Welcome to Administer subsidiary accounts and ledgers.

In this module, you will be exploring subjects relating to accounts and ledgers. This module will help you reconcile and monitor subsidiary accounts in financial accounts receivable systems, identify bad and doubtful debts, plan a recovery action, record creditor invoices, and remit payments to sundry creditors.

It applies to individuals who use specialised knowledge and follow agreed processes to problem solve within the scope of their responsibility.

The knowledge covered in this module includes but is not limited to:

- Key features of debits and credits and their role in accounting systems

- Procedures for identifying bad or doubtful debts

- Key requirements relating to the administration of subsidiary accounts and ledgers detailed in:

- legal systems, regulations and procedures

- industry codes of practice

- Key requirements of organisational policies and procedures relating to reconciling and monitoring financial accounts, including organisational credit policy

- Industry-accepted measures and protocols to remit and collect monies

Throughout this module, you will be presented with activities to practice the skills and knowledge you have acquired from the training. You will also have the opportunity to learn and create before attempting the assessment.

An accounting system is a system employed by a company to manage its income and expenses as well as other financial activities. It can be incorporated into a manual or computerised platform.

An accounting system is usually comprised of manual or computerised records of financial transactions for recording, classifying, summarising, and analysing timely financial information. An accounting system must be systematic and well-structured to facilitate compliance in all facets.

While manual bookkeeping may not be as widely used by businesses today, understanding the underlying principles and theory behind computerised bookkeeping systems, such as, creating journal entries, posting journal entries to the ledger accounts and preparing the financial statements, remains crucial for a well-rounded understanding of accounting practices and making informed decisions.

In this module, we will be entering transactions in a manual accounting system using Microsoft Excel.

It is essential to understand the key features of an accounting system, including the fundamental principles which are applied.

Cash and Accrual Accounting

Revenue and expenses can be recorded on either a cash or accrual basis.

With cash accounting:

- Revenue is recognised when the cash is received from the customer

- Expenses are recognised when the cash is paid

With accrual accounting

- Revenue is recognised in the period in which the revenue is earned

- Expenses are recognised in the period they are incurred

| June | July | |

|---|---|---|

| Activity | Purchase parts, repair car, pay employees | Receive payment for work done in June |

| Accrual basis | Revenue $3,000.00 Expense $1,800.00 Profit $1,200.00 |

Revenue $0.00 Expense $0.00 Profit $0.00 |

| Cash basis | Revenue $- Expense $1,800.00 Loss -$1,800.00 |

Revenue $3,000.00 Expense $0.00 Loss $3,000.00 |

Entry System of Bookkeeping:

The single-entry method of bookkeeping maintains records in which a single entry is made for every transaction. The entry contains only one account and primarily keeps track of the movement of cash. There is no full record-keeping in accordance with the Generally Accepted Accounting Principles (GAAP). A reconciliation of accounts is not possible using this method, and the possibility of errors and fraud is very high.

The double-entry method of bookkeeping, on the other hand, records transactions based on the principle of duality; that is, for each debit entry in the ledger, there is a corresponding credit entry. It fully records the effects of every transaction in the accounts in the chart of accounts, making reconciliation possible, and agrees with Generally Accepted Accounting Principles (GAAP). It is the method most businesses adopt.

Debits and credits

Debits and credits have the following roles in accounting systems:

| Type of Account | By Default | Increase | Decrease |

|---|---|---|---|

| Asset | Debit | Debit | Credit |

| Liability | Credit | Credit | Debit |

| Revenue | Credit | Credit | Debit |

| Expense | Debit | Debit | Credit |

| Owners Equity | Credit | Credit | Debit |

The following are some key features of debits and credits:

Debit

- Debits are always entered on the left side of the ledger

- Commonly abbreviated as Dr.

Credit

- Credits are entered on the right side of the ledger

- Commonly abbreviated as Cr.

| To increase the balance in the following accounts would you debit or credit the account? | ||

|---|---|---|

| Debit | Credit | |

| Cash | Debit | |

| Accounts Payable | Credit | |

| Inventory | Debit | |

| Telephone Charges | Debit | |

| Drawings | Debit | |

| Consulting Revenue | Credit | |

| To decrease the balance in the following accounts would you debit or credit the account? | ||

|---|---|---|

| Debit | Credit | |

| Accounts Receivable | Credit | |

| Stock | Credit | |

| Bank Loan | Debit | |

| Land & Buildings | Credit | |

| Discount Received | Debit | |

| GST collected | Debit | |

The underlying principles of accounting help us to understand why and how transactions are recorded. These fundamental assumptions include:

- Historical Cost Principle

States companies must record the purchase cost of goods, services, or capital assets in their accounts at the price they paid for them.

Example – P & P Pty Ltd purchased a building for $450,000 in 2020. In 2021 the building was valued at $500,000. Under the historical cost principle in the accounts of P & P Pty Ltd, the building would continue to be valued at $450,000. - Going concern principle

States companies must be treated as if they are going to continue to exist and carry on their operations for an indefinite period of time.

Example – P & P Pty Ltd was raided by the Department of Fisheries for illegally catching undersized crayfish. Fisheries confiscated $115,000 of P & P’s crayfish stock and imposed large fines for violating fishing laws. As P & P also wholesale salmon, scallops and abalone they would still be considered a going concern, because it is not likely the fines and punishment would stop its operations. - Accounting Entity Concept

States every company is separate from its owner/s and can be accounted for separately.

Example – Robin, a shareholder in Poles-Hyer Pty Ltd, has $150,000 in the bank and $35,000 owing in personal loans. The amount of cash and personal loans are not reported in Poles-Hyer’s financial statements. - Accrual principle

This principle recognises that income is earned regardless of when collected, and expense is incurred regardless of when paid. All transactions are recorded despite the possible absence of cash inflow or outflow. Accruals include sales and purchases on credit, interest, rent, wages and salaries, and taxes. This principle also gives rise to accounts receivable and accounts payable.

Example – P & P Pty Ltd received packing material they purchased on credit from a supplier on 19/06/2020. Payment for the material is made on 31/07/2020. With the Accrual principle, the expense is recognised in the accounts of P & P Pty Ltd on 19/06/2020 when the stock was delivered. - Accounting period concept

States that the life of a business can be divided into time periods and reports covering that period and be prepared for the business. The time period is usually 12 months.

Example – In Australia, many companies use 1 July – 30 June as their accounting period

Woolworths Group 2020 FY for the 52 weeks ended 27 June 2021

Byron Shire Council‘s 2020 FY ended 30 June - Monetary principle

States that only those things that can be measured in money (the local currency is the monetary unit of measure) be included in the accounts.

Example – The level of customers satisfaction is important to the success of a business; however, this is not included in the financial statements because it is not measurable in money terms.

For more information on basic accounting principles, click here.

Accounting practices are the procedures and controls enforced by a company or department to create and record relevant transactions. These must be consistent to ensure reliable records. Accounting practices must be routinely examined, updated and installed to ensure that they improve and adapt to industry needs over time.

Key accounting practices which should be implemented include:

- Timely updating of General Ledgers.

- Enter data promptly and with accurate transaction dates

- Regularly review debtors, debtors’ ledger/ageing reports

- Accurately record deposits.

- Comply with tax requirements.

- Prompt filing of quarterly tax returns.

- Using a payroll system to streamline salary processing and payments

CPA Australia has developed a checklist to assist small businesses to identify some of the tasks critical for good business practices. To access this resource, click here.

Accounting is a process that’s primary function is to provide reliable and relevant information for reporting and decision making. The accounting process involves:

- Analysing – Thinking about an event that has taken place and consider how it affects the business

- Recording – Entering financial information about an event into the accounting records.

- Classifying – Sorting and categorising similar items together with the accounting system.

- Summarising – This is the grouping of similar events or items into a format that is simple to understand.

- Reporting – How a business tells others about its results in a way that is easy to understand.

- Interpreting – Look at all the reports and interpret the information in the reports.

Read the scenario below

On 12/06/2020, Joe Reader from Smart Books purchased a new printer for the account’s office costing $4,100.00. Joe paid cash for the printer, and it was recorded as an asset in Smart Books accounts.

In July, Peter Pages, the Store Manager, asked for approval to purchase a printer for the bookshop. Joe suggested the bookshop may not need the scanning function, and a cheaper alternative may be sufficient. He also informed Peter the equipment budget for the book shop for the 21FY was 90% of the 20FY equipment spend.

Order the following accounting transaction process flow.

To facilitate this cycle, accounting ledgers and financial reports are used to represent the financial health and performance of a business.

Journals, Chart of Accounts and Ledgers

Journal:

Transactions are initially recorded in chronological order in the journal. The journal is also called the “book of original entry”. A journal can be a general journal or a special journal.

A general journal is used to record non-routine transactions such as depreciation, bad debts, sale of an asset, etc. A special journal is used to record routine transactions such as sales, purchases, cash disbursements, or cash receipts.

For each transaction, a journal shows the account that was debited and the account that was credited.

Chart of Accounts:

All transactions for a business are recorded in accounts set up in the general ledger. This list of accounts is known as the chart of accounts. The account type and account numbers differ from business to business and are dependent on the size and type of business. The type of accounts within the chart of accounts are divided into five (5) subcategories.

- Assets

- Liabilities

- Equity

- Revenue

- Expense

Chart of Accounts

| Balance sheet | |

|---|---|

| Account type | Account number |

| Assets | 1000 |

| Liabilities | 2000 |

| Equity | 3000 |

| Income statement | |

| Account type | Account number |

| Revenue | 4000 |

| Expense | 6000 |

To read more about the chart of accounts, click here.

General Ledger:

The general ledger is a collection of all the business transactions pertaining to the business grouped into accounts. Each account typically has an identification number and a title to help locate accounts when recording data. In a manual accounting system, the general ledger is a "book" with a separate page or ledger sheet for each account. (When a significant amount of detailed information is needed for an account, such as accounts receivable or accounts payable, a subsidiary ledger is often used.)

In a computerised system, the general ledger will be an electronic file of all the needed accounts. This also facilitates the electronic preparation of the company's financial statements.

A ledger can be a general ledger or a subsidiary ledger. (The next topic examines differences between the two.) The process of transferring entries in analytical order from the journal to the ledger is known as ‘posting.’

The process of recording a transaction and posting is illustrated.

- Transaction

On June 1 B. Bird deposits $25,000 into his business account. The money was a personal loan to expand his business. - Analysis

The asset Cash at Bank increased by $25,000. The liability Directors Loan increased by $25,000. - Equation analysis

$$\begin{aligned}&\mathsf{\textbf{Asset}}\\&\mathsf{Cash}\\&\mathsf{\$25,000}\end{aligned}\begin{aligned}\;\;=\;\;\\\;\\\;\end{aligned}\begin{aligned}&\mathsf{\textbf{Liability}}\\&\mathsf{Directors\;loan}\\&\mathsf{\$25,000}\end{aligned}\begin{aligned}\;\;+\;\;\\\;\\\;\end{aligned}\begin{aligned}&\mathsf{\textbf{Equity}}\\&\;\\&\;\end{aligned}$$ - Debit & credit analysis

Debits increase assets: Debit Cash at Bank $25,000. Credits increase liabilities: Credit Directors Loan $25,000. - Journal entry

Date Account name (details) Post ref. Debit Credit 1-Jun Cash at Bank

Directors Loan (Cash loan from director)100

50025,000

25,000 - Posting to ledger

Cash at bank 100 1-Jun Directors loan 25,000 Directors loan 500 1-Jun Cash at bank 25,000

If a business with several hundred credit customers maintains all the transactions for these customers in only one General Ledger account, Accounts Receivable, the determination of the outstanding balances of each customer at any time would be very cumbersome. The same applies to a single Accounts Payable account in the General Ledger. To ease the tracking and monitoring of individual balances, most companies use subsidiary ledgers with the General Ledger account summarising all the detailed data from the subsidiary ledgers.

Wiley describes a subsidiary ledger as a group of accounts with a common characteristic (e.g., all accounts receivable). The subsidiary ledger clears the details of individual balances from the general ledger.

Source: HigheredBCS.Wiley.com: Special Journals and Methods of Processing Accounting Data

The accounts receivable subsidiary ledger includes a separate account for each customer making credit purchases. In this subsidiary ledger, the combined balances of the separate accounts are equal to the balance of the accounts receivable account in the general ledger. The general ledger account that summarises the subsidiary ledger’s account balances is called the accounts receivable control account.

Source: Houghton Mifflin Harcourt: Subsidiary Ledgers

Posting a debit or credit to a subsidiary ledger account and to a general ledger control account does not break the rule that total debits must equal total credits because subsidiary ledger accounts do not form part of the general ledger account. They are additional accounts that sit outside the general ledger and provide details to support the balance in a control account.

There are two (2) common subsidiary ledgers:

- Accounts receivable (customers) subsidiary ledger

- Accounts payable (creditors) subsidiary ledger

Companies generally organise individual subsidiary ledger accounts alphabetically.

At the end of the accounting period, the balance of the general ledger control account must be equal to the balance of each account in the corresponding subsidiary ledger.

Accounts receivables reflect the resources of a company that arise using the accrual basis of accounting. They are promises or pledges made by customers to pay within an established time frame (credit or payment terms) for products sold or services rendered to them. They are money ‘to be received by a business from a client or customer.

Accounts receivable is money earned but which has not yet been received, therefore, pending cash inflows.

Since accounts receivables are normally collected within a company’s normal operating cycle (12 months), they are classified as current assets.

Initial entry

The journal entry to record accounts receivable is:

| Date | Details | Post Ref | Debit | Credit |

|---|---|---|---|---|

| 20-Jun | Accounts Receivable | XX | ||

|

Sales Revenue (To record credit sale) |

XX |

Payment of accounts receivable

If a customer pays, the journal entry to record the receipt of cash is:

| Date | Details | Post Ref | Debit | Credit |

|---|---|---|---|---|

| 20-Jul | Cash | XX | ||

|

Accounts Receivable (To record collection of accounts receivable) |

XX |

Sales returns and allowances

For companies that allow the return of products purchased on credit based on their return policies, the entry to record this is:

| Date | Details | Post Ref | Debit | Credit |

|---|---|---|---|---|

| 25-Jun | Sales Returns and Allowances | XX | ||

|

Accounts Receivable (To record stock returned by customer) |

XX |

Sales discounts

To encourage early payment, companies offer cash discounts. The seller reduces the amount owed by the buyer by a small percentage or a set dollar amount as laid down in terms of the transaction. The entry to record the sales discount is:

| Date | Details | Post Ref | Debit | Credit |

|---|---|---|---|---|

| 29-Jun | Sales Discount | XX | ||

|

Accounts Receivable (To record sales discount offered to customer) |

XX |

Accounts payables are obligations of a company that arise using the accrual basis of accounting. They are promises or pledges made by the company to pay within an established time frame (credit or payment terms) for products sold, services rendered to them, or expenses incurred during operations. They are money ‘to be paid by your company for a product or service provided by a supplier, therefore, pending cash outflows.

Since accounts payable are typically collected within a company’s normal operating cycle (12 months), they are classified as current liabilities.

Accounts payable include pending purchase orders, unpaid bills, or services rendered by an outside contractor on which payment is, for some reason, pending.

Initial entry

The pro entry to record accounts payable is:

| Date | Details | Post Ref | Debit | Credit |

|---|---|---|---|---|

| 10-Jun | Purchase | XX | ||

|

Accounts Payable (To record purchases on credit) |

XX |

Payment of accounts payable

If the company pays, the journal entry to record the disbursement of cash is:

| Date | Details | Post Ref | Debit | Credit |

|---|---|---|---|---|

| 10-Jun | Accounts Payable | XX | ||

|

Cash (To record payment of accounts payable) |

XX |

Purchase returns and allowances

For companies that allow the return of products purchased on credit based on their return policies. The entry to record this is:

| Date | Details | Post Ref | Debit | Credit |

|---|---|---|---|---|

| 16-Jun | Accounts Payable | XX | ||

|

Purchase Returns and Allowances (To record stock returned to supplier) |

XX |

Purchase discounts

To take advantage of discounts offered by suppliers, the seller reduces the amount owed by the buyer by a small percentage or a set dollar amount as laid down in terms of the transaction. The entry to record the purchase discount is:

| Date | Details | Post Ref | Debit | Credit |

|---|---|---|---|---|

| 23-Jun | Accounts Payable | XX | ||

|

Purchase Discount (To record discount offered by supplier) |

XX |

The Corporation Act

In Australia, corporations are registered and regulated by the Commonwealth Government.

The Corporations Act sets out the laws dealing with business entities in Australia at the federal and interstate levels. Although the focus of the Act is primarily on companies, it also covers some laws relating to other entities such as partnerships and managed investment schemes. All states have adopted the Act.

It regulates matters such as the formation and operation of companies (in conjunction with a constitution that might be adopted by a company), duties of officers, takeovers and fundraising.

The Act obliges all companies to maintain written financial records that accurately record and explain their transactions, financial position and performance. These records must permit the preparation and audit of true and fair financial statements.

Key financial records which impact on the administration of subsidiary ledgers that a company should keep include:

- financial statements such as profit and loss, balance sheets and taxation returns (for income tax, instalment activity statements, business activity statements and all supporting documents)

- General ledger

- General journal

- cash records, including the cash receipts journal, bank deposit books, cash payments journal and cheque butts

- bank account statements and bank reconciliations

- records for sales and debtors, including the sales journal, debtors ledger, list of debtors, invoices issued, statements issued, delivery dockets

- invoices and statements received and paid

- Creditors ledger

- unpaid invoices, including correspondence

For more information on what books and records a company should keep, click here

Key legislation which impacts the administration of subsidiary accounts and ledgers

Sourced from Debt collection guidelines: For collectors and creditors

| Commonwealth consumer protection laws |

The Australian Consumer Law (ACL) which is a schedule to the Competition and Consumer Act 2010 (Cth) (CCA). The ACL is jointly enforced by the ACCC and state and territory consumer protection agencies. They include law about treating customers fairly, consumers' rights & obligations and debt collection. Competition and Consumer Act 2010 Part 2, Division 2 of the Australian Securities and Investments Commission Act 2001 (Cth) (ASIC Act), which is enforced by ASIC. Australian Securities and Investments Commission Act 2001 National Consumer Credit Protection Act 2009 (Cth) (NCCP) which includes the National Credit Code (NCC) as Schedule 1 to the NCCP, which is enforced by ASIC. |

|---|---|

| Other Statutory and Common Law Obligations |

Commonwealth privacy laws, which are enforced by the Office of the Australian Information Commissioner (OAIC) The Act outlines credit reporting provisions that apply to the handling of credit-related personal information that credit providers are permitted to disclose to credit reporting bodies for inclusion on individuals’ credit reports. |

|

State and territory fair trading laws, which include conduct prohibitions mirroring those of the Commonwealth consumer protection laws and that are enforced by the state and territory consumer protection agencies |

|

|

The Bankruptcy Act 1966 (Cth) (Bankruptcy Act), which is enforced by the Australian Financial Security Authority (AFSA) Click here to read more about AFSA |

|

|

State and territory unauthorised documents laws Unauthorised Documents Acts in each state and territory make it an offence to design collection letters of demand in a way that makes them look like court documents

|

|

|

Each state and territory set limitation periods on debt recovery actions.121 These generally bar a remedy to the creditor if a defence pleading expiration of the limitation period is filed. In the case of simple contracts (which include the majority of debts referred for collection) the limitation period is normally six years (however, in the Northern Territory a three-year period applies.)

|

|

|

A New Tax System (Goods and Services Tax) Act 1999 (Cth). A valid tax invoice or recipient-created Tax Invoice must be provided for all sales of goods and services over $82.50 (including GST) where GST is charged. |

|

| Tort Law. Creditors or debt collectors who engage in extreme conduct may expose themselves to civil action in tort by a debtor. Depending on the circumstances, action for trespass, assault, wilful infliction of mental injury, nervous shock and defamation (among others) may apply. | |

| Criminal Law. Creditors or debt collectors who engage in extreme conduct may be charged with criminal offences including assault and demanding with menace. A collector who refuses to leave a person’s property may also be charged with trespass. |

The following are the requirements you need to know about compliance related to administering subsidiary ledgers, debt collection and the ability to recover outstanding money from the customer.

| Australian Privacy Principles Guidelines (Privacy Act 1988) |

The Office of the Australian Information Commissioner OAIC has produced guidelines that outline the mandatory requirements of the APPs, how they interpret the APPs, and matters the OAIC may take into account when exercising their functions and powers under the Privacy Act 1988 (Privacy Act). |

|---|---|

| Debt collection guideline: For collectors and creditors |

The Australian Competition and Consumer Commission (ACCC) and Australian Securities and Investments Commission (ASIC) have jointly produced guidelines that aim to assist creditors, collectors, and debtors understand their rights and obligations and ensure that debt collection activity is undertaken in a way that is consistent with consumer protection laws. Debt collection guideline: for collectors and creditors (accc.gov.au) |

The guidelines below may be useful for creditors using external collection agencies to collect debts or sell or assign debts to third parties to understand the application of consumer protection laws by the Commonwealth.

| Services Australia Code of Operation | Services Australia’s guidance on overdrawn savings accounts for debtors and financial institutions. |

|---|---|

| Competition and Consumer Act |

The code applies to just about every aspect of the business, including the following:

|

| Credit and Investments Ombudsman (COSL) | An external dispute resolution provider, the Credit and Investments Ombudsman, operates under terms of reference, which can be found on its website. |

Many professions develop a code of practice that outlines the expected behaviour of persons employed in that profession. These codes:

- Provide guidelines for appropriate practice

- Maintain high standards of behaviour for workers

- Increase the status of the profession

The codes of practice that are relevant to this unit include:

| The Banking Code of Practice | The Code is published by the Australian Banking Association and sets out how a bank should conduct itself in its dealings with customers, as well as specific requirements for banking services. This includes banks obligations relating to financial difficulty and debt collection. |

|---|---|

| Customer Owned Banking Association Code of Practice | The Code of Practice for Customer Owned Banking (COBCOP) is the code of practice for the credit unions, mutual banks, and mutual building societies in Australia. |

| Centrelink Code of Operation | Under the Centrelink Code of Operation with Participating Financial Institutions, the financial institution must allow the recipient of the Centrelink to access up to 90% of its future Centrelink benefits (until the account is overdrawn) unless otherwise agreed. |

| Privacy (Credit Reporting) Code |

Before credit is granted to a person by a credit provider, it is normal practice for the credit provider to check the credit report of the applicant. Credit reporting agencies submit reports to credit providers detailing the applicant's requests for credit, whether they have failed under a credit contract, whether they have received judgments in court and whether the applicant is currently bankrupt or has previously been bankrupt. Credit reporting is subject to the Privacy Act 1988 (Cth). The Act sets out what information a credit reporting agency can or can not record, and one of the primary functions of both the Act and the Credit Reporting Code of Conduct is to ensure that only authorised and accurate information is included in the file of a person. Any organisation wishing to access the credit reporting system must sign up to the code of conduct on credit reporting. The Code is legally binding on subscribers. |

| ePayments Code |

The ePayments Code lays down rules for the operation of electronic payment transactions. Companies may choose to sign up for the code. If they do, in their dealings with you, they must follow the code. The ePayments Code replaces the Electronic Funds Transfer Code (EFT Code) with the transition from 20 September 2011 to 20 March 2013 of companies to the ePayments Code. Electronic payments, including credit card transactions, ATM transactions, EFTPOS transactions, online payments, Internet and mobile banking, and BPAY, are subject to the ePayments code. The ePayments Code:

|

| Australian Privacy Principles |

The Australian Privacy Principles comprise 13 principles to be observed by companies. Some of these relate to the following:

|

| Electronic Funds Transfer Code of Conduct | The EFT Code lays down rules and procedures for the relationship between users and accounting institutions in electronic funds transfers involving electronic access to accounts and rules for the value stored and stored value transactions for consumers. |

| Mutual Banking Code of Practice | Provides ten key promises that mutual members will deliver to always put their customers first. |

| National Consumer Credit Protection Act | The legislation surrounding Consumer Credit including requirements on the issue of Default Notices, Notices of Postponement, etc. |

| ACDBA Code of Practice- Communication | This Code of Practice is developed by the Australian Association of Collectors and Debt Buyers. It is a set of guidelines that help association members conduct their business in an ethical and responsible manner. |

Table 1: Industry Codes of Practice

Each organisation will maintain a policies and procedures manual. In many organisations, especially large organisations, the manual will be a formal document or manual that outlines that organisation’s policies. In smaller organisations, the policies and procedures may be a series of instructions issued to the employees to assist them to do their jobs in the way that the organisation’s management has instructed.

Policies, procedures and processes guide operations. For example, a retail business may want to:

- set a standard (policy) for which customers they offer credit to

- create mandatory procedures for dealing with damaged stock

- put a process in place to pay suppliers within a specified time frame.

Having formalised policies, processes and procedures:

- ensures staff know what they must do

- provide staff access to information that they can use it to solve problems

- can be used for onboarding new staff and staff training

- standardises routine tasks and improves quality

- provides a tool to evaluated how a task is done and implement improvements.

Specific policies relating to subsidiary ledgers include:

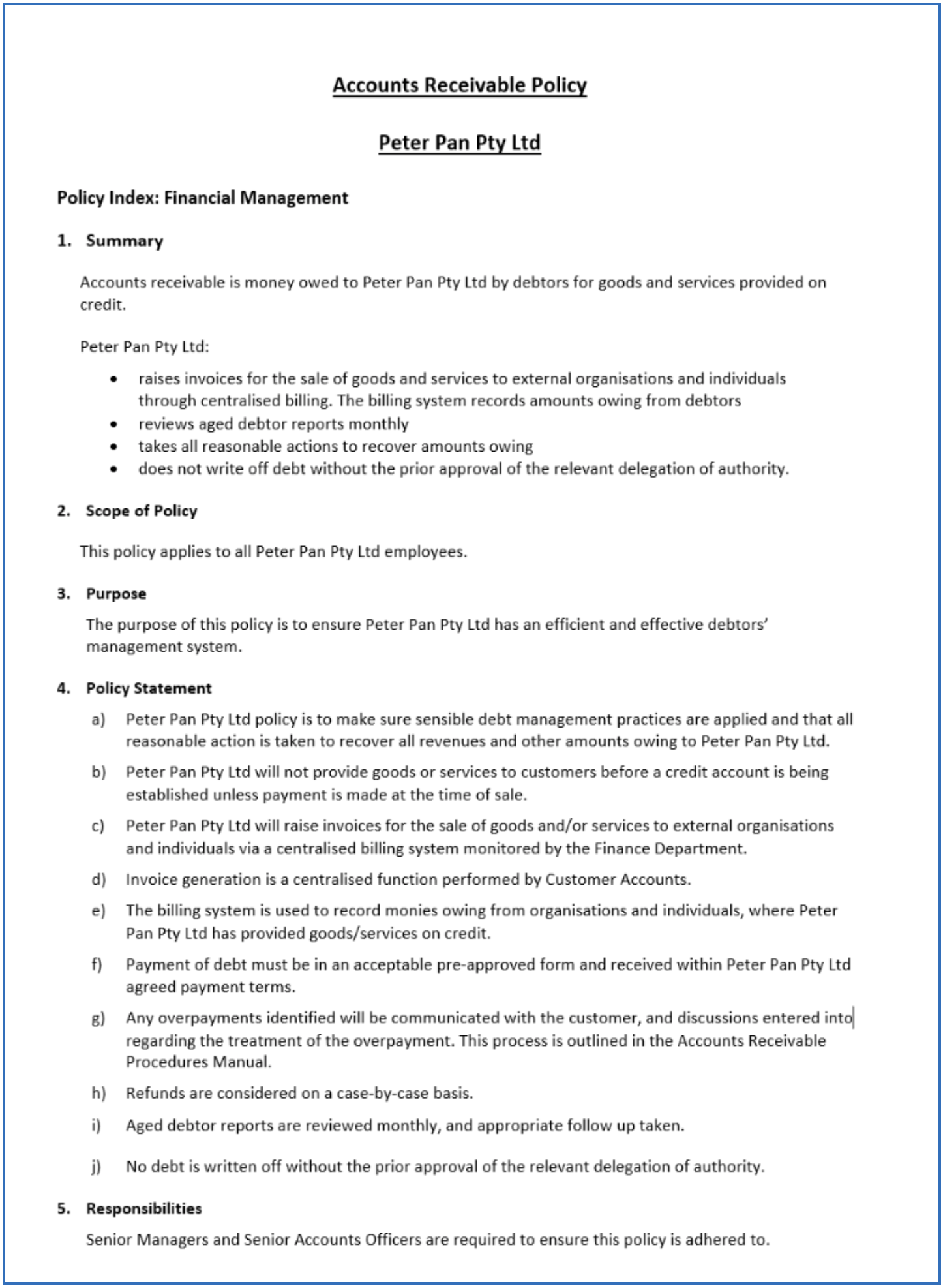

Accounts Receivable Policy

There are several risks associated with a business carrying a large accounts receivable balance:

- Uncollectable debt – High accounts receivables that goes uncollected for a long time often result in bad debt that is written off. This situation occurs when customers who purchase on credit go bankrupt or do not pay their invoices.

- Cash flow deficiencies – Selling on credit may boost revenue and income, but it offers no actual cash inflow. Long-term carrying large accounts receivable balance can cause a business to run short on cash and have to take on other liabilities to fund operations.

These risks can be mitigated by having a well-documented accounts receivable policy.

Example Accounts Receivable Policy

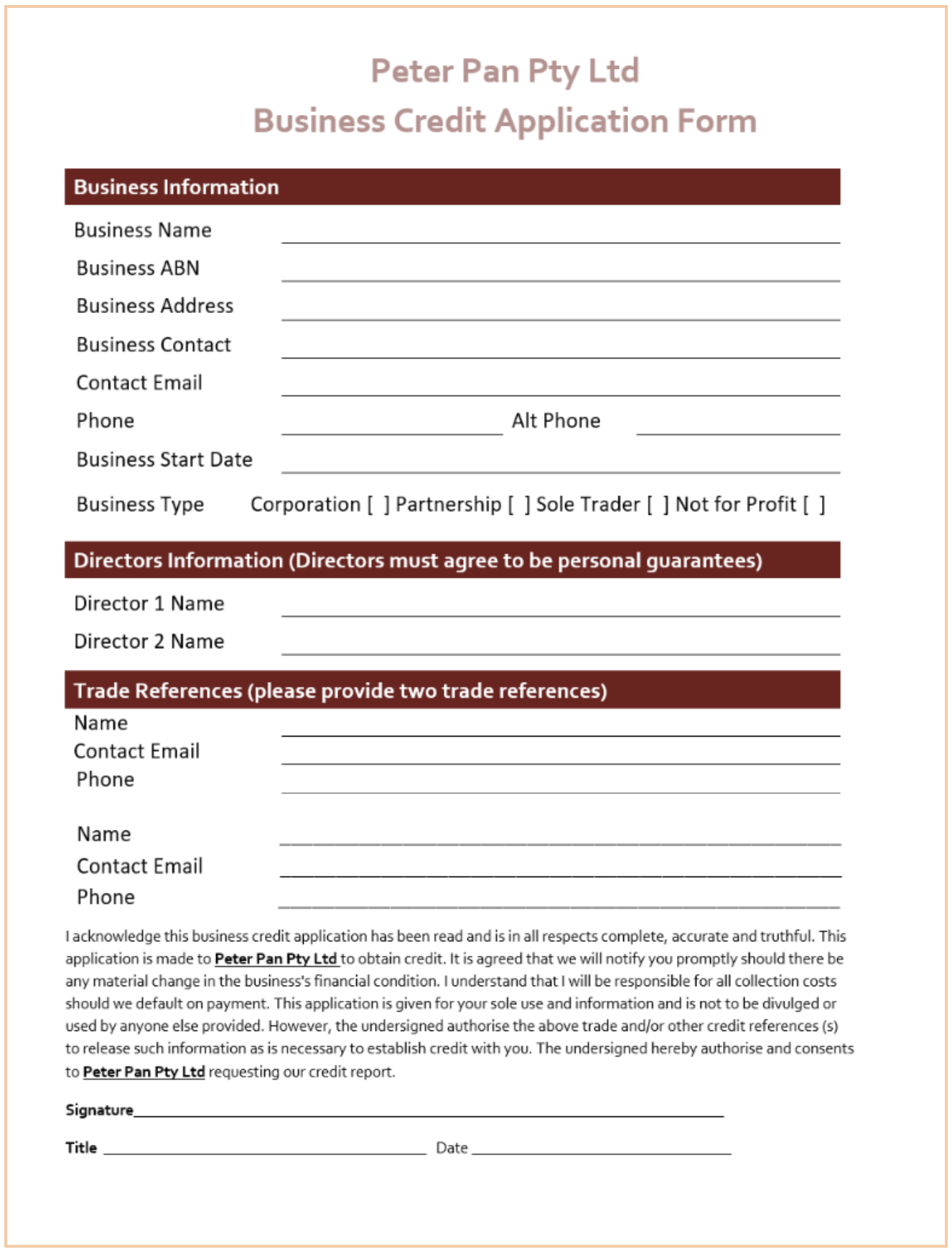

Credit Policy

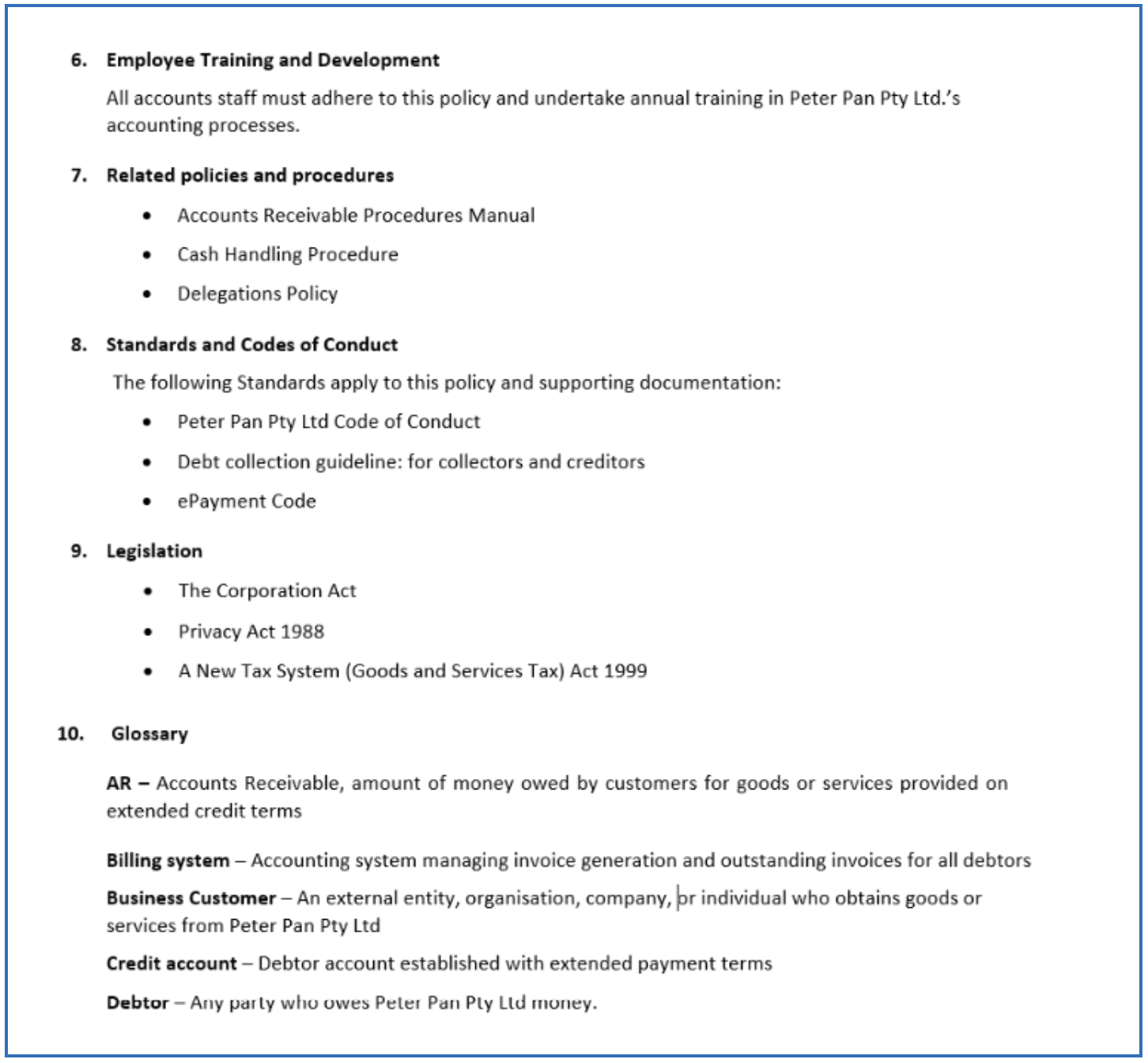

The first step in effectively managing credit is to make informed decisions about which customers should qualify, how much credit they should be extended, the terms of credit and what happens if they do not pay within the credit terms. Credit terms and conditions extended to customers are set out in a business’s credit policy.

A credit policy usually Includes a process to determine a customer’s creditworthiness.

This is usually done by asking potential credit customers to complete a credit application. Information to be included on the credit application can include:

- Full contact details of the applicant.

- ABN of the applicant

- Credit information for the business

- Trade References: Businesses that you can contact to help assess the customer’s creditworthiness.

- Permission to conduct a credit check.

- Personal Guarantee: A personal guarantee added to the credit application gives a business an added layer of security and potential collection tool, as the person providing the guarantee can be held liable for the debt.

- A signature confirming the applicant has read, understood, and agrees to abide by the terms and conditions.

Sample Credit Application Form

Click here to access the Australian Securities and Investments Commission (ASIC) website, which provides a list of credit information brokers offering a range of services, including credit check reports.

Click here to use the ABN Lookup to check a business’s registration.

Example Credit Policy

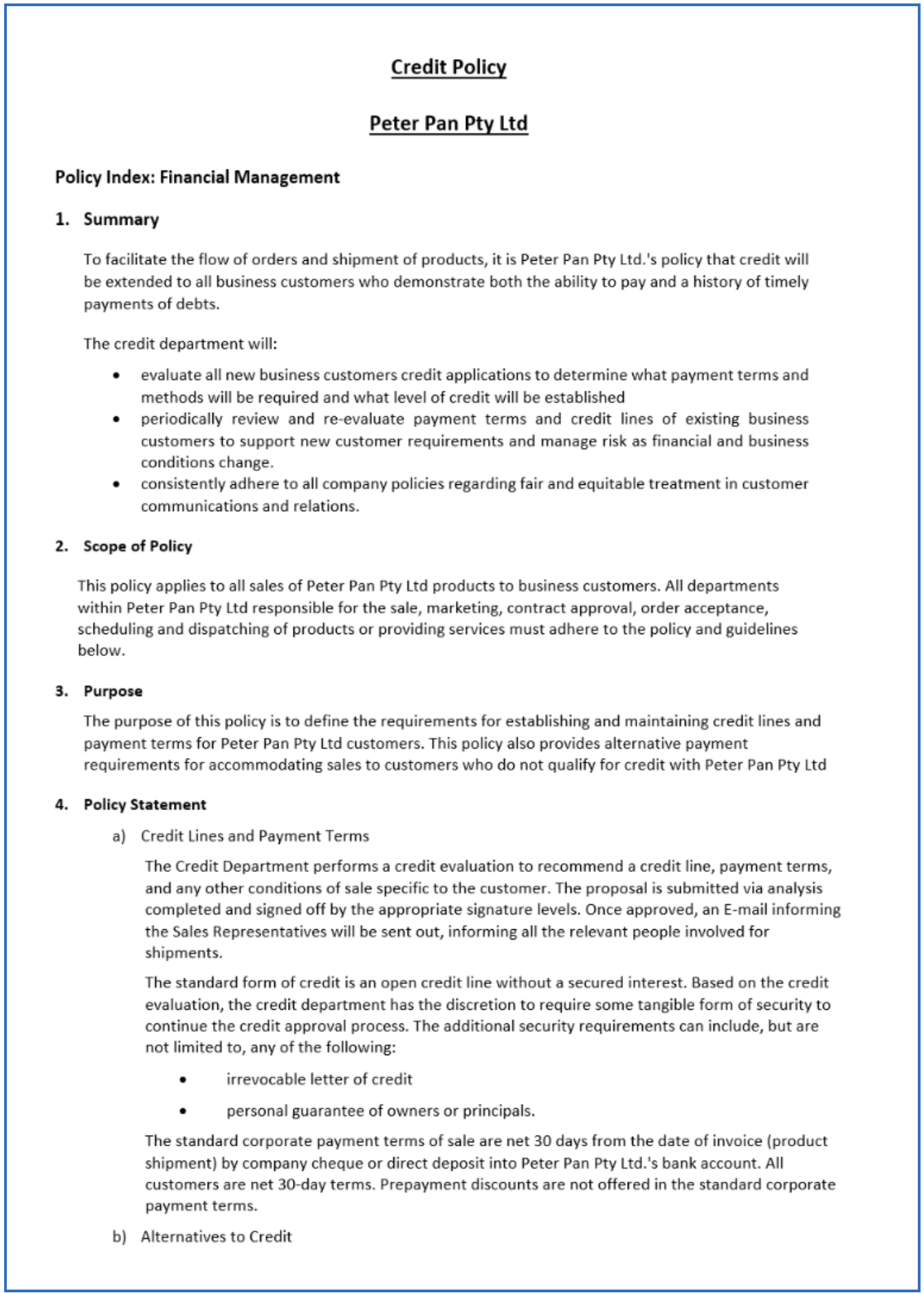

Debt Collection Policy

If a customer owes business money, they are considered to be a debtor. A debt collection policy is a set of procedures a business uses to ensure an efficient and fair process for collecting money from debtors while maintaining positive ongoing customer relations.

Requesting the repayment of a debt is an unpleasant but sometimes essential element of being in business. Sending a pleasant reminder or making a courtesy call to the customer is usually enough to get them to pay; however, if the customer does not respond to a request for payment, the matter may need to be escalated.

A debt collection policy should include:

- when to contact customers

- how to handle disputes

- when to pass unpaid accounts over to a debt collection agency

- when to write off bad debts.

Businesses have a right to seek payment for outstanding debts; however there are laws in place to ensure that debtors are treated with fairly.

The Business Victoria website has a range of resources to help businesses manage their overdue payments and debt recovery whilst ensuring they treat debtors with fairness, respect and courtesy.

They suggest using the following to recover overdue payments from a customer:

- Send a friendly payment reminder when the payment first becomes overdue. – Friendly reminder email

- If the customer misses the next payment date, send an overdue payment reminder. – Overdue email

- If the customer still has not paid and has missed the extended payment date, phone or email the customer to discuss the overdue amount and request payment. Final payment notification email.

- If there is still no payment or contact from the customer, try visiting the customer in person or try a different means of contacting them.

- If all attempts fail and the customer still has not paid the overdue amount or contacted you to discuss payment, send a formal letter of demand. – Letter of demand.

- If you still do not receive payment as a last resort, you can use a debt collection agency.

Example Credit Policy

Accounts Payable Policy

The Accounts Payable System is part of a company’s accounting system. Similar to accounts receivable, there are risks associated when paying invoices. These include:

- Unauthorised purchase

- Duplicate payment of invoices

- Fraudulent payments

- Late processing resulting in late fees or forfeiting a discount.

A documented policy with proper internal controls can effectively and efficiently minimise the risks associated with accounts payable and purchasing activities, reduce the risks of fraud and costly errors, and protect a business’s assets.

Example of an Accounts Payable Policy

For the following task please view the video below to help you understand how to calculate GST using Microsoft Excel. Task: TPIT (Twin Peaks Intrepid Travel) have reached out asking for you to assist them to calculate the GST for their clients and product table.

Download the below Microsoft Excel document and complete the task. Complete the following tasks:

- Before you complete this learning checkpoint, watch this video by clicking on the link.

- In the Learning Checkpoint Workbook M6 LC 6.1 tab calculate the GST for each item in column H.

- Enter the total amount inclusive of GST using a function or formula in column I.

- How can you check that you have entered the entries correctly?

- Check and make any changes but note down if any errors were made. How can this be avoided?