Accounting is a system. It has inputs, processes, and outputs.

Accounting is a process. Evidence of business transactions is collected, transactions are recorded, information is summarised, then reported, analysed, and stored. This allows business decisions to be made.

The accounting system is sometimes referred to as the ‘accounting cycle’ because it continues from one year to the next.

Source Documents

The word source means origin; it is where something comes from. ‘Source documents’ are things like invoices (bills), receipts, cheque butts, bank statements, etc.

A source document is the first step in recording the evidence of a transaction. It provides details of the business transactions which need to be put into the business accounts. They are the evidence that the transaction has taken place – used for internal control and audit purposes. No transaction should take place unless it is supported by a source document.

A business transaction

A business transaction is an event involving an interchange of goods, money, or services between two or more parties. The transaction can be as brief as a cash purchase or as long-lasting as a service contract extending over the years. The business transacted can be between two parties engaged in business and conducting the transaction for their mutual benefit, or between a business entity, like a retail shop, and a customer. Source: Chron

An account

In accounting, an account is a record in the general ledger that is used to sort and store transactions. For example, companies will have a Cash account in which to record every transaction that increases or decreases the company's cash. Another account, Sales, will collect all of the amounts from the sale of merchandise. Most accounting systems require that every transaction will affect two or more accounts. For example, a cash sale will increase the Cash account and will increase the Sales account. Source: Accounting Coach

Journals are used to record day-to-day accounting transactions. They are sometimes called ‘books of first entry’ because this is where the first accounting record of a transaction is made. All the accounting transactions are entered one after another in date order, therefore, the journal contains a complete history of the transactions as they occur.

Main Type of Journals

| Journal | Used to record: |

|---|---|

| 1. Cash Receipts | Money coming in Cash sales and revenue received from customers |

| 2. Cash Payments | Money going out Paying for expenses and buying inventory |

| 3. Sales | Credit sales Selling things to customers who have not yet paid |

| 4. Purchases | Credit purchases Buying things but not paying for them yet |

| 5. General | Unusual or uncommon transactions E.g. transactions affecting owner’s equity, buying assets, or balance day adjustments |

Cash Receipts Journal

The cash receipts journal is used to record all the cash receipts, both electronic and manual; all the money going into the business bank account.

- Bank is an asset. To increase the value of an asset, we ‘debit’ it.

- Accounts receivable is also an asset, but this time the customers are actually paying the money they owe so the value of the account receivable is going to be less. To decrease an asset; we ‘credit’ it.

- Sales and interest received are both forms of revenue. To increase the value of revenue; we ‘credit’ it.

For example, Shelly’s Shop had the following cash receipts for April 2022:

| April | 1 | Received payment from Mr Brown, $4,500 |

| 5 | Received payment from Ms Grey, $7,250 | |

| 10 | Cash sales, $21,000 | |

| 15 | Received interest from bank, $160 | |

| 22 | Received payment from Mr Green, $12,100 | |

| 25 | Received payment from Ms Black, $2,000 | |

| 28 | Cash sales, $19,030 |

Important

The cash receipts journal is as follows:

As you can see, each transaction is recorded in two places: once as a debit and once as a credit. This is the double entry system, and it is used to keep the equality of the accounting equation.

| Assets | + | Expenses | = Liabilities | + Owner’s Equity | + Revenue |

| 66,040.00 | + | 0 | = 0 | + 0 | + 40,030.00 |

| + 25,850.00 | |||||

| + 160.00 |

The following transactions in the cash receipts journal are as follows:

- July 11 - Received $2,987 from Mr Flanders who paid their account in total

- July 11 - Cash sales of $3,908 were made

- July 12 - Received $6,485 from Mr Skinner in full settlement of his account

- July 12 - Cash sales of $2,906 were made

- July 13 - Cash sales of $3,907 were made

| Date | Details | Bank | Acc. Rec. | Sales |

|---|---|---|---|---|

| 11/07 | Mr Flanders | 2,987 | 2,987 | |

| 11/07 | Sales | 3,908 | 3,908 | |

| 12/07 | Mr Skinner | 6,485 | 6,485 | |

| 12/07 | Sales | 2,906 | 2,906 | |

| 13/07 | Sales | 3,907 | 3,907 | |

| 20,193 | 9,472 | 10,721 |

Cash Payments Journal

The cash payments journal is used to record all payments, both electronic and manual; all the money goes out of the business bank account.

- Bank is an asset. To decrease the value of an asset; we ‘credit’ it.

- Accounts payable is a liability. To decrease liability, we ‘debit’ it.

- Payments for things like stationery and rent are expenses. To increase the value of an expense; we ‘debit’ it.

Example: Shelly’s Shop had the following cash payments for April 2022:

| April | 1 | Bought stationery from Paper Plus, for $69.56 |

| 5 | Paid wages, $1,236 | |

| 10 | Paid outstanding electricity bill, $94.30 | |

| 15 | Paid outstanding telephone bill, $173.50 | |

| 22 | Paid rent, $1,125 | |

| 28 | Paid wages, $1,158 |

Important

The cash payment journal is as follows:

Once again, each transaction is recorded in two places: once as a debit and once as a credit. This is the double entry system, and it is used to keep the equality of the accounting equation.

| Assets | + | Expenses | = Liabilities | + Owner’s Equity | + Revenue |

| -3,856.36 | + | 69.56 | = -267.80 | + 0 | + 0 |

| + | 2,394.00 | ||||

| + | 1,125.00 | ||||

Another example of cash payments is as follows:

- July 1 - Purchased goods for resale, $350

- July 1 - Paid rent, $900

- July 3 - Paid for cleaning, $96

- July 4 - Wages of $765 were paid,

- July 4 - Purchased stationery, $35

- July 5 - Paid creditor, S Brown for legal services $250

- July 5 - Paid creditor, Radio NZ, $1,500 for advertising

It looks like this in a table:

| Date | Detail | Bank | Purchases | Rent | Cleaning | Wages | Stationery | Acc Pay |

|---|---|---|---|---|---|---|---|---|

| 01/07 | Purchases | 350 | 350 | |||||

| 01/07 | Rent | 900 | 900 | |||||

| 03/07 | Cleaning | 96 | 96 | |||||

| 04/07 | Wages | 765 | 765 | |||||

| 04/07 | Stationery | 35 | 35 | |||||

| 05/07 | S Brown | 250 | 250 | |||||

| 05/07 | Radio NZ | 1,500 | 1,500 | |||||

| 3,986cr | 350 dr | 900dr | 96dr | 765dr | 35dr | 1,750dr |

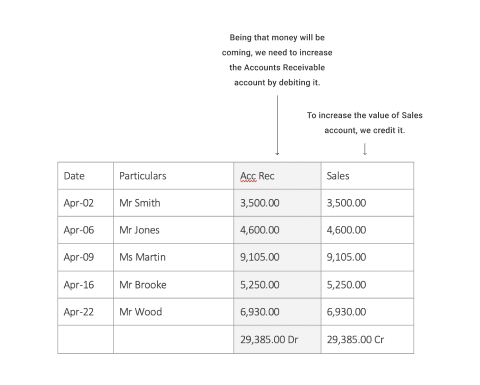

Sales Journal

The sales journal is used to record credit sales such as when a customer buys something but does not pay money yet, i.e. accounts receivable.

- Accounts receivable is an asset. To increase the value of an asset we ‘debit’ it.

- Sales are revenue; the company has earned money. To increase revenue, we ‘credit’ it.

Example: Shelly’s Shop had the following credit sales for April 2022:

| April | 2 | Sold goods on credit to Mr Smith, $3,500 |

| 6 | Sold goods on credit to Mr Jones, $4,600 | |

| 09 | Sold goods on credit to Ms Martin, $9,105 | |

| 16 | Sold goods on credit to Mr Brooke, $5,250 | |

| 22 | Sold goods on credit to Mr Wood, $6,930 |

Important

This is the sales journal in a table:

| Assets | + | Expenses | = Liabilities | + Owner’s Equity | + Revenue |

| 29,385.00 | = | 29,385.00 |

Another example of a sales journal is as follows:

- Jul 01 - Sold goods on credit to Mr Flanders, $2,987

- Jul 02 - Sold goods on credit to Mr Skinner, $6,485

- Jul 04 - Sold goods on credit to Mr Wigham, $2,809

- Jul 08 - Sold goods on credit to Mr Flanders, $2,987

This is the sales journal in a table:

| Date | Details | Acc. Rec. | Sales |

|---|---|---|---|

| 01/07 | Mr Flanders | 2,987 | 2,987 |

| 02/07 | Mr Skinner | 6,485 | 6,485 |

| 04/07 | Mr Wigham | 2,809 | 2,809 |

| 08/07 | Mr Flanders | 2,987 | 2,987 |

| 15,268 dr | 15,268 cr |

Purchases Journal

The purchases journal is used to record credit purchases such as when the company buys goods or services but does not pay money yet, i.e. accounts payable.

- Accounts payable is a liability. To increase the value of liability we ‘credit’ it.

- Purchases mean stock/inventory/supplies are bought for resale; this is an asset.

- To increase an asset, we ‘debit’ it. Items like electricity and telephone are expenses. To increase an expense, we ‘debit’ it.

Example: Shelly’s Shop had the following credit purchases for April 2022:

| April | 14 | Received invoice from Meridian Energy (electricity bill), $98.65 |

| 18 | Received invoice from Telecom (telephone bill), $194.50 | |

| 22 | Bought goods on credit from AB Wholesaler Ltd, $3,654.00 | |

| 26 | Bought goods on credit from Fresh Supplies Ltd, $6,033.00 |

Important

The purchases journal is as follows:

| Assets | + | Expenses | = Liabilities | + Owner’s Equity | + Revenue |

| 9,687.00 | 98.65 | = 9,980.15 | |||

| 194.50 | = | ||||

General Journal

The general journal is used to record all other financial transactions that do not fit into the cash receipts, cash payments, sales, or purchases journals. They are uncommon or unusual transactions, so we need to give more information for each transaction, therefore, the format of the general journal is quite different from the other journals.

The general journal is mainly used to record the following types of transactions:

- Contributions and withdrawals (when the owner puts something in or takes something out of the business).

- Bad debts are written off (when you realise that accounts receivable will never be able to pay you the money they owe you, write this off as an expense; we will study this later).

- Balance day adjustments (we will study this later).

- Sometimes the purchase and sale of assets are recorded here but other journals could also be used, it depends on the individual business’ preference.

Eventually, if the money remains unpaid, it will become classified as “bad debt”. This means the company has reached a point where it considers the money to be permanently unrecoverable and must now account for the loss. Bad debt will be reflected on a company’s income statement (or P&L). Source: Freshbooks

Example: Shelly’s Shop had the following unusual transactions

| April 1 | Shelly contributed a motor vehicle valued at $15,000 to the business |

| 15 | Shelly withdrew $500 from the business |

Important

The opening general journal entries:

As with the other journals, the debits must be equal to the credits.

| Assets | + | Expenses | = Liabilities | + Owner’s Equity | + Revenue |

| 15,000 | = | + 15,000 | |||

| - 500 | = | - 500 | |||

| 14,500 14,500 | |||||

Another example of a general journal is as follows:

- 01 July - Apu contributed a delivery van worth $10,000 to the business

- 02 July Apu took drawings of $500 from the business (As per above on 01 July).

It looks like this in a table:

| Date | Detaiils | Debit | Credit |

|---|---|---|---|

| 01/07 | Van | 10,000 | |

| Capital | 10,000 | ||

| To record the owner contributing van to the business | |||

| 02/07 | Drawings | 500 | |

| Bank | 500 | ||

| To record the owner withdrawing cash from the business |

Complete this interactive activity below to check your knowledge about journals.

Learning Activity: Accounting Recap

Download the following Word document here and in part one of the activity answer the multiple-choice questions. Highlight the answer in red your choice for each question. In the second part of the document, put the correct journal against each of the 17 transactions.

Upload your completed document to the Forum, Accounting Recap.

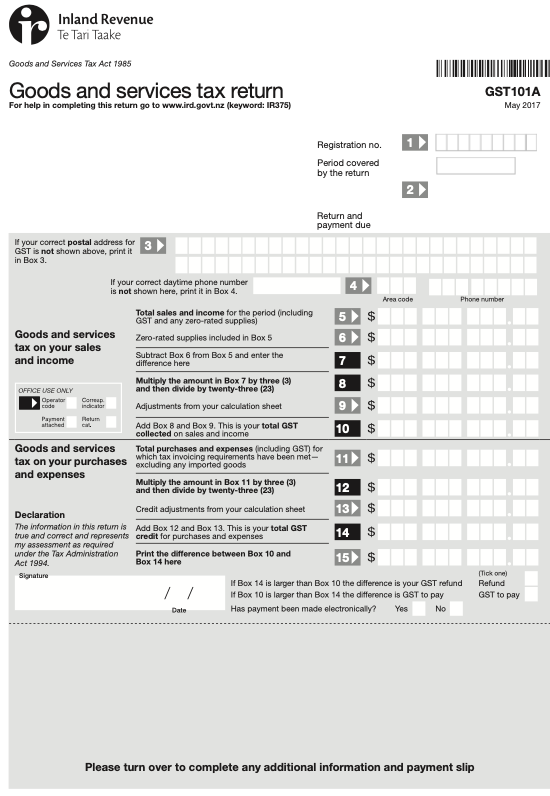

GST is a tax on goods and services. In New Zealand, the GST rate is 15%. GST is a tax on consumption. This is different from income tax which is a tax on profit.

Statutory Requirement

Under the Goods and Services Tax Act 1985, all businesses must register for GST if their turnover:

- for the last 12 months was $60,000 or more, or for the next 12 months is expected to be $60,000 or more.

- was less than $60,000, but they include GST in their prices, for example taxi drivers who have included 15% in their taxi fares.

This image explains how it works:

Calculating GST

Remember that GST is not a cost to a business because any GST that a business pays to get back from the IRD, and all GST that a business receives is paid to the IRD.

The amount of GST that needs to be calculated depends on the type of product or service being bought or sold.

Different categories need to be remembered when calculating GST:

- Standard supplies

- Zero-rates supplies

- Exempt supplies

- Hire purchases

- Standard supplies.

Remember

There are also two terms that you need to become familiar with when calculating GST. If you receive payslips for work completed, then you should be aware of these.

GROSS - means the total or whole of something.

NET - means what remains from the whole after certain deductions are made. Source: CFI

Standard Supplies

“Supplies” is a general term for the goods and services that businesses sell or provide. Most of these supplies are taxable at 15%. Once the business decides on its selling prices, it must add 15% for GST. This is not profit - it will be collected and passed on to IRD.

GST-inclusive price

A GST-inclusive price is when GST is already included in the price.

Important

When you have the GST-inclusive price cost and want to know how much of it is made up of GST.

Formula:

GST inclusive price x 3 / 23

i.e. multiply by 3 and divide by 23 = GST amount.

For example:

- A meal in a restaurant costs $120.51

- It is assumed this price includes GST

- How much is the GST? $120.51 x 3 / 23 = 15.72

- The GST is $15.72, and the meal is $104.79

- Check: $104.79 + $15.72 = $120.51.

GST-exclusive price

GST-exclusive is when the price of a good or service does not already include GST.

You have to pay the GST on top of the price you see (extra charge).

Important

When you have the NET cost and want to know how much GST you should add to get the total cost.

Formula:

NET COST multiplied by 15% = GST.

For example:

- A computer costs $3,500, excluding GST

- How much is the GST amount? $3,500 x 15% = 525.00

- The GST is $525.00, so the total cost of the computer including GST is $3,500 + $525.00 = $4025.00.

There are online GST calculators to help individuals and businesses. (GST exclusive and inclusive calculators.) In addition, there is a factsheet written by the IRD, should students require more information about GST.

Learning Activity: Calculate the GST

Calculate the GST amount for the following and show your calculations in the table supplied in this Word document. Download it here.

(Table 1 is to demonstrate your understanding of calculating the GST amount, and Table 2 is to calculate the GST amount to add).

Post your responses in both tables in the Forum, Calculate the GST.

Table 1

| GST Inclusive | GST Calculation (Required in full) | GST Amount |

|---|---|---|

| $90 | ||

| $960 | ||

| $1,600 | ||

| $2,000 | ||

| $27,000 | ||

| $120,000 |

Table 2

| GST Exclusive | GST Calculation (Required in full) | GST Amount to add |

|---|---|---|

| $240 | ||

| $800 | ||

| $1,600 | ||

| $2,000 | ||

| $18,000 | ||

| $22,500 |

No GST charged

There are certain goods and services that GST is not charged on; these are either zero-rated or exempt from GST.

Zero-Rated Supplies

Zero-rated means that GST is charged at 0%. There are two main examples of zero-rated supplies:

- the sale of a business as a going concern (or land)

- exported goods.

For example: Errol Plane lives in Napier. He visits a local travel agent and buys a single air ticket for flights from Napier to Auckland and then on to Perth. GST is charged at 0% on both flights as the travel is considered to be a contract for international carriage.

Exempt Supplies

Exempt supplies are excused from GST; no GST is calculated at all. Some examples of exempt supplies are:

- certain financial services such as bank charges, credit card charges

- wages (includes drawings)

- rent for a private home (domestic rental)

- donated goods supplied by a non-profit organisation.

For example: A car dealer donates a car to a church. The church uses the car for two years and then sells it. The sale of the car is exempt from GST.

Hire Purchases

Hire purchase is a finance option whereby a business can hire a product, such as a computer, by making payments at regular intervals for a specific time usually paying an additional administration fee; once that time is up the business then owns the computer. A business must account for all hire purchase sales in the taxable period covering the date it agreed, regardless of the accounting basis it uses.

For example: Walter Wall sells a carpet on hire purchase to Homer Ohner on 7 June. The cash price is $550, which includes GST. The agreement is for 36 monthly payments of $23, totalling $828

- 36 months x $23 per month = $828

- $828 - $550 = $278 = finance charge.

Walter accounts for the sale on the cash price of the goods ($550) in the period covering 7 June. Homer also claims for his purchase on the cash price of the goods ($550) in the period covering 7 June. The difference of $278 is the finance charge, which is an exempt supply.

Check Your Knowledge

Accounting to IRD for GST

There are two main options used by businesses to pay GST to IRD:

- Payments Basis

You need to account for GST in the taxable period in which you make or receive payment. The payment basis is different from the invoice basis as you don't account for debtors and creditors at the end of each taxable period.- Advantages

- The payment basis is suitable for a small business, especially if it currently uses the cash system – cash books can easily be used to account for GST.

- You usually only account for GST when payment is received from the customer – this is to your benefit if you give a lengthy period of credit to customers.

- Disadvantage: You may only claim GST on purchases and expenses after making payment to the supplier.

- Advantages

- Invoice Basis

You claim GST when you receive or issue an invoice or receive and make a payment, whichever comes first. The invoice basis is similar to the accrual basis of accounting in that adjustments are made at the end of the taxable period for creditors and debtors.- Advantage:

- you may claim GST on purchases and expenses before making payment to the supplier, except for second-hand goods.

- Disadvantages

- You may have to account for GST before receiving payment.

- You need to keep a list of debtors and creditors at the end of the tax period to account for items for which you've received or issued an invoice but don't appear in your cashbook.

- Advantage:

GST Return

The GST paid and collected by a business is recorded on a form called a GST Return. All businesses must complete returns on a regular basis and pay the GST owed to IRD. It may be that the business has paid more GST than it collected, if this is the case it will complete the GST return as usual but will instead receive a refund from IRD.

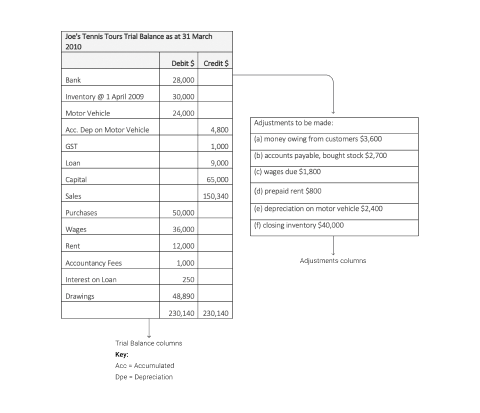

Trial Balance

A trial balance is a summary of all of the accounts as of a particular date. The process of balancing the accounts is an important step in the preparation of financial statements. The trial balance can also be prepared at any time to check if any errors have been made when recording the transactions; this is one way to ensure the accuracy of accounting statements.

- Debit balances are put on the left, and credit balances are on the right.

- Based on the accounting equation, if no mistakes have been made in the journals and ledgers the totals of the debit balances should equal the totals of the credit balances.

- If they don’t match, you must find the mistake and correct it.

Adjustments

Once a trial balance has been prepared some adjustments need to be made before financial statements can be prepared. Adjustments are recorded in the general journal; the general ledger is then adjusted, and an adjusted trial balance is prepared.

Adjustments are necessary to ensure proper matching of costs (expenses) with revenue; and to ensure there will be a correct calculation of net profit within a specific period. The correct calculation of net profit is important for decision-making; therefore, the measurement of net profit has to be done following the accounting concepts. All of the business transactions that occur in a particular accounting period need to be recognised, whether cash has been received or paid or not. If adjustments were not made there would not be a true and fair picture of the financial performance of the business. The elements of the accounting equation might be overstated or understated.

Adjustments we will study:

Depreciation

Depreciation is the method of accounting used to allocate the cost of a fixed asset over its useful life and is used to account for declines in value. It helps companies avoid major losses in the year they purchase the fixed assets by spreading the cost over several years.Freshbooks

A fixed asset is used by the business to generate future revenue. Its value therefore decreases over time, as its revenue-generating power diminishes. Remember, depreciation is a word used to describe the process of spreading the cost of an asset over its useful life to the firm. The cost of the asset is spread over the accounting periods in which it helps to produce income. The depreciation expense is an attempt to match this decline in value of an asset against the revenue earned during the period of its useful life (i.e. over time). Depreciation is an expense incurred in earning revenue.

Possible reasons for depreciation:

- The expiry of a lease

- Change in technology

- General wear and tear

- Changes in market values.

There are different ways to calculate depreciation but for our studies, we do not need to learn them. We will just focus on how to record this depreciation in the accounting system.

For example

- Mike’s Bike Shop has an asset, a van

- It cost $30,000 when Mike first bought it

- Is it still worth $30,000?

- No, once the van has been used it begins to lose its value

- A new asset account called Accumulated Depreciation needs to be created along with a new expense account called Depreciation

- Debit – Depreciation account (expense)

- Credit – Accumulated Depreciation account (asset).

In the above example, if the depreciation for the machinery was $4,000, (this is how much the machinery has depreciated this period, it is not the cost of the machinery), it would be recorded as:

| Date | Account | Debit $ | Credit $ |

|---|---|---|---|

| 31/03 | Depreciation machinery | 4,000 | |

| Accumulated Depreciation | 4,000 | ||

| To record depreciation on machinery |

Prepaid Expenses (Prepayments)

These are expenses that have been paid for in the current accounting period but have not been used yet. They will provide benefits in the next accounting period. Something you pay for in advance, you haven’t used it yet. (It reduces the expense for this accounting year and moves it to next year.)

Example of a Prepaid Expense

- Mike owns a bike shop. On 1 January, he pays the annual insurance of $1,200 for the year Jan-Dec. He recorded this transaction as follows:

- debit – insurance – $1,200 credit – bank – $1,200.

- However, his balance date is 31 March. How much insurance has he used?

- $1,200 for one year (12 months), therefore, insurance costs $100 per month.

- If the balance date is March then ¼ belongs to this year (Jan, Feb, Mar is 3 months). This is $100 x 3 months = $300. Mike has only used $300 worth of insurance.

- How much is available for use in the next accounting period?

- $1,200 - $300 = $900. Mike still has $900 worth of insurance left to use in the next financial period.

- The $900 is a prepayment, which needs to be recorded in a new asset account called Prepaid Insurance. The original entry in the Insurance Expense account needs to be adjusted; the balance needs to be decreased.

- Debit – Prepaid Insurance account (asset)

- Credit – Insurance account (expense).

Important: Shown over 12 months

Here is another example for you: $1,200 was paid for four months of insurance. Only one month has been used. The amount used is calculated as $1,200 / 4 = $300. Therefore, the prepayment is $1,200 - $900.

Calculation: $1200 / 4 months = $300. One month has been used = $300. So, $1200 - $300 = $900 (this is the cost for the remaining three months).

The prepayment would be recorded as:

| Date | Account | Debit $ | Credit $ |

|---|---|---|---|

| 31/03 | Prepaid insurance | 900 | |

| Insurance | 900 | ||

| To record prepaid insurance |

Accrued Expenses or Accounts Payable

This is where the business incurs expenses during the accounting period but has not paid them at the balance date; a liability.

Examples of an Account Payable (or accrued expense):

- On 31 March, balance day, Mike’s Bike Shop wants to record that it has used up one month’s worth of telephone expenses. Mike has received the invoice for $90 but hasn’t paid it yet. This is just like a normal account payable record.

- Debit – Telephone (expense) Revenues Decrease

- Credit – Account Payable (liability) Liabilities Increase.

- On 31 March, balance day, Mike’s Bike Shop wants to record that it has used up one month’s worth of electricity expenses. Mike hasn’t received the electricity bill yet but estimates it to be $120.

- Debit – Electricity account (expense)

- Credit – Account Payable/(or Accrued Electricity) (liability).

To record accrued electricity expense - but not yet paid, the same applies to accrued revenues - to record accrued revenue.

In the above example, the electricity expense would be recorded as:

| Date | Account | Debit $ | Credit $ |

|---|---|---|---|

| 31/03 | Electricity | 120 | |

| Accrued electricity | 120 | ||

| To record accrued electricity expense |

Accrued Revenues

At the end of the year, there may be revenue earned by the business that has not yet been received by the balance date. This may happen because an invoice hasn’t been prepared yet or a payment hasn’t been received. Accrued revenue is an account receivable; an asset.

Example of Accrued Revenue:

- A customer buys a new bike worth $2,000 from Mike’s Bikes Shop

- She does not pay for the bike on the day but promises she will pay next month

- Mike’s Bikes made a credit sale, and earned the revenue but has not received the money yet

- A new account called Accrued Revenue needs to be created

- Debit – Accrued Revenue account (asset)

- Credit – Revenue (revenue).

In the above example, the sale would be recorded as:

| Date | Account | Debit $ | Credit $ |

|---|---|---|---|

| 31/03 | Accrued revenue | 2,000 | |

| Revenue | 2,000 | ||

| To record accrued revenue |

Unearned Revenue

Also called Revenue Received in Advance.

Example of Unearned Revenue:

- A customer orders a new bike worth $1,500 from Mike’s Bike Shop. He pays Mike for the bike, but it will not be delivered until next month. Mike’s Bike has received some money that he has not earned yet.

- A new account called Unearned Revenue needs to be created

- Debit –Revenue (negative income)

- Credit – Unearned Revenue (liability).

In the above example, the sale would be recorded as:

| Date | Account | Debit $ | Credit $ |

|---|---|---|---|

| 31/03 | Revenue | 1,500 | |

| Unearned revenue | 1,500 | ||

| To record revenue received but not earned |

Bad Debts

As we already know, many businesses will make credit sales whereby they allow customers to “buy now, pay later”. These customers are then known as accounts receivable or debtors. Unfortunately, there are times when some customers do not settle their accounts, i.e. do not pay the money that they owe. The business will do what it can to try to collect the money. It can send reminder letters to customers, call them, use a debt collection agency, or even take legal action.

If the business cannot recover the money, then it loses out on this money; it will never recover it. The specific customer (the debtor) is identified, the amount involved is certain and the debt is not collectible. The debt is written off as an expense:

Important

- Debit – Bad Debt account (expense)

- Credit – Accounts Receivable account (reduce asset).

A bad debt of $4,000 would be recorded as:

| Date | Account | Debit $ | Credit $ |

|---|---|---|---|

| 31/03 | Bad debts | 4,000 | |

| Accounts Receivable | 4,000 | ||

| To record bad debts incurred |

Doubtful Debts

In addition to bad debts, some businesses also make allowances for doubtful debts. This means the business will estimate debts that will not be recoverable at the end of each accounting period. This estimate is known as an allowance for doubtful debts. But why is it classed as doubtful debt? A company does not think the current assets will be paid. “An allowance for doubtful accounts is a technique used by a business to show the total amount from the goods or products it has sold that it does not expect to receive payments for.”

Important

Eventually, if the money remains unpaid, it will become classified as “bad debt”. This means the company has reached a point where it considers the money to be permanently unrecoverable and must now account for the loss. Bad debt will be reflected on a company’s income statement (P&L). Source: Freshbooks

In this situation, the specific customer (debtor) is not identified, and the amount involved is estimated, rather than certain.

- The estimation can be made as a percentage of accounts receivable.

- Alternatively, the business can look at individual debtors and make their estimates based on individual debts which they expect to be unrecoverable.

- A combination of both methods can be used; each business has its way of estimating doubtful debts.

By allowing for doubtful debts the business gets a truer picture of its financial position and performance. In comparison to bad debts, this time the Accounts Receivable account is not credited as the business does not know which customer is involved. Instead, the business must:

- Debit – Doubtful Debts account (increased expense)

- Credit – Allowance for Doubtful Debts account (reduce asset).

The figures are estimated throughout the year so at the end of the year, at the balance date, an adjustment may need to be made to this estimate.

For example: Accounts Receivable is $12,000 and allowance is to be 2%, i.e. $240

- Suppose an allowance of $200 has already been made in the financials but this is too low; an adjustment of $40 needs to be made ($240 - $200)

- Debit – Doubtful Debts $40

- Credit – Allowance for Doubtful Debts $40.

- Suppose an allowance of $300 has already been made in the trial balance but this is too high; an adjustment of $60 ($300 - $240) needs to be made

- Debit – Allowance for Doubtful Debts $60

- Credit – Doubtful Debts $60.

- Note: GST is not affected by any doubtful debt adjustments.

For example, the allowance for doubtful debts was $500. It is now estimated to be $662 in total. This increase would be recorded as:

| Date | Account | Debit $ | Credit $ |

|---|---|---|---|

| 31/03 | Doubtful debts | 162 | |

| Allowance for doubtful debts | 162 | ||

| To record adjustments to doubtful debts |

Inventory Stock

At the end of each accounting period, a physical stock take should be completed. This means physically counting and valuing the stock which is left over i.e. has not been sold during the accounting period.

Dealing with the inventory at the balance date does not require an actual “adjustment” as we have done previously. However, it is important to know how much inventory was on hand at the start of the year and the end of the year so that the business can calculate how much inventory was sold during the year. These figures will be used in the statement of financial performance later.

Important

The stock is also an asset that the business owns at the balance date.

- Debit – Stock in the Balance Sheet (asset)

- Credit – Closing stock in the Profit and Loss Account (reduce expenses).

Adjusted Trial Balance

Once all of the adjustments have been made, an adjusted trial balance needs to be prepared. This is simply the original trial balance plus the adjustments, so there will be some new final balances. It is presented in a document called a ‘worksheet’. It is from the adjusted trial balance that the financial statements are prepared.

When adding the trial balance to the adjustments, ensure you take note of whether they are debit or credit entries as this will affect the final answers in terms of whether you add or take away the numbers. You add the same entries together and minus the different ones. Look at the examples below:

- Debit + debit = debit

- Large debit – credit = larger debit

- Large credit – debit = larger credit

- Credit + credit = credit

- Credit & debit where numbers are the same (they cancel each other out or equal 0).

Important

A ‘balance day adjustments worked’ example is:

Click here to download the following table in a Word document.

| Joe's Tennis Tours Adjusted Trial Balance as at 31 March 2010 | ||||||

|---|---|---|---|---|---|---|

| Trial Balance | Adjustments | Adjusted Trial Balance | ||||

| Debit $ | Credit $ | Debit $ | Credit $ | Debit $ | Credit $ | |

| Bank | 28,000 | 28,000 | ||||

| Inventory @ 1 April 2009 | 30,000 | 30,000 | ||||

| Motor Vehicle | 24,000 | 24,000 | ||||

| Acc Dep on Motor Vehicle | 4,800 | (e) 2,400 | 7,200 | |||

| GST | 1,000 | 1,000 | ||||

| Loan | 9,000 | 9,000 | ||||

| Capital | 65,000 | 65,000 | ||||

| Sales | 150,340 | (a) 3,600 | 153,940 | |||

| Purchases | 50,000 | (b) 2,700 | 52,700 | |||

| Wages | 36,000 | (c) 1,800 | 37,800 | |||

| Rent | 12,000 | (d) 800 | 11,200 | |||

| Accountancy Fees | 1,000 | 1,000 | ||||

| Interest on Loan | 250 | 250 | ||||

| Drawings | 48,890 | 48,890 | ||||

| Accounts Receivable | (a) 3,600 | 3,600 | ||||

| Accounts Payable | (b) 2,700 | 2,700 | ||||

| Accrued Expenses | (c) 1,800 | 1,800 | ||||

| Prepayments | (d) 800 | 800 | ||||

| Depreciation - Motor Vehicle | (e) 2,400 | 2,400 | ||||

| Inventory @ 31 March 2010 | (f) 40,000 | (f) 40,000 | 40,000 | 40,000 | ||

| 230,140 | 230,140 | 51,300 | 51,300 | 280,640 | 280,640 | |

Key: Acc. Dep – Accumulated Depreciation

Note that closing inventory is not an adjustment as such, i.e. for simplicity no figure in the original balance sheet is actually adjusted. Nonetheless, the closing value of closing inventory needs to be recorded (one for the Profit and Loss Account and one for the Balance Sheet).

Closing Journal Entries

At the end of the financial year, all income and expense ledger accounts are closed off so that they all have zero balances, and the accounts are ready to be used in the next financial year. Under the double-entry system a new ledger account called the trading, or the profit and loss account is created to record the income and expense closing balances. The balance of this account is then transferred to the capital account; drawings would also be closed off at this stage. When each account is closed an entry is also made in the general journal.

Note: the asset and liability accounts are not closed off as there is no need.

Complete the following multi-choice quiz to ensure you have understood this topic before moving on to the next.