A business’s cash handling and banking management procedures are important in minimising theft and unauthorised transactions. Let’s look at some ways businesses can ensure the safety of their cash.

A bank statement is a ledger account maintained by a financial institution listing deposits and withdrawal transactions occurring within a given period for a bank account held by the business with a financial institution. Companies keep a similar general ledger account called 'Bank' or 'Cash at Bank', which is updated monthly by posting transactions from the cash receipts and cash payments journal.

Periodically, usually monthly but can be more or less often, bank reconciliation is done by comparing the cash records of the business with the financial institution's records. Because the financial institution and the company prepare the same records independently, any differences between the two records are identified.

Fraud detection is also a key reason for completing a bank reconciliation. It identifies any customer cheques that have bounced, or if any cheques issued by the business have been altered, stolen, and cashed without the business’s knowledge.

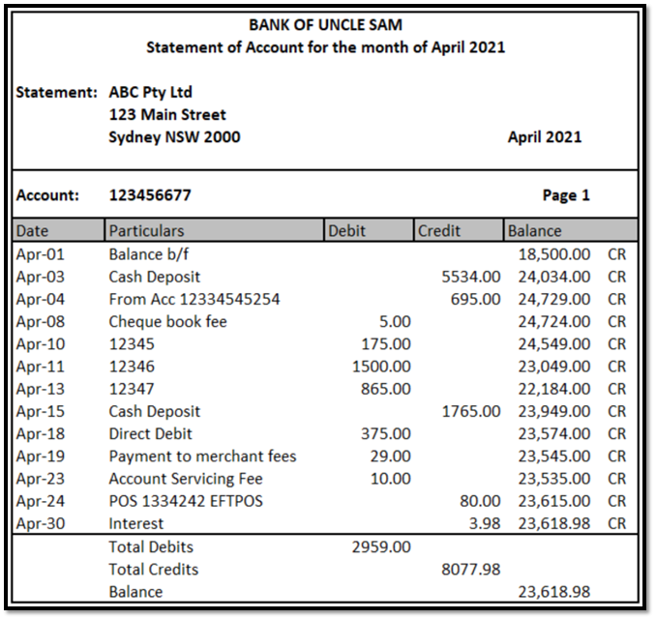

Below is a copy of the bank statement and Bank ledger of ABC Pty Ltd for the month of April 2021. You may expect that the bank statement balance and ABC's Bank ledger account match; however, this is not the case.

The bank statement balance of ABC Pty Ltd shows a credit closing balance of $23618.98. This amount is a liability to the bank as it is the amount the bank owes the business. ABC's Bank ledger account will have a debit balance as the cash held in the Bank of Uncle Sam is an asset for ABC Pty Ltd.

Some items in the bank's records do not appear in the business' records and vice versa. This is often due to a timing difference or fees and charges. It is the purpose of the bank reconciliation to pick up these differences.

Differences that may be picked up off the bank statement include:

- Bank Charges that are automatically deducted each month from the bank account.

- Interest received that is automatically deposited each month into the bank account.

- Bank transfers and direct deposits that the business may have instructed the bank to pay automatically: e.g. power bill, rent, credit card.

Differences that may appear in the business' records but not on the bank statement include:

- Represented cheques – Cheques that have been recorded in the business accounts but have not been presented at the bank for payment during the statement period

- Deposits not credited – Deposits that have been recorded in the cash receipts journal but do not appear on the bank statement yet

A business usually does not record these transactions until it receives its bank statement and does a reconciliation. Consequently, the cash payments and cash receipts journal are not balanced and posted to the ledger until the bank statement has been checked, and missing items identified and recorded in the journals.

Bank reconciliation procedure

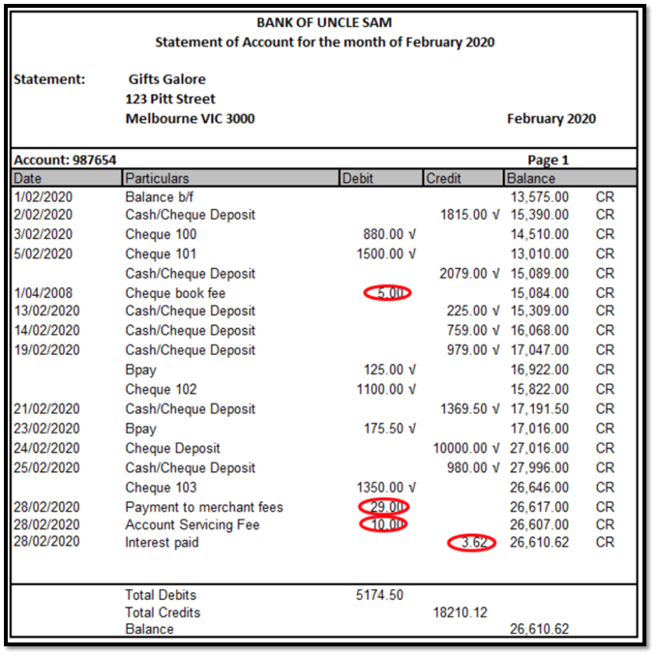

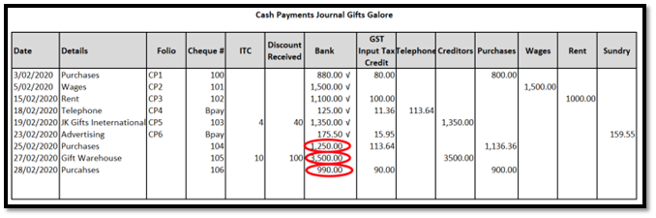

Compare the credit column of the bank statement with the bank column in the cash receipts journal. Tick off items that appear in both columns.

Highlight any item that appears only in one set of records

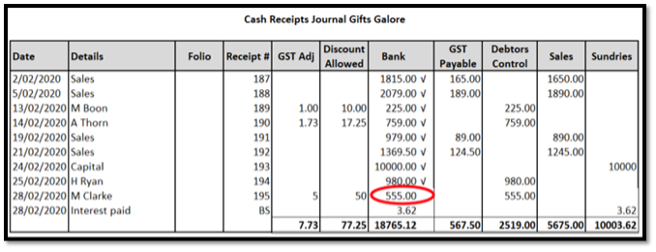

Cash Receipts Journal Gifts Galore

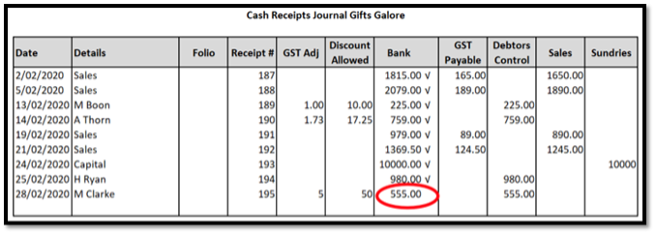

Compare the debit column in the bank statement with the bank column in the cash payments journal. Tick off items that appear in both columns.

Highlight any item that appears only in one set of records.

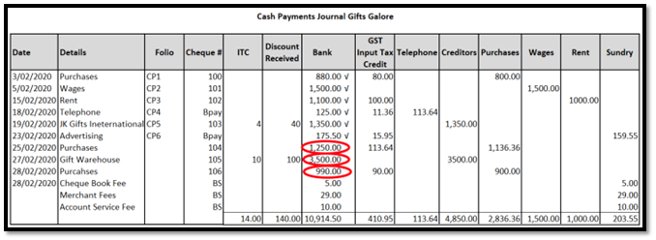

Cash Payments Journal Gifts Galore

Update the cash payments and cash receipts journal by recording any items that appear only on the bank statement and total the journals.

Cash Receipts Journal Gifts Galore

Cash Payments Journal Gifts Galore

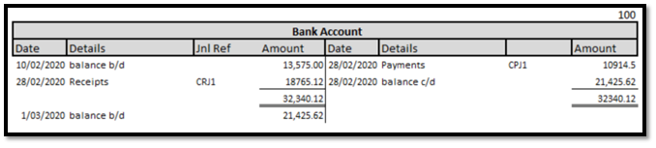

Post the cash receipts and cash payment journals to the ledgers.

Extract from General Ledger Account

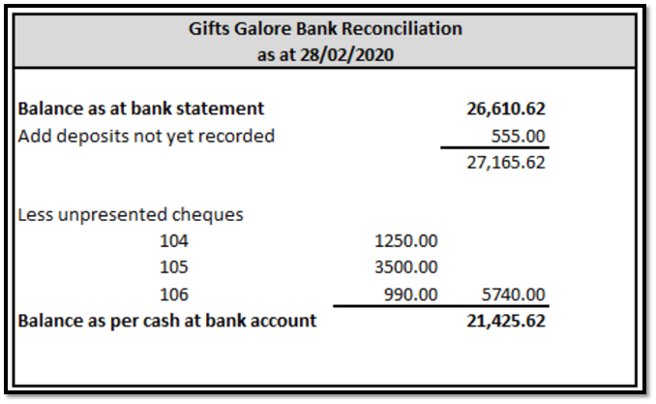

Prepare the bank reconciliation statement listing any transactions in the business records that do not appear on the bank statement.

Online Banking

Each and every time you log onto the internet, your computer is at risk of various threats with the aim of getting your personal details and accessing your money.

Behind the scenes, banks use various security measures to ensure that your transactions and personal information are protected. However, you, as a customer, can also play a big part in protecting your banking and personal information. The first step in that process is to understand the main threats to your computer.

1. Secure Devices

Ensuring that the device you use for online banking has software that helps protect against online threats. This includes:

- keeping any firewall, antivirus, and anti-malware software updated

- ensuring that the operating system on your device is up to date

- when you finish banking, log out and clear your browsing history.

2. Use a Secure Password

Use a strong password that’s unique and uses a combination of letters, numbers, and characters. We suggest using a password manager to generate and store secure passwords for online banking.

3. Secure Password

Don’t share your online banking password or PIN with anyone and don’t keep paper records of these types of credentials. Password managers like Keeper or LastPass store passwords as well as secure notes. Consider using two-factor authentication if it is enabled by your bank to further boost security.

4. Authenticate Websites

Ensure the online banking web address you’re using is correct and not linked to a fake site. You should always:

- manually enter the web address each time you access online banking (bookmark the site if you like)

- ensure the website has the padlock symbol in the website address bar (or ‘https’ in front of the address for a secure website).

- never click on an email link that claims to lead to online banking.

5. Check Bank Statements

Regularly review your bank statements to keep an eye out for suspicious activity. If a transaction is unfamiliar, contact your bank. Sometimes fraudulent transactions may only be for small amounts (a form of probing for online scammers).

6. Transfer Money Safely

Don’t transfer money to people or businesses you don’t know. Scam attempts may involve people contacting you claiming to be from a legitimate company, and asking for funds.

Always independently verify all money requests. Ensure you have followed procedures and have the required authorisation before paying any outstanding bills.

Cash and Cheque Deposits

Coronavirus has sparked the closure of a record number of ATMs and hundreds of bank branches across Australia. With banks encouraging clients to use online banking, it has become less common for businesses to use cash or cheques.

Some of the larger banks like Commbank, NAB and Westpac still allow businesses to deposit cash and cheques through an ATM using a card, an ATM Deposit Code or using their account details.

A cash deposit (notes and coins) limit applies per account per day.

Please Note: Some banks have removed cheques as a method to receive or make payments and are transitioning customers to online banking. If you are depositing cheques they must be in the same name as the account holder. If it is not, it will be rejected by the bank.

If using an ATM ensure the security of your cash by:

- Memorising your PIN, don’t write it down or keep it on you.

- Cover the ATM’s keypad when you’re typing in your PIN.

- Be aware of anyone looking over your shoulder

- Take another staff member with you if banking large amounts of cash

- Try not to make it obvious you are carrying cash

- Alter the route you take to the bank each time

- Store the cash safely in your purse or wallet before leaving the ATM

- Use Tap and PIN where possible, as it is a more secure alternative and reduces skimming opportunities.

Deposit Slips

As mentioned cash deposits are becoming increasingly rare, even among big banks. However, you may still find some businesses using them, so it’s important for you to understand what they are and how they work. Essentially, a bank deposit slip is an accompaniment to a cheque or cash payment that gives the bank teller all the information they need to make sure the right amount of money reaches the correct account. They’re often substituted for debit cards, which carry much of the same information but just in an electronic form.

If you find yourself regularly using deposit slips, you may find that a pre-printed deposit slip is an easier option. These are similar to standard deposit slips, but they come with important information already printed on the document. One of the main benefits of pre-printed deposit slips is the fact that they save you from writing out the same information by hand each time and also eliminate human error to a certain extent. Pre-printed deposit slips may also be useful for businesses that need to make regular bank payments, as they can ensure the correct information is provided.

Example

Like all industries, the financial sector is regulated by legislation, guidelines, and codes of practice specific to the industry. All businesses should have well-designed banking policies and procedures that align with the needs of the business, legislation, and the financial sector's codes of practice.

Banking policies and procedures outline how certain tasks are done and/or policies are adhered to. They can take the form of flow charts, checklists, or written narratives. No matter the form, they should succinctly provide the necessary “how to” information to the individuals tasked with carrying out those procedures. A consideration when developing procedures is identifying who, by role, is involved in the procedure, when the procedure needs to be applied, and how the procedure should be applied. For example, a procedure related to banking may state that “by the 5th day of the following month, the accounting manager reviews the bank reconciliation and signs off and dates the reconciliation.”

If a business accepts cash as a form of payment consideration of how cash is:

processes for example:

- A secure area for processing and safeguarding funds received is to be used and restricted to authorised staff only.

- When cash is being counted by staff, it is to be conducted out of sight of the general public.

stored for example:

- All cash and cheques must be protected using a cash register or safe until deposited. When cash has to be held in an office or store for any length of time, it must be stored in the safe.

- The cash drawer must be closed immediately after completing the transaction. All cash income should be held intact.

- Under no circumstances should deductions be made (i.e. to replenish petty cash floats) without the prior approval of the Finance Manager.

banked for example:

- The cash drawer must be emptied by the employee in the presence of their supervisor.

- The cash must be counted and recorded Cash log and the amount must be confirmed with signatures from both the employee and their supervisor.

- Each Monday, cash and cheques must be deposited into the Business's bank account. If necessary, the frequency of deposits can be increased to ensure the cash held on the premises does not exceed $500.00.

- Cash must be deposited through an ATM at the nearest Commonwealth Bank branch. It is preferable, where practical, for employees who deliver the cash deposit to be escorted by another employee.

Banking Fraud

As a business, you may be seen as a potential target for fraudulent activities when using online banking. However, by arming yourself with information and tools, you can protect yourself from becoming a victim of fraud.

The ACCC uses Scamwatch to track scams and advise the best ways to deal with them. Be particularly wary of phishing scams, card skimming, and credit card scammers. Phishing scams use emails or text messages claiming to be your bank and requesting you provide details via a link. Card skimming is where ATM card details are captured and used. Credit card scammers seek to have you provide your card details. Pause misplaced or lost credit cards and cancel them if they’re stolen, then contact your bank for the next steps.

Phishing Scams

Online banking also has associated risks for businesses. Banking customers are often targeted with hoax emails or text messages. These emails or texts appear to be genuine bank emails. This type of scan is referred to as a phishing scam.

Some emails inform the customer that their security details and passwords need to be updated by logging into an authentic-looking but fake website. The purpose of these websites is to obtain your login details to access your bank accounts.

Others:

- communicate security messages and advise you to install software from the email that checks and removes viruses. By downloading the software, you are, tricked into downloading a virus.

- Ask you to log into your account to confirm your password via a link. By clicking on the link you are, tricked into providing your password to scammers.

Example

Banks will not send you an email asking for your Account Details, Financial Details, or login details for Phone Banking, Mobile Banking or Internet Banking. The following is an example of a hoax email.

Banks will

Banks will

The following is an example of a hoax text message.

These fraudulent communications inform recipients that their account access is compromised or will be locked if they fail to verify details. These are not genuine Bank communications. Do not click the link or reply to the sender.

Identity Theft

Identity theft is where your personal details are obtained to get some sort of financial or another benefit, leaving you the owner of that identity, often in large debt with a negative credit history and in some cases with legal implications.

Your information can be obtained in many ways:

- Theft, including theft of mail from your mailbox at the home

- By going through your garbage bins

- Telephone, fax and mail scams

- Internet.

The following can be used to assume your identity:

- Date of birth

- Utility bills (phone, gas, water and rates notices)

- Address.

Credit Card and Debit Card Skimming

Credit card and debit card fraud is a crime whereby your credit or debit card can be reproduced in order to use the credit balance to obtain a financial advantage. The creation and/or alteration of a credit/debit card occurs when the information contained on the magnetic strip is reproduced. This type of crime is known as ‘skimming’.

Credit or debit card fraud can also occur when your card is lost or stolen and used by a third party to purchase goods with those cards or to remove cash from the cards.

Credit or debit cards can also be intercepted in transit while being sent to you. Your cards can also be compromised by a dishonest merchant who undertakes unauthorised duplicate transactions on your card.

Ways to protect your credit/debit card

- Memorise your personal identification number (PIN). Don't use the same PIN for all your cards, and don't choose your birth date or other easily identifiable numbers that might be on something else in your wallet.

- Check statements and call your credit card issuer immediately if you see anything suspicious on your bill. You could help the company uncover fraud—and save yourself from paying unauthorised charges.

- Do not let your credit card out of your sight at any time – for example, at a restaurant – go with the card. • Card fraud is not applicable in Australia only – be just as vigilant when travelling overseas; credit card skimming is an international crime.

- Always sign your card in ink as soon as you receive it.

- Keep track of when new and reissued cards should arrive, and call the credit card issuer if they don't come on time.

- Make sure your mailbox is secure and that only you and the postal carrier have access to it.

- Tear up all credit card receipts and pre-approved credit card offers into small pieces before you throw them away. Keep your billing statements in a safe place.

- When you use your credit card online, make sure you are using a secure website. Look for a small key or lock symbol at the bottom right of your browser window.

- Never give your card number to strangers or telemarketers who call you on the phone. Don't give your card number unless you initiated the call.

Cheque Fraud

What is cheque fraud?

Cheque fraud is the use of a cheque to get financial advantage by:

- altering the cheque (payee/amount) without authority

- theft of legitimate cheques and then altering them

- duplication or counterfeiting of cheques

- using false invoices to get legitimate cheques

- depositing a cheque into a third-party account without authority

- depositing a cheque for payment knowing that insufficient funds are in the account to cover the deposited cheque.

How to protect yourself from cheque fraud

- Reconcile your accounts promptly and regularly

- Never sign blank cheques, and only sign cheques after all details have been completed.

- Limit the number of signatures to your account to ensure control.

- Ensure that your signature is not with documents that can be accessed by the general public.

- Keep all cheques secure when not in use to deter theft.

- Don’t leave any gaps in completing the payee name amount in words and figures.

- If cheques are lost or stolen, contact the bank immediately and ask them to stop payment on the cheque.

- Ensure that any invoices are valid before payment.

- Consider using electronic means of payment (if possible) for high-value payments.

- Ensure that your mailbox is secure to protect your inward cheques.

ASIC regulates banks and financial service providers, sets and enforces banking standards, and investigates and acts against misconduct in the banking sector. The ASIC's website explains ASIC's role in regulating the banking industry.

If you have an issue with a bank or financial institution you should:

- Contact the bank by phone, email or in-person to discuss

- Make a formal complaint - If you are not happy with their response or if the problem can't be resolved, ask the bank for their complaints handling procedure or find it on their website.

- Complain to the Australian Financial Complaints Authority (AFCA) - If you don't receive a response in a reasonable time or you're unhappy with the response, you can make a complaint to AFCA.

To progress your complaint, you could refer to the banking codes of conduct that have been developed by industry. A code of conduct (or code of practice) is a set of enforceable rules setting out an industry’s commitments to deliver a certain standard of practice.

Banking Codes of Conduct

Banking codes of conduct are intended to raise industry standards, complement legislative requirements and encourage consumer confidence.

Find out more about the Code of Banking Practice

Find out more about the Customer Owned Banking Code of Practice

ePayment Code

Users of electronic payment facilities in Australia are protected by the ePayments Code. ASIC is responsible for monitoring compliance with the Code. The Code regulates consumer electronic payments, including ATM, EFTPOS and credit card transactions, online payments, internet and mobile banking, and BPAY. Almost all banks, credit unions and building societies in Australia – as well as consumer electronic payment facilities, such as PayPal subscribe to the ePayments Code.

Find out more about the ePayments Code.

Privacy Act

Banks and other financial institutions manage a large volume of sensitive information about their customers, and a breach of such data can have dire consequences. As we increasingly depend on online banking data privacy must be a priority for all businesses. You must ensure all customer information is protected, and systems are secure and aligned to the requirements of the Privacy Act.

Where minor payments need to be made for such things as taxi fares, postage, coffee etc. It is sometimes more convenient to pay these small expenses from a small reserve of cash the business has on hand. This reserve of cash is referred to as petty cash. Without adequate controls, petty cash can become a problem. Often petty cash is the area where money is lost, and usually, not a lot of attention is paid to accurately record transactions.

For security purposes and to comply with auditing and tax requirements, it is important that a receipt or docket is provided for every petty cash withdrawal made.

The petty cash imprest system

The petty cash Imprest system is the accounting system most used to control petty cash. The petty cash starts at a fixed balance at the beginning of the month and is reduced during the month due to expenses being paid. At the end of the month, the balance is replenished back to the float limit.

Someone with the business is designated to manage the petty cash system often, this role is assigned to a bookkeeper or accountant. The designated person is responsible for disbursing small amounts of cash and for documenting each payment with a petty cash receipt.

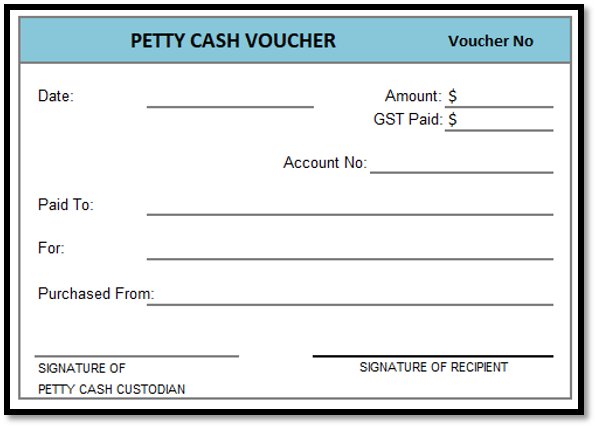

Petty cash vouchers

To obtain money from petty cash, members of staff may need to sign a petty cash voucher and provide receipts that support the expenditure. Before processing any petty cash claims, the custodian of the petty cash must check the petty cash voucher and receipt to ensure the claim is legitimate and the supporting documentation has been completed accurately.

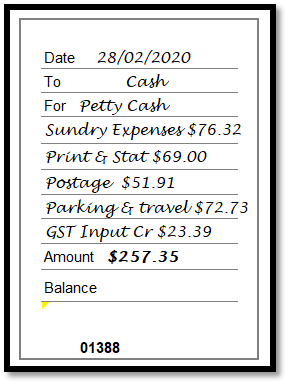

Below is an example of a petty cash voucher.

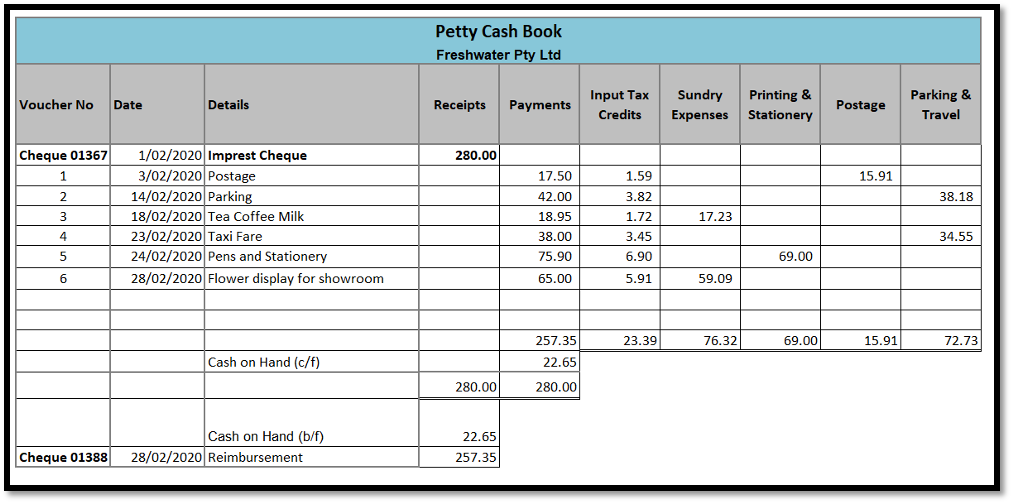

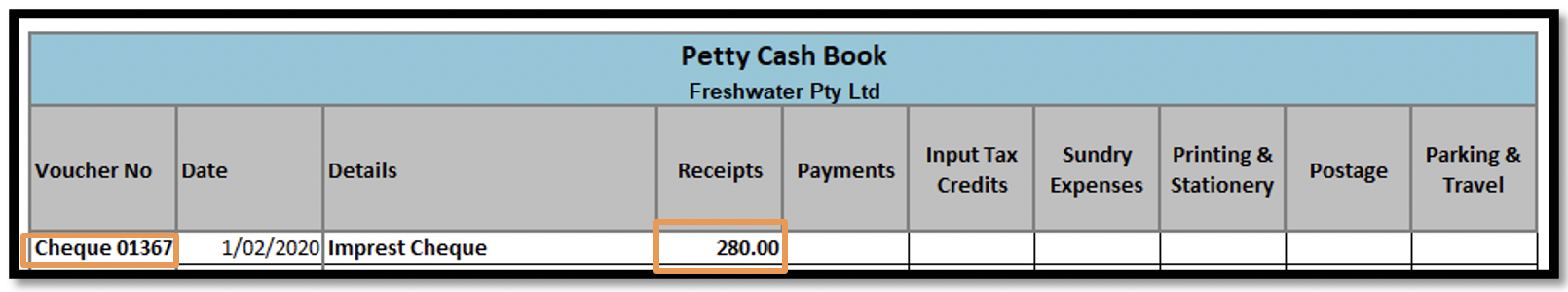

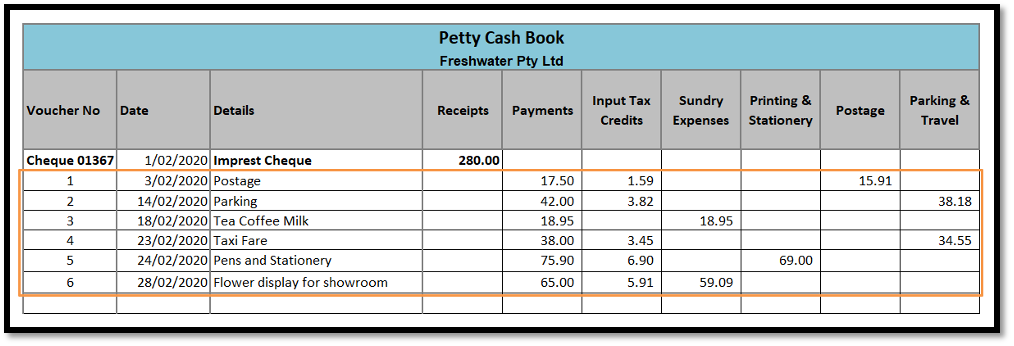

Petty cash book

The petty cash book is used to record details of all petty cash vouchers prepared by the petty cash custodian. Below is an example of the petty cash book for Freshwater Pty Ltd.

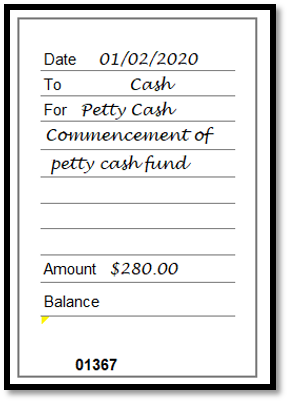

A petty cash fund is established when cash is withdrawn from a business bank account, and the money is placed in the petty cash tin. Cash can be withdrawn by writing a cheque and cashing it at a branch or withdrawing cash from an ATM.

Cheque butt for a cheque drawn for Freshwater Pty Ltd petty cash fund.

The amount and cheque number are recorded in the petty cash book.

Processing petty cash transactions

- A voucher is completed for all purchases made from the petty cash fund.

- All vouchers are recorded in the petty cash book.

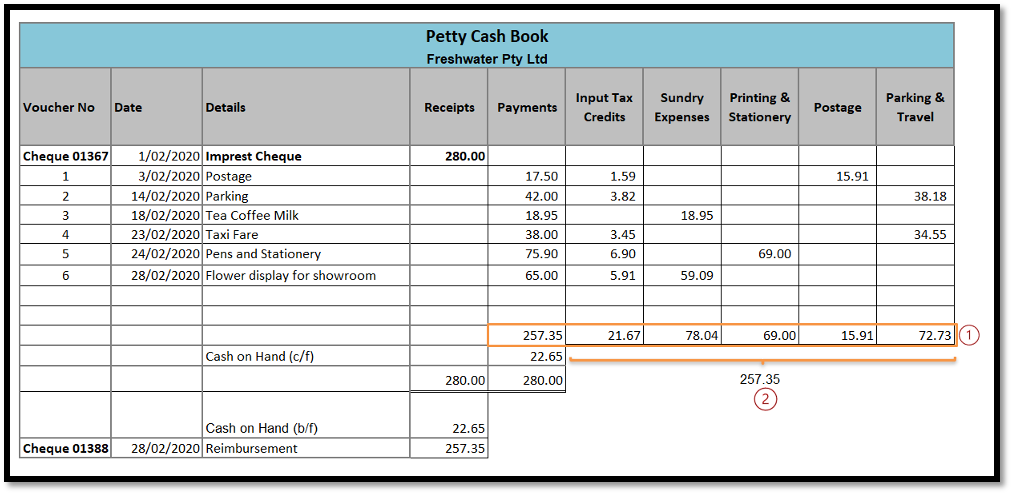

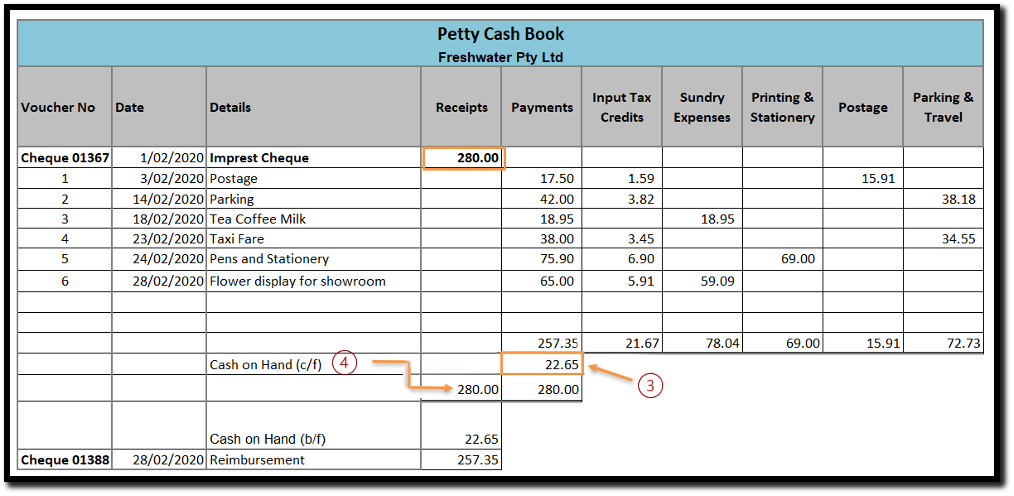

Balancing the petty cash book at the end of the period

Total the Payments, Input Tax Credits and Expense columns.

- Verify the total of the payments column by adding together the totals from each expense column and the total of the Input Tax Credits column.

- Subtract the total of the Payments column from the amount in the Receipts column and record this amount under the total of the payments. This is the carried forward (c/f) cash amount.

- Physically count the amount of cash in the petty cash fund. The amount should equal the c/f amount.

- Rule off the Receipts column and the Payments column below the Cash on Hand amount. Total and rule off with a double line. The Receipts and Payments columns should equal each other.

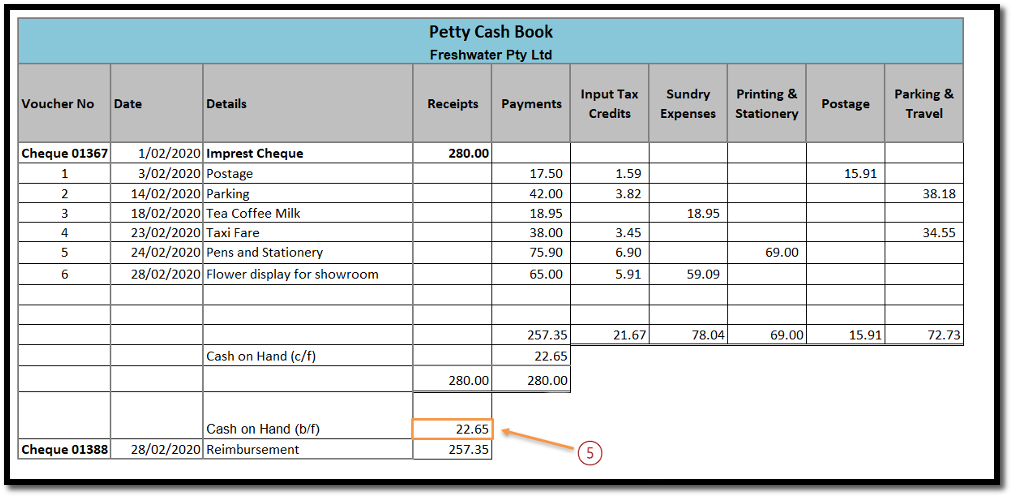

- Transfer the Cash on Hand amount to the receipts column.

Reimbursing the petty cash fund

- Request a cheque for the amount that needs to be reimbursed.

- The cheque will need to be made out to cash and not crossed so that it can be taken to the bank and cashed.

- The cheque butt will record the amount of the cheque, the total of each of the expense columns and the GST paid.

Petty Cash reimbursement cheque butt

For petty cash, there are two journal entries required.

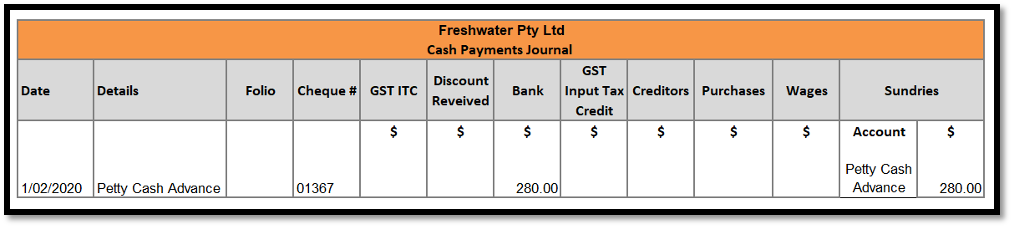

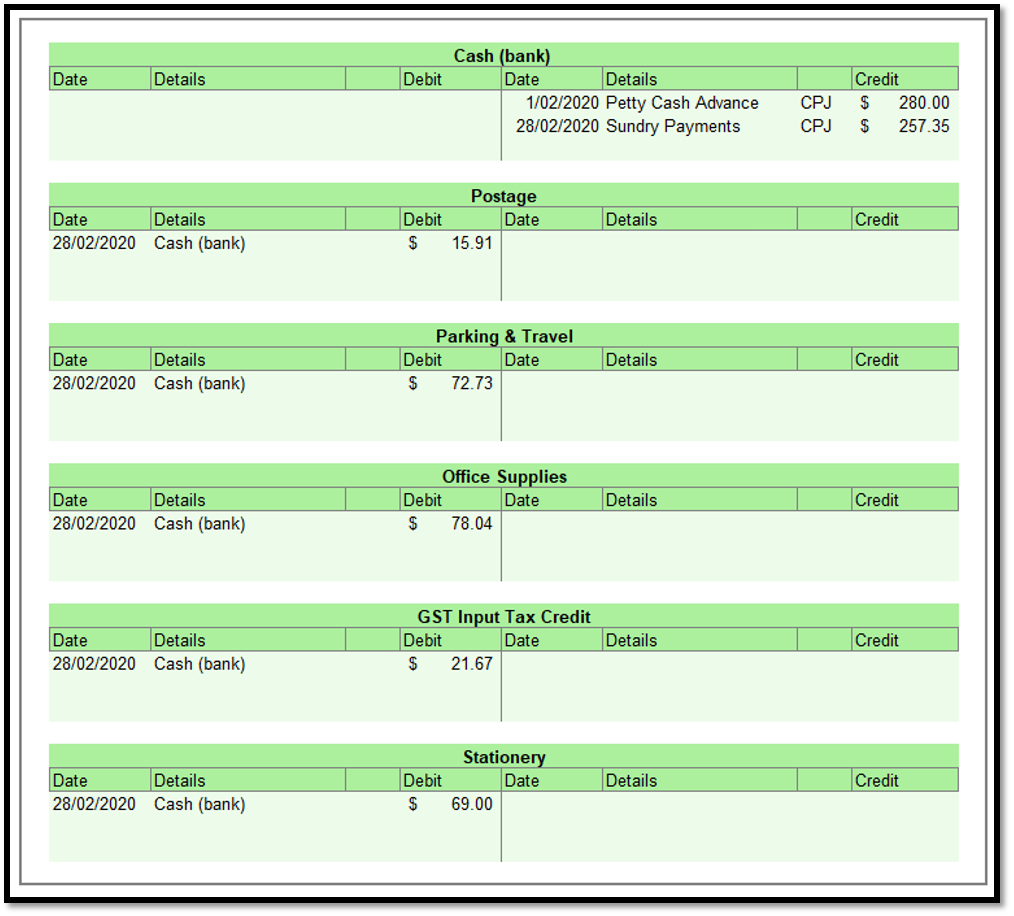

- Cash Payments Journal - A journal entry to record the cheque drawn for the establishment of the petty cash fund. The General Ledger entries result from the Cash Payments Journal.

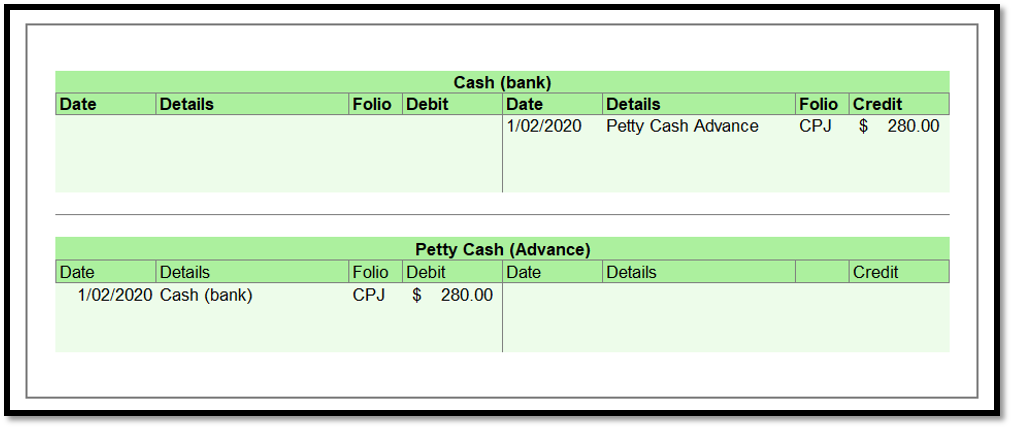

The General Ledger entries result from the Cash Payments Journal.

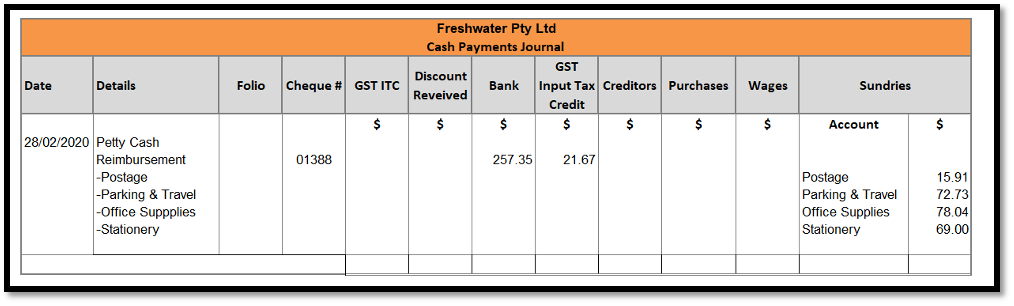

- Cash Payments Journal - A journal entry to record the cheque drawn to reimburse the petty cash fund.

The individual items recorded in the Sundries column are the totals of the individual analysis columns of the Petty Cash Book, representing the various expenses paid from petty cash. The GST paid has been shown as a total in the Cash Payments Journal, being the amount of GST paid on all expenses subject to GST, rather than showing GST individually on each item.

The General Ledger entries recorded resulting from the Cash Payment Journal of Freshwater Pty Ltd are:

Internal Control for Petty Cash

The petty cash must be kept secure, preferably in a locked cash tin, to prevent any thief of cash. Some suggested control methods include:

- Having a maximum amount that can be paid out of petty cash for a single transaction

- Always ensure that a petty cash voucher is completed for each item of expenditure before making payment.

- Sequentially number of petty cash vouchers

- Occasional random surprise audits of the petty cash fund should be conducted

- Keep petty cash in a secure place

- Keep petty cash vouchers and receipts in the petty cash tin until balancing at the end of the month

- Maintain a detailed description of what money is spent on

- When the cheque is prepared to reimburse the petty cash fund, the cheque signatories should review the petty cash vouchers for the money expended from the fund. Any discrepancies should be followed up.

Scammers are very active in our community. Some of Australia’s biggest banks offer advice on how to stay safe when using online banking. Select the bank that you bank with. List five ways you can safeguard your business banking.

- Westpac - Learn how to prepare, prevent, detect and respond to online threats or scams - for you, your family or your business.

- ANZ – Learn more about safeguarding your data and the steps we take to protect you and your money.

- NAB - What to do in the event of fraud or a scam Security guides

- St George – Maximise your online privacy and security Internet and Phone Banking Security Centre

- Commbank – How to protect yourself from scams How to protect yourself from scams

If your bank isn’t listed above, use a search engine to look for ‘online banking safety tips’ with the name of your bank for specific guidance.

Test your understanding of Bank Reconciliations.

Review the following documents provided by Stone Winery. In this Excel workbook:

- Complete the cash journals

- Post to the Bank general ledger account

- Prepare the bank reconciliation statement as at 31/03/2020

When you have completed the bank reconciliation check your answer.