In Topic 1, you were introduced to the accounting process. Now that we have examined the basic elements of the balance sheet and the profit and loss statement, we are going to examine the accounting process in detail.

The accounting process is a proven method for ensuring all the money earned and spent by a business is properly recorded. This process identifies errors early on, improves bookkeeping accuracy, and can assist in generating financial reports.

The accounting process involves:

- Identifying Business Transactions

- Recording Business Transactions

- Posting to the Ledger

- Prepare Un-Adjusted Trial Balance

- Adjusting Entries

- Prepare Adjusted Trial Balance

- Prepare Financial Statement

The accounting process starts with completing an analysis of all transactions and identifying which business transactions need to be recorded in the accounting records.

Many business transactions contain an element of Goods and Services Tax (GST). GST is a broad-based consumption tax that is levied on the supply of most goods and services consumed in Australia. The GST rate is currently 10%.

The following video from the ATO explains what GST is and how it works.

Read for more information on GST and how it works.

All businesses with an annual turnover of $75,000 or more must register for GST.

The current rate of GST is 10%. This means if a business charges $100 for goods or services, their customer will be charged $110. The additional $10 is the GST is then paid to the ATO.

When a business buys supplies for their business, they are charged 10% in GST. This amount can be claimed back as credit. At the end of each GST period, usually quarterly but occasionally monthly, the business has to account for the GST they have collected on their sales minus any that they have paid (the credits) on their purchases. The difference is the amount payable (or refundable if credits on purchases exceed debits on sales). This amount is reported by completing a business activity statement and paying the net GST to the ATO.

All businesses with an annual turnover of $75,000 or more must register for GST.

The current rate of GST is 10%. This means if a business charges $100 for goods or services, their customer will be charged $110. The additional $10 is the GST is then paid to the ATO.

When a business buys supplies for their business, they are charged 10% in GST. This amount can be claimed back as credit. At the end of each GST period, usually quarterly but occasionally monthly, the business has to account for the GST they have collected on their sales minus any that they have paid (the credits) on their purchases. The difference is the amount payable (or refundable if credits on purchases exceed debits on sales). This amount is reported by completing a business activity statement and paying the net GST to the ATO.

Accounting for GST

When you make a taxable sale of more than $82.50 (including GST), GST-registered customers must be given a tax invoice for them to be able to claim the GST credit. If they request one and the business does not provide it at the time, the business has 28 days from their request to give it to them.

Invoices need to display specific information. For sales of $1,000 or more, invoices must display:

- the words 'tax invoice.'

- the seller's name and ABN

- date of the invoice

- buyer name and ABN or address

- a description of the items sold, the quantity and the price

- the GST amount or the total amount includes GST.

Invoices for less than $1,000 need to have all the above but not the buyer's details.

Not all financial transactions and events need to be recorded in the financial statements of a business. A transaction can be defined as any monetary or business event that impacts a business’s financial statements. For example, Freshwater Pty Ltd employed a new employee who signed an employment agreement. The signing of an employment agreement would not be recorded in the accounting records as it does not impact the businesses' financial statements. The new employee is paid a sign-on bonus of $500.00. The paying of the sign-on bonus is an event because it is an employment expense that affects the equity account in the business's financial statements.

Identifying Business Transactions

Source Documents

Financial transactions and events are transactions and events that impact the assets, liabilities or equity of a business. Whenever a financial transaction occurs, a business document is prepared. These documents record all relevant details about the transaction and become the source of an entry in the accounting records.

A source document is an accounting term that describes the original records that contain the details that substantiate the financial transactions that are entered into the internal accounting system of a business. Source documents ensure that there is documentary evidence to support the purchase or sale of items of value and the receipt and payment of money. Source documents provide evidence or proof that a transaction has actually occurred, which makes it difficult for people to misappropriate or steal cash or other resource items from the business. Source documents are also required by both company and tax auditors. It is therefore critical when implementing an accounting process to ensure source documents are checked and verified for completeness and accuracy.

The details from the source document should be recorded in the appropriate accounting journal as soon as possible after the transaction has occurred. After recording, all source documents should be filed away in a document system where they can be retrieved later if required.

Source documents are typically retained for use as evidence when auditors review a company's financial statements and need to verify that transactions have, in fact, occurred. Generally, the Australian Taxation Office (ATO) requires businesses to keep written evidence of financial transactions for five years from the date the business lodges its tax return. The Australian Securities & Investment Commission (ASIC) requires businesses to keep forms and documents for a period of seven years.

The design of business documents will vary between businesses. To ensure efficiency and accurate recording, all businesses will have a standardised set of business documents appropriate to their needs. Businesses should also have a documented set of policies and procedures relating to the authorisation, checking and processing of business documents it receives and issues.

Information contained in a source document

A source document should describe all the key aspects of the transaction, such as:

- the names and addresses of the entity buying/selling the goods/services

- the date when the transaction occurred

- the amount of the transaction

- the amount of any taxes

- the nature and purpose of the transaction (i.e., descriptions)

- the specific terms and conditions of the transaction (i.e., discount, payment and delivery details)

- authorised signature for payment or acceptance of goods/services.

Examples of source documents

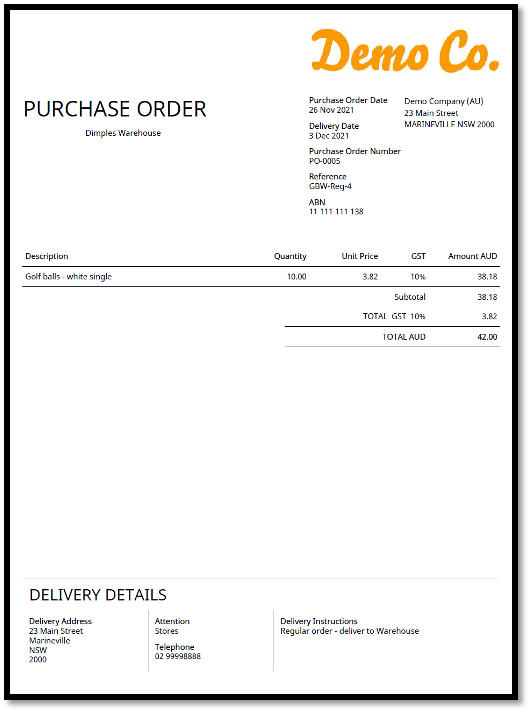

Purchase Order

A purchase order is a written request for the supply of goods or services. They allow a business to keep track of what is ordered, by whom and when. Purchase orders serve as legal documentation that can be enforced. It is therefore important to check purchase orders against other source documents like delivery documents, invoices and credit notes to ensure information is correct and avoid potential conflict or confusion with suppliers.

Example of a purchase order

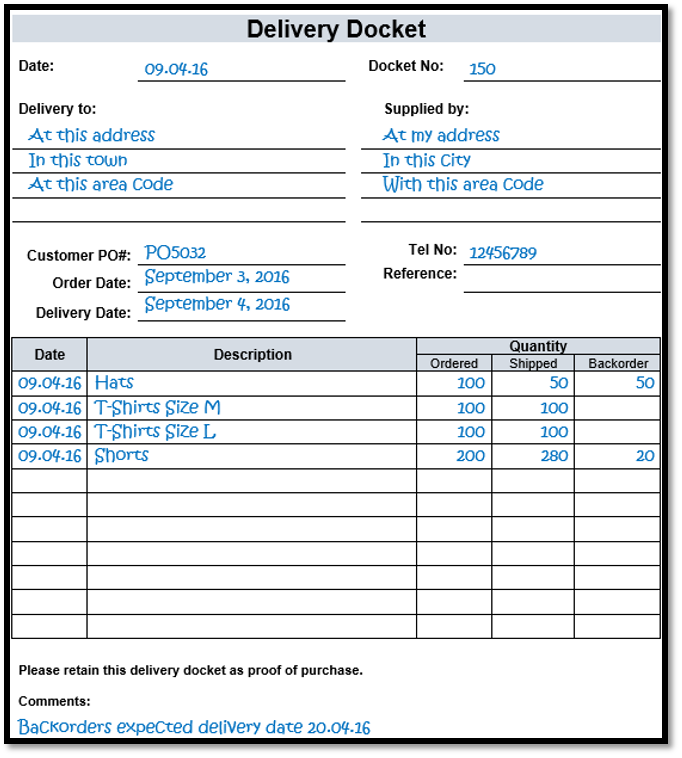

Delivery Docket

A delivery docket is a document that accompanies goods when they are delivered. They are a critical part of the exchange of goods and services between purchaser and supplier, as they document critical delivery information for all parties involved in the exchange. Delivery dockets reduce the chances of disputes and other delivery issues by documenting exactly what was delivered, and what was not delivered, and by acknowledging that delivery through signatures. It is important to check orders received against the delivery dockets to ensure they are accurate. Any errors or damaged goods should be reported to the supplier immediately to avoid any order or delivery disputes.

Example of a delivery docket

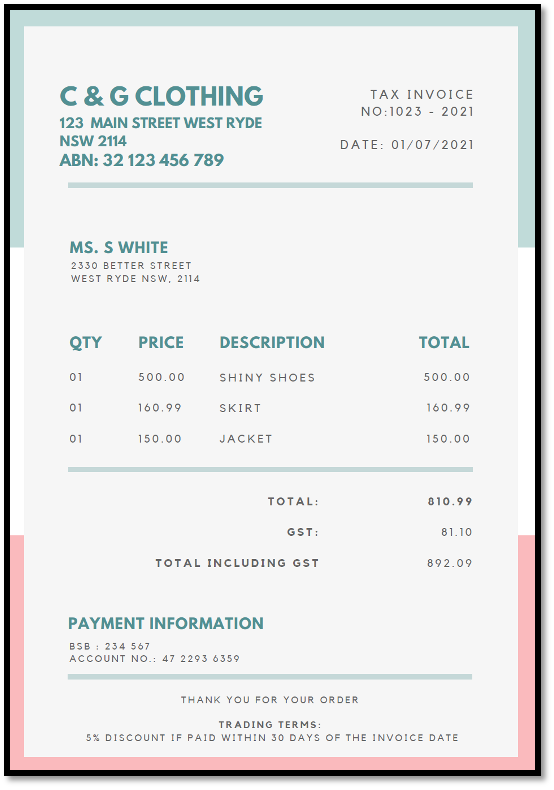

Tax Invoice

A Tax invoice is a bill charging a customer for goods or services supplied.

The tax invoice details should be checked by quantity, price and description against the purchase order. Invoices contain errors that may cost the business money. Some are just human errors; some are system errors, and some are because other business owners might not know the rules when it comes to raising correct invoices.

The Australian Tax office (ATO) deems it to be the business owner’s responsibility to ensure they are paying correct invoices. If an invoice is wrong, the supplier is not at fault, it is the business that has processed the incorrect invoice that is at fault.

Common invoicing errors include:

- Invoices with an invalid ABN (Australian Business Number). If the ABN is incorrect or does not exist, then as the payer, you must withhold tax at the top rate, currently 48.5%. The easiest way is to check the Australian Business Register online.

- An invoice provided to you by your suppliers has an error. If a business receives an invoice with an error, it should contact the supplier and ask them to issue an adjustment note or a new invoice. The supplier has a responsibility to provide a correct invoice before a business makes any payment.

- A supplier is charging GST when they are not registered for GST. The Australian Business Register will also tell you if suppliers are registered for GST.

- The invoice you have received might be just totally wrong. Sometimes suppliers invoice the wrong customer or invoice them for goods or services they do not receive. Question invoices that look suspicious, and don’t be afraid to ask questions.

- Invoices are often in the wrong format. This tends to happen when people are creating invoices in excel or word. Invoices must contain certain information. The ATO provides information on what is mandatory on a tax invoice. Requirements of tax invoices

Business.gov.au has developed a step-by-step process for creating and sending invoices and dealing with unpaid or incorrect invoices. Before continuing, please access and read through this information. You may like to bookmark it for future reference. The information will be useful while completing your assessments.

Example of a tax invoice

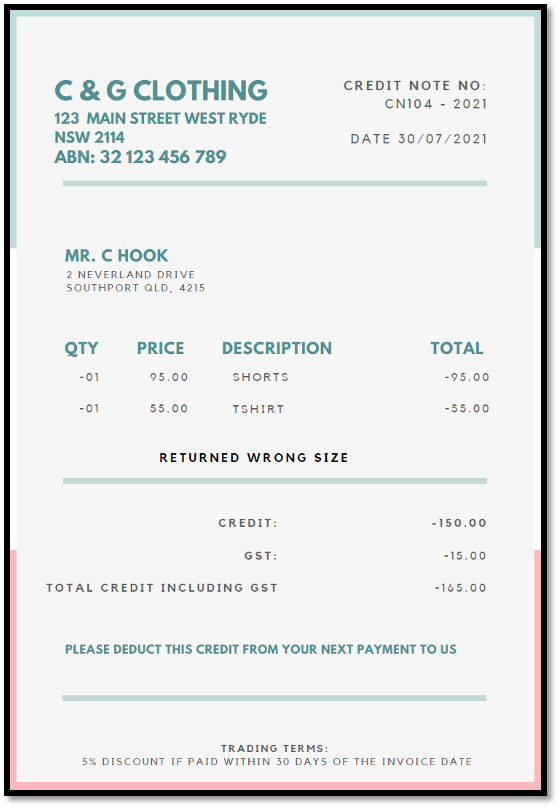

Adjustment Note

An adjustment note is a document that allows a customer a reduction in the original amount charged for goods or services supplied. Adjustment notes are used to correct an error in a previous document. For example, if an invoice incorrectly charges a business for an item the business did not receive, the supplier will issue a credit note. A credit note is an adjustment note.

Example of an adjustment note

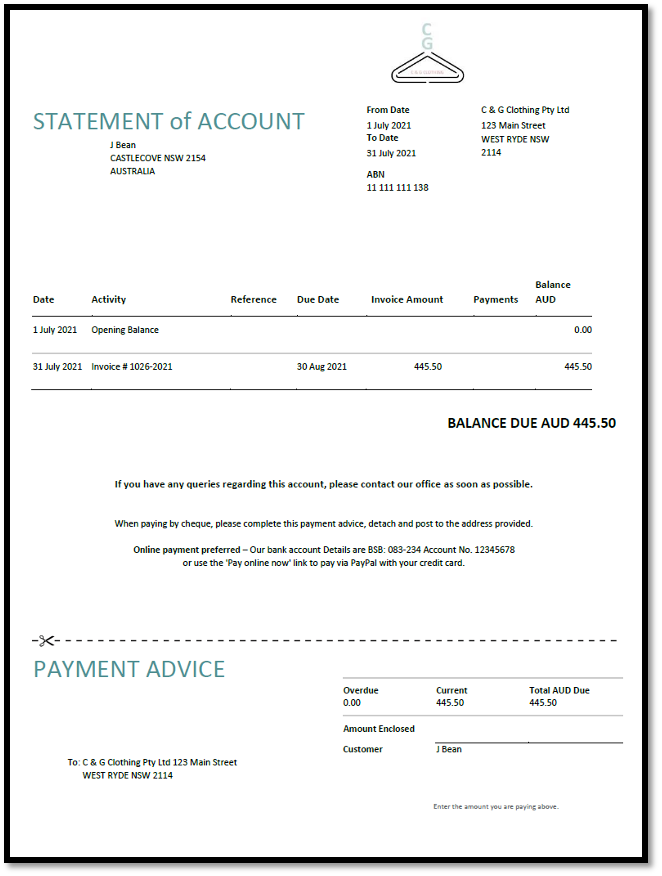

Statement of Account

A statement of account is a document that is prepared by a supplier and sent to the customer each month. It provides the customer with a summary of all the transactions that have occurred during the past month. It is useful for customers as it allows them to view all invoices and credit notes and to identify if they have missed any payments so that discrepancies can easily be rectified.

Example of a statement of account

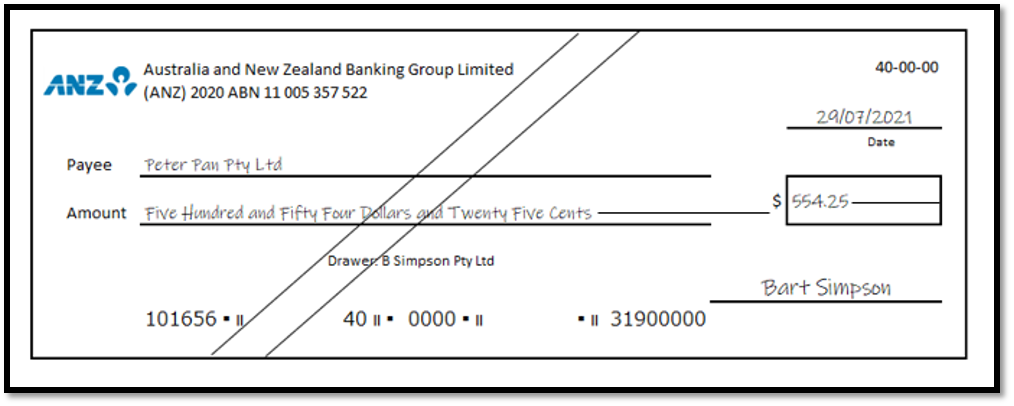

Cheques

A cheque is an order to a bank to pay a sum of money to a specified person. Cheques are being phased out by banks and financial institutions as a payment type. Some businesses do, however, still continue to use cheques. When receiving a cheque as a form of payment, the following should be checked:

- The date is correct. Cheques are valid for 15 Months, after which it is considered "stale."

- The business name is written legibly and clearly as the cheque payee

- Both the amount in numbers and the amount in words is written clearly and match one another

- The cheque is signed by the cheque issuer

- There are no overwriting/edits in the cheque. If so, you must ask the cheque issuer to counter-sign the place that has the edit.

When writing a cheque, security measures you should implement include:

- Don’t leave spaces between words and numbers

- Make sure you cross the cheque so that the payment is deposited in the correct bank account

- Draw a line after the name and amount that carries through to the end to ensure nothing can be added to the cheque after it has been written out.

- When writing the amount, include cents (2 decimal places) so that more numbers cannot be added. e.g., $4567.00.

Example of a cheque

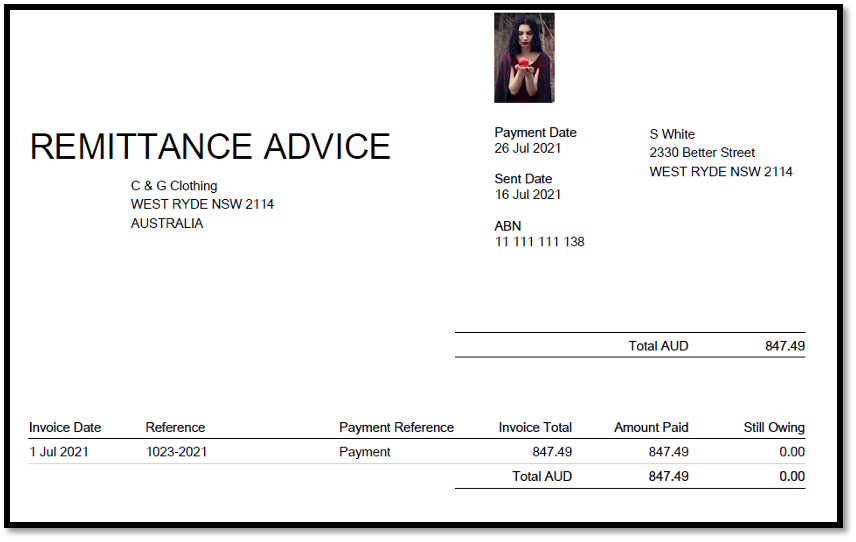

Remittance Advice

A remittance advice is a paper or electronic notification of a payment sent by a payer to a payee. Remittance advice is not proof of payment but only a notification that a payment was sent or processed. Remittance advice is not required when a supplier pays a business. It’s more of a courtesy to help reconcile the payment to the invoice.

Example of remittance advice

Receipt

A receipt is a document used to acknowledge the receipt of money. Most businesses do not issue a receipt unless specifically requested by the customer. The exception to this is the Point of Sale (POS) receipt/tax invoice that is automatically generated by a POS device for over-the-counter electronic funds transfer (EFT) and credit card transactions.

Example of a receipt

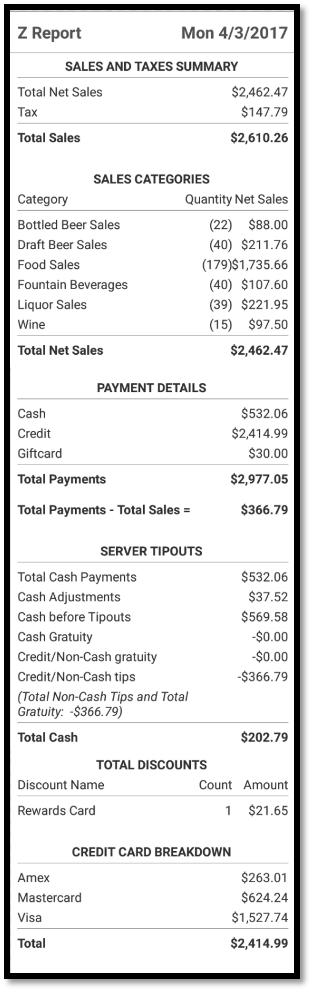

Point-of-sale Daily Summary

A Point-of-sale Daily Summary is a record of the daily takings through a point-of-sale (POS) device such as a cash register or point-of-sale computer terminal.

Example of a point-of-sale daily summary

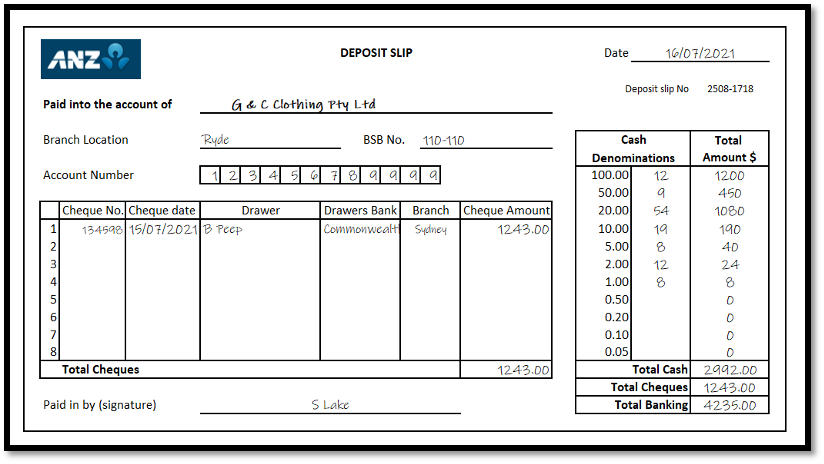

Bank Deposit Slip

Some small businesses only accept cash, although this is becoming less common. A bank deposit slip is a document prepared when depositing cash/cheques in a bank account. Deposit books are printed by banks to facilitate the banking of cash and cheques. They consist of two parts:

- the deposit slip is presented to the bank when the deposit is made and used by the bank as a record of the deposit

- the deposit butt, is retained by the business as proof of the deposit.

The deposit butt should be reconciled against the bank statement to ensure the deposited amount has been recorded correctly.

Example of a bank deposit slip

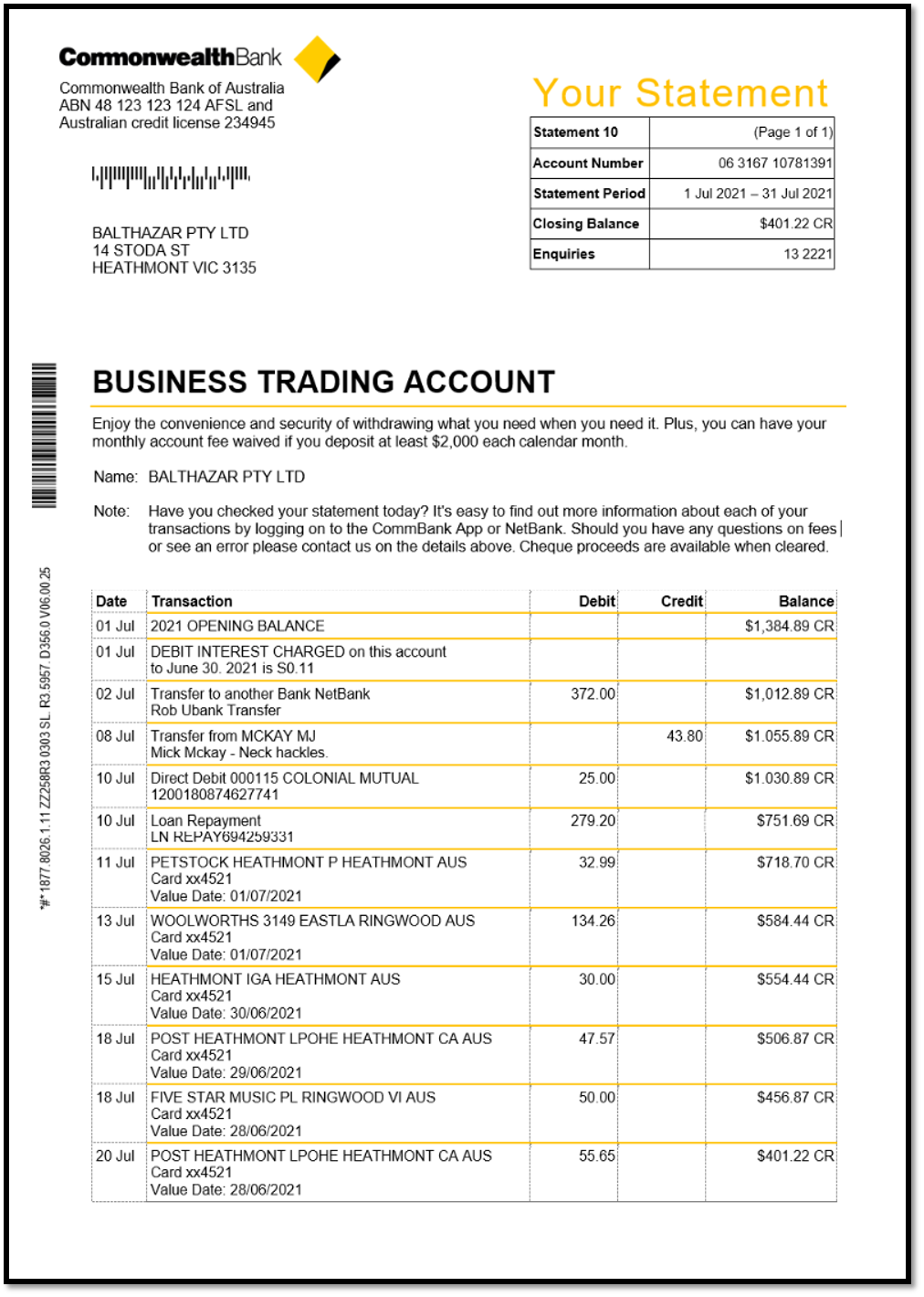

Bank statement

A bank statement is a document that provides evidence of deposits, electronic funds transfer (EFT) transactions, direct debits, direct credits, bank charges, and interest received and paid.

Statements should be reviewed periodically (daily, weekly or monthly, depending on the number of transactions). Deposits and withdrawals should be matched against other source documents like daily point-of-sale daily summaries, remittance advice, deposit slips and cheque butts to check there are no errors. Bank fees and charges are directly deducted from the bank account by the bank. Interest earned is calculated by the bank and directly deposited into the account each period.

Example bank statement

The business will have specific processes for checking different types of source documents.

For documents received from suppliers, it is common practice for the following checks to be made:

- each supplier’s invoices should be checked for against the relevant purchase order and delivery dockets

- prices charged on suppliers’ invoices should be checked against any agreements and for accuracy

- supplier adjustment notes should be matched to the original invoice and prices and checked.

A sound set of internal controls working together to mitigate risk in the accounting system of a business is an effective way of ensuring records are accurate and reliable and that errors in business documents are minimised. Internal controls measures can include:

- Segregation of duties. Tasks are broken up between several employees rather than one person doing the whole process

- Pre-number documents so that missing documents are easier to track down

- Reconciling the balances in accounts to identify if either some documents have not been recorded or if some transactions recorded in the accounts do not appear to have any supporting source documents.

Now that we have identified what a financial transaction is, we need to identify the effect the transaction has on the accounting equation. Previously you may recall, we analysed the transaction of New Business IT of The Accounting Equation.

Analysing transactions involves reviewing and identifying the effect financial transactions have on the asset's liabilities, and equity of a business before recording the transaction. Remember when we analyse transactions, two sides of the accounting equation (Assets = Liabilities + Equity) must remain in balance after every transaction is recorded.

The following video Mark Farber explains business transactions and accounts.

In the second video, Mark uses a consulting company to analyse the effect transaction have on the accounting equation.

After the initial recording, all source documents should be preserved and organised into a file and put into a system so they can be retrieved at any time. Traditionally filing systems were paper-based. However, many businesses have shifted to the paperless office, or close to it, with online, cloud-based storage systems and digital transactions replacing paper-based storage systems.

When filing source documents:

- Avoid saving unnecessary documents. Only keep a document if it's relevant to your work activity or required by your business. Having too many unnecessary documents adds to clutter and makes it harder to find things in the future.

- Follow a consistent method for naming files and folders. For example, divide a main folder into subfolders for customers, suppliers and employees. Use shortened names to identify what or who the folders relate to. Consider using colour coding to make it easier to identify different categories of folders.

- Store related documents together; for example store all suppliers’ invoices together alphabetically and in date order. This will enable you to locate documents faster.

- Organise documents by date. Make sure that the date of a document is clear by highlighting it on a paper document or including it in the title of an electronic one. That will help to keep documents organised chronologically without having to open each one.

- Make digital copies of paper documents. This is useful for businesses that want to:

- implement a paperless system

- don’t have space to store paper documents

- need to archive documents without destroying

- need to share documents electronically

- want to make your information storage more secure.

The Australian Taxation Office (ATO) has the following record-keeping requirements for all businesses:

- The records cannot be changed and further, the information should be kept so that it cannot be changed or damaged.

- The records must be kept for 5 years from the date they were prepared, obtained, or a transaction was completed – or the latest act they relate to. The records might need to be kept for longer periods in certain circumstances.

- The business must be able to show the ATO their records if requested.

- The records must be in English or easily translated into English.

- Businesses may keep paper records electronically i.e. scan paper documents and store them on an electronic medium (and dispose of papers).

- If records are stored electronically, then they should be on a device that owners have all access to, have been backed up, and allows the owner to have control over the information that is processed, entered or sent from the device.

To find out more about what records the ATO requires you need to keep click here

Access the ATO's Overview of record-keeping rules for business to complete the two tasks below.

Task 1

Task 2