Working in the Sport, Fitness and Recreation Industry often means being self-employed or running a small business with a team of assistants. If this is your current situation or if you plan to be a sole operator or small business owner then you will be required to complete a variety of administrative duties as part of running your business.

Some examples of tasks you will be required to undertake are:

-

Maintaining business registration records.

-

Processing financial transactions.

-

Budgeting, accounting, and taxes.

-

Payroll.

-

Rosters/Schedules and handover between shifts.

-

Insurance.

-

Client membership records.

-

Purchasing.

-

Marketing.

-

Workplace, health and safety, hygiene, and security.

There are a variety of software packages and apps designed to assist with these processes, some of which have been developed specifically for the Sport, Fitness and Recreation industry. Some examples are:

-

MYOB and Xero - Accounting software packages, for the purposes of creating invoicing, issuing receipts, maintaining budgets, processing payroll.

-

Standard Business Reporting Program (SBR) - A Government program administered by the Treasury, designed to reduce the reporting burden for business.

-

Worket App - Developed by Fitness Australia it allows you to view sales, receive payments, pay bills, manage schedules, client management, and store pre-exercise screening records.

-

MailChimp - Marketing software for the promotion of a business via email, social media, website and more.

-

Findmyshift - Scheduling software for staff management, developed specifically for gyms and fitness centres.

Having a series of policies relating to appropriate conduct, duties, and reporting is recommended. Procedures should also be developed for specific tasks, these documents include step-by-step instructions and locations of any applicable documents and resources as well as access information such as logins and passwords.

Key policies that your business should have include:

A Workplace, Health and Safety policy outlines employer and employee obligations to work safely and help minimise the risk of injury and illness.

Some important inclusions in a Workplace Health and Safety policy include:

-

Risk assessments and monitoring of hazards and risk - Hierarchy of controls to reduce risks and regular internal audits.

-

Maintaining of plant and equipment - Maintenance schedules, service agreements, warranties.

-

Safe handling and use of hazardous substances - Personal, protective, equipment, Safety Data Sheets (SDS).

-

Pre-exercise health screening, information, instruction, and supervision - To ensure client risks are assessed, correct information and techniques are provided and demonstrated, and adequate monitoring is undertaken.

-

Consultation with employees and staff training - Regular staff meetings and training sessions to renew skills such as first-aid or new equipment use.

-

Responsibility and delegation - Staff must be aware of who they must escalate WHS issues to and when.

-

Accidents, first-aid, physical well-being, and mental health - Includes treatment of acute incidents, reporting, first aid kits, training requirements, and preventative measures taken to reduce risks.

-

Emergency procedures - Evacuation, Fire safety, Bomb-threats, Weather-related events.

-

Hygiene and cleanliness - Helps to prevent the spread of bacteria and viruses such as COVID-19.

-

Security - Helps to prevent theft, vandalism, and dangerous incidents such as robberies.

Workplace, health, and safety incidents are recorded on official documents known as incident reports. There are various templates for these documents available on the internet, they usually allow provision for the recording of:

-

The injured/affected person/s details including contact information, and also any other involved person/s.

-

An account of the actual incident (as reported by witnesses) including date and time.

-

Specific information about any injuries sustained and treatment provided for these injuries.

Employers are legally required to report serious accidents and hazards to their applicable State/Territory safety regulator. They must immediately notify the following circumstances:

-

If there is a fatality.

-

If an injury resulting from a work-related accident results in a worker having more than seven days off work.

-

If there is a dangerous occurrence which may have exposed people to risks, such as a gas leak or structural collapse, even if no one is injured.

This type of policy aims to prevent and eliminate instances of bullying, harassment or discrimination in the workplace. According to the Fair Work Ombudsman website, the following definitions apply to bullying, harassment, and discrimination:

Bullying is when a person or group of people repeatedly acting unreasonably towards an employee or group of workers, especially if the behaviour creates a risk to health and safety. Bullying does not include performance management, appropriate disciplinary action, or reasonable requests for the undertaking of work tasks.

Unreasonable behaviour includes (but is not limited to):

-

Behaving aggressively.

-

Teasing or practical jokes.

-

Pressuring someone to behave inappropriately.

-

Excluding someone from work-related events.

-

Unreasonable work demands.

Harassment is unwanted and often repeated actions or words that demean, humiliates, or embarrasses a person. A common form of harassment in the workplace is sexual harassment in which an employee is subjected to unwanted advances, remarks, gestures, or physical contact from another person.

Discrimination is the taking of adverse action (ie. firing them, demoting) based on their characteristics such as race, religion, gender identity, sexual orientation, age.

A workplace code of conduct is a document that outlines the professional conduct expectations of employees. This may include:

-

Presentation standards.

-

Customer service protocols.

-

Hours of work.

-

Job descriptions.

-

Ethical standards.

-

Misconduct discipline processes.

Includes processes that staff should take to acknowledge, investigate, and resolve client complaints and feedback.

A register of these types of communication is recommended as well as official forms and email templates to ensure information is captured correctly and consistent messages are sent.

Minimum leave entitlements apply for permanent employees and in some cases long-term casual workers. It is important that employers abide by the requirements to pay their staff fairly, provide appropriate entitlements, and avoid legal action.

The National Employment Standards which are administered by the Fair Work Ombudsman website provides a list of the ten minimum entitlements that employees are eligible for in Australia. A summary of this list is set out below:

-

Maximum weekly hours - Typically 38 hours per week for a full-time employee however additional reasonable hours can be negotiated as part of the employment contract. Penalty rates usually apply for additional hours worked.

-

Flexible working arrangements - Employees are entitled to request flexible working arrangements such as changes to start and finish times, split shifts / job sharing, or working from home if the business and their job role can accommodate.

-

Parental leave - Two periods of paid leave are available, one for twelve (12) weeks and another for thirty (30) days. Additional unpaid leave can be taken for up to twelve (12) months after the birth or adoption of a child.

-

Annual leave - Four (4) weeks per year for full-time and part-time workers based on their ordinary hours of work.

-

Personal / Carer's leave - Ten (10) days per year for full-time and part-time workers based on their ordinary hours of work. Compassionate / Bereavement leave of two (2) days each time an immediate family or household member dies or suffers a life-threatening illness or injury also falls within this category.

-

Community service leave - Includes time off to undertake voluntary emergency management services or to undertake jury duty. Time periods for this type of leave are negotiated on an as needs basis between the employer and the employee.

-

Long service leave - Extended periods of leave granted to employees who have worked in continuous service for a company for a set period of time. Eligibility guidelines and length of leave applicable varies depending on the state/territory. For more information refer to the Fair Work Ombudsman website specifically the Long Service Leave section.

-

Public holidays - Exact dates vary depending on state/territory. Refer to the Fair Work Ombudsman website specfically the section on public holidays for a list by geographical region. The site also includes calcualtors for determining appropriate rates of pay for staff who are required to work on public holidays.

-

Notice of termination / Redundancy - There are set periods of time that must be provided to employees who are going to be made redundant. This period can either be worked-out or paid-out depending on business needs. The times and payment amounts vary depending on how long the employee has worked for the company. More information is available on the Fair Work Ombudsman website in the sections on notice of termination and redundancy.

-

Fair Work Information Statement - Employers must give a new employee a copy of the Fair Work Information Statement (the FWIS) before, or as soon as possible after, they start their new job. This provision can be in-person, by mail, by email, by emailing a link to the Fair Work website, or by fax.

A leave and time-off policy would include stipulations about each applicable entitlement as well as the application process that employees must undertake to apply for any leave.

Technology is an increasingly common phenomenon in workplaces and can be as distracting as it is useful. A technology and device use policy will include boundaries as to what technology items an employee can utilise during work hours and for what purposes.

The policy should also include guidelines on the use of company technology such as computers, software packages and portable devices. Appropriate internet conduct, the security of passwords, social media stipulations are sections you may want to include.

Staff may be responsible for processing financial transactions on a daily or intermittent basis and must be aware of appropriate protocols on how to operate equipment, maintain security, provide refunds/exchanges, undertake record-keeping, processes banking. Financial processes are covered in more detail later in this topic.

There are various registrations and processes that require set-up as part of running a small business in Australia. Some of the initial tasks include:

-

Business Name - Sole operators / contractors may market themselves simply by their own personal name, however most businesses will have a separate business name which is required to be registered.

-

Australian Business Number (ABN) - A unique number for your business, it is used to identify the organisation to customers, suppliers, and the Australian Tax Office (ATO). It is free to register for an ABN.

-

Tax Registration - There are various types of taxes that you may have to pay depending on the structure and nature of your business. Examples include Goods and Services Tax (GST) if your business will turnover $75,000 or more; Payroll tax if you have employees; Fringe benefits tax (FBT) if you are providing perks or benefits to employees.

-

Licences and Permits - In a fitness context this may apply if you are planning on running outdoor classes or activities in public areas.

-

Company - Some businesses are setup as a company, if this your plan then you need to register.

-

Business Website - Used for marketing and communication purposes, it is worth investing in a professional site.

The Australian Government has produced comprehensive information and documentation regarding running a small business, it is is well worth reading their Guide to starting a business website.

Another recommendation is to hire a good accountant who can assist with taxes and financial management to ensure all business reporting is undertaken on schedule and completed correctly.

One of the key reporting requirements for business owners, that an accountant can assist with, is the Business Activity Statement (BAS) which is normally lodged quarterly. This is a summary report of all payable taxes owed by the business and is associated with payment of these taxes to the Australian Taxation Office (ATO). Examples of taxes that may be applicable to small business owners in the fitness sector and therefore reported via the BAS include:

-

Goods and services tax (GST) - A value added tax of 10% on the sale of most goods and services.

-

Pay as you go (PAYG) withholding - If a business has employees, the business owner/employer has to withhold their tax contributions and pay it to the ATO in lump sum payments.

-

Pay as you go (PAYG) instalments - Another way of meeting PAYG obligations (rather than pay lump sum payments) is to have regular instalments taken out which contribute toward the expected tax liability.

-

Fringe benefits (FBT) instalments - Non-cash perks and benefits paid to employees are usually taxed under FBT (unless the company is a non-profit entity). Examples of perks and benefits can include company cars, stock options, employee discounts, health insurance, child-care reimbursement, and many others.

Transactions are divided into two categories: Cash and Non-cash. Depending on the nature of the transactions one type may dominate over the other.

For example, people tend to use cash for low-value items (under $50) whereas high-value items such as equipment or medical services are normally processed via non-cash methods. Non-cash payment options include EFTPOS (eg. debit and credit cards, smartphone mobile wallets), Direct Debit, Buy now pay later schemes (eg. After Pay, Zip Pay), PayPal, Gift vouchers, and less commonly cheques.

Individual workplaces will have their own specific policies and procedures relating to the processing of financial transactions, however below are some basic steps regarding cash payments:

-

Communicate clearly with the customer and advise them of the total cost for the goods and services.

-

Receive the cash from your customer and confirm the amount tendered. Note: Your workplace may have a policy whereby you have to confirm with a colleague or supervisor if a customer uses a large note for payment.

-

Input or record the amount tendered into the Point of Sale (POS) terminal.

-

Open the cash drawer and put tendered money inside.

-

If change is required gather the necessary coins and notes that equal the required amount. Note: Refer to the section below relating to providing change.

-

Close the cash drawer.

-

Provide the customer with the relevant change, counting it out loud back to them.

-

Provide the customer with a tax invoice receipt, unless they indicate they do not wish to receive one.

Cash transactions normally require the provision of change to the customer. To calculate change you simply need to extract the amount an item cost from the amount that has been tendered. Most point of sale systems will automatically calculate the change value. However, you need to know how to count back the change as you provide it to the customer, this reassures the customer and helps to ensure you keep your cash draw balanced.

Counting back the change means you are verbally communicating how each item of money contributes to the change amount until it reaches the total amount that the customer provided in the first instance.

If an item cost $67 and the customer paid with a $100 note you need to subtract $67 from $100 to get $33. The change is likely to be made up of a $20 note, a $10 note, a $2 coin and a $1 coin, although some variations may apply.

Starting with the smallest valued coin, hand it to the customer and verbally add the amount onto the item cost, repeat with each coin/note until you reach the amount tendered.

For example:

-

$1 makes $68.

-

$2 makes $70.

-

$10 makes $80.

-

$20 makes $100.

The most common type of non-cash transaction is EFTPOS which stands for Electronic Funds Transfer at Point of Sale.

Customers will have a card which may be a debit or credit or a combination (dual purpose) of both, or they may use their mobile phone and pay via a mobile wallet (eg. Google Pay or Apple Pay). Transactions are divided into three main types Cheque, Savings or Credit depending on the type of card and the type of account the customer holds with their financial institution.

Contactless payment can be processed via EFTPOS machines for transactions under $100, otherwise, the customer must enter their Personal Identification Number (PIN). Likewise, if your workplace allows cash withdrawals from a Cheque or Savings account the customer must enter their PIN rather than utilise the contactless method.

For security purposes, customers are no longer required to sign for purchases that are paid via credit card, microchip technology embedded in the card is used for identification rather than a signature.

The following video shows how to process non-cash EFTPOS transactions.

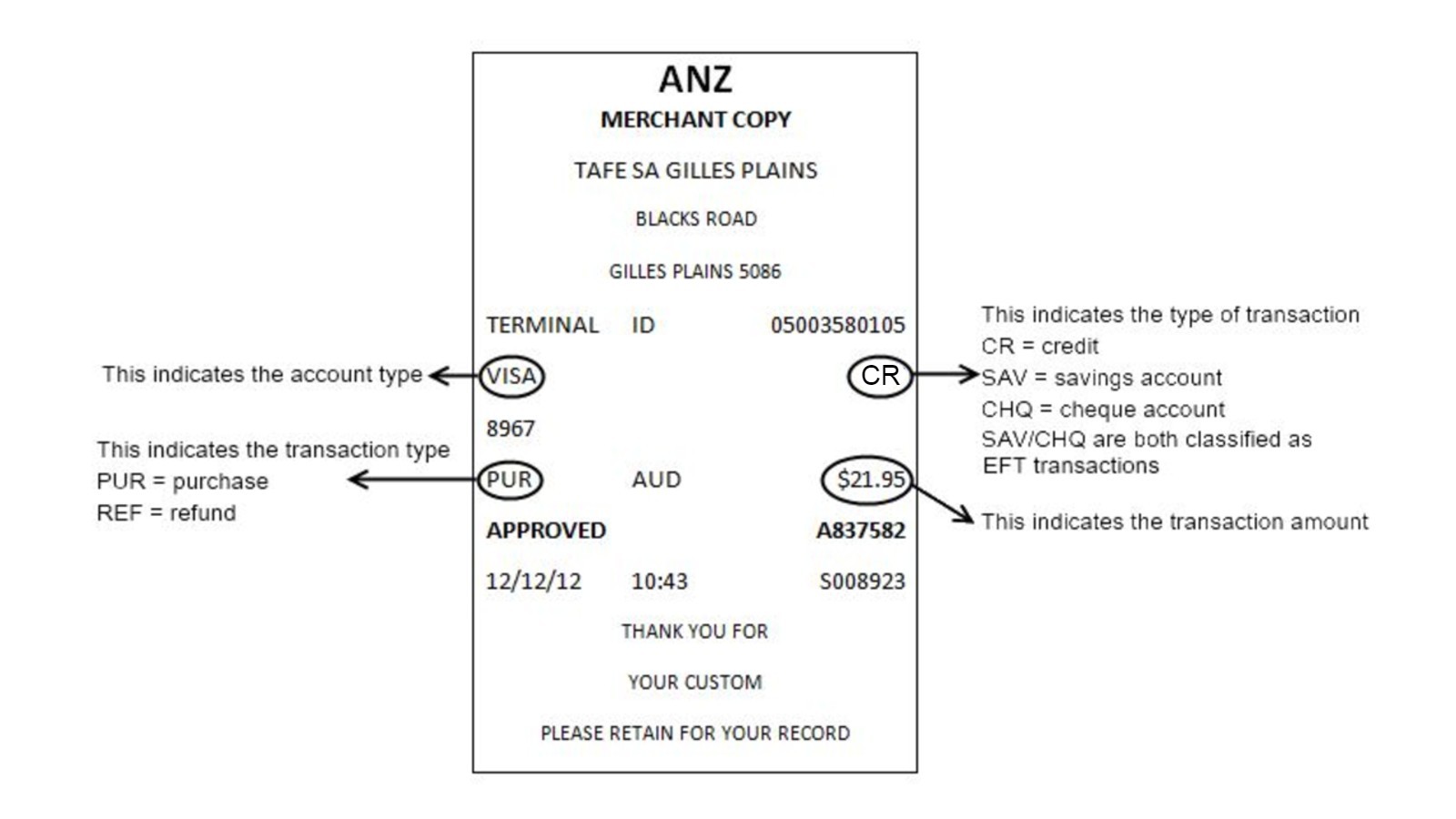

EFTPOS transactions will produce an additional receipt, specific to the card transaction. Note: This receipt is not a tax invoice.

Other types of non-cash transactions, particularly for reoccurring payments like membership fees include:

-

Direct Debit - The client (or payee) authorises the regular withdraw of a set amount of money from their bank account to be paid to a business or other person on a regular schedule (ie. weekly/fortnightly/monthly).

-

Buy Now, Pay Later services - Examples include Afterpay or Zip Money. These services involve the customer establishing a credit account with the service provider to a specific value, these funds can then be used to purchase items at any store or business that allows Buy Now, Pay Later transactions. The retailer/business receives payment immediately from the service provider and the customer then makes regular repayments (and potentially pays interest or fees) to pay the balance off (similar to a credit card).

-

Gift Vouchers - Pre-paid cards or documents for set amounts that can be used to redeem goods and services. Often provided to people as presents hence the name 'gift voucher'.

Regardless of the type of financial transaction, your workplace/place of business should have a refund policy, which will outline the terms and conditions offered to customers regarding the repair, replacement, refund or exchange of goods and services that were sold by the business.

Repairs - Will usually involve the products being returned to the manufacturer in accordance with any warranty that was provided as part of the purchase.

Replacement - Allows the customer to select or be provided with another product identical to the original.

Refund - The product is returned to the store and the customer receives their money back.

Exchange - Allows the customer to swap the product for another item. The new product can be for less, equal or more than the original amount. If the amount was less then the difference is refunded to the customer. If the amount is more then the customer pays the additional amount.

Stores are not allowed to display signs that state 'no refunds' or 'no refunds or exchanges on sale items', however, they don't have to offer a refund or exchange simply because a customer has changed their mind.

Most businesses will require the original tax invoice receipt as proof of purchase before processing any repair, replacement, refund or exchange. If the customer paid for the original purchase using EFTPOS they may require the original card that was used for the transaction so that the refund can be deposited back into the same account.

Keeping accurate and up-to-date financial records is a critical requirement for managing and running a thriving and profitable business. Financial records make required information available to allow you to monitor the running of your business.

Financial Records include;

-

Financial statements – profit and loss accounts, balance sheets, depreciation schedules and taxation returns.

-

General journal and general ledger.

-

Asset register.

-

Cash records – cash payments journal, cash receipts journal, cheque butts, petty cash books and bank deposit books.

-

Work-in-progress records.

-

Bank account statements, bank reconciliations and bank loan documents.

-

Sales/debtor records – for example, sales journal, debtors ledger, a list of debtors, invoices and statements issued, and delivery dockets.

-

Customer or job files.

-

Stock listings.

-

Creditors records – for example, invoices and statements received and paid, creditors ledger and unpaid invoices.

-

All correspondence, annual returns and ASIC forms.

-

Wages and superannuation records.

-

Registers of members (where applicable), options, debenture holders, prescribed interests, charges and unclaimed property.

-

Director and members meeting minutes.

-

Deeds for trusts, contracts and agreements and inter-company transactions, including guarantees.

Taxes are arguably the biggest reason for the importance of financial statements – basically, you have to provide them. The government utilises such reports to ensure that you’re paying your fair share of taxes.

-

The Australian Taxation Office (ATO), by law, requires accurate business records are kept and made available when required. If you don’t comply, penalties may apply.

-

All financial records and documents, for tax purposes, must be kept for a minimum of five years after they are prepared, obtained, or the transactions completed. Your obligation to maintain all the records and documentation for up to five years continues even if you retire, close or sell your business. Financial records must be kept for a minimum of 7 years for legal purposes.

-

The records need to be in plain English and allow for ease of access should the tax office ever wish to see them.

-

Maintaining good financial records will make completing the business activity statements and all required tax documentation as they are due, a lot easier and faster.

-

For reporting requirements to the Australian Taxation Office (ATO), you are required to keep a range of business records including; Income tax and GST Records, Sales records (receipts or sales invoices, cash register tapes, credit card statements, bank deposit books and account statements), purchase/expense records (receipts, cheque butts, tax bills, bank account and credit card statements), year-end income tax records (motor vehicle expenses, a list of debtors and creditors, stocktake sheets and depreciation schedules).

It is a legal requirement that a company keeps all of its financial records that are;

-

Correctly registered and explain its transactions and financial position and performance.

-

Enable genuine and fair financial statements to be prepared and audited ‘Financial records’ include receipts, cheques, invoices, documents and working papers that explain the ways and means by which all the financial reports have been prepared.

-

All financial records are required for seven (7) years.

-

If your financial records are kept electronically, you need to know that they can be changeable in hard copy. Computer backup discs – suggested frequency is at least monthly.

-

If your files are kept on a computer by a third party, such as your accountant’s computer, a hard copy must be provided to a person entitled to inspect the records.

Developing a work plan involves determining what essential tasks are required to be undertaken, by whom, when and in what order. The overarching plan doesn't necessarily include the step-by-step task procedures although it may link to these documents.

Having a work plan in place helps with the development of schedules or staff rosters by listing all required duties thus making it easier to determine the number of staff required each day and providing a visual allocation of what duties these staff members will be undertaking. An added benefit of having all duties listed means that important tasks are not forgotten.

Note: Work plans and schedules do not have to be recreated each day or even regularly, if work tasks are routine and personnel have permanent or regular hours then it may only be necessary to implement one upon initial set-up of the business and perhaps review it if the business expands or if new staff are hired.

Examples of work plan tasks include:

-

Opening.

-

Client Liaison / Customer Service.

-

Personal training.

-

Exercise supervision and advice.

-

Classes / Group Sessions.

-

Stock Control.

-

Equipment Maintenance.

-

Cleaning.

-

Closing.

Work plans can also be developed specifically for once-off special projects and will include tasks lists, allocation of duties and a timeline for completion.

Depending on the operating hours and the size of a business there may be set period of the day when staff handover to another shift of workers. The process of shift handover is the transfer of information pertaining to the previous shift and may include:

-

Client numbers on site.

-

Responsibilities.

-

Instructions.

-

Hazards and risks.

-

Messages.

Often there is a period of overlap between shifts to allow for the provision of this information. This may vary depending on the number of staff on duty and the size of the business. If no overlap period has been allocated then there may be other means to communicate with prior shift colleagues such as message boards, email, phone etc...

Another form of handover is when an outgoing (resigning) staff member handsover to a new recruit who will be taking on their position. This may situation may also include an overlap training period which may be for a couple of days or a couple of weeks, however, there may also be no official handover depending on the circumstances of recruitment. This type of handover typically includes thorough information pertaining to the job role such as general position duties, standard operating procedures, and login information for computer systems.