The payroll set-up is by far the most important, and can even be referred to as the heart and soul of a payroll system, because if you get this wrong then it can cause so many errors further down the line. Because of the risk of compounding errors, a very careful plan needs to be developed and implemented with a high level of detail. This section will take you through the setup process so that by the time you have completed the module learning and activities, you can confidently create your own development and implementation plan.

In the next several topics, you will see how to add employees to the MYOB Business payroll system, add and configure the default pay items, and link bank accounts.

Pay items are the basis in MYOB Business Payroll activities for what you pay and deduct from the compensation that you afford employees. Knowing how you plan to configure your Payroll system will save time when you are actually performing the tasks to set up Pay items.

These are the Pay item tabs you will need to think about and what's in them.

Wages and Salary – deals with all wage type payments to the employee.

A few examples:

- Base Salary – Used to pay base weekly salary, hourly or salaried

- Unused Annual Leave – used to pay accrued holiday leave

- Personal Leave Pay - used to pay accrued personal leave

- Overtime - Set up separate pay items for different pay amounts, i.e., Overtime(1.5x) or Overtime(2x)

- Commission - The pay item associated with the commission an employee earns.

Superannuation – deals with superannuation, guarantee, sacrifice, and additional deductions or payments.

A few examples:

- Superannuation Guarantee (CARE) – used to calculate the correct super guarantee to be paid on a salary

- Salary Sacrifice - used to add pre-tax additional money to Superannuation

Leave – used to calculate and accrue entitlements for personal, holiday, and long service leave.

A few examples:

- Annual Leave Accrual – will accrue holiday leave in hours

- Personal Leave Accrual – will accrue personal leave in hours

Deductions – used to make employee-agreed deductions from wages.

A few examples:

- Employee Purchase - used to deduct a set amount to reimburse an employee.

- Union Fee - used to deduct a set amount to pay a union fee

Expenses – used to track benefits (other than superannuation) that you pay on behalf of your employees.

An example:

- Work cover - used to track expenses paid for Work cover

Tax - used to calculate and deduct PAYG withholding from wages.

An example:

- PAYG Withholding – Most employees are subject to PAYG withholding

There are several requirements a business needs to meet when establishing and maintaining payroll systems. These requirements may vary based on the state or territory where the business operates.

These requirements are:

- Federal legislative requirements. Refer to requirements that apply in the same way to all states and territories within Australia.

- State/territory legislative requirements. Specific to one (1) state/territory only

- Record-keeping requirements.

As an example, listed below are the federal legislative requirements, state/territory requirements, and record-keeping requirements per legislation if your business operates in the territory of Queensland:

(Click the links to jump directly to the content on this page.)

- Fair Work Act

- National Employment Standards (NES)

- Superannuation Guarantee (Administration) Act

- Corporations Act

- Workers compensation

- Work health and safety

- State payroll tax relating to payroll activities

- Privacy Act

- Higher Education Loan Program (HELP)

- Medicare levy

- Tax Agent Services Act (TASA)

- Current industry and modern awards

- Current enterprise bargaining agreements

- Individual Transitional Employment Agreement (ITEA)

- Australian Workplace Agreement (AWA)

- Annual Leaves as outlined in leave legislation

- Personal leaves as outlined in leave legislation

- Paid parental leaves as outlined in leave legislation

- Long service leaves as outlined in leave legislation

- Australian Bureau of Statistics (ABS) Act

- Fringe benefits

Fair Work Act

Federal legislative requirement:

- National minimum wage is set at $18.29 per hour for award and agreement-free employees. Impact on business payroll operations:

- For employees not covered by awards and agreements, their salary package must be set in accordance with the national minimum wage.

State/Territory legislative requirement: N/A

Record-keeping requirement:

- Employee records must not be false or misleading to the employer's knowledge. Impact on reporting requirements:

- Employee records, including payroll records and payslips, must contain information that is true, correct, and verifiable.

National Employment Standards

Federal legislative requirement

- Maximum weekly hours of work for full-time employees is set at 38 hours.

Impact on business payroll operations:

- Full-time employees must be required to work the maximum weekly hours only. Any work rendered in addition to these hours should be counted as overtime and paid accordingly.

State/Territory legislative requirement: N/A

Record-keeping requirement:

- A payment summary of the employee’s income must be given to employees at the end of each financial year.

Impact on reporting requirements:

- All information relating to payments made to the employee, including the taxes applied and timesheets must be diligently and accurately reported in order for the payment summary to be accurate as well.

Superannuation Guarantee (Administration) Act

Federal legislative requirement:

- The employer must pay superannuation contributions on behalf of all eligible employees, in addition to their wages and salaries.

Impact on business payroll operations:

- Superannuation contributions must be factored into all eligible employees’ salary packages.

State/Territory legislative requirement: N/A

Record-keeping requirement:

- You must keep records that show how much super guarantee (SG) you paid for each employee and how it was calculated.

Impact on reporting requirements:

- Super guarantee payments must be diligently and accurately reported.

Corporations Act

Federal legislative requirement:

- A company’s director has a duty to act in good faith in the best interests of the company and for a proper purpose.

Impact on business payroll operations:

- A company’s director must act in the best interests of the company, including its employees. An example of this are enterprise agreements, in which modern awards are overridden for better employment terms in the interest of the employee.

State/Territory legislative requirement:

- States have their own Corporations Act that places the jurisdiction of civil matters to the Supreme Court.

Impact on business payroll operations:

- If any disputes occur and/or legal action must be taken regarding any payroll matters under corporations law, the business must escalate this to the local courts of Queensland.

Record-keeping requirement:

- Under the Corporations Act, all proprietary companies must keep sufficient financial records to record and explain their transactions and financial position and to allow true and fair financial statements to be prepared and audited.1

Impact on reporting requirements:

- Any fringe benefits tax and PAYG withholding applied to employee benefits and wages must be reported in the business’s activity statement.

Workers compensation

Federal legislative requirement:

- Employees must be paid if they are injured at work or become sick due to their work. Impact on business payroll operations:

- In the event an employee is injured or gets sick because of work, they must be given enough payment covering wages while they’re not fit for work and medical expenses and rehabilitation.

State/Territory legislative requirement:

- The business should immediately notify WorkCover Queensland in the event of any injury for which compensation may be payable.

Impact on business payroll operations:

- The requirement must be included in the business’s policies and procedures relating to responding to workplace injuries and accidents.

Record-keeping requirement:

- The business must keep records of all information related to workers compensation claims in a safe and private location and date all correspondence.

Impact on reporting requirements:

- This enables the business’s efficient reporting and notification of workplace injuries and accidents to WorkCover and helps the agency process claims for workers compensation.

Work health and safety

Federal legislative requirement:

- It is the employer’s obligation to manage exposure to risks to employee health and safety by putting controls in place.

Impact on business payroll operations:

- In the context of payroll operations, implementing employee entitlements with respect to breaks, rosters, leaves and maximum weekly hours of work is a form of control to manage risks to employees’ health and wellbeing.

State/Territory legislative requirement:

- Officers of corporations must exercise due diligence to ensure that it meets its work health and safety obligations.

Impact on business payroll operations:

- The business must ensure that payroll processes are developed and implemented relating to personal leaves, claiming workers compensation, arrangements for lengthy leaves due to illness or injury, etc.

Record-keeping requirement:

- The business must keep records of workplace incidents and first aid incident register. Impact on reporting requirements:

- The records above enable the business’s efficient reporting and notification of workplace injuries and accidents to the appropriate agencies.

State payroll tax relating to payroll activities

Federal legislative requirement: N/A

State/Territory legislative requirement:

- A business must register for payroll tax if the total annual Australian taxable wages paid by the business as an employer exceeds $1.1 million.

Impact on business payroll operations:

- If the company’s total annual taxable wages paid exceeds the threshold, then the company must pay payroll tax.

Record-keeping requirement:

- The business must store original documents even if electronic records are kept. For auditing purposes, electronic records must be easy to access and read.

Impact on reporting requirements:

- This makes it easier to reconcile figures when reporting payroll tax returns, as well as preparing the business for future payroll tax audits.

Privacy Act

Federal legislative requirement:

- Individuals’ personal information must be kept private and confidential. Where personal information is collected, the information must be kept secure and should not be disclosed without the individual’s permission.

Impact on business payroll operations:

- The payroll system, whether manual or computerised, must have security measures in place, e.g. locks for manual payroll systems and passwords for computerised payroll systems.

State/Territory legislative requirement:

N/A Record-keeping requirement:

- All records kept in relation to payroll operations must be kept private, confidential and secure.

Impact on reporting requirements:

- Only payroll information in relation to the business’s obligations (e.g. PAYG withholding amounts) are reported on tax returns.

Higher Education Loan Program (HELP)

Federal legislative requirement:

- If an employee has a HELP debt and their repayment income has already exceeded the minimum repayment threshold, the employee must begin making compulsory repayments against their loan.

Impact on business payroll operations:

- Compulsory repayments for employees with HELP debts must be included in the PAYG amount withheld from payment to the employee.

State/Territory legislative requirement: N/A

Record-keeping requirement:

- HELP repayments must be accurately recorded. Impact on reporting requirements:

- HELP repayments included in PAYG withholding amounts must be reported in the business’s activity statements.

Medicare levy

Federal legislative requirement:

- Taxpayers must pay a Medicare levy of 2% of their taxable income. However, if the employee’s taxable income is below a certain threshold, the levy may either be reduced or the employee exempted from paying the levy.

Impact on business payroll operations:

- The Medicare levy must be included in the PAYG amount withheld from payments to employees, unless the employee is exempt from paying the levy.

State/Territory legislative requirement: N/A

Record-keeping requirement:

- Payments of the Medicare levy must be accurately recorded.

Impact on reporting requirements:

- Medicare levy payments included in PAYG withholding amounts must be reported in the business’s activity statements.

Tax Agent Services Act (TASA)

Federal legislative requirement:

- The Act sets out qualifications and requirements for registered tax or BAS agents.

Impact on business payroll operations:

- Only individuals who have met these requirements and are registered tax or BAS agents must be in charge of the business’s payroll operations.

State/Territory legislative requirement: N/A

Record-keeping requirement:

- A BAS agent must maintain records of account such that the registered tax practitioner can account to entitled persons, on demand, for any money or other property held on trust.

Impact on reporting requirements:

- Maintaining complete records of account enables you to be able to accurately report to the client about their money and/or property and protects you from unfounded accusations.

Current industry and modern awards

Federal legislative requirement:

- Employees covered by a modern award should be given the entitlements under that award. Impact on business payroll operations:

- Employees covered by modern awards should have their minimum entitlements as stated in the awards be reflected in the business’s payroll system.

State/Territory legislative requirement:

- State/Territory-based differences included in the applicable modern award must be applied but only up to five (5) years after the award came into operation.

Impact on business payroll operations:

- The business must apply State/ Territory-based differences to employees affected by these, but only until the expiry date stated above.

Record-keeping requirement:

- To ensure that employees get the entitlements under their industry award, businesses are legally required to keep accurate and complete time and wages records and issue pay slips to each employee.

Impact on reporting requirements:

- The employee’s pay slip should accurately reflect the data in their time and wages records.

Current enterprise bargaining agreements

Federal legislative requirement:

- The entitlements made in an enterprise bargaining agreement cannot be lower than that in the applicable modern award.

Impact on business payroll operations:

- When the business sets out to create an enterprise bargaining agreement with its employee, the business must make sure that the entitlements granted are not lower than that in the modern award.

State/Territory legislative requirement:

- Queensland enforces certified agreements, which are negotiated between an employer and public-sector unions. Queensland businesses covered by these agreements must follow the entitlements included in this.

Impact on business payroll operations:

- Any employee covered by a Queensland certified agreement must receive the entitlements set out in that agreement.

Record-keeping requirement:

- The enterprise bargaining agreement must be documented through writing and a copy must be kept in the business’s records.

Impact on reporting requirements:

- The proposed enterprise agreement must then be lodged for approval by the Fair Work Commission within 14 days of the agreement being made.

Individual Transitional Employment Agreement (ITEA)

Federal legislative requirement:

- No new ITEAs can be made. However, existing ITEAs must be applied until terminated.

Impact on business payroll operations:

- Any employees covered by an ITEA must receive the entitlements set out in the ITEA, unless terminated by either employee or employer.

State/Territory legislative requirement: N/A

Record-keeping requirement:

- If an employer and employee decides to terminate the agreement, it must be documented through a termination agreement.

Impact on reporting requirements:

- The person covered by the agreement must apply to the Fair Work Commission for approval of the termination agreement. Only after approval can the agreement be terminated.

Australian Workplace Agreement (AWA)

Federal legislative requirement:

- No new AWAs can be made. However, existing AWAs have a nominal expiry date of up to five (5) years, after which both parties can either agree to terminate the agreement, replace it, or have it remain in force.

Impact on business payroll operations:

- If an employee has an AWA in place, you must check whether the expiry date has passed and what both employer and employee has decided about the AWA.

State/Territory legislative requirement: N/A

Record-keeping requirement:

- If an employer and employee decides to terminate the agreement, it must be documented through a termination agreement.

Impact on reporting requirements:

- The person covered by the agreement must apply to the Fair Work Commission for approval of the termination agreement. Only after approval can the agreement be terminated.

Annual leaves as outlined in leave legislation

Federal legislative requirement:

- As per the National Employment Standards (NES), employees are entitled to a minimum of accumulated four weeks of paid annual leave for each year of service.

Impact on business payroll operations:

- If an employee takes an annual leave, the employee must still be paid the employee’s base pay rate for all ordinary hours worked.

State/Territory legislative requirement:

- According to the Industrial Relations Act (Qld) 2016, annual leave is exclusive of a public holiday that falls during the leave.

Impact on business payroll operations:

- If an employee takes an annual leave and one (1) of the leave days happens to be a public holiday, it should not be counted as part of the annual leave and should not be subtracted from the employee’s annual leave credits.

Record-keeping requirement:

- The business is obliged to keep accurate and complete records of employee leave accruals.

Impact on reporting requirements:

- Accurate and complete records of employee leave accruals enable the business to produce accurate reports (e.g. payslips, payment summaries, etc.) of the employee’s hours of work, wages, etc.

Personal leaves as outlined in leave legislation

Federal legislative requirement:

- As per the National Employment Standards (NES), employees are entitled to 10 days of paid personal/carer’s leave per year.

Impact on business payroll operations:

- If an employee takes a personal leave, the employee must still be paid the employee’s base pay rate for all ordinary hours worked.

State/Territory legislative requirement:

- According to the Industrial Relations Act (Qld) 2016, full-time and part-time employees are entitled to at least 10 days sick/carer’s leave on full pay, 2 days of unpaid carers' leave (if needed), and 2 days of paid compassionate leave (if needed).

Impact on business payroll operations:

- If an employee takes a personal/ carer’s leave, the employee must still be paid. If the extra two (2) days of unpaid leave are taken, it must not be taken against the employee.

Record-keeping requirement:

- The business is obliged to keep accurate and complete records of employee leave accruals.

Impact on reporting requirements:

- Accurate and complete records of employee leave accruals enable the business to produce accurate reports (e.g. payslips, payment summaries, etc.) of the employee’s hours of work, wages, etc

Paid parental leaves as outlined in leave legislation

Federal legislative requirement:

- As per the Paid Parental Leave Act 2010, eligible employees who are the primary carer of a newborn or adopted child get up to 18 weeks' leave paid at the national minimum wage by the government.

Impact on business payroll operations:

- If an eligible employee takes a paid parental leave, the government makes the necessary payment to the employer. The employer is required to pay this amount to the employee.

State/Territory legislative requirement:

- According to the Industrial Relations Act (Qld) 2016, employees are entitled to the following parental leaves: paid birth-related leave, adoption leave, and surrogacy leave.

Impact on business payroll operations:

- If an eligible employee takes a leave from the above types of parental leave, the employee must be paid.

Record-keeping requirement:

- Parental leave payments from the government must be recorded accurately.

Impact on reporting requirements:

- Payslips in which parental leave payments are reported must include the following:

- the gross and net amounts of Parental Leave Pay and the amount of income tax deducted

- if there are other payments on the pay slip, this information must be included as well as the total gross, net and income tax amounts

- the amount of any deduction and the name and bank details of the entity the deduction was given to.

Long service leaves as outlined in leave legislation

Federal legislative requirement:

- As per the National Employment Standards (NES), an employee is entitled to long service leave in accordance with their applicable pre-modernised award. If a pre-modernised award does not apply to an employee, then agreement-derived long service leave entitlements will apply. If there are no applicable awards and agreements, State and Territory long service leave laws must be followed

Impact on business payroll operations:

- If an eligible employee takes a long service leave or opts to collect payment for untaken long service leave instead, all relevant entitlements must be followed, depending on the industrial instrument or legislation that applies.

State/Territory legislative requirement:

- According to the Industrial Relations Act (Qld) 2016, an employee who has completed 10 years of continuous service is entitled to a long service leave of 8.6667 weeks on full pay.

Impact on business payroll operations:

- If an eligible employee takes a long service leave of 8.6667 weeks, the corresponding full payment for that time must be paid to the employee.

Record-keeping requirement:

- The business must keep complete and accurate time and wages records since long service leave entitlements are based on continuous service.

Impact on reporting requirements:

- Unused long service leave can be claimed as payment upon termination and must be reported in the business’s activity statements. The record-keeping requirement above helps the business accurately report amounts paid relating to long service leaves.

Australian Bureau of Statistics (ABS) Act

Federal legislative requirement:

- The ABS Act sets one of the functions of the Australian Bureau of Statistics as the central statistical authority on a wide range of economic, social, population and environmental matters of importance to Australia.

Impact on business payroll operations:

- The business may use statistical information relating to the community, the industry, the social and economic climate from ABS to improve aspects of the payroll system, e.g. salary packages to address social and economic needs identified by ABS.

State/Territory legislative requirement: N/A

Record-keeping requirement: N/A

Fringe benefits

A fringe benefit is something offered to an employee by their employer on top of their salary. It can be used to incentivise and reward employees without increasing wages.

Fringe benefits must be non-cash incentives paid on top of salary. Even if the benefit is provided by a third party, the employer must pay fringe benefit tax (FBT).

There are several types of fringe benefits.

- The private use of a company car

- Car parking and maintenance expenses

- Lifestyle benefits (e.g. gym memberships)

- Payment of personal expenses (e.g. school fees)

- Certain types of entertainment (e.g. tickets to events)

- Low-interest loans used for personal purposes

Employees need to report the fringe benefits they provide to employees if the total taxable value in an FBT year (1 April to 31 March) exceeds $2,000.

The due dates for lodgement of FBT returns are:

- 25 June if the return is lodged electronically

- 21 May if the return is lodged by paper

More information about fringe benefits tax (FBT) rates and thresholds for the 2018–19 to 2022–23 FBT years and calculating the Gross-up rates for FBT can be found on the ATO website.

Fringe benefits tax – rates and thresholds | Australian Taxation Office (ato.gov.au)

More information about reporting, lodging and paying FBT can be found on the ATO website.

Reporting, lodging and paying FBT | Australian Taxation Office (ato.gov.au)

Fringe benefits tax – rates and thresholds | Australian Taxation Office (ato.gov.au)

More information about reporting, lodging and paying FBT can be found on the ATO website.

Reporting, lodging and paying FBT | Australian Taxation Office (ato.gov.au)

ATO requirements relating to payroll systems

Listed here are the requirements mandated by the Australian Taxation Office relating to payroll systems and how they apply to its establishment and maintenance.

(Click the links to jump directly to the content on this page.)

- Australian Business Number (ABN)

- Payment Summary

- Employment Termination Payments (ETPs) (fix title)

- Tax File Number (TFN) Declaration

Australian Business Number (ABN)

The Australian Business Number (ABN) is a unique 11-digit number that identifies your business to the government and the community.

- A business must register for an ABN in order to lodge and pay PAYG instalment and withholding taxes for its employees

- An ABN is needed in order for a business with a total annual taxable wage payment exceeding the threshold to be able to lodge and pay payroll tax

- business must register for an ABN in order to meet its super obligations for eligible employees

Payment summary

A payment summary is a document that had been given by the employer to the employee summarising the employee’s total earnings during the financial year.

From the 2023 financial year (starts 1 July 2022) all businesses are required to use Single Touch Payroll for payroll reporting to the ATO. This means employers are no longer required to send payment summaries, as employees can go to myGov and view their payroll information.

You should be familiar with the various reasons a payment summary may be requested or required.

- A payroll system may need to issue different types of payment summaries2:

- Individual non-business

- Foreign employment

- Business and personal services income

- Withholding where ABN not quoted

- Employment termination payment

- Fringe benefit tax

- Superannuation lump sum

- Superannuation income stream

- Interest, dividend and royalty payments paid to non-residents

- Departing Australia superannuation payment (DASP)

- Foreign residents

- Natural resource payments to foreign residents

- PAYG withholding payment summary statement

- At the end of each financial year a business must lodge a PAYG withholding annual report, including the following:

- all payments and withholdings not reported and finalised through STP

- Businesses in the building and construction industry need to report the total payments made to each contractor for building and construction services on the Taxable payments annual report, due by 28 August each year.

Employment termination payment (ETP)

3Employment termination payments (ETPs) are made from an employer to an employee. Upon the termination of employment, employers need to pay employees their final pay, which consists of a lump sum, or several lump sums.

When calculating final pay, employers need to decide if any part of the payment is classified as an ETP. Only certain payments are eligible, and these are taxed at a lower rate than regular payments.

There are two (2) types of ETPs:

- A ‘life benefit ETP’ is paid to an employee

- If the employee has died, a ‘death benefit ETP’ is paid to their estate.4

Items that can be included in an ETP

- payments for unused sick leave or unused rostered days off

- payments in lieu of notice

- a gratuity or 'golden handshake'

- an employee's invalidity payment (for permanent disability, other than compensation for personal injury)

- compensation for loss of a job or wrongful dismissal

- genuine redundancy payments

- early retirement scheme payments that exceed the tax-free limit

- certain payments made after the death of an employee

- the market value of the transfer of property (less any consideration given for the transfer of this property5).

Payments that aren’t classified as an ETP

- an employee’s salary, wages or allowances

- lump-sum payments for unused annual or long service leave

- the tax-free part of a genuine redundancy payment or an early retirement scheme payment

- superannuation benefits (for example, a lump sum or income stream from a super fund)

- foreign termination payments.5

Tax file number (TFN) declaration

The tax file number (TFN) declaration is completed before an employee starts to receive payments from a new payer. This is where the employer bases their calculations of withholding amounts from payments to the employee.

- Each employee should complete a TFN declaration.

- Employee TFN declarations should be lodged with ATO.

- If the employer lodges their TFN declaration reports electronically, then the employee must also complete an electronic TFN declaration form.

- If the employee completes a new, updated declaration, it will override the previous one.

- If an employee does not give a valid Tax file number declaration within 14 days of starting an employer/employee relationship, the employer must complete a Tax file number declaration with all available details of the employee and send it to ATO.

Routine requirements in the payroll system

- Award Payments

- Salary amount

- Salary packaging

- Superannuation Guarantee (SG)

- Superannuation Reporting

Award payments

- Award payments are minimum payment entitlements prescribed for employees of a certain industry or occupation.

- In maintaining the payroll system, the employee’s pay entitlements (minimum wage, overtime pay, allowances, penalty rates) as outlined in the award must be followed.

- You must also consider whether the business is covered by a registered enterprise bargaining agreement or not. If an agreement applies, then the base pay rates from the agreement must override payments prescribed in the award, unless the agreement rates are lower than that in the award.

- You must also take into consideration whether the employee has an over award payment, an amount in excess of the relevant minimum award wage which an employer may pay for different reasons.

Salary amount

- The salary amount is the amount the employee must be paid for the hours of work they render.

- In maintaining the payroll system, you must consider the employee’s agreed-upon annual salary as documented in the employment contract.

- The salary amount may include the following entitlements:

- minimum weekly wages

- penalties

- overtime

- allowances

- annual leave holding

- The annual salary amount can't be less than the minimum entitlements an employee is entitled to under the award or registered agreement that applies and the National Employment Standards6.

- Award rules about annual salary agreements must also be taken into consideration.

Salary packaging

- Salary packaging (also known as salary sacrifice) is an arrangement between employee and employer where the employee pays for some items or services straight from their pre-tax salary7.

- When maintaining the payroll system, you must take into consideration whether the employee has arrangements for salary packaging or salary sacrifice arrangement.

- The business must pay fringe benefits tax on the benefits included in the salary packaging.

- You must take into consideration when the salary sacrificing arrangement was made. It must have been made before earning the income.

Superannuation guarantee

The Superannuation Guarantee (SG) is a compulsory system of superannuation support for employees, paid for by employers.

Key aspects:

- You must consider the minimum SG contribution rate for the financial year as set by ATO.

- You must consider the employee’s chosen super fund you must make super payments to.

- If an employee has chosen to include super payments into their salary sacrificing arrangement, the amount sacrificed is not subject to PAYG tax and the business’s SG payment obligations will be based on the employee’s reduced salary.

Superannuation reporting

This refers to the reportable employer superannuation contributions that must be included in the annual payment summary given to each employee.

- Consider whether the business pays the following super contributions to the employee and report these in the employee’s payment summary:

- additional contributions as part of an employee's individual salary package

- additional contributions under a salary sacrifice arrangement

- pre-tax amounts paid to an employee's super fund at the employee's direction, such as directing an annual bonus into super8.

- This refers to the reportable employer superannuation contributions that must be included in the annual payment summary given to each employee.

- super guarantee contributions

- contributions required by collectively negotiated industrial agreements

- matching contributions under a collective agreement (but matching contributions under an individual agreement are generally reportable)

- contributions required by super fund rules or a law

- extra contributions that the employee could not influence, such as extra contributions for administrative simplicity or accepted employer policy

- contributions from the employee's after-tax income8.

Non-routine requirements in the payroll system

- Life benefit employment termination payment

- Death benefit employment termination payment

- Superannuation guarantee charge

Life benefit employment termination payment

- Life benefit ETP is a payment made because the employee’s employment has finished.

- If the life benefit ETP is given within 12 months after the employee’s termination, then the following payments must be included in the ETP:

- payments for unused rostered days off

- payments in lieu of notice

- a gratuity or ‘golden handshake’

- an invalidity payment for permanent disability

- The business must give the employee one or more payment summaries showing the amounts paid to the employee and the tax withheld.

Death benefit employment termination payment

- Death benefit ETP is a payment made after the death of an employee. It may have a tax-free and a taxable component.

- The following must be considered in the tax treatment of the taxable component:

- whether the payment is made to the dependent of the deceased

- whether the payment exceeds the ETP cap

- You must also consider the ETP cap as it is indexed each year. The death benefit ETP cap amount is independent of the life benefit ETP cap amount.

Superannuation guarantee charge

The superannuation guarantee charge is a payment made when the employer is unable to pay the minimum super guarantee for the employee by the due date.

The charge includes:

- SG shortfall amounts (including any 'choice liability') calculated on the employee’s salary or wages

- interest on those amounts (currently 10%)

- an administration fee ($20 per employee, per quarter)

You must consider whether the following applies and use the late payment offset to reduce the amount of SGC the business must pay:

- The business made the payment to the employee's super fund.

- The business made the payment before the date the SGC assessment was made.

- The business lodged the late payment offset election with us within four years of employee’s original SGC assessment date.

- You must consider whether the following applies and use the late payment as prepayment of a future super contribution for the same employee:

- The late payment is for the same employee

- The start of the quarter is within 12 months after the payment date

The business can't claim a late payment offset for contributions used as a prepayment for current or future periods. If the business carries a late payment forward, it is tax-deductible in the year paid.

9Linked accounts are the default accounts used for various functions in MYOB. They work behind the scenes to make sure that the right accounts are used consistently and correctly. This saves you from needing to choose an account every time you use a function.

Note: If you want to follow along and create your linked accounts in MYOB Business software, be sure you have set up your 6-month education account. We have complete setup instructions in the following Topic. Go ahead and jump to: 11.5.1 Configuring Payroll System > Chart of Accounts and General Ledger. Then return here to following along and set up your linked accounts.

Feature level and record level linked accounts

There are two types of linked accounts used in MYOB: feature-level and record-level linked accounts.

You can change the default linked accounts and turn some off. However, some feature-level accounts can't be changed or turned off, even if you don't use the feature they're linked to.

Feature-level linked accounts

Feature-level linked accounts are the default accounts that MYOB uses for some of its main features. For example, there’s a linked account for tracking receivables (your trade debtors) and a banking account for receiving customer payments. So whenever you record a credit sale, MYOB knows which account you use to track what customers owe you, and will update it automatically. Likewise, when you receive a customer payment, the linked bank account you’ve selected will be used by default.

You can set or change feature-level linked accounts by going to the Accounting menu and choosing Manage linked accounts. From here you can set up the following types of linked accounts.

- Accounts and banking

- Sales

- Purchase

- Payroll

For this module, we'll just focus on the Payroll linked accounts.

- Bank account for cash payments: This is the bank account from which you withdraw cash to pay employees. The account will automatically be adjusted when you record a pay run. Alternatively, this can be a clearing account that helps you track the total cash that needs to be withdrawn from your bank account.

- Bank account for cheque payments: This is the bank account from which you write cheques to pay employees.

- Bank account for electronic payments: This is a clearing account that’s used to keep track of electronic payments that haven’t been processed yet for your employees. The payments are cleared from this account and withdrawn from your bank account when you process your employees' electronic payments.

- Default employer expense account: This is the default account that’s used for Employer Expense type pay items. Employer Expense pay items are used to track payments you make on behalf of your employees, eg. WorkCover Insurance. You can specify a different account when setting up the pay items.

- Default wages expense account: This is the default account that’s used for Wages type pay items. Wages pay items are used to track employee wage and salary expenses. You can specify a different account when setting up the pay items.

- Default tax/deductions payable account: This is the default account used for Deductions and the Tax type pay items. You can specify a different account when setting up these pay items.

Record-level linked accounts

Accounts linked at the record level are those that you’ve selected as the default accounts used for particular records, like inventory items or pay items. For example, when setting up a wage pay item, you can choose to track payments of that wage pay item by using a specific expense account.

You can easily add linked accounts in the linked account section by using the drop down arrows and selecting Create account.

For more information about linked accounts, including how to turn them off, why some cannot be changed, and linked accounts for tax purposes, view the MYOB help centre article Managing linked accounts and scroll to the bottom of the page then click and expand the topic of interest.

What is electronic payment (EP) and is this the same thing as Electronic Funds Transfer (EFT)?

The answer to this question is no, EFT is not the same as EP. While both of these transmit payment information in an electronic environment, EFT requires a logon to the electronic banking facility of the bank and the user to set up each payment individually.

Electronic payment (EP) allows the accounting system to accumulate payment data until a request is made for payment of the accumulated electronic payments. In MYOB, part of the pay run process will create an electronic payment file (.ABA file) that can be transmitted directly to the banking system that creates one withdrawal and multiple distributions of that withdrawal equal to the payments requested to each payee. An ABA file format, also known as a Direct Entry file, has been adopted by most of the Australian banks as default format for batch transactions. ABA files can be opened with any text editor such as Notepad++10.

The benefit of this process is that bank fees are reduced as all of the payments made are seen by the bank as a single withdrawal. This reduces the cost of banking compared to either cheque payments or EFT payments, where each payment is seen as a withdrawal and therefore generates bank fees for each payment.

This example was taken from comtexABA.com, an organisation that converts CSV files (generated by Excel for example) into ABA files.

You can still opt to pay employees directly rather than use the ABA file, and MYOB supports either option with a similar setup.

Setting up includes making sure a specific account is set up in MYOB (an electronic clearing account). This account works behind the scenes to handle your electronic payments. You'll also enter the bank account details where your electronic payments will come from, and the bank account details for your suppliers and employees11.

How to choose between the two payment types, both of which are electronic. Direct payments are not available to all businesses, but provides additional features and flexibility than paying via ABA file.

What's the difference between paying employees via bank file vs direct payments?

| Using a bank file (ABA) | Direct payments |

|---|---|

|

|

Note: Current MYOB fees are shown on the MYOB help page, in the FAQ section.

Setup Tasks for EPs:

- Check your Electronic Clearing Account

- Enter your employees bank account details

- Set up for Bank files or direct payments

1. Check your Electronic Clearing Account13

When you record a payment in MYOB that's going to be paid electronically, the payment is posted to a temporary holding account in MYOB. This type of account is called a clearing account or a suspense account. The payments you make in MYOB that are to be paid electronically sit in this account until you're ready to process the electronic payment. Once the payment is processed, either one payment or a batch, the payment amount is removed from the clearing account.

Take a look at yours now:

Go to Accounting > Chart of accounts > Electronic Clearing Account.

You shouldn't need to, but if you need to create a new account for this purpose learn about adding, editing and deleting accounts.

Next, check that the Electronic Clearing Account is set as the linked account for electronic payments.

Take a look at yours now:

Go to Accounting > Manage linked accounts > Accounts & Banking tab.

This just ensures that electronic payments work correctly behind the scenes in MYOB. If you've created a different account as your electronic clearing account, you'll need to set that account here and click Save14.

2. Enter your employees' bank account details14

To pay funds into an employee's bank account, you'll need to record their account details in MYOB. It is from these details that payment information will be drawn from and included in the . ABA files sent electronically to the bank.

- Go to Payroll > Employees.

- Click the employee's name to open their details.

- Click the Payment details tab.

- For the Payment method, choose Electronic.

- In the Split net pay between field, choose how many bank accounts you're paying into for this employee. If it's more than one, enter the details of each. See additional information below.

- Enter the Bank statement text to appear on the employee's bank statement for the electronic payments you make to them.

- Enter the employee's banking details.

- Click Save.

- Repeat for each employee you'll be paying electronically.

Splitting pay between accounts15

You can pay an employee into up to three bank accounts, and it's easy to set up as part of paying your employees electronically.

Their pay can be split by percentage, such as 10% into one account, 20% into another and the balance into a third account. Or the pay can be split by amount.

From the Payment details tab (#5 in the list of instructions above), follow these alternative instructions:

- In the Split net pay between field, select the number of accounts. New fields are displayed which allow you to specify how you want to split this employee's pay.

- In the Bank statement text field, enter the text you want to appear on the employee's bank statement for their wage payments.

- Enter the account details for the first account, and specify the amount or percentage to go to that account.

- Enter the account details for the second and, if applicable, a third account. By default, the remaining amount or percentage will go to the last account.

- When you're done, click Save.

3. Set up for Bank files or direct payments16

If you're setting up for bank file payments (ABA files), you'll need to record the details of the bank account where your electronic payments will be paid from. But if you're setting up for direct electronic payments, you'll go through a signup process.

To set up for ABA file payments

Start by entering the banking details for the account your electronic payments will come from. You'll be able to get these details from the account's bank statement or from your bank.

- Go to Accounting > Chart of Accounts.

- Click the account your electronic payments will come from. (This account must be a Bank account type. Learn more about account types.)

- Enter the banking details for the account. If unsure about any of these details, check with your bank.

- Enter your Company trading name. If your trading name is too long, enter as many letters as possible or shorten it.

- Enter your bank account name and number.

- Enter these country-specific details for Australia:

- Select the option I create ABA bank files for this account.

- Type the three-letter Bank code that identifies your bank, for example, NAB, ANZ, CBA or WBC. Check with your bank if unsure.

- Type the Direct entry user ID (sometimes called the APCA ID). This ID is assigned by your bank when you registered with them to process direct credits. Check with your bank if you're unsure about this.

- If your bank file requires a self‑balancing transaction, select the option Include a self-balancing transaction.

- Click Save.

You are now ready to process your electronic payments using bank files. Instructions for this are included in the section for creating a Pay Run in the subtopic: Creating a Pay run.

To set up for direct payments16

Before you begin, you'll need:

- the role of Administrator and the user type of online admin in your MYOB business. This is usually the business owner or administrator.

- your ABN.

- a debit or credit card (the card your electronic payments will be paid from).

- a mobile phone (to authorise electronic payments).

- a government-issued identification (Sole Traders only).

- to be either a Director OR an Ultimate Beneficial Owner (UBO), who is someone who owns 25% or more of the business (Private Australian Companies only). If you are not the owner or director of the business, you will simply need to upload proof of authority—a template of which is available during the sign up process.

- a government-issued identification for all UBOs and at least one Director, including yourself (Private Australian Companies only).

The process:

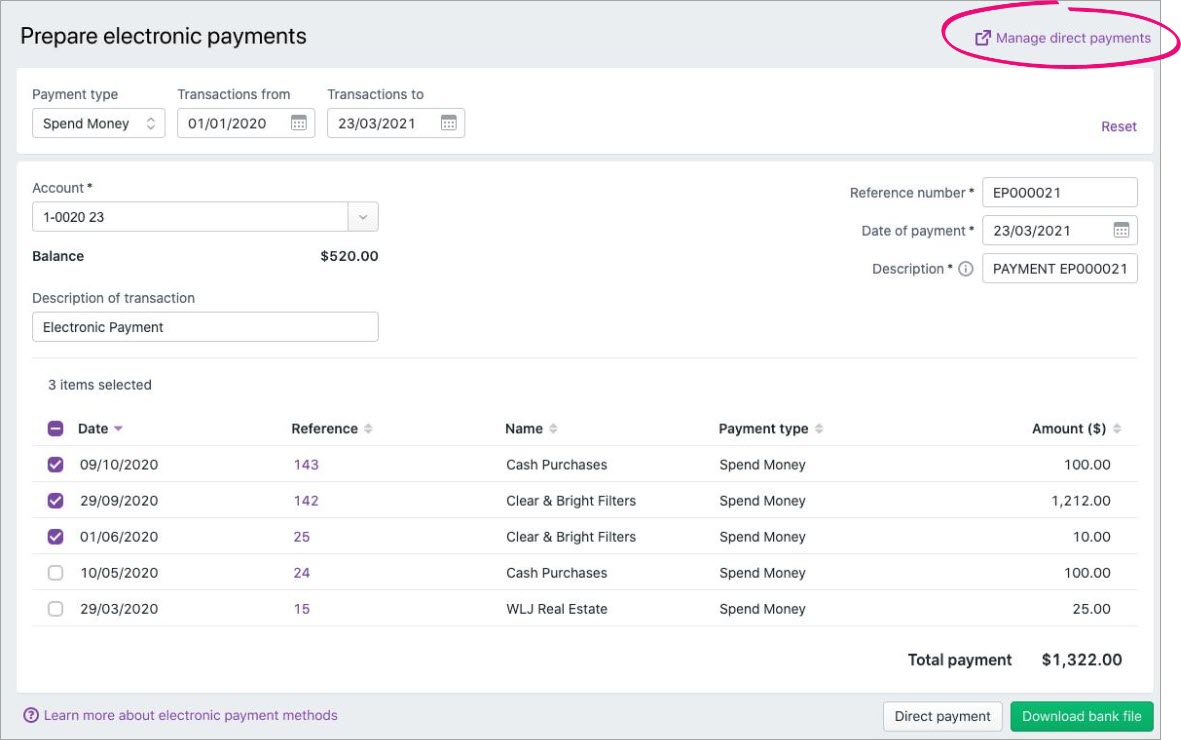

- Go to Banking > Prepare electronic payments.

- Click Manage direct payments. If you don't see this link, your business isn't eligible for direct payments (only Australian businesses registered as Sole Traders and/or Private Companies with the Australian Business Registry are currently eligible).

- If prompted, sign in to your MYOB account.

- Click the business you're setting up for direct payments.

- Follow the onscreen prompts to complete the application.

- When all steps are complete, click Submit application.

They will let you know when your application has been approved. You'll then be able to process direct payments and authorise them.

Take a moment to answer the following questions to check your understanding of the topic.