Once all the necessary data are obtained, compiled and verified, you can prepare the financial statements for the non-reporting entities. As stated in Chapter 1, non-reporting entities must prepare and submit Special Purpose Financial Statements (SPFS).

In 2010, the AASB introduced two tiers for entities preparing financial statements. Tier 2 entities have Reduced Disclosure Requirements (RDR), reducing the disclosure burden on non-reporting entities like charities and sole proprietorships.

The SPFS prepared by these entities must include a balance sheet, a statement of profit and loss, and a cash flow statement.

In this chapter, you will learn more about:

- Prepare financial statements using a structure and format that complies with accounting standards and organisational requirements

- Obtain verification and authorisation from delegated persons

- Reviewing statements for errors

- Reviewing statements for errors for compliance with accounting standards and organisational procedures and amending as required

All financial statements must be prepared in a predetermined manner to ensure uniformity in presentation across various entities. Therefore, they are required to follow a specified structure and format. The structure and format refer to how the financial information is presented and the hierarchy and classification prescribed by the accounting standards.

Structure refers to what information is presented and how it is arranged and sequenced (e.g., assets presented before liabilities).

Format refers to how the info is presented in terms of its overall appearance (e.g., the headers to be used, the notes to be provided, and the signatories).

In addition to adhering to the structure and format of the financial statement, you also have to ensure organisational requirements are met. Organisational requirements include presenting additional information, such as disclosure of financial policies.

The AASB has reduced the reporting requirements and standards applicable to non-reporting entities. However, specific standards and the disclosures specified are still relevant to the non-reporting entities.

Some of these standards are listed below.

- AASB 1 First-time Adoption of Australian Equivalents to International Financial Reporting Standards

- AASB 101 Presentation of Financial Statements

- AASB 116 Property, Plant and Equipment

- AASB 1004 Contributions

- AASB 102 Inventories

- AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors

- AASB 107 Cash Flow Statements

- AASB 1048 Interpretation and Application of Standards

Understanding the Purpose of Preparing Financial Statements of Non-reporting Entities

One may question why contrary to the name of the ‘non-reporting entities’, they are required to prepare financial statements. At this juncture, it is crucial to address why non-reporting entities are still required to prepare financial statements. First, you must understand those non-reporting entities are subject to the RDR while preparing the financial statements and only prepare SPFS.

The necessity to prepare SPFS primarily arises because, despite the absence of the general public relying on the financial information of non-reporting entities, the management of these entities needs to know about their financial position.

The financial statements summarise all the entity's financial transactions into readable and understandable financial information. For example, the statement of profit and loss or the income and expenditure account gives the management a clear picture of the entities' operations. It helps in crucial decision-making, such as cost reduction and price increase.

Similarly, the entity's balance sheet gives a picture of the current financial position of the entity and if it has enough assets to meet its current and future financial obligations.

Irrespective of the constitution and the presence or absence of a profit motive of the entity, it is crucial to pay attention to the entity’s financial position to ensure its going concern. Financial statements help an entity take wise and sustainable commercial decisions.

Understanding the Key Features of Organisational Guidelines

As discussed in Chapter 1, you must understand the organisational guidelines and requirements for preparing financial statements. Organisational guidelines are the set rules to be followed by the organisation's employees, like guidelines for capitalising expenses incurred on purchasing fixed assets. The organisational requirements are the mandatory conditions that have to be fulfilled. For example, the organisation may require filing all relevant invoices to capitalise on expenses incurred for purchasing fixed assets.

Some key guidelines and procedures for preparing financial statements are as follows:

- Ensure that the bank reconciliation is done for the end of the financial year.

- Physical verification of cash

- Ensure that the cash in hand is verified on the last day of the financial year and the report aligns with the cash reported in SPFS.

List the open bills and orders and provide for accruals and provisions while preparing the financial statements.

If the entity has a policy of physically verifying stock, the stock report must be considered while preparing financial statements.

If physical verification of fixed assets is carried out at the end of the financial year, then you must ensure that the key findings of the report are captured while preparing financial statements.

If the entity has a policy of accruing income and expenses, i.e., recording expenses and income in the period they pertain to before actually incurring/earning them, then the policy must be followed.

Outline of Legislation Covering Taxable Transactions

In Australia, several types of tax obligations are critical for keeping the business going. The taxes levied on companies in Australia are as follows:

| Federal Government Taxes | Local Government Taxes | State Taxes |

|---|---|---|

|

|

|

There are both direct and indirect taxes in Australia. Direct taxes, also known as income taxes, are implemented directly on the income of the business entity or individual. The person or entity who bears and pays the tax is the same here. For example, QRW Enterprises is a company registered in Australia and the tax liability on the income of QRW Enterprises is calculated to be $50,000. In such a case, the tax is levied on QRW Enterprises and is payable by them to the ATO.

The Income Tax Assessment Act 1997 deals with maintaining accounting records to ensure compliance with legislative requirements of payment of taxes on the income earned.

Further Reading

The Income Tax Assessment Act is updated regularly to ensure every citizen pays taxes per the legislative requirements. The Act lays down procedures for maintaining financial records to suit the legislature to achieve this objective. You can learn more about this legislation by clicking the link below.

Income Tax Assessment Act 1997

Indirect taxes, also known as the Goods and Services Tax (GST), are the ones that are implemented on the sale and purchase of goods and services. In these cases, the person or entity who bears the tax and the one who pays it is not the same. The buyer bears the tax liability while the seller pays it after charging it from the buyer or the ultimate consumer.

For example, QRW Enterprises is in the business of constructing buildings. It buys 100 bricks from IJKL Construction at $1000. At a hypothetical rate of 10%, the tax is levied on such a sale. The tax amount to be paid is $100. The GST here is payable by QRW Enterprises, which pays it to IJKL Construction. IJKL Construction collects it and then pays it to the government on behalf of QRW Enterprises. QRW Enterprises becomes the company on which the tax is levied here, and IJKL Construction becomes the entity required to pay the tax.

Companies have to pay taxes quarterly to the ATO. If registered under the New Tax System (Goods and Services Tax) Act 1999, they must collect and remit GST monthly. A business entity is said to make a taxable transaction liable for GST if the supply is for consideration in the course of furtherance of business; if the supply is linked to Australia, and if the business is registered or is required to be registered under the New Tax System (Goods and Services Tax) Act 1999. Supplies include the supply of goods, services, provision of information, transfer of any property or rights, a financial supply, an entry or release from any obligation, or a combination of any of these.

Business entities must also remit payroll taxes to the state government every month. Further, if the business entity owns any land, it must pay property and municipal taxes.

In addition to these taxes on regular transactions, other transactions attract special taxes like taxes on the sale of assets.

All taxes mentioned above must be computed according to applicable rules and regulations. They must also be remitted to the ATO within specified due dates.

The taxability of non-reporting entities can be determined based on the activities carried out by them. Some of the taxable transactions for non-reporting entities are:

- Hospitality services provided by clubs and societies wherein there is no restriction on the distribution to members

- Capital gains from the sale of assets held for a long time

- Sales of goods and services that are taxable transactions under the GST

Further Reading

Further reading of tax provisions governing the not-for-profit organisations can be read by accessing the link below.

Further reading of tax provisions contained in the Goods and Services Tax Act can be read by accessing the links below.

A New Tax System (Goods and Services Tax) Act 1999

Outline of Reporting Requirements

The reporting requirements for non-reporting entities are slightly different as they have reduced disclosure requirements. However, the standards are common for both reporting and non-reporting entities.

The non-reporting entities must report to ATO or the ACNC according to financial legislation, including the Income Tax Assessment Act. They are required to fulfil the following requirements:

- Lodging of income taxes or GST with the ATO according to the Income Tax and GST Acts

- Monthly, quarterly, or annually based on the instalment due

- Reconciliation of business activity statement with the financial records

- Submission of Annual Information Statement and Annual Financial Report

- Disclosure of financial year followed to ACNC

- Balance sheet

- Statement of profit and loss

- Cash flow statement

NOTE: Small proprietary companies are not required to prepare financial statements.

Further Reading

Volume 2 of the Corporations Act,2001 provides detailed financial reporting and audit requirements in Chapter 2M. The same can be accessed using the link below

Chapter 2M of the Corporations Act, 2001

Preparation of Financial Statements

Financial statements are a structured representation of an entity's financial position and financial performance. Part 2M.3 Clause 295 (1) of the Corporations Act provides 295 Contents of the annual financial report, which includes the financial statements, notes and a director’s report. According to Part 2M.3 Clause 295 (3) of the Corporations Act, notes should include disclosures required by regulations, notes required by accounting standards and any information that will give a true and fair view of the financial position of the entity. Financial statements illustrate an entity’s financial position, financial performance, and cash flows. There are six components of financial statements covered in this subchapter:

- Revenue Statement/Statement of Profit and Loss

- Statement of Comprehensive Income

- Balance Sheet/Statement of Financial Position

- Statement of Changes in Equity

- Statement of Cash Flows

- Notes for Financial Statements/Annual Reports

Revenue Statement/Statement of Profit and Loss

The profit and loss (P&L) statement (also known as a revenue statement) is a financial statement that summarises the revenues, costs, and expenses incurred during a specified period, usually a financial quarter or year. In other words, the P&L statement includes all the items of income and expense except those recognised in the Statement of Comprehensive Income as mandated by the Accounting Standards.

The general format of the revenue statement will be highly dependent on the size and requirements of your organisation. Review Section 314 of the Corporation Act 2001 and AASB 101 Presentation of Financial Statements for a defined standard format to follow while preparing all financial statements.

The typical format for preparing revenue statements per organisational requirements is shown below.

| Particulars | Notes | Current Year (Amount in $) |

Previous Year (Amount in $) |

|---|---|---|---|

| Revenue | YY | XX | |

| Other Income | YY | XX | |

| Changes in Inventories | YY | XX | |

| Cost of Goods Sold | YY | XX | |

| Depreciation, Amortisation, and Impairment of Financial or Non-Financial Assets | YY | XX | |

| Other Expenses | YY | XX | |

| Operating Profit | YY | XX | |

| Finance Costs | YY | XX | |

| Other Financial Items | YY | XX | |

| Profit Before Tax | YY | XX | |

| Tax Expense | YY | XX | |

| Profit After Tax | YY | XX |

Statement of Comprehensive Income

Along with the revenue statement, the statement of comprehensive income reflects the changes in equity of the company from transactions other than those that affect changes in ownership interests. It also incorporates unrealised gains and losses due to changes in values during the financial period. However, this is not applicable to non-reporting entities, including partnership firms and charitable trusts.

Balance Sheet / Statement of Financial Position

The statement of financial position is another term for the balance sheet. The components of the balance sheet include assets, liabilities, and equity. Assets can be further grouped into current and non-current assets, including tangible assets, accounts receivable cash and bank balance, and stock. The liabilities can also be further divided into current and non-current liabilities and are generally what the company owes to third parties. It includes business loans, accounts payable, and debentures. Equity is the proportion of the owner's financial interest in the business, which generally comprises shareholders' funds, reserves, and surplus.

For the balance sheet to reflect an accurate picture, assets, liabilities and equity must be equal.

It is vital to prepare a balance sheet to reflect the financial position of your organisation at the end of the reporting period due to the following reasons:

- It is a tool for measuring growth.

- It aids stakeholders in understanding the financial position of an organisation.

- It aids in decision-making related to expansion projects.

The typical format followed for preparing a balance sheet is shown below.

| Assets | |||

|---|---|---|---|

| Particulars | Notes | Current Year (Amount in $) | Previous Year (Amount in $) |

| Non-current | |||

| Property, Plant, and Equipment | YY | XX | |

| Goodwill | YY | XX | |

| Other Intangible Assets | YY | XX | |

| Investment Property | YY | XX | |

| Other Long-Term Assets | YY | XX | |

| Other Long-Term Financial Assets | YY | XX | |

| Total Non-current Assets | YY | XX | |

| Current | YY | XX | |

| Inventories | YY | XX | |

| Prepayments and Other Short-Term Assets | YY | XX | |

| Trade and Other Receivables | YY | XX | |

| Other Short-Term Financial Assets | YY | XX | |

| Cash and Cash Equivalents | YY | XX | |

| Total Current Assets | YY | XX | |

| Total Assets | YY | XX | |

| Equity | |||

|---|---|---|---|

| Particulars | Notes | Current Year (Amount in $) | Previous Year (Amount in $) |

| Equity | |||

| Share Capital | YY | XX | |

| Share premium | YY | XX | |

| Other Components of Equity | YY | XX | |

| Retained Earnings | YY | XX | |

| Total Equity | YY | XX | |

| Liabilities | |||

|---|---|---|---|

| Particulars | Notes | Current Year (Amount in $) | Previous Year (Amount in $) |

| Non-current | |||

| Borrowings | YY | XX | |

| Lease Liabilities | YY | XX | |

| Other Liabilities | YY | XX | |

| Total Non-current Liabilities | YY | XX | |

| Liabilities | |||

|---|---|---|---|

| Particulars | Notes | Current Year (Amount in $) | Previous Year (Amount in $) |

| Current | |||

| Provisions | YY | XX | |

| Borrowings | YY | XX | |

| Lease Liabilities | YY | XX | |

| Trade and Other Payables | YY | XX | |

| Current Tax Liabilities | YY | XX | |

| Other Liabilities | YY | XX | |

| Total Current Liabilities | YY | XX | |

| Total Liabilities | YY | XX | |

| Total Liabilities | YY | XX | |

Further Reading

The Corporations Act 2001 regulates the operation of businesses in Australia. Access the Act through the link below.

Statement of Changes in Equity

The Statement of Changes in Equity (SOCE) reconciles the beginning and ending balances in a company’s equity during a reporting period. However, this is not applicable to non-reporting entities, including partnership firms and charitable trusts.

Statement of Cash Flows

A statement of cash flows (also called cash flow statement or CFS) is a part of a financial statement that summarises the amount of cash and cash equivalents entering and leaving an entity. It provides stakeholders with a basis to understand the ability of an entity to generate cash revenue. The general format of the CFS depends on an entity’s size and financial records. However, the Corporation Act 2001, read with AASB 101 Presentation of Financial Statements, has defined a standard format that must be followed while preparing a CFS. Accordingly, the significant components of the CFS are:

- Cash flow from operating activities

- Cash flow from investing activities

- Cash flow from finance activities

- Cash and cash equivalents

The typical format followed for preparing cash flow statements as per organisational requirements is as follows:

| Particulars | Notes | Current Year (Amount in $) | Previous Year (Amount in $) |

|---|---|---|---|

| Operating Activities | |||

| Profit Before Tax | YY | XX | |

| Non-cash Adjustments | YY | XX | |

| Net Changes in Working Capital | YY | XX | |

| Taxes Paid | YY | XX | |

| Net Cash from Operating Activities | YY | XX |

| Particulars | Notes | Current Year (Amount in $) | Previous Year (Amount in $) |

|---|---|---|---|

| Investing Activities | |||

| Purchase of Property, Plant, and Equipment | YY | XX | |

| Proceeds From Disposal of Property, Plant, and Equipment | YY | XX | |

| Purchase of Other Intangible Assets | YY | XX | |

| Proceeds From Disposal of Other Intangible Assets | YY | XX | |

| Interest Received | YY | XX | |

| Dividends Received | YY | XX | |

| Taxes Paid | YY | XX | |

| Net Cash Used in Investing Activities | YY | XX | |

| Financing Activities | |||

| Proceeds From Borrowings | YY | XX | |

| Repayment of Borrowings | YY | XX | |

| Proceeds From Issue of Share Capital | YY | XX | |

| Interest Paid | YY | XX | |

| Dividends Paid | YY | XX | |

| Cash and Cash Equivalents, Beginning of the Year | YY | XX | |

| Cash and Cash Equivalents, End of Year | YY | XX |

Notes for Financial Statements/Annual Reports

Notes to financial statements are the explanatory statements and detailed break-up of the information contained in the financial statements. These include the details of accounting policies followed by the entity, detailed notes of the figures presented in the financial statements, and compliance with various disclosure requirements mandated by accounting standards.

Financial and annual reports accompany financial statements. As the name implies, financial reports provide all information about a company’s economic performance. These include financial statements, income statements, profit and loss accounts, balance sheet statements, and cash flow statements.

The annual report, or the financial year report, is a comprehensive report that collects all the relevant financial information accumulated throughout the year. It reflects all the entity’s activities in a year.

The relevant information includes:

- Financial reports

- A letter from the CEO

- Information about new products or services

- Plans

- Directors and management team presentation

- Future company plans and strategies

Preparation of Financial Statements for Partnership Firms and Not-For-Profit Organisations

The financial statements for a partnership firm are prepared in line with the accounting standards applicable and the specific circumstances of the firm's business. The factors necessitating the preparation of financial statements and the information contained therein could be due to a mandatory clause in the partnership deed requiring the preparation of statements.

The need for the financial statements could be for:

- Appropriation of profits

- Use of the statements for filing the tax returns of the partners

- Meeting the needs of the special purpose users of the financial statements like banks and creditors

It is classified as a non-reporting entity majority of the time, owing to the nature of the constitution of the business of a partnership firm. This negates the need for the preparation of general-purpose financial statements. Consequently, there are no minimum requirements that the SPFS of a partnership firm needs to comply with.

However, if an entity voluntarily opts to prepare a GPFS, it must comply with all the applicable Australian accounting standards. It must also meet the disclosure requirements specified therein.

Below is a sample SPFS of a partnership firm.

Statement of Profit and Loss

| ABC PARTNERSHIP (NON-REPORTING) INCOME STATEMENT FOR THE YEAR ENDED 30 JUNE 20XX |

|||

|---|---|---|---|

| Particulars | Notes | Current Year (Amount in $) | Previous Year (Amount in $) |

| Sales/Revenue | YY | XX | |

| Less: Cost of Goods Sold | YY | XX | |

| Opening Stock | YY | XX | |

| Purchases | YY | XX | |

| Closing Stock | YY | XX | |

| Cost of Goods Sold | YY | XX | |

| Gross Profit | YY | XX | |

| Other Income and Recoveries | YY | XX | |

| Expenses | YY | XX | |

| Depreciation and Amortisation | YY | XX | |

| Other Non-operating Expenses | YY | XX | |

| Net Profit | YY | XX | |

| Distribution to Partners | YY | XX | |

| Partner A (Share – 50%) | |||

| Partner B (Share – 50%) | |||

| Assets | |||

|---|---|---|---|

| Particulars | Notes | Current Year (Amount in $) | Previous Year (Amount in $) |

| Current | |||

| Cash and Cash Equivalents | YY | XX | |

| Trade Debtors | YY | XX | |

| Stock on Hand | YY | XX | |

| Total Current Assets | YY | XX | |

| Non-current | |||

| Financial Assets | YY | XX | |

| Property, Plant and Equipment | YY | XX | |

| Intangible Assets | YY | XX | |

| Total Non-current Assets | YY | XX | |

| Total Assets | YY | XX | |

| Liabilities | |||

|---|---|---|---|

| Particulars | Notes | Current Year (Amount in $) | Previous Year (Amount in $) |

| Current | |||

| Bank Overdraft | YY | XX | |

| Trade Creditors | YY | XX | |

| Accrued Expenses | YY | XX | |

| Annual Leave Accrual | YY | XX | |

| Goods and Services Tax Payable | YY | XX | |

| Total Current Liabilities | YY | XX | |

| Non-current | |||

| Provisions | YY | XX | |

| Borrowings | YY | XX | |

| Current Tax Liabilities | YY | XX | |

| Other Liabilities | YY | XX | |

| Total Non-current Liabilities | YY | XX | |

| Total Liabilities | YY | XX | |

| NET ASSETS/(LIABILITIES) | YY | XX | |

| PARTNERS’ FUNDS | |||

| Partner A | YY | XX | |

| Partner B | YY | XX | |

The financial statements for not-for-profit organisations differ from profit-making organisations' financial statements, primarily due to the non-profit-making objective of these entities. The financial statements consist of the statement of profit and loss and other comprehensive income, the statement of financial position, and the statement of cash flows.

A sample statement of profit and loss is given below.

| XYZ NOT-FOR-PROFIT (NON-REPORTING) LIMITED STATEMENT OF PROFIT & LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 30 JUNE 20XX |

|||

|---|---|---|---|

| Particulars | Notes | Current Year (Amount in $) | Previous Year (Amount in $) |

| Revenue | YY | XX | |

| Less | YY | XX | |

| Administrative Expense | YY | XX | |

| Impairment Losses on Financial Assets | YY | XX | |

| Other Expenses | YY | XX | |

| Current Year Surplus Before Income Tax | YY | XX | |

| Income Tax Expense | YY | XX | |

| Net Current Year Surplus | YY | XX | |

| Other Comprehensive Income | YY | XX | |

| Total Other Comprehensive Income | YY | XX | |

| Total Other Comprehensive Income Attributable to the Members of the Entity | YY | XX | |

| XYZ NOT-FOR-PROFIT (NON-REPORTING) LIMITED STATEMENT OF FINANCIAL POSITION FOR THE YEAR ENDED 30 JUNE 20XX |

|||

|---|---|---|---|

| Assets | |||

| Particulars | Notes | Current Year (Amount in $) | Previous Year (Amount in $) |

| Current | |||

| Cash on Hand | YY | XX | |

| Accounts Receivable and Other Debtors | YY | XX | |

| Inventories on Hand | YY | XX | |

| Other Current Assets | YY | XX | |

| Total Current Assets | YY | XX | |

| Non-current | YY | XX | |

| Property, Plant and Equipment | YY | XX | |

| Intangible Assets | YY | XX | |

| Total Non-current Assets | YY | XX | |

| Total Assets | YY | XX | |

| Liabilities | |||

|---|---|---|---|

| Particulars | Notes | Current Year (Amount in $) | Previous Year (Amount in $) |

| Current | |||

| Accounts Payable and Other Payables | YY | XX | |

| Grants Received in Advance | YY | XX | |

| Goods and Services Tax Payable | YY | XX | |

| Total Current Liabilities | YY | XX | |

| Non-current | |||

| Non-current Liabilities | YY | XX | |

| Total Non-current Liabilities | YY | XX | |

| Total Liabilities | YY | XX | |

| NET ASSETS/(LIABILITIES) | YY | XX | |

| Equity | |||

| Retained Surplus | YY | XX | |

| Total Equity | YY | XX | |

A sample cash flow statement for a non-reporting entity is as follows:

| XYZ NOT-FOR-PROFIT (NON-REPORTING) LIMITED STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 30 JUNE 20XX |

|||

|---|---|---|---|

| Particulars | Notes | Current Year (Amount in $) | Previous Year (Amount in $) |

| Operating Activities | |||

| Profit Before Tax | YY | XX | |

| Non-cash Adjustments | YY | XX | |

| Net Changes in Working Capital | YY | XX | |

| Taxes Paid | YY | XX | |

| Net Cash from Operating Activities | YY | XX | |

| Investing Activities | |||

| Purchase of Property, Plant and Equipment | YY | XX | |

| Purchase of Other Intangible Assets | YY | XX | |

| Proceeds From Disposal of Other Intangible Assets | YY | XX | |

| Interest Received | YY | XX | |

| Net Cash Used in Investing Activities | YY | XX | |

| Net Change in Cash and Cash Equivalents | YY | XX | |

| Cash and Cash Equivalents, Beginning of the Year | YY | XX | |

| Cash and Cash Equivalents, End of Year | YY | XX | |

Checkpoint! Let's Review

- Structure refers to what information is presented and how it is arranged and sequenced

- Format refers to how the info is presented in terms of its overall appearance

- Non-reporting entities need to prepare the SPFS to inform the management of the entities about their financial position.

- The non-reporting entities must report to ATO or the ACNC according to financial legislation, including the Income Tax Assessment Act.

- The Income Tax Assessment Act 1997 deals with maintaining accounting records to ensure compliance with legislative requirements of payment of taxes on the income earned.

Once the financial statements have been prepared, considering the organisational guidelines in line with the accounting standards, it is always essential to check for errors and misrepresentations.

Errors can either be misstatements or misrepresentations. Misstatements refer to errors in the financial information presented, such as showing an incorrect asset or liability value. Misrepresentations are errors that provide a false picture of the entity's financial position. They could be financial or non-financial, like false or inadequate disclosures under various accounting standards. There could also be errors that involve non-compliance with organisational requirements and accounting standards. Irrespective of the nature and impact of errors, they should be identified and rectified for the financial statements to present an accurate and fair view.

The errors can be identified in many ways; one is ratio analysis. For example, an error in the disclosures related to the cost of goods sold can be identified by analysing the trend of the gross profit ratio over the years. Any deviations from the trend could be an indication of error. In this subchapter, you will learn about ratio analysis and other ways of identifying errors. You will also learn about how to rectify the errors.

Understanding Various Financial Ratios, Uses and Their Calculation

Financial ratios are derived from the financial information presented in the financial statements to provide valuable insights into the company's financial position. Ratio analysis is a quick and effective tool to decipher the financial information in financial statements. In addition, they help assess the entity’s liquidity, growth, profitability and return on investment.

Uses of Financial Ratios

- Financial ratios are used to track the entity’s performance.

- One can outline the entity's financial performance trends by analysing them over time. For example, increasing the debt-to-assets ratio indicates a higher risk of default on loans.

- Financial ratios help compare an entity’s financial performance with competitors.

- These ratios enable the users to understand how the entity performs against its competitors. For example, the return on assets of two entities helps understand which of them is better at employing their assets.

The various financial ratios can be broadly classified as follows:

Liquidity ratios, Leverage ratios, efficiency ratios, and Profitability ratios

Liquidity Ratios

Liquidity ratios help measure the liquidity of the entity, i.e., its ability to liquidate assets to meet both its long-term and short-term liabilities. Some of the liquidity ratios are as follows:

- Current Ratio

- The ratio of the current assets to current liabilities

- Computed as Current Ratio=(Current Assets)/(Current Liabilities)

- Acid Test Ratio

- The ability of an entity to meet short-term liabilities with quick assets

- Computed as Acid Test Ratio=((Current Assets-Inventories))/(Current Liabilities)

- Cash Ratio

- The ability of an entity to meet its current liabilities with cash and cash equivalents

- Computed as Cash Ratio=(Cash and Cash Equivalents)/(Current Liabilities)

- Operating Cash Flow Ratio

- Helps to understand how many times an entity can pay its current liabilities using the cash from operating activities generated over a specific period

- Computed as Operating Cash Flow Ratio=(Operating Cash Flow)/(Current Liabilities)

Leverage Ratios

Leverage financial ratios quantify the percentage of capital funded by debt. Some of the leverage ratios are as follows:

- Debt Ratio

- Used to measure the total assets that are funded by debt

- Computed as Debt Ratio=(Total Assets)/(Total Debt)

- Debt Equity Ratio

- Used to measure the percentage of the debt and financial liabilities to total equity

- Computed as Debt Equity Ratio=(Total Liabilities)/(Total Equity)

- Interest Coverage Ratio

- Outlines the ability of the company to meet its interest obligations

- Computed as Interest Coverage Ratio=(Operating Income)/(Interest Expenses)

- Debt Service Coverage Ratio

- Outlines the ability of the company to meet its debt obligations

- Computed as Debt Service Coverage Ratio=(Operating Income )/(Total Debt Service)

Activity Ratios

Efficiency ratios measure the effectiveness and efficiency of an entity utilising its assets and other resources. Some of the activity ratios are as follows:

- Asset Turnover Ratio

- Used to measure the amount of turnover the entity can generate from its assets

- Computed as Asset Turnover Ratio=(Net Sales )/(Average Total Assets)

- Inventory Turnover Ratio

- Measures the quantum of sales and subsequent inventory replenishment in a specified period

- Computed as Inventory Turnover Ratio=(Cost of Goods Sold)/(Average Inventory)

- Receivables Turnover Ratio

- Outlines the number of times an entity can turn its receivables into cash

- Computed as Receivables Turnover Ratio=(Net Credit Sales )/(Average Accounts Receivable)

- Day Sales in Inventory Ratio

- Outlines the holding period of the inventory before sales to consumers

- It is computed as Day Sales in Inventory Ratio=(365 Days)/(Inventory Turnover Ratio)

Profitability Ratios

Profitability ratios measure the profit-making ability of the entity using its assets and other resources. Some of the profitability ratios are as follows:

- Operating Margin Ratio

- Used to measure the operating efficiency of the entity by comparing the net sales to the operating income

- Computed as Operating Margin Ratio=(Operating Income )/(Net Sales)

- Gross Margin Ratio

- Measures the quantum of profit by comparing the gross profit with the net sales made by the entity

- Computed as Gross Margin Ratio=(Gross Profit)/(Net Sales)

- Return on Assets Ratio

- Outlines how efficiently an entity uses its assets to generate income and profits

- Computed as Return on Assets Ratio=(Net Income )/(Total Assets)

- Return on Equity Ratio

- Outlines how efficiently an entity uses its equity to generate income and profits

- Computed as Return on Equity Ratio=(Net Income )/(Shareholder^' s Equity)

Advantages and Disadvantages of Financial Ratios and Comparison Techniques

As explained in the previous section, a financial ratio is a tool to measure an entity’s operational efficiency, profitability and overall financial performance. It is a simple and effective tool for analysing financial information without an in-depth analysis of every line item of the financial statements. As advantageous as a financial ratio is, it also has its limitations and disadvantages. These advantages and disadvantages are outlined below.

- Assists in drawing trends and subsequent analysis, Therefore playing a pivotal role in making forecasts and setting goals

- Assists in forecasting performance and budgeting

- Helps in the estimation of the operational efficiency of the entity

- Facilitates comparison of financial performance of two or more entities

- Assists in the determination of liquidity as well as long-term solvency of the entity

- Financial ratios do not factor in the non-financial factors that impact a business entity's performance.

- In cases where there is a change in accounting policies and assumptions, the financial ratios will not lead to reliable conclusions due to the non-comparability of data.

- It helps set the trend using historical and current financial information. However, there is little scope for predicting future financial positions.

- The computation of ratios does not provide any value to the users of financial statements. Only upon analysis and use of the analysis to take business decisions does the exercise of analysis of ratios offer value addition to the entity.

In addition to the financial ratios, there are other ways in which data can be compared to identify errors. As stated in the previous section, you need to take a role of an auditor while identifying errors. Other comparison techniques for identifying errors include:

- Comparing the closing balance of the previous year with the opening balance of the current year

- Comparing the data in the books of accounts of the current year with the trial balance

- Comparing the balance confirmations obtained from the debtors and creditors with the trial balance

As advantageous as comparison techniques are, they also have limitations and disadvantages. These advantages and disadvantages are outlined below.

- Helps in checking the accuracy of financial data

- Confirms the consistency in the data recorded and presented in the financial statements

- A quick process as the data required for comparison is usually readily available

- The comparative analysis does not factor in the non-financial factors impacting a business entity's performance.

- Comparative analysis cannot be used for concluding decision-making.

- They can be misleading if comparisons are made for different incomparable periods.

Analysing Ratio Calculations

Now that you have understood the types of ratios and the advantages and disadvantages of ratio analysis, it is vital to understand the importance of the ratio analysis so carried out. As discussed earlier, ratio analysis helps in identifying errors and decision-making. Ratios and trend analysis help identify errors when there is a deviation from the trends. Some of the decisions which use ratios as the manner of analysis are:

- Strategic decision-making for the business

- Mergers, acquisitions, and divestments

- Business expansion and diversification plans

- Financial decisions like the issue of shares or borrowing money

The significance of various ratios is as follows:

Liquidity ratios

Current ratio

The current ratio is one of the most commonly used liquidity ratios. The objective of calculating the current ratio is to assess the ability of the enterprise to meet its short-term liabilities. As a standard rule, current assets should be at least twice the current liabilities. A low ratio indicates the inadequacy of the entity to meet its current liabilities and is a sign of inadequate working capital. A high ratio is an indication of inefficient utilisation of funds. An enterprise should have a reasonable current ratio. A current ratio of 2:1 is considered satisfactory.

Acid test ratio

Liquid assets are either cash or cash equivalent or assets that can be converted into cash within a limited period. They include bills receivable, liquid securities, and debtors. Stock is excluded from liquid assets as it takes time to convert into cash. A quick ratio of 1:1 is usually considered favourable. A high liquidity ratio compared to the current ratio may indicate understocking. On the other hand, low and low liquidity ratios are signs of overstocking.

Similarly, a high cash ratio indicates inefficient cash utilisation, and a cash ratio lower than one suggests the entity has a cash crunch. Finally, a high operational cash ratio indicates that the entity has generated sufficient cash to meet its liabilities along the same lines. In contrast, a low ratio indicates an inability to meet liabilities from operations' money.

Leverage ratios

High leverage ratios, such as a high debt ratio or a high debt-equity ratio, indicate that the entity is primarily financed by debt and will consequently have a higher finance cost obligation.

On the contrary, low-interest coverage and debt service coverage ratios are a sign of concern that the entity does not have enough earnings to meet its debt obligations.

Activity ratios

High-efficiency ratios, such as asset turnover ratios, are an indicator of the good performance of the entity. High-efficiency ratio indicates the high operational efficiency of the entity.

Profitability ratios

Again, as the name suggests, these ratios indicate the entity's profitability; Therefore, a higher ratio would entail higher profits.

2.2.4 Methods of Presentation of Financial Data

Stakeholders use financial data within and outside the entity for the decision-making process. Therefore, the business entity must provide data in a manner that will facilitate the decision-making process. Financial statements are a detailed presentation of the financial information of an entity. However, a user of the financial statement will not be able to extract a lot of data from the financial statements for a period and its corresponding period alone. Further, not all users of financial statements are financially literate, i.e., they cannot decipher and make decisions from the financial statements provided to them.

Therefore, it becomes mandatory for an entity to provide and present easily accessible and understandable data. Some of the ways for the presentation of financial data are as follows:

Charts

Charts are the most convenient and easily readable forms of presentation of financial data. They help provide large amounts of historical information in a single image. Charts display a large volume of data in a format that is easier to read and interpret and can facilitate comparing two or more data sets. In addition, they better clarify trends than tables and help estimate values briefly. Charts can be pie charts, bar graphs or even line graphs, depending on the presented data. However, charts cannot provide detailed information as their goal is to simplify the presentation of data. Therefore, one major disadvantage of charts as a data presentation method is that they cannot be used to gather detailed information and must be accompanied by additional written or verbal explanations.

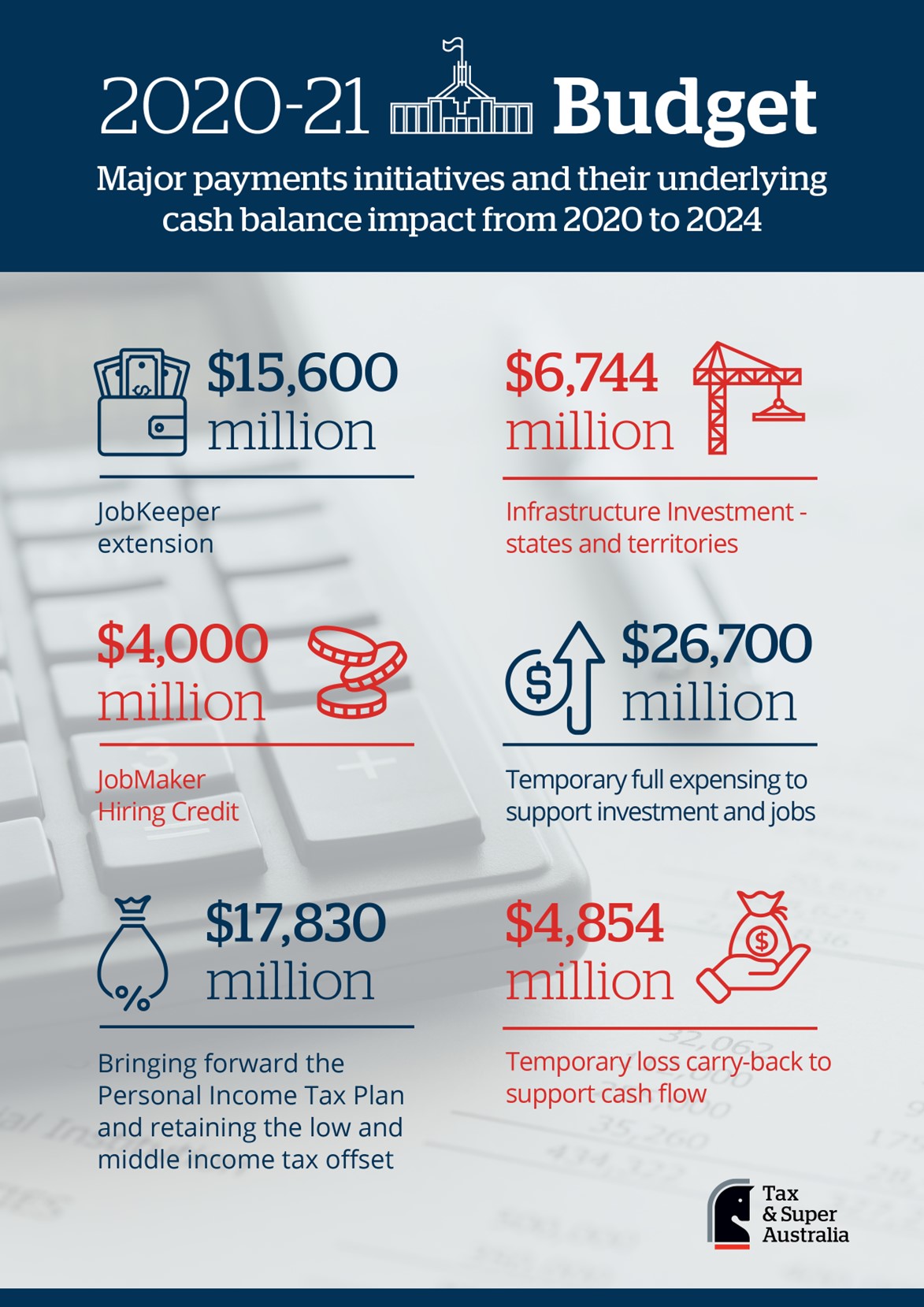

Infographics

Infographics are easily understandable forms of presentation of financial information. Unlike charts, where the data is a graphic representation of numbers, infographics use text and pictures to illustrate the data. In short, they turn complicated information into visual graphics that are easy to understand, retain and catch the eye of the reader. Together with the presentation of data, they also explain the data presented. However, infographics can sometimes be ineffective in providing detailed information, especially when providing large historical information about the entity. It can be challenging to understand and draw conclusions from an infographic at-a-glance. One has to read it in detail to decipher the information provided. They also can be time-consuming to design, and sometimes poor designing could lead to misinterpretation of data without detailed explanations. Further, condensing too much information in an infographic may lead to data overload for the readers. See the fol

lowing example

2.2.5 Review of Financial Statements for Errors and Compliance With Accounting Standards

Material errors are errors that significantly impact the decision-making of the user of the financial statements. Immaterial errors are errors that do not significantly impact the financial decision-making of the users of the financial statements. You must review all material and immaterial errors to present the entity’s financial performance or cash flows appropriately. Reviewing also ensures compliance with the Australian Accounting Standards.

You must ensure errors are corrected or referred for correction because of the following:

- You can build trust with accurate financial statements. Investors, retailers, and lenders need to know that your business is thriving and that they can confidently invest their hard-earned money. It takes more than profits to show how well a company is doing.

- You may lose business when your financial statements are unorganised or full of errors.

- Your entity’s financial statements can help you grow your business. Potential customers, investors, and suppliers hope to see a well-maintained accounting record before doing business with you. Therefore, having well-organised and accurate financial statements can help you expand your business.

- Accurate and up-to-date financial reporting will make your business better prepared for tax returns. In addition, regular financial reporting ensures you correctly report your financial status to the tax department.

It is imperative to ensure that there are set organisational procedures that facilitate statutory and ethical requirements when correcting or referring to errors since:

- Organisational procedures lay down proper processes that you must follow when correcting or referring to errors

- Statutory and ethical requirements must be met while correcting or referring to errors to ensure complex situations, which may attract penalties, can be avoided

The various kinds of errors are:

These are errors arising from incorrectly classifying assets and liabilities. For example, advances received from customers could be grouped with trade receivables instead of current liabilities.

These errors result from the incorrect computation of income and expenditure in the profit and loss statement. For example, some direct costs could be added back to the gross profit instead of reducing it.

These are clerical errors wherein the numbers are incorrectly recorded in the financial transactions and subsequently given effect in the financial statements.

These errors result from using incorrect estimates while preparing financial statements or inconsistently following accounting policies. For example, depreciation was calculated using a straight-line method instead of a written-down value method.

These errors can be identified from the financial statements in the following ways:

- There could be an error of commission in the recording of sales.

- This could be identified by an unexplained increase or decrease in the top line.

- There could be an error in computing and recording depreciation.

- This could be identified by comparing it with the depreciation charged in the previous year.

- Inconsistency in the accounting standards can be identified by checking the financial statements and the disclosures.

- Compare the financial statements and disclosures with the requirements laid down by the standards.

- There could be an error while computing accounting estimates.

- This could be identified by recomputing them based on the computation disclosed.

- Ratio and trend analysis would give compelling insights into the existence of errors.

- A deviation from the trend could be an indication of error.

Other procedures you can adopt to identify and check for errors and compliance include:

- Reviewing sales journals to ensure all sales transactions are recorded

- Reviewing trial balance for classification of ledgers

- Reviewing bank reconciliations

- Routinely checking general ledgers to identify errors

- Reviewing adjusting entries for any errors

- Checking subsidiary ledgers with general ledgers

- Conducting reconciliations

Amendments to Financial Statements

You must review the AASB 108 and use it as a guide for supervision on rectifying an error. If not made intentionally to achieve a particular presentation, immaterial errors do not need to be updated to comply with Australian Accounting Standards. Nevertheless, correcting all errors (including those that are not material) in preparing the financial statements reduces the risk that immaterial errors will gather over reporting periods and become material. You should then evaluate whether a mistake is material by implementing the same considerations as outlined in the description of the materiality process. Establishing materiality judgements regarding errors requires both quantitative and qualitative evidence. The entity must recognise information that, if misrepresented or disregarded, could rationally be necessary to determine primary users’ decisions. You must also examine whether any identified errors are resolved collectively.

Further Reading

AASB 108 deals with accounting policies, changes in accounting estimates and errors. You can access it through the link below.

AASB 108: Accounting Policies, Changes in Accounting Estimates and Errors

The requirements to resolve accounting errors according to accounting principles and organisational and legislative requirements will depend on the organisation’s size and state/territory. Relaxations are available to businesses with low revenue. Generally, provisions under the Corporation Act 2001, Codes of Practice and Accounting Standards must be followed while rectifying discrepancies and errors.

The intention of accounting and auditing while following legislative requirements is to ensure that the accounting reports of an organisation represent an accurate and fair view. When a company's financial records follow accounting standards, the scope of accounting fraud reduces to a bare minimum.

However, accounting errors cannot be ignored and can never end. Here is a step-by-step guide that you must follow to detect and resolve accounting errors:

- Total the debit and credit columns of the trial balance. You can carry out this step by ensuring that the closing values on both sides at the end of the trial balance are equal.

- Recheck the balances of each ledger account.

- Check the casting and carry-forward of subsidiary books.

- Ensure that all accounts' opening balances have been correctly brought downward. You can do this by comparing the closing balance from the previous year’s balance sheet with the opening balances.

- If you cannot identify errors, you can transfer the difference in the trial balance to the suspense account.

Materiality plays a crucial role while identifying errors and correcting them. Mistakes include numerical errors, accounting policies, omissions or misinterpretations of matters, and duplicity. You can follow these general steps to amend errors:

- Indicate the effect of accumulated errors on prior periods: For example, an error leading to excess revenue disclosed in the prior periods, now identified, would impact the top line and the profits of the prior periods. The total reduction in the top line and the profits due to the rectification of the error can be identified to measure the impact of the error.

- Adjust the financial statements by restating the financial statements: Prepare financial statements for each previously disclosed period to indicate an error correction.

- Adjust the balance of assets or liabilities at the beginning of the financial period: the other side of the adjustment goes to the retained earnings

- Restate the initial balance of retained earnings for the previous period shown in the comparative statement if the error precedes the comparison period

- correct the error in each financial statement for which you present comparative financial statements

Checkpoint! Let's Review

- Financial ratios and comparison techniques are used to review for errors in financial statements.

- Financial data can be presented through charts and infographics.

- To review for compliance, compare financial statements with the Accounting Standards and other financial documents.

- AASB 108 serves as the guidance document on amending errors in financial statements.

During the review of financial records, you must take the role of an auditor and present reasonable methods to provide a rational basis for obtaining limited assurance. Assurance should be such that no material changes should be required to ensure that the financial statements conform to the appropriate financial reporting policies and standards.

An error can be a mistake in an accounting entry that is not voluntary. When an error is detected, it must be immediately rectified. If there is no instant resolution, an investigation into the error is initiated to understand the reason behind such an accounting error. An error should not be confused with fraud, which is carried out to deceive stakeholders intentionally and deliberately. Therefore, it is crucial to ensure that errors are resolved immediately.

If one cannot rectify these errors, it is essential that they are escalated as and when required after seeking proper authorisation. Timely resolution of errors ensures:

- Financial records are accurate

- Top management can define the correct aims and goals for the organisation

The errors should be escalated after thoroughly verifying the error and identifying its root cause. Verification refers to ensuring that the errors and the impact of the said errors identified are real.

Once verification is done, it should be escalated to delegated persons. Delegated persons are authorised by the organisational policies to verify and rectify errors. So, for example, if you identify an error of omission, it should be escalated to the Accounts Manager and documents supporting the error identified.

Once the error is escalated, the delegated person must review the mistake with the supporting documents and verify its existence. Following this, an authorisation is given to rectify the said error. Authorisation refers to the vesting of powers by the delegated person to the person who identified the error. Therefore, you are permitted to fix the said errors and make all the necessary changes in the books of accounts or financial statements by receiving authorisation. The delegated person can give authorisation by email or any other internal communication followed by the entity.

However, if the error is due to factors outside the entity, you can escalate the errors to your stakeholder. Stakeholders are the individuals that have an invested interest in the entity. They are affected and can affect the organisation. The stakeholder you must establish communications with will vary depending on the error level.

Stakeholders who will actively participate in rectifying discrepancies include the following:

Suppliers and retailers sell goods and services to your business.

The management collates all business reports to analyse the organisation’s financial health and track financial performance and available growth opportunities.

It also helps carry out a going concern analysis, trend analysis, cost analysis, and liquidity analysis. These analyses all help set future budgets and targets the company wants to achieve.

The government can also be considered a significant business partner. This is because they collect taxes from the company (corporate income tax) and all the people associated with the company (employee tax).

It is essential to ensure proper diligence during the third-party selection of a third party who will be referred to resolve errors. Performing a third-party review helps ensure that the organisation selects the right third party and understands and controls the risks posed by the relationship in line with the organisation's wishes. Providing clear roles and responsibilities to the third party and integrating the third-party resolution management framework enables continuous accountability. Appropriate documentation and reporting facilitate the management's accountability and monitoring during the resolution process.

However, when a third party submits a solution for error resolution, the organisation will ensure that it helps them focus on resolving material misstatements. It must provide that all business and legal matters are taken into consideration.

Further, it is pertinent to note that referring to the third party for error resolution does not absolve the organisation from ensuring that its financial statements are free from material misstatements. You must also understand that third parties are not liable for resolving errors. Instead, their role is to aid in resolving errors and misstatements.

There is no general process for contacting your stakeholders to refer to the errors. You should review the organisational policies and procedures pertinent to communicating with your organisation’s stakeholders, as these will guide you with the correct processes to follow. However, you can escalate discrepancies by involving key stakeholders and following organisational policies and procedures.

This video talks about how to identify errors in income statements.

Checkpoint! Let's Review

- Financial ratios are derived from the financial information presented in the financial statements to provide valuable insights into the company's financial position.

- Verification refers to ensuring that the errors and the impact of the said errors identified are real.

- You must receive authorisation from the delegated person before making changes to the financial statement.