Recording Business Transactions

The second step in the accounting cycle is recording business transactions.

In accounting and bookkeeping, a journal is the company’s official book in which all transactions are recorded in chronological order. A journal is often defined as a book of original entry. The definition was more appropriate when transactions were written in a physical journal prior to manually posting them to the accounts in the general ledger. Businesses may use various kinds of journals to record transactions. These will be explored later in the topic.

Every business uses at least the most basic form of a journal, known as the General Journal. Double-entry bookkeeping is the method used to record journal entries in the General Journal, and all journals follow the same debit and credit format.

The General Journal provides a chronological record of transactions, and it shows the effect the transaction has on the general ledger accounts.

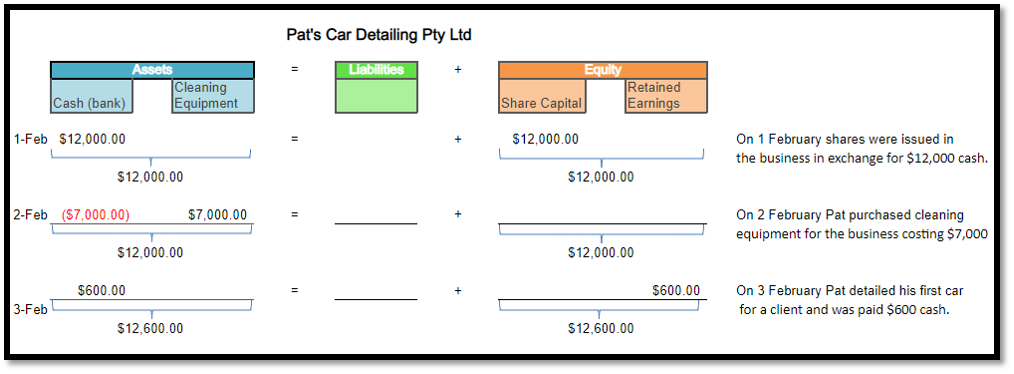

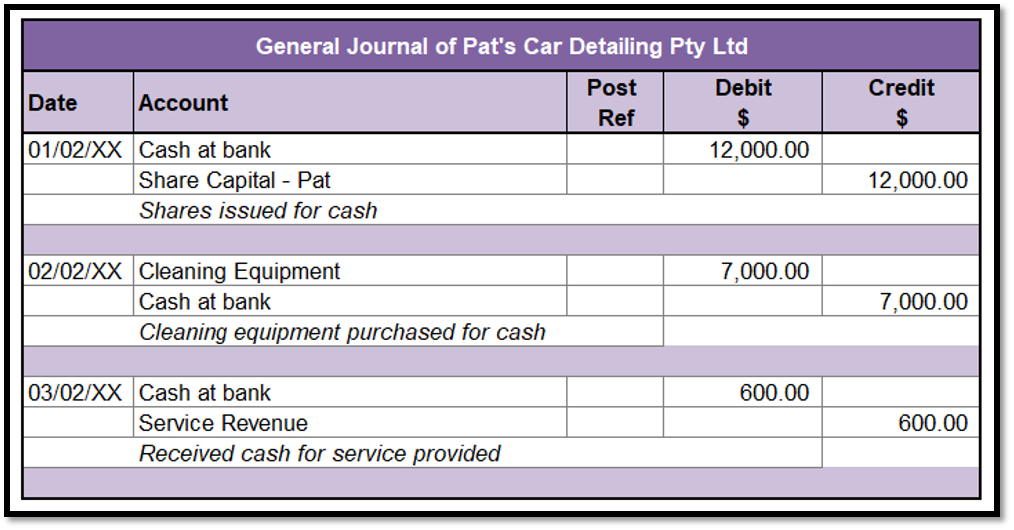

Pat started a new business, Pat’s Car Detailing Pty Ltd. To illustrate how transactions are entered in the general journal, let's examine the following transactions for Pat’s car detailing business.

- On 1 February, shares were issued in the business in exchange for $12,000 cash.

- On 2 February, Pat purchased cleaning equipment for the business costing $7,000

- On 3 February, Pat detailed his first car for a client and was paid $600 cash.

Using the accounting equation, we can analyse these transactions as follows:

Separate journal entries are made for each transaction. The entry includes the date of the transaction, the account and amount to be debited and credited and a brief explanation of the transaction. The Post Ref column is used when posting the transaction to the ledger. (This will be covered later in the learning). The transactions for Pat’s Car Detailing Pty Ltd are journalised as follows:

When a business commences, the amount invested in the business by the owner of the business is called capital. This may occur when:

- a company first starts trading and needs cash or assets to start the business as it is not able to initially generate profit to support itself

- the company needs additional cash or assets, and the owner invests additional cash or assets into the business

- the owner is not able to contribute enough cash to the company so they look for new partners to buy ownership of the business.

The cash is called business capital and is represented on the balance sheet under the share equity section.

Capital Contribution Journal Entry - Cash

When an owner invests cash into the company, a journal transaction needs to be recorded to account for the additional share capital and the cash invested.

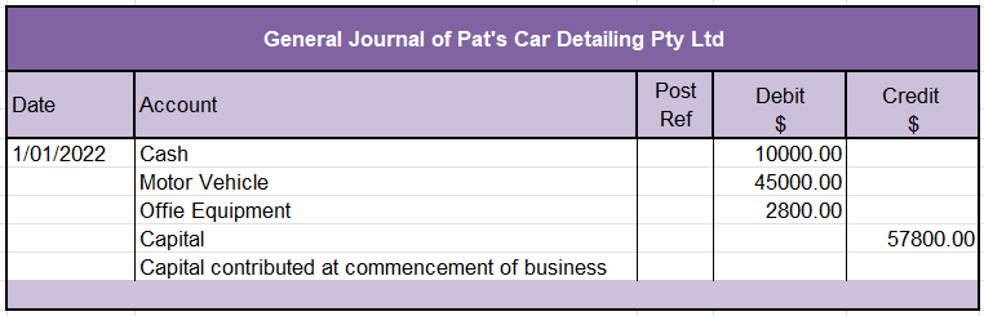

Capital Contribution Journal Entry - Other Assets

Owners can also invest in other fixed assets such as buildings, equipment, or motor vehicles. If the owner contributes a fixed asset to the business, we need to determine the fair value, which needs to be recorded in the financial statements.

When an owner invests fixed assets into the company, a journal transaction needs to be recorded to account for the assets by debiting fixed assets and credit share capital.

Example

On 01/01/2022, Pat started his car detailing business. He deposited $10,000 in the business bank account. He also purchased a new van costing $45,000 and a computer costing $2,800 for the business using his personal funds.

The commencement of business transactions for Pat’s Car Detailing Pty Ltd are journalised as follows:

A practice question has been included in the learning checkpoint at the end of this topic to test your understanding of general journals.

Accounting errors are discrepancies in a business’s financial documents. They are usually made unintentionally and should be corrected as soon as they are identified through the general journal. An accounting error can cause the trial balance not to balance, which is easier to identify, or the error can be such that the trial balance will still balance due to compensating bookkeeping entries, which is more difficult to identify.

Accounting errors that affect the Trial Balance

Errors that affect the trial balance are usually a result of a one-sided entry in the accounting records or an incorrect addition. Sometimes these can be easy to identify and correct. However, if you are unable to identify the error, as a temporary measure allocate the difference in the trial balance to a suspense account. Then carry out a suspense account reconciliation at a later stage.

Example

The entry made in the suspense account is equal to the difference in the two columns of the trial balance. It is made on the side that has a smaller total in the trial balance. Therefore, if the debit side of the trial balance has a total of $55,620.00 and the total of the credit side is $55,500.00, the Suspense Account would appear as follows:

The suspense account allows you to balance the trial balance. When the error is identified, the rectification entry must be a double entry and would appear as follows:

Accounting errors that do not affect the Trial Balance

Accounting errors that do not affect the trial balance fall into one of six categories.

Errors of Principle in Accounting - An error of principle in accounting occurs when the bookkeeping entry is made to the wrong type of account. Identifying an error of principle usually takes some work since looking at a trial balance, which contains the name of the account and its value, only shows whether debits equal credits. If an error of principle is identified prior to the release of a final financial report, it can be most easily resolved by making appropriate correcting entries to reverse and appropriately allocate the transaction.

Example

$3300.00 rent received from a tenant who leases an office owned by the business was incorrectly allocated to the Building Account (Asset).

The correcting entry would be:

Errors of Omission in Accounting - Errors of omission in accounting occur when a bookkeeping entry has been completely omitted from the accounting records.

Example

A credit note for $15,00.00 received from a supplier was misplaced and not recorded in the accounts. The error was discovered several months later. The correcting entry would be:

Errors of Commission - An accounting error of commission can occur when a transaction is entered into the correct type of account but the wrong account. Errors of commission can result from:

- Entering the wrong amount in the correct subsidiary account

- Posting the correct amount in the wrong subsidiary account

- Posting the wrong amount to the correct side of the account

- Posting the correct amount to the wrong side of the account

- Double-posting an entry

- Posting to the wrong account, for example, payment for Advertising is debited to Audit fees.

Example

$500.00 is debited to the internet expenses account instead of to the electricity account.

The correcting entry would be:

Compensating Errors - A compensating error occurs when two or more errors cancel each other out. When errors have been compensated, the trial balance balances and locating the error can become difficult. To correct compensating errors, it is necessary to identify more than one error (or a number of errors).

Example

Advertising costs of $1,000 are posted as a debit to the advertising account as $1,500. Also, the interest received of $2,000 is posted as a credit to the interest account as $2,500.

Then, the excess debit of $500 in the advertising account is set off against the excess credit in the interest account. As the excess debit is compensated with the excess credit, the trial balance does not reveal the errors. To correct compensating errors, each error must be corrected individually. If the error is identified within the same reporting period the error was made, the posted amount can be overwritten. If it is in a different reporting period, a journal entry would need to be created to account for the error.

Errors of Original Entry - An error in the original entry occurs when an incorrect amount is posted to the correct account.

An example of an error of original entry is a transposition error where the numbers are not entered in the correct order.

Example

Cash paid to a supplier of $2345.00 was posted as 2,435.00 then the correcting entry would be:

A good indicator for a transposition error is that the difference (in this case 90) is divisible by 9.

Complete Reversal of Entries - Complete reversal of entries errors occur when the correct amount is posted to the correct accounts but the debits and credits have been reversed.

Example

A cash sale of $550.00 is posted incorrectly.

To correct the error, the original entry must be reversed, and the correct entry must be made.

This can also be achieved by doubling the original amounts as follows:

Bad debts are the number of accounts receivables that have become uncollectible, i.e., cannot be recovered from the debtors. Doubtful debts are the amount of accounts receivables that are likely to become uncollectible and might eventually become bad debts sometime in the future.

Bad debts can be written off using either the allowance method (sometimes referred to as the provision method) or the direct write-off method.

- Direct Write-Off Method – In this method, no provision is created for bad or doubtful debts. When bad debts are incurred, they are directly written off from that year’s profit & loss account.

- Allowance Method – In this method, a separate provision is created for bad & doubtful debts. When bad or doubtful debts are incurred, they are written off from the provision.

Most businesses use the allowance method because it is more practical and in line with the accounting principle of conservatism.

Direct Write-Off Method

Using the direct write-off method, a business recognises the bad debt expense when it is certain that the invoice will not be paid. The journal entry is a debit to the bad debt expense account and a credit to the accounts receivable control account. If using the accrual accounting method, it may also be necessary to reverse any related GST that was charged on the original invoice, which requires a debit to the GST Collected account.

Example

Clearwater Pty Ltd has tried unsuccessfully to recover money owed to them by P Pan Pty Ltd. They have decided to write the amount of $1,100.00 off as a bad debt.

Under the direct write-off method, the bad debt expense is often recorded in a different accounting period than when the original invoice was recorded. It is not until the accounts receivable have been outstanding for a period of time that it becomes apparent that they are uncollectable.

This means that when the loss is reported as an expense in the accounts, it’s being matched against revenue on the income statement, which is unrelated. This results in total revenue being incorrect in both the period the invoice was recorded and the period when the bad debt was expensed.

Allowance Method

The allowance method provides a more accurate picture of the amount of accounts receivable expected to be collected at the end of a reporting period.

The first step in the allowance method is for the business to make an adjusting entry at the end of the accounting period for bad debts that they expect in the future. This allowance can be based on a percentage of net sales method or the aging of receivables method. By creating the allowance, the bad debt expense is being recognised against sales within the same accounting period.

The allowance for doubtful debts is an estimate of the amount of accounts receivable that are expected to become uncollectable. As the business does not know which customers this will be, it uses a contra account instead of direct credit to the accounts receivable account.

Example

Clearwater Pty Ltd has decided to make an allowance in its accounts for any future bad debts it may incur in the financial year.

The Allowance for Bad Debts is a contra-asset account of Accounts Receivable. It is presented in the balance sheet as a deduction from the gross accounts receivable amount.

When the company decides to write off bad debt, it does so by debiting the allowance for doubtful debt accounts and crediting accounts receivable control account.

Example

Clearwater has reviewed their accounts receivable and has decided to write off an outstanding amount of $880.00 owed by S White. To recognise the bad debt they process the following journal.

If the allowance for doubtful debts is overstated or understated, an adjustment is recorded to decrease or increase the allowance provision.

Percentage of Sales Method

The percentage of sales method estimates uncollectible accounts from a given period's credit sales. In theory, the method is based on the percentage of the actual uncollectible accounts of previous years compared to the sales of previous years. This method is used by some businesses for monthly reporting; however, for year-end reporting, the aging of receivables method should be used.

Aging of Receivables method

The aging of receivables method involves preparing an aging schedule in which customers’ accounts receivable balances are grouped depending on the length of time they have been outstanding. Once the accounts have been aged, the expected bad debt is calculated by applying percentages based on past experience to the totals of each group. The estimated percentage of uncollectable debt increases as the number of days the debt is outstanding increases.

Example

Below is the aging schedule for ABC Company. The total estimated bad debts for ABC Company is $36,880.00, with the accounts receivable expected to become uncollectable in the future. This amount represents the required balance of the Allowance for Doubtful Debts on 30 June 2021.

The adjusting entry on 30 June 2021 is the difference between the required balance and the existing balance of the Allowance for Doubtful Debts account.

The existing balance of the allowance for doubtful debts account is $28,880. To bring the account to a credit balance of $36,880, equal to the estimated bad debt in the aging schedule, the allowance for doubtful debts needs to be increased by $8,000.

The journal entry to increase the allowance is:

Recovered bad debts

If a bad debt is recovered, two journal entries are prepared to reverse the write-off entry and record collection, respectively. For example, in the case of the illustration above, out of the $36,880, $2,000 was recoverable.

Sometimes a business might only be able to recover part of a debt. This means the unrecoverable amount only has to be written off.

Special Journals

While small businesses and startups might not have difficulty fitting all their entries in the general journal, that is not the case for larger businesses. For larger businesses, other journals, called special journals, are necessary. Special Journals group and record transactions of a specific type. Special journals include Cash Receipts Journal, Cash Payments Journal, Sales Journal, Sales Returns Journal, Purchases Journal, and Purchases Returns Journal.

If a business uses special journals, they still use the general journal to record the following transactions:

- Capital Contribution

- Correcting Errors

- Accounting for Bad Debts

- General journal: all transactions that do not fit into one of the other journals

- Cash receipt journal: used to record all receipts

- Cash payments journal: used to record all payments

- Sales journal: used to record all credit sales of goods or services

- Sales returns journal: used to record credit given to customers for the return of goods or other allowances

- Purchases journal: used to record all credit purchases for goods or services

- Purchases returns journal: used to record credit provided by suppliers for the return of goods or other allowances

To understand the process of journalising, watch the following video.

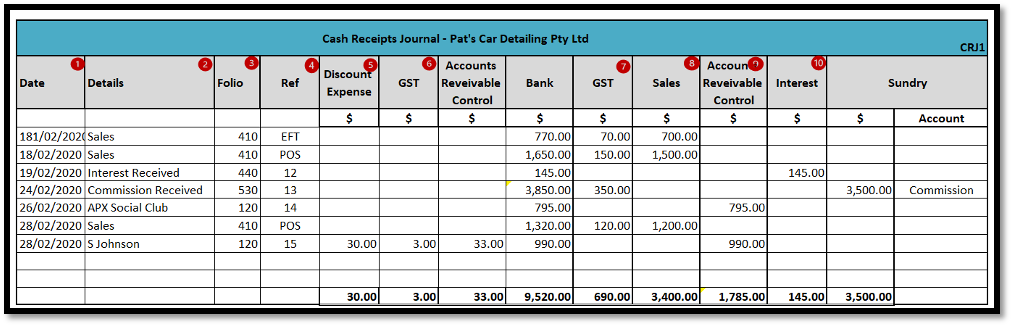

The recording of cash requires the use of two special journals: the cash receipts journal and the cash payments journal. Most businesses customise their cash receipts and cash payments journal to suit their business needs.

The cash receipts journal records all receipts of cash, EFT and cheques that have been received by the business. The most common types of receipts are:

- Cash sales

- Cash received for payments of accounts receivable

The cash receipts journal can also include the following:

- Money received from bank loans

- Bank Interest

- Cash received from selling equipment assets

- Commission received

- Cash received from dividends.

Written receipts, cheques, cash register rolls and, point of sale system receipts (POS), bank statements are all source documents for the cash receipts journal.

Recording transactions in the cash receipts journal

- Transactions are recorded in date order in the Date column.

- The Details column records a description of the transaction or the name of the person from whom the amount was received from.

- The Folio column is used when the journals are posted to the ledger.

- The Ref column contains a reference to the source of the transaction.

- Discount expense is the situation where the seller offers the buyers a discount in the form of a trade, settlement, or volume discount. The Discount Expense column in the Cash Receipts Journal records the amount of the discount minus GST.

- The GST column records the GST on the discounts allowed to the customer, which represents an adjustment (reduction) to GST collected on sales. The Accounts Receivable Control column shows the discount expense plus the GST amount.

- The GST column records the GST collected on cash sales.

- The Sales column records all cash sales. EFT and PSO transactions need to be added separately in the Sales column as the bank credits these amounts individually to the business’s bank account.

- The Accounts Receivable Control control account records all receipts from debtors (accounts receivable).

- The Interest column is used to record interest received on money invested.

Where there is no special column provided for a transaction, the Sundry column is used. The name of the appropriate ledger account applicable to each of these transactions should be recorded in the Account column.

At the end of a period, a line is drawn under the Discount Expense, GST, Accounts Receivable Control, Bank, Sales, Interest and Sundry columns. The columns are totalled, and a double line is drawn.

A practice question has been included in the learning checkpoint at the end of this topic to test your understanding of cash receipts journals.

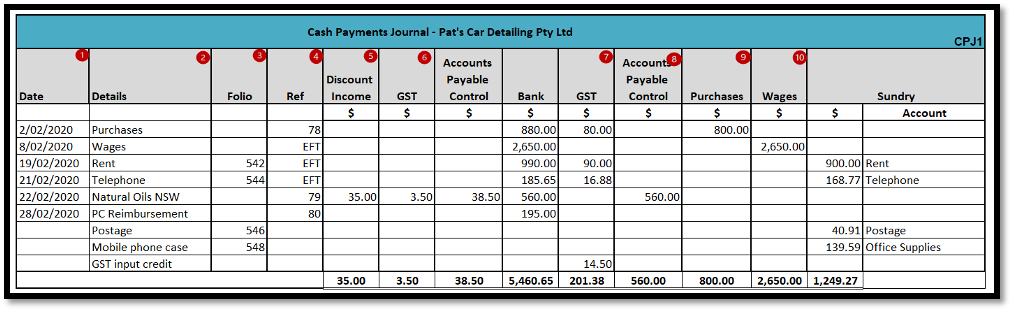

The cash payments journal is used to record all cash going out of the business. It demonstrates how the Cash in the bank account is decreasing. Cash payments include:

- Payment of cash for cash purchases.

- Payment of cash for previous credit purchases, e.g. payment to accounts payable or creditors.

- Payment of cash for various expenses, e.g. rent, advertisement, wages and salaries.

- Payment of cash for the purchase of an asset.

- Bank charges are automatically deducted from the account by the bank or financial institution.

- Payment of cash for donations.

Written receipts, cheque butts, bank statements and remittance advice are all source documents for the cash receipts journal. These documents prove that the transaction took place.

At the end of a period, a line is drawn under the GST Input tax credit Adj: Discount Received, Creditors Purchases, GST Input tax credit, Sundries and Bank columns. The columns are totalled, and a double line is drawn.

Recording transactions in the cash payments journal:

- Transactions are recorded in date order in the Date column.

- The Details column records a description of the transaction or the name of the person from whom the amount was paid.

- The Folio column is used when the journals are posted to the ledger

- The Ref column contains a reference to the source of the transaction. For example, the cheque number or EFT payment.

- Discount Income is the situation where the supplier offers the business a discount in the form of a trade, settlement, or volume discount. The Discount Income column in the Cash Payments Journal records the discount amount minus GST.

- The GST column records the GST amount on the discount offered by the supplier. Which represents an adjustment (reduction) to GST paid on purchases. This represents an adjustment (reduction) to GST paid on business inputs. The Accounts Payable Control column shows the discount expense plus the GST amount.

- The GST column records the GST paid by the business, for which it can claim a GST input credit.

- The Purchases column records all cash purchases.

- The Accounts Payable Control account records all payments to creditors (accounts payable).

- The Wages column is used to record all wages paid to staff.

Where there is no special column provided for a transaction, the Sundry column is used. The name of the appropriate ledger account applicable to each of these transactions should be recorded in the Account column.

At the end of a period, a line is drawn under the Discount Income, GST, Accounts Payable Control, Bank, GST Purchases, Wages and Sundry columns. The columns are totalled, and a double line is drawn.

A practice question has been included in the learning checkpoint at the end of this topic to test your understanding of cash payment journals.

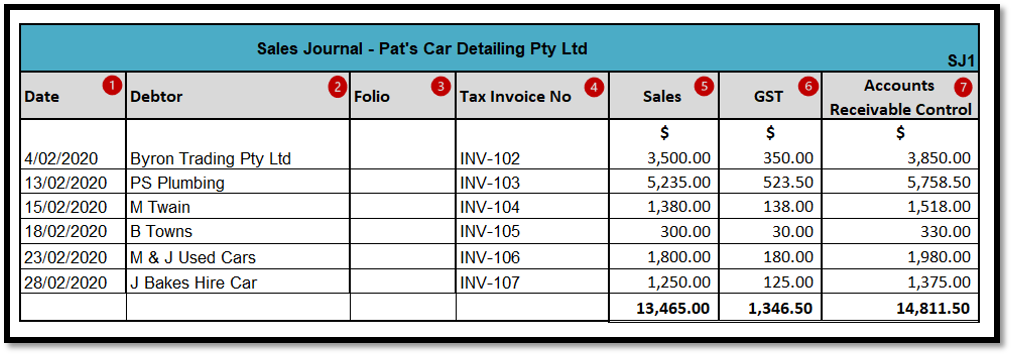

When a business sells trading stock or provides a service on credit, the transaction is recorded in the Sales Journal. No Cash sales are recorded in the Sales Journal. Tax invoices are source documents for the Sales Journal.

Recording transactions in the Sales Journal

Below are the February credit sales that were processed through the Sales Journal for Pat’s Car Detailing Pty Ltd. An explanation of the columns in the Sales Journal follows.

11. Transactions are recorded in date order in the Date column.

12. The Debtor column records the name of the debtor involved in the transaction.

13. The Folio column is used when posting the transaction to the ledger. (This will be covered later in the learning).

14. The invoice number is recorded in the Tax Invoice No column.

15. The amount recorded in the Sales column is the total amount recorded on the invoice before the 10% GST is added.

16. The GST amount recorded on the invoice is recorded in the GST column.

17. The total invoiced amount, including GST, is recorded in the Accounts Receivable Control column. The sales and GST payable column should equal the accounts receivable control column.

At the end of the period, the Sales, GST and Accounts Receivable Control columns are totalled.

A practice question has been included in the learning checkpoint at the end of this topic to test your understanding of sales journals.

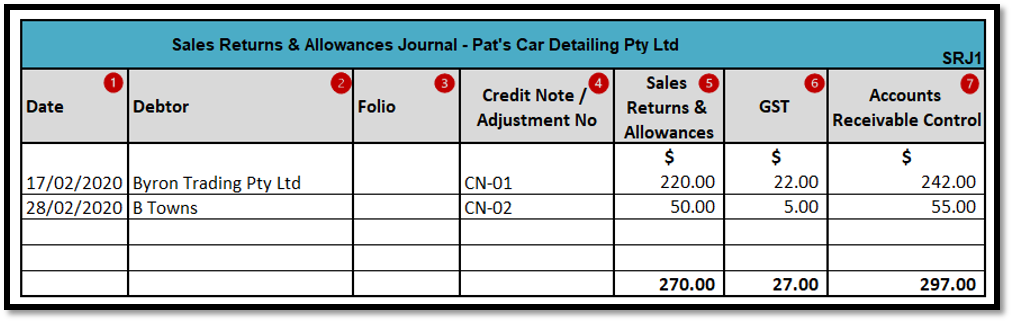

When a customer returns goods sold on credit, or the business makes an allowance because the customer is dissatisfied with a service provided on credit, the transaction is recorded in the Sales Returns and Allowance Journal.

Credit notes and adjustment notes are source documents for the Sales Returns and Allowances Journal. The Sales Returns and Allowance Journal only records returns or allowances for credit sales.

Recording transactions in the Sales Returns and Allowances Journal

Below are the February sales returns and allowance transactions that were processed through the Sales Returns and Allowances Journal for Pat’s Car Detailing Pty Ltd. An explanation of the columns in the Sales Returns and Allowances Journal follows.

- Transactions are recorded in date order in the Date column.

- The Debtor column records the name of the debtor involved in the transaction.

- The Folio column is used when posting the transaction to the ledger. (This will be covered later in the learning).

- The credit note/adjustment number is recorded in the Credit Note / Adjustment No column.

- The amount recorded in the Sales Returns & Allowances column is the total amount recorded on the credit note/adjustment number before the 10% GST is added.

- The GST amount recorded on the credit note/adjustment number is recorded in the GST column.

- The total credited amount, including GST, is recorded in the Accounts Receivable Control column. The sales returns and allowances and GST column should equal the accounts receivable control column.

At the end of the period, the Sales Returns & Allowances, GST and Accounts Receivable Control columns are totalled.

A practice question has been included in the learning checkpoint at the end of this topic to test your understanding of sales returns and allowances journals.

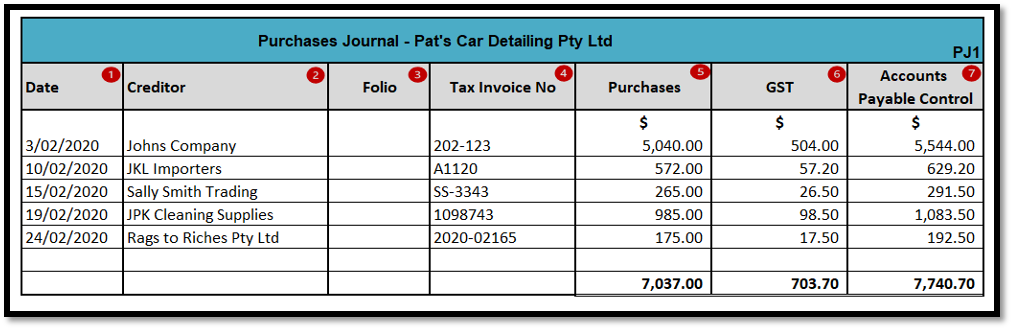

When a business buys a trading stock or service on credit, the transaction is recorded in the Purchases Journal. Supplier tax invoices are source documents for the purchases journal. No Cash purchases are recorded in the Purchases Journal.

Recording transactions in the Purchases Journal

Below are the February credit purchases that were processed through the Purchases Journal for Pat’s Car Detailing Pty Ltd. The journalising of transactions is similar to that used in the Sales Journal. An explanation of the columns in the Purchases Journal follows.

- Transactions are recorded in date order in the Date column.

- The Creditor column records the name of the creditor involved in the transaction.

- The Folio column is used when posting the transaction to the ledger. (This will be covered later in the learning).

- The supplier invoice number is recorded in the Tax Invoice No column. The invoices will not be sequential, as they are from different suppliers.

- The amount recorded in the Purchases column is the total amount recorded on the supplier invoice before the 10% GST is added.

- The GST amount recorded on the supplier invoice is recorded in the GST column.

- The total invoiced amount, including GST, is recorded in the Accounts Payable Control column. The purchases and GST payable column should equal the accounts payable control column.

At the end of the period, the Purchases, GST, and Accounts Payable Control columns are totalled.

A practice question has been included in the learning checkpoint at the end of this topic to test your understanding of purchases journals.

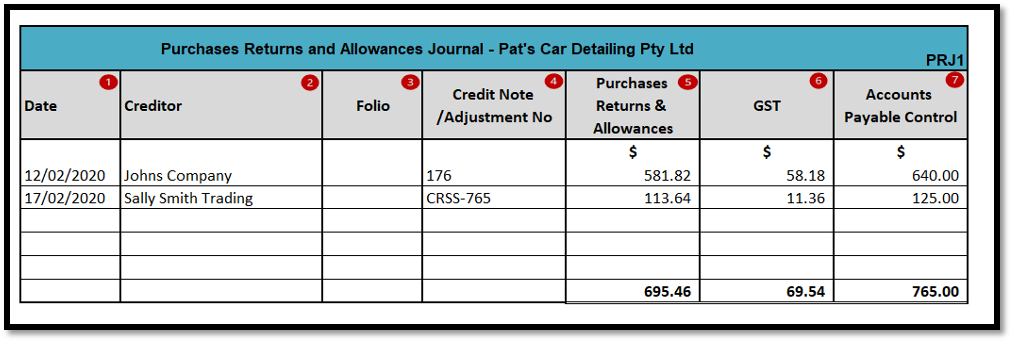

Sometimes, a business that has purchased goods on credit is dissatisfied with the goods it receives, and it returns the stock to the supplier or keeps the stock and requests a credit. Similarly, a business that pays for service on credit may be dissatisfied with the quality of the service and request a reduction in the amount they pay. When this happens, a credit note or adjustment is issued by the supplier. This transaction is recorded in the business's Purchases Returns and Allowances Journal. The purchases, returns, and allowances journal only records goods or services previously purchased on credit.

Recording transactions in the Purchases Returns and Allowances Journal

Below are the February credit purchase returns and allowances that were processed through the Purchases Returns and Allowances Journal for Pat’s Car Detailing Pty Ltd. The journalising of transactions is similar to that used in the Sales Returns and Allowances Journal. An explanation of the columns in the Purchases Returns and Allowances Journal follows.

- Transactions are recorded in date order in the Date column.

- The Creditor column records the name of the creditor involved in the transaction.

- The Folio column is used when posting the transaction to the ledger. (This will be covered later in the learning).

- The Credit Note / Adjustment No number is recorded in the Credit Note / Adjustment No column. The Credit Note / Adjustment No will not be sequential as they are from different suppliers.

- The amount recorded in the Purchases Returns column is the total amount recorded on the supplier Credit Note / Adjustment No before the 10% GST is added.

- The GST amount recorded on the supplier invoice is recorded in the GST column.

- The total invoiced amount, including GST, is recorded in the Accounts Payable Control column. The purchases return and GST columns should equal the accounts payable control columns.

At the end of the period, the Purchases Returns, GST and Accounts Payable Control columns are totalled.

A practice question has been included in the learning checkpoint at the end of this topic to test your understanding of purchases, returns, and allowances journals.

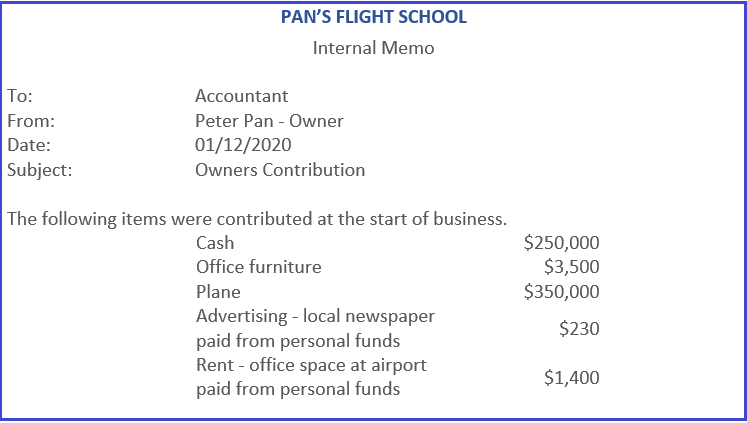

Test your understanding of General Journals

Use this Excel workbook to:

- Record the general journal entry for the commencement of business of Pan’s Flight School using the information contained in the internal memo from Peter Pan to his accountant.

- On 08/12/2020, Peter purchased a computer priced at $3300 (GST incl) on credit from Olga’s Office Supplies (Tax invoice # 2020-4343). Record the computer purchase by Peter Pan in the general journal.

We encourage you to attempt the task before checking the answer provided in the workbook.

Test your understanding of the Cash Receipts Journal

Use this Excel workbook to record the following receipts for Greg's Golf Shop.

- Add 10% GST to all cash sales.

- Total the cash receipts journal once you have entered all the transactions.

We encourage you to attempt the task before checking the answer provided in the workbook.

Test your understanding of the Cash Payments Journal

Use this Excel workbook to record the following payments for Ken's Candy Shop.

Total the cash payments journal once you have entered all the transactions.

We encourage you to attempt the task before checking the answer provided in the workbook.

Test your understanding of the Sales and Sales Returns & Allowances Journal.

Use this Excel workbook to:

- Enter the following transactions for the ABC Book Company in the sales and sales returns and allowances journals.

- ABC’s trading terms are 14 days from the end of the month.

- Calculate and add 10% GST to each of the invoices.

- Total the sales and sales returns and allowances journals at the end of May 2020.

We encourage you to attempt the task before checking the answer provided in the workbook.

Test your understanding of the Purchases and Purchases Returns and Allowances Journal.

Use this Excel workbook to:

- Enter the following transactions in ABC Book Company’s purchases and purchase returns and allowances journal.

- Calculate the GST amount for each transaction.

- Total the purchases and purchase returns and allowances journals at the end of May 2020.

We encourage you to attempt the task before checking the answer provided in the workbook.