your BAS.

You’ll need to complete up to 20 labels on the calculation worksheet to calculate the amounts to be reported at 1A (GST on sales) and 1B (GST on purchases) on your BAS. If you use this method, the amounts you report must include GST. That is, the amounts you report at all labels must take into account both:

- any GST you are liable to pay on sales

- the GST is included in the price of purchases and importations that you make.

You must indicate that your amounts include GST by marking the Yes box on your BAS at G1 (total sales, shown on the previous screenshot above.)

As a reminder, you can choose to exclude GST from G1 only if you are using the accounts method but you must include GST in amounts you report at all labels on your BAS if you are using the calculation worksheet method.

Don’t lodge the worksheet with your BAS but it's good practice to file it with a copy of the BAS it relates to.

MYOB offers an excellent description of how to use the Calculation worksheet method. Scroll down the page for a list of each label and how to complete it. 62

Learn more about the Calculation Worksheet method at the ATO.

Choosing a GST method of reporting63

The goods and services tax (GST) reporting method you use is based on your business's GST turnover and other reporting requirements:

- If your GST turnover is less than $10 million

- you generally report GST using the default Simpler BAS reporting method

- if your aggregated turnover is greater than $10 million, or you make input taxed supplies as your main business or enterprise activity, you have the option to use either Simpler BAS or the GST full reporting method (Option 1 or 2)

- If you pay GST instalments quarterly and report annually, you may use the GST instalment method. (Option 3)

- If your GST turnover is $10 million or more

- you report GST using the full reporting method. (Option 1)

The GST turnover figure the ATO uses to determine GST reporting method is obtained from the business's ATO records, which were previously advised by the organisation (at GST registration or subsequently).

Your GST reporting method will generally be rolled over at the end of each financial year based on your GST turnover. You can contact the ATO to change your GST reporting method.

Simpler BAS

Simpler BAS is the default reporting method for small businesses with a GST turnover of less than $10 million. 63

Completion instructions

- Enter whole dollar amounts – leave cents out and don't round up to the next dollar

- Enter each invoice once only

- If you account for GST on a cash basis, your expenses and sales must fall within the period you made or received payment

- Only complete the fields that apply to you – if you have nothing to report, enter zero

- If you're doing this manually, double-check your figures and calculations you can always correct a mistake made on an earlier BAS

- Print clearly using a black pen

- Don’t report negative figures or use symbols such as +, −, ÷, $.

The ATO provides these instructions to help bookkeepers manage the Simpler BAS.

For the Simpler BAS, on your monthly or quarterly activity statement, or your annual GST return, you must report the following GST information:

- G1 Total sales

- 1A GST on sales

- 1B GST on purchases

Activity: Know your BAS reporting methods

What to report

The ATO provides clear guidance around what is included, excluded, calculated and more. Review each link here carefully to get a clear guide on how to report sales and GST credits for purchases on the BAS using either method.

- G1, G2, G3 - Sales

- G4, G5, G6, G7, G8, G9 - Calculation worksheet method

- G10 and G11: Purchases

- G12 to G20: Calculating purchases using the calculation worksheet

- 1A and 1B Summary

- Check yourself

- Scroll down the page and review the list of links under additional instructions and review that information as well.

2. PAYG Withholding - The 'W' labels

Some businesses report PAYG Withholding quarterly and others report monthly.

Under PAYG withholding, you must withhold tax from certain payments.

These payments include:

- payments to employees, company directors and office holders

- payments to workers under labour-hire agreements

- payments under voluntary agreements

- payments where an Australian business number (ABN) has not been quoted in relation to a supply.65

You must report any withheld amounts in the PAYG tax withheld section of your business activity statement (BAS), and pay all withheld amounts to the ATO.

If you fail to comply with the PAYG withholding obligations for a payment to a worker, you may not be entitled to a deduction for that payment. Penalties may also apply.66

You can use this handy decision tool from the ATO to help determine what type of relationship the business has with a worker.

- W1 – Total salary, wages and other payments

This includes:- salary, wages, allowances and leave loading paid to employees (including those subsidised by JobKeeper payments)

- director fees

- salary and allowances paid to office holders (including members of parliament, statutory office holders, defence force members and police officers)

- payments made by a labour hire firm to labour hire workers under a labour hire arrangement

- employment termination payments

- payment for unused annual or long service leave

- payments to religious practitioners

- superannuation (super) income stream

- super lump sum

- Commonwealth education and training payments.

- attributed personal services income.

Include all payments subject to withholding, even if you weren't required to withhold any amount. For example, if you pay an employee $80 a week, and they claim the tax-free threshold, there is generally no obligation to withhold as long as they have previously provided their tax file number, but you still need to report the total payment at W1.67

This does not include:

- amounts subject to salary sacrifice arrangements

- super contributions

- departing Australia superannuation payments

- payments from which you withheld an amount because an ABN was not quoted (see W4)

- an investment distribution from which you withheld an amount for non-quotation of a tax file number

- interest, dividends or royalty payments from which you withheld an amount for a payment to a foreign resident

- payments to foreign residents for entertainment, sports, construction and casino gaming junket activities.

These amounts must be subtracted from the employee's total wages otherwise the ATO will treat them as employee extra (after-tax payments). If you did not make any payments, leave the boxes blank.

- W2 – Amounts withheld from salaries or wages and other payments shown at W1

- Include at W2 the total amount you withheld from salaries, wages and other payments shown at W1.

- If you didn't withhold any amounts, leave the box blank.

- This is the main type of withholding. If you have no other withholding obligations, go to W5.

- W4 – Amounts withheld where no ABN is quoted

- Where you make payments to suppliers who do not quote their ABN to you, you must withhold 47% (from 1 July 2017) of the invoice amount and pay this to us. Not quoting their ABN means that there was no ABN on the invoice and the supplier did not provide it to you in any other way.

Include at W4 the total amount you withheld from payments to suppliers who did not quote their ABN to you. If you have nothing to report, leave W4 blank. - Read more about what to do if a supplier does not quote an ABN.

- Where you make payments to suppliers who do not quote their ABN to you, you must withhold 47% (from 1 July 2017) of the invoice amount and pay this to us. Not quoting their ABN means that there was no ABN on the invoice and the supplier did not provide it to you in any other way.

- W3 – Other amounts withheld (excluding any amount shown at W2 or W4)

- W3 covers other types of withholding.

Include the total amount you withheld from:

- interest, dividends, unit trust or other investment distributions you made, where the person you are paying has not filled in a tax file number (TFN) declaration form or otherwise provided you with a TFN (includes a foreign resident)

- interest, dividends or royalty payments you made to a foreign resident

- any departing Australia superannuation payments you made

- any payments you made to foreign residents, for

- entertainment and sport activities

- construction and related activities

- arranging casino gaming junket activities.

- W3 covers other types of withholding.

If you have nothing to report, leave W3 blank.

- W5 – Total amounts withheld (sum of W2, W4 and W3)

- Include at W5 the total of W2 + W4 + W3.

- Do not include W1 in your W5 total.

- Copy the total at W5 to 4 in the 'Summary' section of your activity statement. If your activity statement only asks you to report PAYG withholding, you will not have a summary section. Your total withholding will be reported at 9 in the 'Payment or refund' section of your activity statement.

- Include at W5 the total of W2 + W4 + W3.

- Large withholders

You are a large withholder if you either:

- have withheld amounts totalling more than $1 million in a previous income year

- are part of a company group which has withheld more than $1 million in a past income year.

- If you are a large withholder, you only need to complete W1 on your activity statement. Do not complete W2, W3, W4, W5 or 4 in the 'Summary' section. Large withholders must pay the amounts they withhold to us electronically.67

As a reminder, review when to pay and report on activity statements – Large withholders

Note: If you report through Single Touch Payroll, you no longer have to report amounts at W1 on your activity statements.

The ATO takes your GST credit as payment for PAYG withholding

Use this form to offset a net GST credit against a pay as you go (PAYG) withholding liability. 68

3. PAYG Instalments- The 'T' labels68

If you receive an:

- activity statement, complete and lodge it to report your pay as you go (PAYG) instalment

- instalment notice, you do not need to complete or lodge it, unless you wish to vary the amount. You can simply pay the amount shown on the notice.

You may have two options

On your first activity statement of the income year, you may have the choice between 2 options:

- Option 1: Pay a PAYG instalment amount

- Option 2: Calculate PAYG instalment using income × rate.

You can find out how these options work on this page, Calculate your PAYG instalments.

Option 1: Completing the instalment amount

Pay the amount we have calculated for you.

Instalment amount – T7

T7 (ATO instalment amount) shows either:

- the amount we have calculated for you

- the amount you calculated in your most recent variation (if you varied a previous instalment).

If you do not need to vary the amount, and do not have any other obligations (such as GST) that require a business activity statement, you can just pay the amount. You do not need to lodge your activity statement or instalment notice.

Vary the instalment amount

- If you think your instalment amount will result in you paying more, or less, than your expected income tax for the year, you can vary it. Be aware that variances resulting in too small a payment may incur a penalty, so do this with caution.

- You do not have to vary your PAYG instalments. When you lodge your tax return, your PAYG instalments are credited against your income tax liability. The ATO refunds any excess, and you pay any shortfall.

T8 - Estimated tax for the year

Enter the tax you expect to pay on your business and investment income for the year.

T9 - Varied amount

- Enter your varied amount. If this is nil or a negative amount, enter 0.

- If it is a negative amount, you can claim a credit at 5B .

T4 - Reason code for variation

Choose the variation reason code that best describes why you varied your PAYG instalment amount.

5A - PAYG income tax instalment

The amount of your PAYG instalment for the period is shown at 5A (PAYG income tax instalment).

If you are lodging a paper statement, you will need to fill in this field. Enter the amount from either:

- T7 (instalment amount)

- T9 (if you are varying the amount).

5B - Credit from PAYG income tax instalment variation

If your varied amount for the period (entered at T9) is negative, you may be refunded any excess from previous instalments in the same income year.

To claim a credit, enter your varied instalment amount at 5B (credit from PAYG income tax instalment variation).

You do not have to claim a credit it in your activity statement. You can wait until you lodge your tax return and the ATO will take any credit into account when they work out any tax shortfall or refund for the year.

Option 2: Completing the instalment rate

With this option, you calculate the amount to pay by multiplying your instalment rate by your business and investment income. The ATO tells you what rate to use.

T1 - PAYG instalment income68

Work out your instalment income for the period and enter this at T1 (PAYG instalment income). If you do not have any instalment income for the period, enter '0'.

Generally, your instalment income is your gross business and investment income, excluding GST.

T2 - Instalment rate

The rate at T2 (instalment rate) will be either:

- the instalment rate worked out by us

- your most recent varied rate, if you have varied the instalment rate in a previous quarter in the same income year.

Vary the instalment rate68

If you think your instalment rate will result in you paying more, or less, than your expected income tax for the year, you can vary it. The ATO provides guidance and a form to complete if that choice is made.

You do not need to vary simply because your income has changed – the payment you calculate will go up and down in line with your income.

Varying your PAYG instalments will not change how much income tax you pay for the year. When you lodge your tax return, your PAYG instalments are credited against your income tax liability. The ATO refunds any excess, and you pay any shortfall. There are penalties for paying too little for your instalment, so proceed with caution, and follow the guidance of the ATO.

If you want to vary your instalment rate, enter the new varied rate at T3 and the reason code for variation T4 on your activity statement.

T3 - New varied rate

Calculate your varied rate and enter it at T3.

T4 - Reason code for variation

Choose the variation reason code that best describes why you varied your PAYG instalment amount.

Instalment − T11

To work out your instalment for the period (T11):

- multiply your instalment income (T1) by your instalment rate (T2 or T3).

5A - PAYG income tax instalment

The amount of your PAYG instalment for the period is shown at 5A (PAYG income tax instalment).

- If you are lodging a paper statement, you will need to fill in this field. Enter the amount from T11.

Christopher a sole trader who is registered for GST has a small flower stall in Melbourne. He has total sales for the quarter of $55,000 which includes $5,000 GST. He also received $55 in interest and a $500 dividend.

The ATO has offered him a choice of reporting options in the first quarter of the financial year. Christopher decides to pay using the instalment rate (option 2).

His instalment income of $50,555 was calculated using this equation:

sales - GST + other income. The instalment rate shown at T2 on his statement is 10%.

At T-1 he enters the instalment income of $50,555.

He then calculates the instalment amount of T1 x T2, which is $50,555 x 10% = $5,055.50

At T11 and 5A he enters $5,055.00 (dropping the cents)

Christopher lodges his activity statement and pays $5,055.00 by 28 October, the due date for the first quarter. He then adjusts his accounting books to adjust for the fifty cents.

Credit from PAYG income tax instalment variation – 5B

If your varied instalment rate (entered at T3) is less than the instalment rate at T2, you may be entitled to a credit from earlier instalments in the same income year.

To claim a credit, enter the amount at 5B. You do not have to claim a credit in your activity statement. You can wait until you lodge your tax return and the ATO will take any credit into account when they work out any tax shortfall for you to pay or refund you are due. Use the following table to calculate the amount of credit you can claim at 5B.

| Step | Calculation |

|---|---|

| 1 | Add up your earlier instalments (the amounts reported at 5A), even if you have not paid all of them |

| 2 | Add up any credits claimed in previous quarters of the income year (amounts reported at 5B on previous activity statements) |

| 3 | Subtract the amount at step 2 from step 1 |

| 4 | Add up instalment income for all earlier quarters of the income year |

| 5 | Multiply the amount at step 4 by the varied instalment rate |

| 6 | Subtract the amount at step 5 from the amount at step 3 |

| 7 | If the result is a positive amount, this is the amount of credit you can claim at 5B |

For example

Christopher, the florist from Melbourne we met earlier, has decided to reduce his instalment rate because his input taxed costs have skyrocketed due to the impact of Covid-19, which changed the taxable proportion of his sales.

He lowered it from 10% to 5%.

For his next instalment, his instalment income dropped to $40,555. He didn't need to make this change, it will not change how much income tax he pays for the year. However, he wanted to offset his burden this quarter. The ATO will manage credits and refunds when his income tax is filed.

To calculate his instalment rate for the second quarter of the financial year, Christopher multiplies $40,555 x 5% to come up with $2,027.75.

He then chooses to claim a credit. He used the table below to calculate the amount of credit he can claim. Christopher entered $2,027 at 5B. He then adjusted his account to accommodate the .75c.

| Step | Calculation | Amount |

|---|---|---|

| 1 | Christopher adds up his earlier instalments (the amounts reported at 5A) including the instalments he hasn't paid for | 4,055 |

| 2 | He adds up any credits claimed in previous quarters (amounts reported at 5B on a previous activity statement) | 0 |

| 3 | He subtracts the amount at step 2 from step 1 | 4,055 |

| 4 | He adds up his instalment income for all earlier quarters of the income year | 40,555 |

| 5 | He multiplies the amount at step 4 by the varied instalment rate | 42,027 x 5%=$2,027 |

| 6 | He subtracts the amount at step 5 from the amount at step 3 | 4,055-2,027 = 2,027 |

| 7 | Christopher's amount of credit he can claim at 5B | $2027 |

Take a look at how the accountants at e-BASS accounts describe the PAYG labels of the BAS form.

FBT - The 'F' labels69

We'll start by reviewing what taxing a fringe benefit means.

What is a fringe benefit?

A fringe benefit is a non-financially-based 'payment' to an employee. This tax is the ATO's acknowledgement that the employee is getting a benefit beyond the scope of work. As such, it's considered 'payment'.

In this case, the ATO considers an employee to be a:

- current, future or past employee

- director of a company

- beneficiary of a trust who works in the business.

Examples of fringe benefits include:

- allowing an employee to use a work car for private purposes

- giving an employee a discounted loan

- paying an employee's gym membership

- providing entertainment by way of free tickets to concerts

- reimbursing an expense incurred by an employee, such as school fees

- giving benefits under a salary sacrifice arrangement with an employee.

The following are not considered fringe benefits:

- salary and wages

- shares purchased under approved employee share acquisition schemes

- employer contributions to complying super funds

- employment termination payments (including for example, the gift or sale at a discount of a company car to an employee on termination)

- payment of amounts deemed to be dividends under Division 7A

- benefits provided to volunteers and contractors

- exempt benefits such as certain benefits provided by religious institutions to their religious practitioners.

What is the fringe benefits tax?

This tax is paid by employers (or a third party on their behalf), for the taxable value of the fringe benefits that are given to their employees (or anyone on the employee's behalf.)

The FBT financial year

The employer should be accounting for their FBT liability for the FBT year — 1 April to 31 March — and lodge an FBT return.

Income tax deduction and GST credits

Employers can generally claim an income tax deduction for the cost of providing fringe benefits and for the FBT they pay. Employers can also generally claim GST credits for items provided as fringe benefits, though specific concessions apply to some non-profit organisations.69

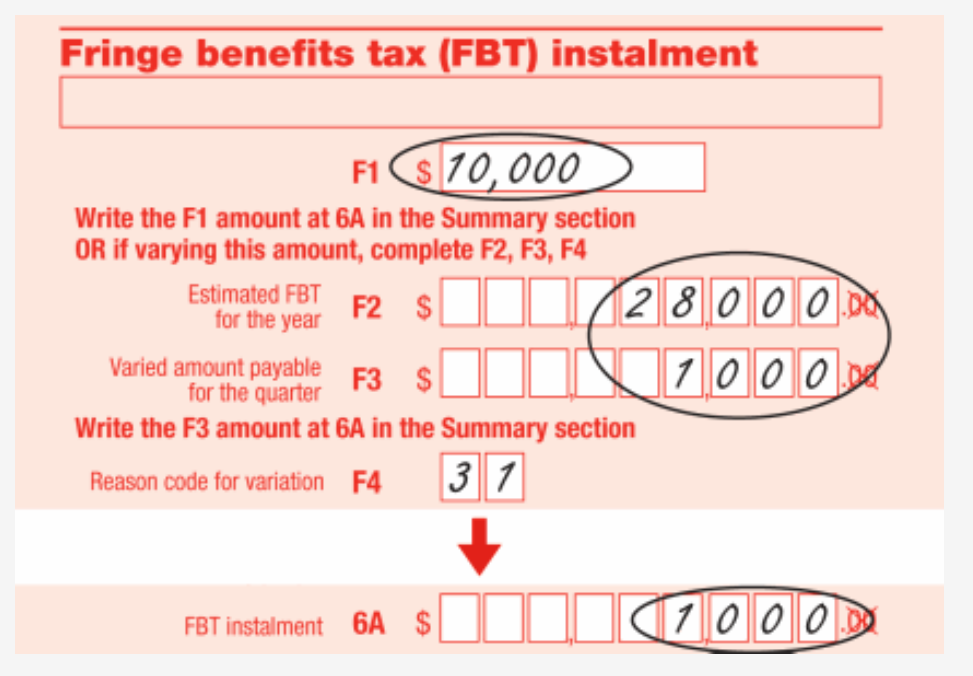

- F1 – ATO instalment amount

- If you pay FBT quarterly, a pre-determined instalment will be shown at F1.

- The ATO calculates the amount at F1 based on the FBT payable on your most recent FBT assessment.

- If you think that using the amount displayed at F1 will result in you paying more (or less) than your expected FBT liability for the year, you can vary it.

- If you are not varying your instalment amount, copy the amount at F1 to 6A in the Summary section of your business activity statement (BAS).

- 6A – FBT instalment

- If you're using the FBT instalment amount displayed at F1, copy this amount to 6A.

- If you've varied your FBT instalment amount for the quarter, copy the FBT instalment amount you wrote at F3 to 6A.

- 6B - Credit from FBT instalment variation

- If you vary your estimated FBT for the year to an amount lower than the FBT you had to pay last year, you may get an FBT instalment credit. You should take this credit into account when working out any amount payable. The credit is only available where the calculation of the F3 amount gives a negative amount.68

If you vary your FBT

Follow the links to the ATO to learn more about varying FBT requirements

- F2 – Estimated FBT for the year

- F3 – Varied amount for the quarter

- F4 – Reason code for variation

- 6B – Credit from FBT instalment variation

LCT, WET and FTC - The numbered labels

Follow the links to the ATO to learn more about how to complete the activity statement labels for these taxes.

The accoutants at e-BAS accounts have also provided instructions for completing the BAS sections for FBT, LCT, WET, and FTC.

Everyone makes mistakes and the ATO provides help when that happens.

To clarify, according to the ATO:

- A mistake is an error in reporting the information to the ATO at the time of lodgment.

- An adjustment is a change to the information since lodgment.

The ATO provides guidance for common mistakes on the import and export of goods.

Fixing mistakes70

Despite all the work done to prepare information to report on the BAS, sometimes mistakes get through, such as:

- clerical or transposition errors

- classifying a GST-free sale or purchase as taxable and vice versa

- double counting some of your purchases.

Many mistakes relating to GST and fuel tax credit can be corrected in your next BAS. If you can't correct your mistake in your next BAS, you need to lodge a revision.

You cannot correct a credit or debit error on a later activity statement if any of the following apply:

- The GST error relates to a matter we have advised is subject to a compliance activity or the GST error was made in a reporting period that is subject to compliance activity.

- You have corrected the GST error in another reporting period.

- You are revising a lodged activity statement to correct an error from an earlier reporting period.

If you correct a GST error on a later activity statement, keep a note to record the reporting period when the error was made and the activity statement it was corrected on. You must also keep records and other relevant information to explain the correction.

Credit error71

An error in working out your net GST amount that results in you reporting or paying too much GST for the reporting period is a credit error.

Examples:

- reporting a GST sale twice

- overstating the GST on sales (for example, reporting a larger figure for GST on sales than the correct amount)

- under-claiming a GST credit for your purchases

- omitting or understating a decreasing GST adjustment or overstating an increasing GST adjustment.

You can correct a credit error on a later activity statement if it is within the credit error time limit. Credit errors are not subject to value limits.

Credit error time limit

You can correct a credit error on a later activity statement that is lodged within the period of review of the earlier reporting period. The period of review starts on the day you lodge your activity statement and ends four years and one day later.

See the ATO for more information about time limits on GST credits and refunds.

Debit error71

An error in working out your net GST amount that results in you reporting or paying too little GST for the reporting period is a debit error.

Examples of debit errors include:

- failing to include GST on a taxable sale

- understating the GST on sales (for example, reporting a lesser amount for GST on sales, rather than the correct amount)

- overstating GST credits (for example, claiming GST credits for a purchase twice)

- omitting or understating an increasing GST adjustment or overstating a decreasing GST adjustment.

You can correct a debit error on a later activity statement if:

- the debit error is within the Debit error time limit

- the net sum of the debit errors is within the Debit error value limit

- the debit error is not a result of recklessness or intentional disregard of a GST law.

You can correct a debit error on a later activity statement if:

- the debit error is within the Debit error time limit

- the net sum of the debit errors is within the Debit error value limit

- the debit error is not a result of recklessness or intentional disregard of a GST law.

Revised activity statement72

If you need to correct information on an activity statement and you aren't eligible to correct it on a later statement, you may need to complete a revised activity statement.

The ATO treats a revised activity statement as an application to amend an assessment. You can do this either online or on paper.

If we accept your revised amount in full and the amendment is made within the period of review, the revised statement will be taken to be a notice of amended assessment. The date of effect is the day we adjust your running balance account.

If we don't accept your revised amounts in full, we will issue a notice of amended assessment.

Online revision

Registered users of the following online services can complete a revised activity statement online:

- Using ATO online services – individuals and sole traders

- Online services for business

- Online services for agents

- Practitioner lodgment service – amendments and provisions.

Using Online services for business

Go to: the ATO for instructions on how to sign up to online services.

Once you have registered an d have access, you can follow the directions below.

- Select Lodgments and Activity statements.

- Select Revise next to the processed activity statement from the History list.

- Enter the revised values.

If the Revise button doesn't display, you can't revise the activity statement through the service.

Tax professionals

Registered tax and BAS agents can lodge a revision for their client using Online services for agents or the practitioner lodgment service.

See also:

- Online services for agents user guide – payment options

- Practitioner lodgment service user guide – amendments and provisions

Paper revision

Contact the ATO to get a paper version of the revised activity statement. Don't send them a copy or a version generated from a commercial software package.

Fill in the items that are to be revised and the revised amounts. If changing one item leads to a change to other items, update those items and values as well.

If you report pay as you go (PAYG) instalments using the rate method and you vary the rate, you need to write the new rate at T3.

Read more about sending in a paper revision on the ATO website including the address where to send the form.

Managing adjustments to the BAS73

You may have to make changes on your current activity statement to increase or decrease the amount of GST you must pay for a reporting period. These changes are known as 'adjustments'.

There are two types of adjustments:

- increasing adjustments, which increase how much GST you must pay for a reporting period

- decreasing adjustments, which decrease how much GST you must pay for a reporting period.

As a reminder, making GST adjustments is different from correcting GST errors made on an earlier activity statement. A GST adjustment relates to a reported sale or purchase that was correct at the time of lodgment, whereas a GST error relates to an amount that was incorrect at the time of lodgment.74

Read more about adjustments to the BAS at the ATO.

Activity: Handling errors on the BAS

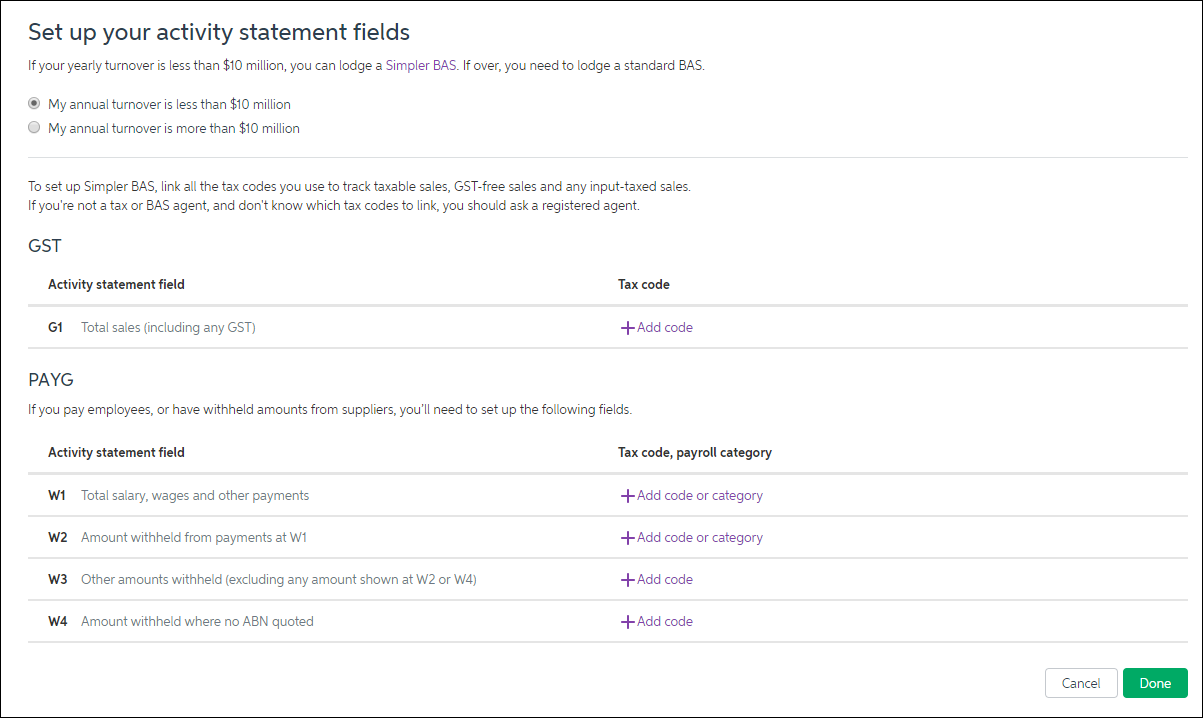

There’s a one-time setup process you need to complete before you can start preparing activity statements. This might take 10-15 minutes to complete. At this point, please just read through the instructions as you won't be able to complete them without a valid ABN and registration number for the submitting agent.

Setup MYOB

Nominate MYOB as the reporting entity for your BAS and IAS

- In MYOB, go to the Accounting menu and choose Prepare BAS or IAS.

- Click Get started.

- If prompted, sign in to your MYOB account.

- When the online activity statement dashboard appears, click Get started.

- Select whether you're preparing this activity statement for your own business (or a business you work for), or as a registered agent for another business.

Note that if you're preparing a non-business IAS, you should still select I lodge as a business. - Enter your name. If you’re an agent, you’ll need to provide your Registration number and ABN to lodge the form with the ATO. Click Next.

- You’ll now be shown a unique Software ID. This ID enables you to lodge activity statements with the ATO using MYOB.

Click Copy to save the Software ID to your Windows clipboard and then paste it into a document (or you can just write down the ID). Click Next. -

If you have a myGovID and you can access it now, complete the following steps to nominate MYOB as your software provider with the ATO. Don’t have a myGovID, or can’t access it right now? You can call the ATO to complete this process by phone instead - call 1300 852 232.

- Log in to the ATO’s Access Manager website (https://am.ato.gov.au).

- Click My Hosted SBR Software Services in Access Manager’s menu.

- Click Notify the ATO of your hosted service.

- Type "MYOB" in the Software Provider Name field, then click Search.

- Click MYOB’s ABN when it appears.<

- Paste or type the software ID in the Add Software IDs field and click Next.

- Read the declaration, then click Save.<

- Return to the Nominate MYOB as your software provider message, and click I've done this.

-

When the online activity statement dashboard appears, click Check field setup in the banner. You can now set up your GST and PAYG Withholdings activity statement fields.

- Select whether your annual turnover is less than or more than $10 million. If it's less than $10 million, you can lodge a simpler BAS, meaning that you have fewer GST fields to complete on your form.

- (BAS only) For the GST fields, link the tax codes you’ve used in MYOB to the relevant fields on the statement.

Click + Add code to link a tax code to a field, or click the tax code’s x icon to unlink it. - For the PAYG fields, link the payroll categories and tax codes you use to track the salaries, wages and other payments to employees and others at W1, and the amounts you withhold from those payments at W2.

Link the tax codes you use to track withholdings (other than those already reported at W2 or W4) at W3, and the amounts withheld due to suppliers not providing their ABN on their invoices at W4.

- Click Done.

The online activity statement dashboard will retrieve information from the ATO and show the statements you can complete via MYOB.

Activities: Completing the BAS

- The Australian accounting practice, e-BAS Accounts. offers a great resource for BAS preparation. Download their checklist and review it.

- Answer the following questions

- Can you see where we are up to at this point in the course in terms of what needs to be done to prepare for BAS?

- Were there any surprises on that list?

- Is there anything you felt you needed more learning around?

- Discuss the checklist in the forum.

- Answer the following questions

- Review and bookmark the BAS Details page at the ATO.

- Review the material at the ATO on BAS and GST tips

- Scenario + Activity: As the BAS agent for Crystal H2O Pty Ltd, you have just run the GST detail report so you can complete the GST portion of the BAS using the Calculation Worksheet method.

- Please complete the steps below.

- Download the GST detail report and Calculation Worksheet

- Note the tabs at the bottom for the data and worksheet

- Determine the values for all of the labels on the worksheet

- Compare your answer to ours by selecting the (+) sign below.

- Download the GST detail report and Calculation Worksheet

- Please complete the steps below.

Do your numbers match ours?

Download the document with the solution so you can see the figures that make up each of the totals.

To do this, as an example, look at the cells from the GST Report that make up label G1:

- Ensure you are on the worksheet tab

- Click on cell I5

- Look at the formula bar:

This means that the cell will calculate the total of G188 and G209 on the GST Report tab, and show a result that eliminates the cents using the function, ROUNDDOWN -

You can click on any of the cells to see the source data for the labels.