The third step in the accounting cycle is posting transactions to the general ledger.

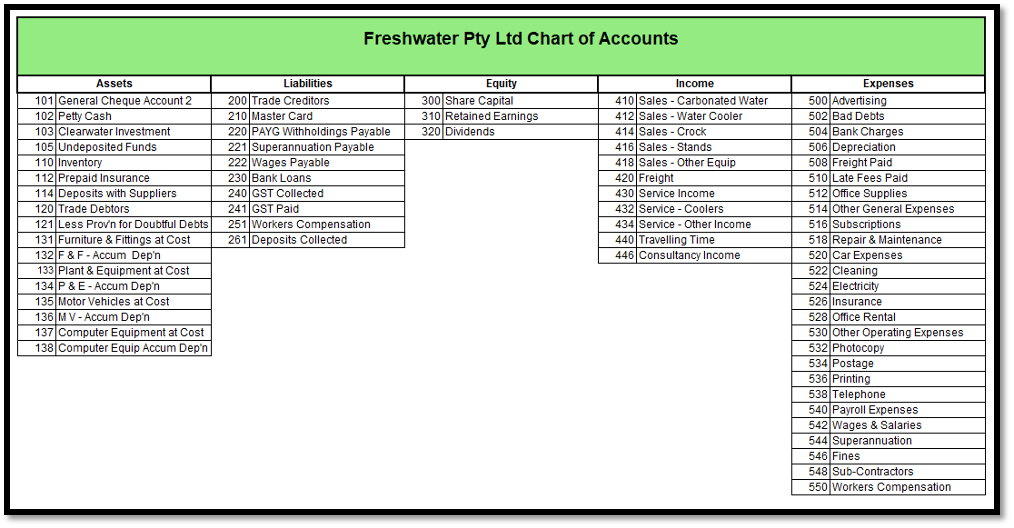

A chart of accounts (COA) is a list of the financial accounts for a business. It is used by bookkeepers to record transactions in the business's general ledger. See below for an explanation of the general ledger.

Accounts are grouped into:

- assets

- liabilities

- equity

- revenue

- expenses.

The number and type of accounts in the chart of accounts are different for every business. For example, the number of accounts will depend on the business's size, type, and complexity of the reporting requirements of the owners or management.

When creating a chart of accounts, it should be flexible enough for the business to allow the business to grow.

Example Chart of Accounts

The General Ledger

The general ledger is a record of all the financial transactions of a business for a given financial period, recorded in general ledger accounts.

General ledger accounts are accounts that record all the financial transactions of a business, presenting detailed information about each financial transaction, such as the date, the description of the transaction, and the amount involved.

A general ledger comprises five different types of accounts:

- assets - e.g. cash, accounts receivable, property, inventory, and investments

- liabilities - e.g. accounts payable, loans, and customer deposits

- owners’ (shareholders’) equity - e.g. shares, capital and retained earnings

- income (revenue) - e.g. sales of goods and/or services rendered

- expenses - e.g. salaries, rent, maintenance of equipment, depreciation, and advertising.

General ledger accounts are arranged with the balance sheet accounts (assets, liabilities, and owner’s equity) appearing first, followed by the income statement accounts (revenue and expenses).

All the general ledger accounts with their closing balances are listed in a trial balance, validating the general ledger’s accuracy and confirming that all the debit balances equal the credit balances.

The process of transferring a transaction from a journal to the ledger is called posting.

The following video explains the process of posting transactions to the ledger accounts.

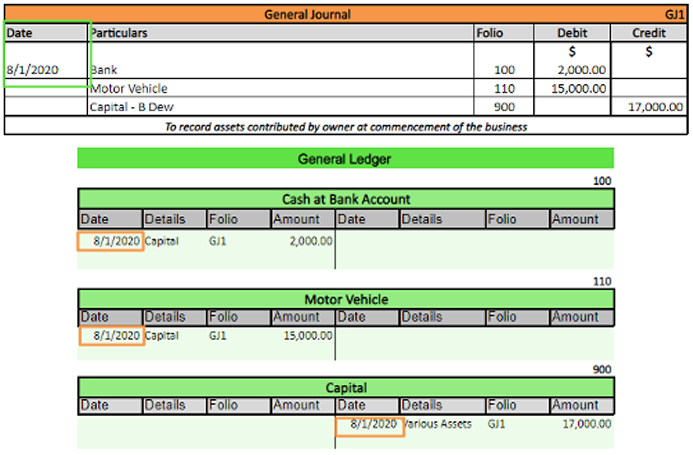

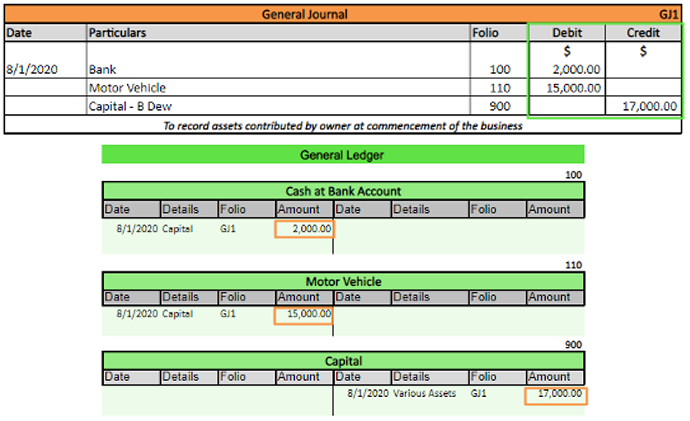

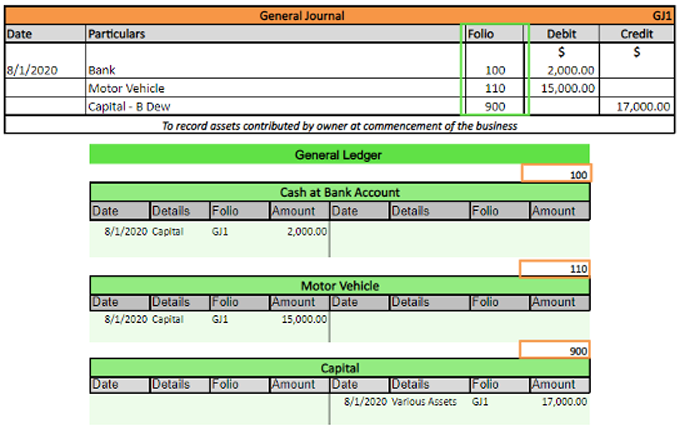

The general journal is the easiest journal to post to the general ledger because the journal tells you which ledgers to post to and the debit and credit amounts.

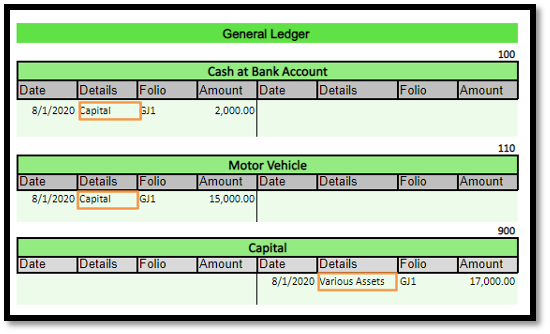

A ledger account is created for each account listed in the chart of accounts. General journal entries are posted directly to the ledger accounts affected.

The date of entry in the general journal is the same date used in the ledger account.

The amount debited in the general journal is posted as a debit in the ledger account. The amount credited in the general journal is posted as a credit in the ledger account. The total debit entries are equal to the total credit entries.

The information in the details column of the ledger account is cross-referenced to the other account/s affected by the transaction. A cross-reference to the general ledger is useful as it provides additional information on each amount recorded.

The folio column in the general journal is used to track the ledger account the transaction has been posted to and vice versa.

A practice question has been included in the learning checkpoint at the end of this topic to test your understanding of posting from the general journal.

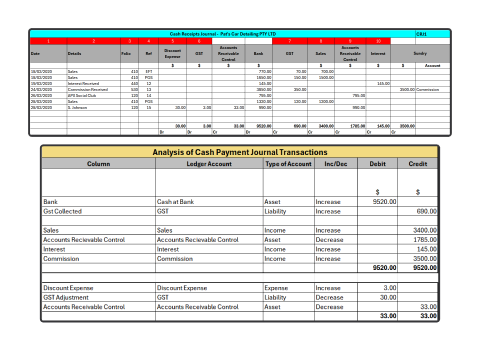

The cash receipts journal records all cash, cheque and EFT amounts received. Amounts received can be from sales, interest received, debtors or commission received.

When posting from special journals (cash receipts, cash payments, sales, sales returns, purchases and purchases returns), the heading of each column is usually the name of the ledger that you post the account to, and the column total is usually the amount posted.

Discount allowed represents a discount the business offers to their customers for prompt payment. A discount reduces the amount of the sale, which also results in a reduction in the GST the business receives from its customers and, in turn, has to pay to the ATO.

To help you identify which general ledger account you need to post transactions to, analyse the transactions in a table before you post them. By doing this, you can ensure the debits will equal the credit and the accounting equation stays in balance.

Once you have identified which accounts need to be debited and which accounts need to be credited, you post the transactions to the general ledger accounts. The posting to the general ledger is illustrated below.

The last date in the cash receipts journal is used when posting to the general ledger.

The sundry account column in the cash receipts journal is used to record the ledger account to which sundry items are posted. In the example above, this is the commission ledger account.

The folio in the general ledger is used to cross-reference the journal (CRJ1).

A practice question has been included in the learning checkpoint at the end of this topic to test your understanding of posting from the cash receipts journal.

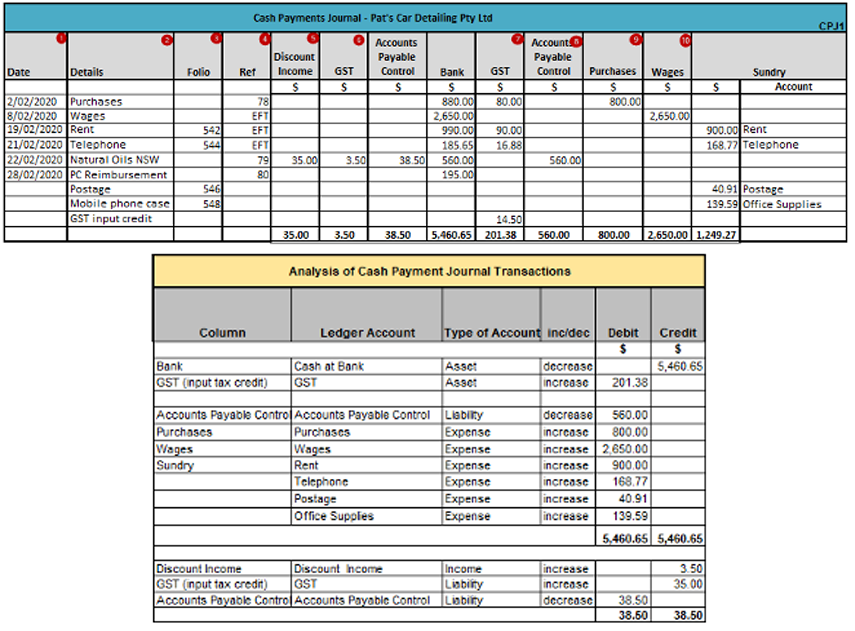

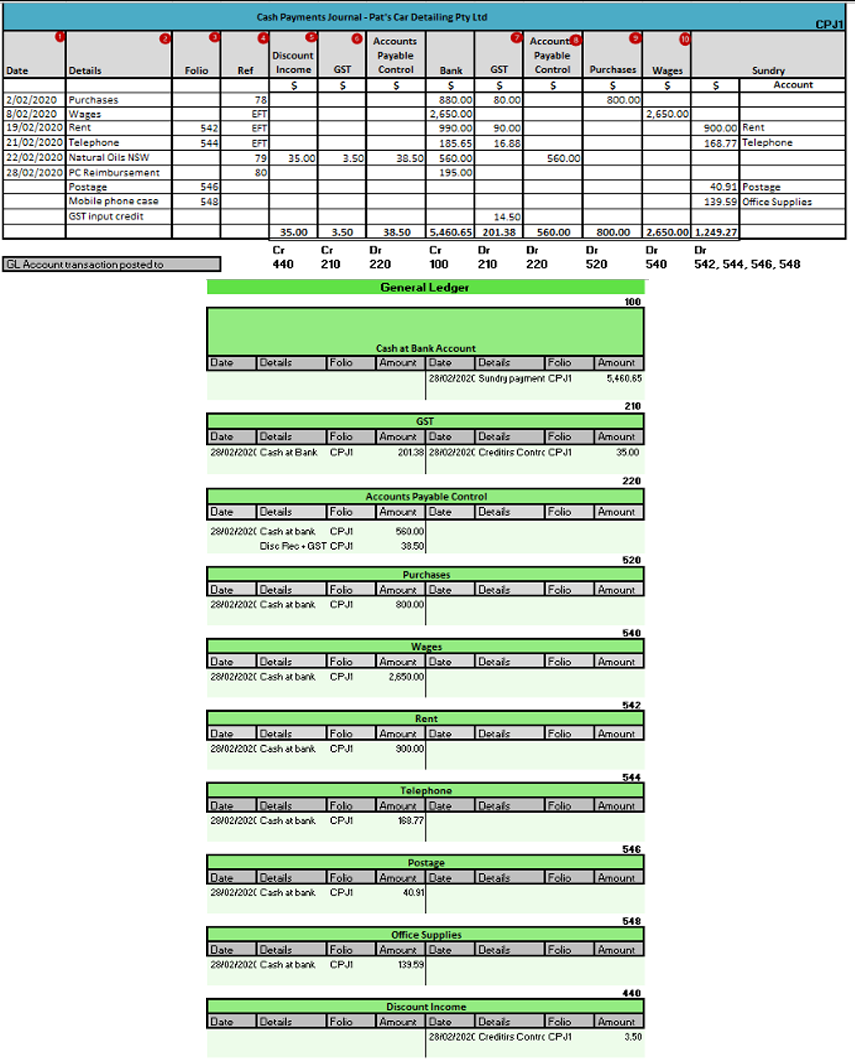

The cash payments journal records all payments. These include payments for wages and salaries, as well as suppliers and expenses.

When posting from special journals (cash payments, cash receipts, sales, sales returns, purchases and purchases returns), the heading of each column is usually the name of the ledger that you post the account to, and the column total is usually the amount posted.

Discount received represents a discount the business receives from its suppliers for prompt payment. A discount reduces the amount of the sale, which also results in a reduction in the GST the business must pay the supplier.

To help you identify which general ledger account you need to post transactions to analyse the transactions in a table before you post them. By doing this, you can ensure the debits will equal the credit and the accounting equation stays in balance.

Once you have identified which accounts need to be debited and which accounts need to be credited, you post the transactions to the general ledger accounts. The posting to the general ledger is illustrated below.

The last date shown in the cash payments journal is used when posting to the ledger.

The transactions in the sundry column are posted separately to the individual ledger accounts.

The journal ref in the ledger is used to cross-reference the journal (CPJ1). Petty cash transactions are posted in the same way as other payments in the cash payments journal. We will examine the petty cash in more detail in the next topic.

A practice question has been included in the learning checkpoint at the end of this topic to test your understanding of posting from the cash payments journal.

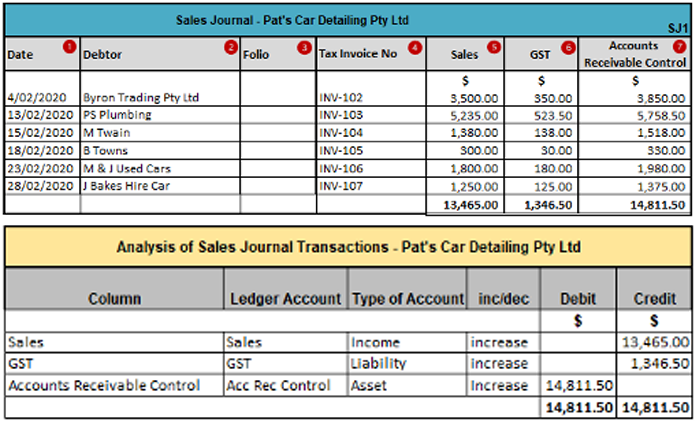

Sales Journal

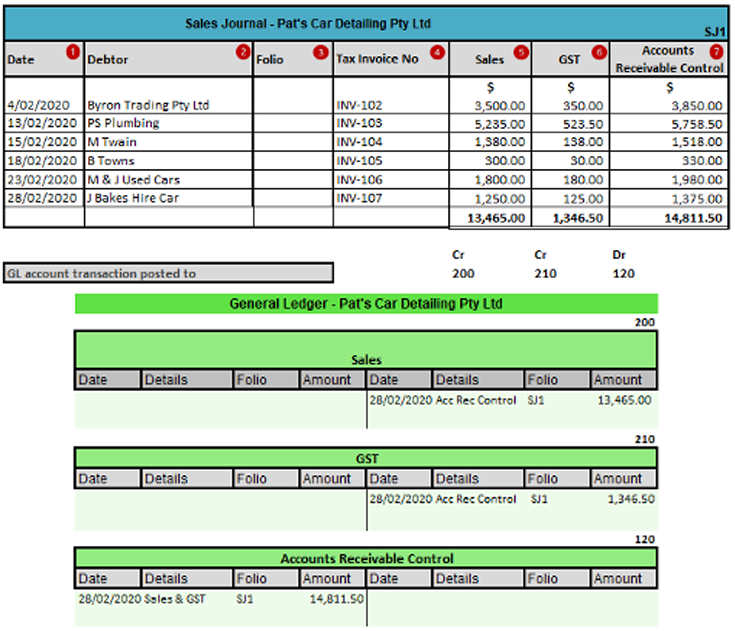

Posting from the Sales Journal

When posting from special journals (sales, sales returns, cash receipts, cash payments, purchases and purchases returns), the heading of each column is usually the name of the ledger that you post the account to, and the column total is usually the amount posted.

To help you identify which general ledger account you need to post transactions to, analyse the transactions in a table before you post them. By doing this, you can ensure the debits will equal the credit and the accounting equation stays in balance.

- Instead of having individual ledger accounts for each individual debtor in the general ledger, we post to the accounts receivable control account in the general ledger.

- The posting date is the last day of the period.

- The information in the Details column of the ledger account is cross-referenced to the other ledger account/s affected by the transaction.

- The Folio column is used to track the sales journal account from which the transaction was posted.

- The total of the Sales column is posted to the sales ledger.

- The total GST column is posted to the GST ledger.

- The total of the Accounts Receivable Control column is posted to the Accounts Receivable Control account in the general ledger.

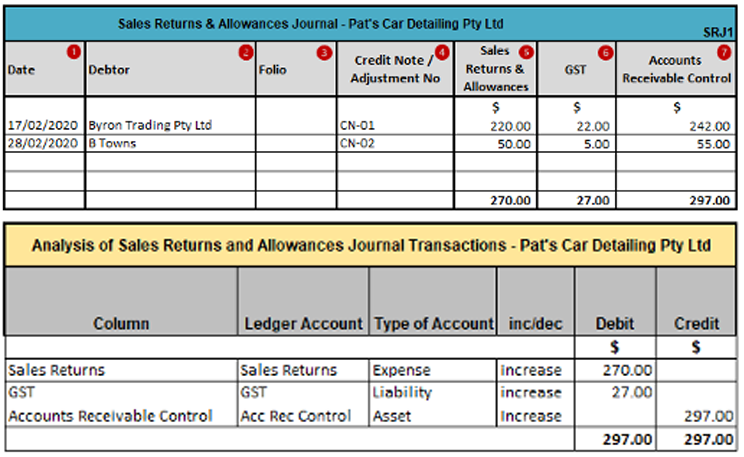

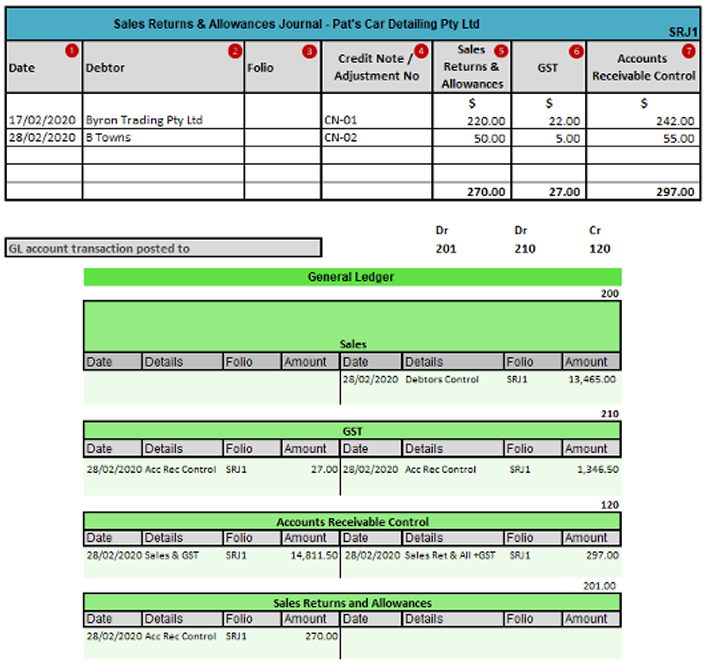

Posting from the Sales Returns and Allowances Journal

When posting from special journals (sales, sales returns, cash receipts, cash payments, purchases and purchases returns), the heading of each column is usually the name of the ledger that you post the account to, and the column total is usually the amount posted.

To help you identify which general ledger account you need to post transactions to, analyse the transactions in a table before you post them. By doing this, you can ensure the debits will equal the credit and the accounting equation stays in balance.

- Instead of having individual ledger accounts for each individual debtor in the general ledger, we post to the accounts receivable control account in the general ledger.

- The posting date is the last day of the period.

- The information in the Details column of the ledger account is cross-referenced to the other ledger account/s affected by the transaction.

- The Folio column is used to track the sales returns and allowances in the journal account from which the transaction was posted.

- The total of the Sales Returns and Allowances column is posted in the Sales Returns and Allowances ledger.

- The total GST column is posted to the GST ledger.

- The total of the Accounts Receivable Control column is posted to the Accounts Receivable Control account in the general ledger.

A practice question has been included in the learning checkpoint at the end of this topic to test your understanding of posting from the sales and sales returns and allowances journal.

The purchases journal records all credit purchases of goods or services. The purchases return journal records credit received from suppliers for goods returned or other allowances for overcharges.

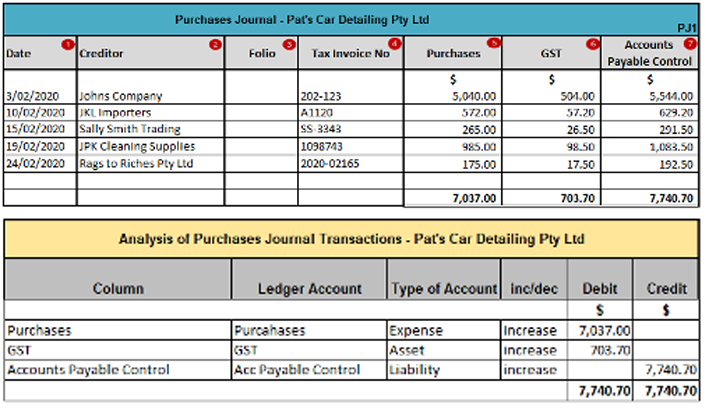

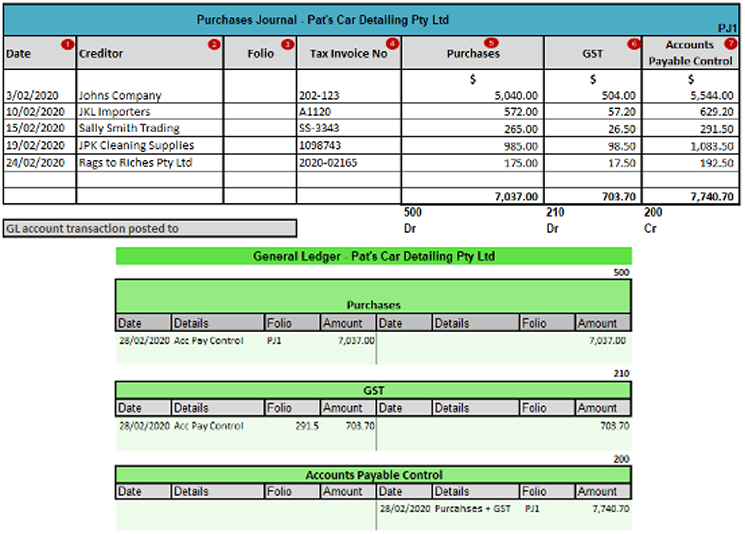

Posting from the Purchases Journal

When posting from special journals (sales, sales returns, cash receipts, cash payments, purchases and purchases returns), the heading of each column is usually the name of the ledger that you post the account to, and the column total is usually the amount posted.

To help you identify which general ledger account you need to post transactions to, analyse the transactions in a table before you post them. By doing this, you can ensure the debits will equal the credit and the accounting equation stays in balance.

- Instead of having individual ledger accounts for each individual creditor in the general ledger, we post to the accounts payable control account in the general ledger.

- The posting date is the last day of the period.

- The information in the Details column of the ledger account is cross-referenced to the other ledger account/s affected by the transaction.

- The Folio column is used to track the purchases journal account the transaction was posted from.

- The total of the Purchases column is posted to the purchase’s ledger.

- The total GST column is posted to the GST ledger.

- The total of the Accounts Payable Control column is posted to the Accounts Payable Control account in the general ledger.

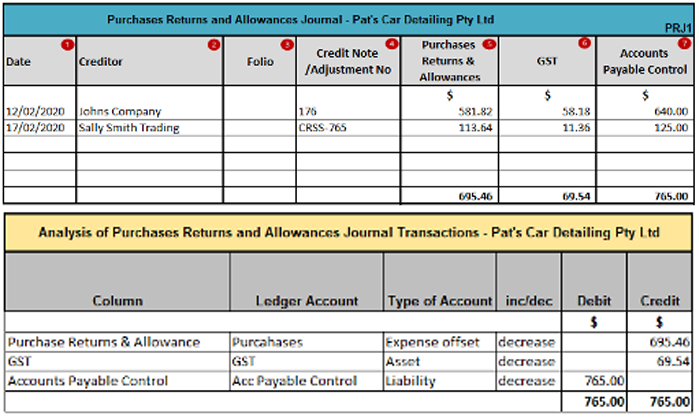

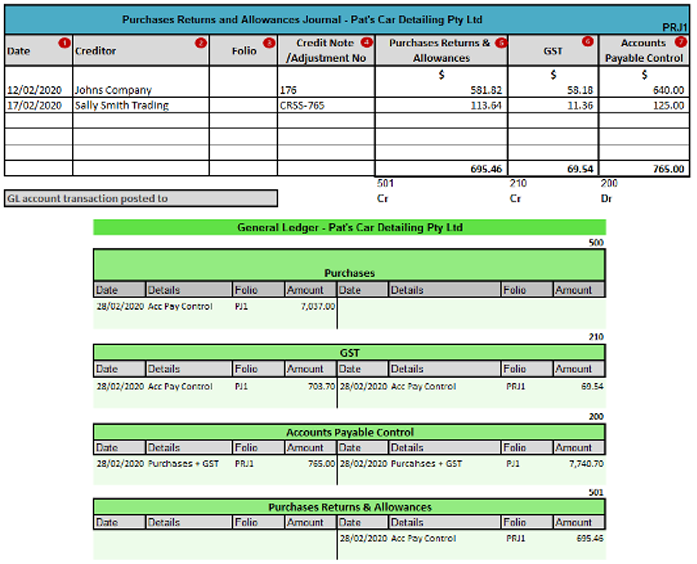

Posting from the Purchases Returns and Allowances Journal

When posting from special journals (sales, sales returns, cash receipts, cash payments, purchases and purchases returns), the heading of each column is usually the name of the ledger that you post the account to, and the column total is usually the amount posted.

To help you identify which general ledger account you need to post transactions to, analyse the transactions in a table before you post them. By doing this, you can ensure the debits will equal the credit, and the accounting equation stays in balance.

- Instead of having individual ledger accounts for each individual debtor in the general ledger, we post to the accounts receivable control account in the general ledger.

- The Posting Date is the last day of the period.

- The information in the Details column of the ledger account is cross-referenced to the other ledger account/s affected by the transaction.

- The Folio column is used to track the purchases, returns, and allowances in the journal account from which the transaction was posted.

- The total of the Purchases Returns and Allowances column is posted to the Purchases Returns and Allowances ledger.

- The total GST column is posted to the GST ledger.

- The total of the Accounts Payable Control column is posted to the Accounts Payable Control account in the general ledger.

A practice question has been included in the learning checkpoint at the end of this topic to test your understanding of posting from the purchases and purchases returns and allowances journal.

Test your understanding of posting from the General Journal

Use this Excel workbook to:

- general journal to the general ledger &

- Pan's Flight School.

Save a copy of the workbook to your desktop. In the next topic, you will need to use the information you have entered to generate a trial balance.

We encourage you to attempt the task before checking the answer provided in the workbook.

Test your understanding of posting from the Cash Receipts Journal

Use this Excel workbook to:

- post the transactions from the cash receipts journal to the general ledger

Save a copy of the workbook to your desktop. In the next topic, you will need to use the information you have entered to generate a trial balance.

We encourage you to attempt the task before checking the answer provided in the workbook.

Test your understanding of posting from the Cash Payments Journal

Use this Excel workbook to:

- post the transactions from the cash payments journal to the general ledger

- close the general ledger for Ken’s Candy Shop.

Save a copy of the workbook to your desktop. In the next topic, you will need to use the information you have entered to generate a trial balance.

We encourage you to attempt the task before checking the answer provided in the workbook.

Test your understanding of posting from the Sales and Sales Returns & Allowances Journal.

Use this Excel workbook to post the transactions from the sales and sales returns & allowances journal to the general ledger.

Save a copy of the workbook to your desktop. In the next learning checkpoint, you will add to the general ledger.

We encourage you to attempt the task before checking the answer provided in the workbook.

Test your understanding of posting from the Purchases and Purchases Returns and Allowances Journal

Open the Excel workbook you used to post the transactions from the sales and sales returns & allowances journal to the general ledger and:

- post the transactions from the purchases and purchases returns & allowances journal to the general ledger

- close the general ledger for ABC Company.

- Resave the workbook to your desktop. In the next topic, you will need to use the information you have entered to generate a trial balance.

We encourage you to attempt the task before checking the answer provided in the workbook.